Home>Finance>How Do I Estimate The Tax Brackets In Future Years For Retirement Planning

Finance

How Do I Estimate The Tax Brackets In Future Years For Retirement Planning

Published: January 21, 2024

Learn how to estimate tax brackets for retirement planning in future years. Gain valuable insights on finance and tax strategies to optimize your retirement savings.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding Tax Brackets

- Factors Affecting Future Tax Brackets

- Methods for Estimating Future Tax Brackets

- Historical Analysis of Tax Bracket Changes

- Economic and Political Factors Impacting Tax Brackets

- Adjusting for Inflation and Cost-of-Living Changes

- Importance of Accurate Tax Bracket Estimates for Retirement Planning

- Conclusion

Introduction

When it comes to retirement planning, understanding tax brackets and estimating them accurately can play a vital role in ensuring financial stability during your golden years. Tax brackets determine the percentage of your income that will be subject to federal income taxes, with different brackets corresponding to different income ranges. As tax rates and brackets can change over time, it is important to have a strategy in place to estimate future tax brackets.

Estimating tax brackets in future years can be challenging due to numerous factors that affect tax policy, such as changes in economic conditions, political changes, and inflation rates. However, by analyzing historical tax bracket trends, considering economic and political factors, and adjusting for inflation, you can make more informed estimates for your retirement planning.

In this article, we will explore the factors that impact future tax brackets and discuss various methods for estimating them. We will also highlight the importance of accurate tax bracket estimates in retirement planning and provide insights into adjusting for inflation and cost-of-living changes. By gaining a deeper understanding of these concepts, you will be better equipped to make informed financial decisions to secure a comfortable retirement.

Understanding Tax Brackets

Tax brackets are the ranges of income subject to different tax rates. The tax bracket system is progressive, which means that as your income increases, the percentage of your income that you owe in taxes also increases.

For example, let’s say there are three tax brackets: 10%, 15%, and 20%. If you fall into the 10% tax bracket, you will owe 10% of your income in federal taxes. If you fall into the 15% tax bracket, you will owe 15% of your income, and so on.

It’s important to note that tax brackets apply to different portions of your income. For instance, if you are in the 15% tax bracket, you will only owe 15% on the income that falls within that specific bracket, not on your entire income.

Understanding tax brackets is crucial for retirement planning because it allows you to estimate your tax liability and budget accordingly. By knowing which tax bracket you fall into, you can make strategic decisions about your retirement income sources and expenses to minimize your tax burden.

Another important factor to consider is the difference between marginal tax rate and effective tax rate. Marginal tax rate refers to the tax rate applied to the last dollar of your income, while effective tax rate is the average tax rate you pay on your total income. The effective tax rate takes into account the different tax brackets you fall into.

By understanding your tax brackets and the corresponding rates, you can optimize your retirement income to minimize your tax liability and maximize your savings.

Factors Affecting Future Tax Brackets

Estimating future tax brackets requires considering several factors that can influence tax policy and rates. By understanding these factors, you can make more accurate predictions for your retirement planning. Here are some of the key factors affecting future tax brackets:

- Economic Conditions: Economic conditions, such as GDP growth, inflation rates, and unemployment rates, can impact tax brackets. During periods of economic growth, tax rates may be adjusted to generate revenue or stimulate the economy. Conversely, during economic downturns, tax rates may be adjusted to provide relief or support fiscal stability.

- Political Changes: Changes in government leadership and political priorities can have a significant impact on tax policy. Different political parties may advocate for changes in tax rates or the structure of tax brackets, which can result in new legislation affecting future tax brackets.

- Income Inequality: Income inequality is a pressing issue globally. Governments may address this issue by implementing tax reforms, such as adjusting tax brackets to redistribute wealth or introduce new tax brackets targeting specific income levels.

- Tax Legislation: Tax laws are subject to amendments and revisions over time. Changes in tax legislation can result from political decisions, economic needs, or societal trends. Keeping track of tax law changes can help in estimating future tax brackets more accurately.

- Demographic Shifts: Demographic changes, such as an aging population or shifts in workforce composition, can influence tax policy. Governments may introduce new tax brackets or adjust rates to address the evolving needs and demographics of society.

- Global Factors: Global economic trends and geopolitical events can also impact tax policy. For example, changes in international trade agreements or global economic crises can influence tax rates and brackets as governments respond to these external factors.

It’s important to note that predicting future tax brackets is not an exact science, as it involves a complex interplay of various factors. However, by keeping these influential factors in mind, you can make more informed estimations for your retirement planning.

Methods for Estimating Future Tax Brackets

Estimating future tax brackets is a challenge due to the dynamic nature of tax laws and the factors that influence them. However, several methods can help you make educated estimations for your retirement planning. Here are some common methods used:

- Historical Analysis: Examining historical tax data can provide insights into past trends and patterns in tax brackets. By reviewing historical tax rate changes and adjusting for inflation, you can identify common patterns and use them as a basis for estimating future tax brackets.

- Economic Projections: Keeping an eye on economic forecasts and projections can help you anticipate changes in tax policy. Economic indicators, such as GDP growth, inflation rates, and government debt, can provide clues about potential tax changes. Consulting reputable economic sources can provide valuable insights for estimating future tax brackets.

- Political Landscape: Monitoring political developments and understanding the priorities of different political parties can give you an idea of potential tax policy changes. Pay attention to election platforms, proposed tax reforms, and statements from key policymakers to gauge potential shifts in tax brackets.

- Expert Opinion: Seeking advice from tax professionals, financial planners, or economists can provide valuable expertise in estimating future tax brackets. These professionals have in-depth knowledge of tax laws and can help you navigate through the complexities of tax forecasting.

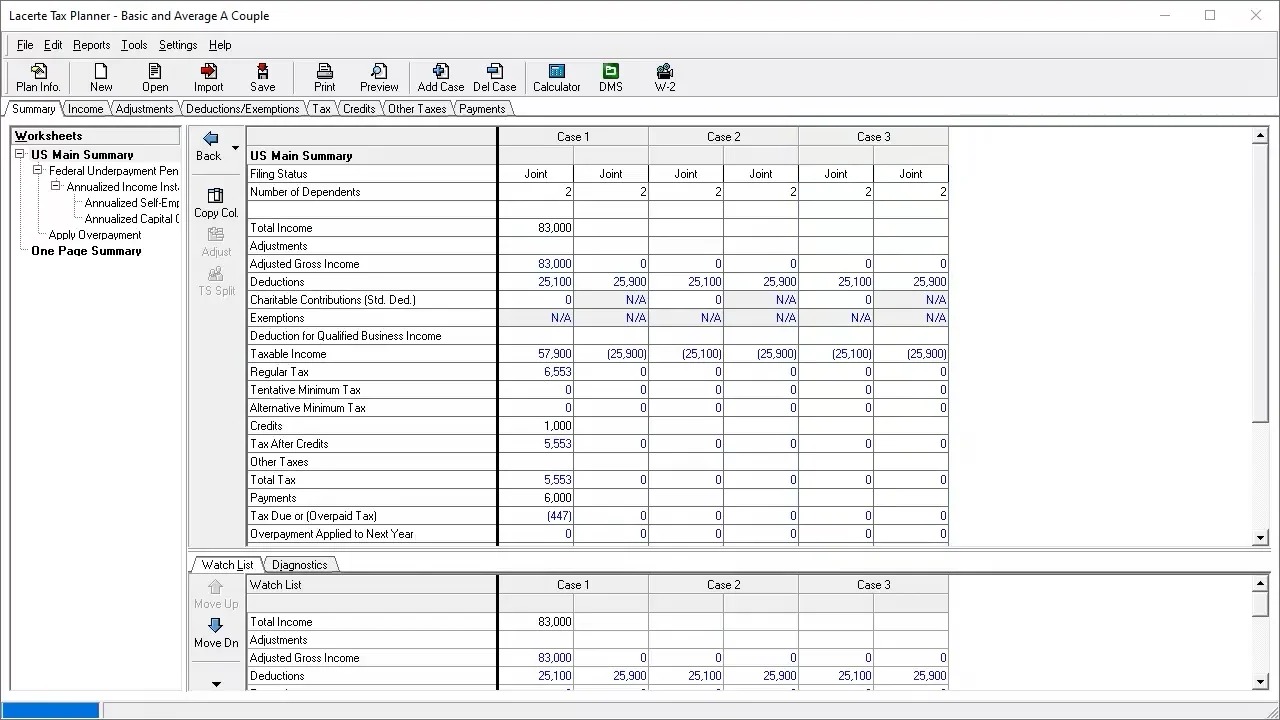

- Simulations and Modeling: Using tax simulation software or online calculators can help you estimate your future tax liability based on different scenarios. These tools consider factors such as income, deductions, and anticipated tax law changes to provide projections of your potential tax brackets in the future.

It’s important to remember that these methods are not foolproof, and predicting future tax brackets with precision is challenging. However, by combining multiple estimation methods and regularly reviewing your projections, you can make more informed decisions for your retirement planning.

Historical Analysis of Tax Bracket Changes

Examining the historical changes in tax brackets provides valuable insights into how tax policies have evolved over time. While past performance does not guarantee future outcomes, historical analysis can help identify patterns and trends that may inform estimations of future tax brackets.

One approach to historical analysis is to review the tax bracket changes over the years. This involves studying how tax rates and income thresholds for various tax brackets have fluctuated. By analyzing these changes, you can gain a better understanding of the factors that have influenced tax policy and the direction in which tax rates have moved.

For example, you may find that over the past few decades, there has been a tendency for tax rates to either increase or decrease in response to economic conditions or political priorities. By identifying these patterns, you can make educated assumptions about potential future tax changes.

Another aspect to consider is the impact of legislative changes on tax brackets. Tax laws are subject to amendments and revisions, often reflecting changes in economic, social, and political landscapes. By studying the historical context surrounding these legislative changes, you can gauge the potential drivers for future tax bracket movements.

However, it’s important to note that tax policy is influenced by a wide range of factors, including economic conditions, political dynamics, and societal attitudes. Therefore, it is essential to consider these elements alongside a historical analysis. Furthermore, tax policy changes can be influenced by external events and global economic trends, making it crucial to have a broader perspective when conducting a historical analysis.

By combining historical analysis with other methods, such as economic projections and expert opinions, you can develop a more comprehensive view of potential future tax brackets. Remember that historical analysis should serve as a foundation for estimation rather than a definitive predictor of future tax rates. Regularly monitoring tax law changes and staying informed about current economic and political events will further enhance the accuracy of your tax bracket estimations.

Economic and Political Factors Impacting Tax Brackets

Estimating future tax brackets requires an understanding of the economic and political factors that can influence tax policy. These factors play a significant role in shaping tax brackets and determining the rates at which individuals and businesses are taxed. Here are some key economic and political factors impacting tax brackets:

1. Economic Conditions: Economic factors, such as the state of the national economy, GDP growth rates, and unemployment levels, can have a direct impact on tax brackets. During periods of economic growth, governments may consider raising tax rates to generate additional revenue. Conversely, during economic downturns, tax rates may be adjusted to provide relief and stimulate consumer spending and investment.

2. Government Revenue Needs: Tax brackets are designed to fulfill the revenue requirements of governments. Changes in government spending priorities and funding needs can lead to adjustments in tax rates and brackets. Governments may seek to increase tax revenue by adjusting tax brackets for higher-income individuals or introducing new tax brackets to target specific income ranges.

3. Political Agendas and Priorities: Tax policy is influenced by the political agenda of the ruling party or government. Different political parties may have distinct ideologies and priorities regarding taxation. Changes in the political landscape, such as shifts in power or election outcomes, can lead to revisions in tax brackets and rates.

4. Tax Reform Initiatives: Governments may introduce tax reform initiatives aimed at simplifying the tax system, promoting economic growth, or redistributing wealth. Tax reform efforts can involve significant changes to tax brackets, including the creation of new brackets, adjustments to income thresholds, or modifications in tax rates for specific income groups.

5. Public Opinion and Social Factors: Public opinion and societal attitudes towards taxation play a role in shaping tax policy. Governments may respond to public demand for more progressive tax systems by introducing changes to tax brackets and rates. Social factors, such as income inequality and disparities, can also influence discussions on tax policy and the need for adjustments in tax brackets.

6. International Economic and Political Events: Global economic trends and geopolitical events can impact tax policy as governments respond to changing circumstances. Factors such as international trade agreements, currency fluctuations, and cross-border economic activities can influence tax brackets and rates, especially for individuals and businesses engaged in international transactions.

It is important to recognize that economic and political factors interact with each other and can vary in importance depending on the specific country or region. Predicting future tax brackets requires a thorough understanding of these factors and how they interplay in the tax policymaking process.

Adjusting for Inflation and Cost-of-Living Changes

When estimating future tax brackets, it is crucial to consider the impact of inflation and changes in the cost of living. Over time, the value of money decreases due to inflation, resulting in higher prices for goods and services. Failing to account for inflation can lead to inaccurate estimations of future tax brackets and potential financial miscalculations. Here are key considerations for adjusting for inflation and cost-of-living changes:

1. Inflation Rate: Inflation erodes the purchasing power of money and can push individuals into higher tax brackets even if their real income has not increased. Estimating future tax brackets requires accounting for expected inflation rates at the time of retirement planning. This can be done by using historical inflation data or consulting economic forecasts and projections.

2. Tax Brackets and Inflation Adjustments: Some tax systems incorporate automatic adjustments to tax brackets to counteract the effects of inflation. These adjustments, often referred to as inflation indexation or bracket creep, ensure that taxpayers are not penalized by moving into higher tax brackets solely due to inflation. Understanding how your tax system handles inflation adjustments is essential for more accurate estimations.

3. Cost-of-Living Changes: In addition to inflation, changes in the cost of living can impact your tax liability. Costs such as housing, healthcare, and education may increase at rates higher than inflation, impacting your overall tax burden. Consider potential changes in these expenses when estimating future tax brackets to account for the impact of rising living costs.

4. Regional Variations: Tax brackets can vary across different regions or jurisdictions within a country. Take into account any regional disparities in the cost of living when estimating future tax brackets. Expenses can differ significantly between urban and rural areas or high-cost regions, which may affect the income necessary to fall into specific tax brackets.

5. Retirement Income and Expenses: Adjusting for inflation is particularly important when estimating retirement income and expenses. Consider how your retirement income sources, such as pensions, investments, or Social Security benefits, may change due to inflation. Likewise, factor in inflation when estimating your future living expenses, healthcare costs, and other retirement expenditures to ensure you accurately estimate your tax liability.

Regularly updating your estimations for inflation and cost-of-living changes is crucial to maintaining the accuracy of your retirement planning. By factoring in these adjustments, you can make more informed decisions and develop a comprehensive understanding of your future tax obligations.

Importance of Accurate Tax Bracket Estimates for Retirement Planning

Accurate tax bracket estimates are essential for effective retirement planning. Understanding and estimating your future tax brackets can help ensure that you allocate the appropriate amount of funds for tax obligations and maximize your retirement savings. Here are some key reasons why accurate tax bracket estimates are crucial for retirement planning:

1. Budgeting for Retirement Expenses: Estimating your future tax brackets allows you to budget for your retirement expenses more accurately. Taxes can significantly impact your overall financial situation, and failing to account for them properly can result in insufficient funds for other essential retirement needs, such as housing, healthcare, and leisure activities.

2. Managing Cash Flow: Knowing your likely tax brackets in retirement helps you manage your cash flow effectively. By estimating your tax liability, you can plan for tax payments throughout the year, ensuring that you don’t face financial strain when tax season arrives. This allows you to make adjustments to your income sources and expenses strategically.

3. Minimizing Tax Liability: Accurate tax bracket estimates enable you to develop tax-efficient strategies to minimize your tax liability in retirement. By understanding which income sources are taxed at different rates, you can optimize your retirement income to make the most of deductions, credits, and favorable tax treatments. This can result in significant tax savings over the long term.

4. Optimizing Social Security Benefits: Social Security benefits can be subject to income taxes based on your provisional income. Estimating your tax brackets can help you determine the optimal strategy for claiming Social Security benefits to minimize taxes. This may involve strategic timing of benefit withdrawals to avoid pushing yourself into higher tax brackets.

5. Adjusting Retirement Savings Contributions: Estimating your future tax brackets allows you to adjust your retirement savings contributions accordingly. If you expect to be in a higher tax bracket during retirement, you may prioritize contributions to tax-advantaged retirement accounts, such as a 401(k) or IRA, to lower your taxable income in the present and potentially reduce your tax liability in retirement.

6. Adapting to Tax Law Changes: Accurate tax bracket estimates help you adapt to potential tax law changes in the future. By staying informed about proposed tax reforms or legislative changes that may impact tax brackets, you can make adjustments to your retirement planning strategies in advance to mitigate any adverse effects on your financial goals.

In summary, accurate tax bracket estimates are a critical component of retirement planning. They allow you to effectively manage your finances, budget for retirement expenses, minimize your tax liability, optimize Social Security benefits, adjust retirement savings contributions, and adapt to potential tax law changes. By considering these estimates, you can make more informed decisions and ensure a financially secure and comfortable retirement.

Conclusion

Accurately estimating future tax brackets is a key aspect of retirement planning. Understanding how tax brackets work and the factors that influence them is essential for making informed financial decisions and ensuring a secure retirement. By considering historical tax bracket trends, economic and political factors, and adjusting for inflation and cost-of-living changes, you can develop more accurate estimations for your future tax obligations.

Estimating future tax brackets allows you to budget for retirement expenses effectively and manage your cash flow. It enables you to minimize your tax liability by implementing tax-efficient strategies, optimizing Social Security benefits, and making appropriate retirement savings contributions. Additionally, accurate tax bracket estimates help you adapt to potential tax law changes and adjust your retirement planning strategies accordingly.

It is important to recognize that predicting future tax brackets is challenging and subject to various uncertainties. Economic and political factors, as well as changes in tax laws, can have a significant impact on tax brackets. Regularly reviewing your estimations, staying informed about tax policy developments, and seeking guidance from tax professionals or financial advisors can help you refine your estimates and make necessary adjustments.

By incorporating accurate tax bracket estimates into your retirement planning, you can ensure that you have sufficient funds to cover your tax obligations, maintain your desired lifestyle, and achieve your long-term financial goals. Take the time to conduct thorough research, consider multiple estimation methods, and regularly update your projections to account for changes in economic and legislative landscapes.

Remember, retirement planning is a complex process, and tax considerations play a critical role. By taking a proactive approach to estimating future tax brackets, you can enhance your financial preparedness and pave the way for a comfortable and financially secure retirement.