Home>Finance>How Can I Buy Things Online Without A Credit Card

Finance

How Can I Buy Things Online Without A Credit Card

Published: November 5, 2023

Learn how to make online purchases without a credit card. Explore alternative financing options and find the best method to buy items online without relying on traditional credit cards.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

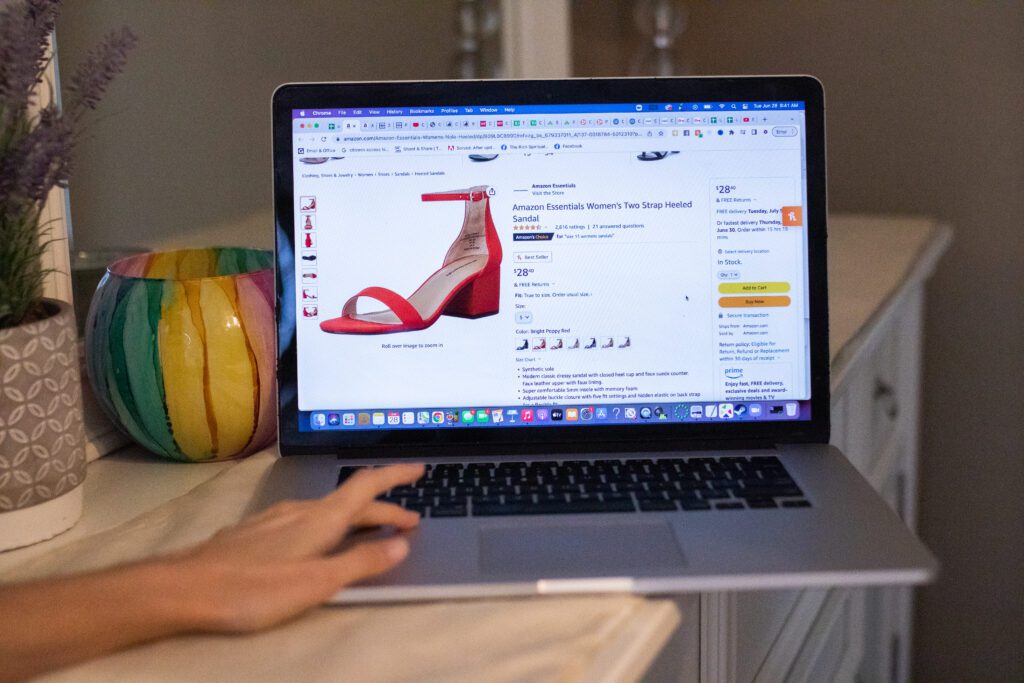

Online shopping has revolutionized the way we purchase goods and services. With just a few clicks, you can have items delivered to your doorstep without ever leaving the comfort of your home. However, many people are hesitant to make online purchases due to concerns about sharing their credit card information.

The good news is that there are several alternative payment methods available for those who do not have a credit card or prefer not to use one online. In this article, we will explore seven options that allow you to buy things online without a credit card.

Whether you are cautious about sharing your personal and financial information online, are unable to qualify for a credit card, or simply prefer to use alternative forms of payment, the options outlined here will enable you to shop online with ease and peace of mind.

From debit cards to digital wallets and even gift cards, there are various ways to make secure and convenient online purchases without relying on a credit card. Let’s dive into the details of each option to help you find the best alternative payment method that suits your needs.

Option 1: Debit Cards

Debit cards are a popular alternative to credit cards for online shopping. With a debit card, you can make purchases using the funds available in your bank account.

Using a debit card for online transactions is simple. Just enter your card details, including the card number, expiration date, and security code, when prompted at the checkout. Some online retailers may also ask for the billing address associated with the card for added security.

One advantage of using a debit card is that you are spending your own money, so there is no need to worry about accumulating debt or paying interest. Additionally, many banks offer fraud protection services for debit card transactions, providing an added layer of security.

However, it is important to keep in mind that using a debit card for online shopping means that the funds are immediately deducted from your bank account. This may result in an insufficient funds situation if you do not have enough money in your account. Furthermore, if there is any unauthorized activity on your debit card, it may take longer to resolve compared to a credit card dispute.

Before using your debit card for online purchases, it is advisable to review your bank’s policy on liability for unauthorized transactions and any associated fees. Additionally, ensure that your debit card is affiliated with a major card network (such as Visa, Mastercard, or American Express) so that it can be used for online transactions.

Debit cards provide a convenient and widely accepted method of payment for online shopping, making them an excellent alternative to credit cards. Consider using a debit card for your next online purchase to enjoy hassle-free and secure transactions.

Option 2: Prepaid Cards

If you prefer not to use a debit card or credit card for online purchases, prepaid cards offer an excellent alternative. These cards, often available from major card issuers, can be loaded with a specific amount of money and used just like a regular credit or debit card.

Prepaid cards are convenient because they are not linked to your bank account or credit history. You can purchase them at various retail locations or online and load them with the desired amount of funds. Some prepaid cards may also offer the option of reloading them with more money when needed, giving you flexibility and control over your spending.

When using a prepaid card for online shopping, you will typically need to register the card on the issuer’s website and provide your personal information. This step adds an extra layer of security and helps protect against unauthorized use.

It’s essential to note that prepaid cards come with certain fees, including activation fees, monthly fees, and transaction fees. Be sure to read the terms and conditions carefully before purchasing a prepaid card to understand the associated costs.

Additionally, not all prepaid cards may be accepted by every online retailer. Before making a purchase, verify that the website accepts prepaid cards as a form of payment.

Prepaid cards are a great option if you want to control your spending or if you prefer not to share your bank account or credit card information online. They provide a secure and convenient method for making online purchases without the need for a traditional credit card.

Option 3: Digital Wallets

Digital wallets have gained popularity as a convenient and secure way to make online purchases without relying on a credit card. Also known as e-wallets or mobile wallets, these digital payment platforms allow users to store their payment information securely and make transactions with just a few taps on their smartphones or other devices.

To use a digital wallet for online shopping, you typically need to download the wallet application onto your smartphone and link it to your bank account, debit card, or credit card. Some popular digital wallets include PayPal, Apple Pay, Google Pay, and Samsung Pay.

When making a purchase, you can select the digital wallet as your payment option at the checkout and authorize the transaction using your fingerprint, facial recognition, or a PIN. The advantage of using a digital wallet is that it adds an extra layer of security since your payment information is not directly shared with the merchant.

Many digital wallets also offer buyer protection and the ability to dispute transactions if there are any issues with the purchase. Additionally, some wallets provide loyalty rewards programs or exclusive discounts when using their platform for online shopping.

One potential drawback of using digital wallets is that not all online retailers accept them as a payment option. However, the number of merchants accepting digital wallet payments is growing each day, making it more accessible and convenient for online shoppers.

Overall, digital wallets offer a secure and user-friendly way to make online purchases without the need to enter credit card information. With the wide range of options available, you can choose the digital wallet that best suits your needs and start enjoying the benefits of effortless online transactions.

Option 4: Bank Transfers

Bank transfers provide a direct and secure method for making online purchases without the need for a credit card. With this option, you can transfer funds directly from your bank account to the merchant’s account.

To initiate a bank transfer, you will typically need the merchant’s bank account details, including their account number and routing number. This information is usually provided during the online checkout process. Once you have the necessary details, you can log in to your online banking portal or use a mobile banking app to initiate the transfer.

One advantage of using bank transfers is that they are often free of charge or involve minimal fees, depending on your bank’s policies. It is important to check with your bank regarding any potential fees or limitations associated with online transfers.

While bank transfers are a secure way to make payments, it’s essential to ensure that you are transacting with a reputable merchant. This is particularly true if you are not using a secure payment gateway provided by the merchant but rather manually entering their bank details.

Keep in mind that bank transfers may take longer to process compared to other payment methods. It can take several business days for the funds to reflect in the merchant’s account, so plan your purchases accordingly to avoid any delays.

Bank transfers are a reliable and straightforward option for online shopping, allowing you to make purchases directly from your bank account without the need for a credit card. Just ensure that you have the necessary funds available and verify the merchant’s bank details to complete the transaction securely.

Option 5: Payment Systems

Payment systems are third-party platforms that enable secure online transactions without the need for a credit card. These systems act as intermediaries, facilitating the transfer of funds between the buyer and the seller.

One popular payment system is PayPal, which allows users to link their bank accounts or credit cards to their PayPal account. When making a purchase, you can select the PayPal option at checkout and log in to your PayPal account to authorize the transaction. The funds are then transferred from your linked payment source to the merchant.

Payment systems like PayPal offer added security as they act as a buffer between your financial information and the merchant. Instead of directly sharing your credit card details with the seller, you provide your information to the payment system, minimizing the risk of your financial information being compromised.

In addition to PayPal, there are various other payment systems available, such as Stripe, Venmo, and Square. Each system may have its own features, benefits, and acceptance among online merchants, so it’s important to ensure the system you choose is widely accepted and suits your needs.

While payment systems offer convenience and security, it is worth noting that some may charge transaction fees or have certain limitations and restrictions. Therefore, it’s important to review the terms and conditions of the payment system you choose to understand any associated costs.

Payment systems are a popular alternative payment method for online shopping, allowing you to make purchases without a credit card. They provide an additional layer of security and offer a convenient way to manage your online transactions.

Option 6: Online Platforms with Alternative Payment Methods

Many online platforms and marketplaces offer alternative payment methods to accommodate users who do not have a credit card or prefer not to use one. These platforms understand the need for diverse payment options and aim to make online shopping accessible to a wider audience.

One example of such a platform is Amazon, which offers various payment methods, including Amazon Pay. With Amazon Pay, users can utilize their Amazon account to make online purchases on third-party websites that accept this payment method. This eliminates the need to enter credit card information for each transaction.

Similarly, other e-commerce platforms may offer their own payment systems or integrate with popular digital wallets, allowing users to make purchases using the funds in their wallet accounts. This convenient feature eliminates the need for a credit card and provides users with more flexibility in their payment options.

Additionally, some online platforms may offer buy-now-pay-later options, where customers can split their payments into installments or delay the payment for a certain period. These options allow users to make purchases without the immediate need for a credit card and provide more financial flexibility.

Before making a purchase on an online platform, it’s important to explore the available payment options and choose the one that aligns with your preferences and needs. Check the platform’s website or contact their customer service to inquire about the alternative payment methods they offer.

Online platforms with alternative payment methods make it easier for individuals without credit cards to engage in online shopping. With the availability of various payment options, these platforms ensure that everyone can enjoy the convenience of shopping online, regardless of their access to traditional payment methods.

Option 7: Gift Cards

Gift cards are a versatile and popular option for online shopping without the need for a credit card. They are essentially prepaid cards that can be purchased in various denominations and used to make purchases on specific online platforms or with specific retailers.

Gift cards can be acquired from retailers, supermarkets, or online platforms, making them easily accessible. They can be used to buy a wide range of items, including clothing, electronics, books, and more, depending on the specific store or platform they are linked to.

Using a gift card for online shopping is simple. When making a purchase, you enter the gift card code or number at the checkout page. The purchase amount is deducted from the balance of the gift card, allowing you to complete the transaction without the need for a credit card.

One advantage of using gift cards is that they offer a sense of financial security. Since the card has a predefined value, you can control your spending and avoid accumulating debt. It also eliminates the need to share sensitive financial information online, providing an additional layer of privacy and security.

However, it’s important to note that gift cards are typically limited to a specific retailer or online platform. Before purchasing a gift card, ensure that it can be used at the desired online store or platform. Additionally, gift cards may have expiration dates or certain restrictions, so be sure to read the terms and conditions associated with the card.

If you receive a gift card as a present, it provides you with the opportunity to explore new online retailers, try out new products, or purchase items you’ve been eyeing without the need for a credit card.

Gift cards serve as a convenient and secure option for online shopping without the need for a credit card. They make great gifts and allow recipients to enjoy a personalized shopping experience while maintaining control over their spending.

Conclusion

Shopping online without a credit card is not only possible but also becoming increasingly accessible with the wide range of alternative payment methods available. Whether you prefer to avoid using credit cards for security reasons, do not qualify for one, or simply want more flexibility in your payment options, there are several solutions to meet your needs.

Debit cards offer a convenient way to make online purchases by utilizing the funds available in your bank account. Prepaid cards provide a prepaid option, allowing you to load a specific amount of money onto the card for online transactions. Digital wallets offer a secure and streamlined method of payment where you can link your bank account or cards to a mobile application and make purchases with a few taps.

Bank transfers allow you to transfer funds directly from your bank account to the merchant, while payment systems act as intermediaries to securely facilitate transactions. Online platforms often offer alternative payment methods, such as their payment systems or integration with popular e-wallets, making the checkout process more versatile. Lastly, gift cards provide a prepaid solution for online shopping, offering convenience and financial security.

Each of these options comes with its own benefits and considerations, so it’s important to choose the method that best aligns with your preferences, needs, and the specific online platforms or retailers you frequently shop with.

By exploring these alternative payment methods, you can confidently shop online without a credit card and enjoy the convenience and security of e-commerce. Whether you value privacy and control over your spending or simply prefer to diversify your payment options, these alternatives empower you to participate in the digital marketplace with ease.

Remember to prioritize security, read the terms and conditions, and verify the acceptance of your chosen method by the online platform or retailer. By doing so, you can experience the joy of online shopping while maintaining peace of mind.