Finance

How To Do Tax Planning

Published: January 20, 2024

Learn effective tax planning strategies and techniques to maximize your financial savings and optimize your overall financial situation. Find expert advice and tips on finance, taxes, and investment planning.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding Tax Planning

- Assessing Your Financial Situation

- Identifying Tax Deductions and Credits

- Maximizing Retirement Contributions

- Utilizing Tax-Advantaged Savings Accounts

- Managing Capital Gains and Losses

- Taking Advantage of Tax Deferral Strategies

- Planning for Medical Expenses

- Considering Charitable Contributions

- Reviewing Your Estate and Gift Tax Planning

- Seeking Professional Tax Advice

- Conclusion

Introduction

When it comes to managing your finances, tax planning plays a crucial role in ensuring that you maximize your savings and minimize your tax liability. Tax planning involves strategic decision-making and taking advantage of various tax deductions, credits, and exemptions available to you.

In this article, we will explore the key aspects of tax planning and provide you with actionable tips to optimize your tax situation. Whether you are an individual or a business owner, understanding tax planning can help you make informed financial decisions and keep more money in your pocket.

Tax planning involves assessing your current financial situation, identifying tax deductions and credits, maximizing retirement contributions, utilizing tax-advantaged savings accounts, managing capital gains and losses, taking advantage of tax deferral strategies, planning for medical expenses, considering charitable contributions, reviewing your estate and gift tax planning, and seeking professional tax advice when necessary.

By implementing effective tax planning strategies, you can reduce the amount of tax you owe and potentially qualify for tax refunds. This not only leaves you with more money to allocate towards your financial goals but also provides peace of mind knowing that you are optimizing your tax situation within the bounds of the law.

While tax planning may seem daunting, especially with complex tax regulations and frequent updates, it is worth investing time and effort to ensure that you are utilizing all available opportunities to your advantage. A well-executed tax plan can have a significant impact on your overall financial well-being and help you achieve your short-term and long-term goals.

In the following sections, we will delve into each aspect of tax planning and provide practical tips to help you navigate the intricacies of the tax system. By the end of this article, you will have a solid understanding of how to optimize your tax situation and make informed decisions to effectively manage your finances.

Understanding Tax Planning

Tax planning is the process of analyzing your financial situation and making strategic decisions to minimize your tax liability while staying in compliance with tax laws. It involves evaluating various tax deductions, credits, exemptions, and strategies to optimize your overall tax situation.

One of the key goals of tax planning is to reduce the amount of taxable income you report to the tax authorities. By taking advantage of tax deductions, such as mortgage interest, medical expenses, and education expenses, you can lower your taxable income and potentially decrease the tax you owe.

Tax credits are another important component of tax planning. Unlike deductions that reduce your taxable income, tax credits directly reduce the amount of tax you owe. Examples of tax credits include the Child Tax Credit, the Earned Income Tax Credit, and the Lifetime Learning Credit. By exploring and utilizing available tax credits, you can further maximize your tax savings.

Additionally, tax planning involves understanding and strategically managing your investments to minimize taxes on capital gains and losses. By holding investments for the long term and utilizing tax-managed investment strategies, you may be able to reduce the tax burden associated with investment returns.

Another aspect of tax planning is retirement planning. By maximizing contributions to retirement accounts, such as a 401(k) or an IRA, you can not only save for your future but also reduce your taxable income in the current year. Contributions to these retirement accounts are typically tax-deductible, providing immediate tax benefits.

Furthermore, tax planning considers the utilization of tax-advantaged savings accounts, such as Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs). Contributions to these accounts are tax-deductible, and qualified withdrawals are tax-free, making them valuable tools to manage healthcare expenses and save on taxes.

It’s essential to mention that tax planning is a year-round endeavor. Rather than waiting until tax-filing season, proactive tax planning involves monitoring your financial situation and implementing strategies throughout the year. Regular review of tax laws and regulations can help you identify new opportunities or changes that could impact your tax situation.

In the next sections, we will explore specific tax planning strategies and provide actionable tips to help you make informed decisions. Understanding tax planning and implementing effective strategies can have a significant impact on your financial well-being and long-term financial goals.+

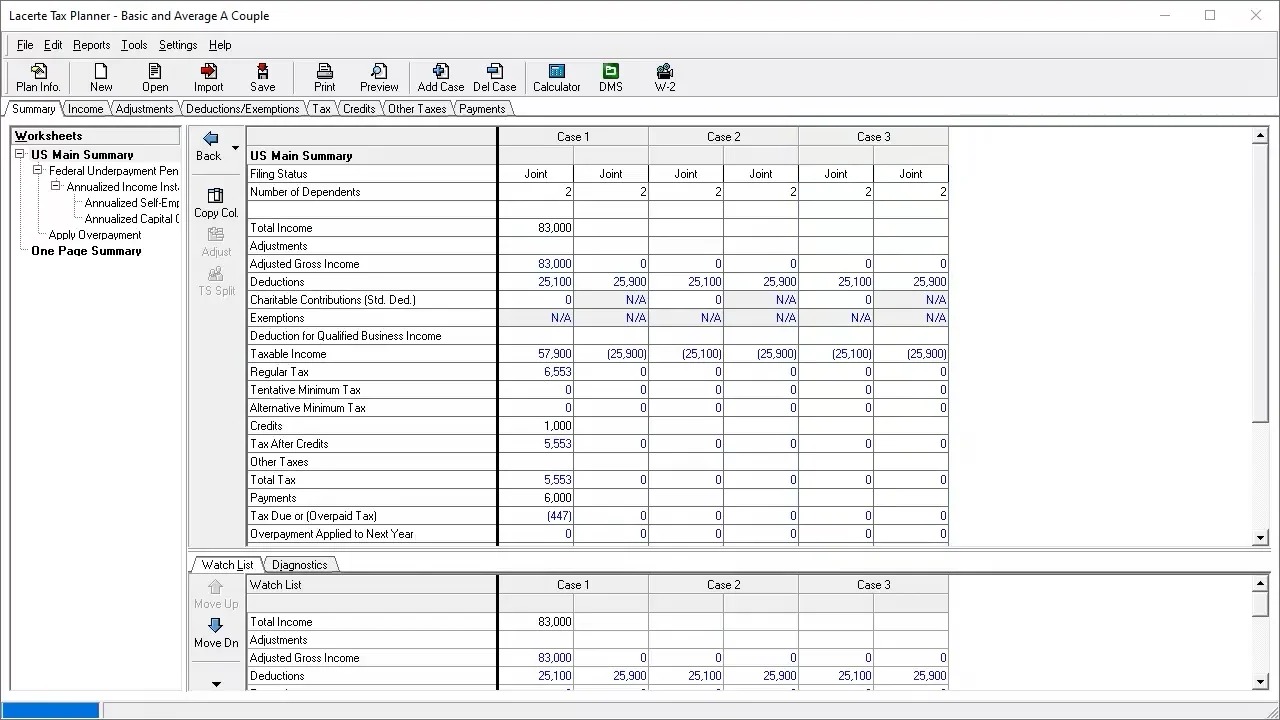

Assessing Your Financial Situation

Before diving into tax planning strategies, it’s crucial to assess your financial situation. Understanding your income, expenses, assets, and liabilities is the foundation for effective tax planning. Here are a few key steps to get started:

- Evaluate Your Income: Take stock of all sources of income, including wages, self-employment income, rental income, and investment income. This will give you a clear picture of your overall income and help determine which tax brackets and deductions may be applicable to you.

- Track Your Expenses: Categorize and track your expenses, such as housing costs, transportation, healthcare, education, and entertainment. Having a comprehensive understanding of your expenses will not only help you create a realistic budget but also identify potential tax deductions or credits that you may be eligible for.

- Review Your Assets and Liabilities: Assess your assets, such as properties, investments, and retirement accounts, as well as your liabilities, such as mortgages, loans, and credit card debt. This analysis will help you identify potential tax strategies related to investment gains or losses, mortgage interest deductions, and debt management.

- Analyze Your Tax Withholdings or Estimated Payments: Ensure that your tax withholdings from your paycheck or estimated tax payments are aligned with your expected tax liability. This prevents underpayment penalties or excessive tax refunds.

By thoroughly assessing your financial situation, you gain insights into your income, expenses, assets, and liabilities, creating a strong foundation for effective tax planning. This assessment allows you to identify potential tax-saving opportunities and make informed decisions regarding various tax strategies.

Throughout the year, regularly review your financial situation to stay updated with any changes that may impact your tax planning. Life events like marriage, having children, buying or selling property, or starting a business can all have significant tax implications. By staying proactive and adapting your tax planning strategies to these changes, you can optimize your tax situation and maximize your savings.

In the next sections, we will explore specific tax deductions, credits, and strategies to help you further optimize your tax planning efforts. Remember, each person’s financial situation is unique, so always consult with a tax professional to ensure that you are making well-informed decisions based on your individual circumstances.

Identifying Tax Deductions and Credits

One of the key aspects of tax planning is identifying tax deductions and credits that you may be eligible for. These deductions and credits can help lower your taxable income and reduce the amount of tax you owe. Let’s explore some common deductions and credits:

- Standard Deduction vs. Itemized Deductions: As a taxpayer, you have the option to take the standard deduction or itemize your deductions. The standard deduction is a predetermined amount set by the IRS based on your filing status. Itemized deductions, on the other hand, require you to list individual deductions such as mortgage interest, state and local taxes, medical expenses, and charitable contributions. Compare these options to determine which one results in a greater deduction for you.

- Mortgage Interest Deduction: If you own a home and have a mortgage, you may be eligible to deduct the interest paid on your mortgage. This deduction can result in significant tax savings, especially in the early years of your mortgage when the majority of your payments go towards interest.

- State and Local Tax Deduction: You can deduct state and local income taxes or state and local sales taxes paid, whichever is higher. This deduction is particularly valuable if you live in a state with high income tax rates or if you made significant purchases subject to sales tax.

- Medical and Dental Expense Deduction: You can deduct qualified medical and dental expenses that exceed a certain percentage of your adjusted gross income (AGI). This deduction can be particularly beneficial for individuals with high medical expenses, such as those with chronic conditions or who require extensive medical treatments.

- Education-Related Deductions and Credits: There are various deductions and credits available for education-related expenses. The Lifetime Learning Credit, American Opportunity Credit, and the deduction for student loan interest are just a few examples. These can help offset the costs of higher education and increase your tax savings.

- Child and Dependent Care Credit: If you paid for child or dependent care to enable you to work or look for work, you may be eligible for the Child and Dependent Care Credit. This credit can help reduce the cost of childcare and is based on a percentage of your qualifying expenses.

- Earned Income Tax Credit (EITC): The EITC is a refundable credit available to individuals with low to moderate income. It is designed to provide financial assistance to working individuals and families. The amount of the credit depends on your income, filing status, and the number of qualifying children you have.

These are just a few examples of the many deductions and credits available. When it comes to tax planning, it’s essential to research and understand all potential deductions and credits that apply to your situation. Keeping accurate records and understanding the requirements for each deduction and credit is crucial to ensure that you can take full advantage of these tax-saving opportunities.

Remember that tax laws and regulations change, so it’s important to stay updated and consult with a tax professional to ensure you are maximizing your tax savings and meeting all necessary requirements.

Maximizing Retirement Contributions

Retirement planning is an integral part of tax planning. By maximizing contributions to retirement accounts, you not only save for the future but also enjoy immediate tax benefits. Here are some key retirement accounts to consider:

- 401(k) or 403(b) Plans: If your employer offers a 401(k) or 403(b) plan, take advantage of it. These plans allow you to contribute a portion of your pre-tax income, reducing your taxable income for the year. Some employers may also offer matching contributions, which is essentially free money towards your retirement savings.

- Traditional IRA: Contributions to a Traditional Individual Retirement Account (IRA) are also tax-deductible. You can contribute up to a certain annual limit, and the contributions grow tax-deferred until you withdraw the funds during retirement. Keep in mind that tax benefits phase out at certain income levels if you or your spouse is covered by an employer-sponsored retirement plan.

- Roth IRA: While contributions to a Roth IRA are not tax-deductible, the earnings in the account grow tax-free, and qualified withdrawals in retirement are tax-free as well. Roth IRAs are especially beneficial if you expect to be in a higher tax bracket during retirement or if you want to enjoy tax-free growth on your investments.

- Simplified Employee Pension (SEP) IRA: If you are self-employed or own a small business, a SEP IRA allows you to contribute a percentage of your net earnings. Contributions are tax-deductible and grow tax-deferred until withdrawal.

- Solo 401(k) or Individual 401(k): These plans are designed for self-employed individuals with no employees, except for a spouse. They allow for higher contribution limits compared to traditional IRAs and SEP IRAs, providing an opportunity to save more for retirement and lower your taxable income.

By maximizing your contributions to these retirement accounts, you can lower your taxable income in the current year and build a solid foundation for your retirement savings. It’s important to note that contribution limits for each retirement account are set by the IRS and may change from year to year.

If you are unable to contribute the maximum amount, make it a goal to contribute at least enough to take advantage of any employer matching contributions. This is essentially free money and can significantly boost your retirement savings.

Remember to review your retirement contributions annually and make adjustments as needed. As your income and financial situation evolve, you may be able to increase your contributions and take advantage of additional tax savings opportunities.

Consult with a financial advisor or tax professional to determine the best retirement savings strategy based on your individual circumstances and goals.

Utilizing Tax-Advantaged Savings Accounts

When it comes to tax planning, utilizing tax-advantaged savings accounts can provide significant benefits. These accounts offer tax advantages that can help you save on taxes now or in the future. Let’s explore some popular tax-advantaged savings accounts:

- Health Savings Account (HSA): An HSA is available to individuals with a high-deductible health insurance plan. Contributions to an HSA are tax-deductible, and qualified withdrawals for medical expenses are tax-free. HSAs offer a triple tax advantage as contributions, earnings, and withdrawals are all tax-free, making them a powerful tool to manage healthcare expenses.

- Flexible Spending Account (FSA): An FSA is typically offered through an employer and allows you to set aside pre-tax dollars for qualified medical expenses. The contributions to an FSA are not subject to federal income tax, Social Security tax, or Medicare tax. However, it’s important to note that FSA funds must be used within the plan year or within a grace period determined by your employer.

- 529 College Savings Plan: A 529 plan is a tax-advantaged savings plan designed to help individuals and families save for education expenses. Contributions to a 529 plan grow tax-free, and qualified withdrawals for educational expenses, such as tuition, books, and room and board, are also tax-free.

- Coverdell Education Savings Account (ESA): Similar to a 529 plan, a Coverdell ESA is another tax-advantaged savings account designed for education expenses. Contributions to a Coverdell ESA are not tax-deductible, but earnings grow tax-free, and qualified withdrawals for educational expenses are tax-free.

By utilizing these tax-advantaged savings accounts, you can benefit from tax deductions on contributions, tax-free growth of funds, and tax-free withdrawals for qualifying expenses. These accounts provide valuable opportunities to save on taxes while planning for healthcare expenses, education costs, and other financial goals.

It’s important to carefully consider the contribution limits and eligibility requirements for each type of tax-advantaged account. Additionally, familiarize yourself with any restrictions or guidelines regarding qualified expenses to ensure that you maximize the tax benefits of these accounts.

As part of your tax planning strategy, evaluate your financial goals and determine which tax-advantaged savings accounts align with your needs. Consult with a financial advisor or tax professional to explore the options available to you and develop a plan that optimizes your tax savings.

Remember to review and adjust your contributions to these accounts annually based on changes in your financial situation and goals. Regularly monitor your account balances, investment choices, and any updates to tax laws that may impact these savings vehicles.

Managing Capital Gains and Losses

Capital gains and losses are an important aspect of tax planning, especially for individuals who have investments in stocks, real estate, or other assets. Understanding how to manage and optimize capital gains and losses can help reduce your tax liability. Here are some key strategies:

- Long-Term vs. Short-Term Capital Gains: Capital gains are categorized as either long-term or short-term, depending on how long you held the assets before selling them. Long-term capital gains are generally taxed at a lower rate than short-term capital gains. Consider holding investments for more than a year to qualify for long-term capital gains tax rates.

- Harvest Losses to Offset Gains: Capital losses can be used to offset capital gains. If you have investments that have declined in value, consider selling them to harvest the losses. These losses can be used to offset any capital gains you may have, thereby reducing your overall tax liability. Note that there are specific rules and limitations regarding the use of capital losses, so consult with a tax professional for guidance.

- Consider Tax-Loss Harvesting: Tax-loss harvesting involves strategically selling investments at a loss to offset capital gains and potentially reduce your taxable income. However, be mindful of the wash-sale rule, which disallows the deduction of losses if you repurchase substantially identical securities within a 30-day period. Proper planning and coordination of investment activities is necessary for effective tax-loss harvesting.

- Donate Appreciated Assets: If you have appreciated assets such as stocks or mutual funds, consider donating them instead of cash. By donating these assets, you can avoid paying capital gains taxes on the appreciation while still receiving a charitable deduction based on the fair market value of the asset.

- Utilize Capital Gain Tax Rates: Take advantage of the different tax rates for long-term capital gains. Depending on your income, you may be eligible for a 0%, 15%, or 20% tax rate on long-term capital gains. Consider strategic planning to stay within these lower tax brackets and maximize tax savings.

It’s important to monitor your investments regularly and assess the tax implications of buying or selling assets. Understanding the tax consequences of your investment decisions can help you make informed choices and minimize your overall tax liability.

Consult with a tax professional or financial advisor to develop a comprehensive strategy for managing capital gains and losses based on your unique financial situation and investment portfolio. They can provide guidance on tax-efficient investment strategies and help you navigate any complexities associated with capital gains taxation.

By effectively managing capital gains and losses, you can optimize your tax situation and potentially reduce your tax burden, allowing you to keep more of your investment returns in your pocket.

Taking Advantage of Tax Deferral Strategies

Tax deferral strategies can be valuable tools for tax planning, allowing you to delay the payment of taxes to a future date. By deferring taxes, you can free up more money for investment and savings, potentially benefiting from compounding growth. Here are some tax deferral strategies to consider:

- Retirement Contributions: As mentioned earlier, maximizing contributions to retirement accounts like a 401(k) or an IRA can provide immediate tax benefits by reducing your taxable income. The contributions grow tax-deferred until you withdraw the funds during retirement when you may be in a lower tax bracket.

- Deferred Compensation Plans: If you have the option to participate in a deferred compensation plan, such as a nonqualified deferred compensation plan or an executive deferred compensation plan, consider taking advantage of it. These plans allow you to defer a portion of your income until a later date, typically retirement, when you may be in a lower tax bracket.

- 1031 Like-Kind Exchange: For real estate investors, a 1031 like-kind exchange provides the opportunity to defer taxes on the sale of a property by reinvesting the proceeds into a similar property. By exchanging properties rather than selling and purchasing new ones, you can defer capital gains taxes indefinitely.

- Installment Sales: If you are selling an asset, such as real estate or a business, consider structuring the sale as an installment sale. With an installment sale, you receive payments over time, allowing you to defer the recognition of the taxable gain and potentially lower your overall tax liability.

- Deferred Annuities: Deferred annuities are insurance contracts that allow you to invest and grow your money on a tax-deferred basis. You pay taxes on the earnings when you withdraw the funds in the future, potentially at a lower tax rate. This strategy can be particularly beneficial for individuals looking for tax-efficient ways to save for retirement.

These tax deferral strategies can provide significant benefits by reducing your current tax burden and allowing your investments to grow tax-free until a later date. However, it’s important to note that deferring taxes does not mean avoiding taxes altogether. You will eventually have to pay taxes when you withdraw the funds or sell the assets.

When considering tax deferral strategies, consult with a tax professional or financial advisor who can assess your specific situation and provide guidance based on your goals and objectives. They can help you evaluate the potential tax savings, explore the feasibility of implementing these strategies, and ensure compliance with tax laws and regulations.

Remember that tax laws and regulations can change, so it’s important to stay informed and review your tax deferral strategies periodically to ensure they align with your long-term financial goals.

Planning for Medical Expenses

Medical expenses can be a significant financial burden, so effective tax planning can help alleviate some of the costs. Here are some strategies to consider when planning for medical expenses:

- Health Savings Account (HSA): If you have a high-deductible health insurance plan, consider contributing to an HSA. HSAs offer tax advantages as contributions are tax-deductible, earnings grow tax-free, and qualified withdrawals for medical expenses are tax-free. By contributing to an HSA, you can save on taxes while building a fund specifically designated for medical expenses.

- Flexible Spending Account (FSA): If your employer offers an FSA, take advantage of it. FSAs allow you to set aside pre-tax dollars to pay for eligible medical expenses. It’s important to plan your FSA contributions carefully as funds must be used within the plan year or within a grace period determined by your employer.

- Itemize Medical Expenses: If your total medical expenses exceed a certain percentage of your adjusted gross income (AGI), you may be able to itemize and deduct them on your tax return. Qualified medical expenses can include doctor’s fees, prescription medications, hospital bills, and certain medical equipment.

- Long-term Care Insurance: Consider investing in long-term care insurance, especially if you anticipate significant medical and care expenses in the future. Premiums for long-term care insurance are generally deductible as medical expenses, subject to certain limits based on your age.

- Medical Expense Reimbursement Plans: If you are self-employed, you may be eligible to establish a Medical Expense Reimbursement Plan (MERP). MERPs allow self-employed individuals to deduct medical expenses as a business expense, potentially providing significant tax savings.

When planning for medical expenses, it’s essential to keep accurate records of all your medical bills, receipts, and reimbursement statements. This documentation will support your claims and help you maximize your tax deductions or credits.

Additionally, stay informed about changes in tax laws and regulations related to medical expenses, as they can impact your tax planning strategies. Consult with a tax professional or financial advisor to ensure you are taking full advantage of available deductions, credits, and tax-advantaged accounts.

By incorporating these strategies into your tax planning, you can better manage the financial impact of medical expenses and potentially reduce your overall tax liability.

Considering Charitable Contributions

Charitable contributions not only benefit worthy causes but also provide valuable tax incentives. By strategically planning your charitable giving, you can make a positive impact while potentially lowering your tax liability. Here are some key considerations for maximizing the tax benefits of charitable contributions:

- Itemize Your Deductions: To claim a deduction for charitable contributions, you must itemize your deductions on your tax return. This means you’ll need to forgo taking the standard deduction and instead list individual deductions, including your charitable contributions.

- Choose Qualified Charities: Ensure that the organizations you contribute to are qualified charities recognized by the IRS. Contributions to religious organizations, educational institutions, public charities, and other eligible nonprofits generally qualify for tax deductions.

- Keep Detailed Records: When making charitable donations, keep detailed records of your contributions. This includes receipts, acknowledgment letters from the charities, and documentation of the donation amounts. Maintaining accurate records is essential to substantiate your deduction claims.

- Donate Appreciated Securities: If you have appreciated stocks, mutual funds, or other securities, consider donating them directly to a charity. By doing so, you may be eligible for a charitable deduction for the fair market value of the securities, while also avoiding capital gains taxes on the appreciated value.

- Donor-Advised Funds: Donor-advised funds (DAFs) allow you to contribute to a fund that is then distributed to various charities. With a DAF, you can claim a charitable deduction in the year you contribute to the fund, while having the freedom to recommend grants to charities at a later time.

- Qualified Charitable Distributions (QCDs): If you are age 70 ½ or older and have an individual retirement account (IRA), you can make QCDs directly from your IRA to a qualified charity. These distributions count towards your required minimum distribution (RMD) but are not taxed as income. QCDs can be a tax-efficient way to fulfill your charitable intentions while reducing your taxable income.

Remember that there are limits to the deductions you can claim for charitable contributions. Consult with a tax professional or financial advisor to ensure you are maximizing your deductions based on your specific financial situation and the current tax laws.

Lastly, it’s important to approach charitable giving with a genuine desire to make a difference. Choose causes that align with your values and passions, and research charities to ensure they are reputable and effective in their mission.

By strategically planning your charitable contributions, you can make a positive impact in the world while maximizing your tax benefits.

Reviewing Your Estate and Gift Tax Planning

Estate and gift tax planning involves managing your assets and wealth to minimize the tax burden on your estate and ensure a smooth transfer of assets to your beneficiaries. While estate and gift taxes affect high net worth individuals more significantly, it’s crucial for everyone to review their planning periodically. Here are some key considerations:

- Know the Exemption Limits: Familiarize yourself with the estate and gift tax exemption limits set by the IRS. These exemptions determine the amount of assets you can transfer during your lifetime or upon your death without incurring estate or gift taxes. It’s essential to stay updated on any changes to these limits, as they can impact your planning strategies.

- Utilize Annual Gift Exclusions: Take advantage of the annual gift tax exclusion to transfer assets to your beneficiaries tax-free. Currently, you can gift up to a certain amount per person each year without incurring gift tax. This strategy not only reduces your taxable estate but also allows you to contribute to the financial well-being of your loved ones during your lifetime.

- Consider Charitable Giving: Charitable giving can be an effective strategy for reducing your taxable estate while supporting causes you care about. Donating to qualified charities can provide valuable deductions that can offset the value of your estate and potentially lower your overall tax liability. Consult with a tax professional to explore options for incorporating charitable giving into your estate planning.

- Establish Trusts: Trusts can be valuable vehicles for estate planning. Irrevocable trusts, such as life insurance trusts or charitable remainder trusts, can help protect assets, maintain control over the distribution of assets, and potentially reduce estate taxes. Revocable living trusts can provide flexibility in managing and distributing assets during your lifetime and after your death.

- Review and Update Estate Planning Documents: Regularly review and update your estate planning documents, such as wills, trusts, and beneficiary designations. Changes in family circumstances, financial situations, or tax laws may necessitate updates to ensure your wishes are accurately reflected and your estate plan is optimized.

Estate and gift tax planning can be complex, so it’s wise to work with an experienced estate planning attorney or tax professional who specializes in this area. They can help you navigate the legal and tax implications and provide guidance based on your unique circumstances and goals.

Remember that effective estate planning goes beyond tax considerations. It also involves ensuring that your loved ones are provided for, minimizing potential disputes, and preserving your legacy. Consider consulting with a professional to develop a comprehensive and tailored estate plan.

Seeking Professional Tax Advice

When it comes to tax planning, seeking professional tax advice is invaluable. Tax laws and regulations are complex and ever-changing, making it crucial to work with a qualified tax professional who can provide guidance based on your specific financial situation. Here are some reasons why seeking professional tax advice is beneficial:

- Expertise and Knowledge: Tax professionals, such as Certified Public Accountants (CPAs) or Enrolled Agents (EAs), have a deep understanding of tax laws and regulations. They stay updated on changes in tax legislation and have the expertise to navigate complex tax matters. Their knowledge and experience allow them to identify tax-saving opportunities and develop effective strategies tailored to your situation.

- Optimized Tax Benefits: Tax professionals can identify deductions, credits, and strategies that you may not be aware of. They can review your financial situation, assess your goals, and identify opportunities to minimize your tax liability while staying compliant with tax laws. Their insights can help you maximize your tax benefits and potentially save significant amounts of money.

- Compliance and Risk Mitigation: Tax professionals ensure that you comply with tax laws and regulations, minimizing the risk of errors or omissions that could lead to penalties or audits. They help you navigate complex tax forms, record-keeping requirements, and tax deadlines, ensuring that you meet all necessary obligations and submit accurate and complete tax returns.

- Guidance for Complex Financial Situations: If you have complex financial circumstances, such as owning a business, investing in multiple properties, or working as a freelancer, a tax professional can offer guidance specific to your situation. They can help you navigate the intricacies of self-employment taxes, business deductions, depreciation, estimated tax payments, and other complexities that may arise.

- Long-Term Planning: Tax professionals can provide valuable insight for long-term tax planning. They can help you develop strategies that align with your financial goals, whether it’s planning for retirement, saving for education, or leaving a legacy for your loved ones. Their guidance can ensure that you are taking advantage of tax-saving opportunities throughout your financial journey.

When seeking professional tax advice, it’s important to choose a reputable and qualified tax professional. Consider their credentials, experience, and expertise in areas relevant to your tax needs. Personal recommendations, reviews, and referrals can also be helpful in finding a trusted tax advisor.

Remember that tax professionals are bound by ethical standards and confidentiality rules. They work in your best interest and are committed to helping you navigate the complexities of the tax system.

Whether you are an individual taxpayer or a business owner, consulting with a tax professional can provide peace of mind, optimize your tax situation, and help you make informed financial decisions. Partnering with a tax professional ensures that you are maximizing your tax benefits and staying on top of your tax obligations throughout the year.

Conclusion

Effective tax planning is a crucial component of managing your finances and maximizing your savings. By understanding the various strategies and opportunities available, you can optimize your tax situation and keep more money in your pocket. Throughout this article, we have explored key aspects of tax planning, including assessing your financial situation, identifying tax deductions and credits, maximizing retirement contributions, utilizing tax-advantaged savings accounts, managing capital gains and losses, planning for medical expenses, considering charitable contributions, reviewing estate and gift tax planning, and seeking professional tax advice.

By assessing your financial situation, you gain a clear understanding of your income, expenses, assets, and liabilities, providing a foundation for your tax planning efforts. Identifying tax deductions and credits allows you to lower your taxable income and potentially reduce your tax liability. Maximizing retirement contributions and utilizing tax-advantaged savings accounts can provide immediate tax benefits and long-term savings growth. Managing capital gains and losses helps you optimize your investment returns while minimizing your tax burden. Planning for medical expenses and considering charitable contributions provide avenues for reducing taxes while supporting important causes. Reviewing estate and gift tax planning ensures a smooth transfer of assets and potential tax savings. Lastly, seeking professional tax advice brings expertise, compliance, and long-term planning strategies to optimize your tax situation.

Remember that tax laws and regulations are complex and subject to change. It is crucial to stay informed, regularly review your financial situation, and consult with a tax professional or financial advisor to navigate the intricacies of the tax system. They can provide personalized guidance based on your unique circumstances, goals, and the current tax landscape.

By incorporating these tax planning strategies and staying proactive in managing your tax situation, you can minimize your tax liability, maximize your savings, and ensure that you are making informed decisions regarding your finances. Take control of your tax planning today and build a solid foundation for your financial future.