Finance

How To Calculate Business Cash Flow

Published: December 21, 2023

Learn how to calculate business cash flow and make informed financial decisions. Enhance your understanding of finance with our step-by-step guide.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding Cash Flow

- Components of Cash Flow

- Operating Cash Flow

- Investing Cash Flow

- Financing Cash Flow

- Calculation of Cash Flow

- Step 1: Determine Cash Inflows

- Step 2: Determine Cash Outflows

- Step 3: Calculate Net Cash Flow

- Importance of Cash Flow Analysis

- Benefits of Positive Cash Flow

- Challenges of Negative Cash Flow

- Cash Flow Management Strategies

- Conclusion

Introduction

Welcome to our comprehensive guide on how to calculate business cash flow. As a business owner or financial professional, understanding cash flow is crucial to the success and longevity of your company. Cash flow refers to the movement of money into and out of your business, and it is a key indicator of its financial health.

Monitoring and analyzing cash flow allows you to make informed decisions about your business operations, investments, and financing. By accurately calculating your cash flow, you can gain insights into your business’s ability to generate cash, its liquidity, and its overall financial stability.

In this article, we will delve into the components of cash flow and provide a step-by-step guide on how to calculate it. We will also discuss the importance of cash flow analysis, the benefits of positive cash flow, the challenges of negative cash flow, and strategies for effective cash flow management.

Whether you are a seasoned entrepreneur or just starting your business journey, this guide will equip you with the knowledge and tools to effectively manage your cash flow and make informed financial decisions.

Understanding Cash Flow

Cash flow is the lifeblood of any business. It represents the movement of money into and out of your company during a specific time period, such as a month, quarter, or year. Understanding cash flow is essential for effectively managing your business’s finances and ensuring its long-term sustainability.

There are three main components of cash flow: operating cash flow, investing cash flow, and financing cash flow. Let’s take a closer look at each of these components:

- Operating Cash Flow: This component represents the cash generated or expended through your business’s core operations. It includes revenue from sales, payments received from customers, and cash spent on expenses such as wages, rent, and inventory. A positive operating cash flow indicates that your business is generating enough cash to cover its day-to-day operations.

- Investing Cash Flow: Investing cash flow involves the buying and selling of long-term assets, such as property, equipment, or investments. Cash inflows in this category can come from selling assets, receiving dividends or interest on investments, or receiving loans. Outflows can include the purchase of new equipment or investments. Monitoring investing cash flow helps you assess the returns on your investments and make strategic decisions regarding asset purchases or disposals.

- Financing Cash Flow: This component tracks the cash flow related to your business’s financing activities. It includes cash received from borrowing or issuing stock, as well as cash used to repay loans or pay dividends to shareholders. Financing cash flow provides insights into your business’s ability to acquire capital and manage its debt obligations.

By analyzing these three components, you can gain a holistic understanding of your business’s cash flow patterns and identify areas that may require attention or improvement.

Having a deep understanding of cash flow is not only essential for day-to-day financial management, but it also helps you make informed strategic decisions. For example, if your business consistently has a positive operating cash flow, you may consider investing in new growth opportunities or expanding your operations. On the other hand, if your business is experiencing negative cash flow, you may need to review your expenses, improve your cash collection processes, or seek additional financing options.

In the next sections, we will explore the calculation of cash flow and discuss strategies for effective cash flow management. Understanding and analyzing your cash flow will empower you to make sound financial decisions and ensure the financial stability and growth of your business.

Components of Cash Flow

To accurately calculate your business’s cash flow, it is important to understand the different components that contribute to it. These components reflect the various sources and uses of cash within your organization. Let’s break down the three main components of cash flow:

- Operating Cash Flow: Operating cash flow represents the cash inflows and outflows resulting from your business’s day-to-day operations. It involves the revenue generated from sales and the cash spent on operating expenses. Positive operating cash flow indicates that your core business activities are generating sufficient cash to cover your operational costs and provide a surplus for future investments or working capital. Conversely, negative operating cash flow may indicate that your business is not generating enough revenue to cover its expenses, which could lead to financial instability.

- Investing Cash Flow: Investing cash flow accounts for the cash inflows and outflows related to the acquisition and disposal of long-term assets. This includes the purchase and sale of property, equipment, and investments. Positive investing cash flow typically occurs when you sell assets or receive dividends or interest from investments. Negative investing cash flow occurs when you invest in new assets or make capital expenditures. Analyzing your investing cash flow helps you assess your business’s capital allocation decisions and the returns on your investments.

- Financing Cash Flow: Financing cash flow represents the cash inflows and outflows resulting from your business’s financing activities. This includes cash received from borrowing, issuing stock, or other external sources of capital, as well as cash used to repay debt or pay dividends to shareholders. Positive financing cash flow generally occurs when you secure new financing or raise capital, while negative financing cash flow occurs when you repay debt or distribute cash to shareholders. Understanding your financing cash flow is crucial for managing your business’s debt obligations and evaluating its ability to attract additional funding.

By analyzing the individual components of cash flow, you can gain insights into the sources and uses of cash within your business. This understanding enables you to identify areas of strength or weakness and make informed decisions to optimize your cash flow position.

It is important to note that while each component is distinct, they are interconnected and collectively contribute to your overall cash flow. Monitoring and managing these components holistically will help you maintain a healthy cash flow, improve financial stability, and support the growth of your business.

Operating Cash Flow

Operating cash flow is a critical component of cash flow analysis as it reflects the cash generated or utilized from your business’s day-to-day operations. It provides insights into the core financial health of your company and its ability to generate sufficient cash to cover operational expenses.

Calculating operating cash flow involves considering the cash inflows and outflows directly related to your business’s core operations. Here are some key elements to consider:

- Revenue: Operating cash flow starts with the cash inflows from your sales or services provided. It includes cash received from customers as payment for your products or services. Depending on your business model, this can be cash received immediately or in the form of accounts receivable that will be collected at a later date.

- Operating Expenses: Operating cash flow also takes into account the cash outflows from your business’s operating expenses. This includes costs such as wages, rent, utilities, inventory purchases, marketing expenses, and any other expenses directly related to your core operations. It is important to consider only the actual cash payments made, not the accrued expenses.

- Depreciation and Amortization: While depreciation and amortization are non-cash expenses, they should be added back to the operating cash flow calculation. Since these expenses do not require immediate cash outflows, adding them back provides a more accurate representation of the cash generated by your operations.

- Changes in Working Capital: Changes in working capital can also impact your operating cash flow. An increase in accounts receivable or inventory, for example, can tie up cash within your business. Similarly, a decrease in accounts payable or accruals can result in cash outflows. It is important to consider these changes as they directly impact the liquidity of your business.

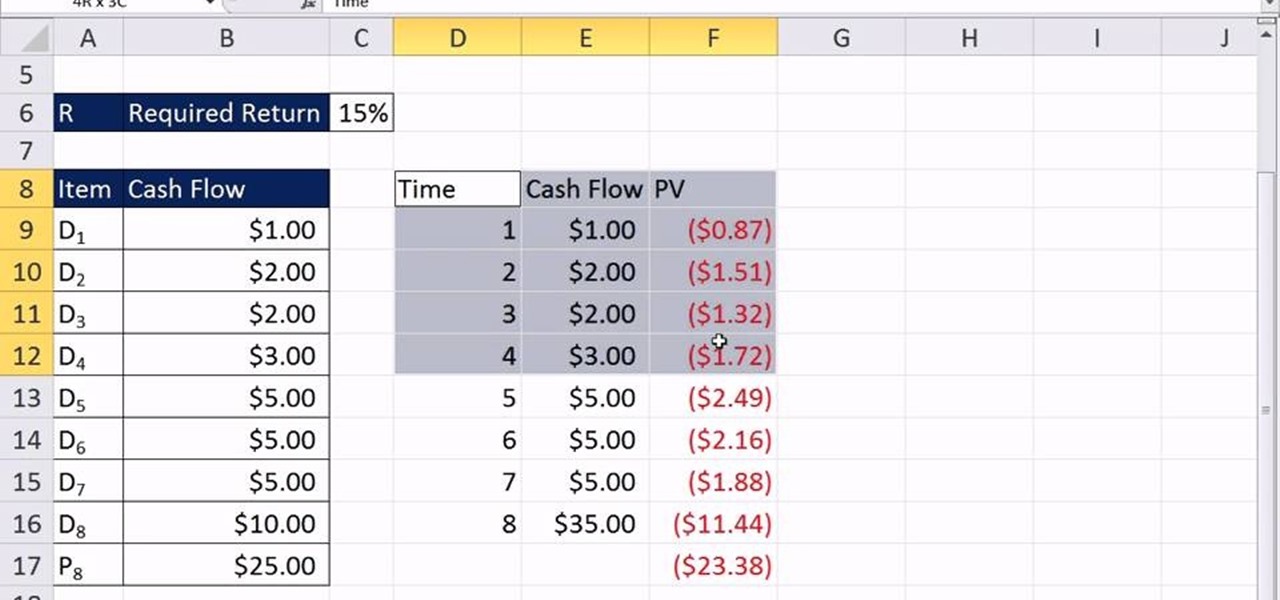

By considering all these elements, you can calculate your business’s operating cash flow using the following formula:

Operating Cash Flow = Revenue – Operating Expenses + Depreciation/Amortization +/- Changes in Working Capital

A positive operating cash flow indicates that your business is generating enough cash from its core operations to cover expenses and potentially reinvest in the business. It demonstrates financial stability and a strong foundation for growth. Conversely, a negative operating cash flow suggests that your business is not generating enough cash from operations to cover expenses, which may require additional financing or cost-cutting measures.

Regularly monitoring and analyzing your operating cash flow allows you to identify trends, evaluate the effectiveness of your business operations, and make informed decisions to optimize your cash flow. By managing your operating cash flow effectively, you can ensure the financial health and sustainability of your business.

Investing Cash Flow

Investing cash flow is a crucial component of cash flow analysis that focuses on the cash flows related to the acquisition and disposal of long-term assets. It provides insights into your business’s investment activities and helps determine the returns on those investments.

When calculating investing cash flow, you need to consider the cash inflows and outflows associated with your business’s investments. Here are some key elements to consider:

- Sale of Assets: Cash inflows in investing cash flow can occur when you sell long-term assets such as property, equipment, or investments. These cash inflows reflect the proceeds received from the sale and can provide a boost to your cash position.

- Investment Income: If your business has invested in stocks, bonds, or other financial instruments, you may receive dividends or interest as cash inflows. These cash inflows should be included in your investing cash flow analysis.

- Purchase of Assets: Investing cash flow also includes the cash outflows related to the acquisition of long-term assets. This can include the purchase of new equipment, property, or investments. These cash outflows represent the capital invested in expanding or improving your business’s capabilities.

By considering these elements, you can calculate your business’s investing cash flow using the following formula:

Investing Cash Flow = Cash Inflows from Asset Sales + Investment Income – Cash Outflows for Asset Purchases

A positive investing cash flow indicates that your business is generating cash inflows from the sale of assets or investments, potentially indicating a good return on those investments. This can be a positive sign of financial stability and wise capital allocation. On the other hand, a negative investing cash flow suggests that your business is using cash to acquire long-term assets, which could impact your overall cash position.

Regularly monitoring and analyzing your investing cash flow allows you to assess the effectiveness of your investment decisions and make informed choices. It helps you evaluate the returns on your assets and determine if adjustments need to be made to your investment strategy.

Additionally, understanding your investing cash flow allows you to plan for future investments, assess the timing and financing requirements, and evaluate the potential risks and rewards of various investment opportunities. This analysis enables you to make sound investment decisions and optimize the use of your business’s financial resources.

By effectively managing your investing cash flow, you can ensure that your business’s investments contribute to its long-term growth and success.

Financing Cash Flow

Financing cash flow is a significant component of cash flow analysis that focuses on the cash inflows and outflows related to your business’s financing activities. It provides insights into how your business raises capital, manages its debt obligations, and distributes cash to its stakeholders.

When calculating financing cash flow, you need to consider the cash flows associated with your business’s financing activities. Here are some key elements to consider:

- Borrowings: Cash inflows in financing cash flow occur when your business raises capital by borrowing funds. This includes cash received from bank loans, lines of credit, or other forms of financing. These inflows serve to increase your business’s cash position and provide additional working capital.

- Issuing Stock: If your business raises funds through the issuance of stock or other equity instruments, the cash received from the sale of those securities should be included in your financing cash flow. These inflows represent an infusion of capital and can provide the resources needed for expansion or other strategic initiatives.

- Debt Repayment: Financing cash flow also includes cash outflows related to the repayment of debt. This can include principal payments on loans, interest payments, or other debt obligations. These outflows reflect the cash used to reduce your business’s debt load and fulfill its financial obligations.

- Dividends and Distributions: If your business distributes cash to shareholders in the form of dividends, these cash outflows should be included in your financing cash flow. Dividends represent a return of profits to owners or shareholders and can impact your business’s cash position.

By considering these elements, you can calculate your business’s financing cash flow using the following formula:

Financing Cash Flow = Cash Inflows from Borrowings + Cash Inflows from Issuing Stock – Cash Outflows for Debt Repayment – Cash Outflows for Dividends and Distributions

A positive financing cash flow indicates that your business is raising capital through borrowing or issuing stock, potentially signaling financial strength or growth opportunities. It demonstrates your ability to attract external funding and manage your capital structure efficiently. However, a negative financing cash flow suggests that your business is using cash to repay debt or distribute cash to shareholders.

Regularly analyzing your financing cash flow allows you to assess your business’s debt management practices, evaluate its dividend policy, and make informed decisions regarding future financing needs. It helps you determine the impact of your financing activities on your overall cash position and assess the sustainability of your business’s capital structure.

Understanding and managing your financing cash flow is crucial for maintaining a healthy balance between debt and equity, meeting your financial obligations, and ensuring the long-term stability and growth of your business.

Calculation of Cash Flow

Calculating cash flow is a fundamental aspect of financial analysis that provides insights into the movement of cash in and out of your business. It allows you to assess your business’s financial health, its ability to generate cash, and its overall liquidity. Here are the steps to calculate cash flow:

Step 1: Determine Cash Inflows

The first step is to identify all sources of cash inflows into your business. This includes revenue from sales, cash received from customers, investment income, and any other sources of cash coming into your business during the period under consideration.

Step 2: Determine Cash Outflows

The next step is to identify all cash outflows from your business. This encompasses your operating expenses, payments to suppliers, salaries and wages, loan repayments, taxes, and any other cash payments made during the period.

Step 3: Calculate Net Cash Flow

Once you have determined your cash inflows and outflows, you can calculate the net cash flow. This is done by subtracting the total cash outflows from the total cash inflows. The net cash flow can be positive if your business has generated more cash than it has spent or negative if your business has spent more cash than it has generated.

Net Cash Flow = Total Cash Inflows – Total Cash Outflows

A positive net cash flow indicates that your business has a surplus of cash, which can be used for reinvestment, expansion, or other strategic initiatives. It signifies financial strength and stability. On the other hand, a negative net cash flow suggests that your business is facing a cash deficit, which may require additional financing or cost-cutting measures to address.

Regularly calculating and analyzing your cash flow allows you to understand the financial dynamics of your business and make informed decisions. It helps you assess the timing and availability of cash, identify trends and patterns in your cash flow, and ensure that your business has adequate liquidity to meet its obligations.

Having a comprehensive understanding of your cash flow enables you to optimize your financial management strategies, maintain stability, and position your business for long-term success.

Step 1: Determine Cash Inflows

When calculating cash flow for your business, the first step is to identify and determine all sources of cash inflows. Cash inflows represent the money coming into your business during a specific period and can include various revenue streams and other sources of cash. Here’s how you can determine your cash inflows:

- Revenue from Sales: Revenue from sales is one of the primary sources of cash for most businesses. This includes cash received from the sale of products or services to customers. It is important to consider cash sales as well as any accounts receivable that have been collected during the period.

- Cash Received from Customers: In addition to revenue from sales, you may have other cash inflows from customers. This can include upfront payments, prepaid orders, or other cash received directly from customers for various reasons. It is crucial to track these cash inflows separately from revenue to get an accurate picture of your cash flow.

- Investment Income: If your business has invested in stocks, bonds, or other financial instruments, you may receive dividends, interest, or capital gains as cash inflows. These investment incomes should be included in your calculation of cash inflows.

- Loan Proceeds: If your business has borrowed funds, the money received from loan proceeds should be considered as a cash inflow. This can include bank loans, lines of credit, or any other form of borrowed funds that have been received during the period.

- Other Sources: Cash inflows can come from various other sources, such as grants, subsidies, or asset sales. It is important to identify and include all cash inflows from these sources in your cash flow calculation.

By identifying and considering these sources of cash inflows, you can get a comprehensive understanding of the money coming into your business during the specified period. This will help you accurately assess your business’s ability to generate cash and determine its overall financial health.

Remember, when calculating cash inflows, it is essential to focus on actual cash received during the period and not revenue recognized or invoiced. Having a clear understanding of your cash inflows will enable you to make informed decisions, manage your business’s liquidity effectively, and ensure its long-term financial stability.

Step 2: Determine Cash Outflows

In the process of calculating cash flow for your business, the second step is to determine and identify all sources of cash outflows. Cash outflows represent the expenses and expenditures made by your business during a specific period. It is important to account for all cash payments in order to accurately assess your business’s cash position. Here’s how you can determine your cash outflows:

- Operating Expenses: Start by identifying and categorizing your operating expenses. This includes payments made for wages and salaries, rent, utilities, office supplies, marketing expenses, and any other expenses directly related to your daily operations. Consider all cash payments made during the period.

- Supplier Payments: If your business purchases goods or services from suppliers, you need to identify and record the cash payments made to them during the specific period. This includes payments for raw materials, inventory, services rendered, or any other purchases made to support your operations.

- Loan Repayments: If your business has outstanding loans or borrowings, you need to consider the cash payments made to repay these debts. This includes principal repayments and any interest payments made during the period.

- Tax Payments: Cash outflows also include payments made for taxes. This includes federal, state, and local taxes, as well as any other applicable taxes such as sales tax or employment taxes. Identify and record all cash payments made towards tax obligations.

- Other Expenses: In addition to the above, consider any other cash payments that do not fall into the categories mentioned. This can include insurance premiums, professional fees, equipment purchases, repairs and maintenance costs, and any other miscellaneous expenses.

By identifying and considering these sources of cash outflows, you can get a comprehensive understanding of the cash leaving your business during the specified period. This will help you accurately assess your business’s cash flow and its ability to manage its expenses.

Remember to focus on actual cash payments rather than accruals or expenses recognized but not yet paid. By tracking and analyzing your cash outflows, you can identify areas where you may need to control costs, optimize spending, or explore opportunities for efficiency. This analysis enables you to make informed financial decisions and improve the overall financial health of your business.

Step 3: Calculate Net Cash Flow

After determining the cash inflows and outflows in your business, the next step is to calculate the net cash flow. The net cash flow represents the overall change in your business’s cash position during a specific period. It is the difference between the total cash inflows and the total cash outflows.

To calculate the net cash flow, follow these steps:

- Add Up Cash Inflows: Sum up all the cash inflows you identified in Step 1. This includes revenue from sales, cash received from customers, investment income, loan proceeds, and any other sources of cash coming into your business.

- Add Up Cash Outflows: Sum up all the cash outflows you determined in Step 2. This includes operating expenses, supplier payments, loan repayments, tax payments, and any other expenses or expenditures made during the period.

- Calculate Net Cash Flow: Subtract the total cash outflows from the total cash inflows to calculate the net cash flow. Use the following formula:

Net Cash Flow = Total Cash Inflows – Total Cash Outflows

The net cash flow can be positive, negative, or zero, depending on whether your business has generated a surplus of cash, experienced a shortfall, or maintained a constant cash position during the period.

A positive net cash flow indicates that your business has generated more cash than it has spent. It suggests financial strength, liquidity, and the ability to meet financial obligations. Positive cash flow can be used for expansion, investments, debt reduction, or building reserves.

A negative net cash flow, on the other hand, indicates that your business has spent more cash than it has generated. It signals a cash shortfall, potential liquidity challenges, or the need for additional financing to cover expenses and obligations.

A net cash flow of zero means that your business has neither generated excess cash nor experienced a cash deficit. It suggests a balance between cash inflows and outflows during the period.

Regularly calculating and analyzing your net cash flow is essential for understanding your business’s overall cash position, managing your financial resources effectively, and making informed decisions about budgeting, investment, and financing. It enables you to evaluate your business’s cash flow trends, identify areas of improvement, and take necessary actions to maintain a healthy financial position.

By monitoring and optimizing your net cash flow, you can ensure the financial stability, growth, and sustainability of your business.

Importance of Cash Flow Analysis

Cash flow analysis is a critical tool for businesses of all sizes and industries. It provides valuable insights into the movement of cash within your business and serves as a key indicator of its financial health. Understanding and analyzing cash flow is essential for several reasons:

1. Assessing Financial Stability:

Cash flow analysis allows you to evaluate your business’s ability to generate sufficient cash to cover its expenses and financial obligations. It provides a clear picture of your business’s financial stability, indicating whether it has enough cash on hand to meet its short-term and long-term needs. A positive cash flow signals that your business is in a solid position, while a negative cash flow may indicate underlying financial challenges that need to be addressed.

2. Planning for Growth and Expansion:

By monitoring cash flow, you can identify surplus cash that can be reinvested into your business for growth and expansion opportunities. A positive cash flow provides the financial means to invest in new ventures, expand operations, purchase assets, or hire additional staff. Cash flow analysis allows you to make strategic decisions about allocating resources and capitalizing on opportunities that can drive business growth.

3. Managing Cash Flow Gaps:

Understanding your cash flow allows you to identify periods when cash inflows may not be sufficient to cover expenses. By analyzing your cash flow, you can anticipate potential cash flow gaps and take proactive measures to manage them. This may involve negotiating extended payment terms with suppliers, adjusting payment schedules with customers, securing additional financing, or implementing cost-cutting measures to bridge the gap.

4. Making Informed Financial Decisions:

Cash flow analysis provides valuable insights that support informed financial decision-making. It enables you to evaluate the financial impact of various decisions, such as acquiring assets, launching new products or services, restructuring debt, or pursuing business partnerships. By considering the cash flow implications, you can assess the potential risks and rewards of these decisions and their impact on your business’s overall cash position.

5. Securing Financing and Building Relationships with Stakeholders:

When seeking external financing or engaging with stakeholders, cash flow analysis plays a crucial role. Lenders and investors often rely on cash flow assessments to evaluate a business’s ability to repay loans or generate returns on their investments. By having a clear understanding of your cash flow, you can present a compelling case to lenders, investors, and other stakeholders, enhancing your credibility and fostering trust in your business.

Ultimately, cash flow analysis equips you with the knowledge and insights to make effective financial decisions, manage your business’s liquidity, and navigate through both challenging and prosperous times. It provides a solid foundation for financial planning and enables you to build a resilient and sustainable business.

Benefits of Positive Cash Flow

Achieving and maintaining positive cash flow is a significant milestone for any business. Positive cash flow occurs when the cash inflows exceed the cash outflows during a specific period. Here are some key benefits of having positive cash flow:

1. Financial Stability and Security:

Positive cash flow provides your business with a stable and secure financial foundation. It ensures that you have enough cash on hand to cover your operating expenses, debts, and other financial obligations. This stability minimizes the risk of financial distress and provides peace of mind, allowing you to focus on running and growing your business.

2. Ability to Seize Opportunities:

Positive cash flow grants your business the flexibility and ability to seize opportunities that may arise. With surplus cash, you can invest in new projects, technologies, or strategic partnerships that drive growth and innovation. It enables you to take advantage of favorable market conditions, expand your operations, or explore new markets.

3. Investment in Growth and Expansion:

Positive cash flow provides the resources to invest in the growth and expansion of your business. It allows you to allocate funds for marketing initiatives, research and development, hiring and training talent, or upgrading your infrastructure and equipment. This reinvestment can lead to increased market share, enhanced competitiveness, and improved long-term profitability.

4. Enhanced Financial Planning and Forecasting:

With positive cash flow, you can engage in effective financial planning and forecasting. By projecting your cash inflows and outflows, you can anticipate potential cash flow gaps, plan for future expenses, and make informed decisions on budget allocation. This proactive approach enables you to manage your working capital efficiently and reduce the risk of financial surprises.

5. Stronger Relationship with Stakeholders:

Positive cash flow fosters stronger relationships with stakeholders, including lenders, investors, suppliers, and employees. Lenders and investors view positive cash flow as a sign of financial strength and reliability, increasing your credibility and access to financing options. Suppliers and vendors are confident in your ability to make timely payments, which can lead to favorable terms and discounts. Positive cash flow also enables you to provide stable employment and rewards to your employees, fostering loyalty and motivation.

6. Improved Risk Management:

Positive cash flow provides a cushion for unforeseen circumstances or downturns in the business environment. It allows you to set aside funds for emergencies, unforeseen expenses, or economic downturns. By maintaining a healthy cash position, you can mitigate risks, withstand temporary setbacks, and navigate challenging times with greater resilience.

Overall, positive cash flow is crucial for the financial success and sustainability of your business. It empowers you to make informed decisions, invest in growth, and navigate through both favorable and challenging business conditions. By prioritizing positive cash flow, you create a solid foundation for long-term success and achieve your business objectives.

Challenges of Negative Cash Flow

Negative cash flow occurs when a business’s cash outflows exceed its cash inflows during a specific period. It poses significant challenges and can have detrimental effects on the financial health and stability of a business. Here are some key challenges that arise from negative cash flow:

1. Financial Instability:

Negative cash flow creates financial instability for a business. When cash inflows don’t cover cash outflows, it becomes difficult to meet regular expenses, such as payroll, rent, and supplier payments. This can lead to missed payments, damaged relationships with vendors, and potential disruptions in the supply chain. Financial instability can also negatively affect the business’s credit rating and its ability to secure future financing.

2. Inability to Cover Operating Expenses:

Negative cash flow makes it challenging for a business to cover its day-to-day operating expenses. Without sufficient cash on hand, routine costs such as utilities, employee salaries, inventory purchases, and marketing expenses may go unpaid. As a result, the business may experience a decline in product or service quality, reduced customer satisfaction, or potential staff turnover.

3. Difficulty in Repaying Debt:

When a business is experiencing negative cash flow, it becomes challenging to meet debt repayment obligations. This can lead to missed payments or late payments, which not only damages the business’s creditworthiness but may also result in penalties, higher interest rates, or collection efforts by lenders. The inability to meet debt repayments can further worsen the financial situation and increase the risk of overall business failure.

4. Limited Growth and Expansion Opportunities:

Negative cash flow severely restricts a business’s ability to invest in growth and expansion initiatives. The lack of available cash makes it difficult to allocate funds for marketing, research and development, new product launches, or entering new markets. Without the necessary resources to seize growth opportunities, the business may fall behind competitors and struggle to adapt to changing market demands.

5. Lowered Confidence from Stakeholders:

Stakeholders, including lenders, investors, suppliers, and employees, often view negative cash flow as a sign of financial instability. This can erode their confidence in the business and create uncertainty about the business’s ability to meet its financial obligations. Suppliers may tighten credit terms or raise prices, lenders may be less willing to extend credit, and investors may shy away from providing additional funding. Employee morale and loyalty may also be affected, as they may question the business’s long-term viability.

6. Increased Risk of Business Failure:

Consistent negative cash flow can lead to a higher risk of business failure. The inability to generate enough cash to cover expenses and financial obligations puts the business at risk of insolvency. This may lead to bankruptcy, closure, or the need for drastic cost-cutting measures that can negatively impact the quality of products, services, and the overall reputation of the business.

Managing and addressing negative cash flow is vital for the survival and success of a business. It requires a thorough assessment of expenses, revenue streams, and strategic decision-making to improve cash inflows, reduce expenses, and secure alternative sources of financing. Timely action, effective financial management, and a commitment to positive cash flow are critical to overcoming these challenges and steering the business towards long-term stability and growth.

Cash Flow Management Strategies

Effective cash flow management is crucial for the financial health and success of any business. Implementing strategic practices can help optimize your cash flow, maintain sufficient liquidity, and improve overall financial stability. Here are some key strategies to manage your business’s cash flow:

1. Cash Flow Forecasting:

Develop a comprehensive cash flow forecast to project your cash inflows and outflows over a specific period. This allows you to anticipate cash flow gaps, plan for upcoming expenses, and make informed financial decisions. Regularly review and update your cash flow forecast to reflect changes in market conditions, customer payment patterns, or business operations.

2. Efficient Invoicing and Accounts Receivable Management:

Implement efficient invoicing processes to expedite customer payments. Send invoices promptly, clearly communicate payment terms, and follow up on overdue payments. Consider offering incentives, such as early payment discounts, to encourage timely payments. Regularly monitor your accounts receivable and implement measures to address delinquent accounts, such as using collection agencies or renegotiating payment terms.

3. Vendor Negotiations and Accounts Payable Management:

Negotiate favorable terms with your suppliers to optimize your cash flow. Seek extended payment terms or discounts for early payment. However, ensure that you maintain good relationships with your vendors by making timely payments and honoring your commitments. Monitor and manage your accounts payable to ensure timely payments while taking advantage of available cash flow opportunities.

4. Working Capital Management:

Efficiently manage your working capital, which includes accounts receivable, accounts payable, and inventory. Aim to reduce the time it takes to convert inventory into sales and collect customer payments. Implement inventory management techniques, such as just-in-time inventory or demand forecasting, to avoid excessive inventory holding costs. Optimize your payment terms with suppliers to maintain a balanced cash flow cycle.

5. Expense Control:

Regularly review and evaluate your operating expenses to identify areas for cost reduction. Look for opportunities to streamline operations, negotiate better pricing with suppliers, and eliminate unnecessary expenses. Implement cost-saving measures without compromising the quality of your products or services. Keep a close eye on discretionary spending and prioritize expenses that directly contribute to revenue generation or essential business operations.

6. Capital Expenditure Planning:

Carefully plan and prioritize your capital expenditures to align with your cash flow. Evaluate whether investments are essential for your business’s growth and profitability. Consider alternative financing options, such as leasing equipment rather than purchasing outright. Align your capital expenditure plan with your cash flow forecast to ensure that you have adequate cash resources to support these investments.

7. Access to External Financing:

Develop strong relationships with lenders and explore various financing options to manage cash flow gaps. Maintain open communication, provide accurate financial information, and demonstrate the ability to repay loans. Consider working capital loans, lines of credit, or invoice financing to bridge temporary cash flow constraints. Keep in mind that additional financing should be used judiciously and in line with your business’s cash flow management strategy.

By implementing these cash flow management strategies, you can proactively control and enhance your business’s cash flow. Regularly monitor and analyze your cash flow, adjust your strategies as needed, and seek professional advice when required. Effective cash flow management will contribute to the financial stability, growth, and long-term success of your business.

Conclusion

Cash flow is the lifeblood of any business, and effective cash flow management is essential for its financial health and success. Understanding, analyzing, and carefully managing your business’s cash flow allows you to make informed decisions, allocate resources effectively, and navigate through both prosperous and challenging times.

Through the comprehensive process of cash flow analysis, you gain insights into the various components of cash flow, including operating cash flow, investing cash flow, and financing cash flow. By accurately calculating your cash inflows and outflows, you can determine your net cash flow and assess your business’s overall cash position.

Positive cash flow brings numerous benefits, including financial stability, the ability to seize growth opportunities, and enhanced confidence from stakeholders. It enables you to plan for future investments, manage working capital efficiently, and secure financing when needed.

Conversely, negative cash flow poses significant challenges, such as financial instability, difficulty in covering expenses, and limited growth opportunities. Effective cash flow management strategies, including cash flow forecasting, efficient invoicing, vendor management, and expense control, can alleviate these challenges and help steer your business towards positive cash flow.

Regular monitoring, analysis, and optimization of your cash flow are crucial for sustaining and growing your business. Maintain a proactive approach, seek opportunities for improvement, and adapt your strategies as market conditions change.

By prioritizing cash flow management, you lay the foundation for financial stability, achieve sustainable growth, and position your business for long-term success. Take the necessary steps to maintain positive cash flow, maximize profitability, and ensure the financial health of your business in the years to come.