Finance

How Do I Buy Corporate Bonds Online

Published: October 12, 2023

Looking to invest in corporate bonds online? Discover the steps to buy corporate bonds conveniently and securely through our finance platform.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

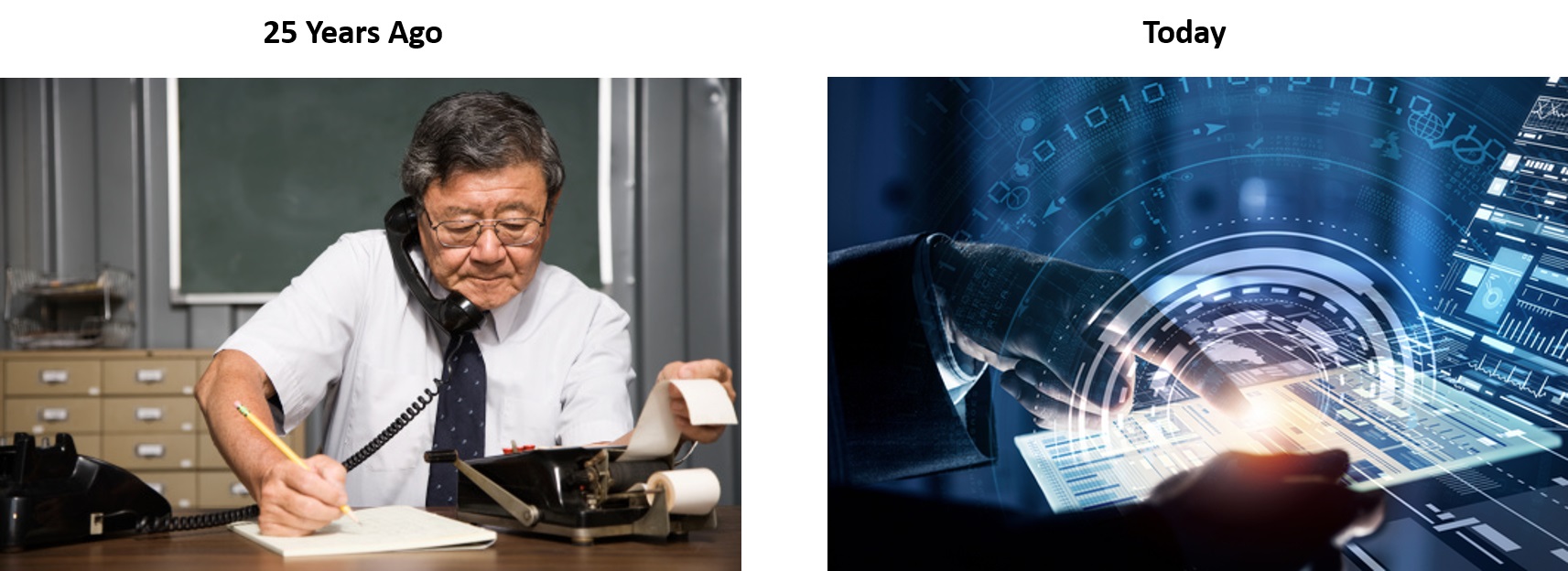

Welcome to the world of corporate bonds! These financial instruments provide investors with the opportunity to lend money to companies in exchange for regular interest payments and the return of their principal when the bonds mature. Investing in corporate bonds can be a lucrative strategy for generating income and diversifying a portfolio. In the past, buying and selling corporate bonds required working with a broker and conducting transactions over the phone or in person. However, with the advent of online investing, individual investors can now easily buy and sell corporate bonds from the comfort of their own homes.

In this article, we will explore the process of buying corporate bonds online, including the benefits, considerations, and steps involved. Whether you are a seasoned investor or new to the world of bonds, this guide will help you navigate the online marketplace and make informed decisions about your investments.

Before diving into the details of buying corporate bonds online, it is important to have a basic understanding of what corporate bonds are and how they work. Corporate bonds are debt instruments issued by companies to raise capital for various purposes, such as financing projects, expanding operations, or refinancing existing debt. When you buy a corporate bond, you are essentially lending money to the issuing company for a fixed period of time, typically ranging from a few months to several years. In return, the company pays you periodic interest payments, known as coupon payments, and promises to repay the principal amount when the bond matures.

Now that we have covered the basics of corporate bonds, let’s explore the benefits of buying corporate bonds online.

Understanding Corporate Bonds

To successfully navigate the world of corporate bonds, it is crucial to have a solid understanding of how these financial instruments work. When a company needs to raise capital, it has the option to issue corporate bonds to investors. These bonds are essentially loans made by investors to the company, which agrees to pay interest on the borrowed amount and repay the principal at maturity.

Corporate bonds typically have a predetermined lifespan known as the maturity date. This can range from a few months to several years, and during this time, the investor receives regular interest payments. The interest rate, also known as the coupon rate, is determined at the time of issuance and remains fixed throughout the bond’s lifespan. The coupon payments provide investors with a steady stream of income.

One important aspect of corporate bonds is their credit quality, which indicates the likelihood of the issuing company defaulting on its payment obligations. Credit rating agencies assess the creditworthiness of companies and assign ratings based on their evaluation. These ratings range from AAA (highest quality) to D (default). Investors should consider the credit rating of a company before investing in its bonds, as higher-rated bonds generally offer lower interest rates but are considered less risky.

Corporate bonds also come with different types of structures, such as callable and convertible bonds. Callable bonds give the company the right to redeem the bond before its maturity date, while convertible bonds can be converted into a predetermined number of the company’s shares. Understanding these various structures will help investors make informed decisions based on their investment goals and risk appetite.

In addition to understanding the fundamentals of corporate bonds, investors should also be aware of the unique risks associated with these investments. Market factors, such as interest rate fluctuations and changes in the issuer’s financial health, can impact bond prices. It’s important to always consider these risks and conduct thorough research before investing in any corporate bond.

Now that we have a solid foundation in understanding corporate bonds, let’s explore the benefits of buying these bonds online.

Benefits of Buying Corporate Bonds Online

The internet has revolutionized the way we invest, making it easier and more convenient to buy and sell financial instruments, including corporate bonds. Here are some of the key benefits of buying corporate bonds online:

1. Convenience: Online platforms offer investors the convenience of buying corporate bonds from the comfort of their own homes. Gone are the days of having to schedule appointments with brokers or visit physical brokerage offices. With just a few clicks, investors can access a wide range of corporate bonds and execute transactions at their own convenience.

2. Access to a Variety of Bonds: Online platforms provide investors with access to a vast selection of corporate bonds from different issuers, industries, and regions. This allows investors to diversify their portfolios and tailor their bond holdings to their specific investment objectives and risk tolerance.

3. Cost Efficiency: Buying corporate bonds online often comes with lower fees compared to traditional brokerage services. Online platforms typically have reduced overhead costs, which are passed on to investors in the form of lower transaction costs. This can translate into savings for investors, especially for those who regularly buy and sell bonds.

4. Transparency: Online platforms provide investors with transparency in terms of bond prices, yields, and historical performance. This enables investors to compare different bonds, evaluate the risk-return profile, and make informed investment decisions. Additionally, online platforms often provide access to research tools and educational resources to assist investors in their decision-making process.

5. Enhanced Speed and Efficiency: Buying corporate bonds online allows for faster and more efficient execution of transactions. Investors can quickly review available bonds, place orders, and receive confirmation almost instantaneously. This speed and efficiency can be crucial, especially in fast-moving markets where bond prices can change rapidly.

6. Monitoring and Management: Online platforms provide investors with real-time access to their bond holdings, allowing for easy monitoring and management of their investments. Investors can track their portfolio performance, view coupon payments, and make adjustments as needed. This level of control and visibility enables investors to stay on top of their investments and make timely decisions.

7. Flexibility: Online platforms offer investors the flexibility to buy and sell corporate bonds at their own pace. Investors can choose to invest in short-term or long-term bonds, depending on their investment objectives. Furthermore, online platforms often provide tools for setting up automated investment strategies, allowing investors to systematically build their bond portfolios over time.

In summary, buying corporate bonds online offers investors convenience, access to a wide range of bonds, cost efficiency, transparency, speed, and flexibility. With these advantages, it’s no wonder that more and more investors are turning to online platforms to invest in corporate bonds. In the next section, we will explore how to research and select the right corporate bonds for your portfolio.

Researching Corporate Bonds

Before investing in corporate bonds, it is important to conduct thorough research to identify bonds that align with your investment objectives and risk tolerance. Here are some key steps to consider when researching corporate bonds:

1. Understand the Issuer: Start by researching the issuing company to gain insight into its financial health, business model, and industry. Review the company’s financial statements, annual reports, and news articles to assess its performance, market position, and potential risks. It is crucial to evaluate the issuer’s creditworthiness and credit rating provided by reputable credit rating agencies.

2. Analyze Bond Structure and Terms: Examine the structure and terms of the bond, including its maturity date, coupon rate, and any special features it may have. Consider factors such as callability, which allows the issuer to redeem the bond before maturity, and convertibility, which allows the bond to be converted into shares of the company’s stock. Understanding these features will help you determine the potential returns and risks associated with the bond.

3. Evaluate Yield and Risk: Consider the yield-to-maturity (YTM) and yield-to-call (YTC) of the bond. These measures estimate the total return an investor can expect if the bond is held until maturity or called by the issuer. The YTM takes into account the price of the bond, its coupon payments, and the time left until maturity. Assess the risk of the bond by examining its credit rating, as well as external factors such as market conditions and industry trends.

4. Compare Bonds: Compare different bonds within the same sector or industry to identify the most favorable investment opportunities. Look at factors such as yield, credit rating, and maturity dates to evaluate the potential risk-return trade-off. Consider diversifying your bond portfolio by investing in bonds from multiple issuers and industries to spread the risk.

5. Utilize Online Research Tools: Many online brokerage platforms provide research tools and resources to assist investors in their bond research. Take advantage of these tools to access bond ratings, historical performance data, and market insights. Additionally, explore online financial news and publications for industry-specific information and expert analysis.

6. Consider Tax Implications: Understand the tax implications of investing in corporate bonds, as interest income from bonds is generally subject to taxes. Consult with a tax advisor or utilize online tax calculators to determine the impact of taxes on the bond’s overall returns.

Remember, thorough research is key to making informed investment decisions. Take the time to evaluate the issuer, assess the bond’s structure and terms, analyze yield and risk factors, and compare different bonds. Utilize the resources available through online brokerage platforms to enhance your research process. In the next section, we will discuss how to choose the right online brokerage for buying corporate bonds.

Choosing an Online Brokerage

When buying corporate bonds online, selecting the right online brokerage is crucial for a smooth and successful investing experience. Here are some factors to consider when choosing an online brokerage:

1. Reputation and Reliability: Choose a reputable and reliable online brokerage with a history of providing excellent customer service and secure transactions. Look for brokerage firms that are well-established and regulated by relevant financial authorities. Reading reviews and seeking recommendations from experienced investors can help in determining the reputation of a brokerage.

2. Bond Offering: Consider the variety and availability of corporate bonds offered by the online brokerage. A comprehensive selection of investment-grade and high-yield bonds from different issuers and industries provides opportunities for diversification. Ensure that the brokerage offers bonds with varying maturities and features to suit your investment objectives.

3. Research Tools and Resources: Evaluate the research tools and resources provided by the online brokerage. Look for platforms that offer comprehensive bond research, including access to credit ratings, issuer information, historical data, and market insights. These tools can assist in making informed decisions and identifying potential investment opportunities.

4. Cost and Fees: Compare the fees and costs associated with trading corporate bonds. Online brokerages may charge commissions, markups, or transaction fees for buying and selling bonds. Consider the cost structure and factor it into your investment strategy, especially if you plan to trade bonds frequently. Look for brokerages with competitive pricing and transparent fee structures.

5. User Experience and Platform Interface: Consider the user experience and ease of navigation offered by the online brokerage’s trading platform. A user-friendly interface can simplify the process of researching, buying, and tracking your corporate bond investments. The platform should provide real-time market data, order placement capabilities, and customizable portfolio tracking.

6. Customer Support: Assess the quality and availability of customer support provided by the online brokerage. Efficient and responsive customer support can be crucial when encountering any issues or needing assistance with transactions. Look for brokerages that offer multiple channels for customer support, such as phone, email, or live chat.

7. Additional Investment Options: Consider whether the online brokerage offers other investment options such as stocks, mutual funds, or exchange-traded funds (ETFs). Having a diverse range of investment options within the same brokerage can provide convenience and help in managing your overall investment portfolio.

By considering these factors, you can find an online brokerage that meets your specific requirements and aligns with your investment goals. Take the time to research and compare different brokerages to make an informed decision. Once you have chosen an online brokerage, the next step is to open an account, which we will explore in the next section.

Opening an Account

Once you have chosen an online brokerage to buy corporate bonds, the next step is to open an account. Opening an account is a straightforward process that typically involves the following steps:

1. Choose the Account Type: Determine the account type that best suits your needs. Most online brokerages offer individual accounts, joint accounts, retirement accounts (such as IRAs), and trust accounts. Carefully consider your investment goals and consult with a financial advisor if needed to select the appropriate account type.

2. Gather Required Documents: Prepare the necessary documents for the account opening process. This may include identification documents (such as a passport or driver’s license), proof of address, and Social Security or tax identification numbers. Ensure that you provide accurate and up-to-date information to comply with regulatory requirements.

3. Complete the Application: Fill out the online application form provided by the brokerage. The application typically asks for personal information, financial details, and investment preferences. Take your time to carefully review and accurately complete the application to avoid any delays in the account opening process.

4. Verification Process: Once you have submitted the application, the brokerage will verify your identity and conduct a Know Your Customer (KYC) process. This may involve providing additional documentation or answering security questions. The purpose of the verification process is to ensure compliance with legal and regulatory requirements.

5. Fund Your Account: After your account is approved, you will need to fund it to start buying corporate bonds. Online brokerages usually offer multiple funding options, such as electronic funds transfer (EFT), wire transfer, or linking your bank account. Follow the instructions provided by the brokerage to transfer funds into your account securely.

6. Familiarize Yourself with the Trading Platform: Once your account is funded, take some time to explore and familiarize yourself with the brokerage’s trading platform. Understand how to search for bonds, view pricing information, place orders, and track your investments. Many brokerages offer educational resources and tutorials to help you navigate their platform effectively.

7. Review Account Settings and Security Measures: Pay close attention to your account settings and security measures. Set up strong and unique passwords, enable two-factor authentication if available, and regularly monitor your account for any unauthorized activity. It is crucial to take proactive steps to protect your online brokerage account and safeguard your investments.

Opening an account with an online brokerage is a crucial step towards buying corporate bonds. By following these steps and providing the required information accurately, you can open an account smoothly and begin your journey as an online bond investor. In the next section, we will explore the process of placing an order to buy corporate bonds online.

Placing an Order

Once you have opened an account with an online brokerage, you are ready to start buying corporate bonds. Placing an order to buy bonds online typically involves the following steps:

1. Research the Bonds: Start by researching the corporate bonds you are interested in purchasing. Consider factors such as the issuer, credit rating, coupon rate, maturity date, and any special features. Evaluate the risk-return profile of each bond and determine which ones align with your investment goals and risk tolerance.

2. Find the Bonds on the Platform: Log in to your online brokerage account and navigate to the bond trading platform. Use the search tools and filters provided to find the specific bonds you want to purchase. The platform should provide detailed information about each bond, including its current price, yield, and any available trading volume.

3. Determine the Order Type: Decide on the type of order you want to place. Common order types include market orders, where the bond is bought at the prevailing market price, and limit orders, where you specify a maximum price you are willing to pay. Limit orders provide more control over the purchase price but may not be executed if the market price does not reach your specified limit.

4. Enter the Quantity: Enter the quantity of bonds you wish to purchase. Consider your desired investment amount and the minimum denominations allowed by the bond issuer. You can typically enter either the number of bonds or the total investment amount, depending on the brokerage’s order entry system.

5. Review and Confirm: Before finalizing your order, review all the details, including the bond information, order type, price, and quantity. Double-check that everything is accurate and ensure that the total cost of the order is within your available funds. Once you are satisfied, confirm the order.

6. Monitor Order Execution: After placing your order, monitor its execution status. Online brokerages usually provide real-time updates on the status of your order, including whether it has been partially or fully filled. You can track the progress of your order through the brokerage’s trading platform or by accessing your account’s order history.

7. Settlement and Ownership Confirmation: Once your order is completed, you will receive confirmation of the settlement and ownership of the purchased bonds. The bonds will be added to your account’s holdings, and you will start receiving interest payments and updates on the bond’s performance.

Keep in mind that the process of placing an order can vary slightly between different online brokerages. It is important to familiarize yourself with the specific order entry system and procedures of the brokerage you are using. If you have any questions or need assistance, reach out to the brokerage’s customer support team for guidance.

In the next section, we will explore how to effectively monitor your corporate bond investments after placing an order.

Monitoring Your Investments

Once you have purchased corporate bonds online, it is essential to monitor your investments to stay informed about their performance and make any necessary adjustments. Here are some key steps for effectively monitoring your corporate bond investments:

1. Regularly Review Bond Performance: Stay updated on the performance of your bonds by regularly reviewing their price movements, interest payments, and any credit rating changes. Online brokerage platforms often provide real-time price quotes, historical data, and performance charts to help you track your investments. Monitor for any significant changes that may affect the value or creditworthiness of your bonds.

2. Monitor Interest Payments: Keep track of the interest payments you receive from your corporate bonds. These payments are typically made at regular intervals, such as quarterly or semi-annually. Ensure that you are receiving the correct amount and that the payments are being deposited into your brokerage account as expected.

3. Stay Informed about Corporate News: Stay abreast of news and developments related to the companies whose bonds you own. This includes monitoring company financial reports, news releases, and industry news. Significant changes in the company’s financial health, management, or industry conditions can impact the overall performance and creditworthiness of the bonds.

4. Assess Market Conditions: Keep an eye on broader market conditions that may influence the performance of corporate bonds. Factors such as changes in interest rates, economic indicators, and geopolitical events can impact bond prices. Stay informed about market trends and consider their potential impact on your bond investments.

5. Reassess Investment Objectives: Periodically review your investment objectives and risk tolerance. Consider whether the current bond holdings align with your investment goals and if any adjustments need to be made. If your objectives have changed or your risk tolerance has shifted, you may need to reallocate your bond portfolio accordingly.

6. Consider Diversification: Evaluate the diversification of your bond portfolio. Spread your investments across different issuers, industries, and bond maturities to reduce concentration risk. Regularly assess the overall risk exposure and consider rebalancing your portfolio if needed.

7. Utilize Portfolio Tracking Tools: Take advantage of portfolio tracking tools provided by your online brokerage platform. These tools can help you monitor the performance of your bond investments, track interest payments, and calculate overall portfolio returns. Additionally, they may offer features such as alerts and customizable performance reports.

8. Seek Professional Advice if Needed: If you are uncertain about any aspects of monitoring your corporate bond investments, consider seeking advice from a financial advisor or bond specialist. They can offer guidance, review your portfolio, and provide insights tailored to your specific investment needs.

Remember, monitoring your corporate bond investments is an ongoing process. Regularly review your bond performance, stay informed about company and market developments, reassess your investment objectives, and ensure proper diversification. By actively monitoring your investments, you can make informed decisions and optimize your bond portfolio for your financial goals.

In the next section, we will explore the process of selling corporate bonds online.

Selling Corporate Bonds

At some point, you may decide to sell your corporate bonds to take profits, reallocate your portfolio, or respond to changes in market conditions. Selling corporate bonds online is a straightforward process that involves the following steps:

1. Assess Your Investment Strategy: Before selling your corporate bonds, reassess your investment strategy and objectives. Consider factors such as your desired returns, risk tolerance, and current market conditions. Determine if selling your bonds aligns with your overall investment goals.

2. Review Market Conditions: Stay informed about market conditions that may impact the value of your corporate bonds. Monitor interest rate changes, relevant economic indicators, and industry news. Assess whether current market conditions present favorable selling opportunities or potential risks to your bond investments.

3. Determine Selling Price: Evaluate the current market value of your bonds based on prevailing bond prices. Online brokerage platforms typically display real-time price quotes for the bonds you own. Consider the bond’s yield, credit rating, and any changes in market conditions since the time of purchase. Set a realistic selling price that reflects its current market value.

4. Place a Sell Order: Log in to your online brokerage account and locate the “Sell” or “Trade” section. Enter the details of the bond you wish to sell, including the quantity and selling price. Select the appropriate order type, such as a market order or a limit order, which allows you to specify a minimum selling price.

5. Review and Confirm: Double-check the order details to ensure accuracy. Take a moment to review the selling price, quantity, and any fees associated with the transaction. Confirm the order to execute the sale of your corporate bonds.

6. Monitor Order Execution: Once your sell order is placed, monitor its execution status. Online brokerages typically provide real-time updates on the status of your order, including whether it has been partially or fully filled. Keep track of the progress through the brokerage’s trading platform or by accessing your account’s order history.

7. Settlement and Proceeds: After the sale is completed, you will receive the proceeds from the transaction. The funds will be deposited into your brokerage account, where you can utilize them for further investments or withdraw them as needed. Verify the settlement and ensure the correct proceeds are credited to your account.

8. Evaluate Investment Alternatives: After selling your corporate bonds, evaluate alternative investment opportunities that align with your updated investment strategy. Consider factors such as risk, return potential, and diversification. Research different asset classes or other corporate bonds that may suit your objectives.

It’s important to note that before selling corporate bonds, carefully consider any potential tax implications, such as capital gains or losses. Seek guidance from a tax advisor to understand the tax consequences of selling your bonds.

By following these steps, you can effectively sell your corporate bonds online. Regularly review your investment strategy, stay informed about market conditions, and make informed decisions when adjusting your bond portfolio. In the next section, we will discuss important risks and considerations to keep in mind when investing in corporate bonds.

Risks and Considerations

While investing in corporate bonds can offer attractive returns, it is crucial to be aware of the risks and considerations associated with these investments. Here are some important factors to keep in mind:

1. Credit Risk: Corporate bonds are not risk-free. There is always the possibility that the issuing company may default on interest payments or fail to repay the principal amount at maturity. Assess the creditworthiness of the issuer by considering their credit rating and financial health. Higher-rated bonds generally have lower credit risk but may offer lower yields.

2. Interest Rate Risk: Corporate bond prices are sensitive to changes in interest rates. When interest rates rise, bond prices tend to decrease, and vice versa. This interest rate risk can impact the value of your bond holdings, particularly if you plan to sell them before maturity. Monitor interest rate movements and understand how they can affect your bond investments.

3. Market and Liquidity Risk: The corporate bond market can be subject to fluctuations and volatility. Market conditions, economic factors, and investor sentiment can impact bond prices and liquidity. In times of market stress, it may be challenging to sell bonds at desired prices. Be prepared to hold bonds until maturity or consider diversifying your portfolio to manage liquidity risk.

4. Inflation Risk: Inflation erodes the purchasing power of future interest payments and the principal value of bonds. If the rate of inflation exceeds the yield on your bonds, the real return after accounting for inflation may be negative. Consider the potential impact of inflation on your bond investments, particularly for long-term bonds.

5. Call and Redemption Risk: Callable bonds give the issuer the option to redeem the bonds before their maturity date. This introduces call risk, where the issuer may choose to call back the bonds when interest rates are lower, leaving investors with reinvestment challenges. Evaluate the call provisions of the bonds you own and understand the potential impact on your investment returns.

6. Diversification: Diversification is essential in managing risk. Spreading your bond investments across different issuers, industries, and bond maturities can help mitigate the impact of any single default or adverse event. Consider diversifying your bond portfolio to reduce concentration risk and improve overall risk-adjusted returns.

7. Tax Considerations: Understand the potential tax implications of investing in corporate bonds. Interest income from corporate bonds is generally subject to taxes. Research the tax rules in your jurisdiction and assess the impact of taxes on your investment returns. Consulting with a tax advisor can provide valuable guidance in managing tax obligations.

8. Brokerage Risk: When buying corporate bonds online, there is a risk associated with the brokerage platform itself. Ensure that you choose a reputable brokerage with a solid track record. Review safety measures, customer reviews, and the broker’s regulatory compliance to minimize this risk.

It is important to carefully consider these risks and factors before investing in corporate bonds. Conduct thorough research, diversify your portfolio, stay updated on market conditions, and consult with financial advisors when needed. By understanding and managing these risks, you can make informed investment decisions and enhance the potential for successful bond investing.

In the final section, we will conclude our discussion on buying corporate bonds online and summarize the key takeaways.

Conclusion

Buying corporate bonds online offers individual investors the opportunity to participate in the bond market and potentially earn attractive returns. It provides convenience, access to a variety of bonds, cost efficiency, transparency, speed, and flexibility. By choosing the right online brokerage, conducting thorough research, and effectively monitoring your investments, you can navigate the world of corporate bonds with confidence.

Understanding the basics of corporate bonds, such as their structure, credit ratings, and risks, is essential for making informed investment decisions. Researching and comparing bonds, utilizing online tools, and staying informed about market conditions are crucial steps in the process.

Choosing the right online brokerage involves considering factors such as reputation, bond offerings, research tools, cost and fees, user experience, and customer support. Opening an account, placing an order, and monitoring your investments can all be done conveniently through these platforms.

However, it is important to be aware of the risks and considerations associated with investing in corporate bonds. Credit risk, interest rate risk, inflation risk, call and redemption risk, and market volatility are factors to consider and manage. Diversification and tax considerations should also be taken into account.

In conclusion, buying corporate bonds online allows individual investors to access the bond market and potentially earn steady income. With proper research, monitoring, and risk management, investors can make informed decisions, build diversified portfolios, and achieve their investment objectives. Remember to regularly review and adjust your bond holdings based on changing market conditions and personal goals.

As with any investment, it is recommended to consult with a financial advisor or bond specialist to evaluate your specific financial situation and goals. With the right knowledge and tools, online investing in corporate bonds can be a rewarding endeavor for investors seeking to grow their wealth and generate consistent income over time.