Finance

What Are Net Fixed Assets On A Balance Sheet

Modified: December 30, 2023

Learn about net fixed assets on a balance sheet in finance. Understand the importance and implications of this key financial metric.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When assessing the financial health and stability of a company, one crucial aspect to consider is its net fixed assets. Net fixed assets, also known as net property, plant, and equipment (PP&E), are a vital component of a company’s balance sheet. They provide valuable insights into the company’s investment in long-term assets that are used in its operations.

Net fixed assets are the result of deducting accumulated depreciation and impairment losses from the total value of fixed assets. These assets include tangible assets like land, buildings, machinery, and vehicles, as well as intangible assets like patents, trademarks, and copyrights.

The net fixed assets figure is significant because it represents the net worth of a company’s long-term investments in productive assets. It allows investors, creditors, and other stakeholders to gauge the company’s ability to generate future cash flows and its capacity to withstand economic downturns.

In this article, we will explore the concept of net fixed assets in more detail. We will delve into the components that make up net fixed assets, the calculation method, and the importance of this figure on a company’s balance sheet. So, let’s dive in!

Definition of Net Fixed Assets

Net fixed assets, also referred to as net property, plant, and equipment (PP&E), are a financial metric that represents the value of a company’s long-term tangible and intangible assets after deducting accumulated depreciation and impairment losses. These assets are used in a company’s operations to generate revenue and facilitate its growth.

Tangible assets included in net fixed assets typically comprise land, buildings, machinery, vehicles, and equipment. These assets have a physical presence and are essential for producing goods or providing services. On the other hand, intangible assets encompass patents, trademarks, copyrights, and other intellectual property rights. Although intangible assets lack physical substance, they can still contribute significantly to a company’s value and competitive advantage.

Accumulated depreciation, an important component of net fixed assets, reflects the wear and tear, obsolescence, or aging of the company’s fixed assets over time. Depreciation is the systematic allocation of the cost of a tangible asset over its useful life, while amortization is the similar process for intangible assets. By deducting accumulated depreciation from the historical cost of an asset, the net book value or carrying value is obtained, which represents the value of the asset net of its accumulated depreciation.

Moreover, impairment losses are another factor to consider when calculating net fixed assets. Impairment occurs when the carrying amount of an asset exceeds its recoverable amount, which is the higher of its fair value less costs to sell or its value in use. When an asset is impaired, its carrying value is decreased, and the impairment loss is reported in the income statement, reducing the company’s net income.

Ultimately, the net fixed assets figure provides valuable information about the long-term investments made by a company to support its operations. It reflects the value of the assets that are expected to generate future economic benefits and allows stakeholders to assess the company’s asset management and capital allocation.

Components of Net Fixed Assets

Net fixed assets consist of various components that contribute to a company’s long-term asset base. These components can be broadly categorized into two types: tangible fixed assets and intangible fixed assets.

Tangible Fixed Assets

Tangible fixed assets are physical assets that have a distinct physical presence and are used in the production process or for administrative purposes. Here are some common examples of tangible fixed assets:

- Land: This includes the value of the land on which the company’s facilities or buildings are situated.

- Buildings: The value of structures owned by the company, such as offices, manufacturing plants, warehouses, or retail spaces.

- Machinery and Equipment: The value of various machines, equipment, and tools that are utilized in the production or operation processes.

- Vehicles: This includes cars, trucks, vans, or any other vehicles owned by the company for transportation or delivery purposes.

- Furniture and Fixtures: The value of desks, chairs, cabinets, and other furniture used in office spaces or retail environments.

Tangible fixed assets often have a useful life beyond a single accounting period and are subject to depreciation, as they experience wear and tear or become technologically obsolete over time.

Intangible Fixed Assets

Intangible fixed assets are non-physical assets that lack a physical presence but provide value to a company through legal rights or intellectual property. Some common examples of intangible fixed assets include:

- Patents: Exclusive rights granted to an inventor or assignee for a novel invention or process.

- Trademarks: Distinctive signs, logos, or symbols that represent a particular brand or product.

- Copyrights: Exclusive rights granted to the creator of original artistic, literary, or musical works.

- Software: The value of software programs or applications that are developed or acquired by the company.

- Customer Lists: The value of databases or lists containing customer information and relationships.

Intangible fixed assets are typically amortized over their useful lives and, similar to tangible fixed assets, contribute to the company’s ability to generate future revenues and remain competitive.

By understanding the components of net fixed assets, stakeholders can assess the composition and value of a company’s long-term asset base, which is critical for analyzing its financial health and growth prospects.

Tangible Fixed Assets

Tangible fixed assets are physical assets that have a distinct physical presence and are used in the production process or for administrative purposes. These assets form a significant part of a company’s net fixed assets and play a crucial role in its operations and value creation.

Here are some common examples of tangible fixed assets:

- Land: This includes the value of the land on which the company’s facilities or buildings are situated. Land is a valuable asset that can appreciate over time and may also provide additional opportunities for expansion.

- Buildings: The value of structures owned by the company, such as offices, manufacturing plants, warehouses, or retail spaces. Buildings provide a physical space for employees to work, machinery and equipment to be housed, and the storage of inventory or finished goods.

- Machinery and Equipment: The value of various machines, equipment, and tools that are utilized in the production or operation processes. This includes items such as manufacturing equipment, assembly lines, forklifts, and specialized tools that are essential for carrying out specific tasks.

- Vehicles: This includes cars, trucks, vans, or any other vehicles owned by the company for transportation or delivery purposes. Vehicles enable the company to transport goods, deliver services, or travel for business needs.

- Furniture and Fixtures: The value of desks, chairs, cabinets, and other furniture used in office spaces or retail environments. These assets provide a comfortable and functional work environment for employees and enhance the overall aesthetic appeal of the premises.

Tangible fixed assets typically have a useful life beyond a single accounting period and are subject to wear and tear, technological obsolescence, or changes in market demand. To account for the usage and decrease in value over time, companies are required to depreciate these assets using methods such as straight-line depreciation or accelerated depreciation.

It is essential for companies to properly maintain and manage their tangible fixed assets to extend their useful life and maximize their value. Regular maintenance, upgrades, and strategic utilization can help companies optimize their fixed asset investments and improve operational efficiency.

In summary, tangible fixed assets serve as the backbone of a company’s infrastructure and operational capabilities. They provide physical resources and facilities necessary for the production of goods and services, thereby contributing to the generation of revenue and overall growth of the business.

Intangible Fixed Assets

Intangible fixed assets are non-physical assets that lack a physical presence but provide value to a company through legal rights or intellectual property. These assets play a crucial role in shaping a company’s competitive advantage and contributing to its overall value.

Here are some common examples of intangible fixed assets:

- Patents: Exclusive rights granted to an inventor or assignee for a novel invention or process. Patents protect the innovative ideas and technologies developed by a company, giving them a competitive edge by preventing others from using or commercializing the same invention.

- Trademarks: Distinctive signs, logos, or symbols that represent a particular brand or product. Trademarks help companies establish brand recognition and differentiate their products or services from competitors in the market.

- Copyrights: Exclusive rights granted to the creator of original artistic, literary, or musical works. Copyrights protect original content such as books, music, software, or artwork, ensuring that the creator has control over its distribution and use.

- Software: The value of software programs or applications that are developed or acquired by the company. Software plays a critical role in modern business operations, enabling automation, data analysis, communication, and resource management.

- Customer Lists: The value of databases or lists containing customer information and relationships. Customer lists provide insights into a company’s customer base, including preferences, purchase history, and potential sales opportunities, allowing for targeted marketing efforts and customer relationship management.

Intangible assets are typically amortized over their useful lives, reflecting the gradual consumption or expiration of their value. This process allocates the cost of the intangible asset over time to reflect its diminishing value as it contributes to the company’s operations and generates revenues.

Intangible fixed assets can significantly affect a company’s competitive position and market value. They provide intangible benefits that go beyond tangible assets and often play a critical role in attracting customers, building brand reputation, and fostering innovation.

It is essential for companies to protect and manage their intangible fixed assets effectively. This includes monitoring and enforcing intellectual property rights, investing in ongoing development and improvement, and leveraging these assets strategically to drive business growth.

In summary, intangible fixed assets represent valuable resources that contribute to a company’s success and competitive advantage. They encompass legal rights, intellectual property, and customer relationships that have the potential to generate long-term value and differentiate the company in the marketplace.

Depreciation and Amortization

In the context of net fixed assets, depreciation and amortization are important concepts that reflect the systematic allocation of the cost of tangible and intangible assets over their useful lives. These accounting practices recognize the wear and tear, obsolescence, or expiration of value associated with these assets.

Depreciation

Depreciation is the process of allocating the cost of tangible assets, such as buildings, machinery, and vehicles, over their estimated useful lives. It reflects the decrease in value and the wear and tear of these assets as they are utilized in the business operations. Depreciation is typically calculated using various methods, including straight-line depreciation, declining balance depreciation, or units of production depreciation.

The purpose of recording depreciation is to match the cost of the asset with the revenues it helps generate over its useful life. By spreading the cost of the asset over its expected lifespan, depreciation allows for a more accurate representation of the asset’s value on the balance sheet and the company’s income statement.

Amortization

Amortization, on the other hand, is the process of allocating the cost of intangible assets over their estimated useful lives. Intangible assets, such as patents, trademarks, and copyrights, are subject to amortization as their value is consumed or expires over time.

Amortization methods are similar to depreciation methods, with the most common being straight-line amortization. The amortization expense is recorded on the income statement and reduces the carrying value of the intangible asset on the balance sheet over its useful life.

Both depreciation and amortization have significant implications for financial reporting and analysis. They impact the company’s net income, assets, and equity. These non-cash expenses are added back to a company’s net income when calculating cash flows from operating activities, as they don’t represent actual cash outflows.

It’s important to note that depreciation and amortization are accounting conventions and do not necessarily reflect the actual decrease in the market value of assets. They provide a systematic approach to allocating costs that is accepted in financial reporting and helps stakeholders assess the true economic performance of a company.

By appropriately accounting for depreciation and amortization, companies can accurately reflect the consumption of asset values, measure their profitability, evaluate return on investment, and properly assess the value and useful life of their net fixed assets.

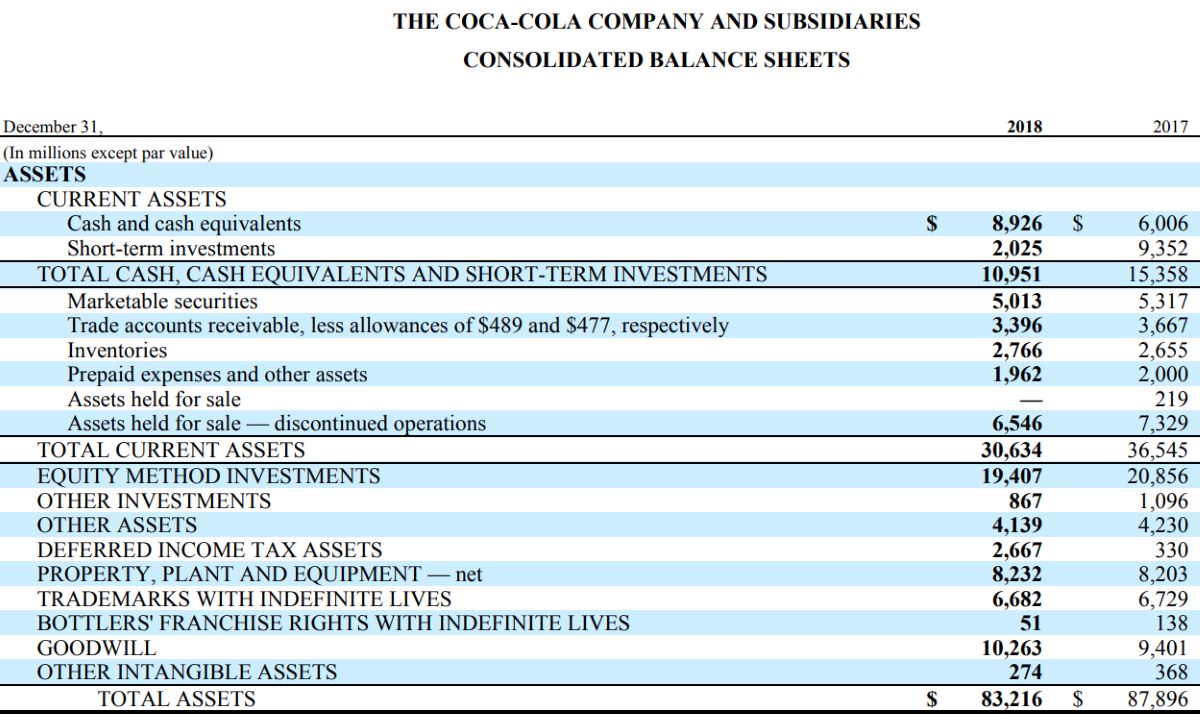

Calculation of Net Fixed Assets

The calculation of net fixed assets involves deducting accumulated depreciation and impairment losses from the total value of fixed assets. This calculation provides a clear picture of the net worth of a company’s long-term investments in tangible and intangible assets used in its operations.

To calculate net fixed assets, follow these steps:

- Start with the total value of fixed assets: Begin by identifying the total value of all tangible and intangible fixed assets listed on the company’s balance sheet. This includes land, buildings, machinery, vehicles, patents, trademarks, and other relevant assets.

- Account for accumulated depreciation: Determine the total accumulated depreciation for all tangible fixed assets. Accumulated depreciation represents the total amount of depreciation recorded for these assets over their useful lives. Subtract the accumulated depreciation from the historical cost of the tangible fixed assets to obtain their net book value.

- Consider impairment losses: Assess if any tangible or intangible fixed assets are impaired. An impairment loss occurs when the carrying amount of an asset exceeds its recoverable amount. Deduct any recognized impairment losses from the net book value of the impaired asset.

- Calculate the net fixed assets: Subtract the accumulated depreciation and impairment losses from the total value of fixed assets. The resulting figure represents the net fixed assets, which is also known as the net property, plant, and equipment (PP&E).

Net fixed assets provide valuable information about a company’s long-term investments in productive assets and their net value after accounting for their usage and impairment. This figure is crucial for analyzing the financial health, profitability, and growth potential of a company.

It’s important to note that the calculation of net fixed assets should consider any additions, disposals, or changes in impairment status throughout the reporting period. Additionally, different accounting frameworks may have specific guidelines for depreciation and impairment recognition, so it’s vital to follow the appropriate accounting principles relevant to the company’s jurisdiction.

By calculating net fixed assets accurately and consistently, stakeholders can assess a company’s asset management, determine the effectiveness of capital investments, and gain insights into its long-term financial stability and operational capacity.

Importance of Net Fixed Assets on a Balance Sheet

Net fixed assets play a crucial role in providing insights into a company’s financial health and stability. They provide important information about a company’s investments in long-term tangible and intangible assets and their net value after accounting for depreciation and impairment. Here are several reasons why net fixed assets are important on a balance sheet:

1. Asset Management and Efficiency

Net fixed assets allow stakeholders to assess how effectively a company manages its long-term assets. By analyzing the composition, value, and age of these assets, investors and creditors can evaluate the company’s ability to generate future cash flows, utilize its resources efficiently, and make optimal investment decisions.

2. Operational Capacity

The value of net fixed assets provides insights into a company’s operational capacity. It reflects the resources available to support and facilitate the production of goods or provision of services. Stakeholders can determine the company’s ability to meet demand, fulfill orders, and scale its operations by assessing the value and condition of tangible assets like machinery, equipment, and buildings.

3. Long-term Investment Risk

Net fixed assets help stakeholders assess the level of risk associated with a company’s long-term investments. A high proportion of net fixed assets relative to total assets indicates that a significant portion of the company’s resources is tied up in long-term assets. This can indicate higher investment risk, as the company’s liquidity may be lower and it may have less flexibility to adapt to changing market conditions.

4. Financial Stability and Collateral

Net fixed assets serve as a measure of a company’s financial stability and collateral. They provide a tangible base of assets that could be used as collateral for loans or other financial arrangements. Lenders and creditors often consider the value and condition of net fixed assets when assessing a company’s creditworthiness and the security of their investment.

5. Determining Valuation and Firm Value

Net fixed assets are a crucial component in determining the valuation and overall value of a company. By subtracting the debt and other liabilities from the value of net fixed assets, stakeholders can estimate the net worth or equity of the company. This valuation is useful for understanding the company’s intrinsic value and potential returns for shareholders.

Overall, net fixed assets provide valuable information about a company’s long-term investments, operational capacity, financial stability, and potential risks. Analyzing this figure enables stakeholders to make informed decisions and gain a deeper understanding of a company’s financial health and future prospects.

Conclusion

Net fixed assets are an integral component of a company’s balance sheet, providing valuable insights into its long-term investments in tangible and intangible assets. These assets, after deducting accumulated depreciation and impairment losses, represent the net worth of the company’s productive resources.

The components of net fixed assets include tangible assets like land, buildings, machinery, vehicles, as well as intangible assets like patents, trademarks, and copyrights. Tangible fixed assets provide the physical resources necessary for production and operations, while intangible fixed assets encompass the legal rights and intellectual property that contribute to a company’s competitive advantage.

Depreciation and amortization are accounting practices used to allocate the cost of these assets over their useful lives. By considering the wear and tear, obsolescence, and expiration of value, these practices provide a more accurate representation of the assets’ value over time.

The importance of net fixed assets on a balance sheet cannot be overstated. They provide crucial information for assessing a company’s asset management, operational capacity, financial stability, investment risk, and valuation. Analyzing net fixed assets allows stakeholders to make informed decisions and gain insights into a company’s financial health, growth potential, and ability to generate future cash flows.

In conclusion, net fixed assets provide a comprehensive snapshot of a company’s investments in productive resources and their net value. Understanding and analyzing net fixed assets are vital for investors, creditors, and other stakeholders in assessing the overall financial strength and value of a company.