Finance

How To Activate My First Premier Credit Card

Published: October 24, 2023

Looking to activate your first Premier credit card? Learn how to do it efficiently and easily in this comprehensive finance guide.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of credit cards! As a new cardholder of the First Premier Credit Card, you’re probably eager to start using it and enjoying the benefits it offers. But before you can take advantage of your new card, you’ll need to activate it.

Activating your First Premier Credit Card is a simple process that can be done online, by phone, or through traditional mail. In this article, we’ll guide you through the steps of activating your card, ensuring that you can begin using it as soon as possible.

Before we dive into the activation process, it’s essential to mention that activating your First Premier Credit Card is necessary to verify your identity and protect against any unauthorized use. This extra layer of security ensures that only you can access and utilize your credit card.

Now let’s get started with the activation process. Whether you prefer the convenience of online activation, the personal touch of a phone call, or the traditional method of mailing, we’ve got you covered.

Step 1: Gathering Your Information

Before you begin the activation process, it’s important to gather the necessary information and have it on hand. This will ensure a smooth and efficient activation experience. Here’s what you’ll need:

- Your First Premier Credit Card: Make sure you have your physical card in front of you. You’ll need the card number, expiration date, and the three-digit CVV code located on the back of the card.

- Personal Information: Have your personal details ready, including your full name, date of birth, social security number, and contact information. This information is essential for identity verification during the activation process.

- Valid Identification: Depending on the activation method you choose, you may need a valid form of identification, such as a driver’s license or passport. This is typically required when activating over the phone or by mail.

Having all the necessary information readily available will save you time and prevent any delays during the activation process. Make sure to double-check that the information you have matches the details provided during your card application to avoid any discrepancies. Once you have everything gathered, you’re ready to proceed with the activation process.

Step 2: Activating Online

Activating your First Premier Credit Card online is a quick and convenient option. Here’s a step-by-step guide on how to do it:

- Visit the First Premier Bank website: Open your preferred web browser and go to the official First Premier Bank website.

- Locate the credit card activation page: Look for the “Activate Card” or “Card Activation” section on the website. This is usually found on the homepage or within the credit card section.

- Enter your card details: Once you’re on the activation page, you’ll be prompted to enter your card information. This typically includes your card number, expiration date, and CVV code. Fill in the required fields accurately.

- Provide personal information: In addition to your card details, you’ll be asked to enter your personal information, such as your name, date of birth, and social security number. Ensure that the information is correct and matches the details you provided during your card application.

- Complete any additional steps: Depending on the bank’s requirements, you may need to complete extra steps such as verifying your identity through a one-time password sent to your registered phone number or email address.

- Review and submit: Before finalizing the activation, carefully review all the information you’ve provided to ensure accuracy. Once you’re satisfied, click on the “Submit” or “Activate” button.

- Confirmation: After submitting your information, you should receive a confirmation message indicating that your First Premier Credit Card has been successfully activated. You can now start using your card for purchases and transactions.

Activating your First Premier Credit Card online is typically the fastest and most convenient option. It allows you to complete the process from the comfort of your own home without the need to wait for a phone call or mail. Plus, you have the added advantage of immediate access to your credit card once activated.

Step 3: Activating by Phone

If you prefer a more personal and interactive approach, you can choose to activate your First Premier Credit Card by phone. Follow these steps to activate your card via phone:

- Locate the activation phone number: Look for the phone number provided by First Premier Bank specifically for credit card activation. It is usually printed on a sticker attached to your card or included in the activation instructions.

- Dial the activation phone number: Using your preferred phone, dial the activation phone number listed on the sticker or in the instructions.

- Follow the prompts: Once connected, you will be guided through an automated phone menu system. Listen carefully to the instructions and select the option for credit card activation.

- Enter your card details: You will be prompted to enter your First Premier Credit Card details, including the card number, expiration date, and CVV code. Ensure that you enter the information correctly, as any errors may result in activation issues.

- Provide personal information: As part of the activation process, you will likely need to verify your identity by providing your personal information, such as your full name, date of birth, and social security number. Make sure that the information matches the details provided during your card application.

- Confirm activation: Once you have entered all the required information, carefully review it for accuracy. Follow the instructions provided by the automated system to confirm the activation of your First Premier Credit Card.

- Speak to a representative (optional): If you encounter any issues during the automated process or have questions, you may have the option to speak to a live representative. This will allow you to address any concerns or seek clarification before completing the activation process.

Activating your First Premier Credit Card by phone gives you the opportunity to interact with a customer service representative, making it a suitable option if you prefer a more personalized experience. Ensure that you activate your card from a secure and private location to protect your personal and card information.

Step 4: Activating by Mail

If you prefer a more traditional method or don’t have access to the internet or a phone, you can activate your First Premier Credit Card by mail. Here’s how:

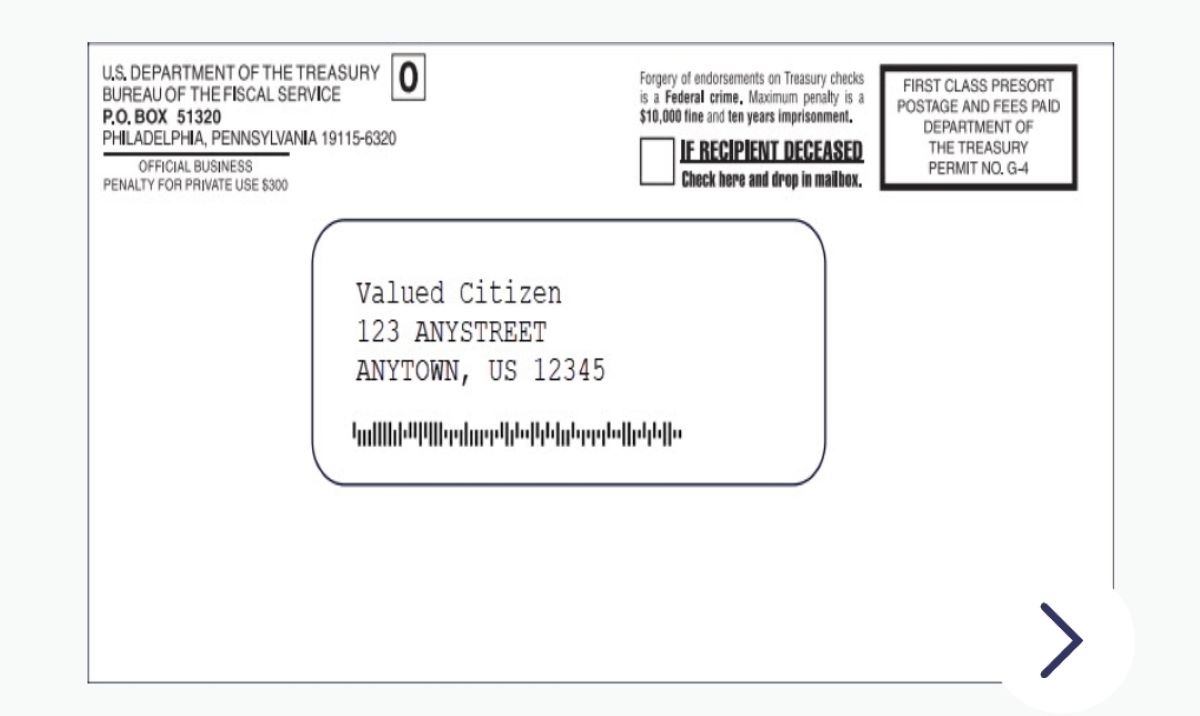

- Locate the activation instructions: When you receive your First Premier Credit Card in the mail, it will typically come with an activation instruction booklet or letter. Locate this document.

- Fill out the necessary forms: The activation instruction booklet or letter will contain a form that you need to fill out. Provide the required information, which typically includes your personal details (name, date of birth, social security number), card details (card number, expiration date, CVV code), and any other requested information.

- Include additional documentation: In some cases, you may be required to include additional documentation as proof of identity or address. This can include a copy of your driver’s license, utility bill, or other official documents. Check the activation instructions to see if any additional documentation is required.

- Securely mail the form: Once you have filled out the form and included any necessary documentation, securely seal the envelope and mail it to the address provided in the activation instructions. Consider using certified mail or a tracking service if you want to ensure the safe delivery of your information.

- Wait for confirmation: After mailing the activation form, it may take a few days for First Premier Bank to process your request. Keep an eye on your mailbox for a confirmation letter or email, which will indicate that your card has been successfully activated.

Activating your First Premier Credit Card by mail may not be the quickest option, as it involves physical processing and mail delivery. However, it can be a suitable choice for individuals who prefer the traditional method or have limited access to the internet or phone services. Make sure to follow the instructions carefully and provide accurate information to ensure a successful card activation.

Step 5: Tips and Troubleshooting

While the activation process for your First Premier Credit Card is typically straightforward, it’s important to be aware of some tips and troubleshooting methods to ensure a smooth experience. Here are some helpful tips:

- Double-check your information: Before submitting your card details and personal information, double-check that everything is accurate. Small errors can lead to activation delays or issues.

- Use a secure internet connection: If you choose to activate your card online, make sure you’re using a secure and private internet connection. Avoid public Wi-Fi networks to protect your personal and card information.

- Keep your card information confidential: Throughout the activation process, as well as when using your credit card, it’s crucial to keep your card details confidential. Never share your card number, expiration date, CVV code, or personal information with anyone you don’t trust.

- Contact customer service if you encounter issues: If you experience any difficulties during the activation process or have questions, don’t hesitate to contact First Premier Bank customer service. They will be able to provide guidance and help resolve any issues you may encounter.

- Register for online banking: After activating your First Premier Credit Card, consider registering for online banking. This will allow you to manage your account, view transactions, and make payments conveniently online.

- Activate and start using your card promptly: Once your First Premier Credit Card is activated, start using it responsibly and take advantage of its benefits. Make sure to review the card’s terms and conditions to understand the fees, interest rates, and any rewards or benefits associated with your card.

If you run into any difficulties during the activation process, don’t worry; there are solutions available. Reach out to First Premier Bank’s customer service for assistance, and they will guide you through the necessary steps to resolve any issues you may encounter. Remember, activating your card is an important step in enjoying the benefits and convenience of your First Premier Credit Card.

Conclusion

Congratulations on obtaining your First Premier Credit Card! By following the activation process, you can start using your card and take advantage of its benefits. Whether you choose to activate your card online, by phone, or through traditional mail, the activation steps are designed to ensure your card’s security and protect against unauthorized use.

Remember to gather all the necessary information before beginning the activation process. This includes having your card details and personal information readily available. Taking the time to double-check your information will help prevent any delays or issues during activation.

Activating online offers a quick and convenient option, allowing you to instantly access your card once the process is complete. If you prefer a more personal touch, activating by phone gives you the opportunity to interact with a customer service representative. And for those who prefer a traditional method, activating by mail is still a reliable option.

Throughout the activation process, it’s important to prioritize the security and confidentiality of your card information. Remember to keep your card details private and use secure internet connections when activating online. Additionally, don’t hesitate to reach out to customer service if you encounter any issues or have questions.

Once your First Premier Credit Card is activated, make sure to use it responsibly and familiarize yourself with the card’s terms and conditions. Registering for online banking can also provide added convenience in managing your account.

Now that you have successfully activated your First Premier Credit Card, enjoy the benefits it offers and use it wisely. Whether it’s for everyday purchases, travel, or building credit, your card can be a valuable financial tool. Remember to make timely payments and keep your credit utilization in check for a positive credit card experience.

Thank you for choosing First Premier Credit Card as your financial partner. We wish you success and financial well-being!