Finance

How Does Inflation Affect Bonds

Modified: February 21, 2024

Discover how inflation impacts the finance world and specifically, bond investments. Gain insights into the importance of understanding this crucial relationship.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to our comprehensive guide on how inflation affects bonds. As an investor or someone interested in personal finance, understanding the relationship between inflation and bonds is crucial to making informed investment decisions. In this article, we will delve into the concept of inflation, explore the characteristics of bonds, and explain how inflation influences bond prices and yields.

Inflation is a fundamental economic concept that refers to the general increase in prices of goods and services over time. When inflation occurs, the purchasing power of money decreases, as it takes more money to buy the same amount of goods. This erosion of purchasing power affects various aspects of the economy, including investments, savings, and consumption.

Bonds, on the other hand, are debt instruments that governments and corporations issue to borrow money from investors. These fixed-income securities offer regular interest payments, known as coupon payments, and return the principal amount to the investor at maturity. Bonds are considered relatively safer investments compared to stocks, as they provide a predictable income stream and are backed by the issuer’s ability to repay the debt.

The relationship between inflation and bonds stems from the impact of inflation on the purchasing power of future cash flows. As inflation increases, the future value of money decreases. This has significant implications for bond investors, as the fixed interest payments they receive may not hold the same value in real terms.

In the following sections, we will discuss the impact of inflation on bond prices and yields. We will also explore inflation-protected securities, known as Treasury Inflation-Protected Securities (TIPS), which are specifically designed to safeguard investors from the erosion of purchasing power caused by inflation. Finally, we will provide strategies for managing inflation risk in bonds to maximize returns and mitigate potential losses.

Understanding the relationship between inflation and bonds is essential for investors seeking to preserve and grow their wealth. Join us as we explore the intricate dynamics at play and equip ourselves with the knowledge to make informed investment decisions in the face of inflation.

Understanding Inflation

To grasp the impact of inflation on bonds, it is crucial to have a clear understanding of what inflation is and how it is measured. Inflation is the sustained increase in the general price level of goods and services in an economy over a period of time. It is typically measured using various inflation indices, such as the Consumer Price Index (CPI) or the Producer Price Index (PPI).

Inflation can be caused by several factors, including increased production costs, high demand, money supply growth, or government policies. Regardless of the cause, the consequences of inflation are felt by individuals, businesses, and the overall economy.

When inflation occurs, the purchasing power of money decreases. This means that the same amount of money can buy fewer goods and services. For example, if the inflation rate is 3% per year, an item that cost $100 today may cost $103 a year from now. This erosion of purchasing power affects both consumers and investors.

For investors, inflation poses a unique challenge as it erodes the real returns on their investments. Real returns refer to the returns adjusted for the effects of inflation. If an investor earns a 5% return on their investment, but inflation is running at 3%, their real return is only 2%. This means that the purchasing power of their investment has only increased by 2% after accounting for inflation.

Inflation has a profound impact on fixed-income investments, such as bonds. Bonds are typically issued with a fixed interest rate, known as the coupon rate, and have a defined maturity date. However, the fixed nature of bond payments makes them vulnerable to the effects of inflation.

When inflation rises, the future value of the fixed coupon payments from a bond decreases in real terms. For example, if an investor holds a bond that pays a 2% coupon annually, and inflation is running at 3%, the real value of the coupon decreases by 1%. This means that the purchasing power of the interest income received from the bond is diminished by inflation.

In the next sections, we will explore how inflation affects bond prices and yields, and discuss strategies to manage inflation risk in bond investing. Understanding the intricate relationship between inflation and bonds is essential for investors seeking to protect their purchasing power and achieve their financial goals.

Bonds and Their Characteristics

Before diving into how inflation impacts bonds, it is important to have a solid understanding of bonds and their key characteristics.

A bond is a debt instrument issued by government entities, municipalities, or corporations to raise capital. When an investor purchases a bond, they are effectively lending money to the issuer in exchange for periodic interest payments and the return of the principal amount at maturity.

Here are some key characteristics of bonds:

- Principal (Face Value): The principal, also known as the face value or par value of the bond, represents the amount that the issuer promises to repay to the bondholder at maturity.

- Coupon Rate: The coupon rate is the fixed interest rate that the issuer pays to the bondholder over the life of the bond. It is expressed as a percentage of the bond’s face value. For example, a bond with a face value of $1,000 and a coupon rate of 5% would pay $50 in annual interest.

- Maturity Date: The maturity date is the date on which the issuer is obligated to repay the bond’s face value to the bondholder. Bonds can have various maturity periods, ranging from a few months to several decades.

- Yield to Maturity (YTM): The yield to maturity represents the total return an investor can expect to earn if the bond is held until maturity. It takes into account the purchase price, coupon rate, and the time remaining until maturity.

- Market Price: The market price of a bond refers to the current price at which the bond is trading in the secondary market. It can be influenced by various factors, including interest rates, credit ratings, and investor demand.

- Rating: Bonds are assigned credit ratings by independent agencies, such as Standard & Poor’s, Moody’s, and Fitch. These ratings assess the creditworthiness of the issuer and indicate the likelihood of timely interest payments and repayment of the principal amount.

One of the key advantages of bonds is their fixed income nature, which provides a predictable stream of interest payments. However, this fixed income characteristic also exposes bond investors to inflation risk, as the value of those fixed payments can be eroded by rising prices.

Now that we have a solid understanding of bonds and their characteristics, let’s explore the relationship between inflation and bonds, and how inflation impacts bond prices and yields.

Relationship between Inflation and Bonds

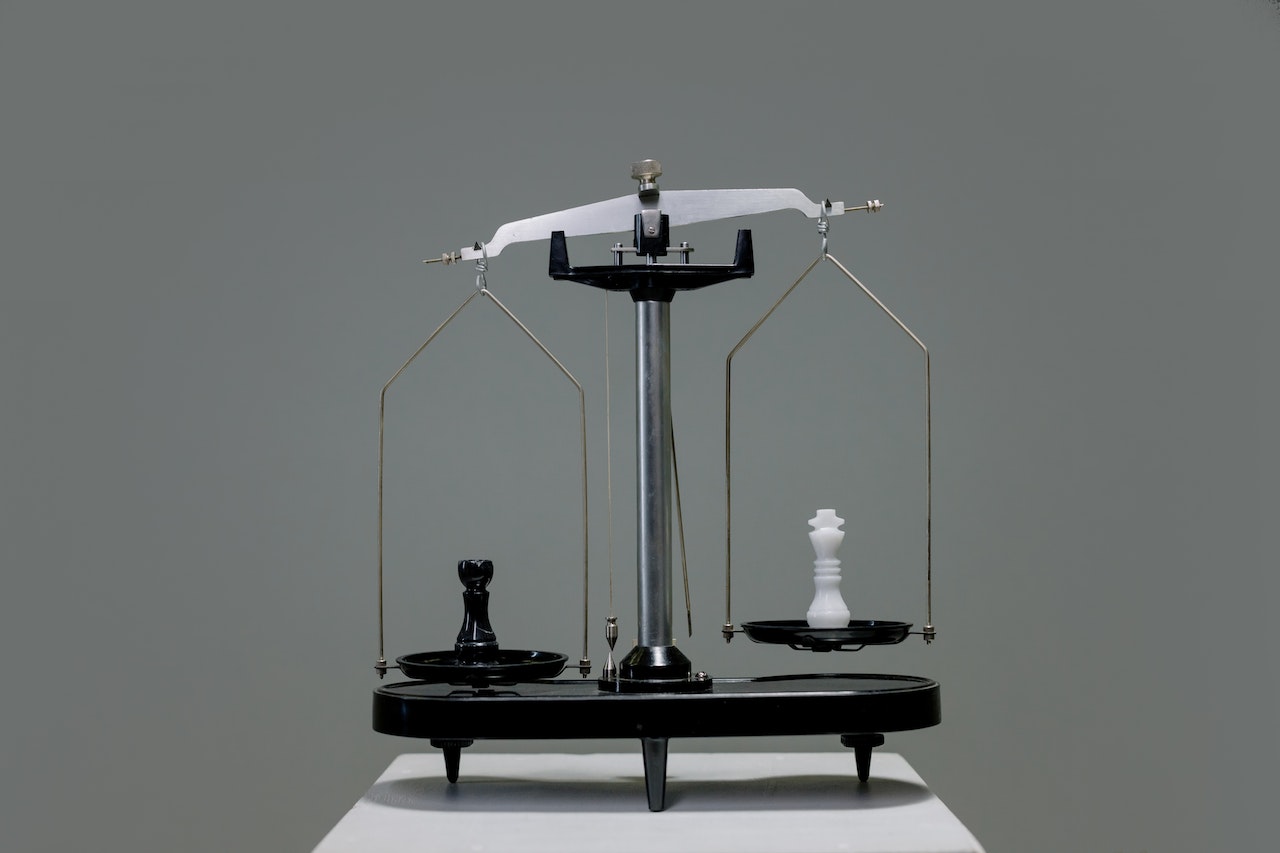

The relationship between inflation and bonds is complex but interconnected. As inflation rises, the purchasing power of money decreases, which has implications for the fixed coupon payments and future value of bonds.

In general, the relationship between inflation and bonds can be summarized as follows:

- Inverse Relationship with Bond Prices: When inflation rises, the prices of existing bonds in the market generally decrease. This is because inflation erodes the purchasing power of the fixed coupon payments received from bonds. Investors are willing to pay less for a bond that offers fixed coupon payments that will have reduced real value in the future.

- Direct Relationship with Bond Yields: As inflation increases, bond yields tend to rise. Bond yields represent the return that investors receive relative to the price they pay for the bond. When inflation expectations rise, bondholders demand higher yields to compensate for the decreased purchasing power of the bond’s fixed coupon payments.

It’s important to note that the relationship between inflation and bonds is not always linear or immediate. There are various factors that can influence the extent and speed of the impact of inflation on bond prices and yields, such as market conditions, monetary policy, and investor sentiment.

Short-term bonds typically have lower price sensitivity to inflation compared to longer-term bonds. This is because short-term bonds have a shorter time to maturity, and investors face less uncertainty about future inflation levels. On the other hand, long-term bonds are more sensitive to inflation as their fixed payments are exposed to a potentially higher level of inflation over the longer time horizon.

Furthermore, market expectations play a crucial role in determining the impact of inflation on bond prices and yields. If investors anticipate that inflation will rise significantly in the future, bond prices may already reflect these expectations, leading to higher yields and lower prices in the present.

The relationship between inflation and bonds highlights the importance of managing inflation risk in bond portfolios. Investors must carefully consider their investment objectives, time horizon, and risk tolerance when selecting bonds to mitigate potential losses due to inflation.

Next, we will explore the impact of inflation on bond prices and yields in more detail, and discuss strategies for managing inflation risk in bonds.

Impact of Inflation on Bond Prices

Inflation has a significant impact on bond prices. As inflation rises, the purchasing power of the fixed coupon payments from bonds decreases, leading to a decrease in the market value of existing bonds.

The relationship between inflation and bond prices can be understood through the concept of “discounting.” When inflation erodes the future purchasing power of an investment, investors require a higher return to compensate for the diminished value. This means that they are willing to pay less for a bond that offers fixed coupon payments in an inflationary environment.

Let’s consider an example to illustrate this impact. Suppose you hold a bond with a face value of $1,000 and a fixed coupon rate of 4% per year. In a low inflation environment, where the purchasing power remains relatively stable, the market value of the bond may be close to its face value. However, if inflation were to increase significantly, let’s say to 5% per year, the fixed coupon payments become less valuable in real terms.

If new bonds are issued in the market with a higher coupon rate to compensate for inflation, investors would require a higher yield to invest in the existing bond with a lower coupon rate. As a result, the price of the bond would need to decrease to increase its yield and align with market expectations.

Therefore, when inflation rises above the coupon rate of the bond, the bond’s price tends to decrease. This decrease in bond prices is an attempt to align the bond’s yield with the prevailing interest rates and inflation expectations in the market.

It’s important to note that the sensitivity of bond prices to inflation depends on the bond’s maturity and the time remaining until the bond matures. Generally, longer-term bonds are more sensitive to inflation than shorter-term bonds because they have a longer time horizon over which fixed coupon payments are subject to the impact of inflation.

Investors must carefully consider these dynamics when evaluating the performance of their bond portfolio and assessing the potential impact of inflation on their investments. Understanding the relationship between inflation and bond prices is essential for making informed investment decisions and managing the risk of declining bond values due to inflation.

In the next section, we will explore the effect of inflation on bond yields and how it influences the overall return on bond investments.

Effect of Inflation on Bond Yields

Inflation has a direct impact on bond yields, which represent the return that investors receive relative to the price they pay for a bond. As inflation rises, bond yields tend to increase to compensate for the diminished purchasing power of the fixed coupon payments.

When inflation is low, bond yields typically reflect the prevailing interest rates in the market. However, as inflation rises, investors demand higher yields to maintain the real value of their investment. This higher yield compensates them for the expected loss of purchasing power caused by inflation.

Let’s consider an example to illustrate this relationship. Suppose you hold a bond with a fixed interest rate of 3% and the current market yield for similar bonds is also 3%. In this scenario, the bond’s yield matches the prevailing market conditions.

If inflation were to increase, let’s say to 4%, bondholders would require a higher yield to offset the expected loss in purchasing power. To attract investors, the bond’s yield would need to increase to 4% or higher to align with the higher inflation rate.

Conversely, if inflation were to decrease, bond yields could decrease as well. In a low inflation environment, investors may be willing to accept lower yields as the erosion of purchasing power is less of a concern.

It’s important to note that the relationship between inflation and bond yields is not always linear. Many factors can influence bond yields, including market expectations, monetary policy, economic conditions, and investor sentiment. Changes in these factors can impact bond yields independently of changes in inflation.

The sensitivity of bond yields to changes in inflation is known as the “inflation risk premium.” This premium represents the additional yield investors require to compensate for the uncertainty associated with future inflation levels. If investors anticipate higher future inflation, the inflation risk premium may increase, leading to higher bond yields.

Investors and bond traders closely monitor inflation indicators and market factors to anticipate changes in bond yields. Understanding the relationship between inflation and bond yields is vital for evaluating the potential returns and risks of bond investments.

In the next section, we will discuss inflation-protected securities known as Treasury Inflation-Protected Securities (TIPS), which are specifically designed to address the impact of inflation on bond investments.

Inflation-Protected Securities (TIPS)

As investors seek to protect their investments from the erosive effects of inflation, inflation-protected securities come into play. One prominent type of inflation-protected security is Treasury Inflation-Protected Securities (TIPS).

Treasury Inflation-Protected Securities are bonds issued by the U.S. Department of the Treasury. What sets TIPS apart from conventional bonds is their unique ability to adjust for inflation and provide investors with protection against rising prices.

Here are some key features of TIPS:

- Inflation Adjustment: The principal value of TIPS is adjusted based on changes in the Consumer Price Index (CPI). This means that as the CPI rises due to inflation, the principal value of the bond increases, thereby adjusting for the impact of inflation.

- Fixed Interest Rate: TIPS pay a fixed interest rate, also known as the coupon rate, which remains constant throughout the life of the bond. However, the interest payments adjust according to the adjusted principal value due to inflation.

- Semi-Annual Interest Payments: TIPS pay interest to investors twice a year, providing them with a regular income stream.

- Deflation Protection: In the event of deflation, where the CPI decreases, the principal value of TIPS can decrease as well. However, the U.S. Treasury ensures that investors receive at least the original principal value at maturity.

- Tax Treatment: Unlike the inflationary adjustments in TIPS, the interest income from TIPS is subject to federal income tax, but it is exempt from state and local taxes.

TIPS provide investors with a direct hedge against inflation, allowing them to maintain the purchasing power of their investments. As the CPI rises, the principal value of TIPS increases accordingly, ensuring that investors receive the adjusted value at maturity.

With their unique inflation adjustment feature, TIPS can provide a level of certainty and protection to investors in times of rising inflation. They are often favored by investors who prioritize capital preservation and seek to safeguard their purchasing power.

Investors interested in TIPS can purchase them directly from the U.S. Treasury through TreasuryDirect or from the secondary market through brokerage firms. TIPS are available in various maturities, providing investors with flexibility to match their investment horizons.

It’s important to note that while TIPS provide inflation protection, their yields may be lower than those of conventional bonds. This lower yield reflects the embedded inflation protection and the diminished risk of future purchasing power erosion.

In the next section, we will discuss strategies for managing inflation risk in traditional bonds, beyond the realm of inflation-protected securities like TIPS.

Strategies for Managing Inflation Risk in Bonds

Managing inflation risk is crucial for bond investors who seek to protect their investments from the erosive effects of rising prices. While inflation-protected securities like Treasury Inflation-Protected Securities (TIPS) offer direct protection, there are strategies available to manage inflation risk in traditional bonds as well. Here are some strategies to consider:

- Diversify Your Bond Portfolio: One effective strategy is to diversify your bond portfolio across different maturities. Allocating investments to both short-term and long-term bonds can help mitigate the impact of inflation, as short-term bonds are less sensitive to inflation compared to long-term bonds. This diversification can provide a balance between income and potential capital appreciation.

- Consider Floating Rate Bonds: Floating rate bonds, also known as adjustable-rate bonds, are fixed-income securities with interest rates that adjust periodically based on changes in a benchmark rate, such as the London Interbank Offered Rate (LIBOR). These bonds provide a natural hedge against inflation, as their interest rates rise along with increases in market rates. Investing in floating rate bonds can help protect against the erosion of purchasing power caused by inflation.

- Invest in High-Yield Bonds: High-yield bonds, also known as junk bonds, are issued by companies with lower credit ratings. While they carry higher credit risk, they often offer higher yields to compensate investors. Investing in high-yield bonds can provide an income stream that has the potential to outpace inflation, thus protecting the purchasing power of your investment.

- Consider Inflation-Linked ETFs: Exchange-Traded Funds (ETFs) that track inflation-linked bonds or inflation indexes are another option for managing inflation risk. These ETFs provide exposure to a diversified portfolio of inflation-protected securities, offering investors an indirect way to gain inflation protection without holding individual bonds.

- Monitor and Adjust Your Portfolio: Regularly monitoring inflation trends and economic indicators can help you make informed decisions and adjust your bond portfolio accordingly. Keep track of inflation expectations and market conditions to determine if adjustments need to be made to your allocation or to take advantage of opportunities that arise.

It’s important to note that managing inflation risk requires careful consideration and an understanding of your investment objectives, risk tolerance, and time horizon. Consulting with a financial advisor who specializes in bond investments can provide valuable insights and help tailor a strategy that best suits your needs.

By implementing these strategies, investors can mitigate the impact of inflation on their bond portfolios and potentially preserve their purchasing power over the long term.

Let’s wrap up our discussion on the impact of inflation on bonds.

Conclusion

Understanding the relationship between inflation and bonds is essential for investors looking to protect their investments and maintain their purchasing power. Inflation can have a significant impact on bond prices and yields, affecting the real returns that investors receive.

When inflation rises, bond prices generally decrease, as fixed coupon payments become less valuable in real terms. This inverse relationship between inflation and bond prices highlights the importance of managing inflation risk in bond portfolios.

Inflation-protected securities like Treasury Inflation-Protected Securities (TIPS) offer direct protection against inflation by adjusting their principal value based on changes in the Consumer Price Index (CPI). TIPS can be a valuable component of a diversified bond portfolio, providing investors with certainty in maintaining their purchasing power.

However, traditional bonds can also be managed to mitigate inflation risk. Diversifying bond holdings, considering floating rate bonds, investing in high-yield bonds, or exploring inflation-linked ETFs are strategies that can help investors navigate and alleviate the impact of inflation on their bond investments.

It is important for investors to regularly monitor inflation trends, market conditions, and their investment objectives. By staying informed and making adjustments to their portfolios when necessary, investors can better position themselves to manage inflation risk and potentially enhance investment returns.

Ultimately, managing inflation risk in bonds requires careful consideration, diversification, and staying proactive in response to changing economic conditions. By implementing sound strategies and staying vigilant, investors can navigate the complexities of the bond market and secure their financial well-being in the face of inflation.

We hope this comprehensive guide has provided you with valuable insights into the impact of inflation on bonds and strategies for managing inflation risk. Armed with this knowledge, you can make informed investment decisions and work towards achieving your financial goals.