Home>Finance>How Does Cost Of Equity Affect Capital Structure Of A Company? Explain With An Example

Finance

How Does Cost Of Equity Affect Capital Structure Of A Company? Explain With An Example

Modified: December 29, 2023

Understanding the impact of cost of equity on a company's capital structure and its financial decisions. Explore with a finance example.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When it comes to financial decision-making, the capital structure of a company plays a crucial role. The capital structure refers to the way a company finances its operations through a combination of debt and equity. It determines the proportion of debt and equity that a company uses to fund its activities and influences its overall financial health and risk profile. One key element that heavily impacts the capital structure is the cost of equity.

The cost of equity is the return that investors require for holding shares in a company. It represents the compensation that shareholders expect to receive for taking on the risk associated with their investment. This cost of equity is primarily influenced by factors such as interest rates, market conditions, and the perceived riskiness of the company’s stock. Understanding the relationship between the cost of equity and capital structure is crucial for companies to make informed decisions about how to finance their activities.

In this article, we will delve into the concept of the cost of equity and explore its significance in determining a company’s capital structure. We will also examine the factors that influence the cost of equity and provide an example to illustrate how changes in the cost of equity can impact a company’s capital structure.

Definition of Cost of Equity

The cost of equity is the rate of return that an investor expects to earn by owning shares of a company’s common stock. It represents the opportunity cost of investing in that particular equity rather than pursuing alternative investment opportunities with similar levels of risk.

There are different methods to calculate the cost of equity, but the most commonly used approach is the Capital Asset Pricing Model (CAPM). The CAPM formula takes into account the risk-free rate of return, the equity risk premium, and the beta of the company’s stock.

The risk-free rate of return is the return an investor can earn from a risk-free investment, such as a government bond. It represents the minimum return investors expect to receive for taking on no risk.

The equity risk premium is the additional return that investors demand for investing in equities rather than risk-free assets. It compensates for the higher level of risk associated with stock investments.

The beta of a stock measures the sensitivity of the stock’s returns to changes in the overall market. A beta greater than 1 indicates that the stock tends to move more than the market, while a beta less than 1 indicates that the stock tends to move less than the market.

By considering these components, the CAPM calculates the cost of equity as follows:

Cost of Equity = Risk-Free Rate + (Equity Risk Premium x Beta)

The cost of equity is expressed as a percentage and represents the minimum return that shareholders require to compensate them for the risks associated with owning the company’s stock.

Importance of Cost of Equity in Capital Structure

The cost of equity plays a crucial role in shaping a company’s capital structure. Here are several reasons why it is important:

1. Determining Optimal Financial Mix: The cost of equity helps companies determine the optimal mix of debt and equity in their capital structure. By analyzing the cost of equity alongside the cost of debt, companies can strike a balance between maximizing financial leverage and minimizing financial risk. This optimal mix increases the value of the company and boosts shareholders’ wealth.

2. Assessing Investment Opportunities: The cost of equity is utilized to evaluate the viability of investment projects. It serves as a benchmark for comparing the return expected from an investment with the expected return from the cost of equity. If the projected return on an investment exceeds the cost of equity, it suggests that the project is potentially profitable and should be undertaken.

3. Attracting Investors: Companies with a lower cost of equity are considered less risky and more attractive to investors. A lower cost of equity indicates that shareholders require a lower return on their investment, which makes the company’s stock more appealing. This, in turn, can lead to increased demand for the company’s shares, potentially lowering the company’s cost of capital and reducing the cost of raising additional equity in the future.

4. Valuing the Company: The cost of equity is a critical component in estimating the value of a company. The cost of equity, along with the company’s expected future earnings, helps determine the present value of those earnings. This information is crucial for investors, analysts, and potential acquirers to assess the worth of the company and make informed investment decisions.

5. Risk Management: Understanding the cost of equity helps companies manage risk effectively. By assessing the risk associated with the cost of equity, companies can implement risk mitigation strategies such as improving financial performance, diversifying revenue streams, or enhancing governance practices to reduce risk levels. This enables companies to maintain a sustainable capital structure and ensure financial stability.

Overall, the cost of equity serves as a vital metric for companies to make informed capital structure decisions, attract investors, evaluate investment opportunities, determine company value, and manage risk. By carefully considering the cost of equity, companies can optimize their financing strategies and enhance their overall financial position.

Relationship between Cost of Equity and Capital Structure

The cost of equity and the capital structure of a company are intrinsically linked. The cost of equity, which represents the return required by shareholders, impacts the capital structure by influencing the company’s financing decisions. There are several key aspects to consider in understanding the relationship between the cost of equity and the capital structure:

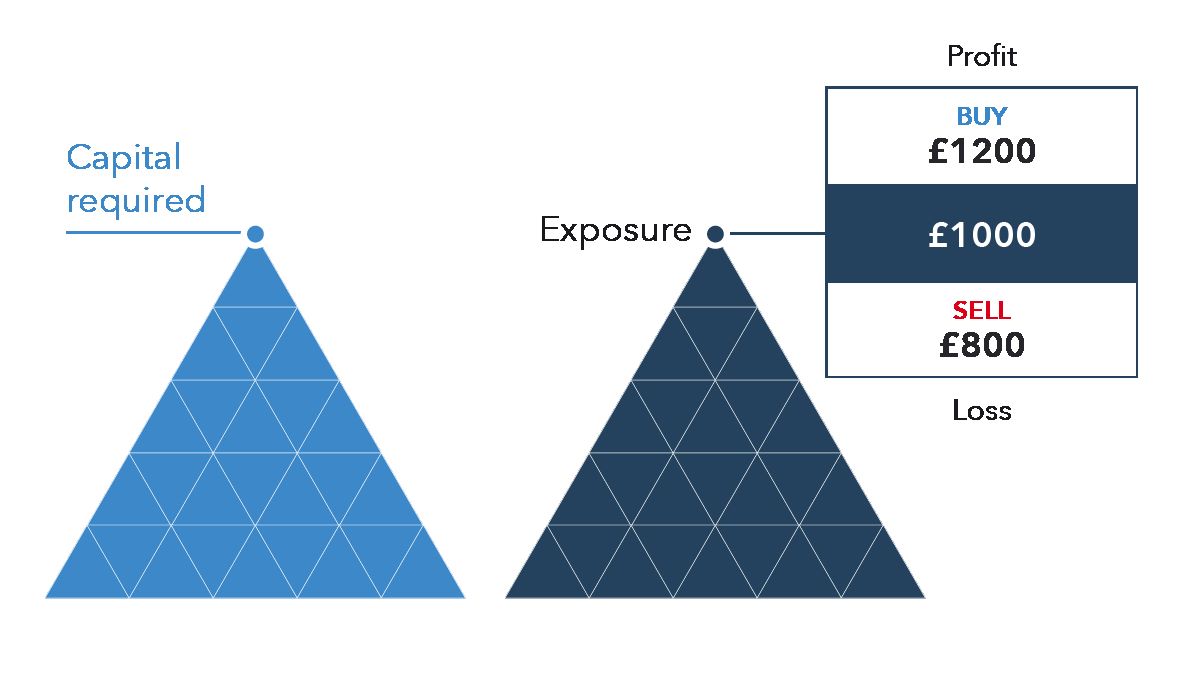

1. Impact on Debt-to-Equity Ratio: The cost of equity affects the optimal mix of debt and equity in a company’s capital structure. When the cost of equity is high, companies may opt for a higher proportion of debt financing to lower their overall cost of capital. On the other hand, when the cost of equity is low, companies may prefer to rely more on equity financing, reducing their financial risk and potential bankruptcy costs.

2. Influence on WACC: The Weighted Average Cost of Capital (WACC) is the average rate of return required by all capital providers, including both debt and equity investors. The cost of equity is a major component of the WACC calculation. As the cost of equity increases, the WACC also rises, making it more expensive for the company to raise capital. This can lead to higher borrowing costs and impact the affordability of debt for the company.

3. Risk Perception and Capital Structure: The cost of equity reflects the perceived riskiness of a company’s stock. Higher risk perception often results in a higher cost of equity. As a result, companies with higher costs of equity may need to rely more heavily on debt financing to maintain a balanced capital structure. This is because the additional debt can provide tax advantages and lower the weighted average cost of capital, offsetting the higher cost of equity.

4. Market Conditions and Capital Structure: The cost of equity is influenced by market conditions, such as interest rates and investor sentiment. During times of economic downturn or higher interest rates, the cost of equity tends to increase. This can lead to companies opting for less equity financing and more debt financing to compensate for the higher cost of equity and minimize the impact on the cost of capital.

5. Flexibility in Capital Structure: The cost of equity also affects the company’s flexibility in adjusting its capital structure. When the cost of equity is high, companies may face difficulties in issuing new equity or repurchasing existing shares. This constraint can limit their ability to raise capital or adjust the capital structure to adapt to changing market conditions. As a result, companies may rely more heavily on debt financing to maintain financial flexibility.

Overall, the relationship between the cost of equity and the capital structure is a dynamic one. The cost of equity influences the choice between debt and equity financing and impacts the overall cost of capital for the company. By carefully analyzing the cost of equity and its relationship to the capital structure, companies can make informed decisions to optimize their financing strategy and balance the trade-off between risk and cost of capital.

Factors Influencing Cost of Equity

The cost of equity is influenced by a variety of factors that determine the return shareholders expect to receive for investing in a company’s stock. Understanding these factors is crucial for companies to accurately determine their cost of equity. Here are some key factors that impact the cost of equity:

1. Interest Rates: Interest rates have a direct effect on the cost of equity. When interest rates are low, the cost of equity tends to be lower as well because shareholders expect a lower required rate of return compared to alternative investments. Conversely, when interest rates rise, the cost of equity is also likely to increase.

2. Market Risk Premium: The market risk premium represents the additional return that investors demand for holding risky assets such as stocks instead of risk-free assets like government bonds. An increase in the market risk premium leads to a higher cost of equity as shareholders expect greater compensation for taking on the inherent risks associated with investing in stocks.

3. Company’s Beta: Beta measures the volatility of a company’s stock price relative to the overall market. A higher beta indicates that the stock’s price is more sensitive to market movements, suggesting greater risk. Companies with higher betas tend to have a higher cost of equity as shareholders expect a higher return to compensate for the increased risk.

4. Company’s Financial Performance: The financial performance of a company, including profitability, growth prospects, and stability, influences the cost of equity. Investors are more likely to demand a higher return if the company’s financial performance is weaker or if there are uncertainties regarding future earnings potential.

5. Industry and Sector Risks: The risks associated with a company’s industry or sector can impact the cost of equity. Industries that are more volatile or subject to regulatory changes may have higher costs of equity as shareholders require greater compensation for the added risk.

6. Investor Sentiment and Market Conditions: Investor sentiment and overall market conditions play a role in determining the cost of equity. During periods of economic uncertainty or market downturns, investors may perceive higher risks, leading to an increase in the cost of equity. Conversely, positive market conditions and optimistic investor sentiment can result in a lower cost of equity.

7. Dividend Policy: The dividend policy of a company can also influence the cost of equity. Companies that have a history of paying consistent and increasing dividends may attract investors who seek a steady income stream. This can lead to a lower cost of equity as shareholders are willing to accept a lower required rate of return.

8. Company Size: The size of a company can affect the cost of equity. Smaller companies may be perceived as riskier and therefore have a higher cost of equity compared to larger, more established companies that are considered more stable and have greater access to resources.

It is important for companies to assess these factors and their potential impact on the cost of equity. By understanding the key drivers, companies can make informed decisions about their financing strategies and accurately estimate the return required by shareholders.

Example of Cost of Equity’s Impact on Capital Structure

To illustrate the impact of the cost of equity on a company’s capital structure, let’s consider the hypothetical case of Company XYZ, which operates in the technology sector. Company XYZ is considering two financing options: issuing new equity or issuing new debt.

Initially, Company XYZ has a capital structure with 80% equity and 20% debt. The cost of equity is estimated to be 15%, and the cost of debt is 8%. The weighted average cost of capital (WACC) for the company, taking into account the initial capital structure, is 12%.

Now, let’s analyze the impact of changes in the cost of equity on the capital structure. If external factors, such as increased market risk or a downturn in the technology sector, raise the cost of equity to 18%, Company XYZ may revisit its capital structure to minimize its overall cost of capital.

One option Company XYZ might consider is increasing its debt-to-equity ratio to reduce its reliance on equity financing. By issuing more debt, Company XYZ can take advantage of the lower cost of debt financing compared to the higher cost of equity.

Assuming Company XYZ decides to issue new debt and reduces its equity component to 60%, while increasing its debt to 40%, let’s evaluate the impact on the company’s overall cost of capital.

The cost of equity component would remain at 18% (15% initially), and the cost of debt would be 8% (unchanged). The WACC, taking into account the revised capital structure, would then be calculated as follows:

(0.6 x 18%) + (0.4 x 8%) = 14.4% + 3.2% = 17.6%

By adjusting the capital structure and increasing the proportion of debt, Company XYZ has effectively lowered its WACC from 12% to 17.6%. This decision reduces the overall cost of capital, enabling Company XYZ to potentially undertake new investment projects with higher expected returns, as the cost of capital now aligns more closely with the cost of the investment opportunities.

It’s important to note that altering the capital structure comes with its own risks. Higher debt levels can increase financial leverage and financial risk. In addition, the company needs to assess its ability to service the additional debt and ensure that it can meet the required interest and principal payments.

In this example, the impact of the cost of equity on the capital structure demonstrates the trade-off between equity and debt financing. By considering the cost of equity and its influence on the overall cost of capital, companies can optimize their capital structure to minimize costs and maximize shareholder value.

Conclusion

The cost of equity is a crucial factor in determining a company’s capital structure. It represents the return that shareholders expect for investing in a company’s stock and influences the company’s financing decisions. By understanding the relationship between the cost of equity and capital structure, companies can optimize their financing strategies and enhance their overall financial health.

Throughout this article, we have explored the definition of the cost of equity and its importance in determining a company’s capital structure. We have discussed how factors such as interest rates, market conditions, and company-specific variables influence the cost of equity. Additionally, we have highlighted the impact of the cost of equity on the capital structure through an example.

It is crucial for companies to carefully assess the cost of equity and its components before making financing decisions. By accurately estimating the cost of equity, companies can determine the optimal mix of debt and equity in their capital structure. This analysis enables them to strike the right balance between maximizing financial leverage and minimizing financial risk, ultimately contributing to the company’s value and shareholders’ wealth.

Moreover, understanding the cost of equity helps companies evaluate investment opportunities, attract investors, assess company value, and effectively manage risk. By considering the cost of equity alongside other factors, companies can make informed decisions regarding capital structure adjustments, business expansion, and financial management.

In conclusion, the cost of equity is a critical concept in finance that significantly impacts a company’s capital structure. By closely analyzing the cost of equity and its implications, companies can make strategic financing decisions that align with their growth objectives, optimize their cost of capital and enhance their overall financial performance.