Finance

How Do I Cancel My First Premier Credit Card

Published: October 24, 2023

Learn how to cancel your First Premier credit card and manage your finances effectively with our step-by-step guide.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

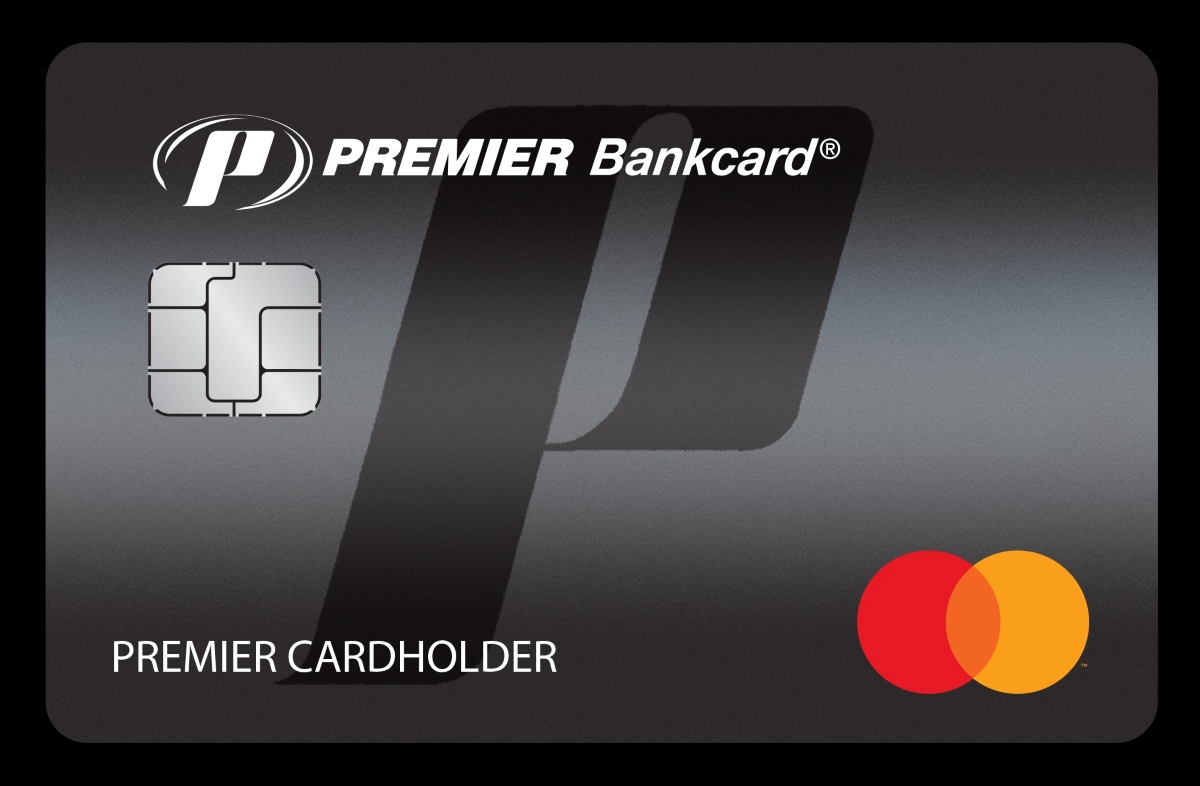

First Premier Credit Card is a popular choice among individuals looking to establish or rebuild their credit. With its wide acceptance and various benefits, this credit card has gained a significant following. However, there may come a time when you decide that it’s time to cancel your First Premier Credit Card. Whether you’re looking to switch to a different credit card or you simply no longer require its services, canceling your First Premier Credit Card can be a straightforward process.

In this article, we will guide you through the steps to cancel your First Premier Credit Card and provide you with important considerations to keep in mind before making this decision. We will also discuss alternative options that you may want to explore before completely canceling your card.

It is important to note that canceling a credit card can have both positive and negative effects on your credit score and financial standing. It’s crucial to make an informed decision based on your individual circumstances and financial goals. With that said, let’s explore the reasons for canceling your First Premier Credit Card and the steps you can take to do so.

Reasons to Cancel Your First Premier Credit Card

While First Premier Credit Card offers certain advantages, there may be several reasons why you might consider canceling your card:

- High Annual Fee: One of the main reasons individuals decide to cancel their First Premier Credit Card is the high annual fee associated with the card. If you find that the annual fee is outweighing the benefits and rewards you receive, it may be worth considering canceling the card.

- Interest Rates: First Premier Credit Card typically comes with high interest rates. If you consistently carry a balance on your credit card and find it difficult to manage the interest charges, canceling the card and seeking out a card with lower interest rates could save you money in the long run.

- Limited Rewards Program: First Premier Credit Card may not offer the rewards program you desire. If you find that you’re not earning significant rewards or the rewards program doesn’t align with your spending habits, it may be worth exploring other credit cards with more appealing rewards programs.

- Unsatisfactory Customer Service: If you’ve had negative experiences with First Premier Credit Card’s customer service, such as long wait times or unhelpful representatives, you might decide to cancel your card and seek out a credit card company known for its superior customer service.

It’s crucial to assess your personal financial situation and evaluate whether the benefits of the First Premier Credit Card outweigh the drawbacks. If you find that the reasons to cancel the card outweigh the reasons to keep it, it may be time to consider canceling and exploring alternative credit card options.

Steps to Cancel Your First Premier Credit Card

If you’ve made the decision to cancel your First Premier Credit Card, follow these steps to ensure a smooth and successful cancellation process:

- Review the Terms and Conditions: Before canceling your First Premier Credit Card, carefully review the terms and conditions of your card agreement. Take note of any outstanding balances, accrued interest, or fees that may need to be settled before canceling.

- Pay off Balances: If you have any outstanding balances on your First Premier Credit Card, it’s important to pay them off in full. This will help you avoid any additional interest charges or late fees.

- Contact Customer Service: Get in touch with First Premier Credit Card’s customer service to inform them of your decision to cancel. You can find the customer service contact information on the back of your credit card or on the First Premier Credit Card website.

- Follow Cancellation Instructions: When speaking with a customer service representative, they will guide you through the cancellation process. Follow their instructions carefully and provide any necessary information they may require.

- Request Written Confirmation: Once you have canceled your First Premier Credit Card, request written confirmation of the cancellation. This will serve as proof that you have successfully canceled the card.

- Destroy the Card: After receiving confirmation of your cancellation, securely destroy your First Premier Credit Card by cutting it into multiple pieces or shredding it to ensure that it cannot be misused.

It’s important to keep in mind that canceling your First Premier Credit Card does not automatically remove it from your credit report. The credit card will continue to appear on your credit history, reflecting the account closure. Therefore, it’s essential to monitor your credit report after cancellation to ensure that it accurately reflects the closure of your First Premier Credit Card account.

Now that you know the steps involved in canceling your First Premier Credit Card, let’s explore the next section on how to contact First Premier customer service.

Contacting First Premier Customer Service

If you’re ready to cancel your First Premier Credit Card, you’ll need to contact their customer service. Here are the different ways you can reach out to them:

- Phone: The easiest and most direct way to contact First Premier customer service is by calling their dedicated phone number. You can find this number on the back of your credit card or on the First Premier Credit Card website.

- Online Chat: First Premier also offers an online chat feature on their website. This allows you to communicate with a customer service representative in real-time and get your questions answered or request card cancellation.

- In-Person: If you prefer face-to-face communication, you can visit one of the First Premier Credit Card offices to speak with a customer service representative. Check the company’s website for office locations near you.

- Mail: If you prefer written communication, you can send a letter to First Premier Credit Card’s mailing address, stating your intention to cancel your card. Be sure to include your account details and contact information in the letter.

When contacting First Premier customer service, be prepared with your credit card details and any necessary documentation. Clearly communicate your intention to cancel the card and follow any instructions given to complete the cancellation process.

Keep in mind that hold times may vary when contacting customer service, so it’s best to allocate enough time for the call or online chat. Remember to remain patient and polite during your interaction with customer service representatives.

Now that you know how to contact First Premier customer service, let’s move on to the important considerations before canceling your First Premier Credit Card.

Important Considerations Before Canceling Your First Premier Credit Card

Canceling your First Premier Credit Card is a decision that should be made after careful consideration. Before proceeding with the cancellation, it’s crucial to take the following factors into account:

- Impact on Credit Score: Canceling a credit card can have an impact on your credit score. It may lower your overall available credit and potentially affect your credit utilization ratio. Consider how canceling your First Premier Credit Card may affect your credit score and weigh it against the reasons for canceling.

- Outstanding Balances: Ensure that you have paid off any outstanding balances on your First Premier Credit Card before canceling. Failure to do so can result in additional fees and damage your credit score.

- Length of Credit History: The age of your credit history plays a role in your credit score. If your First Premier Credit Card is one of your oldest credit accounts, canceling it may shorten your credit history. This could impact your credit score, especially if you have a limited credit history.

- Alternative Credit Options: Before canceling your First Premier Credit Card, consider exploring alternative credit card options that may better suit your needs. Research other credit cards with lower fees, better rewards programs, or more favorable interest rates.

- Downgrading Instead of Canceling: If you’re canceling your First Premier Credit Card primarily due to the annual fee, consider downgrading to a no-fee or lower-fee version of the same credit card. This allows you to keep your credit history and account while avoiding the high annual fee.

It’s important to carefully evaluate your individual financial situation and future credit needs when deciding whether to cancel your First Premier Credit Card. If you’re unsure about the potential impact of canceling on your credit score or require further guidance, consider consulting with a financial advisor or credit counseling service.

Now that you’ve considered these important factors, let’s explore some alternatives to canceling your First Premier Credit Card.

Alternatives to Canceling Your First Premier Credit Card

If you have concerns about canceling your First Premier Credit Card but still want to explore other options, here are a few alternatives to consider:

- Downgrade to a Lower Fee Card: Instead of canceling your First Premier Credit Card, you can inquire about downgrading to a card with lower fees or no annual fee. This allows you to keep your credit history intact while avoiding the high costs associated with your current card.

- Request a Credit Limit Decrease: If your main concern is the high credit limit on your First Premier Credit Card, you can request to have it reduced. This can help you manage your credit utilization and potentially lower the associated fees.

- Explore Balance Transfer Options: If you’re primarily concerned about high interest rates, consider transferring your balance to a credit card with a lower interest rate. This can help you save money on interest charges and potentially improve your overall financial situation.

- Add an Authorized User: If you have a trusted family member or friend who can benefit from using your First Premier Credit Card, you can add them as an authorized user. This way, they can enjoy the perks of the card while helping you utilize the card responsibly and potentially earn rewards.

- Build Credit with the Card: If your primary reason for canceling is to establish or rebuild credit, consider keeping your First Premier Credit Card open and using it responsibly. Make regular payments and keep your credit utilization low to gradually improve your credit score over time.

By exploring these alternatives, you may find a solution that addresses your concerns without completely canceling your First Premier Credit Card. Remember to assess your personal financial goals and review the terms and conditions of any alternative options before making a decision.

Now that you have explored these alternatives, you have a better understanding of the options available to you beyond canceling your First Premier Credit Card. Let’s conclude this article with a brief summary.

Conclusion

Canceling your First Premier Credit Card is a decision that should be made after careful consideration of your individual financial situation and goals. While there may be valid reasons to cancel, such as high annual fees or unsatisfactory rewards programs, it’s important to weigh the potential impact on your credit score and credit history. Before canceling, explore alternatives such as downgrading to a lower fee card or requesting a credit limit decrease.

When canceling your First Premier Credit Card, follow the necessary steps: review the terms and conditions, pay off any outstanding balances, contact customer service, and securely destroy your card. Request written confirmation of the cancellation to keep for your records.

Remember to consider the potential impact on your credit score and explore alternative credit options before canceling. Downgrading your card, exploring balance transfer options, or adding an authorized user are all viable alternatives that can help address your concerns while maintaining your credit history.

If you’re unsure about the best course of action or need more guidance, consult with a financial advisor or credit counseling service. They can provide personalized recommendations and help you make an informed decision based on your specific needs and circumstances.

Ultimately, the decision to cancel your First Premier Credit Card rests in your hands. By considering all the factors, exploring alternatives, and weighing the pros and cons, you can confidently make a choice that aligns with your financial goals and improves your overall financial well-being.