Finance

How Do You Add A Tradeline To Your Credit

Published: January 6, 2024

Looking to boost your credit score? Learn how to add a tradeline to your credit for better financial opportunities.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding Tradelines

- Reasons to Add a Tradeline

- How Tradelines Impact Your Credit Score

- Steps to Add a Tradeline to Your Credit

- Finding a Reputable Tradeline Provider

- Assessing the Cost and Terms of Tradelines

- Applying for a Tradeline

- Monitoring the Impact of the Tradeline on Your Credit

- Precautions and Risks of Adding Tradelines

- Conclusion

Introduction

When it comes to credit, having a strong credit score is crucial for financial stability and flexibility. Your credit score is a reflection of your creditworthiness and affects your ability to secure loans, obtain low-interest rates, and even rent an apartment. One way to bolster your credit profile is by adding a tradeline to your credit.

Tradelines are credit accounts that appear on your credit report, providing a snapshot of your borrowing history and payment behavior. They can come in the form of credit cards, loans, or other types of credit accounts. Adding a tradeline to your credit can be a strategic move to help improve or establish your creditworthiness.

In this article, we will explore what tradelines are, the reasons to add them to your credit, how they impact your credit score, and the steps to add a tradeline. We will also discuss how to find a reputable tradeline provider, the cost and terms involved, and the precautions to consider before adding a tradeline. By the end, you’ll have a clear understanding of how to add a tradeline to your credit and make informed decisions about improving your credit profile.

Understanding Tradelines

Tradelines play a vital role in the world of credit. Essentially, a tradeline refers to any credit account that appears on your credit report. This can include credit cards, personal loans, student loans, mortgages, and other types of credit accounts.

Each tradeline represents a specific credit account associated with your name or jointly held by you and another individual. It includes information such as the creditor’s name, the account number, the balance owed, the credit limit, and the payment history.

When you add a tradeline to your credit, it means you are adding a new credit account to your credit report. This can be done by becoming an authorized user on someone else’s credit card or by opening a new credit account in your name. Being an authorized user means that you have permission to use someone else’s credit card, and the account activity will be reflected on your credit report.

It’s important to note that not all tradelines are created equal. The age, payment history, credit limit, and overall utilization of the tradeline can all have an impact on how it affects your credit score. For example, a tradeline with a long history of on-time payments and a low utilization rate can have a positive impact on your credit, while a tradeline with late payments or high balances can have a negative impact.

Understanding the concept of tradelines is essential before delving into the process of adding them to your credit. It’s important to assess your current credit profile and determine how adding specific tradelines can benefit your credit journey.

Reasons to Add a Tradeline

There are several compelling reasons why you might consider adding a tradeline to your credit profile. Let’s explore some of the key benefits:

- Building Credit History: If you have a limited credit history or are just starting to establish credit, adding a tradeline can help you build a positive credit history. By making timely payments and maintaining low credit utilization, you demonstrate responsible credit behavior, which can boost your credit score over time.

- Improving Credit Mix: Credit scoring models take into account the types of credit accounts you have. By diversifying your credit mix and adding a different type of tradeline, such as a credit card or loan, you can demonstrate your ability to manage various forms of credit. This can positively impact your credit score.

- Increasing Credit Limit: Adding a tradeline can also increase your overall available credit limit. This can result in a lower credit utilization ratio, which is the percentage of your available credit that you are currently using. A lower utilization ratio is generally seen as a positive factor in credit scoring models and can help improve your credit score.

- Boosting Credit Score: If your credit score is less than stellar, adding a positive tradeline can help boost your score. For example, becoming an authorized user on a credit card with a long history of on-time payments and low utilization can have a positive impact on your credit score, as long as the primary account holder has good credit habits.

- Accessing Better Credit Opportunities: A strong credit profile opens doors to better credit opportunities, such as lower interest rates on loans and credit cards. By adding positive tradelines, you increase your chances of qualifying for these favorable terms and saving money over time.

Before adding a tradeline, it’s important to assess your specific credit goals and determine how adding a tradeline will align with those objectives. Understand the potential impact on your credit score and consider consulting with a financial advisor or credit expert for personalized guidance.

How Tradelines Impact Your Credit Score

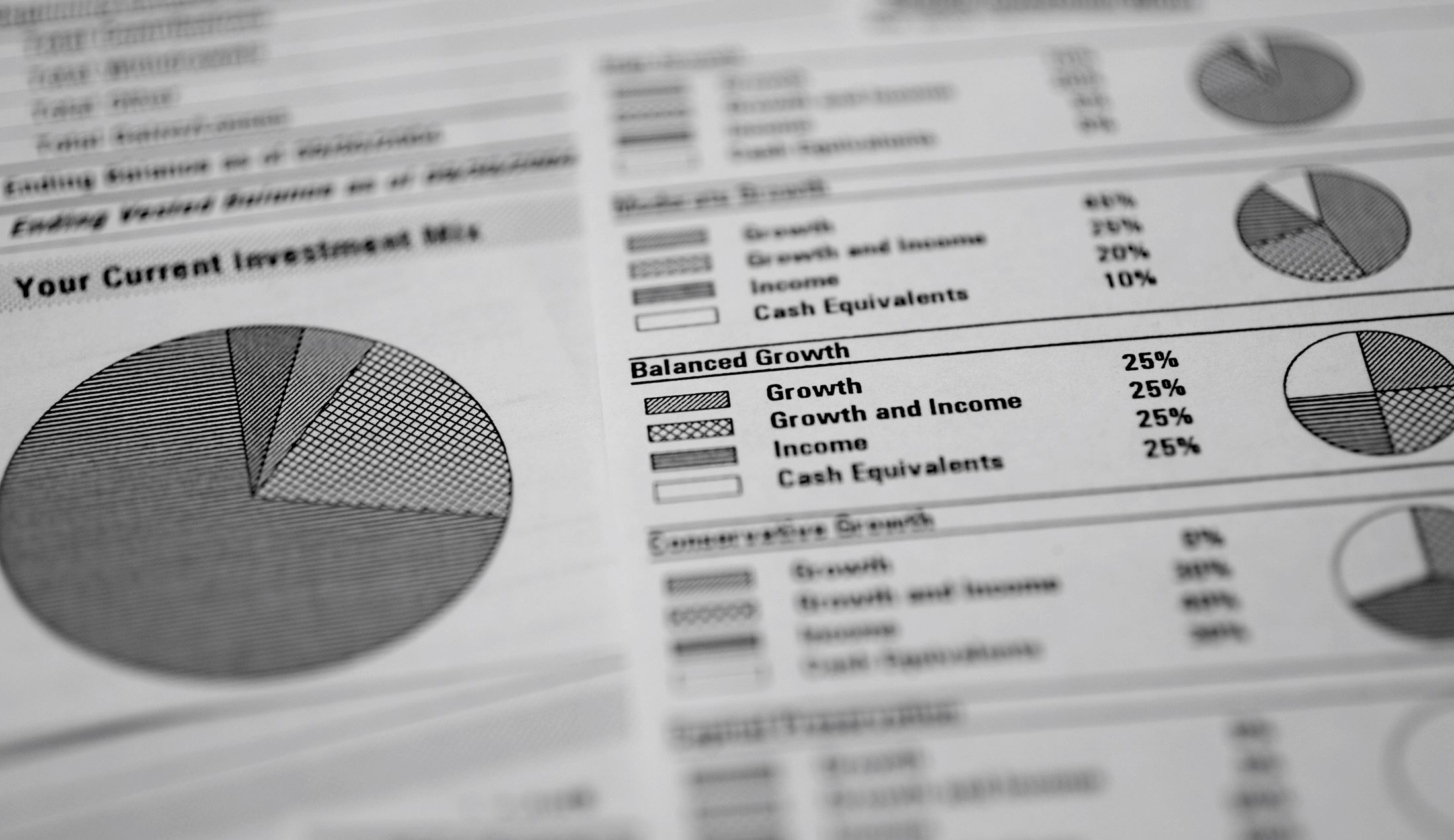

Tradelines have a significant impact on your credit score. Your credit score is a numerical representation of your creditworthiness and is calculated based on various factors, including your payment history, credit utilization, length of credit history, types of credit, and new credit inquiries. Adding a tradeline can influence these factors and, consequently, your credit score. Here’s how:

- Payment History: When you add a new tradeline, such as a credit card or loan, it creates an opportunity to establish a positive payment history. Making timely payments on your tradeline shows responsible credit behavior and contributes to a higher credit score over time. On the other hand, missing payments or making late payments can have a negative impact on your credit score.

- Credit Utilization: The credit utilization ratio measures the amount of credit you are currently using compared to your total available credit. Adding a tradeline can impact this ratio in two ways. Firstly, if the tradeline has a high credit limit and you maintain a low balance, your credit utilization ratio will decrease, which can positively affect your credit score. Secondly, if the tradeline carries a balance close to its credit limit, it can increase your credit utilization ratio and potentially lower your credit score. It’s important to be mindful of your credit utilization when adding a tradeline.

- Length of Credit History: The age of your tradelines factors into the length of your credit history. By adding a new tradeline, you are increasing the average age of your credit accounts. Generally, a longer credit history is seen as a positive factor in credit scoring models, so adding a new tradeline can potentially enhance your credit score in the long run.

- Types of Credit: Credit scoring models look for a diverse mix of credit accounts in your credit profile. By adding a new tradeline of a different type, such as a credit card or installment loan, you can demonstrate your ability to manage various forms of credit. This credit mix can positively impact your credit score.

- New Credit Inquiries: When you apply for a new tradeline, the creditor will typically perform a credit inquiry to assess your creditworthiness. While a single credit inquiry may only have a minimal impact on your credit score, multiple inquiries within a short period can be seen as a red flag. It’s important to be mindful when applying for new tradelines to avoid excessive inquiries that could lower your credit score.

Understanding how tradelines impact your credit score can help you make informed decisions about when and how to add them to your credit profile. It’s essential to monitor your credit report regularly and ensure that the impact of your tradelines aligns with your credit goals.

Steps to Add a Tradeline to Your Credit

Adding a tradeline to your credit may seem like a complex process, but it can be relatively straightforward if you follow these essential steps:

- Evaluate Your Credit Profile: Start by assessing your current credit profile. Determine if you need to build credit from scratch or if you’re looking to improve an existing credit history. Understanding your specific credit goals will help you choose the right tradelines to add.

- Research and Identify Tradeline Options: Research different tradeline options available to you. Consider becoming an authorized user on someone else’s credit card or applying for a new credit account in your name. Understand the terms, such as credit limits, interest rates, and repayment terms, to make an informed decision.

- Find a Reputable Tradeline Provider: If you choose to become an authorized user, look for a reputable tradeline provider. Ensure that the provider reports to the credit bureaus and has a history of positive results. Read reviews, check their website, and ask for recommendations from trusted sources.

- Apply to Become an Authorized User: If you decide to become an authorized user on someone else’s credit card, obtain their permission and provide the necessary information to the credit card company. They will issue a new credit card with your name on it, and the account activity will be reported on your credit report.

- Open a New Credit Account: If you choose to open a new credit account in your name, research different lenders and credit card companies. Compare their offers, such as interest rates, rewards, fees, and credit limits. Once you’ve chosen the best option, complete the application process and wait for approval.

- Maintain Responsible Credit Behavior: After adding a tradeline, it’s essential to practice responsible credit behavior. Make timely payments, keep your credit utilization low, and avoid excessive debt. This will help you build a positive credit history and maximize the benefits of the added tradeline.

- Monitor Your Credit Report: Regularly monitor your credit report to ensure that the added tradeline is accurately reported and positively affecting your credit. Keep an eye on any changes, updates, or discrepancies and address them promptly with the credit bureaus if necessary.

Adding a tradeline to your credit can be a valuable step towards improving your credit profile. By following these steps, you can take control of your credit journey and work towards achieving your financial goals.

Finding a Reputable Tradeline Provider

When considering adding a tradeline to your credit, it’s crucial to find a reputable provider that offers legitimate and reliable services. Here are some essential steps to help you find a reputable tradeline provider:

- Do Your Research: Start by conducting thorough research on different tradeline providers. Look for providers with a solid reputation and positive reviews from customers. Check their website, social media presence, and any other online platforms to gather information about their services and track record.

- Check Reporting to Credit Bureaus: One of the key aspects of adding a tradeline is ensuring that the provider reports the account activity to the credit bureaus. This is important because the tradeline’s impact on your credit score depends on its reporting. Verify that the provider has a track record of reporting to all three major credit bureaus: Experian, Equifax, and TransUnion.

- Assess Experience and Industry Knowledge: Look for a tradeline provider with experience and expertise in the industry. A provider that has been operating for a significant period is more likely to have a better understanding of credit reporting practices, legal compliance, and the best strategies for maximizing the impact of tradelines.

- Ask for References: Request references or testimonials from previous customers. Reach out to individuals who have utilized the provider’s services in the past to gather insights into their experience. This will give you a better idea of the provider’s credibility and customer satisfaction levels.

- Consider Customer Support: Evaluate the level of customer support provided by the tradeline provider. Ideally, the provider should be responsive, address any concerns promptly, and have a clear communication channel for customers to reach out for assistance. Good customer support ensures a smooth and reliable experience throughout the process.

- Verify Legitimacy: Verify the legitimacy of the tradeline provider by checking if they operate within legal boundaries. Ensure they comply with industry regulations and guidelines. Avoid providers that make false promises or engage in fraudulent practices.

- Consult with Experts: Seek advice from financial advisors or credit experts before selecting a tradeline provider. They can offer insights and recommendations based on their knowledge and experience in the field. Their guidance can help you make an informed decision and avoid potential pitfalls.

Remember, the tradeline provider you choose can have a significant impact on the outcomes of adding tradelines. Take the time to thoroughly research and evaluate potential providers to ensure that you work with a reputable and trustworthy organization.

Assessing the Cost and Terms of Tradelines

Before adding a tradeline to your credit, it’s essential to assess the cost and terms associated with the tradeline. Different providers may offer varying prices and conditions, so it’s crucial to evaluate them carefully. Here are some key considerations when assessing the cost and terms of tradelines:

- Pricing Structure: Look for transparent pricing structures from tradeline providers. Some providers may charge a one-time fee for adding a tradeline, while others may have a monthly fee. Ensure you understand the cost structure and any additional fees that may apply.

- Credit Limit: Consider the credit limit offered by the tradeline. Higher credit limits can have a more significant impact on your credit utilization ratio and credit score. However, keep in mind that higher credit limits may also come with higher costs.

- Terms of Use: Review the terms of use provided by the tradeline provider. Understand any limitations or restrictions that may apply, such as the duration of the tradeline, any required actions (such as making monthly payments), and any consequences of non-compliance with the terms.

- Reporting Duration: Determine how long the tradeline provider will report the account activity to the credit bureaus. Some providers may report for a specific period, while others may report indefinitely. Longer reporting durations can provide more long-term benefits to your credit score.

- Credibility of the Provider: Assess the reputation and credibility of the provider. Consider factors such as customer reviews, their track record in the industry, and any certifications or affiliations that demonstrate their legitimacy. Ensure that the provider has a history of delivering on their promises.

- Return Policy: Inquire about the tradeline provider’s return policy or guarantee. Understand the conditions under which you may be eligible for a refund or if there are any provisions for replacing a tradeline that does not meet your expectations.

- Comparison Shopping: Don’t settle for the first tradeline provider you come across. Take the time to compare different providers and their offerings. Consider the cost, terms, customer reviews, and the overall value you will receive. This comparison will help you choose the provider that aligns best with your needs.

By carefully assessing the cost and terms of tradelines, you can make an informed decision and select a tradeline that suits your budget, credit goals, and desired outcomes. Remember to prioritize transparency, credibility, and long-term value when evaluating different tradeline providers.

Applying for a Tradeline

Once you have identified a reputable tradeline provider and determined the specific tradeline you want to add to your credit profile, it’s time to go through the application process. Applying for a tradeline involves several steps to ensure a smooth and successful experience:

- Gather Required Information: Start by gathering all the necessary information and documents required for the application process. This may include personal identification, proof of address, social security number, and any other details specific to the provider’s requirements.

- Complete the Application: Fill out the application form provided by the tradeline provider. Provide accurate and up-to-date information to avoid any delays or complications in the approval process. Double-check your application for any errors before submitting it.

- Provide Supporting Documents: In some cases, the tradeline provider may require additional documentation to verify your identity or financial standing. Be prepared to provide any requested documents promptly to avoid delays in the processing of your application.

- Review Terms and Conditions: Carefully review the terms and conditions of the tradeline you are applying for. Understand the responsibilities and obligations associated with the tradeline, including fees, repayment terms, and any potential consequences for non-compliance.

- Submit the Application: Once you have completed the application and reviewed the terms, submit the application to the tradeline provider. Ensure that you submit all required documents and information accurately and securely.

- Wait for Approval: After submitting your application, the tradeline provider will review your application and assess your eligibility. The approval process may take some time, so be patient and wait for their response. Stay in touch with the provider and follow up if necessary.

- Monitor Your Credit Report: While waiting for the tradeline to be added to your credit, it’s important to continue monitoring your credit report. Check regularly to ensure that the tradeline appears correctly on your report and that the information is accurate. Address any discrepancies promptly with the credit bureaus.

- Maintain Responsible Credit Behavior: Once the tradeline is added to your credit, it’s essential to practice responsible credit behavior. Make timely payments, keep your credit utilization low, and avoid excessive debt. This will help you maximize the benefits of the tradeline and build a positive credit history.

By following these steps and being diligent throughout the application process, you can increase your chances of successfully adding a tradeline to your credit. Remember to stay informed, provide accurate information, and maintain open communication with the tradeline provider to ensure a smooth and efficient experience.

Monitoring the Impact of the Tradeline on Your Credit

Once you have successfully added a tradeline to your credit profile, it’s essential to monitor its impact on your credit. Tracking the changes in your credit score and credit report will help you assess the effectiveness of the tradeline and make informed decisions. Here are some key steps to monitor the impact of the tradeline:

- Check Your Credit Report Regularly: Obtain copies of your credit report from the major credit bureaus—Experian, Equifax, and TransUnion. Review your report to ensure that the tradeline appears accurately, reflecting the correct information about the account, payment history, credit limit, and any other relevant details.

- Monitor Changes in Credit Score: Keep an eye on your credit score to gauge its progress over time. Use reputable credit monitoring services or check your credit score through free platforms. Note any significant changes in your score and correlate them with the addition of the tradeline.

- Assess Changes in Credit Utilization: Examine your credit utilization ratio, which is the percentage of your available credit that you are utilizing. Adding a tradeline can impact this ratio. If the tradeline has a higher credit limit and you maintain a low balance, your utilization ratio may decrease, potentially improving your credit score.

- Review Payment History: Evaluate the payment history associated with the tradeline. Ensure that all payments are made on time to maintain a positive payment history. Late or missed payments can have a detrimental effect on your credit score.

- Track Credit Inquiries: Be aware of any credit inquiries resulting from the addition of the tradeline. While one or two inquiries may have a minor impact, excessive inquiries within a short period can negatively affect your credit score. Monitor your credit report for any unauthorized or unfamiliar inquiries.

- Keep Communication Channels Open: Stay in touch with the tradeline provider and maintain open lines of communication. Address any concerns or discrepancies promptly. If you notice any inaccuracies on your credit report related to the tradeline, reach out to the credit bureaus to have them corrected.

- Evaluate Overall Credit Progress: Don’t focus solely on the impact of the tradeline. Assess your overall credit progress by considering various factors, such as your payment history, credit utilization, credit mix, and length of credit history. Understand how the tradeline fits into the bigger picture of improving your creditworthiness.

Monitoring the impact of the tradeline on your credit will provide valuable insights into its effectiveness and help you make informed decisions about future credit-related steps. Regularly reviewing your credit report and score will ensure that any issues or discrepancies are addressed promptly, allowing you to maintain a healthy credit profile.

Precautions and Risks of Adding Tradelines

While adding tradelines to your credit can be a strategic move to improve your credit profile, it’s essential to understand and consider the potential precautions and risks involved. Here are some key factors to keep in mind:

- Authorized User Risks: If you choose to become an authorized user on someone else’s credit card, ensure that the primary account holder has a strong credit history and responsible credit habits. Late payments, high balances, or other negative factors associated with the primary account can have a negative impact on your credit score.

- Credit Impact Variability: The impact of a tradeline on your credit score may vary depending on various factors, including your overall credit history, credit mix, and utilization ratio. While adding a positive tradeline can potentially boost your credit score, it may not guarantee immediate or significant improvements.

- Credit Misuse: Adding tradelines should not be seen as an opportunity for credit abuse or obtaining credit you cannot afford. Misusing credit can lead to excessive debt, missed payments, and damage to your credit profile. Practice responsible credit behavior by making timely payments and maintaining a low credit utilization ratio.

- Provider Legitimacy: Be cautious when selecting a tradeline provider. There are fraudulent providers in the market who may engage in illegal practices or provide false information about the tradelines they offer. Research thoroughly, check reviews, and verify the legitimacy and credibility of any provider before proceeding.

- Cost Considerations: Adding tradelines may come with costs, such as fees for the service or interest charges on the account. Assess the affordability and value of the tradeline before committing. Compare prices and terms from different providers to ensure you are getting the best deal that aligns with your financial situation.

- Temporary Impact: Remember that the impact of a tradeline on your credit score may be temporary. If the tradeline is removed, or if you close the account associated with it, the positive effects on your credit score may diminish. Consider the long-term commitment and potential consequences before adding a tradeline.

- Legal Compliance: Ensure that the tradeline provider operates within legal boundaries. Adding tradelines through fraudulent or illegal methods can have severe consequences, including potential legal issues and further damage to your credit profile. Choose a provider that adheres to regulatory guidelines and industry best practices.

It’s crucial to be aware of these precautions and risks when adding tradelines to your credit. By exercising caution, conducting thorough research, and making well-informed decisions, you can maximize the benefits of tradelines and effectively improve your creditworthiness.

Conclusion

Adding tradelines to your credit can be a strategic step towards improving your credit profile and increasing your creditworthiness. Tradelines provide an opportunity to build credit history, improve credit mix, and boost your credit score. By following the right steps and considering key factors, you can navigate the process effectively.

Understanding the concept of tradelines, assessing your credit goals, and finding a reputable tradeline provider are crucial initial steps. It is imperative to evaluate the cost and terms of tradelines, ensuring that they align with your budget and financial objectives. Completing the application process diligently, monitoring the impact on your credit, and practicing responsible credit behavior are essential for long-term success.

However, it is important to exercise caution and be aware of the potential risks associated with adding tradelines. These include the variable impact on credit scores, the legitimacy of tradeline providers, and the need to avoid credit misuse or abuse. Being knowledgeable and diligent in the selection and management of tradelines will help you navigate these risks effectively.

Overall, adding tradelines can be a valuable tool in improving your creditworthiness and expanding your credit opportunities. By taking the necessary precautions, monitoring the impact, and making informed decisions, you can make significant strides in your credit journey and achieve your financial goals.