Home>Finance>What Role Do Interest Rates Play In Mounting Consumer Debt?

Finance

What Role Do Interest Rates Play In Mounting Consumer Debt?

Published: November 1, 2023

Discover the impact of interest rates on consumer debt and gain insights into how finance is intertwined with debt accumulation.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding Consumer Debt

- The Role of Interest Rates in Consumer Debt

- Factors Influencing Interest Rates

- Impact of Interest Rates on Consumer Debt

- The Relationship between Interest Rates and Consumer Behavior

- The Effects of High Interest Rates on Consumers

- Strategies for Managing Consumer Debt in a High-Interest Rate Environment

- Conclusion

Introduction

Welcome to the world of consumer debt, a realm where financial decisions and economic factors converge. Consumer debt refers to the accumulated debt that individuals incur through credit cards, loans, and mortgages to finance their daily needs, education, or personal pursuits. With the increasing availability and ease of accessing credit, consumer debt has become a widespread issue globally, affecting millions of people.

One significant factor that plays a crucial role in the rise of consumer debt is interest rates. Interest rates are the percentage charged by lenders to borrowers for the use of borrowed funds. They serve as a catalyst for economic growth and stability, and they can also have a profound impact on consumers.

In this article, we will delve into the relationship between interest rates and mounting consumer debt. We will explore the various factors influencing interest rates, examine the impact of interest rates on consumer borrowing behavior, and discuss strategies for managing consumer debt in a high-interest rate environment.

Understanding the dynamics of interest rates and consumer debt is essential for individuals, policymakers, and financial institutions. It provides insights into the underlying factors driving the borrowing trends, the risks associated with indebtedness, and the potential strategies to mitigate the negative consequences of high interest rates.

So, let’s embark on this journey to comprehend the complexities of consumer debt and the pivotal role that interest rates play in its trajectory.

Understanding Consumer Debt

Consumer debt is a broad term encompassing the debt that individuals accumulate through various financial instruments such as credit cards, personal loans, student loans, auto loans, and mortgages. It represents the amount of money owed by individuals to creditors or financial institutions.

Often, consumer debt is necessary to facilitate essential purchases and investments, such as education, housing, or starting a business. However, excessive consumer debt can pose significant challenges and risks, affecting an individual’s financial stability and overall well-being.

Consumer debt can be categorized into two main types: revolving debt and installment debt. Revolving debt refers to credit card debt, where individuals can borrow money up to a certain limit and make minimum monthly payments. In contrast, installment debt involves borrowing a specific amount for a fixed period, such as auto loans or mortgages, with regular monthly payments until the debt is fully repaid.

The ease of accessing credit, combined with consumer spending habits and socioeconomic factors, has contributed to the growth of consumer debt worldwide. Factors such as rising living costs, stagnant wages, and societal pressure to maintain a certain lifestyle have fueled the desire for instant gratification and increased reliance on debt.

Understanding consumer debt involves recognizing the risks and consequences associated with excessive borrowing. It can result in financial strain, reduced disposable income, limited access to credit for future needs, and the potential for bankruptcy. It is essential for individuals to have a clear understanding of their borrowing capacity, financial goals, and responsible debt management strategies to avoid falling into a cycle of debt.

Overall, consumer debt is a significant aspect of the modern financial landscape. Its impact on individuals and the broader economy highlights the need for consumer education, financial literacy, and effective debt management practices. By understanding the intricacies of consumer debt, individuals can make informed financial decisions and build a solid foundation for their financial well-being.

The Role of Interest Rates in Consumer Debt

Interest rates play a crucial role in consumer debt by influencing the cost of borrowing and shaping consumer borrowing behavior. They serve as a mechanism for balancing the supply and demand of credit in the economy and are determined by a variety of economic factors.

When interest rates are low, borrowing becomes more affordable, encouraging consumers to take on debt for various purposes such as purchasing homes, cars, or funding education. Low interest rates can stimulate economic growth by increasing consumer spending and investment, as individuals are more inclined to borrow and spend when the cost of borrowing is low.

Conversely, high interest rates act as a deterrent to borrowing. They increase the cost of borrowing, making it more expensive for individuals to take on debt. Higher interest rates reduce the purchasing power of consumers and can lead to a decrease in consumer spending and investment. This can have a dampening effect on economic growth.

Interest rates also affect the affordability and repayment capacity of consumers. Higher interest rates result in higher monthly payments for outstanding debts, which can put a strain on household budgets and lead to financial distress for some individuals. Conversely, lower interest rates can reduce monthly payments, making debt more manageable and freeing up disposable income for other expenditures or savings.

Moreover, interest rates have a significant impact on the overall level of debt in the economy. When interest rates are low, individuals may be more inclined to borrow larger amounts, which can contribute to an increase in consumer debt levels. On the other hand, high interest rates can discourage borrowing and promote deleveraging, potentially leading to a decrease in consumer debt levels.

It is important to note that interest rates can vary depending on the type of debt. For example, credit card interest rates tend to be higher than mortgage or auto loan rates due to the higher risk associated with unsecured debt. This variation in interest rates across different types of debt can influence consumer borrowing decisions and financial planning.

In summary, interest rates have a substantial impact on consumer debt. They affect the affordability, borrowing behavior, and overall levels of debt in the economy. Understanding the role of interest rates in consumer debt is vital for individuals, policymakers, and financial institutions to make informed decisions and effectively manage debt in different economic environments.

Factors Influencing Interest Rates

Interest rates are influenced by a wide range of economic and financial factors, which can fluctuate over time. Understanding these factors is essential for individuals and businesses to make informed financial decisions and anticipate changes in borrowing costs.

1. Monetary Policy: Monetary policy set by central banks, such as the Federal Reserve in the United States, plays a significant role in determining interest rates. Central banks adjust interest rates to manage inflation, stimulate or cool economic activity, and maintain overall monetary stability. Changes in central bank policy rates can trickle down to impact consumer borrowing rates.

2. Inflation: Inflation refers to the general increase in prices of goods and services over time. When inflation is high, it erodes the purchasing power of money. To compensate for the loss in value, lenders typically charge higher interest rates to borrowers. Conversely, when inflation is low, interest rates are likely to be lower as well.

3. Economic Conditions: The overall state of the economy, including factors such as economic growth, employment levels, and business conditions, can influence interest rates. During periods of robust economic growth, demand for credit may increase, leading to higher interest rates. Conversely, during economic downturns, central banks may lower interest rates to stimulate borrowing and economic activity.

4. Market Forces: Market forces such as supply and demand for credit also play a role in determining interest rates. When there is high demand for credit relative to the supply, lenders can charge higher interest rates to borrowers. Additionally, financial market conditions, investor sentiment, and global economic factors can impact interest rates in a particular country.

5. Government Policies and Regulations: Government policies and regulations can influence interest rates indirectly. For example, regulations that promote competition in the banking sector can lead to lower interest rates, while policies that restrict lending or impose higher capital requirements on banks can result in higher borrowing costs for consumers.

6. Global Economic Factors: Interest rates are not solely influenced by domestic factors but can be influenced by global economic trends as well. Events such as changes in global economic growth, geopolitical tensions, or fluctuations in currency exchange rates can impact interest rates in various countries.

It’s important to note that these factors interact with each other and can have both short-term and long-term effects on interest rates. Moreover, interest rates are not solely determined by one factor but are influenced by a combination of these factors.

By considering the various factors influencing interest rates, individuals and businesses can have a better understanding of the dynamics that drive borrowing costs and make informed financial decisions based on the prevailing economic environment.

Impact of Interest Rates on Consumer Debt

Interest rates have a direct impact on consumer debt, affecting the affordability, borrowing capacity, and overall level of indebtedness. The relationship between interest rates and consumer debt is closely intertwined, and changes in interest rates can significantly influence borrowing behavior and repayment capabilities.

1. Affordability of Debt: Interest rates directly affect the cost of borrowing. When interest rates are low, consumers can enjoy lower monthly payments on their loans, making debt more affordable. This can encourage individuals to take on more debt or refinance existing loans to take advantage of the lower rates. Conversely, high interest rates increase the cost of borrowing, making debt less affordable. It can discourage consumers from taking on additional debt or limit their ability to make loan payments, potentially leading to financial stress and defaults.

2. Borrowing Capacity: Interest rates also impact consumers’ borrowing capacity. Lower interest rates can increase the amount of money individuals can borrow for a given monthly payment as the interest cost decreases. This can result in higher debt levels. On the other hand, higher interest rates reduce borrowing capacity, as the higher interest costs eat into the available income for repayment. It can prompt individuals to borrow less or rethink their borrowing decisions.

3. Refinancing and Debt Repayment: Interest rates can motivate consumers to refinance their existing debts. When interest rates fall, individuals may choose to refinance their loans at lower rates to reduce their monthly payments or pay off their debts faster. This can provide financial relief and flexibility. Conversely, when interest rates rise, refinancing becomes less attractive, and consumers may struggle to keep up with higher monthly payments.

4. Consumer Behavior: Interest rates influence consumer behavior when it comes to borrowing and spending. Low interest rates can incentivize consumers to borrow and spend more, leading to higher consumer debt levels. This can translate into increased demand for goods and services, stimulating economic activity. Conversely, higher interest rates can reduce borrowing and spending, causing consumers to cut back on purchases and potentially slowing down economic growth.

5. Financial Stability: The level of consumer debt and the affordability of repayments can impact individuals’ financial stability. When interest rates are high, individuals with large amounts of debt may struggle to meet their monthly obligations, increasing the risk of default and financial distress. This can have broader ramifications for the stability of the financial system as well.

Overall, interest rates have a significant impact on consumer debt by influencing the cost of borrowing, borrowing capacity, and consumer behavior. Understanding the relationship between interest rates and consumer debt is crucial for individuals to make prudent borrowing decisions, manage debt effectively, and adapt to changing economic conditions.

The Relationship between Interest Rates and Consumer Behavior

The relationship between interest rates and consumer behavior is significant, as interest rates directly influence borrowing decisions and consumer spending patterns. Changes in interest rates can have a profound impact on consumer behavior, leading to shifts in borrowing, saving, and spending habits.

1. Borrowing Behavior: Interest rates play a crucial role in shaping consumer borrowing behavior. When interest rates are low, borrowing becomes more affordable, and consumers are more inclined to take on debt for major purchases or investments. Low interest rates can stimulate borrowing, leading to increased consumer spending and economic growth. On the other hand, when interest rates are high, borrowing becomes more expensive, and consumers may be more cautious about taking on debt, which can result in decreased spending and restrained economic activity.

2. Savings: Interest rates can impact consumer savings behavior. When interest rates are high, saving becomes more attractive, as individuals can earn more interest on their savings. Higher interest rates can incentivize consumers to save, which can lead to a reduction in consumer spending. Conversely, when interest rates are low, the returns on saving are diminished, and consumers may be more inclined to spend rather than save.

3. Investment Decisions: Interest rates influence investment decisions as well. When interest rates are low, borrowing costs are reduced, making it cheaper for businesses and individuals to finance investments. This can lead to increased investment activity, job creation, and economic expansion. However, when interest rates rise, the cost of borrowing increases, making investments less attractive. Higher interest rates can deter businesses and individuals from making significant investments, potentially slowing down economic growth.

4. Consumer Confidence: Interest rates can impact consumer confidence and sentiment, which plays a vital role in consumer spending behavior. When interest rates are low, consumers may feel more confident about their financial situation and future prospects. This can lead to increased consumer spending, which contributes to economic growth. Conversely, when interest rates rise, consumers may become more cautious about their spending, potentially affecting consumer confidence and dampening economic activity.

5. Housing Market: Interest rates heavily influence the housing market and consumer behavior related to homeownership. Lower interest rates make mortgages more affordable, driving higher demand for housing. This can lead to increased home sales, prices, and construction activity. Conversely, higher interest rates can reduce affordability, resulting in decreased home sales and slower growth in the housing market.

It is important to recognize that consumer behavior is not solely influenced by interest rates but is also influenced by various other factors such as income levels, employment conditions, and consumer sentiment. However, interest rates are a fundamental factor that shapes borrowing and spending behavior, influencing saving, investment, and overall economic activity.

Understanding the relationship between interest rates and consumer behavior is crucial for policymakers, businesses, and individuals to anticipate changes in spending patterns, adjust financial strategies, and make informed decisions based on prevailing interest rate conditions.

The Effects of High Interest Rates on Consumers

High interest rates can have significant ramifications for consumers, affecting their financial well-being, borrowing capacity, and overall economic stability. When interest rates are high, consumers may experience several negative effects:

1. Increased Cost of Borrowing: High interest rates directly translate to higher borrowing costs for consumers. This means that individuals will have to pay more in interest on their loans, including credit card debt, mortgages, auto loans, and personal loans. The increased cost of borrowing can put a strain on household budgets, making it more challenging to meet monthly repayment obligations and reducing disposable income for other expenses.

2. Reduced Affordability: Higher interest rates make loans and credit less affordable for consumers. Financial institutions charge higher interest rates to compensate for the increased risk of lending at higher rates. As a result, consumers may find it more difficult to acquire or qualify for loans, particularly for large purchases such as homes and cars. Reduced affordability can limit the choices available to consumers and delay their financial goals.

3. Inhibited Consumer Spending: High interest rates can discourage consumer spending. When the cost of borrowing is high, consumers are less likely to take on new debt for discretionary purchases, leading to a decrease in spending on goods and services. This reduction in consumer spending can have a ripple effect on the overall economy, impacting businesses and employment opportunities.

4. Impact on Debt Repayment: High interest rates can make it more challenging for consumers to repay their outstanding debts. With higher interest rates, the monthly payments on loans and credit cards increase. This can lead to financial strain and potentially result in missed payments or defaults. Consumers may also find it difficult to reduce their overall debt burden, as more significant portions of their payments go towards interest rather than principal repayment.

5. Stifled Economic Growth: High interest rates can dampen economic growth. When consumers face higher borrowing costs and reduced affordability, they are more likely to cut back on spending, which can curtail economic activity. Decreased consumer spending can lead to reduced demand for goods and services, affecting businesses and job creation.

6. Financial Stress and Bankruptcy Risk: In a high-interest rate environment, consumers carrying significant debt may experience increased financial stress. Higher monthly payments can strain household budgets and may push some individuals into financial distress. Consumers may resort to additional borrowing to meet their financial obligations, potentially exacerbating their debt burden and increasing the risk of bankruptcy.

Overall, high interest rates have wide-ranging effects on consumers. Increased borrowing costs, reduced affordability, inhibited consumer spending, challenges in debt repayment, and potential financial instability can all contribute to a less favorable financial environment for consumers. It is crucial for individuals to be aware of these effects and to evaluate their borrowing decisions carefully in order to mitigate the negative impacts of high interest rates.

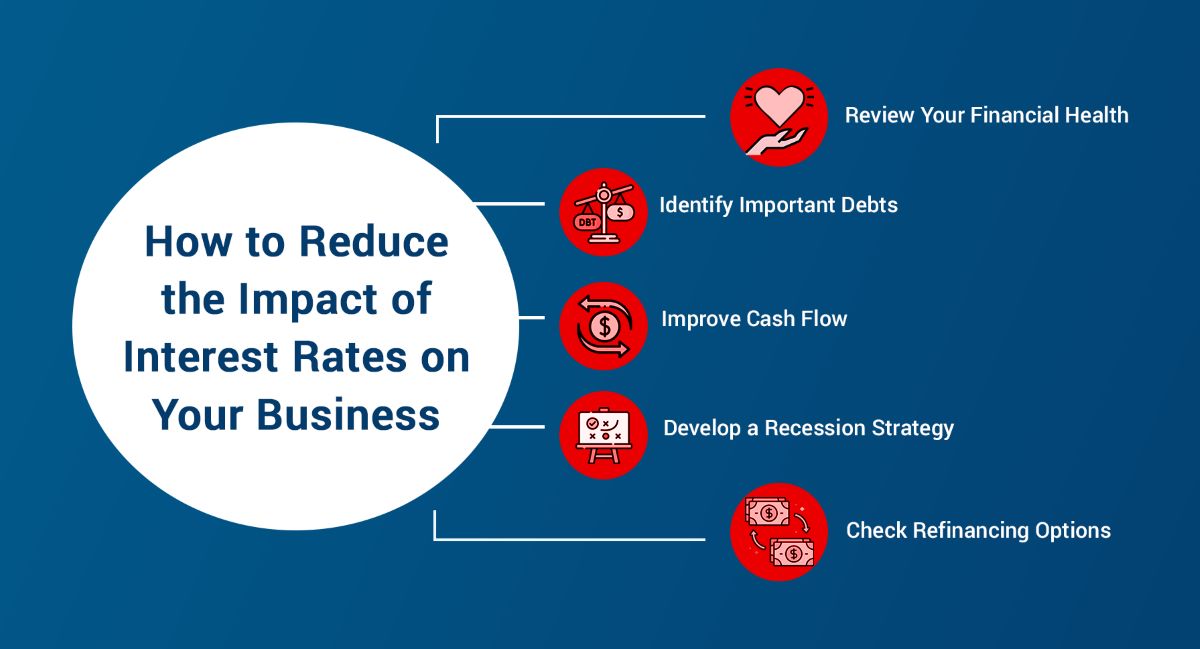

Strategies for Managing Consumer Debt in a High-Interest Rate Environment

Navigating a high-interest rate environment requires careful planning and effective strategies to manage consumer debt. Here are several strategies that can help individuals manage their debt effectively:

1. Create a Budget: Start by creating a detailed budget that outlines your income, expenses, and debt obligations. This will give you a clear picture of your financial situation and help prioritize debt repayment.

2. Prioritize Debt Repayment: Focus on paying off high-interest debt first. Allocate any additional funds towards these high-interest debts to reduce the overall interest costs over time.

3. Consider Debt Consolidation: Explore the option of consolidating your debts into a single loan with a lower interest rate. This can simplify debt repayment and potentially reduce the overall interest paid.

4. Negotiate with Creditors: Reach out to your creditors to negotiate lower interest rates or more manageable repayment terms. Many creditors are willing to work with borrowers to find mutually beneficial solutions.

5. Explore Balance Transfer Offers: Look for credit card balance transfer offers with lower interest rates. Transferring high-interest credit card debt to a card with a lower interest rate can provide temporary relief and save on interest costs.

6. Build an Emergency Fund: Set aside funds for emergencies to avoid relying on credit in unexpected situations. Having an emergency fund can prevent the need to take on additional debt when faced with unexpected expenses.

7. Adjust Spending Habits: Review your spending habits and identify areas where you can cut back. Choose more cost-effective alternatives and focus on needs rather than wants to free up funds for debt repayment.

8. Seek Financial Counseling: Consider seeking assistance from a financial counselor who can provide personalized guidance and strategies for managing debt in a high-interest rate environment.

9. Refinance Loans: If feasible, explore opportunities to refinance loans at lower interest rates. This can help generate savings on monthly payments and reduce the overall interest paid over the loan term.

10. Monitor Credit Score: Keep track of your credit score and strive to maintain or improve it. A good credit score can help you qualify for lower interest rates in the future, providing greater flexibility and savings on borrowing costs.

Remember, managing consumer debt in a high-interest rate environment requires discipline, commitment, and a proactive approach. By implementing these strategies and being mindful of your financial situation, you can work towards reducing debt, improving financial stability, and mitigating the impact of high interest rates on your personal finances.

Conclusion

In conclusion, the role of interest rates in consumer debt is undeniable. Interest rates significantly impact borrowing costs, borrowing capacity, and consumer behavior. Understanding the dynamics of interest rates and consumer debt is essential for individuals, policymakers, and financial institutions.

When interest rates are low, borrowing becomes more affordable, stimulating consumer spending and investment. However, high interest rates increase the cost of borrowing, potentially limiting consumer borrowing capacity and leading to decreased spending. Moreover, high interest rates can result in financial strain for consumers, making debt repayment more challenging and increasing the risk of default.

Various factors influence interest rates, including monetary policy, inflation, economic conditions, market forces, government policies, and global economic factors. These factors interact to shape borrowing costs and conditions in an economy.

The relationship between interest rates and consumer behavior is significant. Interest rates influence borrowing decisions, savings behavior, investment choices, consumer confidence, and the housing market. Changes in interest rates can lead to shifts in consumer spending, saving, and borrowing patterns, impacting economic activity and financial stability.

Managing consumer debt in a high-interest rate environment requires careful planning and strategies. Prioritizing debt repayment, negotiating with creditors, consolidating debt, and adjusting spending habits are some effective strategies for debt management. Building an emergency fund, monitoring credit scores, and seeking financial counseling can also contribute to improved financial well-being.

In conclusion, being aware of the impact of interest rates on consumer debt and implementing appropriate strategies can help individuals navigate the challenges of borrowing in a high-interest rate environment and work towards achieving financial stability and debt management goals.