Finance

How Does Renters Insurance Deductible Work

Published: November 13, 2023

Learn how the renters insurance deductible works in this comprehensive guide. Understand the financial implications and make informed decisions.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of renters insurance! If you’re a renter, protecting your belongings and personal liability should be a top priority. While you may have heard about renters insurance, you might not be familiar with all the details, such as deductibles. In this article, we will explore the ins and outs of renters insurance deductibles and how they work.

When unexpected events like theft, fire, or water damage occur, renters insurance can provide financial protection. It helps cover the cost of replacing or repairing your belongings as well as any liability you may face if someone is injured in your rental property.

A deductible is a key aspect of any insurance policy, including renters insurance. It is the portion of a claim that you are responsible for paying out of pocket before the insurance company steps in to cover the rest. Understanding how a renters insurance deductible works is crucial for making informed decisions about your coverage.

In the following sections, we will delve into the details of how renters insurance deductibles function and discuss the factors to consider when choosing the deductible amount that suits your needs.

What is Renters Insurance?

Renters insurance is a type of insurance policy designed specifically for tenants who are renting a property. It provides coverage for your personal belongings and provides liability protection in case someone is injured within your rental unit.

While your landlord is responsible for insuring the physical building, their insurance does not cover your personal belongings or provide liability coverage for you as a renter. That’s where renters insurance comes in.

With renters insurance, you can have peace of mind knowing that your personal possessions are protected against losses resulting from events such as theft, fire, vandalism, or water damage. It can help you recover financially if your belongings are damaged, destroyed, or stolen.

In addition to protecting your belongings, renters insurance also offers liability coverage. If a guest falls and injures themselves in your rental property, or if you accidentally damage someone else’s property, you could be held responsible for medical expenses or repair costs. Renters insurance can help cover these expenses and protect you from personal liability.

It’s important to note that renters insurance not only covers your belongings inside your rental unit but also provides coverage for your belongings when you are outside the property as well. This means that if your laptop is stolen while you’re at a coffee shop or if your bike is vandalized while locked outside your friend’s house, you can file a claim and be reimbursed for the loss.

Before purchasing renters insurance, take an inventory of your belongings to determine the approximate value of your possessions. This will help you choose the appropriate coverage amount for your policy. Remember, the cost of renters insurance is relatively affordable compared to the potential losses you could face without it.

Now that you understand what renters insurance is, let’s dive into the concept of deductibles and how they work within a renters insurance policy.

What is a Deductible?

A deductible is a specified amount of money that you, as the policyholder, are responsible for paying before your insurance company begins to cover the remaining costs of a claim. It is a common feature of insurance policies, including renters insurance.

Think of the deductible as your financial responsibility towards any covered losses or damages. When you file a claim, you will need to pay your deductible amount out of pocket before the insurance company will contribute to the remaining expenses.

For example, let’s say you have a renters insurance policy with a $500 deductible. If you experience a covered loss, such as a burglary resulting in the theft of your electronics worth $3,000, you would need to pay the $500 deductible, and your insurance company would cover the remaining $2,500.

The purpose of a deductible is to prevent people from filing numerous small claims for minor losses and to encourage policyholders to take responsible steps to prevent claims whenever possible. By requiring policyholders to contribute financially, insurance companies can manage the overall cost of claims and maintain affordable premiums for all policyholders.

It’s important to note that the deductible applies to each claim you make. So if you experience multiple covered losses within a policy period, you will need to pay the deductible for each individual claim.

When selecting your renters insurance policy, you will have the option to choose your deductible amount. Insurance companies typically offer a range of deductible options, such as $250, $500, or $1,000. The higher the deductible you choose, the lower your insurance premium will usually be. However, a higher deductible also means you will have a greater out-of-pocket expense in the event of a claim.

Understanding how a renters insurance deductible works is essential for managing your finances and making informed decisions about your coverage. In the next section, we will explore how the deductible functions in the context of a renters insurance policy.

How Does a Renters Insurance Deductible Work?

When you file a claim with your renters insurance policy, the deductible is the amount of money you will need to pay out of pocket before your insurance coverage kicks in. It’s important to understand how the deductible works to know what to expect in the event of a covered loss.

Let’s say you have a renters insurance policy with a $500 deductible and your laptop gets stolen. The cost of replacing your laptop is $1,500. In this scenario, you would need to pay the $500 deductible, and your insurance company would cover the remaining $1,000 to replace your stolen laptop.

It’s crucial to keep in mind that the deductible applies to each separate claim you make. If you were to experience multiple losses, such as a theft and a fire, you would need to pay the deductible for each individual claim.

For example, if you filed a claim for a theft with a $500 deductible and then had a fire-related claim a few months later, you would need to pay the deductible again for the fire claim. The deductible doesn’t accumulate or carry over across multiple claims.

It’s also worth noting that the deductible and the coverage limit are not the same. The coverage limit is the maximum amount your insurance company will pay out for a claim, while the deductible is the amount you need to contribute before the insurance coverage comes into play.

When selecting your renters insurance policy, you usually have the flexibility to choose your deductible amount. It’s common for insurance companies to offer different deductible options, such as $250, $500, or $1,000. The amount you choose will impact your premium—the higher the deductible, the lower your premium is likely to be.

It’s essential to strike a balance when selecting your deductible amount. While a higher deductible can help lower your insurance premium, it also means you will have a higher out-of-pocket expense if you need to file a claim. On the other hand, a lower deductible means a higher premium but a lower out-of-pocket cost if you need to make a claim.

Consider your budget, your risk tolerance, and the value of your belongings when choosing your deductible amount. Finding the right balance can ensure you have adequate financial protection without placing an undue burden on your finances.

Now that you understand how a renters insurance deductible works, let’s explore how insurance companies determine the deductible amount in the next section.

Determining the Deductible Amount

When choosing a renters insurance policy, one of the key decisions you’ll need to make is determining the deductible amount. The deductible is the portion of a claim that you are responsible for paying out of pocket before the insurance company covers the rest. Here are some factors to consider when determining the deductible amount:

- Financial Capacity: Assess your financial situation and consider how much you could comfortably afford to pay in the event of a claim. Select a deductible that aligns with your budget and doesn’t strain your finances.

- Risk Tolerance: Consider your willingness to take on additional risk. A higher deductible means you will have a greater out-of-pocket expense if you need to make a claim, but it will also lower your insurance premium. If you prefer the peace of mind of a lower out-of-pocket expense, opt for a lower deductible even if it means paying a slightly higher premium.

- Value of Belongings: Evaluate the value of your personal belongings. If you own expensive items or have a significant amount of valuable possessions, you may want a lower deductible to ensure you can replace them in case of loss or damage.

- Frequency of Claims: Consider your claims history and the likelihood of filing a claim. If you rarely make claims and prefer to have insurance for major incidents only, a higher deductible may be appropriate. However, if you anticipate filing claims more frequently, such as for smaller losses, a lower deductible may be more suitable.

- Insurance Premium: Keep in mind that the deductible and insurance premium are interconnected. Typically, a higher deductible will result in a lower premium, while a lower deductible will lead to a higher premium. Find a balance that provides adequate coverage at a premium you can afford.

Remember, your deductible amount should be a personal decision based on your unique circumstances. It’s essential to review and reassess your deductible periodically to ensure it still aligns with your financial situation and risk tolerance.

Now that you have a better understanding of how to determine the deductible amount, let’s move on to the next section, which explores how to file a claim with a deductible.

Filing a Claim with a Deductible

When the unfortunate happens and you need to file a claim with your renters insurance policy, there are a few important steps to follow, including dealing with the deductible. Here’s a breakdown of how to navigate the claim filing process:

- Assess the Loss: Start by assessing the extent of the loss or damage to your belongings. Take photos and document any evidence to support your claim. This will help the insurance company evaluate the situation and determine the appropriate payout.

- Reach out to your Insurance Company: Contact your insurance company as soon as possible to start the claims process. They will provide you with the necessary forms and guide you through the required documentation. Be prepared to provide details about the incident, including the date, location, and a description of the loss or damage.

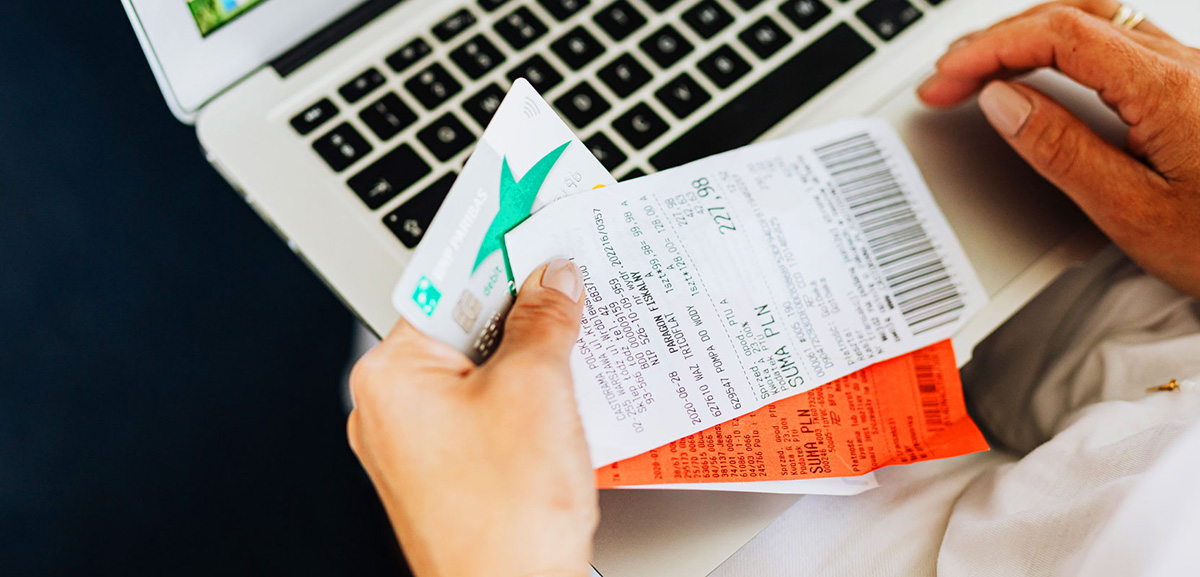

- Pay the Deductible: When filing a claim, you will need to pay your deductible amount upfront. This payment is typically required before the insurance company proceeds to cover the remaining costs of the claim. Ensure that you have the funds available to cover your deductible.

- Submit Supporting Documents: Along with the claim form, you will need to include any supporting documents, such as photos, receipts, or police reports, depending on the nature of the claim. These documents will help validate your claim and expedite the process.

- Claim Evaluation: Once the insurance company receives your claim, they will assign an adjuster to assess the validity of the claim and determine the appropriate payout. The adjuster may contact you for additional information or conduct an inspection if necessary.

- Claim Settlement: After evaluating your claim, the insurance company will determine the amount they will reimburse you for the covered loss or damage. This payout will be minus your deductible amount, as you are responsible for covering that portion of the claim.

- Receive the Claim Payout: Once the claim is settled, the insurance company will issue a payment for the approved amount, minus the deductible. This payout will help you replace or repair your damaged or stolen belongings.

It’s important to keep in mind that insurance companies have different processes and timelines for handling claims. Be sure to familiarize yourself with your specific insurance provider’s requirements and adhere to any deadlines they set for submitting claims.

Remember, filing a claim with a deductible means you will need to cover the deductible amount out of pocket. Carefully consider your financial situation and the value of your claim when deciding whether to file a claim. Sometimes, for minor damages that are close to the deductible amount, it may be more beneficial to handle the repairs or replacement costs yourself and avoid the claims process altogether.

Now that we’ve explored the process of filing a claim with a deductible, let’s delve into the pros and cons of having a renters insurance deductible in the next section.

Pros and Cons of a Renters Insurance Deductible

Having a deductible as part of your renters insurance policy comes with both advantages and disadvantages. Let’s take a closer look at the pros and cons:

Pros:

- Reduced Premiums: One of the main benefits of having a deductible is that it can lower your renters insurance premium. By opting for a higher deductible, you are assuming a greater portion of the financial risk, which allows insurance companies to reduce your premium as a result.

- Encourages Responsible Behavior: A deductible serves as a deterrent for filing frequent or minor claims. It encourages policyholders to be more cautious and take preventive measures to avoid losses, as they will be responsible for covering a portion of the cost. This can lead to more responsible behavior and fewer claims overall, which helps keep insurance premiums lower for everyone.

- Customizable Options: Renters insurance policies often offer a range of deductible options, allowing you to customize your coverage to fit your needs and budget. This flexibility empowers you to find a deductible amount that strikes the right balance between affordability and financial protection.

- Greater Control Over Premium Costs: By choosing a deductible amount that you can comfortably afford to pay out of pocket, you have more control over your insurance premium. Adjusting your deductible can help make your policy more affordable while still providing the coverage you need.

Cons:

- Out-of-Pocket Expenses: The most significant drawback of a renters insurance deductible is that it requires you to cover a portion of the claim amount out of pocket before the insurance coverage kicks in. This can be burdensome if you experience a significant loss or damage and need to pay a substantial deductible.

- Potential Financial Strain: Opting for a lower deductible may provide more immediate relief during a claim, but it also means higher premiums. This can put a strain on your finances in the long run, especially if you have other financial obligations or are on a tight budget.

- Complex Decision-Making: Determining the right deductible amount requires careful consideration of your financial situation, risk tolerance, and the value of your belongings. It can be challenging to find the optimal balance, and choosing the wrong deductible may result in either higher premiums or unexpected financial burdens when a claim arises.

Remember, the pros and cons of a renters insurance deductible may vary depending on your specific circumstances. It’s important to evaluate your personal situation and weigh the advantages and disadvantages before deciding on the deductible amount that works best for you.

In the next section, we will provide some valuable tips to help you choose the right deductible amount for your renters insurance policy.

Tips for Choosing the Right Deductible Amount

Choosing the right deductible amount for your renters insurance policy is an important decision that requires careful consideration. Here are some useful tips to help you make an informed choice:

- Assess Your Budget: Take a close look at your finances and determine how much you can comfortably afford to pay out of pocket in the event of a claim. Consider your monthly expenses, savings, and any other financial obligations to find a deductible that fits within your budget.

- Evaluate the Value of Your Belongings: Consider the value of your personal belongings and the potential cost of replacing them. If you own expensive items or have a significant number of valuable possessions, you may want to opt for a lower deductible to ensure you can cover the cost of potential losses.

- Consider your Risk Tolerance: Evaluate your willingness to assume more risk in exchange for potentially lower premiums. If you have a higher risk tolerance and can afford a higher out-of-pocket expense in case of a claim, you may opt for a higher deductible to enjoy lower insurance premiums.

- Analyze Claim Frequency: Reflect on your past claims history and assess the likelihood of future claims. If you rarely make claims or prefer to handle smaller losses on your own, a higher deductible may be suitable. On the other hand, if you anticipate filing claims more frequently, a lower deductible might be more appropriate.

- Compare Costs: Obtain quotes from different insurance companies or speak with an insurance agent to compare the costs associated with different deductible options. Consider how deductible amounts affect the overall premium and find a balance between cost and coverage that works for you.

- Review Regularly: Regularly review your deductible amount to ensure it still aligns with your financial situation and needs. As your circumstances change, such as an increase in income or the acquisition of valuable items, you may need to adjust your deductible to maintain appropriate coverage.

Remember, choosing the right deductible is a personal decision influenced by your financial capacity, risk tolerance, and the value of your belongings. Take the time to evaluate these factors and weigh the pros and cons before making a final decision.

Lastly, consult with an insurance professional who can provide personalized guidance based on your specific circumstances. They can analyze your risks and help you choose the deductible amount that best suits your needs.

Now that you have some valuable tips for selecting the right deductible amount, let’s conclude our exploration of renters insurance deductibles.

Conclusion

Renters insurance is a crucial component of protecting your belongings and personal liability as a tenant. Understanding how renters insurance deductibles work is essential for making informed decisions about your coverage. By choosing the right deductible amount, you can strike a balance between affordability and financial protection.

A renters insurance deductible is the amount you must pay out of pocket before your insurance coverage kicks in. It helps insurance companies manage claim costs and encourages policyholders to exhibit responsible behavior when filing claims.

When determining the deductible amount, consider factors such as your financial capacity, risk tolerance, the value of your belongings, and the frequency of claims you expect to make. Balancing these factors will help you select a deductible that aligns with your needs and budget.

Remember that having a deductible comes with advantages, including reduced premiums, customizable options, and greater control over premium costs. However, there are also drawbacks, such as out-of-pocket expenses and potential financial strain.

By following our tips for choosing the right deductible amount, you can make a well-informed decision that meets your unique circumstances. Regularly review and reassess your deductible to ensure it remains appropriate for your financial situation and needs.

Renters insurance is a valuable investment that provides financial protection, peace of mind, and coverage for unexpected events. It helps safeguard your personal belongings and provides liability protection in case of accidents. Be sure to shop around, compare quotes, and choose a reputable insurance provider that offers a policy with the deductible amount that suits your needs.

Now that you are armed with the knowledge of renters insurance deductibles, you can confidently choose the right deductible amount that provides the ideal balance of protection and affordability for your rental property.