Home>Finance>How Do I Get My Insurance License In All 50 States

Finance

How Do I Get My Insurance License In All 50 States

Published: November 13, 2023

Get your insurance license in all 50 states with our comprehensive finance-focused guide. Start your career with confidence and expertise.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Obtaining an insurance license can open up a world of opportunities in the finance industry, allowing individuals to provide valuable protection and financial services to clients. While getting licensed in one state is a significant achievement, expanding your reach by obtaining licenses in all 50 states can be a game-changer for your career.

Each state has its own set of requirements and regulations for obtaining an insurance license. From pre-licensing education to passing exams and completing application processes, navigating the licensing process can seem daunting at first. However, with the right knowledge and preparation, you can successfully obtain your insurance license in all 50 states.

In this article, we will guide you through the step-by-step process of getting your insurance license in all 50 states. We will discuss the general steps that apply to most states, as well as the differences you may encounter along the way.

Before diving into the specific licensing requirements, it’s important to note that the finance industry is highly regulated, and obtaining an insurance license demonstrates your commitment to professionalism and adherence to ethical standards. It also allows you to legally sell insurance products and provide financial advice to clients, ensuring that you operate within the confines of the law.

With the increasing demand for insurance products and financial services, having licenses in multiple states can significantly enhance your career prospects and increase your earning potential. It allows you to access a broader client base and offer your expertise to individuals across the country, irrespective of their location.

Now, let’s explore the core steps involved in obtaining your insurance license in all 50 states and the benefits that come along with it.

State Licensing Requirements

Before embarking on the journey of obtaining your insurance license in all 50 states, it’s crucial to understand the licensing requirements specific to each state. While many states have similar licensing processes, there are often nuances and variations that you need to be aware of.

First and foremost, each state has its own Department of Insurance (DOI) or equivalent regulatory agency that oversees the licensing of insurance professionals. It’s important to familiarize yourself with the DOI website of each state you’re interested in to access accurate and up-to-date information on licensing requirements.

Generally, the licensing process includes several common steps across most states:

- Determine Eligibility: Before applying for a license, you need to determine if you meet the eligibility requirements set by the state. This typically includes being at least 18 years old, having no felony convictions, and demonstrating good moral character.

- Complete Pre-Licensing Education: Most states require individuals to complete a certain number of pre-licensing education (PLE) hours. The PLE courses provide you with essential knowledge and understanding of insurance principles, products, and regulations. These courses can be taken online or in-person, and the number of hours varies from state to state.

- Schedule and Pass the Exam: Once you’ve completed the PLE requirements, you must schedule and pass the state insurance licensing exam. The exam assesses your comprehension of insurance concepts, laws, and regulations. It’s crucial to thoroughly study the exam content and take practice tests to ensure success.

- Apply for the License: After passing the exam, you’ll need to submit an application to the state DOI along with any required supporting documents, such as fingerprints, background checks, and identification. It’s important to carefully fill out the application and provide accurate information to avoid any delays or complications.

- Maintain Continuing Education Credits: Once you’ve obtained your insurance license, it’s essential to stay up-to-date with changes in the industry and maintain your knowledge through continuing education credits. Most states require licensed professionals to complete a certain number of continuing education hours to renew their licenses on a regular basis.

While these steps provide a general overview of the licensing process, it’s crucial to note that each state may have additional requirements or variations. Some states also offer reciprocity or streamlined processes for individuals who already hold a license in another state.

In the next section, we will delve deeper into the specific steps involved in obtaining your insurance license and highlight the differences you may encounter between states.

Step 1: Determine Eligibility

Before you begin the process of obtaining your insurance license in all 50 states, it’s essential to determine if you meet the eligibility requirements set by each state’s Department of Insurance (DOI) or regulatory agency. While specific requirements may vary, there are common factors that most states consider when determining eligibility.

Here are some common eligibility criteria to be aware of:

- Age Requirement: Each state has an age requirement for obtaining an insurance license. In most cases, you must be at least 18 years old. However, some states may have a higher or lower age requirement, so it’s important to check the requirements of each state you are interested in.

- Background Check: Many states require a background check as part of the licensing process. This is to ensure that applicants have no prior felony convictions or other disqualifying criminal history. Be prepared to provide fingerprints or other identification information for the background check.

- Residency: Some states may have a residency requirement, meaning you must be a resident of the state to obtain a license. However, many states allow non-residents to apply for a license as long as they meet other eligibility requirements, such as having a valid license in their home state.

- Good Moral Character: Most states require applicants to demonstrate good moral character as part of the licensing process. This typically involves disclosing any previous disciplinary actions or ethical violations and providing character references.

- Educational Background: While not all states have specific educational requirements, some may require applicants to have a high school diploma or equivalent. Additionally, some states may give preference to applicants with a college degree or relevant industry experience.

It’s important to carefully review the eligibility requirements of each state you intend to obtain a license in. Some states may have additional requirements or specific criteria that need to be met. If you have any doubts or questions about your eligibility, it’s recommended to contact the state’s DOI or regulatory agency for clarification.

By thoroughly understanding the eligibility requirements, you can determine which states you qualify for and create a strategic plan for obtaining your insurance licenses in all 50 states.

Now that you understand the importance of determining your eligibility, let’s move on to the next step: completing pre-licensing education.

Step 2: Complete Pre-Licensing Education

Once you have determined your eligibility to obtain an insurance license in a particular state, the next step is to complete the required pre-licensing education (PLE). PLE is a mandatory educational requirement that provides aspiring insurance professionals with the knowledge and understanding of insurance principles, products, regulations, and ethics.

Here are the key details to know about completing PLE:

State Requirements: Each state has its own specific requirements for the number of PLE hours you need to complete. The number of hours can range from as little as 20 hours to over 100 hours, depending on the state and the type of insurance license you are pursuing. It is essential to check the state’s Department of Insurance (DOI) or regulatory agency website for the exact PLE requirements.

Course Options: PLE courses are offered by various approved providers, both online and in-person. These courses cover topics such as insurance fundamentals, legal and ethical considerations, risk management, sales techniques, and more. Some states may also require specific courses tailored to the type of insurance you will be selling, such as life insurance or property and casualty insurance.

Study Materials and Resources: PLE courses often come with study materials and resources to help you prepare for the licensing exam. These can include textbooks, study guides, practice exams, and online resources. It is important to allocate enough time to study and review the course materials thoroughly to ensure a solid understanding of the content.

Course Completion: To successfully complete the PLE requirement, you must fulfill the specified number of hours and pass any quizzes or assessments mandated by the course provider. Once you have completed your PLE, you will receive a certificate of completion, which is often required when applying for the licensing exam.

Validity Period: It’s important to note that the completion of PLE courses has a validity period in most states. This means that you must pass the licensing exam and apply for your license within a certain timeframe, typically one to two years, from the date of completing the PLE. If you exceed this timeframe, you may need to retake the PLE courses.

Completing your PLE is a crucial step in obtaining your insurance license. It equips you with the necessary knowledge and understanding to serve clients in a professional and ethical manner. By investing time and effort into your PLE, you are setting a strong foundation for your insurance career and increasing your chances of success in the licensing exam.

Now that we’ve covered the importance of pre-licensing education, let’s move on to the next step: scheduling and passing the licensing exam.

Step 3: Schedule and Pass the Exam

After completing the required pre-licensing education (PLE) for your insurance license, the next step is to schedule and pass the licensing exam. This exam is designed to assess your understanding of insurance concepts, laws, regulations, and ethical practices. Passing the exam is a crucial milestone towards obtaining your insurance license in a specific state.

Here’s what you need to know about scheduling and passing the licensing exam:

State Exam Requirements: Each state has its own licensing exam requirements, including the content covered, the format of the exam, and the passing score. It is essential to familiarize yourself with the exam specifications outlined by the state’s Department of Insurance (DOI) or regulatory agency. This information can usually be found on their website or in the exam candidate handbook.

Exam Content: The licensing exam typically covers a wide range of insurance topics, including insurance fundamentals, policy provisions, types of insurance, ethics, legal concepts, and state-specific regulations. You can expect multiple-choice questions that test your knowledge and comprehension of these subjects. Some states may also have specific exams for different lines of insurance, such as life insurance or property and casualty insurance.

Exam Preparation: Preparing for the licensing exam is crucial to ensure success. Study materials and resources provided during the pre-licensing education (PLE) phase can serve as valuable study aids. Additionally, there are numerous exam prep courses, practice exams, and study guides available online and through approved providers. Taking practice exams can help familiarize you with the exam format and improve your confidence and performance.

Scheduling the Exam: To schedule your licensing exam, you will need to contact the designated exam administrator approved by the state’s DOI or regulatory agency. They will provide you with the necessary information on how to register, choose an exam date and location, and pay any exam fees. It’s important to plan and schedule your exam in advance to ensure availability and adequate time for further preparation.

Exam Day Tips: On the day of the exam, make sure to arrive early, bring proper identification, and follow any specific instructions outlined by the exam administrator. It’s essential to read and understand each question carefully before selecting your answer. If you come across a difficult question, it’s often helpful to eliminate obviously incorrect choices and make an educated guess.

Passing Score and Results: Each state has its own passing score for the licensing exam. Typically, a score of 70% or higher is required to pass. After completing the exam, you will receive your score report indicating whether you passed or failed. In the case of a failed attempt, most states allow for retesting after a certain waiting period, usually a few weeks or months.

Scheduling and passing the licensing exam is a significant milestone in your journey to obtaining an insurance license. It demonstrates your knowledge and understanding of insurance principles, ensuring that you are well-equipped to protect and serve your future clients.

Now that you know the importance of the licensing exam, let’s move on to the next step: applying for your insurance license.

Step 4: Apply for the License

Once you have successfully passed the licensing exam, the next step in obtaining your insurance license is to apply for the license itself. Applying for the license involves submitting an application to the state’s Department of Insurance (DOI) or regulatory agency and providing any required supporting documents.

Here are the key points to consider when applying for your insurance license:

Application Process: The application process may vary slightly from state to state, but it generally involves completing an online or paper application provided by the DOI or regulatory agency. The application will require you to provide personal information, such as your name, address, contact information, and social security number.

Supporting Documents: Along with the application form, you may be required to submit additional supporting documents. Common documents include proof of completion of pre-licensing education (PLE), passing score report from the licensing exam, fingerprints for a background check, and proof of residency (if applicable).

Fees: Most states require a licensing fee to be paid at the time of application. The fee amount varies from state to state and depending on the type of insurance license you are applying for. It’s important to ensure that you have the necessary funds available to cover the fees.

Background Check: As part of the licensing process, many states conduct a background check on applicants. This typically involves submitting fingerprints for a criminal background check. It’s important to comply with any instructions provided by the DOI or regulatory agency regarding the background check process.

Application Review: Once you have submitted your application and supporting documents, the DOI or regulatory agency will review your application to ensure that all required information is provided and that you meet the licensing criteria. This review process can take several weeks or even months, depending on the workload and processing times of the agency.

License Issuance: Upon successful review and approval of your application, the state will issue your insurance license. This license serves as legal proof that you are qualified and authorized to sell insurance in that state. You will typically receive a physical license or a digital copy that you can print and keep for your records.

It’s important to carefully complete the application and provide accurate information to avoid any delays or complications in the licensing process. If you have any questions or concerns during the application process, reach out to the DOI or regulatory agency for guidance and clarification.

Now that you have applied for your insurance license, the final step is to maintain your license by earning continuing education credits. We’ll cover this in the next step of the process.

Step 5: Maintain Continuing Education Credits

Obtaining your insurance license is not the end of your journey as a licensed insurance professional. To stay up-to-date with industry trends, regulations, and best practices, it is essential to maintain your license by earning continuing education credits (CEC).

Here’s what you need to know about maintaining your license through continuing education:

State Requirements: Each state has its own specific requirements for continuing education. These requirements typically dictate the number of hours you need to complete within a specific time period, such as every two years. It’s crucial to check the requirements set by the state’s Department of Insurance (DOI) or regulatory agency to ensure compliance.

Approved Courses and Providers: Continuing education courses must be offered by approved providers and cover topics relevant to the insurance industry. Many organizations and educational institutions provide these courses either in-person or online. It’s important to verify that the courses you choose are approved by the state and will count towards your continuing education requirements.

Course Topics: The topics covered in continuing education courses can vary but often include updates on laws and regulations, product knowledge, ethics, sales techniques, and emerging trends. These courses offer valuable insights and ensure that you stay informed about changes and advancements in the industry.

Earning Continuing Education Credits: To earn continuing education credits, you will need to successfully complete the approved courses and submit your completion certificates to the DOI or regulatory agency. Some states may require you to report your completed credits on a regular basis or during the license renewal process.

License Renewal: In most states, you will need to renew your insurance license periodically, usually every two years. License renewal involves submitting an application, paying the renewal fee, and ensuring that your continuing education credits are up-to-date. Failing to renew your license before the expiration date can result in a lapse in your license and the need to go through the entire licensing process again.

Continuing education is a critical component of maintaining your insurance license and staying knowledgeable in the ever-evolving insurance industry. By keeping up with continuing education credits, you demonstrate your commitment to professional growth, ethical practices, and providing top-quality service to your clients.

Always stay informed about the specific continuing education requirements in your state and seek out approved courses and providers that align with your professional interests and goals. By staying current in your knowledge and skills, you can thrive as a licensed insurance professional.

As a final note, throughout your insurance career, it’s important to stay up-to-date with industry news, engage in networking opportunities, and seek ongoing professional development beyond the mandatory continuing education requirements.

Congratulations on completing all the steps to obtain and maintain your insurance license! Now, you can enjoy the benefits of having multiple state licenses and take advantage of the opportunities offered by a national presence in the insurance industry.

Differences between States

While the general process of obtaining an insurance license follows similar steps in most states, it’s important to acknowledge that there are significant differences between states regarding licensing requirements and regulations. These differences arise from variations in state laws, insurance markets, and the specific needs of each jurisdiction. It’s crucial to understand these distinctions when pursuing licenses in multiple states.

Here are some common differences you may encounter between states:

Pre-Licensing Education Requirements: The number of pre-licensing education (PLE) hours required can vary significantly between states. Some states may have minimal hour requirements, while others may have extensive PLE mandates, particularly for specialized lines of insurance. Researching and understanding the PLE requirements of each state is essential to ensure compliance.

Licensing Exam Content: The content and format of the licensing exam can differ between states. While most exams cover similar insurance principles and regulations, the specific emphasis and focus may vary. Some states may have additional exams or specific exams for different lines of insurance, requiring you to study and prepare accordingly.

Reciprocity and Non-Resident Licensing: States differ in their policies regarding reciprocity and non-resident licensing. Reciprocity allows individuals who hold an insurance license in one state to obtain a license in another state without retaking exams. Non-resident licensing allows individuals to sell insurance in a state where they are not a resident. Understanding the reciprocity agreements and non-resident licensing options between states can help you streamline the process of obtaining licenses in multiple jurisdictions.

License Renewal and Continuing Education: Each state has its own requirements for license renewal and continuing education. The renewal period and continuing education credit hours may differ, as well as the specific topics and courses that are accepted. Staying informed about the unique renewal and continuing education requirements of each state is crucial to maintain your licenses compliantly.

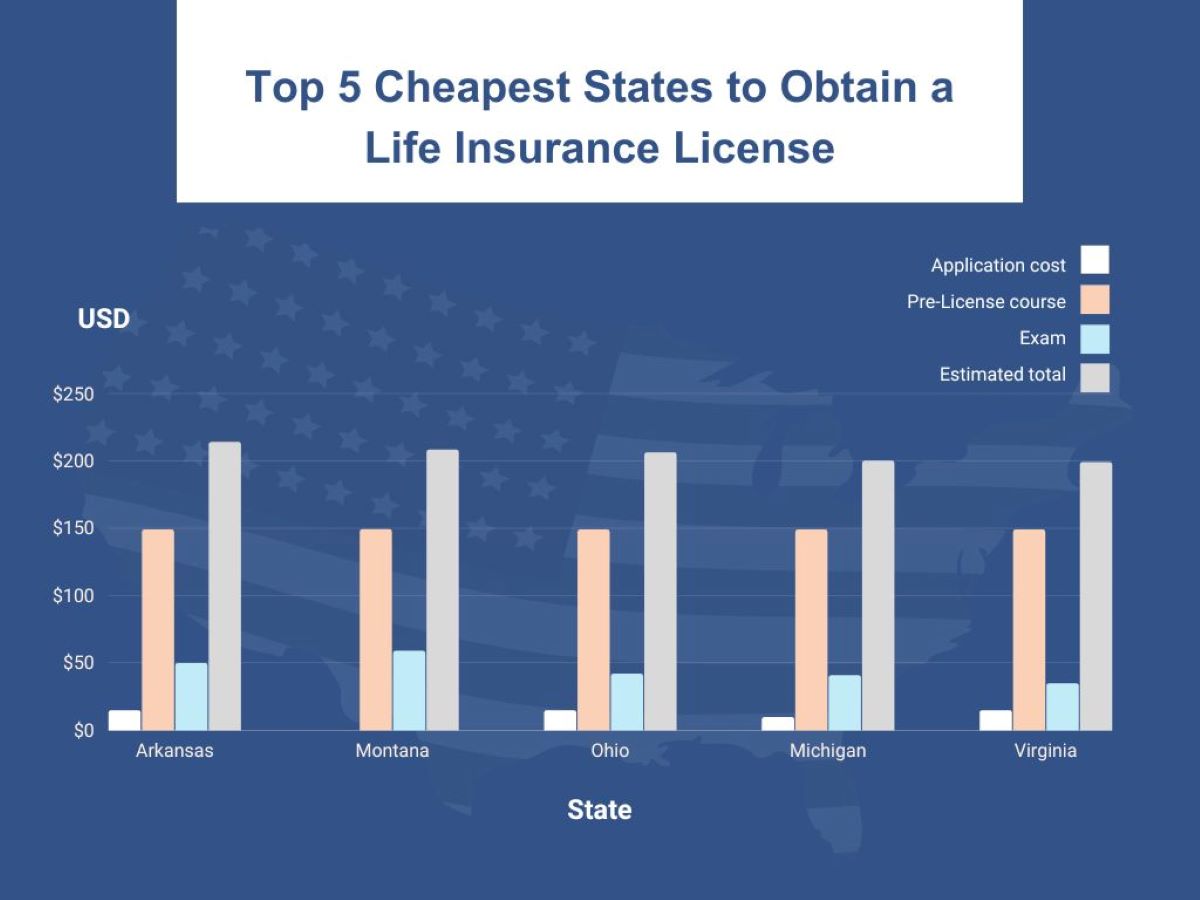

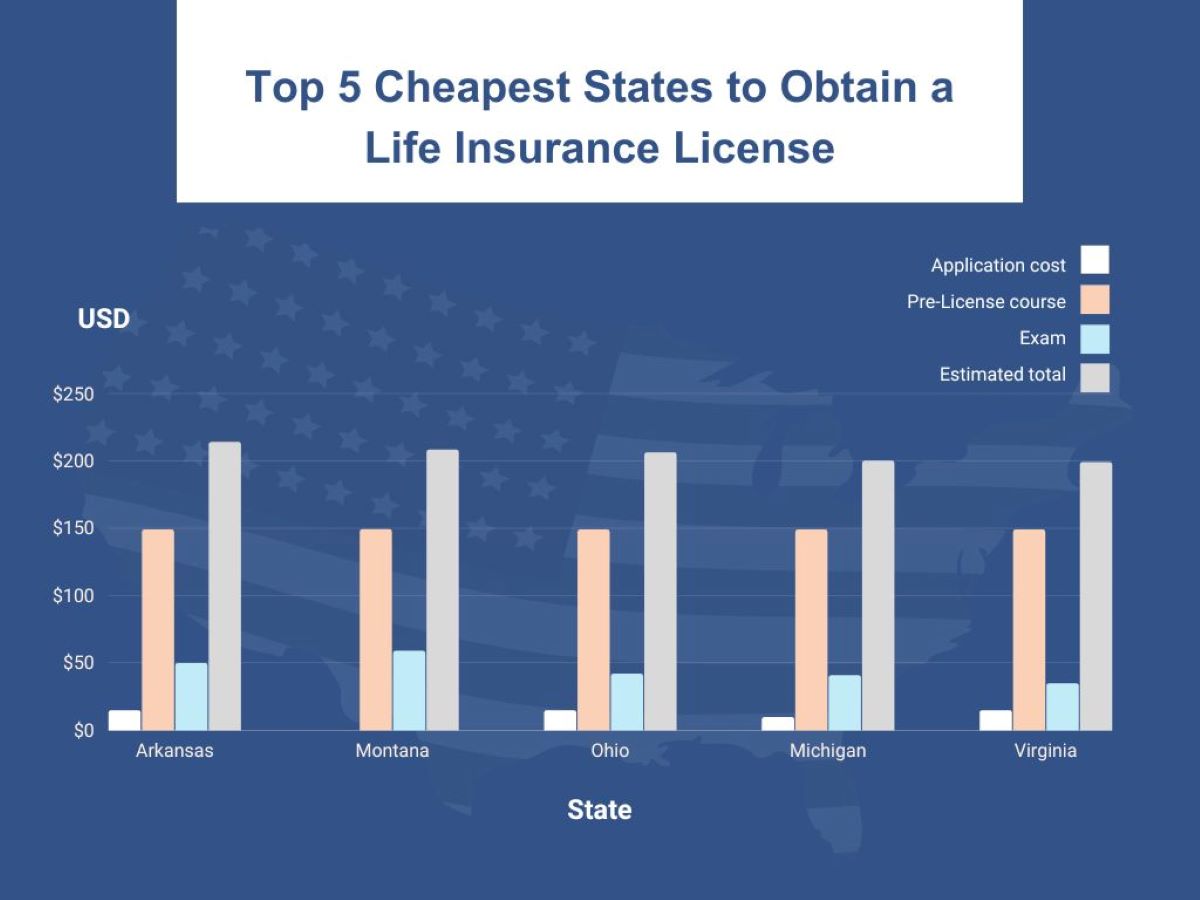

Licensing Fees: Licensing fees can vary widely between states. The fee structures may be based on the type of insurance license, the number of lines of insurance being licensed, or other factors. It’s important to factor in the licensing fees when planning to obtain licenses in multiple states and ensure that you allocate the necessary funds.

Additional Requirements: Some states may have additional requirements, such as background checks, fingerprinting, or specific documentation that needs to be submitted along with the license application. Understanding and meeting these additional requirements is essential to ensure a smooth licensing process.

Being aware of these differences and staying informed about the specific requirements and regulations of each state can help you navigate the licensing process more effectively. Conduct thorough research, consult with the state’s Department of Insurance (DOI) or regulatory agency, and utilize available resources to ensure compliance with all state-specific requirements.

Now that you understand the differences between states, you can better strategize and plan your approach to obtaining licenses in multiple jurisdictions. With diligence and knowledge, you can expand your reach as a licensed insurance professional.

Benefits of Holding Multiple State Licenses

Obtaining an insurance license in multiple states can offer a wide range of benefits and opportunities for licensed insurance professionals. Here are some of the key advantages of holding multiple state licenses:

Expanded Client Base: Having licenses in multiple states allows you to expand your reach and access a larger client base. You can connect with clients across different geographic areas, serving individuals and businesses in various states. This broader client base opens up new opportunities for growth and increased earning potential.

National Presence: Holding licenses in multiple states creates a national presence for your insurance business. It demonstrates your ability to operate and provide services on a larger scale, which can enhance your professional reputation and attract clients who are looking for a well-established and trusted insurance provider.

Diversity of Products and Markets: Each state has its own unique insurance market and demands. By holding licenses in multiple states, you can tap into diverse markets and offer a wider range of insurance products. This flexibility allows you to cater to different needs and preferences, potentially increasing your competitiveness in the industry.

Flexibility and Mobility: Having licenses in multiple states provides you with the flexibility and mobility to work from different locations. Whether you prefer to operate from a home office or travel for business, holding licenses in multiple states allows you to serve clients regardless of their location. This flexibility can provide a better work-life balance and the freedom to adapt to changing circumstances.

Reciprocity Opportunities: Some states have reciprocity agreements that can make it easier to obtain licenses in additional states. If you already hold a license in one state, you may be able to obtain licenses in other states without having to repeat pre-licensing education or take additional exams. This reciprocity can streamline the licensing process and save you time and effort.

Professional Development and Learning: Obtaining licenses in multiple states requires staying up-to-date with different state-specific regulations, market dynamics, and industry trends. This commitment to continuous learning and professional development helps you build a strong foundation of knowledge and expertise. It can also enhance your credibility and differentiate you from competitors.

Opportunities for Collaboration: Holding licenses in multiple states opens doors for collaboration and networking opportunities with insurance professionals across different jurisdictions. By connecting with colleagues and industry experts in various states, you can exchange insights, share best practices, and expand your professional network, which can lead to new partnerships and business referrals.

Transferable Skills and Portability: The skills and experience gained from obtaining licenses in multiple states are transferable and portable. If you decide to relocate or change professional paths, these skills can be an asset wherever you go. The knowledge and expertise you acquire can open doors to various job opportunities and growth potential within the insurance industry.

Holding licenses in multiple states can significantly enhance your career prospects in the insurance industry. It grants you the ability to reach more clients, diversify your offerings, and expand your professional horizons. Consider the benefits and advantages as you navigate the licensing process and take your insurance career to new heights.

Conclusion

Obtaining your insurance license in all 50 states is a monumental achievement that can open up a world of opportunities in the finance industry. By following the step-by-step process outlined in this article, you can successfully obtain licenses in multiple states and expand your reach as a licensed insurance professional.

Throughout the process, it is crucial to understand the specific licensing requirements and regulations of each state. Conduct thorough research, familiarize yourself with the state’s Department of Insurance (DOI) or regulatory agency, and seek guidance when needed. This will ensure that you meet all eligibility criteria, complete the necessary pre-licensing education, pass the licensing exam, and submit a well-prepared application.

By holding licenses in multiple states, you can enjoy a range of benefits, including an expanded client base, national presence, diversity in products and markets, and increased flexibility and mobility. Additionally, reciprocity agreements and networking opportunities can further enhance your professional growth and success in the industry.

Remember to stay committed to ongoing professional development and maintain your licenses through continuing education credits. This will keep you informed about industry changes, regulations, and best practices, ensuring that you provide excellent service to your clients and stay ahead in the competitive insurance landscape.

As you navigate the licensing process and expand your professional presence, always prioritize honesty, integrity, and ethical practices. Cultivating strong relationships with clients, colleagues, and industry stakeholders will contribute to your long-term success and reputation as a trusted insurance professional.

Congratulations on embarking on the journey to obtain your insurance license in all 50 states! With dedication, perseverance, and a deep understanding of the process, you can achieve your goals and establish yourself as a knowledgeable and respected insurance expert in the finance industry.

Best of luck as you pursue your multi-state licensing journey and may your efforts bring you great success and fulfillment in your insurance career.