Home>Finance>Why Do Companies Choose Defined Contribution Plans

Finance

Why Do Companies Choose Defined Contribution Plans

Published: January 2, 2024

Discover why companies opt for defined contribution plans and how they benefit from the financial advantages they offer. Simplify your finance strategy with this popular retirement plan option.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When it comes to retirement planning, companies have different options to consider. One such option is a defined contribution plan, which has become increasingly popular among businesses of all sizes. Unlike traditional pension plans, which guarantee employees a specific benefit upon retirement, defined contribution plans offer employees the opportunity to save for their future through contributions made by both the employee and the employer.

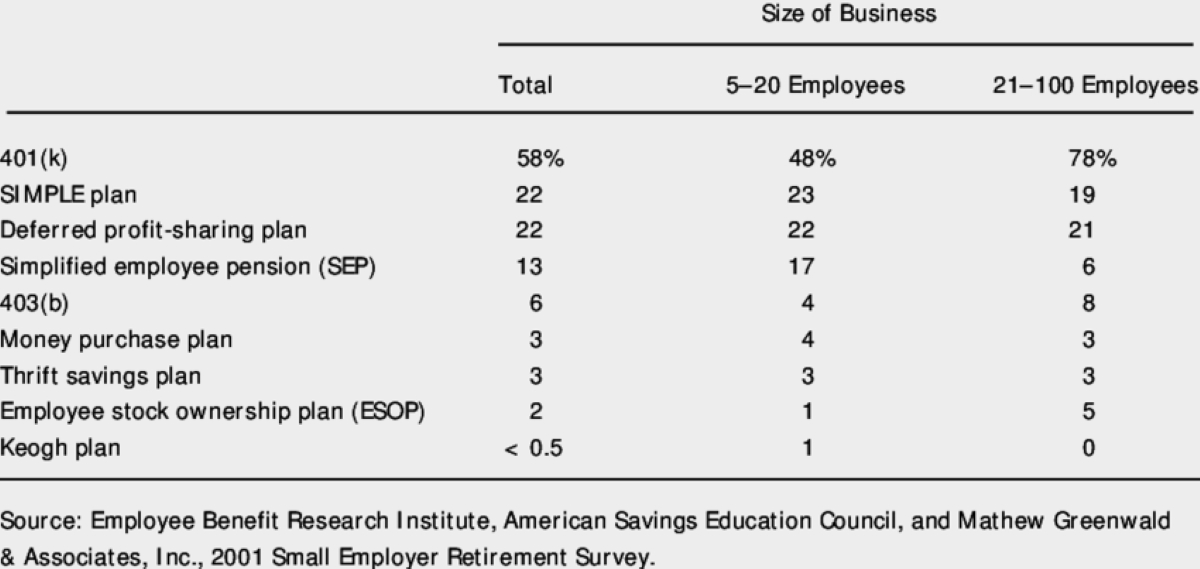

Defined contribution plans, such as 401(k) plans in the United States, have gained popularity due to their flexibility, cost control, and potential tax advantages. These plans allow employees to have more control over their retirement savings, offering a range of investment options to suit individual preferences and risk tolerance. Companies, on the other hand, benefit from the ease of administration and the ability to manage their retirement benefit costs.

In this article, we will delve into the reasons why companies choose defined contribution plans over other retirement benefit options. We will explore how these plans provide cost control, employee flexibility and choice, potential tax advantages, ease of administration, portability, and risk management features. By understanding the benefits of defined contribution plans, businesses can make informed decisions to meet the retirement needs of their employees.

Cost Control

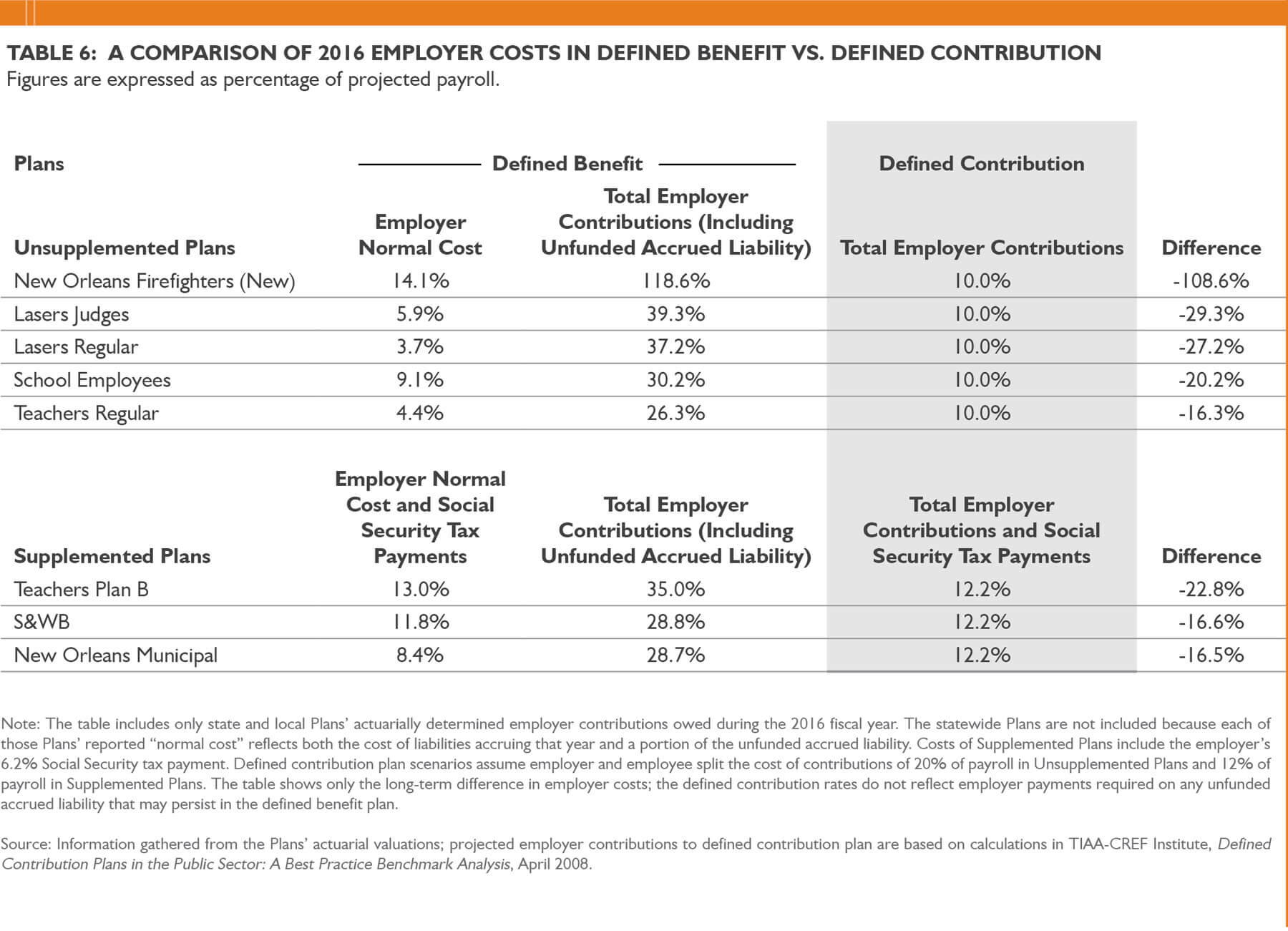

One of the primary reasons why companies choose defined contribution plans is the ability to have greater control over their retirement benefit costs. Unlike traditional pension plans, where the employer is responsible for funding and guaranteeing a specific retirement benefit for each employee, defined contribution plans shift the responsibility to the employees themselves.

With defined contribution plans, companies can set a predetermined percentage or dollar amount that they are willing to contribute to employees’ retirement savings. This allows businesses to have a clear understanding of the costs associated with offering retirement benefits, making it easier to budget and plan for the future.

Furthermore, defined contribution plans offer flexibility in employer contributions. Employers can choose to match a certain percentage of the employees’ contributions, up to a specified limit. This matching contribution can incentivize employees to save more for their retirement, while still allowing businesses to control their overall costs.

Another advantage in terms of cost control is that companies have more control over the investment options offered within the plan. By carefully selecting the investment funds available, companies can ensure that the fees and expenses associated with the plan are reasonable and competitive. This means that employees’ retirement savings are not eroded by high administrative fees, maximizing the value of their investment.

In addition, defined contribution plans allow companies to keep their costs predictable even as the workforce changes. As employees come and go, companies are only responsible for the contributions made during the employees’ tenure with the company. If an employee leaves before reaching retirement age, the employer’s financial obligation to the employee’s retirement savings ends, unlike with traditional pension plans where the company would still be liable for ongoing benefits.

Overall, defined contribution plans provide companies with greater control and predictability over their retirement benefit costs. By setting contribution limits and carefully selecting investment options, businesses can effectively manage their financial responsibilities while still offering valuable retirement benefits to their employees.

Employee Flexibility and Choice

Defined contribution plans offer employees a level of flexibility and choice that is highly valued in today’s workforce. Unlike traditional pension plans, where the retirement benefit is determined solely by the employer, defined contribution plans empower employees to make decisions about their own financial future.

One of the key advantages of defined contribution plans is the ability for employees to choose how much they contribute to their retirement savings. They have the option to allocate a percentage of their salary or a fixed dollar amount towards the plan. This flexibility allows employees to align their contributions with their individual financial situation and retirement goals.

Additionally, defined contribution plans offer employees a range of investment options. These plans often include a selection of mutual funds, stocks, and bonds, allowing employees to diversify their retirement portfolio according to their risk tolerance and investment preferences. This level of choice enables employees to customize their investment strategy and potentially earn higher returns based on their individual investment decisions.

Furthermore, defined contribution plans often provide employees with the ability to make investment changes within the plan. This means that employees can adjust their investment allocations based on market conditions or personal circumstances. By having control over their investments, employees can adapt to market fluctuations and optimize their retirement savings.

Another aspect of flexibility is the portability of defined contribution plans. When employees change jobs, they typically have the option to roll over their retirement savings into an individual retirement account (IRA) or transfer it to their new employer’s retirement plan. This allows employees to maintain their investment and continue saving for retirement without disruption. The ability to take their retirement savings with them provides employees with peace of mind and a sense of ownership over their financial future.

In summary, defined contribution plans offer employees the flexibility and choice to take an active role in their retirement savings. From determining the contribution amount to selecting investment options and managing their investments, employees have the power to shape their financial future according to their unique needs and preferences.

Potential Tax Advantages

Another compelling reason why companies choose defined contribution plans is the potential tax advantages they offer to both the employer and the employees. These tax advantages can provide significant incentives for both parties to participate in and contribute to retirement savings.

For employees, one of the primary tax benefits of contributing to a defined contribution plan is the ability to defer taxes on their contributions. The money contributed to the plan is often deducted from their taxable income, reducing their overall tax liability for the year. This means that employees can lower their current tax burden and potentially increase their take-home pay.

Additionally, the investment earnings within a defined contribution plan grow on a tax-deferred basis. This means that any capital gains, dividends, or interest earned on investments within the plan are not subject to immediate taxes. Instead, taxes are only paid when withdrawals are made during retirement. This tax deferral can lead to significant growth in the retirement savings over time without the impact of annual taxes reducing the investment returns.

Furthermore, in some countries, such as the United States, there are additional tax advantages for employees who contribute to defined contribution plans. For example, some plans offer a Roth option, where employees can make after-tax contributions. Although these contributions are not tax-deductible upfront, the qualified distributions during retirement are tax-free, including both contributions and earnings. This can be advantageous for individuals who anticipate being in a higher tax bracket in retirement.

Employers also benefit from potential tax advantages by offering defined contribution plans. In many countries, such as the United States, employer contributions to these plans are tax-deductible as a business expense. This can help reduce the company’s overall tax liability and potentially provide a valuable tax benefit for the business.

Overall, the potential tax advantages of defined contribution plans make them an attractive option for both employees and employers. The ability to defer taxes on contributions, enjoy tax-deferred investment growth, and take advantage of specific tax provisions can provide significant financial incentives for individuals to save for retirement and for companies to offer these plans as part of their employee benefits package.

Ease of Administration

One of the key factors that make defined contribution plans an appealing choice for companies is the ease of administration compared to other retirement benefit options. Unlike traditional pension plans, which require complex calculations and ongoing management, defined contribution plans offer a streamlined and efficient administrative process.

One of the main reasons for the ease of administration is the simplicity of the contribution structure. With defined contribution plans, both the employer and the employee contribute a predetermined amount or percentage to the plan. This contribution is typically based on the employee’s salary and can easily be automated through payroll deductions. This straightforward contribution process minimizes the administrative burden for employers as they do not have to calculate and track individual benefit accruals like in traditional pension plans.

Additionally, the investment aspect of defined contribution plans is typically handled by financial institutions or plan administrators. These entities are responsible for managing the investment options, providing regular statements, and facilitating transactions. This outsourcing of investment management tasks further eases the administrative responsibilities for companies, allowing them to focus on their core business operations.

Another administrative advantage of defined contribution plans is the use of online portals and technology platforms. Most plans provide employers and employees with access to online tools, allowing them to view account information, access educational resources, and make investment changes. This self-service aspect reduces the need for manual paperwork and enables participants to manage their retirement accounts conveniently, reducing administrative overhead for companies.

In addition, defined contribution plans typically require less ongoing administrative oversight compared to traditional pension plans. These plans are typically designed as individual accounts, where each participant has their own separate account. This eliminates the need for complex calculations and tracking of benefit obligations on an individual basis, simplifying the ongoing administration requirements for employers.

Overall, the ease of administration associated with defined contribution plans is a significant factor driving companies to choose this retirement benefit option. The simplified contribution structure, outsourcing of investment management, availability of online tools, and reduced ongoing administrative requirements make these plans efficient and user-friendly for businesses of all sizes.

Portability

Portability is a key advantage of defined contribution plans that companies consider when choosing retirement benefit options. Defined contribution plans offer employees the flexibility to take their retirement savings with them when they leave the company, providing portability and continuity in their long-term financial planning.

When employees change jobs, they typically have the option to roll over their accumulated retirement savings from their previous employer’s defined contribution plan into an individual retirement account (IRA) or transfer it to their new employer’s retirement plan. This portability feature allows employees to maintain their retirement savings and continue building on their investment, regardless of their employment status.

By allowing employees to transfer their retirement savings, defined contribution plans eliminate the concern of losing the accrued benefits when changing jobs. This not only provides peace of mind to employees but also enhances their overall financial flexibility and mobility in the job market.

In addition, the ability to consolidate retirement savings into a single account can simplify the management and oversight of retirement investments. Instead of having multiple retirement accounts spread across different employers, employees can consolidate their savings into a single account, making it easier to track and manage their investments effectively.

Furthermore, portability also offers employees the opportunity to take advantage of better investment options and lower fees. Not all retirement plans are created equal, and some employers may offer more advantageous investment options or lower administrative fees. By having the ability to transfer their retirement savings, employees can assess the available options and choose the plan that best suits their needs, maximizing their investment potential.

Portability also extends to situations where employees may decide to pursue self-employment or become entrepreneurs. In these cases, the ability to maintain and continue contributing to their existing defined contribution plan ensures that they can continue saving for retirement, even without the support of a traditional employer-sponsored plan.

Overall, the portability feature of defined contribution plans provides employees with the freedom to take their retirement savings with them, regardless of their employment status. This flexibility enhances financial continuity, simplifies management, and allows employees to make informed choices about their retirement investments.

Risk Management

Risk management is an important consideration for companies when choosing retirement benefit options, and defined contribution plans offer certain advantages in this area. These plans allow both employers and employees to manage and mitigate certain risks associated with retirement savings.

One key risk that defined contribution plans address is investment risk. With these plans, employees bear the investment risk, as they have the responsibility to manage their own retirement savings and make investment decisions within the provided options. This shift of investment risk from the employer to the employee allows companies to mitigate their exposure to market volatility and fluctuations.

Furthermore, defined contribution plans provide employees with a range of investment options to choose from. This diversification of investment options helps mitigate the risk of having all retirement savings tied to a single investment. Employees can allocate their contributions across different assets, such as stocks, bonds, and mutual funds, reducing the impact of poor performance in one particular investment.

Additionally, defined contribution plans offer transparency to employees regarding their retirement savings. Employees receive regular statements and updates on the value of their accounts, giving them insight into the progress of their investments. This transparency helps individuals assess their financial situation and adjust their saving and investment strategies as needed, contributing to better risk management and planning.

Another risk that defined contribution plans address is longevity risk. In traditional pension plans, the employer bears the risk of the employee living longer than anticipated, which can increase the cost of providing retirement benefits. In defined contribution plans, the retirement benefit is based on the accumulated savings and investment returns, allowing employees to manage their own longevity risk by saving and investing accordingly.

Furthermore, defined contribution plans offer employees the option to contribute more to their retirement savings to compensate for any potential future shortfall. Employees can increase their contributions or take advantage of catch-up contributions if they are nearing retirement age, providing an additional layer of risk management by actively addressing their retirement needs.

Overall, defined contribution plans provide a framework for both employers and employees to manage various risks associated with retirement savings. By shifting investment risk, providing diversification options, offering transparency, and empowering employees to stay proactive in their financial planning, these plans equip individuals with the tools they need to effectively manage and mitigate risk throughout their retirement journey.

Conclusion

Defined contribution plans have emerged as a popular choice for companies seeking to provide retirement benefits for their employees. These plans offer numerous advantages that make them appealing options for businesses of all sizes.

The ability to control costs is a significant factor in why companies choose defined contribution plans. With the predetermined contribution structure, businesses can budget and plan for their retirement benefit expenses effectively. Additionally, the flexibility to set contribution limits and the availability of matching options allow companies to manage their financial obligations while still offering valuable retirement benefits.

Employee flexibility and choice are also compelling reasons for companies to opt for defined contribution plans. These plans empower employees to take an active role in their retirement savings, allowing them to contribute based on their individual financial situations and goals. The range of investment options and the ability to make investment changes provide employees with the freedom to tailor their retirement portfolio to their unique preferences and risk tolerance.

The potential tax advantages associated with defined contribution plans further contribute to their appeal. Employees can benefit from tax-deferred contributions and investment growth, reducing their current tax liability and potentially increasing their take-home pay. Employers, on the other hand, may enjoy tax deductions on their contributions, offering valuable tax benefits for the business.

The ease of administration and the portability of defined contribution plans are additional reasons why companies choose this retirement benefit option. The streamlined administrative process, combined with online tools and plan administrators, simplifies the management of the plans, reducing the administrative burden for employers. The ability to transfer retirement savings when changing jobs provides employees with financial continuity and the freedom to choose the most suitable plan for their needs.

Risk management is also a significant advantage of defined contribution plans. With the burden of investment risk shifted to employees, companies can mitigate their exposure to market volatility. Employees, in turn, can diversify their investments and actively manage their retirement savings to address longevity and investment risks.

In conclusion, defined contribution plans offer companies a range of benefits, including cost control, employee flexibility and choice, potential tax advantages, ease of administration, portability, and risk management. By understanding these advantages, companies can make informed choices in providing retirement benefits that align with their financial goals and meet the needs of their employees.