Home>Finance>Why Have Employers Moved From Defined Benefit Plans To Defined Contribution Plans

Finance

Why Have Employers Moved From Defined Benefit Plans To Defined Contribution Plans

Modified: December 29, 2023

Discover why employers have shifted from defined benefit plans to defined contribution plans in the realm of finance. Gain insight into the reasons behind this strategic change.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Definition of Defined Benefit Plans

- Definition of Defined Contribution Plans

- Reasons for Employers’ Transition to Defined Contribution Plans

- Cost Control

- Employee Choice and Flexibility

- Shift of Risk to Employees

- Portability and Individual Control

- Advantages and Disadvantages of Defined Contribution Plans

- Conclusion

Introduction

Over the past several decades, there has been a significant shift in employer-sponsored retirement plans from defined benefit plans to defined contribution plans. This transition reflects a fundamental change in how employers provide retirement benefits to their employees. In a defined benefit plan, also known as a traditional pension plan, employers promise a specified monthly benefit to employees upon retirement. On the other hand, in a defined contribution plan, such as a 401(k) or 403(b) plan, employers contribute a fixed amount or a percentage of the employee’s salary to an individual account that can be invested in various investment options chosen by the employee.

The shift from defined benefit plans to defined contribution plans can be attributed to various factors, including cost control, employee choice and flexibility, the transfer of risk to employees, and the desire for portability and individual control. By understanding the reasons behind this transition, both employers and employees can better grasp the advantages and disadvantages associated with these different types of retirement plans.

In this article, we will delve into the reasons why employers have moved away from defined benefit plans and embraced defined contribution plans. We will examine the benefits and drawbacks of this shift and highlight the implications for both employers and employees. By exploring these factors, we can gain a deeper understanding of the evolving landscape of employer-sponsored retirement plans and make informed decisions about our own financial future.

Definition of Defined Benefit Plans

A defined benefit plan, also known as a traditional pension plan, is a retirement plan in which an employer guarantees a specified monthly benefit to employees upon their retirement. The benefit amount is typically based on a predetermined formula that considers factors such as the employee’s salary history, years of service, and age at retirement.

With a defined benefit plan, the employer bears the investment risk and is responsible for funding the plan to ensure that there are sufficient assets to fulfill the future benefit obligations. This means that regardless of how the plan’s investments perform, employees are entitled to receive the promised benefit amount.

One key characteristic of defined benefit plans is that the employer assumes the longevity risk. This means that if employees live longer than expected, the employer is obligated to continue providing the monthly benefit for an extended period. On the other hand, if employees do not live as long as anticipated, the employer benefits from paying out fewer years of benefits.

Defined benefit plans offer a stable and predictable retirement income for employees, as they can rely on a fixed amount that they will receive each month upon retirement. This can provide a sense of security and help individuals plan for their retirement years.

However, maintaining a defined benefit plan can be costly for employers. They are required to make ongoing contributions to fund the plan and fulfill their obligations to employees. The funding requirements may increase over time, especially if the plan’s investments underperform or if there are changes in actuarial assumptions, such as longer life expectancies or lower interest rates.

In recent years, the prevalence of defined benefit plans has decreased as employers seek alternatives that offer more cost control and flexibility. This has led to the rise of defined contribution plans as the preferred retirement plan arrangement for many employers.

Definition of Defined Contribution Plans

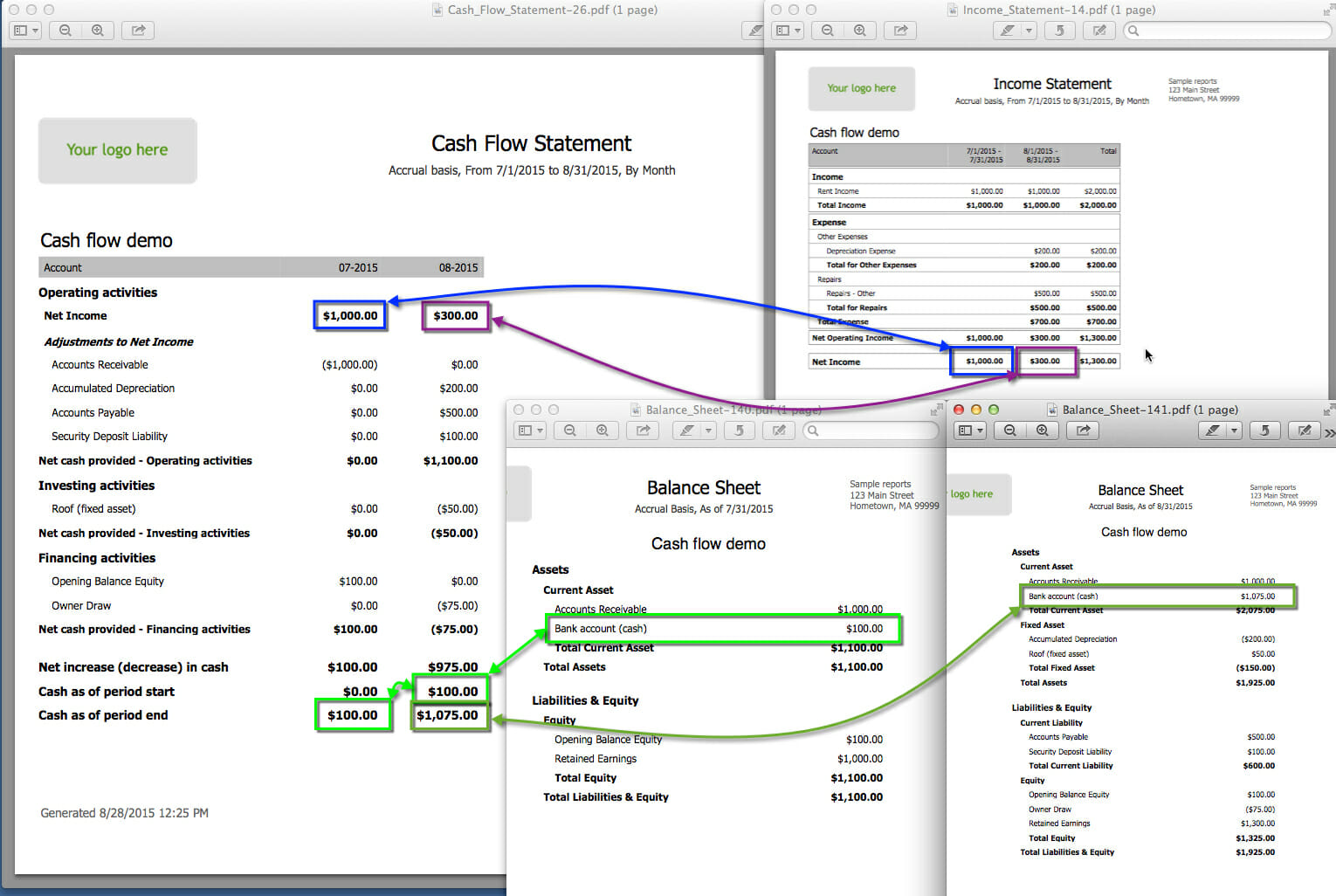

A defined contribution plan is a type of retirement plan in which both employers and employees make contributions to individual accounts on behalf of the employee. Unlike defined benefit plans, the ultimate benefit amount in a defined contribution plan is not predetermined or guaranteed. Instead, it depends on factors such as the amount of contributions made, the investment performance of the individual account, and the employee’s investment decisions.

In a defined contribution plan, such as a 401(k) or 403(b) plan, employees have the opportunity to contribute a portion of their pre-tax income to their retirement savings. Employers may also choose to match a percentage of employees’ contributions or make non-elective contributions on their behalf. The contributions made by both parties are typically invested in a variety of investment options, including mutual funds, stocks, bonds, and other financial instruments.

One of the defining characteristics of defined contribution plans is the individual account ownership. Each employee has their own account, which they can manage and monitor according to their investment preferences and risk tolerance. The accumulated funds in the account, including the contributions made by both the employee and employer, as well as any investment earnings, belong solely to the employee.

Upon reaching retirement age, employees can withdraw funds from their defined contribution accounts to provide income during their retirement years. The amount of income available depends on the account balance and the chosen withdrawal strategy. Common options include installment payments, lump-sum distributions, or the purchase of an annuity to provide a steady stream of income for life.

Defined contribution plans offer employees flexibility and portability. They can choose how much to contribute, within specified limits, and have the ability to control their investment decisions. This empowers employees to take an active role in their retirement planning and tailor their investment strategy based on their individual financial goals.

However, a key drawback of defined contribution plans is that the investment risk is shifted from the employer to the employee. The value of the individual account is subject to market fluctuations, and employees bear the responsibility for managing their investment portfolio and making prudent decisions.

Defined contribution plans have become increasingly popular among employers due to their cost control advantages and the shift of investment risk to employees. They provide a more predictable retirement plan expense for employers, as they are not responsible for guaranteeing specific benefit amounts. Additionally, defined contribution plans offer flexibility for employees, allowing them to take ownership of their retirement savings and make investment decisions that align with their individual financial circumstances.

Reasons for Employers’ Transition to Defined Contribution Plans

The transition from defined benefit plans to defined contribution plans has been driven by several factors that prompt employers to adopt the latter as the preferred retirement plan arrangement. These reasons include cost control, employee choice and flexibility, the transfer of risk to employees, and the desire for portability and individual control.

Cost Control: One of the primary reasons for the shift to defined contribution plans is the desire for cost predictability and control. Defined contribution plans allow employers to determine the exact amount they will contribute to employees’ retirement accounts, thus providing more certainty in their retirement plan expenses. By contrast, in defined benefit plans, employers are obligated to contribute based on a formula that takes into account factors such as employee salaries, years of service, and age at retirement. These formula-driven contributions can prove to be expensive and unpredictable for employers, especially considering potential longevity risks and volatile investment markets. Defined contribution plans eliminate the obligation of funding future benefit obligations, offering more control over retirement plan expenditures.

Employee Choice and Flexibility: Defined contribution plans offer employees greater autonomy and decision-making power over their retirement savings. With individual accounts, employees have the opportunity to choose from a range of investment options based on their risk tolerance and financial goals. This flexibility empowers employees to customize their investment portfolios and potentially achieve higher returns. Additionally, employees can contribute a portion of their pre-tax income to their defined contribution accounts, providing them with potential tax advantages and the ability to save for retirement in a manner that aligns with their personal preferences.

Shift of Risk to Employees: Another reason behind the transition to defined contribution plans is the transfer of investment and longevity risks from employers to employees. In defined benefit plans, employers bear the responsibility of ensuring that the promised benefits are funded and paid out to retirees, regardless of investment performance. This can result in substantial financial obligations and risks for employers. In contrast, defined contribution plans shift the investment risk to employees. The ultimate benefit amount in these plans depends on the performance of the individual account. Employees assume the responsibility of managing their investments, and any gains or losses directly affect their retirement savings. This transfer of risk allows employers to mitigate their financial liabilities and provides employees with the opportunity to take control of their retirement savings.

Portability and Individual Control: Defined contribution plans offer employees the advantage of portability and individual control over their retirement savings. When employees change jobs, they have the option to take their defined contribution account with them, either by rolling it over into their new employer’s plan or by transferring it to an individual retirement account (IRA). This flexibility ensures that employees can maintain continuity in their retirement savings and continue to contribute to their account regardless of their employment situation. This portability factor provides employees with greater freedom and control over their retirement savings, allowing them to make decisions that align with their long-term financial objectives.

By transitioning from defined benefit plans to defined contribution plans, employers can achieve cost savings, offer employees more freedom and flexibility, transfer investment risks to employees, and provide greater portability and individual control over retirement savings. However, it is important for both employers and employees to carefully consider the advantages and disadvantages of defined contribution plans to ensure they align with their respective retirement goals and financial capabilities.

Cost Control

One of the key reasons why employers have transitioned from defined benefit plans to defined contribution plans is the desire for greater cost control. Defined contribution plans offer employers more predictability and control over their retirement plan expenses compared to defined benefit plans.

In a defined benefit plan, employers are obligated to contribute funds based on a formula that takes into account factors such as employees’ salaries, years of service, and age at retirement. These contributions can fluctuate significantly, depending on changes in workforce demographics, investment performance, and actuarial assumptions. As a result, employers face uncertain and potentially escalating retirement plan costs.

By contrast, defined contribution plans allow employers to determine the exact amount they will contribute to employees’ retirement accounts. Employers can choose to contribute a fixed dollar amount or a percentage of employees’ salaries. This provides more certainty in retirement plan expenses and enables employers to budget and forecast their employee benefit costs more accurately.

Furthermore, defined contribution plans shift the investment risk from the employer to the employee. In a defined benefit plan, employers are responsible for ensuring that the plan’s investments generate sufficient returns to meet the future benefit obligations. If the investments underperform, the employer may need to make additional contributions to cover the shortfall. This investment risk can be volatile and potentially costly for employers.

With defined contribution plans, employees bear the investment risk. The ultimate benefit amount in these plans depends on the performance of the individual account, which is subject to market fluctuations. Employers no longer have to worry about funding shortfalls due to investment losses or managing investment portfolios. Consequently, this shift of investment risk allows employers to mitigate their financial liabilities and have better control over their retirement plan costs.

Moreover, the administration and maintenance costs of defined contribution plans can be more manageable for employers compared to defined benefit plans. Defined contribution plans often have simpler administrative requirements, as the focus is on individual accounts rather than calculating and managing complex benefit formulas. This simplicity can lead to reduced administrative costs and streamlined processes, contributing to overall cost savings for employers.

In summary, employers are drawn to defined contribution plans for their cost control advantages. The ability to determine fixed contributions, shift investment risk to employees, and simplify plan administration can provide employers with greater predictability and control over retirement plan expenses. By embracing defined contribution plans, employers can better manage their financial obligations and budget for retirement benefits more effectively.

Employee Choice and Flexibility

Another significant reason for employers’ transition to defined contribution plans is the desire to offer employees greater choice and flexibility in their retirement savings. Defined contribution plans empower employees to take an active role in planning and managing their retirement funds.

One of the key advantages of defined contribution plans is the ability for employees to make their own contribution decisions. Employees can choose to contribute a portion of their pre-tax income to their individual retirement account, typically through salary deferrals. This allows employees to have control over the amount they save for retirement and tailor their contributions based on their financial circumstances and long-term goals.

Furthermore, defined contribution plans provide employees with a range of investment options. Employees can choose from a variety of investment vehicles, such as mutual funds, stocks, bonds, and target-date funds, depending on their risk tolerance and investment preferences. This flexibility enables employees to build a diversified portfolio that aligns with their individual financial objectives.

Employees are also given the opportunity to manage their investment strategy within the defined contribution plan. They can actively monitor their account, review investment performance, and make adjustments as needed. This level of control allows employees to respond to market conditions and make informed decisions to maximize their retirement savings potential.

In addition to investment choices, defined contribution plans often provide employees with the flexibility to choose their desired retirement age. Employees can decide when to start withdrawing funds from their accounts, provided they meet certain eligibility requirements. This flexibility allows employees to align their retirement plans with their personal circumstances, whether they prefer an early retirement or choose to work longer to accumulate more savings.

Another aspect of employee choice and flexibility in defined contribution plans is the portability factor. When employees change jobs, they have the option to take their defined contribution account with them. They can either roll over the funds into their new employer’s plan or transfer them to an individual retirement account (IRA). This portability ensures that employees can maintain continuity in their retirement savings and continue to contribute to their account, regardless of their employment situation.

The ability to have choice and flexibility within a retirement plan empowers employees to take ownership of their financial future. It allows them to customize their retirement savings strategy based on their unique needs and preferences. Defined contribution plans provide employees with the tools and options to build a retirement nest egg that suits their individual circumstances.

In summary, defined contribution plans offer employees greater choice and flexibility compared to defined benefit plans. The ability to make contribution decisions, choose from various investment options, manage their investment strategy, and control their retirement age provides employees with a sense of empowerment in planning for their future. The flexibility and customization options within defined contribution plans can have a profound impact on employees’ retirement outcomes and financial well-being.

Shift of Risk to Employees

One of the significant factors driving the transition from defined benefit plans to defined contribution plans is the shift of risk from employers to employees. Defined contribution plans transfer the investment risk and the responsibility for retirement savings management from employers to individual employees.

In a defined benefit plan, employers bear the investment risk. They are responsible for ensuring that the plan’s investments generate sufficient returns to meet the future benefit obligations of employees. If the investments underperform, the employer may need to make additional contributions to cover the shortfall. This investment risk can be unpredictable and potentially costly for employers.

With defined contribution plans, employees assume the investment risk. The ultimate benefit amount in these plans depends on the performance of individual accounts, which are subject to market fluctuations and investment returns. By shifting the investment risk to employees, employers can mitigate their financial liabilities and have better control over their retirement plan costs.

This shift of risk provides employees with the opportunity to take ownership of their retirement savings and make investment decisions that align with their individual risk tolerance and financial goals. Employees have the flexibility to choose from a range of investment options within their defined contribution plans, such as mutual funds, stocks, bonds, and target-date funds. They can actively manage their investment strategy, monitor performance, and make adjustments as needed.

While the shift of investment risk empowers employees, it also means that they bear the consequences of potential investment losses. Market volatility and economic downturns can impact the value of individual accounts, potentially affecting retirement savings. It becomes crucial for employees to understand investment principles, diversify their portfolios, and make informed decisions to mitigate risk and maximize returns.

Additionally, defined contribution plans also transfer the longevity risk from employers to employees. In defined benefit plans, employers are responsible for providing monthly benefits for the rest of an employee’s life, regardless of how long they live. This longevity risk exposes employers to the financial burden of supporting retirees for an extended period.

In defined contribution plans, however, employees are responsible for managing their retirement savings throughout their lifetime. If employees outlive their retirement savings, they may face financial challenges in their later years. This highlights the importance of prudent savings behavior, effective retirement planning, and considering various income sources, such as Social Security or annuities, to ensure long-term financial security.

Overall, the shift of risk to employees within defined contribution plans allows employers to reduce their financial liabilities and costs associated with retirement benefits. It gives employees the opportunity to actively manage their retirement savings and investment strategy. However, it also places the responsibility on employees to navigate investment risks and make informed decisions to secure their financial future.

Portability and Individual Control

Portability and individual control are two key advantages of defined contribution plans that have led to employers’ transition from defined benefit plans. These features offer employees greater flexibility and allow them to have more control over their retirement savings.

One significant aspect of defined contribution plans is the portability factor. When employees change jobs, they have the option to take their defined contribution account with them. They can choose to roll over their funds into their new employer’s plan or transfer them to an individual retirement account (IRA). This portability ensures continuity in employees’ retirement savings and the ability to continue contributing to their account, regardless of their employment situation.

The portability of defined contribution accounts allows employees to avoid the disruption of their retirement savings when transitioning between jobs. It eliminates the need to start over with a new retirement plan and ensures that employees can continue to build upon their previous savings efforts. This benefit is especially valuable in today’s dynamic workforce where job changes and career transitions are increasingly common.

Moreover, portability offers employees more control over their retirement savings. They can actively monitor and manage their accounts, make investment decisions, and adjust contributions according to their financial goals. Whether an employee stays with a single employer for their entire career or switches jobs multiple times, their defined contribution account remains with them, providing a sense of ownership and allowing them to have a direct impact on the growth of their retirement savings.

Individual control is another crucial aspect of defined contribution plans. In these plans, employees have the opportunity to make their own contribution decisions. They can choose to contribute a portion of their pre-tax income to their individual retirement account, often through salary deferrals. This control allows employees to determine the amount they save for retirement based on their financial circumstances and long-term goals.

Furthermore, defined contribution plans offer employees a range of investment options. Employees can select from various investment vehicles, such as mutual funds, stocks, bonds, and target-date funds, depending on their risk tolerance and investment preferences. This flexibility empowers employees to build a diversified portfolio and tailor their investments to align with their individual financial objectives.

The ability to manage their investment strategy within a defined contribution plan allows employees to take an active role in their retirement savings. They can monitor the performance of their investments, make adjustments as needed, and potentially achieve higher returns. This level of control provides a sense of empowerment and allows employees to personalize their savings strategy based on their unique circumstances.

In summary, the portability and individual control offered by defined contribution plans give employees greater flexibility and autonomy concerning their retirement savings. The ability to take their accounts with them when changing jobs ensures continuity and avoids the disruption of their savings efforts. Moreover, the ability to make contribution decisions, choose from various investment options, and actively manage their investment strategy empowers employees to have a direct influence on the growth and management of their retirement funds. Overall, these features enhance employees’ sense of ownership and control over their financial future.

Advantages and Disadvantages of Defined Contribution Plans

Defined contribution plans offer several advantages and disadvantages compared to defined benefit plans. It’s important for both employees and employers to consider these factors when evaluating retirement plan options.

Advantages of Defined Contribution Plans:

- Employee Control: Defined contribution plans empower employees to take control of their retirement savings. They have the flexibility to determine their contribution amount, choose from various investment options, and manage their investment strategy. This level of control allows employees to tailor their retirement plan to their individual financial goals and risk preferences.

- Portability: Defined contribution plans offer portability, allowing employees to take their retirement savings with them when they change jobs. Employees can choose to roll over their funds into a new employer’s plan or transfer them to an individual retirement account (IRA). This portability ensures continuity in retirement savings and avoids disruption.

- Cost Control for Employers: Defined contribution plans provide employers with greater cost control compared to defined benefit plans. Employers can determine fixed contributions, shifting the investment risk to employees. This enables employers to have more predictable retirement plan expenses and mitigates the financial obligations associated with funding future benefit obligations.

- Flexibility in Contributions: Defined contribution plans allow employees to choose how much they contribute to their retirement savings, within specified limits. Employees have the flexibility to adjust their contributions based on their individual financial circumstances, offering more freedom in managing their retirement savings.

- Enhanced Transparency: Employees in defined contribution plans have greater visibility into their retirement savings. They can access their individual accounts and monitor investment performance, contributions, and expenses. This transparency provides employees with a clear understanding of their retirement savings progress and enables them to make informed decisions.

Disadvantages of Defined Contribution Plans:

- Investment Risk: One of the key disadvantages of defined contribution plans is the transfer of investment risk from employers to employees. The ultimate benefit amount in these plans depends on investment performance, and employees bear the consequences of potential investment losses. Employees need to be knowledgeable about investment principles and make informed decisions to mitigate risk.

- Uncertain Retirement Income: Unlike defined benefit plans that provide a predetermined monthly benefit, defined contribution plans do not guarantee a specific income amount in retirement. The final benefit is subject to market fluctuations and investment returns. Employees need to carefully manage their contributions and investment strategy to ensure they save enough for a comfortable retirement.

- Responsibility for Decision-Making: Defined contribution plans require employees to actively manage their retirement savings. This responsibility includes selecting investment options, monitoring performance, and making adjustments as needed. Employees need to have the financial literacy and time to engage in these activities or seek professional guidance.

- Lack of Lifetime Income Guarantee: Unlike defined benefit plans that provide a guaranteed income for life, defined contribution plans do not offer the same level of income security. Employees need to carefully plan and manage their retirement distributions to ensure their savings last throughout their lifetime.

- Dependency on Market Performance: The ultimate retirement savings in defined contribution plans depend on market conditions and investment returns. Poor market performance can negatively impact account balances, especially for those nearing retirement. Diversification and long-term investment strategies are crucial to mitigate market volatility.

Despite these disadvantages, defined contribution plans remain popular due to the control, flexibility, and autonomy they offer employees. Understanding the advantages and disadvantages of these plans can help employees make informed decisions about saving for retirement and establishing a suitable long-term financial strategy.

Conclusion

The transition from defined benefit plans to defined contribution plans represents a significant shift in how employers provide retirement benefits to their employees. This transition has been driven by factors such as cost control, employee choice and flexibility, the transfer of risk to employees, and the desire for portability and individual control.

Defined contribution plans offer employers greater cost predictability and control compared to defined benefit plans. Employers can determine the exact amount they will contribute, shifting the investment risk to employees. This shift allows employers to mitigate financial liabilities and have a better understanding of retirement plan expenses.

Employees benefit from the choice and flexibility inherent in defined contribution plans. They have the autonomy to make contribution decisions, select investment options, and manage their investment strategy. This level of control empowers employees to tailor their retirement savings to their specific financial goals and preferences.

The portability of defined contribution plans allows employees to maintain continuity in their retirement savings when changing jobs. They can take their accounts with them, avoiding disruption and establishing a sense of ownership and control over their retirement savings.

However, there are also disadvantages to consider. Defined contribution plans place investment risk on employees, requiring them to actively manage their retirement savings and make informed decisions. Employees bear the responsibility for retirement income planning and must navigate market volatility and investment performance.

In conclusion, the shift from defined benefit plans to defined contribution plans offers both advantages and disadvantages for employers and employees alike. Employers can achieve cost control and predictability, while employees gain flexibility and individual control over their retirement savings. Regardless of the type of retirement plan chosen, it is essential for individuals to carefully assess their financial objectives, risk tolerance, and long-term goals to make informed decisions that align with their unique circumstances. With proper planning and prudent financial management, employees can strive for a secure and fulfilling retirement.