Finance

How Do I Learn Tax Planning

Published: January 20, 2024

Learn tax planning techniques to optimize your finances. Gain valuable knowledge and strategies to effectively plan your taxes.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding Tax Planning

- Importance of Tax Planning

- Key Tax Planning Concepts

- Tax Deductions and Credits

- Tax Bracket and Marginal Tax Rate

- Types of Taxes

- Strategies for Tax Planning

- Tracking and Organizing Tax Documents

- Utilizing Retirement Accounts

- Maximizing Tax Deductions

- Timing Income and Expenses

- Charitable Contributions and Donations

- Hiring a Professional Tax Planner

- Conclusion

Introduction

Tax planning is a crucial aspect of personal finance that often gets overlooked or underestimated. It involves understanding and utilizing various strategies to minimize the amount of taxes you owe and maximize your after-tax income.

With the ever-changing tax laws and regulations, it can be challenging to stay on top of the latest updates and figure out the most effective tax planning strategies. That’s where this guide comes in. In this article, we’ll walk you through the basics of tax planning, its importance, and key concepts you need to know to make informed decisions.

Whether you are a salaried employee, a small business owner, or an investor, proper tax planning can make a significant difference in your financial well-being. It can help you save money, avoid penalties, and ensure compliance with relevant tax laws.

In this fast-paced world, it’s crucial to be proactive and proactive in managing your tax affairs. By doing so, you can optimize your financial situation, achieve your financial goals, and secure a better future for yourself and your loved ones. So, let’s dive into the world of tax planning and explore the strategies and tools you can use to minimize your tax burden and maximize your wealth.

Understanding Tax Planning

Tax planning is the process of organizing your financial affairs in a way that minimizes your tax liability while remaining compliant with the tax laws and regulations. It involves analyzing your income, expenses, deductions, and credits to strategically plan your financial decisions throughout the year.

When it comes to tax planning, it’s essential to have a clear understanding of the tax code and how it applies to your specific situation. Each country has its own tax laws, and they can be complex and subject to frequent changes. Therefore, it’s crucial to stay informed about updates and seek professional advice if needed.

Tax planning is not about evading taxes or engaging in illegal activities. It is about taking advantage of legal deductions, incentives, and exemptions provided by the tax code to reduce your tax burden. By utilizing various tax planning strategies, you can legally minimize your tax liability and keep more of your hard-earned money.

Successful tax planning requires careful consideration of different factors, such as your income sources, investments, deductions, and credits. It involves evaluating your financial goals and making informed decisions that align with those goals.

It’s important to distinguish tax planning from tax preparation. While tax preparation involves filing your tax return and ensuring accurate reporting of your income and expenses, tax planning focuses on the strategic decisions made throughout the year to optimize your tax situation.

With a solid understanding of tax planning, you can make informed financial decisions and take advantage of tax-saving opportunities. In the following sections, we’ll delve deeper into the importance of tax planning and explore key concepts that will help you make the most of your tax situation.

Importance of Tax Planning

Tax planning plays a crucial role in your overall financial well-being. Here are some key reasons why tax planning is important:

Minimizing tax liability: The primary goal of tax planning is to reduce your tax burden by taking advantage of available deductions, credits, and exemptions. By strategically planning your finances, you can optimize your tax situation and keep more of your hard-earned money.

Maximizing after-tax income: By minimizing your tax liability, you can increase your after-tax income. This extra money can be used to pay off debts, save for the future, or invest in opportunities that can further grow your wealth.

Compliance with tax laws: Tax planning ensures that you are in compliance with the tax laws and regulations. By staying informed about the tax code and seeking professional advice when needed, you can reduce the risk of facing penalties, audits, or other legal consequences.

Strategic financial decisions: Tax planning encourages you to make informed financial decisions throughout the year, rather than scrambling to meet tax deadlines at the last minute. By incorporating tax considerations into your financial planning, you can make strategic choices that align with your long-term goals.

Planning for future financial goals: Tax planning allows you to factor in your future financial goals and make decisions that support those goals. Whether it’s saving for retirement, buying a home, or funding your children’s education, considering the tax implications can help you optimize your savings and investment strategies.

Utilizing available tax incentives: Tax laws often provide various incentives to promote certain behaviors or stimulate specific sectors of the economy. Through tax planning, you can identify and take advantage of these incentives, such as tax credits for energy-efficient upgrades or deductions for contributions to retirement accounts.

Overall, tax planning is a proactive approach to managing your finances. It allows you to take control of your tax situation, maximize your after-tax income, and align your financial decisions with your long-term goals. By investing time and effort into tax planning, you can unlock opportunities for significant savings and enhance your financial well-being.

Key Tax Planning Concepts

When it comes to tax planning, understanding key concepts is essential for making informed decisions. Here are some important tax planning concepts to be familiar with:

Tax Deductions: Tax deductions are expenses that you can subtract from your taxable income, reducing the amount of income subject to tax. Common deductions include mortgage interest, medical expenses, and state and local taxes. By maximizing your deductions, you can lower your tax liability.

Tax Credits: Unlike deductions, tax credits directly reduce your tax liability. They are more valuable as they provide a dollar-for-dollar reduction in the amount of tax owed. Examples of tax credits include the Child Tax Credit, the Earned Income Tax Credit, and education credits. Taking advantage of available tax credits can significantly lower your tax bill.

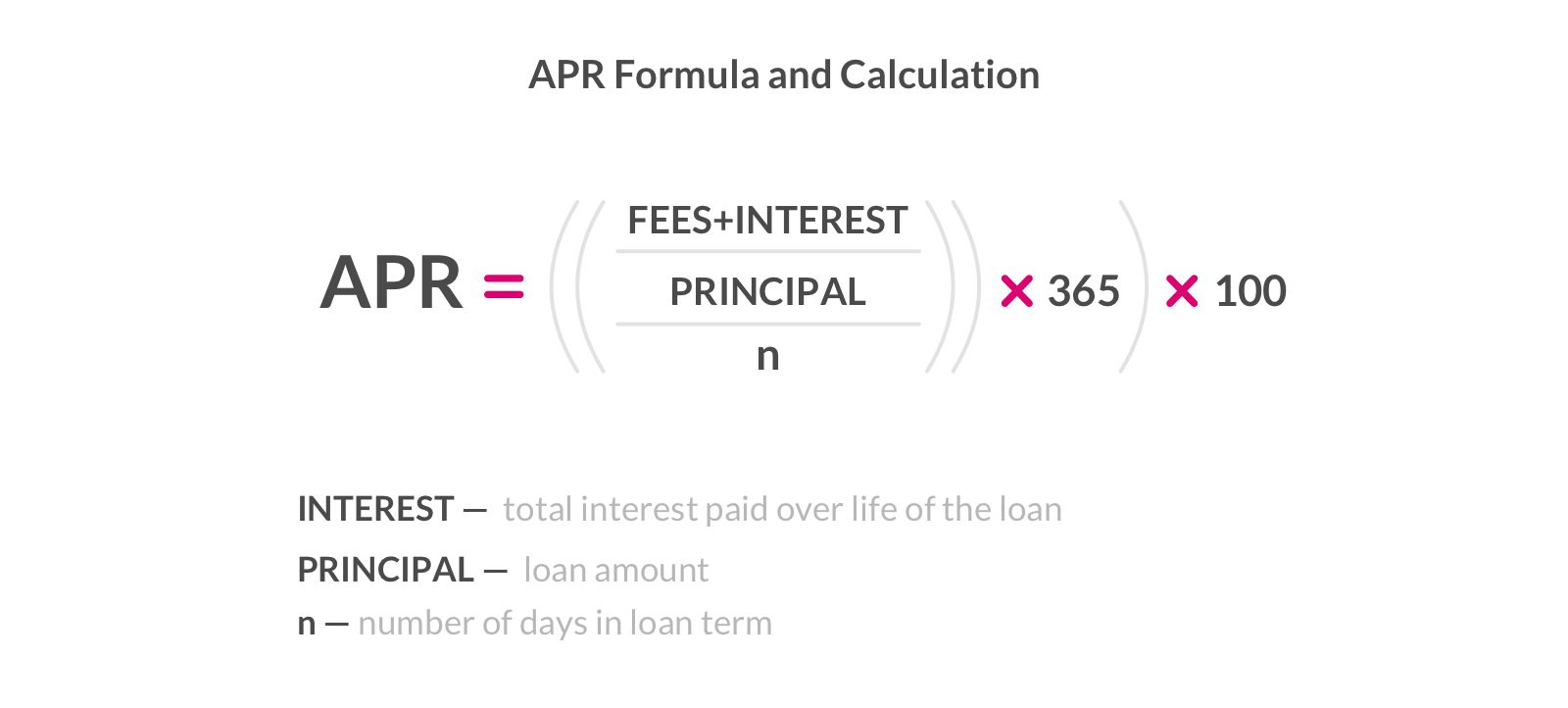

Tax Bracket: Tax brackets determine the tax rate at which your income is taxed. They are often referred to as marginal tax rates. In a progressive tax system, as your income increases, you move into higher tax brackets and pay a higher tax rate on the additional income. Understanding your tax bracket can help you plan your income and expenses more effectively.

Marginal Tax Rate: Your marginal tax rate is the tax rate applied to the last dollar of your income. It’s crucial to understand this rate when making financial decisions that could push you into a higher tax bracket. For example, if you are near the threshold of a higher tax bracket, deferring income to the following year may help you save on taxes.

Types of Taxes: Tax planning also involves understanding the different types of taxes you may encounter. Some common types include income tax, capital gains tax, property tax, and sales tax. Each type of tax has its own rules and regulations, and effective tax planning considers the impact of each tax on your overall financial situation.

Tax-Advantaged Accounts: Tax-advantaged accounts, such as 401(k)s and Individual Retirement Accounts (IRAs), offer tax benefits, such as tax-deferred growth or tax-free withdrawals in retirement. Contributing to these accounts can help reduce your current taxable income and allow your investments to grow without immediate tax implications.

Tax Loss Harvesting: Tax loss harvesting involves strategically selling investments that have declined in value to offset capital gains or reduce taxable income. By taking advantage of investment losses, you can potentially lower your tax liability and optimize your investment portfolio.

Understanding these key tax planning concepts will empower you to make informed financial decisions and take advantage of available tax-saving opportunities. By incorporating these concepts into your tax planning strategy, you can optimize your tax situation and work towards achieving your financial goals.

Tax Deductions and Credits

Tax deductions and credits are valuable tools in tax planning that can significantly reduce your tax liability. Understanding the difference between these two concepts is crucial for optimizing your tax situation.

Tax Deductions: Tax deductions are allowable expenses that you can subtract from your taxable income. They reduce the amount of income that is subject to tax. Some common tax deductions include mortgage interest, state and local taxes, medical expenses, and charitable contributions. Deductions can be either itemized deductions or standard deductions, depending on your eligibility and financial situation.

Itemizing deductions involves listing your deductible expenses individually on your tax return, while the standard deduction is a fixed amount that varies based on your filing status. You can choose to either itemize deductions or take the standard deduction, depending on which option results in a greater reduction of your taxable income.

Tax Credits: Tax credits are direct reductions of your tax liability. They provide a dollar-for-dollar reduction in the amount of tax you owe. Tax credits can be non-refundable or refundable.

Non-refundable tax credits reduce your tax liability but cannot result in a refund. For example, if you owe $2,000 in taxes and qualify for a $1,000 non-refundable tax credit, your tax liability will be reduced to $1,000, but you will not receive the remaining $1,000 as a refund.

On the other hand, refundable tax credits can result in a refund even if the credit amount exceeds your tax liability. If you owe $2,000 in taxes and qualify for a $3,000 refundable tax credit, your tax liability will be reduced to $0, and you may receive the remaining $1,000 as a refund.

Common tax credits include the Child Tax Credit, the Earned Income Tax Credit, and education credits. Taking advantage of tax credits can significantly lower your tax bill and increase your potential for tax refunds.

It’s important to stay informed about eligible tax deductions and credits to maximize your tax savings. Keeping track of your expenses, maintaining proper documentation, and seeking professional advice can help you identify and utilize all available deductions and credits.

Remember, tax deductions and credits are not one-size-fits-all. They can vary depending on your individual circumstances, such as your filing status, income level, and eligible expenses. Consulting with a tax professional or utilizing tax preparation software can help you navigate the complexities of deductions and credits to optimize your tax planning strategy.

Tax Bracket and Marginal Tax Rate

Understanding your tax bracket and marginal tax rate is crucial for effective tax planning. These concepts determine the tax rate at which your income is taxed and can help you make strategic decisions to optimize your tax situation.

Tax Bracket: Tax brackets are ranges of income levels that correspond to different tax rates. In a progressive tax system, as your income increases, you move into higher tax brackets and pay a higher tax rate on the additional income. The tax code typically has multiple tax brackets, each with its own tax rate.

For example, let’s say you are in the 2021 tax year and fall into the following tax bracket:

- 10% on income up to $9,950

- 12% on income between $9,951 and $40,525

- 22% on income between $40,526 and $86,375

- …

In this example, the first $9,950 of your income is taxed at a 10% rate, the next portion of your income between $9,951 and $40,525 is taxed at a 12% rate, and so on.

Marginal Tax Rate: Your marginal tax rate is the tax rate applied to the last dollar of income you earn. It is the highest tax rate you pay on any part of your income. Understanding your marginal tax rate is essential for making financial decisions that can potentially affect your tax liability.

For instance, if you are on the cusp of a higher tax bracket, earning more income could push you into that higher bracket and subject you to a higher tax rate. In such a situation, you might consider deferring some income to a future year or timing your expenses strategically to minimize your tax liability.

It is important to note that being in a higher tax bracket does not mean that all your income is taxed at that higher rate. Only the portion of your income within that specific tax bracket is subject to the corresponding tax rate.

By understanding your tax bracket and marginal tax rate, you can effectively plan your income and expenses to minimize your overall tax liability. It may be helpful to consult with a tax professional or use online tools to calculate your tax liability under different scenarios and determine the most advantageous strategies for your specific situation.

Ultimately, being aware of your tax bracket and marginal tax rate empowers you to make informed financial decisions and optimize your tax planning strategy to minimize your tax burden.

Types of Taxes

When it comes to tax planning, it’s important to understand the different types of taxes that you may encounter. Here are some of the most common types of taxes:

Income Tax: Income tax is a tax imposed on the income you earn from various sources. It is typically the largest component of an individual’s tax liability. Income tax rates vary based on your income level and filing status. In most countries, including the United States, income tax is progressive, meaning that higher income earners are subject to higher tax rates.

Capital Gains Tax: Capital gains tax is a tax on the profit you earn from the sale of assets, such as stocks, bonds, real estate, or artwork. The tax rate on capital gains depends on the duration of the investment and the type of asset being sold. Capital gains can be either short-term (held for one year or less) or long-term (held for more than one year), with long-term capital gains typically subject to lower tax rates.

Property Tax: Property tax is a tax imposed on the value of real estate properties you own, such as your home or land. It is generally assessed and collected by local governments to fund public services, such as schools, infrastructure, and emergency services. The amount of property tax you owe is based on the assessed value of your property and the tax rate set by the local jurisdiction.

Sales Tax: Sales tax is a tax imposed on the purchase of goods and services. It is typically a percentage of the sale price and is collected by the seller at the point of sale. Sales tax rates can vary by jurisdiction, and some items may be exempt from sales tax, such as certain groceries or prescription medications.

Excise Tax: Excise tax is a tax imposed on specific products or activities deemed to be harmful or in need of regulation. This tax is typically included in the price of the goods or services and is collected at the point of sale. Examples of goods subject to excise tax include tobacco, alcohol, gasoline, and luxury items.

Payroll Tax: Payroll tax is a tax imposed on the wages and salaries paid by employers and employees. It includes Social Security tax, which funds the Social Security program, and Medicare tax, which funds the Medicare program. Payroll taxes are typically withheld from employee wages by the employer and remitted to the government.

These are just a few examples of the types of taxes you may encounter. It’s important to stay informed about the specific tax laws and regulations in your country or jurisdiction. Understanding the different types of taxes can help you plan your finances more effectively and ensure compliance with relevant tax obligations.

Strategies for Tax Planning

Effective tax planning involves implementing strategies to minimize your tax liability while remaining compliant with tax laws. Here are some key strategies to consider:

Tracking and Organizing Tax Documents: Start by maintaining organized records of your financial transactions throughout the year. This includes keeping track of receipts, invoices, and other relevant documents that support your income and deductions. Having well-organized tax records will make it easier to prepare your tax return accurately and ensure that you don’t miss out on any eligible deductions or credits.

Utilizing Retirement Accounts: Contributing to tax-advantaged retirement accounts, such as 401(k)s or IRAs, can offer immediate tax benefits. Depending on the type of account, your contributions may be tax-deductible, meaning they reduce your taxable income in the year of contribution. Additionally, the investments within these accounts can grow tax-deferred or even tax-free. By taking advantage of these accounts, you can simultaneously save for retirement and lower your current tax burden.

Maximizing Tax Deductions: Identify and utilize all eligible tax deductions available to you. This may involve itemizing deductions instead of taking the standard deduction if your expenses exceed the standard deduction amount. Common deductions include mortgage interest, state and local taxes, medical expenses, and charitable contributions. Keep a record of these expenses and consult with a tax professional to ensure you are maximizing your deductions.

Timing Income and Expenses: Timing plays a crucial role in tax planning. Consider whether it’s beneficial to accelerate or defer income or expenses. For example, if you expect to be in a lower tax bracket next year, you may want to defer receiving a bonus until then. On the other hand, if you anticipate a higher tax rate in the future, it might be beneficial to accelerate income or claim deductions in the current year.

Charitable Contributions and Donations: Donating to qualified charities allows you to take advantage of tax deductions while supporting causes you care about. Keep track of your charitable contributions and ensure that you are donating to eligible organizations. Remember to obtain proper documentation, such as receipts or acknowledgment letters, to substantiate your donations for tax purposes.

Hiring a Professional Tax Planner: Consider engaging the services of a professional tax planner or a certified public accountant (CPA) specializing in tax planning. They can provide personalized advice tailored to your unique financial situation, help you identify opportunities for tax savings, and ensure compliance with tax laws. A tax professional’s expertise can be invaluable in maximizing your tax planning strategies.

Keep in mind that tax planning strategies are not set in stone and may vary depending on your specific circumstances. It’s important to stay informed about changes in tax laws and regulations that may impact your tax planning decisions. Consulting with a tax professional or using tax planning software can provide additional guidance and ensure that you are making strategic and informed choices.

By implementing these tax planning strategies, you can optimize your tax situation, reduce your tax liability, and ultimately keep more of your hard-earned money.

Tracking and Organizing Tax Documents

Tracking and organizing your tax documents throughout the year is a crucial step in effective tax planning. By maintaining well-organized records, you can ensure accurate reporting of your income and deductions, maximize your eligible tax benefits, and minimize the chances of errors or omissions on your tax return. Here are some important tips for tracking and organizing your tax documents:

Keep a Dedicated Folder: Designate a specific folder or file drawer to keep all your tax-related documents in one place. This can include your W-2 forms, 1099 forms, receipts, invoices, and any other relevant documents. By having a dedicated folder, you can easily locate and access your tax documents when it’s time to prepare your tax return.

Save Digital Copies: In addition to physical copies, it’s recommended to save digital copies of your tax documents. Scan your paper documents or save electronic versions as PDFs to a secure location, such as a cloud storage service or an encrypted hard drive. Digital copies can serve as backups and make it easier to retrieve your documents if the need arises.

Organize by Tax Year: Create separate subfolders or digital folders for each tax year to keep your documents organized chronologically. Clearly label the folders with the corresponding tax year to ensure clarity and ease of access. This practice will also help you track your financial progress from year to year.

Separate Personal and Business Expenses: If you have both personal and business expenses, it’s important to keep them separate. Maintain separate folders or subfolders for personal and business-related tax documents, receipts, and other relevant records. This will streamline the tax preparation process and prevent confusion or mix-ups.

Track Income Sources: Keep a record of all your income sources throughout the year. This includes employment income, freelance or self-employment income, rental income, investment income, and any other sources of income. Retain copies of relevant pay stubs, invoices, and other income documentation to accurately report your income on your tax return.

Document Deductible Expenses: Track and document all expenses that may be eligible for tax deductions. This includes receipts for medical expenses, mortgage interest, property taxes, charitable donations, educational expenses, and business-related expenses. Properly categorize and store these documents for easy reference when preparing your tax return.

Retain Tax Forms for Reference: Keep a copy of your previous year’s tax return, along with any supporting schedules and forms, as a reference for the current year’s tax planning. Reviewing your previous return can provide valuable insights into deductions and credits you previously claimed and help you identify areas for potential tax savings.

Seek Professional Guidance: If you’re unsure about the specific documents you need to track or have complex tax situations, consider consulting with a professional tax advisor or certified public accountant (CPA). They can provide guidance on the necessary documents to track for your specific situation and assist you in organizing your tax records.

By tracking and organizing your tax documents year-round, you’ll be better prepared for tax time. You can efficiently and accurately report your income, claim eligible deductions and credits, and ensure compliance with tax laws. Implementing good record-keeping practices will not only streamline your tax planning process but also provide peace of mind knowing that your tax documents are organized and easily accessible.

Utilizing Retirement Accounts

One effective strategy for tax planning is to maximize the use of retirement accounts. These tax-advantaged accounts offer numerous benefits, including potential tax deductions, tax-deferred growth, and tax-free withdrawals in retirement. Here’s how you can effectively utilize retirement accounts in your tax planning:

Types of Retirement Accounts: There are various types of retirement accounts available, such as 401(k)s, Individual Retirement Accounts (IRAs), and Roth IRAs. These accounts come with different eligibility requirements, contribution limits, and tax advantages. Understanding the features of each account will help you determine which ones are suitable for your situation.

Tax Deductible Contributions: Traditional 401(k)s and Traditional IRAs offer the advantage of tax-deductible contributions. Contributions made to these accounts are generally tax-deductible in the year they are made, which can help lower your taxable income. This means that the more you contribute to these accounts, the more you can potentially reduce your current tax liability.

Tax-Deferred Growth: One of the key benefits of retirement accounts is the ability to grow your investments tax-deferred. This means that any interest, dividends, or capital gains earned within the account are not subject to annual taxation. The growth compounds over time, allowing your savings to potentially grow more quickly compared to taxable accounts.

Tax-Free Withdrawals: Roth 401(k)s and Roth IRAs offer a different tax advantage. While contributions to these accounts are made with after-tax money, qualified withdrawals in retirement are tax-free, including the growth on your investments. This can provide significant tax benefits in retirement when you may have lower income tax rates.

Contribution Limits: It’s important to be aware of the contribution limits for each type of retirement account. For example, in 2021, the annual contribution limit for 401(k)s is $19,500 ($26,000 for those aged 50 and older), while the annual contribution limit for Traditional and Roth IRAs is $6,000 ($7,000 for those aged 50 and older). Maximizing your contributions within these limits can help you make the most of the tax benefits offered by these accounts.

Employer Matching Contributions: If your employer offers a matching contribution to your retirement account, be sure to contribute enough to take full advantage of the match. This is essentially free money and can significantly boost your retirement savings. Employer contributions are typically made to traditional 401(k) accounts and are tax-deductible for the employer.

Convert Traditional IRAs to Roth IRAs: Depending on your tax situation, it may be beneficial to convert some or all of your traditional IRA funds into a Roth IRA. This conversion will result in a taxable event as you’ll need to pay taxes on the converted amount. However, the funds in the Roth IRA will grow tax-free, and qualified withdrawals in retirement will be tax-free, providing potential long-term tax advantages.

Required Minimum Distributions (RMDs): For traditional retirement accounts, such as traditional 401(k)s and traditional IRAs, be aware of the required minimum distributions (RMDs) that kick in once you reach the age of 72 (or 70 ½ if you were born before July 1, 1949). RMDs are taxable withdrawals that you must take annually from these accounts. Failing to meet the RMD requirements can result in significant penalties.

By effectively utilizing retirement accounts, you can not only benefit from potential tax deductions and tax-deferred growth but also create a tax-efficient income stream in retirement. To make the most of these accounts, it’s essential to consider your current financial situation, future retirement goals, and consult with a financial advisor or tax professional to ensure that you’re optimizing your tax planning strategy.

Maximizing Tax Deductions

When it comes to tax planning, maximizing tax deductions is a key strategy to reduce your taxable income and lower your overall tax liability. By taking advantage of eligible deductions, you can optimize your tax situation and potentially save a significant amount of money. Here are some tips for maximizing tax deductions:

Itemize Deductions: Determine whether itemizing deductions is more advantageous for your situation than taking the standard deduction. Itemizing deductions involves listing individual deductible expenses on your tax return, which can potentially result in a larger deduction than the standard deduction. Common itemized deductions include mortgage interest, state and local taxes, medical expenses, and charitable donations. Keep detailed records of your expenses throughout the year to accurately calculate your itemized deductions.

Track Medical Expenses: Medical expenses can be deductible if they exceed a certain threshold. Keep track of all medical expenses, including doctor’s visits, prescriptions, medical supplies, and insurance premiums. These expenses can add up, and if they exceed a certain percentage of your adjusted gross income (AGI), you may be eligible to deduct the excess amount. Consult IRS guidelines or a tax professional to determine the current threshold for deducting medical expenses.

Deduct Mortgage Interest: If you have a mortgage on your primary or secondary residence, you may be eligible to deduct the interest paid on your mortgage. Keep track of your mortgage interest statements (Form 1098) provided by your lender and include this amount when itemizing deductions. Note that there are limitations on the amount of mortgage debt eligible for the deduction, so be sure to consult the tax code or a tax professional to understand the current rules.

Maximize State and Local Tax Deductions: State and local taxes paid, such as income taxes or property taxes, may be deductible. Keep records of your tax payments, including any estimated tax payments made during the year. These amounts can be included in your itemized deductions. However, it’s important to note that there are annual limits on the total amount of state and local taxes that can be deducted, so be mindful of these limitations.

Document Charitable Contributions: Contributions made to qualified charitable organizations can be deductible. Maintain proper documentation, such as receipts or acknowledgment letters from the charities, to substantiate your donations. Take note that there are specific rules and limitations for deducting charitable contributions, depending on the nature of the donation and the organization receiving it. Be sure to follow IRS guidelines or seek guidance from a tax professional to ensure compliance and maximize your charitable deduction.

Consider Above-the-Line Deductions: Above-the-line deductions, also known as adjustments to income, are deductions you can claim regardless of whether you itemize deductions or take the standard deduction. Examples of above-the-line deductions include contributions to retirement accounts, student loan interest, and self-employed health insurance premiums. Utilizing above-the-line deductions can reduce your taxable income, even if you choose not to itemize deductions.

Keep Records of Business Expenses: If you are self-employed or own a small business, keep detailed records of your business-related expenses. These can include office supplies, travel expenses, equipment purchases, and professional fees. Properly tracking and documenting these expenses can help you claim deductions and reduce your self-employment tax liability.

By taking advantage of tax deductions, you can lower your taxable income and potentially save a significant amount of money. Keep thorough records, stay informed about the current tax laws and limits, and consider consulting with a tax professional to ensure you are maximizing your tax deductions within the bounds of the law.

Timing Income and Expenses

Timing your income and expenses strategically can be a powerful tax planning strategy that can help optimize your tax situation. By carefully considering when to receive income and when to incur expenses, you can potentially reduce your taxable income and lower your overall tax liability. Here are some tips for effectively timing your income and expenses:

Accelerating Income: Consider whether it’s beneficial to accelerate the receipt of income into the current tax year. For example, if you are self-employed and expecting payments in late December, you may opt to invoice clients earlier to receive payment before the year-end. By doing this, you can include the income in the current tax year and potentially take advantage of lower tax rates or maximize deductions that are subject to income-based limitations.

Deferring Income: In certain situations, it may be advantageous to defer the receipt of income into the following year. For example, if you anticipate being in a lower tax bracket next year due to expected changes in income or other factors, you can delay invoicing clients or deferring the receipt of bonuses until after January 1st. By doing so, you can potentially reduce your taxable income and take advantage of lower tax rates in the next tax year.

Prepaying Expenses: Consider prepaying deductible expenses before the end of the tax year. This can include making early payments on mortgage interest, property taxes, or other deductible expenses that would normally be paid in the following year. By making these payments in the current year, you can claim the deduction in the current tax year, potentially lowering your taxable income and reducing your tax liability.

Delaying Expenses: On the other hand, there may be situations where it’s beneficial to delay incurring deductible expenses until the following year. This strategy is suitable if you anticipate higher income or if you’ve already reached certain deductions or limitations for the current tax year. By delaying the payment of certain expenses, you can potentially maximize the deduction in the following year when you may need it more.

Optimizing Capital Gains: If you have investments that have appreciated but are not subject to short-term capital gains tax, consider when to sell them strategically. By holding onto investments for longer than one year, you can potentially qualify for long-term capital gains rates, which are often lower than short-term rates. Timing the sale of investments can help optimize your tax liability and maximize your after-tax returns.

Managing Retirement Contributions: Contributing to retirement accounts, such as a Traditional 401(k) or Traditional IRA, can lower your taxable income for the current tax year. Consider making contributions before the end of the tax year to take advantage of the immediate tax benefit. However, be aware of the contribution limits and deadlines for each type of retirement account.

It’s important to note that timing income and expenses requires careful consideration of your specific financial situation and the current tax laws. Additionally, factors such as expected changes in income, deductions, and tax rates should be taken into account. Consulting with a tax professional or financial advisor can provide personalized guidance tailored to your circumstances.

By strategically timing your income and expenses, you can potentially reduce your taxable income, optimize your tax deductions, and minimize your overall tax liability. Remember to stay informed about the tax laws and plan accordingly to make the most of this tax planning strategy.

Charitable Contributions and Donations

Utilizing charitable contributions and donations is not only a meaningful way to support causes you care about but also a valuable tax planning strategy. By making charitable contributions, you can potentially reduce your taxable income and make a positive impact in your community. Here are some key considerations for maximizing the tax benefits of charitable contributions:

Choose Qualified Charities: To claim a tax deduction for your charitable contributions, ensure that you donate to qualified charitable organizations. These include nonprofit organizations that are recognized as tax-exempt by the Internal Revenue Service (IRS). Verify the tax-exempt status of an organization by checking the IRS Exempt Organizations Select Check tool or consult with a tax professional.

Document Your Donations: Keep proper records of your charitable contributions. For cash donations, save bank statements, canceled checks, or receipts provided by the charity. If donating non-cash items, maintain a detailed list of donated items, their estimated value, and any receipts or acknowledgments received from the charity.

Itemizing Deductions: To claim a tax deduction for charitable contributions, you must itemize deductions instead of taking the standard deduction on your tax return. Evaluate whether your total itemized deductions, including the charitable contributions, exceed the standard deduction for your filing status. If so, itemizing deductions may result in a larger tax deduction.

Donating Appreciated Assets: Consider donating appreciated assets, such as stocks or mutual funds, instead of cash. By donating appreciated assets held for more than one year, you may be eligible for a deduction equal to the fair market value of the asset at the time of the donation. This strategy can provide a dual benefit of potentially eliminating capital gains tax on the appreciation while still receiving a tax deduction for the full value of the asset.

Qualified Charitable Distributions (QCDs): If you are over the age of 70½ and have an individual retirement account (IRA), consider making qualified charitable distributions (QCDs). QCDs allow you to directly transfer funds from your IRA to a qualified charity, up to a certain limit. These distributions can satisfy your required minimum distribution (RMD) for the year while excluding the distribution from your taxable income.

Donor-Advised Funds: Donor-advised funds (DAFs) are charitable giving accounts that allow you to contribute funds or assets to a fund managed by a charitable organization. You can then recommend grants to specific charities over time. Contributions to DAFs are deductible in the year they are made, even if the funds are not distributed to charities immediately. DAFs can provide flexibility and tax advantages for strategic charitable giving.

Non-Cash Donations: In addition to cash donations, consider donating non-cash items, such as clothing, household goods, or used vehicles, to qualified charitable organizations. Be sure to donate items in good condition and obtain a receipt or acknowledgment from the charity. Keep in mind that special rules and limitations apply to non-cash donations, so consult IRS guidelines or seek professional advice for accurate valuation and documentation.

It’s important to remember that tax laws and regulations surrounding charitable contributions may change, so staying informed about the latest rules is essential. Consult with a tax professional to ensure compliance and optimize your tax planning strategy.

By strategically planning your charitable contributions and donations, you can make a positive difference in your community while maximizing the tax benefits. Take the time to research qualified charities, keep proper documentation, and evaluate the most advantageous strategies for your unique financial situation.

Hiring a Professional Tax Planner

When it comes to taxes, the complexity of laws and regulations can often be overwhelming. Hiring a professional tax planner or certified public accountant (CPA) who specializes in tax planning can be a wise investment. Here’s why hiring a professional tax planner can benefit your tax planning strategy:

Expertise and Knowledge: Professional tax planners have extensive knowledge and expertise in tax laws and regulations. They stay up to date with the latest changes and developments, ensuring that you receive accurate and timely advice tailored to your specific situation. Their in-depth understanding of the tax code can help you navigate complex tax matters and identify opportunities for tax savings.

Strategic Tax Planning: A tax planning professional can develop a strategic tax plan based on your unique financial situation and goals. They can assess your income, deductions, investments, and other factors to create a personalized tax strategy. By analyzing various scenarios and exploring different tax planning options, they can help you optimize your tax situation and minimize your tax liability.

Maximizing Deductions and Credits: Tax professionals have a deep understanding of eligible deductions, credits, and incentives. They can identify deductions and credits that you may have overlooked, ensuring that you claim all available tax-saving opportunities. This can help you maximize your tax deductions and potentially increase your tax refunds.

Complex Tax Situations: If you have complex tax situations, such as owning a business, multiple income sources, or foreign investments, professional tax planners can provide valuable guidance. They can navigate the intricacies of your situation, ensuring compliance with tax laws and optimizing your tax planning strategy. Handling complex tax issues on your own can be challenging and may expose you to the risk of errors or penalties.

Tax Compliance and Reduced Risk: Tax planners can assist with tax compliance, ensuring that you meet all necessary reporting requirements and deadlines. They can help you accurately complete and file your tax return, reducing the risk of mistakes or omissions that could trigger an audit or penalties. By taking care of your tax obligations accurately and efficiently, tax professionals provide peace of mind and confidence in your tax filing.

IRS Representation: In the event of an IRS audit or a dispute with tax authorities, a tax professional can represent you and act as your advocate. They can communicate with the IRS on your behalf, handle necessary paperwork, and provide expert guidance throughout the process. Having a professional by your side can help diffuse the stress and complexities of dealing with tax authorities.

Financial Planning Integration: Professional tax planners can collaborate with other financial professionals, such as financial planners or investment advisors, to align your tax planning with your overall financial goals. They can coordinate efforts to ensure that your tax strategies complement your long-term financial plan and support your broader financial objectives.

While hiring a tax planner comes at a cost, the potential benefits and peace of mind they offer can outweigh the expense. They can save you time, help you navigate complex tax matters, and ensure compliance with tax laws. Consider consulting with a few tax professionals to find the one who best understands your needs and has the necessary expertise in your specific tax concerns.

Remember, tax planning is an ongoing process, and having a tax professional by your side can provide insights and guidance year-round. By partnering with a professional tax planner, you can optimize your tax planning strategy, reduce your tax liability, and make well-informed financial decisions.

Conclusion

Tax planning is a critical aspect of managing your personal finances effectively. By understanding key concepts, implementing strategies, and optimizing the use of deductions and credits, you can minimize your tax liability and maximize your after-tax income. Throughout this guide, we’ve explored various elements of tax planning, including tracking and organizing tax documents, utilizing retirement accounts, maximizing tax deductions, timing income and expenses, and leveraging charitable contributions.

Remember, tax planning is not a one-size-fits-all approach. Each individual’s financial situation is unique, and it’s important to consider personal circumstances, changes in tax laws, and consult with a professional tax planner or certified public accountant (CPA) for personalized advice.

By being proactive and strategic in your tax planning, you can ensure compliance with tax laws, optimize your financial decisions, and work towards achieving your long-term financial goals. A well-executed tax planning strategy can provide both immediate and long-term financial benefits, such as reducing your tax burden, increasing your after-tax income, and supporting your overall financial well-being.

Make use of the tools, resources, and professional expertise available to you, whether it’s online tax planning software, tax professionals, or educational materials provided by tax authorities. Staying informed, organized, and proactive will help you navigate the complexities of the tax system and make informed financial decisions throughout the year.

Remember, tax planning is an ongoing process. As tax laws change and your financial situation evolves, regularly review and revise your tax planning strategies to ensure they align with your current circumstances and goals.

By taking the time to understand the fundamentals of tax planning, implementing effective strategies, and seeking professional guidance when needed, you can navigate the complexities of the tax system with confidence and optimize your tax situation to secure a better financial future.