Finance

How Does Student Loan Interest Work?

Published: February 16, 2024

Learn how student loan interest works and its impact on your finances. Understand the basics of finance and manage your student loans effectively.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

**

Introduction

**

Student loans are a crucial part of financing higher education for millions of students across the globe. While these loans provide the necessary funds to pursue academic goals, they also come with the responsibility of understanding and managing student loan interest. The concept of student loan interest can be complex and overwhelming, especially for those new to the world of borrowing and lending. However, with the right knowledge and strategies, students can navigate this aspect of their financial journey more effectively.

Understanding how student loan interest works is essential for making informed decisions about borrowing, repayment, and overall financial planning. This article aims to demystify the intricacies of student loan interest, providing clarity on its types, calculation methods, and ways to minimize its impact. By gaining a comprehensive understanding of student loan interest, borrowers can take proactive steps to manage their loans more effectively and potentially save money in the long run.

Navigating the world of student loans can be daunting, but with the right information and a clear understanding of how student loan interest operates, borrowers can make more informed decisions about their educational and financial future. Let's delve into the details of student loan interest to empower borrowers with the knowledge they need to make sound financial choices.

**

Understanding Student Loan Interest

**

Student loan interest is essentially the cost of borrowing money to finance education. When students take out loans, they are not only responsible for repaying the amount borrowed, but also for paying the additional cost of borrowing, which is the interest. This interest is calculated as a percentage of the loan balance and is typically charged on a monthly basis. Understanding the dynamics of student loan interest is crucial for borrowers as it directly impacts the total amount repaid over the life of the loan.

One key aspect of student loan interest is that it begins accruing as soon as the funds are disbursed. This means that even while students are still in school, the loan balance is gradually accumulating interest. For subsidized federal loans, the government covers the interest while the student is in school, during the grace period after leaving school, and during any periods of deferment. On the other hand, with unsubsidized federal loans and private loans, interest accrues from the disbursement date, adding to the total amount owed.

Moreover, the interest rate on student loans can be fixed or variable. A fixed interest rate remains constant throughout the life of the loan, providing borrowers with predictability and stability in their monthly payments. In contrast, a variable interest rate is tied to a financial index and can fluctuate over time, potentially leading to varying monthly payments. Understanding the type of interest rate on a student loan is crucial for borrowers to anticipate and plan for potential changes in their repayment obligations.

Comprehending the nuances of student loan interest empowers borrowers to make informed decisions about their educational financing. By understanding how interest accrues, the differences between subsidized and unsubsidized loans, and the implications of fixed versus variable interest rates, borrowers can navigate their student loan journey with greater confidence and financial acumen.

**

Types of Student Loan Interest

**

When it comes to student loans, there are different types of interest that borrowers may encounter. Understanding these variations is essential for making informed decisions about borrowing and managing student loan debt.

1. Subsidized Interest: Subsidized student loans are offered by the government and designed to assist students with financial need. The unique aspect of subsidized loans is that the government pays the interest while the student is in school at least half-time, during the grace period after leaving school, and during authorized periods of deferment. This means that the loan balance does not accrue interest during these periods, providing significant cost savings for borrowers.

2. Unsubsidized Interest: Unsubsidized student loans are available to eligible students regardless of financial need. Unlike subsidized loans, interest on unsubsidized loans begins accruing from the disbursement date. Borrowers have the option to pay the interest while in school and during grace periods to avoid it capitalizing and adding to the total amount owed. If not paid, the accrued interest is added to the principal balance, leading to a higher overall repayment amount.

3. Fixed Interest Rate: Some student loans have a fixed interest rate, which means that the rate remains constant throughout the life of the loan. This provides borrowers with predictability in their monthly payments, as the interest rate does not fluctuate with market conditions. Fixed-rate loans are advantageous for budgeting and planning, as borrowers can anticipate the same monthly payment amount over the repayment term.

4. Variable Interest Rate: In contrast to fixed interest rates, variable interest rates are tied to a financial index and can fluctuate over time. Changes in the index lead to adjustments in the interest rate, potentially resulting in varying monthly payments. While variable rates may initially offer lower interest charges, they also introduce the risk of payment fluctuations, making it essential for borrowers to carefully consider their financial stability and tolerance for potential payment changes.

Understanding the types of student loan interest empowers borrowers to evaluate their options and choose the most suitable financing strategies for their educational pursuits. By comprehending the nuances of subsidized and unsubsidized interest, as well as the implications of fixed and variable interest rates, borrowers can make informed decisions that align with their financial goals and circumstances.

**

How is Student Loan Interest Calculated?

**

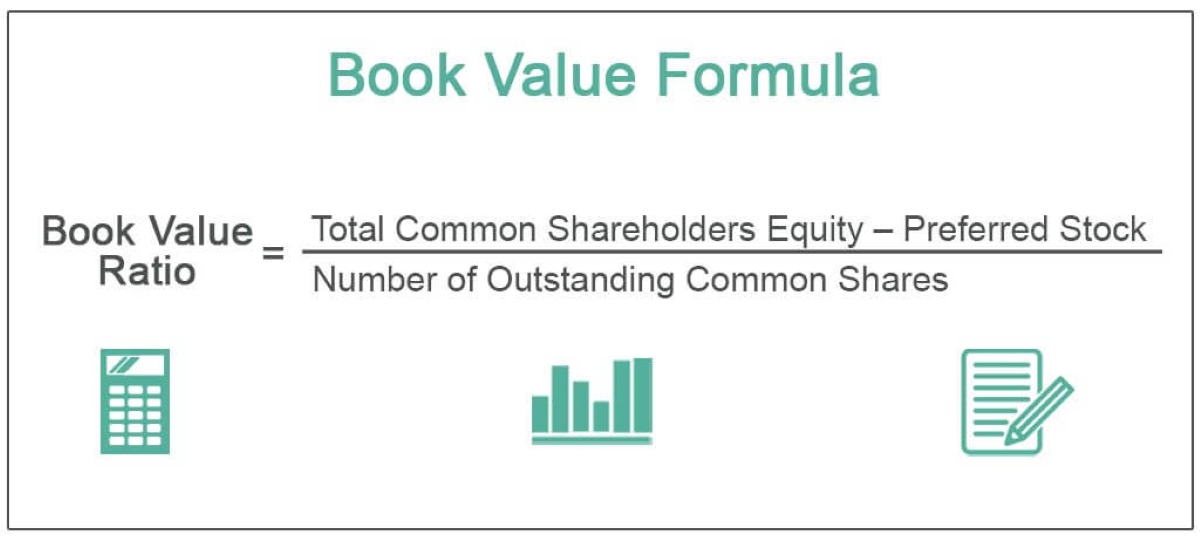

Student loan interest is typically calculated using a simple daily interest formula, which considers the outstanding loan balance and the annual interest rate. The first step in this calculation is determining the daily interest rate, which is derived by dividing the annual interest rate by the number of days in the year. This daily interest rate is then multiplied by the outstanding principal balance to assess the interest accrued for that day.

For example, consider a student loan with an annual interest rate of 5% and an outstanding balance of $10,000. To calculate the daily interest, the annual rate is divided by 365 days, resulting in a daily interest rate of approximately 0.0137%. This daily rate is then multiplied by the $10,000 balance, yielding a daily interest accrual of approximately $1.37.

Over time, as the outstanding balance decreases through regular payments, the daily interest amount also decreases. This is due to the fact that the interest is calculated based on the remaining principal balance. As a result, more of each subsequent payment goes toward reducing the principal, leading to a gradual decrease in the overall interest charges.

It’s important to note that the frequency of compounding interest also impacts the total amount repaid. Compounding refers to the process of adding accumulated interest back to the principal balance, resulting in interest being charged on the new, higher principal amount. Student loans typically compound interest on a daily basis, meaning that interest accrues daily and is added to the principal balance, leading to the capitalization of interest.

Understanding how student loan interest is calculated empowers borrowers to grasp the factors influencing their total repayment amount. By comprehending the daily interest formula, the impact of the outstanding balance, and the concept of compounding, borrowers can gain insight into the dynamics of their loan and make informed decisions about repayment strategies and long-term financial planning.

**

How to Minimize Student Loan Interest

**

Minimizing student loan interest can lead to significant savings over the life of the loan and can help borrowers achieve financial freedom more quickly. Here are several strategies to consider:

1. Make Interest Payments During School: If feasible, consider making interest payments on unsubsidized loans while still in school. By addressing the interest as it accrues, borrowers can prevent it from capitalizing and adding to the principal balance, ultimately reducing the total amount repaid.

2. Explore Loan Refinancing: For borrowers with strong credit and a stable financial situation, refinancing student loans at a lower interest rate can be a viable option. This can lead to reduced interest charges and potentially lower monthly payments, providing long-term savings.

3. Opt for Biweekly Payments: Making biweekly payments instead of monthly payments can lead to significant interest savings over time. By aligning payments with the biweekly pay schedule, borrowers effectively make one extra monthly payment each year, reducing the outstanding balance and the total interest paid.

4. Consider Loan Forgiveness Programs: Certain professions, such as public service or teaching, may qualify for loan forgiveness programs. By fulfilling the requirements of these programs, borrowers can have a portion of their student loans forgiven, reducing the overall repayment amount and interest charges.

5. Apply Windfalls to Loan Payments: Any unexpected financial windfalls, such as tax refunds or work bonuses, can be allocated toward student loan payments. Applying these additional funds directly to the principal balance can expedite the repayment process and minimize overall interest costs.

6. Maintain Automatic Payments: Many lenders offer interest rate reductions for borrowers who enroll in automatic payment programs. By setting up automatic payments, borrowers can benefit from these interest rate reductions, leading to long-term interest savings.

By implementing these strategies, borrowers can take proactive steps to minimize the impact of student loan interest, potentially saving money and accelerating their journey toward financial freedom. It’s important for borrowers to assess their individual financial circumstances and explore the options that align with their goals and priorities.

**

Conclusion

**

Understanding the intricacies of student loan interest is paramount for borrowers embarking on their educational and financial journey. By grasping the nuances of subsidized and unsubsidized interest, fixed and variable interest rates, and the calculation methods employed, borrowers can make informed decisions that align with their financial goals and circumstances.

Minimizing student loan interest through proactive strategies, such as making interest payments during school, exploring refinancing options, and leveraging loan forgiveness programs, can lead to substantial long-term savings and expedite the path to financial freedom. Moreover, comprehending the impact of interest on the total repayment amount empowers borrowers to take control of their financial future and make informed decisions about borrowing, repayment, and long-term financial planning.

As borrowers navigate the complexities of student loans, it’s essential to approach the process with diligence, awareness, and a proactive mindset. By staying informed, exploring available options, and seeking guidance when needed, borrowers can effectively manage their student loan interest and work toward achieving their educational and financial aspirations.

Ultimately, the journey of repaying student loans is a significant aspect of many individuals’ lives, and understanding student loan interest is a crucial component of this process. By equipping themselves with knowledge and strategic insights, borrowers can navigate their student loan experience with confidence, financial acumen, and a clear vision for a brighter financial future.