Home>Finance>Where Does Depreciation Expense Go On A Balance Sheet

Finance

Where Does Depreciation Expense Go On A Balance Sheet

Modified: December 30, 2023

Discover the role of depreciation expense in a balance sheet and its impact on finance. Gain insights into where depreciation expense is recorded with our comprehensive guide.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of finance! In this article, we will be exploring the topic of depreciation expense and its placement on a balance sheet. Whether you are a seasoned investor or just beginning your journey into the world of finance, understanding how depreciation expense affects financial statements is crucial for making informed decisions.

Depreciation expense is an accounting method used to allocate the cost of an asset over its useful life. It is a non-cash expense that reflects the decrease in value of an asset due to wear and tear, obsolescence, or age. While depreciation expense is not an out-of-pocket expense, it plays a vital role in accurately reflecting the financial health of a company.

To comprehend the implications of depreciation expense on a balance sheet, it is essential to have a clear understanding of the purpose and structure of the balance sheet itself. The balance sheet is one of the three primary financial statements used to evaluate a company’s financial position.

What is Depreciation Expense?

Depreciation expense is an accounting concept that represents the systematic allocation of the cost of a tangible asset over its useful life. It accounts for the wear and tear, obsolescence, or deterioration of an asset as it is used in the operations of a business.

Assets such as buildings, machinery, vehicles, and equipment are long-term investments for a company. However, these assets do not last forever. Just like any other object, they have a limited lifespan. Depreciation expense allows a company to spread out the cost of these assets over their useful life.

It is important to note that depreciation expense is a non-cash expense. This means that it does not involve an actual outflow of cash. Instead, it is a way of allocating the initial cost of the asset over its useful life to reflect its decrease in value. This systematic allocation of cost helps to match expenses with the revenue generated by the asset over time.

There are various methods used to calculate depreciation expense, including straight-line depreciation, accelerated depreciation, and units-of-production depreciation. Each method has its own set of rules and assumptions, and the choice of method depends on the nature of the asset and industry practices.

Depreciation expense is not limited to physical assets but can also be applied to intangible assets such as patents, copyrights, and trademarks. In the case of intangible assets, the term “amortization” is used instead of “depreciation.”

Now that we have covered the basics of depreciation expense, let’s delve into the purpose it serves in the financial statements of a company.

Purpose of Depreciation Expense

The purpose of depreciation expense goes beyond just reflecting the decrease in value of an asset. It serves several important functions in the financial statements of a company. Let’s explore these purposes:

- Accurate Financial Reporting: Providing an accurate representation of a company’s financial position is one of the primary purposes of depreciation expense. By allocating the cost of an asset over its useful life, depreciation expense helps to accurately reflect the value of the asset on the balance sheet. This ensures that the financial statements present a true and fair view of the company’s assets and liabilities.

- Matching Principle: Depreciation expense plays a crucial role in adhering to the matching principle in accounting. The matching principle states that expenses should be recognized in the same period as the revenues they help generate. By spreading out the cost of an asset over its useful life, depreciation expense allows for the matching of the expense with the revenue generated by the asset. This creates a more accurate representation of the company’s profitability in each accounting period.

- Cash Flow Management: Although depreciation expense is a non-cash expense, it indirectly impacts a company’s cash flow. By recognizing depreciation expense, a company can allocate funds for the future replacement or repair of assets. This ensures that the company can continue its operations smoothly and avoids sudden cash outflows when an asset needs to be replaced.

- Tax Deduction: Depreciation expense also has important tax implications. In many jurisdictions, companies are allowed to deduct depreciation expense from their taxable income. This reduces the amount of tax a company needs to pay. By taking advantage of depreciation expense, companies can reduce their tax liability and increase their cash flow.

By understanding the purpose of depreciation expense, investors, creditors, and stakeholders can gain insights into a company’s financial health, operational efficiency, and future cash flow management. Depreciation expense is a critical component of financial analysis and decision-making processes.

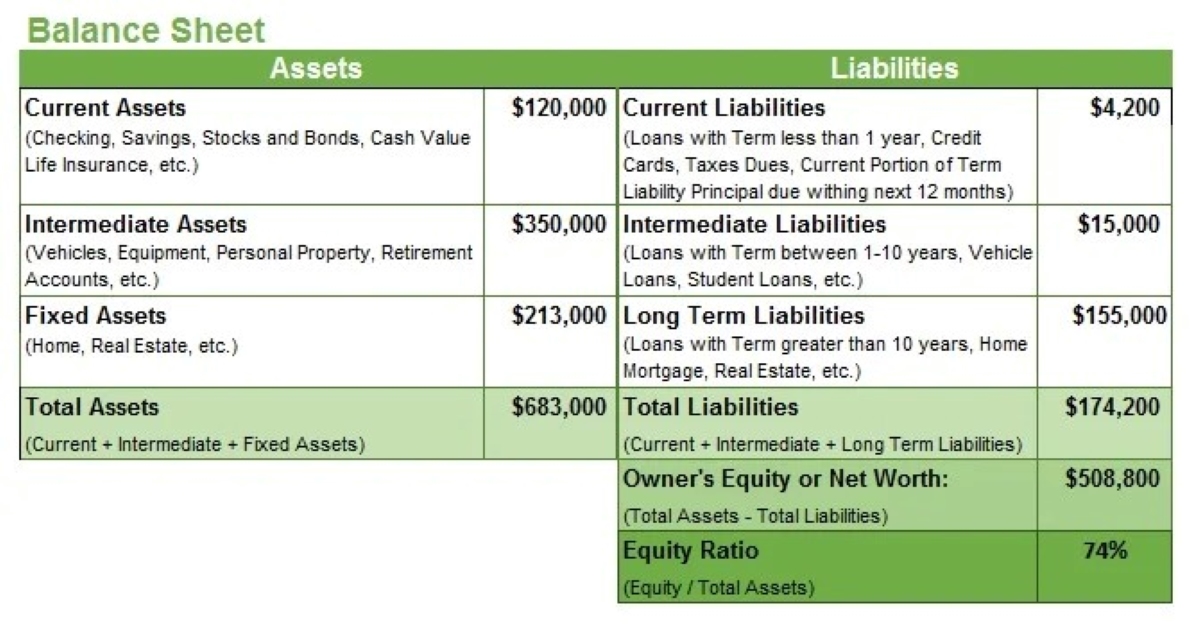

Understanding the Balance Sheet

The balance sheet is a financial statement that provides a snapshot of a company’s financial position at a specific point in time. It is composed of three main sections: assets, liabilities, and shareholders’ equity. Understanding the components of a balance sheet is essential for comprehending the placement of depreciation expense.

Assets: Assets are the resources owned by a company that have economic value and can be used to generate future benefits. They are classified into current assets and non-current assets. Current assets include items such as cash, accounts receivable, and inventory. Non-current assets, also known as long-term assets, include things like property, plant, and equipment, as well as intangible assets.

Liabilities: Liabilities are the obligations of a company to repay existing debts or fulfill other obligations. They are divided into current liabilities and long-term liabilities. Current liabilities include items such as accounts payable and short-term loans. Long-term liabilities consist of long-term loans, bonds, and other obligations that are not due within the next year.

Shareholders’ Equity: Shareholders’ equity represents the residual interest in the assets of a company after deducting liabilities. It includes the capital invested by shareholders and retained earnings accumulated over time. Shareholders’ equity is also known as net worth or book value.

On a balance sheet, assets are listed first, followed by liabilities, and then shareholders’ equity. This order reflects the basic accounting equation: Assets = Liabilities + Shareholders’ Equity. The balance sheet provides a snapshot of how a company’s assets are financed through liabilities and shareholders’ equity.

Now that we have a better understanding of the balance sheet, let’s explore where depreciation expense fits into this financial statement.

Placement of Depreciation Expense on the Balance Sheet

Depreciation expense itself does not appear as a separate line item on the balance sheet. Instead, it affects the value of the asset it is allocated to and subsequently impacts the overall financial position of the company. Let’s explore how depreciation expense is reflected on the balance sheet:

Accumulated Depreciation: Depreciation expense is accumulated over the years and is recorded in a separate account called “Accumulated Depreciation.” This account is a contra asset account, meaning it is subtracted from the related asset’s carrying value. Accumulated Depreciation represents the total amount of depreciation expense charged against an asset since its acquisition. It is classified as a negative asset and is reported directly below the related asset on the balance sheet.

Net Book Value: The net book value of an asset is calculated by subtracting the accumulated depreciation from the asset’s original cost. It represents the remaining value of the asset after accounting for depreciation. The net book value is also referred to as the carrying value or the book value of the asset. It is listed on the balance sheet under the respective asset category.

By including accumulated depreciation in the calculation of an asset’s value, the balance sheet provides a more accurate representation of the asset’s current worth. This reflects the fact that the asset has been utilized and has experienced a decrease in value over time due to depreciation.

It is important to note that not all assets are subject to depreciation. Some assets, such as land or certain types of investments, may have an indefinite useful life and are not depreciated. These assets are reported at their original cost on the balance sheet and do not have accumulated depreciation.

The placement of depreciation expense on the balance sheet through accumulated depreciation and net book value ensures transparency and accuracy in reporting a company’s assets. It allows users of the financial statements to understand the impact of depreciation on the value of the assets and assess the overall financial health and efficiency of the company.

Impact of Depreciation Expense on Financial Statements

Depreciation expense has a significant impact on a company’s financial statements, affecting both the balance sheet and the income statement. Understanding this impact is crucial for evaluating a company’s financial performance and making informed decisions. Let’s explore the effects of depreciation expense on the financial statements:

Balance Sheet: Depreciation expense has a direct impact on the balance sheet through the following components:

- Assets: Accumulated Depreciation, as discussed earlier, is a contra asset account that reduces the value of the related asset. This decrease in the carrying value of the asset is reflected on the balance sheet, reducing the total value of the company’s assets.

- Shareholders’ Equity: As the value of the assets decreases due to depreciation, the retained earnings portion of shareholders’ equity also decreases. This reduction is a result of the matching principle, whereby the depreciation expense is recognized as an expense, reducing the overall profitability of the company.

Income Statement: Depreciation expense also impacts the income statement in the following ways:

- Operating Expenses: Depreciation expense is included as part of the operating expenses on the income statement. It is subtracted from the revenue earned from operations to arrive at the operating income or operating profit. By recognizing depreciation as an expense, it accurately reflects the cost of utilizing the asset in the production of goods or services.

- Net Income: Depreciation expense directly affects the net income of a company. Since it is recognized as an expense, it reduces the net income. A lower net income may impact various financial ratios and can influence investor perceptions of the company’s profitability.

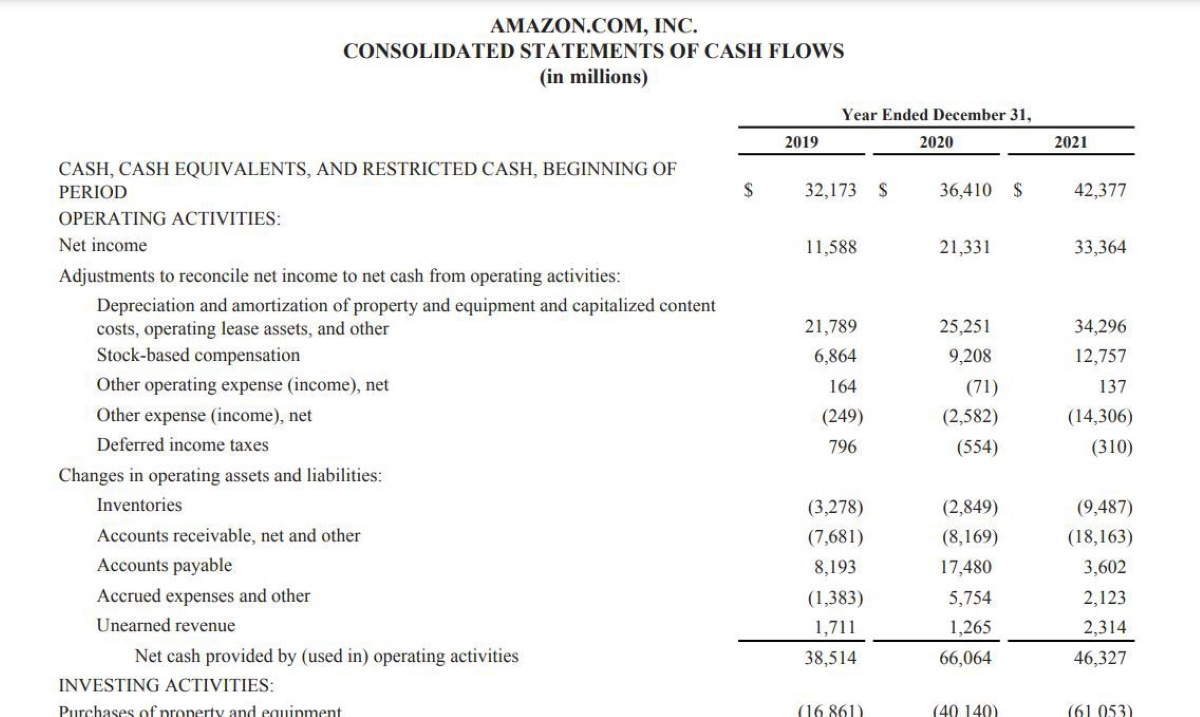

It is important to note that while depreciation expense impacts the financial statements, it is not a cash outflow for the company. This allows for the separation of non-cash expenses from the company’s cash flow statement, providing a more accurate picture of the cash inflows and outflows.

By considering the impact of depreciation expense on the financial statements, analysts, investors, and stakeholders can gain insights into a company’s profitability, asset values, and overall financial performance. It helps assess the sustainability of the company’s operations and its ability to generate future cash flows.

Example of Depreciation Expense on a Balance Sheet

Let’s take a look at an example to better understand how depreciation expense is presented on a balance sheet:

Assume Company XYZ purchases a piece of machinery for $100,000. The machinery has an estimated useful life of 10 years and no salvage value. Using the straight-line depreciation method, the annual depreciation expense would be $10,000 ($100,000 divided by 10 years).

After the first year of use, Company XYZ’s balance sheet would reflect the following:

- Assets: The machinery would be listed on the balance sheet under the category of non-current assets with a value of $100,000.

- Accumulated Depreciation: Accumulated Depreciation is a contra asset account that represents the total depreciation expense recorded over time. After the first year, the accumulated depreciation would be $10,000.

- Net Book Value: The net book value of the machinery can be calculated by subtracting the accumulated depreciation from the original cost. In this case, it would be $90,000 ($100,000 – $10,000).

The impact of the depreciation expense on the income statement would be as follows:

- Operating Expenses: The $10,000 depreciation expense would be included in the operating expenses on the income statement, reducing the company’s operating income.

- Net Income: The net income would also be affected by the depreciation expense. As the expense is subtracted from the operating income, it results in a lower net income for the company.

Each subsequent year, the company would record an additional $10,000 in depreciation expense and update the balance sheet accordingly. Over time, the accumulated depreciation would continue to increase, reducing the net book value of the machinery.

This example demonstrates how depreciation expense is reflected on a balance sheet and how it impacts the financial statements. It allows stakeholders to track the decrease in value of the asset and accurately assess the financial health and performance of the company.

Conclusion

Depreciation expense plays a significant role in the financial statements of a company, particularly on the balance sheet. It reflects the decrease in value of assets over time and ensures the accurate portrayal of a company’s financial position. By understanding the placement and impact of depreciation expense, investors, creditors, and stakeholders can make informed decisions regarding the company’s financial health and future prospects.

Depreciation expense is crucial for accurate financial reporting, adhering to the matching principle, managing cash flow, and optimizing tax deductions. It is reflected on the balance sheet through the contra asset account of Accumulated Depreciation and the net book value of assets. This provides transparency in reporting the true value of assets and their contribution to the company’s overall financial position.

Furthermore, depreciation expense impacts the income statement by reducing operating income and net income. While it is a non-cash expense, it has significant implications for a company’s profitability and financial performance.

In conclusion, a thorough understanding of depreciation expense and its placement on the balance sheet is essential for evaluating a company’s financial statements and assessing its long-term viability. It enables stakeholders to gauge the efficiency of asset utilization, predict future cash flows, and make informed investment decisions. Depreciation expense is a vital component of financial analysis, providing valuable insights into the underlying value and performance of a company.