Finance

How Do You Calculate Nominal GDP?

Modified: February 21, 2024

Learn how to calculate nominal GDP in finance. Discover the formula and methods used to determine the total value of goods and services produced within an economy.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

In the world of economics and finance, Gross Domestic Product (GDP) is a key indicator used to measure the economic performance of a country. It provides valuable insights into the size and growth of a nation’s economy. There are different ways to calculate GDP, and one of the fundamental measures is nominal GDP.

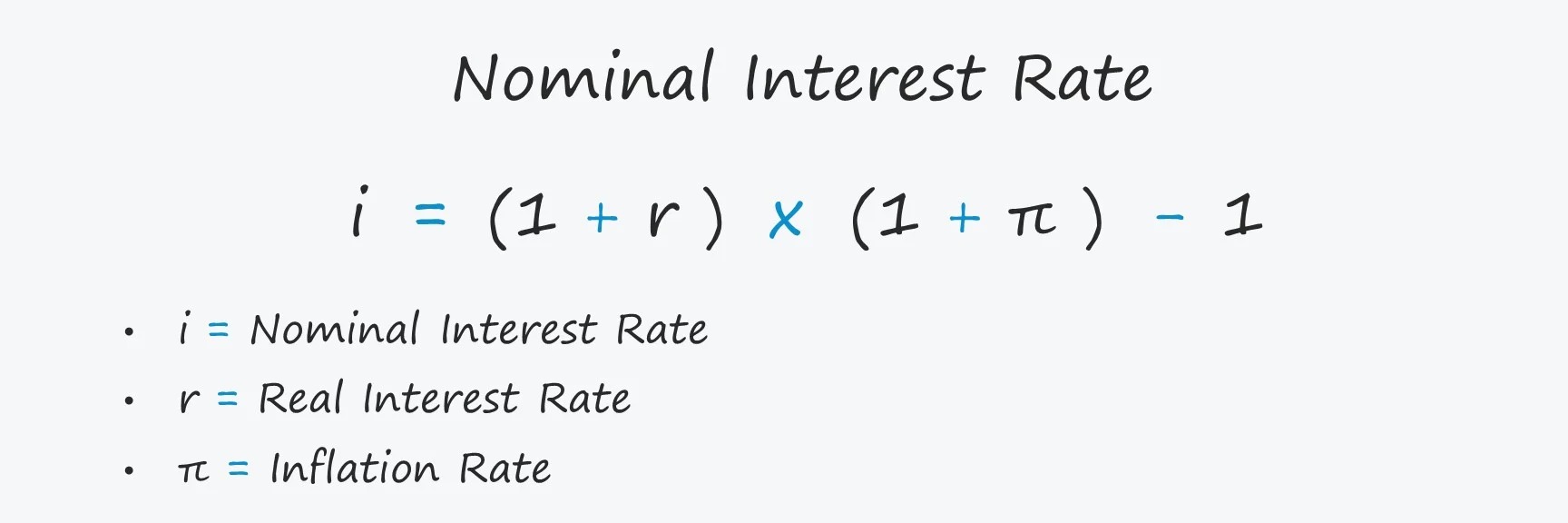

Nominal GDP represents the total value of goods and services produced in an economy at current market prices. It takes into account both the changes in output and the changes in prices. Understanding how to calculate nominal GDP is crucial for economists, policymakers, and investors in assessing the overall health of an economy.

This article will delve into the definition of nominal GDP, the components involved in its calculation, the methodology used, and an example to illustrate the process. Furthermore, we will discuss the limitations of using nominal GDP and the importance of accurately calculating it.

By the end of this article, you will have a comprehensive understanding of nominal GDP and its significance, allowing you to make informed financial decisions and better analyze economic trends.

Definition of Nominal GDP

Nominal GDP, also known as current dollar GDP, is a measure that quantifies the total economic output of a country in terms of current market prices. It represents the value of all final goods and services produced by an economy over a specific period, such as a year or a quarter.

Unlike real GDP, which adjusts for the impact of inflation by using constant prices, nominal GDP reflects the actual prices prevailing in the market. This means that changes in nominal GDP can be influenced by both changes in output and changes in prices.

Nominal GDP takes into account consumer spending, investment, government spending, and net exports. It provides a broad picture of the economic activity in a country, including the effects of inflation, changes in consumer behavior, and fluctuations in prices.

As an important economic indicator, nominal GDP helps policymakers understand the current state of the economy and make informed decisions regarding monetary and fiscal policies. It also serves as a benchmark for comparing the economic performance of different countries and tracking their progress over time.

It is important to note that nominal GDP may not accurately reflect the changes in the standard of living or the real growth of an economy. This is because it does not account for differences in purchasing power or changes in the general price level. To account for these factors, economists use another measure called real GDP, which adjusts nominal GDP for inflation.

In summary, nominal GDP is a monetary measure of a country’s economic output that represents the value of goods and services produced at current market prices. It provides a snapshot of the overall economic activity and helps analyze trends and make economic decisions.

Components of Nominal GDP Calculation

Calculating nominal GDP involves considering various components that contribute to the overall measurement of economic output. These components are:

- Consumer Spending: Also known as personal consumption expenditure (PCE), this component represents the total amount spent by households on goods and services. It includes spending on necessities, such as food and clothing, as well as discretionary items like entertainment and travel.

- Investment: Investment expenditure includes spending on business capital, such as machinery, equipment, and structures. It also encompasses residential investment, which refers to residential housing construction and improvements. Investment is a crucial component as it represents spending aimed at expanding productive capacity and generating future economic growth.

- Government Spending: Government spending refers to the total expenditures made by all levels of government, including federal, state, and local. This includes spending on public goods and services, such as defense, education, healthcare, and infrastructure projects.

- Net Exports: Net exports, also known as the trade balance, represent the difference between a country’s exports and imports. If a country’s exports exceed its imports, it is said to have a trade surplus, which adds to the nominal GDP. Conversely, if imports exceed exports, it leads to a trade deficit, which subtracts from nominal GDP.

By summing up these four components, we arrive at the total nominal GDP. Each component reflects a different aspect of the economy and contributes to the overall measure of economic output.

It is important to note that nominal GDP calculations do not take into account inflation or changes in real output. Therefore, nominal GDP can be influenced by fluctuations in prices and does not provide an accurate representation of economic growth. To address this limitation, economists use real GDP, which adjusts for inflation and provides a more accurate measure of economic performance over time.

Understanding the components of nominal GDP is essential for policymakers, economists, and investors as it allows them to analyze the various drivers of economic activity and identify trends and patterns that impact the overall health of an economy.

Calculation Methodology

The calculation of nominal GDP involves a straightforward methodology that combines data from various sources and components of economic activity. To calculate nominal GDP, follow these steps:

- Gather Data: Collect data on consumer spending, investment, government spending, and net exports. These data points are usually available through government reports, economic databases, and surveys.

- Consumer Spending: Sum up all the expenditures made by households on goods and services during the specified period. This includes spending on durable goods, non-durable goods, and services.

- Investment: Add up the total spending on business capital, such as machinery, equipment, and structures. Include residential investment, which includes spending on housing construction and improvements.

- Government Spending: Calculate the total amount of spending by all levels of government, including federal, state, and local. This includes spending on public goods, services, and infrastructure.

- Net Exports: Determine the difference between a country’s exports and imports. If exports exceed imports, subtract the trade deficit from the total. If imports exceed exports, add the trade surplus to the total.

- Total Nominal GDP: Sum up the consumer spending, investment, government spending, and net exports to arrive at the total nominal GDP.

The resulting figure represents the nominal GDP of the specified period. Remember that nominal GDP is expressed in current market prices and is influenced by changes in both output and prices.

It is important to note that in some cases, the data used for the calculation of nominal GDP may not be directly available or may require estimations. In such situations, economists use statistical methods and models to approximate the values and ensure accuracy in the calculations.

By following this methodology consistently, economists are able to track the changes in nominal GDP over time, analyze economic trends, and make informed decisions based on the performance of different sectors of the economy.

Example of Calculating Nominal GDP

Let’s consider an example to illustrate the process of calculating nominal GDP. Suppose we want to determine the nominal GDP for a country during the year 2020. We will look at the three main components: consumer spending, investment, and government spending.

1. Consumer Spending: According to data from the Department of Statistics, consumer spending in 2020 amounted to $2.5 trillion.

2. Investment: Investment data from the Central Bank shows that business investment was $1.2 trillion, while residential investment amounted to $0.8 trillion.

3. Government Spending: Government reports indicate that total government spending for 2020 was $1.5 trillion.

Now let’s calculate the nominal GDP:

Total Consumer Spending: $2.5 trillion

Total Investment: $1.2 trillion + $0.8 trillion = $2.0 trillion

Total Government Spending: $1.5 trillion

Total Nominal GDP: $2.5 trillion + $2.0 trillion + $1.5 trillion = $6.0 trillion

Based on the data provided, the nominal GDP for the year 2020 for this country would be $6.0 trillion.

This example demonstrates how different components of economic activity are combined to calculate the overall nominal GDP. By having access to accurate and reliable data, policymakers and economists can make informed decisions regarding fiscal and monetary policies, as well as analyze the overall economic performance of the country.

Limitations of Using Nominal GDP

While nominal GDP is a useful measure for evaluating the economic performance of a country, it does have its limitations. It is important to be aware of these limitations when interpreting and analyzing nominal GDP figures. Some of the main limitations include:

- Impact of Inflation: Nominal GDP does not account for changes in the general price level or changes in purchasing power. Therefore, an increase in nominal GDP could be primarily driven by higher prices rather than real economic growth. To address this limitation, economists often use real GDP, which adjusts for inflation and provides a more accurate measure of economic growth.

- Changes in Exchange Rates: Nominal GDP does not consider the impact of changes in exchange rates. Fluctuations in exchange rates can significantly affect the value of exports and imports, thereby impacting the overall measurement of economic output. As a result, changes in nominal GDP may not necessarily reflect changes in the country’s economic well-being.

- Underground Economy and Informal Sector: Nominal GDP calculations may not accurately capture economic activity that occurs in the underground economy or informal sector. These sectors involve unrecorded or underreported economic transactions, such as illegal activities or cash-based transactions, which are not reflected in official GDP figures. Consequently, nominal GDP may underestimate the true size of the economy.

- Quality of Goods and Services: Nominal GDP does not account for changes in the quality of goods and services produced. As improvements in technology and productivity occur over time, the value created by goods and services may increase even if their prices remain constant. This improvement in quality is not captured in nominal GDP calculations.

- Non-Market Activities: Nominal GDP does not capture non-market activities, such as unpaid household work or volunteer services. These activities contribute to the overall well-being of society but are not included in the measurement of nominal GDP.

Despite these limitations, nominal GDP remains a valuable measure for assessing the overall economic activity of a country. However, it is important to use it in conjunction with other economic indicators and measures to obtain a more comprehensive understanding of an economy’s health and performance.

Importance of Nominal GDP Calculation

Calculating nominal GDP plays a crucial role in understanding and analyzing the economic performance of a country. It provides valuable insights and serves several important purposes. Some of the key importance of nominal GDP calculation are:

- Economic Health Assessment: Nominal GDP is a primary indicator of an economy’s overall health and size. It provides a measure of the total economic output, reflecting the production of goods and services within a specific timeframe, usually a year or a quarter. By tracking changes in nominal GDP over time, economists and policymakers can evaluate the growth and fluctuations of the economy.

- Comparison between Countries: Nominal GDP allows for meaningful comparisons between different countries. By expressing economic performance in a common unit (currency), it enables analysts to compare the size and output of different economies. This is particularly useful for policymakers and investors in assessing international trade prospects and making informed decisions.

- Investment Decisions: Nominal GDP serves as a critical input in investment decisions. Investors often look at the size and growth rate of an economy, measured by nominal GDP, to determine the potential profitability and stability of the market. It helps investors gauge the overall economic conditions, market potential, and business opportunities in a particular country or region.

- Policy Formulation and Evaluation: Nominal GDP calculations provide policymakers with essential information for formulating and evaluating economic policies. By analyzing changes in nominal GDP, policymakers can identify areas of the economy that require attention and implement appropriate fiscal, monetary, and structural policies to promote growth, stability, and sustainability.

- Benchmark for Economic Goals: Nominal GDP serves as a benchmark for setting economic goals and targets. It helps governments and policymakers establish growth targets, inflation targets, employment targets, and other macroeconomic objectives. By monitoring and comparing actual growth with targeted growth, policymakers can assess economic performance and adjust their policies accordingly.

By calculating and analyzing nominal GDP, economists, policymakers, and investors can gain valuable insights into the state of the economy and make informed decisions. However, it is important to consider the limitations of nominal GDP and use it in conjunction with other economic indicators for a comprehensive understanding of economic performance.

Conclusion

Nominal GDP is a fundamental measure used to assess the economic performance of a country. It represents the total value of goods and services produced within a specified period at current market prices. By calculating nominal GDP, economists, policymakers, and investors gain valuable insights into the state of the economy, make informed decisions, and formulate economic policies.

In this article, we have explored the definition of nominal GDP, the components involved in its calculation, the methodology used, and an example to illustrate the process. We have also discussed the limitations of using nominal GDP, such as the impact of inflation, changes in exchange rates, and the omission of non-market activities.

Despite its limitations, nominal GDP remains a critical tool for assessing economic health, making international comparisons, and guiding investment decisions. It serves as a benchmark for economic goals and provides policymakers with information to formulate effective policies.

However, it is important to note that nominal GDP does not provide a complete picture of economic well-being. To gain a more accurate understanding of an economy, it should be used in conjunction with other economic indicators, such as real GDP, inflation rates, unemployment rates, and income distribution measures.

Understanding how to calculate nominal GDP and its significance allows individuals to navigate the complex world of finance and economics. By analyzing nominal GDP trends and patterns, stakeholders can make informed decisions, mitigate risks, and contribute to the stability and growth of an economy.

In conclusion, nominal GDP is a powerful tool that provides valuable insights into the economic standing of a country. It allows us to assess growth, compare economies, and make informed decisions. However, it is crucial to recognize its limitations and use it alongside other relevant indicators to obtain a comprehensive view of an economy’s performance.