Home>Finance>How Are Distrobutions From Defined Benefit Plans Taxed

Finance

How Are Distrobutions From Defined Benefit Plans Taxed

Modified: February 21, 2024

Learn how distributions from defined benefit plans are taxed in finance to maximize your retirement savings and minimize tax liabilities.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding Defined Benefit Plans

- Distribution Options from Defined Benefit Plans

- Taxation of Distributions from Defined Benefit Plans

- Ordinary Income Tax Rates

- Lump-Sum Distribution Taxation

- Annuity Distribution Taxation

- Additional Taxes on Distributions

- Roth Distributions from Defined Benefit Plans

- Tax Planning Strategies for Defined Benefit Plan Distributions

- Conclusion

Introduction

Defined Benefit Plans are retirement savings vehicles that provide employees with a steady income stream during their retirement years. These plans are typically offered by employers and are designed to ensure financial security in retirement by guaranteeing a specific benefit amount based on factors such as years of service and salary history. Understanding how distributions from defined benefit plans are taxed is crucial for retirees to effectively plan their finances and optimize their tax situation.

In this article, we will delve into the intricacies of defined benefit plan distributions and explore how they are taxed. We will discuss the different distribution options available to retirees, the tax rates applied to these distributions, and any additional taxes that may be incurred. Furthermore, we will explore the tax implications of Roth distributions and highlight key tax planning strategies for defined benefit plan distributions.

By gaining a comprehensive understanding of the taxation of defined benefit plan distributions, retirees can make informed decisions regarding their retirement income and effectively manage their tax liabilities. Let’s dive into the details of how these distributions are taxed to help retirees navigate the complex world of retirement planning.

Understanding Defined Benefit Plans

Defined Benefit Plans are employer-sponsored retirement plans that guarantee a specific benefit amount to employees upon retirement. These plans differ from other retirement savings vehicles, such as Defined Contribution Plans (e.g., 401(k) plans), in that the benefit amount is determined by a formula and not by the contributions made or the investment performance of the plan’s assets.

The benefit amount in a defined benefit plan is typically based on factors such as an employee’s years of service and salary history. Employers contribute to the plan on behalf of the employee, and these contributions are invested to generate returns over time. The plan administrator is responsible for managing the investments and ensuring that there are sufficient funds to pay out the guaranteed benefits.

One key feature of defined benefit plans is that the retirement income is predictable and reliable. Participants in these plans can be confident that they will receive a specific monthly amount during their retirement years, providing them with financial security. This steady income stream can be particularly valuable for retirees who may not have other sources of income or who want to ensure a consistent standard of living during retirement.

Another distinguishing characteristic of defined benefit plans is that they typically do not allow employees to make contributions on their own. The responsibility for funding the plan lies solely with the employer. This sets defined benefit plans apart from defined contribution plans, where employees can make contributions and often have more control over their investment decisions.

While defined benefit plans offer the advantage of guaranteed retirement income, they also come with certain limitations. For example, participants may have limited access to their funds before retirement, and the benefit amount may be affected by factors such as early retirement or a change in employment status.

Understanding the inner workings of defined benefit plans is crucial for individuals who are covered by these plans or are considering them as part of their retirement savings strategy. By gaining a thorough understanding of how these plans operate, participants can make informed decisions, optimize their benefits, and plan for a financially secure retirement.

Distribution Options from Defined Benefit Plans

When it comes to receiving distributions from a defined benefit plan, retirees typically have a few different options to choose from. The distribution options available may vary depending on the specific plan provisions and the retirement plan administrator. Let’s explore some of the common distribution options:

- Single Life Annuity: With this option, retirees receive a fixed monthly payment for the rest of their lives. The amount is determined based on the retiree’s age at the time of retirement and the plan’s benefit formula. While this option provides a consistent stream of income, it does not offer any survivor benefits, meaning that the payments will cease upon the retiree’s death.

- Joint and Survivor Annuity: In a joint and survivor annuity, retirees receive a reduced monthly payment during their lifetime, and after their death, a percentage of that amount continues to be paid to their surviving spouse. This option provides the security of continued income for the surviving spouse, but the initial monthly payment is typically lower compared to a single life annuity.

- Lump-Sum Distribution: Some defined benefit plans offer retirees the option to receive their entire benefit as a lump sum payment. This allows retirees to have immediate access to the entire amount and the flexibility to manage the funds as they see fit. However, it’s important to consider the tax implications and potential investment risks when opting for a lump-sum distribution.

- Partial Lump-Sum and Annuity: This distribution option allows retirees to receive a portion of their benefit as a lump sum payment and the remaining balance as a monthly annuity. This can provide retirees with the best of both worlds – immediate access to a portion of their savings while ensuring a steady income stream for the future.

It’s important for retirees to carefully consider their financial goals and personal circumstances when choosing a distribution option. This decision can have long-term implications for their retirement income and tax situation. Consulting with a financial advisor and understanding the specific provisions of the defined benefit plan can help retirees make an informed decision that aligns with their retirement objectives.

Taxation of Distributions from Defined Benefit Plans

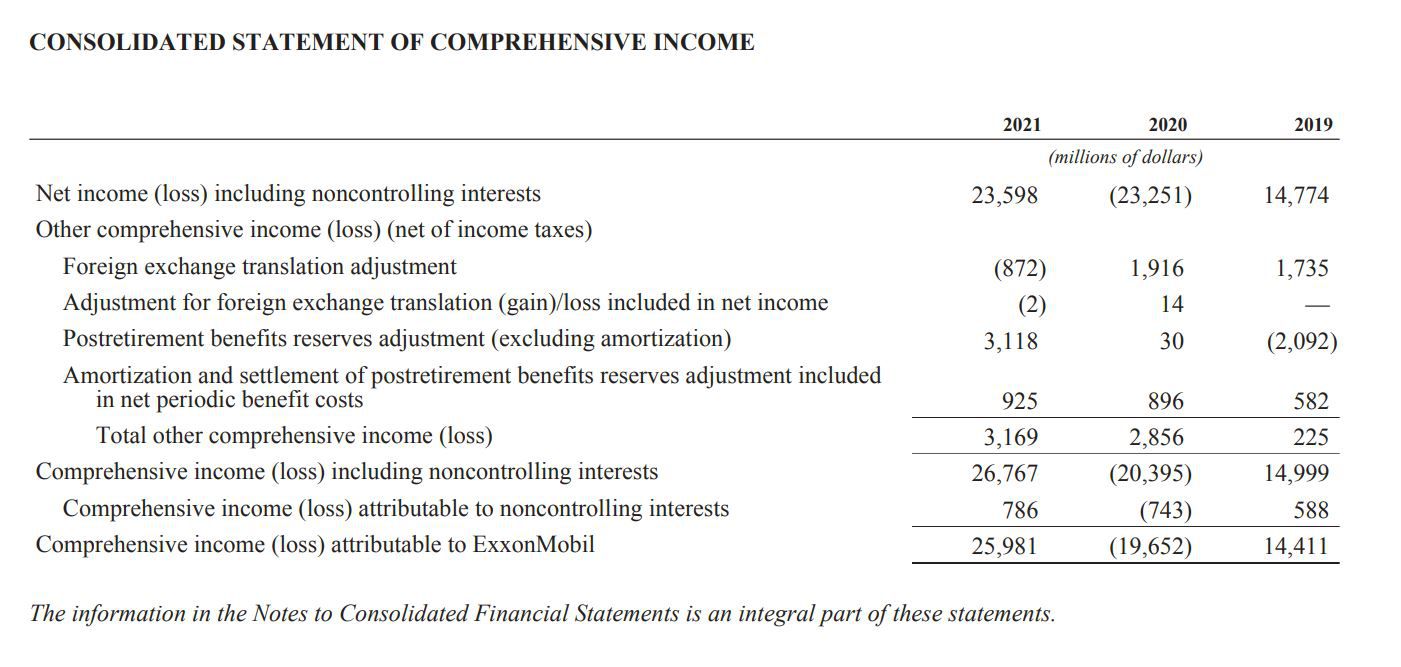

When it comes to the taxation of distributions from defined benefit plans, it’s important for retirees to understand how these payments are taxed to effectively plan their finances. Generally, distributions from defined benefit plans are treated as ordinary income and subject to federal income tax. Let’s dive into the details:

Ordinary Income Tax Rates: Distributions from defined benefit plans are taxed at ordinary income tax rates, which are progressive and dependent on the retiree’s income level. These tax rates range from 10% to 37% for federal income tax purposes. State income tax may also apply, depending on the retiree’s state of residence.

Lump-Sum Distribution Taxation: If a retiree chooses to receive a lump-sum distribution from their defined benefit plan, special tax treatment may apply. The lump sum is typically subject to a different tax calculation, known as the “3-year rule” or “10-year rule,” depending on the circumstances. Under these rules, the lump sum is allocated to the previous three or ten years and taxed at the tax rates applicable for those years. This can result in a lower overall tax liability for the retiree.

Annuity Distribution Taxation: For retirees who choose to receive their defined benefit plan as an annuity, the income received is taxed annually as ordinary income. The tax liability is spread out over the duration of the annuity payments, providing retirees with consistent tax obligations.

Additional Taxes on Distributions: In addition to ordinary income taxes, there may be additional taxes on distributions from defined benefit plans. For example, if a retiree withdraws funds from the plan before reaching the age of 59 ½, they may be subject to an early withdrawal penalty of 10% of the distribution amount. It’s important to be mindful of these additional taxes and plan withdrawals accordingly.

Roth Distributions from Defined Benefit Plans: In some cases, individuals may have a Roth component within their defined benefit plan. Roth contributions are made with after-tax funds, and qualified distributions from a Roth account can be tax-free. However, it’s essential to meet the requirements for a qualified distribution, such as holding the Roth account for at least five years and being at least 59 ½ years old.

Understanding the taxation of distributions from defined benefit plans is crucial for retirees to effectively plan their finances and optimize their tax situation. By being aware of ordinary income tax rates, the taxation of lump-sum and annuity distributions, and any additional taxes or penalties, retirees can make informed decisions and take advantage of potential tax-saving strategies.

Ordinary Income Tax Rates

When it comes to the taxation of distributions from defined benefit plans, ordinary income tax rates play a crucial role. These tax rates are progressive, meaning that the percentage of income taxed increases as the retiree’s income level rises. Understanding how ordinary income tax rates apply to defined benefit plan distributions is essential for retirees to effectively plan their finances. Here’s a breakdown of the different tax brackets for 2021:

- 10% tax bracket: The lowest tax bracket applies to individuals with taxable income up to $9,950 for single filers and up to $19,900 for married couples filing jointly.

- 12% tax bracket: This bracket applies to individuals with taxable income between $9,951 and $40,525 for single filers, and between $19,901 and $81,050 for married couples filing jointly.

- 22% tax bracket: Individuals with taxable income between $40,526 and $86,375 for single filers, and between $81,051 and $172,750 for married couples filing jointly fall into this bracket.

- 24% tax bracket: This bracket applies to taxable income between $86,376 and $164,925 for single filers, and between $172,751 and $329,850 for married couples filing jointly.

- 32% tax bracket: Individuals with taxable income between $164,926 and $209,425 for single filers, and between $329,851 and $418,850 for married couples filing jointly fall into this bracket.

- 35% tax bracket: This bracket applies to taxable income between $209,426 and $523,600 for single filers, and between $418,851 and $628,300 for married couples filing jointly.

- 37% tax bracket: The highest tax bracket applies to individuals with taxable income over $523,600 for single filers, and over $628,300 for married couples filing jointly.

It’s important to note that these tax rates are subject to change and may vary based on legislative changes. Additionally, state income taxes should be factored in, as each state has its own tax brackets and rates.

As defined benefit plan distributions are considered ordinary income, retirees will be taxed according to these brackets. The amount of taxable income from the defined benefit plan, along with other sources of income, will determine the specific tax bracket and corresponding tax rate.

Understanding the ordinary income tax rates is essential for retirees to effectively plan their finances and optimize their tax situation. Consulting with a tax advisor or financial planner can provide additional guidance on how to manage tax liabilities and explore potential strategies to minimize the impact of income taxes on defined benefit plan distributions.

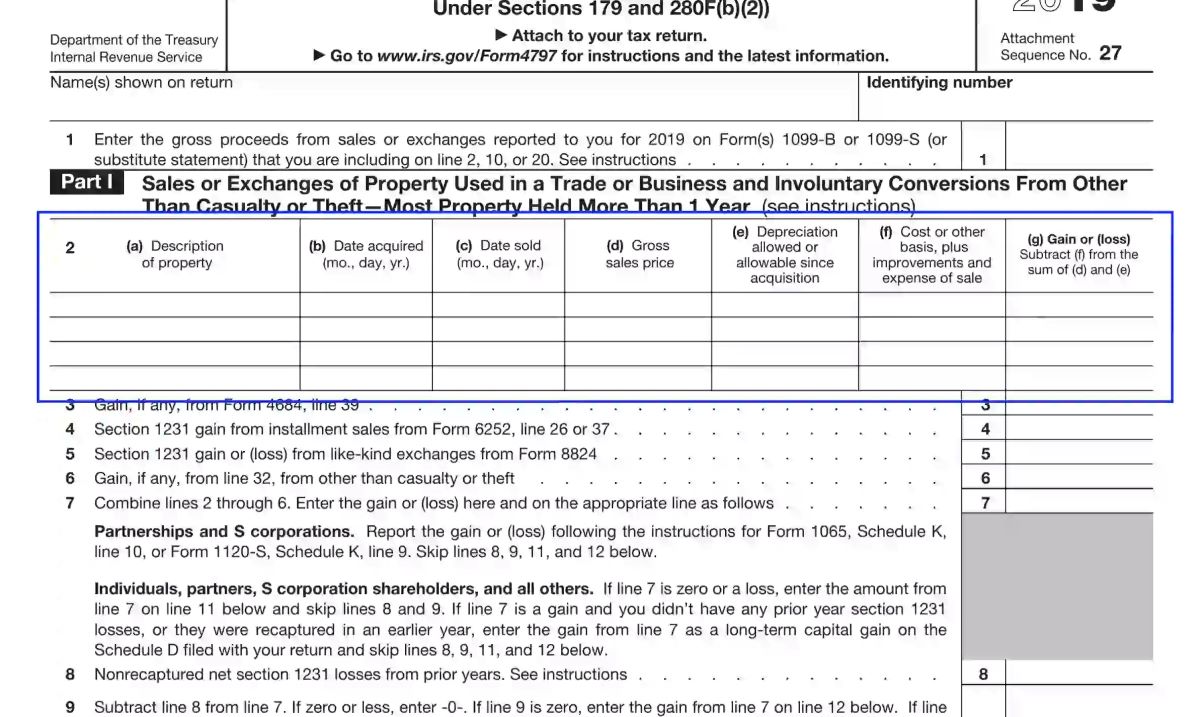

Lump-Sum Distribution Taxation

When retirees choose to receive a lump-sum distribution from their defined benefit plan, special tax treatment may apply. Typically, the lump sum is subject to a different tax calculation known as the “3-year rule” or “10-year rule,” depending on the circumstances. Understanding the taxation of lump-sum distributions is important for retirees to effectively plan their finances. Here’s an overview of how it works:

3-Year Rule: Under the 3-year rule, the lump sum from a defined benefit plan is allocated evenly over the previous three years for tax purposes. This means that the distribution is divided into three equal parts, with each portion taxed based on the tax rates applicable for those years. This can potentially result in a lower overall tax liability for the retiree, especially if their income was lower in the previous years.

10-Year Rule: Alternatively, some lump-sum distributions may be eligible for the 10-year rule. This rule allows retirees to spread the tax liability over a period of ten years, rather than three. Similar to the 3-year rule, the distribution is divided into equal portions and taxed based on the tax rates applicable for each year.

It’s important to note that not all lump-sum distributions qualify for the 3-year rule or the 10-year rule. Consult with a tax advisor or financial planner to determine if your lump-sum distribution qualifies and to understand the specific tax implications based on your individual circumstances.

Moreover, it’s crucial to consider the potential tax consequences of taking a lump-sum distribution. While receiving a significant amount of money upfront may sound appealing, it can push retirees into a higher tax bracket, resulting in higher tax rates on the distribution. Additionally, taking a lump-sum distribution may also impact other aspects, such as eligibility for certain tax credits or deductions.

Retirees should evaluate their overall financial situation, including current and projected tax liabilities, before making a decision on a lump-sum distribution. A thoughtful analysis, taking into account tax implications and potential long-term financial goals, can help retirees make an informed choice that aligns with their unique circumstances.

Annuity Distribution Taxation

For retirees who choose to receive their defined benefit plan as an annuity, it’s important to understand how the income from these annuity distributions is taxed. Annuity distributions are treated as ordinary income and subject to federal income tax. Let’s take a closer look at the taxation of annuity distributions:

When a retiree receives an annuity distribution, the income is taxed annually as ordinary income. The tax liability for annuity distributions is based on the retiree’s tax bracket, which is determined by their income level. The income tax rates applicable to annuity distributions are the same as the ordinary income tax rates that apply to other sources of income.

One advantage of receiving annuity distributions is that the tax liability is spread out over the duration of the annuity payments. This provides retirees with consistent tax obligations and allows for better financial planning. The annuity payments are typically made on a regular schedule, such as monthly or quarterly, and each payment is subject to taxation in the year it is received.

It’s important to note that state income taxes may also apply to annuity distributions, depending on the retiree’s state of residence. Each state has its own tax laws and regulations, so it’s crucial to consult with a tax advisor or financial planner to understand the specific tax implications in your state.

Retirees should also be aware of the potential impact of annuity distributions on their overall tax situation. Depending on the amount of the annuity payments, they could potentially push retirees into a higher tax bracket, resulting in higher tax rates. It’s essential to consider the potential tax consequences before choosing an annuity distribution as the preferred method of receiving retirement income.

Furthermore, retirees should be aware of any additional taxes or penalties that may apply to annuity distributions. For instance, if a retiree withdraws funds from the annuity before reaching the age of 59 ½, they may be subject to an early withdrawal penalty of 10% of the distribution amount. It’s important to be mindful of these additional taxes and penalties and plan annuity withdrawals accordingly.

By understanding the taxation of annuity distributions and considering their overall tax situation, retirees can effectively plan their finances and make informed decisions regarding their defined benefit plan distributions.

Additional Taxes on Distributions

When it comes to distributions from defined benefit plans, retirees should be aware of potential additional taxes that may apply. In addition to ordinary income taxes, there are certain circumstances where retirees may be subject to extra tax obligations. Here are some common additional taxes on distributions:

Early Withdrawal Penalty: If a retiree withdraws funds from their defined benefit plan before reaching the age of 59 ½, they may be subject to an early withdrawal penalty. This penalty is typically 10% of the distribution amount and is in addition to the ordinary income tax owed. The purpose of this penalty is to discourage early access to retirement funds and encourage individuals to save for their retirement over the long term.

RMD Penalties: RMD, or Required Minimum Distribution, refers to the minimum amount that retirees must withdraw annually from their qualified retirement plans, including defined benefit plans, once they reach a certain age (usually 72 years old). Failure to take the required minimum distribution can result in a hefty penalty of 50% of the amount not withdrawn. It’s important for retirees to stay informed about the RMD rules and make sure they meet the distribution requirements to avoid this penalty.

State Income Taxes: In addition to federal income tax, retirees should consider the potential impact of state income taxes on their defined benefit plan distributions. Each state has its own tax rules, rates, and exemptions, so it’s essential to understand the specific tax implications in the retiree’s state of residence. Some states may tax retirement income differently or offer exemptions for certain retirement income sources, while others may tax it fully.

It’s important for retirees to plan their distributions carefully to minimize the impact of these additional taxes. This may involve considering the timing of distributions, managing withdrawals to avoid penalties, and exploring strategies to optimize tax efficiency.

Consulting with a tax advisor or financial planner can help retirees navigate the complex landscape of additional taxes on defined benefit plan distributions. These professionals can provide guidance on tax planning strategies specific to the retiree’s financial situation and help ensure compliance with tax laws and regulations.

By understanding and accounting for these additional taxes, retirees can effectively plan their finances, maximize their retirement income, and minimize unnecessary tax liabilities.

Roth Distributions from Defined Benefit Plans

In some cases, individuals may have a Roth component within their defined benefit plan. Roth contributions are made with after-tax funds, meaning that the contributions have already been taxed at the time they are made. As a result, qualified distributions from a Roth account can be tax-free. Let’s delve into the details of Roth distributions from defined benefit plans:

When retirees receive Roth distributions from their defined benefit plans, they are typically not subject to federal income tax. This is because the contributions were made with after-tax dollars, and therefore, the distributions are considered nontaxable qualified distributions.

In order for a Roth distribution to be considered qualified and tax-free, certain requirements must be met. First, the Roth account must have been held for at least five years. This five-year period generally starts from the first year in which the Roth contributions were made. Second, the retiree must be at least 59 ½ years old at the time of the distribution. If these criteria are satisfied, the Roth distributions from the defined benefit plan can be received free of federal income tax.

It’s important to note that while qualified Roth distributions are not subject to federal income tax, state income taxes may still apply. Each state has its own tax laws regarding Roth distributions, and it’s crucial for retirees to understand the specific tax implications in their state of residence.

Retirees should also be aware of the potential tax consequences of taking nonqualified distributions from their Roth accounts. Nonqualified distributions may be subject to income tax and potentially an additional 10% early withdrawal penalty if the retiree is under the age of 59 ½. It’s crucial to understand the rules and regulations surrounding Roth distributions to avoid unexpected tax liabilities.

Furthermore, it’s important for retirees to evaluate their overall retirement income strategy when considering Roth distributions. Depending on their individual circumstances, it may be beneficial to strategically time when to take Roth distributions along with distributions from other retirement accounts in order to optimize their tax situation.

Consulting with a tax advisor or financial planner can provide valuable guidance on navigating the complexities of Roth distributions from defined benefit plans. These professionals can help retirees develop a tax-efficient distribution strategy that aligns with their retirement goals and minimizes tax liabilities.

By understanding the tax advantages of Roth distributions and meeting the requirements for qualified distributions, retirees can potentially enjoy tax-free income during their retirement years, providing them with greater financial flexibility and security.

Tax Planning Strategies for Defined Benefit Plan Distributions

As retirees navigate the world of defined benefit plan distributions, implementing tax planning strategies can help optimize their tax situation. By strategically managing their retirement income, retirees can minimize their tax liabilities and maximize their after-tax income. Here are some tax planning strategies to consider:

1. Roth Conversions: Consider converting a portion of the defined benefit plan into a Roth IRA. This involves transferring funds from the traditional defined benefit plan to a Roth account, which will be subject to income tax at the time of conversion. However, future qualified distributions from the Roth account will be tax-free, providing tax diversification and potentially reducing overall tax burden during retirement.

2. Lump-Sum Distribution Timing: Evaluate the timing of lump-sum distributions from the defined benefit plan. Depending on your financial situation, it may be beneficial to take the distribution in a year when your overall taxable income is lower, potentially resulting in a lower tax liability.

3. Partial Lump-Sum and Annuity Combinations: Consider combining a partial lump-sum distribution with an annuity. By taking a portion of the distribution as a lump sum, you can have immediate access to some funds while maintaining a steady income stream through the annuity. This strategy allows for greater flexibility in managing taxes and income during retirement.

4. Capitalizing on Marginal Tax Rates: Optimize your retirement income withdrawals to take advantage of lower tax brackets. By carefully managing the amount you withdraw each year, you can minimize your tax liability by staying within lower tax brackets and avoiding higher tax rates.

5. Charitable Contributions: Explore the option of making charitable contributions directly from your defined benefit plan. Qualified charitable distributions (QCDs) allow retirees who are 70 ½ or older to donate up to $100,000 per year to qualified charities, satisfying their required minimum distribution (RMD) and potentially reducing their taxable income.

6. Harvesting Capital Losses: If you have capital losses from other investments, consider offsetting those losses against any capital gains generated from your defined benefit plan distributions. This can help minimize your overall capital gains tax liability and reduce your tax burden.

It’s important to work closely with a tax advisor or financial planner to determine the most suitable tax planning strategies for your specific circumstances and goals. They can assess your overall financial picture, consider current tax laws, and guide you towards effective strategies that align with your retirement objectives.

By implementing these tax planning strategies, retirees can optimize their defined benefit plan distributions, reduce their tax liabilities, and have greater control over their retirement income. Proactive tax planning can lead to significant savings and ensure a financially secure retirement.

Conclusion

Navigating the taxation of distributions from defined benefit plans is essential for retirees to effectively plan their finances and optimize their tax situation during retirement. Understanding the various distribution options available, such as single life annuities, joint and survivor annuities, lump-sum distributions, and partial lump-sum and annuity combinations, allows retirees to choose the option that best aligns with their financial goals and tax considerations.

When it comes to the taxation of defined benefit plan distributions, ordinary income tax rates play a significant role. Retirees should be aware of the progressive tax brackets and plan their distributions strategically to minimize their tax liability. It’s also crucial to consider any additional taxes or penalties that may apply, such as early withdrawal penalties and state income taxes.

Roth distributions from defined benefit plans provide retirees with an opportunity for tax-free income, as qualified distributions from Roth accounts are not subject to federal income tax. By meeting the requirements for qualified distributions and understanding the state-specific tax implications, retirees can potentially enjoy tax advantages and greater flexibility in their retirement income.

Implementing tax planning strategies can further optimize the tax efficiency of defined benefit plan distributions. Roth conversions, careful timing of lump-sum distributions, partial lump-sum and annuity combinations, capitalizing on marginal tax rates, and exploring charitable contributions are just a few strategies retirees can employ to minimize their overall tax burden.

Working closely with a tax advisor or financial planner who specializes in retirement tax planning is crucial. They can provide personalized guidance based on your unique circumstances and help you make informed decisions regarding your defined benefit plan distributions.

In conclusion, understanding the taxation and implementing effective tax planning strategies for defined benefit plan distributions can enhance retirees’ financial well-being during their golden years. By carefully navigating the tax landscape, retirees can optimize their retirement income, reduce tax liabilities, and ensure a financially secure and rewarding retirement.