Finance

How Does Truebill Smart Savings Work

Published: January 16, 2024

Learn how Truebill Smart Savings can help you save money on your finances. Get personalized recommendations and track your savings progress.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Managing personal finances can be challenging, especially when it comes to saving money. Many people struggle to set aside funds for their goals or emergencies, often due to a lack of awareness about their spending habits or a lack of discipline in sticking to a savings plan. That’s where Truebill Smart Savings comes in!

Truebill Smart Savings is a revolutionary tool designed to help individuals take control of their finances and save money effortlessly. Using advanced algorithms and artificial intelligence, Truebill analyzes your spending patterns and creates a personalized savings plan tailored to your financial goals.

Whether you’re looking to save for a vacation, build an emergency fund, or pay off debt, Truebill Smart Savings can help you achieve your objectives faster and more efficiently. In this article, we’ll explore how Truebill Smart Savings works and the benefits of using this innovative financial tool.

So, if you’re tired of struggling to save money or feeling overwhelmed by your financial situation, let’s dive deeper into the workings of Truebill Smart Savings and discover how it can transform your financial life!

Understanding Truebill Smart Savings

Truebill Smart Savings is an intelligent and intuitive savings feature offered by Truebill, a popular personal finance app. This powerful tool is designed to help users save money effortlessly and achieve their financial goals with ease. Understanding how Truebill Smart Savings works is crucial to make the most of this innovative financial tool.

When you sign up for Truebill Smart Savings, the app securely connects to your bank accounts and credit cards to analyze your spending patterns. By utilizing advanced algorithms and machine learning, Truebill categorizes your expenses and identifies areas where you can potentially save money.

Through its analysis, Truebill Smart Savings provides you with valuable insights into your spending habits, such as recurring subscriptions, unnecessary fees, or overspending in certain categories. This comprehensive understanding of your finances allows you to make informed decisions and take control of your money.

Once Truebill identifies areas where you can save, it creates a personalized savings plan tailored to your financial situation and goals. The savings plan is designed to be realistic and achievable, taking into account your income, expenses, and any existing financial commitments.

Truebill Smart Savings doesn’t stop at simply providing a savings plan. It goes a step further by automating the process of saving money. The app calculates the ideal amount that can be saved based on your income and spending habits, and automatically transfers that amount from your checking account to a separate savings account.

This automation feature not only saves you time and effort but also eliminates the temptation to spend the money that you are trying to save. By automating your savings, Truebill Smart Savings ensures that you consistently save money without the need for constant manual monitoring or intervention.

The beauty of Truebill Smart Savings lies in its adaptability. As your financial situation changes, such as receiving a pay raise or a decrease in expenses, the app adjusts your savings plan accordingly. This flexibility ensures that your savings strategy remains aligned with your current financial goals.

Now that we have a good understanding of how Truebill Smart Savings works, let’s explore how this personalized savings plan is created.

How Truebill Analyzes Your Spending

Truebill utilizes cutting-edge technology to analyze your spending habits and gain valuable insights into your financial patterns. By examining your transactions across your connected bank accounts and credit cards, Truebill can identify areas where you can potentially save money.

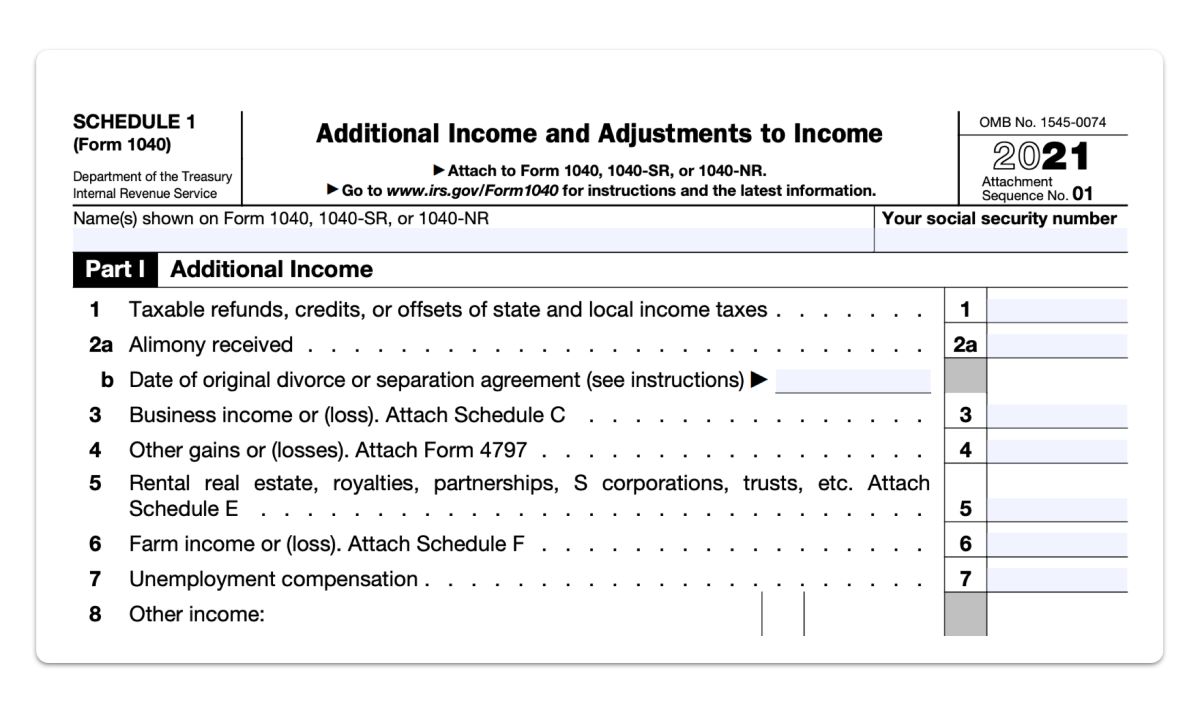

The process begins with Truebill categorizing your expenses into different categories like groceries, dining out, utilities, subscriptions, and more. This categorization allows you to see a comprehensive breakdown of where your money is going, giving you a clear picture of your spending habits.

Truebill also goes beyond categorization by providing detailed information about your subscriptions. It identifies recurring monthly expenses and shows you which subscriptions you have and how much you’re paying for each. This feature is particularly beneficial for those who may have forgotten about certain subscriptions or are looking to cut back on unnecessary expenses.

In addition to categorization, Truebill analyzes your bill payments and identifies any potential savings opportunities. For example, it can detect if you’re overpaying on your utility bills or if there are any other billing errors. By bringing such issues to your attention, Truebill helps you optimize your expenses and save money.

Moreover, Truebill monitors your spending patterns over time to identify trends and provide actionable insights. It can highlight areas where you may be overspending or recommend adjustments in your spending habits to help you save more effectively.

By providing this detailed analysis of your spending, Truebill empowers you to make more informed financial decisions. You can identify areas where you can cut back on expenses, negotiate better deals, or make smarter choices to achieve your savings goals.

Now that we understand how Truebill analyzes your spending, let’s discover how it creates a personalized savings plan based on this analysis.

Creating a Personalized Savings Plan

Once Truebill has analyzed your spending habits and identified potential areas for saving, it works its magic by creating a personalized savings plan tailored to your financial goals and circumstances. This plan takes into account your income, expenses, and any existing financial commitments, ensuring that it is realistic and achievable.

To begin creating your personalized savings plan, Truebill evaluates your current financial situation. It considers factors such as your income, regular bills, and expenses to determine how much you can comfortably save each month.

Truebill then sets savings goals based on your preferences and financial objectives. Whether you’re saving for a down payment on a house, building an emergency fund, or planning for a dream vacation, Truebill factors in your desired savings timeline and creates a plan that helps you reach your goals within the specified timeframe.

The savings plan created by Truebill is not a one-size-fits-all approach. It takes into account your unique financial circumstances and adjusts accordingly. For example, if your income fluctuates or you have irregular expenses, Truebill adapts the savings plan to accommodate these factors and make it more feasible for you to meet your targets.

Truebill also considers any existing financial commitments you may have, such as loan repayments or credit card debt. By factoring in these obligations, the app ensures that your savings goals align with your ability to manage your current debt load.

Once your personalized savings plan is established, Truebill sets up automatic savings transfers from your checking account to a separate savings account. These transfers occur regularly, based on the plan’s schedule, so you don’t have to worry about manually moving money around or risking the temptation to spend what you should be saving.

The automation feature not only simplifies the savings process but also helps you develop consistent saving habits. It allows you to stay on track with your financial goals by ensuring that the allocated funds are consistently set aside for savings.

Now that we know how Truebill creates a personalized savings plan, let’s explore how it automates your savings to make the process even more seamless.

Automating Your Savings with Truebill

One of the key features that sets Truebill Smart Savings apart is its ability to automate your savings process. By automating your savings with Truebill, you can effortlessly build your nest egg without the need for constant manual intervention.

Once your personalized savings plan is in place, Truebill automatically transfers the designated amount from your checking account to a separate savings account. These transfers occur based on the schedule outlined in your savings plan, whether it’s weekly, bi-weekly, or monthly.

The automation feature not only saves you time and effort but also eliminates the temptation to spend the money you are trying to save. By automatically setting aside funds for savings, Truebill removes the need for constant willpower or self-discipline to manually transfer money to your savings account.

Automating your savings also helps you develop consistent saving habits. With regular and automated transfers, you can create a saving routine that becomes ingrained in your financial habits. This helps ensure that you consistently and steadily build your savings over time.

Truebill’s automation feature is customizable and flexible. If you want to increase or decrease the amount that is automatically transferred to your savings account, you can adjust the settings within the app. This allows you to adapt your savings strategy to your changing financial circumstances or savings goals.

In addition to automating your savings transfers, Truebill Smart Savings provides you with a real-time view of your progress. The app tracks your savings growth and displays it in an easy-to-understand format, allowing you to stay motivated and see the impact of your efforts.

By automating your savings with Truebill, you can save money effortlessly and consistently. With the burden of manual transfers lifted, you can focus on other aspects of your financial life while still making progress towards your savings goals.

Now that we understand how Truebill automates your savings, let’s explore how the app helps you track your progress and make adjustments along the way.

Tracking Progress and Adjustments

Truebill understands that tracking your progress and making adjustments to your savings plan are essential for long-term success. That’s why the app provides robust tools to help you monitor your savings growth, stay motivated, and make necessary adjustments along the way.

Within the Truebill app, you can easily access a dashboard that displays your savings progress in real-time. This dashboard provides a visual representation of how your savings are growing over time, allowing you to see the impact of your consistent saving efforts.

By tracking your progress, you can celebrate milestones and small victories along the way. This positive reinforcement helps you stay motivated and committed to your savings goals, especially during times when it may be tempting to stray from your plan.

Additionally, the Truebill app allows you to set up notifications and reminders to keep you accountable. You can receive alerts when transfers are made, see your savings milestones, and even get personalized recommendations to help optimize your savings strategy.

But what if your financial circumstances change or you need to make adjustments to your savings plan? Truebill makes it easy to modify your plan as needed. If you experience a pay raise, for example, you can adjust the amount being transferred to your savings account to take advantage of the increased income.

Furthermore, if you have a major expense or unexpected financial emergency, Truebill enables you to temporarily pause or adjust your savings plan to accommodate the new circumstances. This flexibility ensures that you can adapt your savings strategy to align with your changing financial needs.

Truebill also provides valuable insights and recommendations based on your spending and saving patterns. It can suggest areas where you can potentially save more or offer tips to optimize your financial habits. By leveraging these insights, you can continuously improve your financial well-being and make smarter financial decisions.

With the ability to track your progress, receive personalized alerts, and make adjustments when necessary, Truebill empowers you to stay in control of your savings journey and make the most out of your financial resources.

Now that we understand how Truebill helps you track progress and make adjustments, let’s explore the benefits of using Truebill Smart Savings.

Benefits of Using Truebill Smart Savings

Using Truebill Smart Savings comes with a variety of benefits that can help you take control of your finances and achieve your savings goals. Let’s explore some of the key advantages of using this innovative tool:

- Simplicity and Convenience: Truebill Smart Savings streamlines the saving process and eliminates the need for extensive manual tracking and transfers. With automated savings, you can effortlessly build your savings without the hassle of constant monitoring and intervention.

- Personalization: Truebill creates a personalized savings plan tailored to your financial goals and circumstances. It takes into account your income, expenses, and any existing financial commitments, ensuring that the plan is realistic and achievable.

- Financial Insights: By analyzing your spending patterns, Truebill provides valuable insights into your expenses, subscriptions, and potential savings opportunities. This gives you a clearer picture of your financial habits and empowers you to make more informed decisions.

- Motivation and Accountability: Truebill tracks your savings progress and provides real-time updates, keeping you motivated and accountable. Notifications and reminders help you stay on track and celebrate milestones along your savings journey.

- Flexibility: Truebill allows you to make adjustments to your savings plan as your financial circumstances change. Whether it’s increasing or decreasing the amount being transferred or pausing your savings temporarily, Truebill provides the flexibility to adapt your savings strategy accordingly.

- Savings Optimization: With its recommendations and insights, Truebill helps you optimize your savings. It identifies potential areas where you can save more and offers tips for smarter financial habits, allowing you to make the most out of your money.

- Time and Effort Savings: By automating your savings, Truebill saves you time and effort. You no longer have to manually transfer money to your savings account or constantly monitor your progress. This frees up your time to focus on other aspects of your financial life.

- Mobile Accessibility: Truebill’s mobile app allows you to access your savings plan, track your progress, and make adjustments on the go. You can conveniently manage your savings from anywhere, anytime, making it a user-friendly and accessible tool.

By leveraging all these benefits, Truebill Smart Savings empowers you to take control of your financial future, build your savings, and achieve your financial goals with ease.

Now that we have explored the benefits of Truebill Smart Savings, let’s address some common questions users might have.

Frequently Asked Questions

1. Is Truebill Safe and Secure?

Yes, Truebill prioritizes the security and privacy of its users’ financial information. The app uses bank-level encryption to protect your data and employs secure authentication protocols to ensure that only authorized users can access your account. Truebill also has strict internal controls and policies to safeguard your information.

2. Are there any fees associated with using Truebill Smart Savings?

Truebill offers both free and premium versions of its app. The free version provides basic savings features, while the premium version offers additional benefits such as personalized insights and bill negotiation services for a monthly fee. You can choose the plan that best suits your needs.

3. Can I pause or cancel my savings plan with Truebill?

Yes, you can pause or cancel your savings plan at any time. Truebill provides you with the flexibility to make adjustments as needed. Simply go to the settings within the app to pause or cancel your savings plan.

4. Can I customize my savings plan with Truebill?

Absolutely! Truebill allows you to customize your savings plan based on your financial goals and preferences. You can adjust the amount being transferred to your savings account and the frequency of transfers to align with your specific needs.

5. Can Truebill help me save money on bills?

Yes, Truebill offers bill negotiation services as part of its premium plan. The app analyzes your bills and attempts to negotiate better rates or discounts on your behalf, potentially saving you money on your regular expenses.

6. Can I use Truebill if I have multiple bank accounts?

Absolutely! Truebill can connect to multiple bank accounts and credit cards, providing you with a comprehensive view of your finances. You can manage and track all your accounts within a single app.

7. Is Truebill available internationally?

Currently, Truebill is available for users in the United States and Canada. However, the company has plans to expand its services to other countries in the future.

8. Can Truebill help me save for specific financial goals?

Definitely! Truebill allows you to set specific financial goals, whether it’s saving for a vacation, a down payment, or an emergency fund. With its personalized savings plan and automated transfers, Truebill can help you save efficiently towards your desired goals.

9. Can I use Truebill without linking my bank accounts?

While linking your bank accounts is a key component of Truebill’s analysis and automation process, the app also offers manual entry options. You can manually input your income, expenses, and savings goals, although the experience may be more limited compared to using the full banking integration.

10. What happens if I have an issue with my savings transfers?

If you encounter any issues or concerns with your savings transfers, you can reach out to Truebill’s customer support. They have a dedicated team to address any problems or questions you may have and assist you in resolving any issues.

These answers cover some of the common questions users have about Truebill Smart Savings. If you have any additional inquiries or need further assistance, feel free to reach out to Truebill’s customer support team.

Now let’s wrap up and summarize the benefits of Truebill Smart Savings.

Conclusion

Truebill Smart Savings is a powerful tool that can revolutionize the way you save money and take control of your finances. By leveraging advanced algorithms and automation features, Truebill simplifies the savings process and empowers you to achieve your financial goals effortlessly.

With its ability to analyze your spending, create personalized savings plans, automate transfers, and provide valuable insights, Truebill Smart Savings offers a comprehensive and convenient solution for building your savings. Whether you’re saving for a long-term goal or simply looking to improve your financial well-being, Truebill can help you make significant progress.

From its simplicity and customization options to its ability to track progress and make adjustments, Truebill offers a seamless and user-friendly experience. The app keeps you motivated, accountable, and informed, ensuring that you stay on track with your savings goals.

Moreover, Truebill’s commitment to privacy and security gives you peace of mind as you link your financial accounts to the app. Your data is encrypted and protected, allowing you to use the app with confidence.

So, if you’re ready to take control of your savings and achieve financial success, consider utilizing Truebill Smart Savings. Sign up for the app, connect your accounts, and let Truebill work its magic in helping you reach your financial goals.

Start your journey with Truebill Smart Savings today and experience a new level of financial empowerment and freedom. Your future self will thank you!