Finance

What Is A Good Cash Flow On A Rental Property

Published: December 20, 2023

Learn about finance and discover what constitutes a good cash flow on a rental property. Maximize your investments with expert advice and insights.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding Cash Flow

- Factors Affecting Cash Flow

- Calculating Cash Flow

- Evaluating Cash Flow as a Measure of Rental Property Performance

- Determining a Good Cash Flow on a Rental Property

- Benefits of Having a Good Cash Flow

- Risks and Challenges Associated with Cash Flow on Rental Properties

- Conclusion

Introduction

Investing in rental properties can be a lucrative venture, providing a steady stream of income and potential long-term wealth accumulation. One of the key factors to consider when evaluating the profitability of a rental property is its cash flow. Cash flow refers to the difference between the rental income generated from the property and the expenses associated with its operation and maintenance.

In simple terms, cash flow represents the money that is left over after deducting all the costs related to the property, including mortgage payments, property taxes, insurance, maintenance expenses, and vacancies. Positive cash flow indicates that the property is generating more income than it is costing to operate, while negative cash flow implies that the expenses are outweighing the income.

Understanding cash flow is essential for any real estate investor as it serves as a key indicator of the property’s financial performance. A positive cash flow can provide additional income for the investor, fund future property purchases, or be reinvested into the property for improvements and growth. On the other hand, negative cash flow can lead to financial strain and may require the investor to inject additional funds to cover the shortfall.

In this article, we will delve into the concept of cash flow on rental properties, exploring the factors that can affect it, the methods used to calculate it, and the significance of cash flow as a measure of rental property performance. We will also discuss what constitutes a good cash flow and the benefits and challenges associated with it.

Understanding Cash Flow

Cash flow is a crucial aspect of rental property investing as it determines the financial viability and profitability of an investment. It is the net amount of money that flows into or out of the rental property each month. Positive cash flow occurs when the income generated from the property exceeds the total expenses, while negative cash flow occurs when the expenses outweigh the income.

There are three main components that contribute to the cash flow of a rental property:

- Rental Income: This is the amount of money collected from tenants as rent on a monthly basis. Rental income is the primary source of cash flow for a rental property.

- Expenses: These are the costs associated with owning and operating the rental property. Some common expenses include mortgage payments, property taxes, insurance, maintenance and repairs, property management fees, utilities, and vacancies.

- Financing: If the property is financed through a mortgage or other loans, the monthly payments will impact the cash flow. These payments typically include both principal and interest.

In order to determine the overall cash flow of a rental property, the rental income needs to be subtracted from the total expenses and financing costs. The resulting amount will indicate whether the property is generating positive or negative cash flow.

Positive cash flow is a desirable outcome for rental property investors as it signifies that the property is generating enough income to cover its expenses and provide a surplus. This surplus can be used for various purposes such as reinvesting in the property, paying down the mortgage faster, or as additional income for the investor.

On the flip side, negative cash flow indicates that the property’s expenses exceed its rental income. This can occur due to factors like high mortgage payments, high maintenance costs, vacancies, or low rental rates. When faced with negative cash flow, investors may need to inject additional funds to cover the shortfall and sustain the property. However, negative cash flow is not always a negative outcome, as it may be offset by other benefits such as property appreciation or tax advantages.

Understanding the basics of cash flow is vital for investors to make informed decisions about their rental property investments. It allows them to evaluate the financial viability of a property, assess its potential for growth, and determine the returns they can expect to receive. By analyzing the cash flow, investors can effectively manage their rental properties and work towards achieving their investment goals.

Factors Affecting Cash Flow

Several factors can impact the cash flow of a rental property. These factors can either contribute to a positive cash flow or lead to negative cash flow. It is important for investors to analyze and consider these factors when evaluating the financial viability of a rental property. Here are some key factors that can affect cash flow:

- Rental Market Conditions: The state of the rental market, including supply and demand dynamics, rental rates, and occupancy rates, can significantly influence cash flow. In a competitive rental market with high demand and low vacancies, landlords can command higher rental rates, resulting in increased cash flow. Conversely, in markets with high vacancies and low demand, rental rates may be lower, impacting the cash flow negatively.

- Property Location: The location of the rental property plays a crucial role in determining its cash flow. Properties in desirable locations, such as those close to amenities, transportation, schools, and job opportunities, tend to attract higher rental rates and lower vacancies, leading to positive cash flow. Conversely, properties in less desirable locations may struggle to command higher rental rates, potentially resulting in negative cash flow.

- Property Condition and Maintenance: The condition of the rental property and the maintenance required can impact cash flow. Properties that are well-maintained and require fewer repairs and maintenance expenses are likely to have higher cash flow. On the other hand, properties that need regular repairs or have significant maintenance costs can eat into the rental income and reduce cash flow.

- Property Management: The effectiveness of property management can affect cash flow. Property management companies charge fees for their services, which reduce the overall cash flow of the rental property. However, professional property management can also help in minimizing vacancies, ensuring timely rent collection, and handling maintenance issues efficiently, ultimately benefiting cash flow.

- Financing and Interest Rates: The financing terms and interest rates of the mortgage can impact cash flow. Higher mortgage payments or interest rates can reduce the cash flow of a rental property, while lower mortgage payments or favorable interest rates can boost cash flow.

- Tax Implications: Tax laws and regulations can have an impact on the cash flow of a rental property. Tax advantages such as deductions for property expenses, depreciation, and tax credits can help reduce the overall tax liability, positively impacting cash flow.

It is important for investors to carefully analyze these factors and assess their potential impact on the cash flow of a rental property. Conducting thorough due diligence and market research can help investors make informed decisions and identify properties with the potential for positive cash flow.

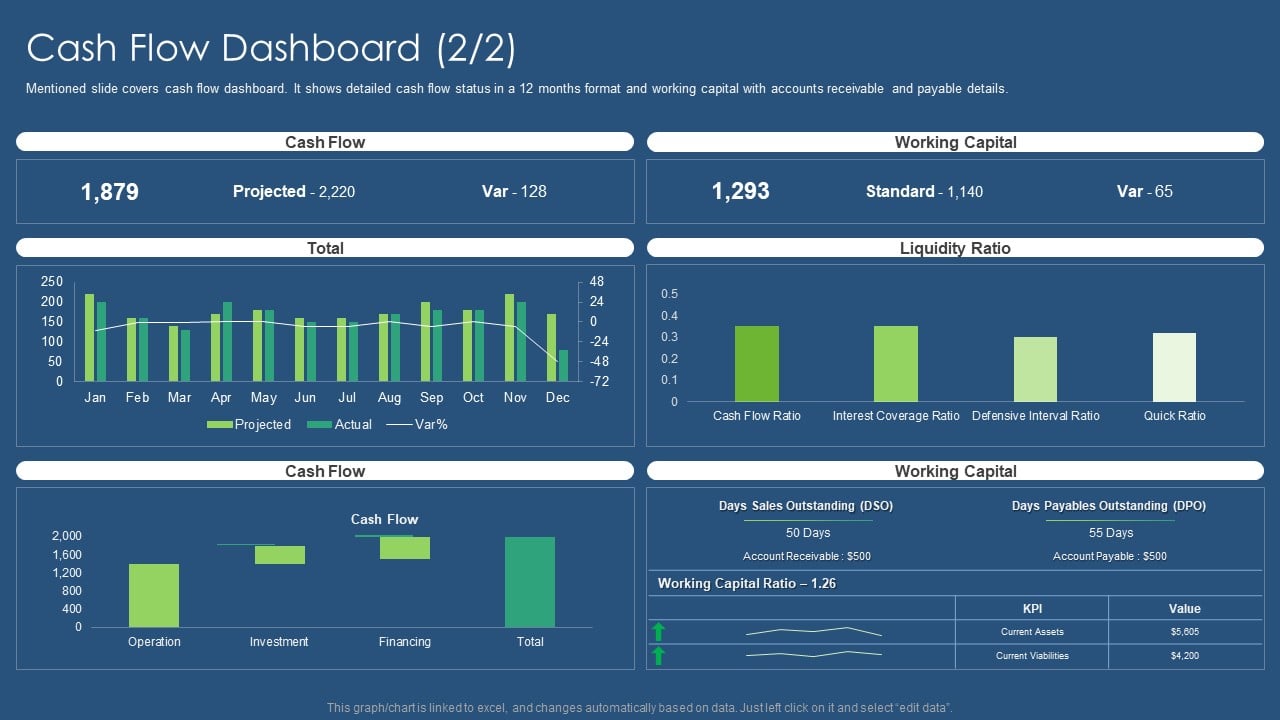

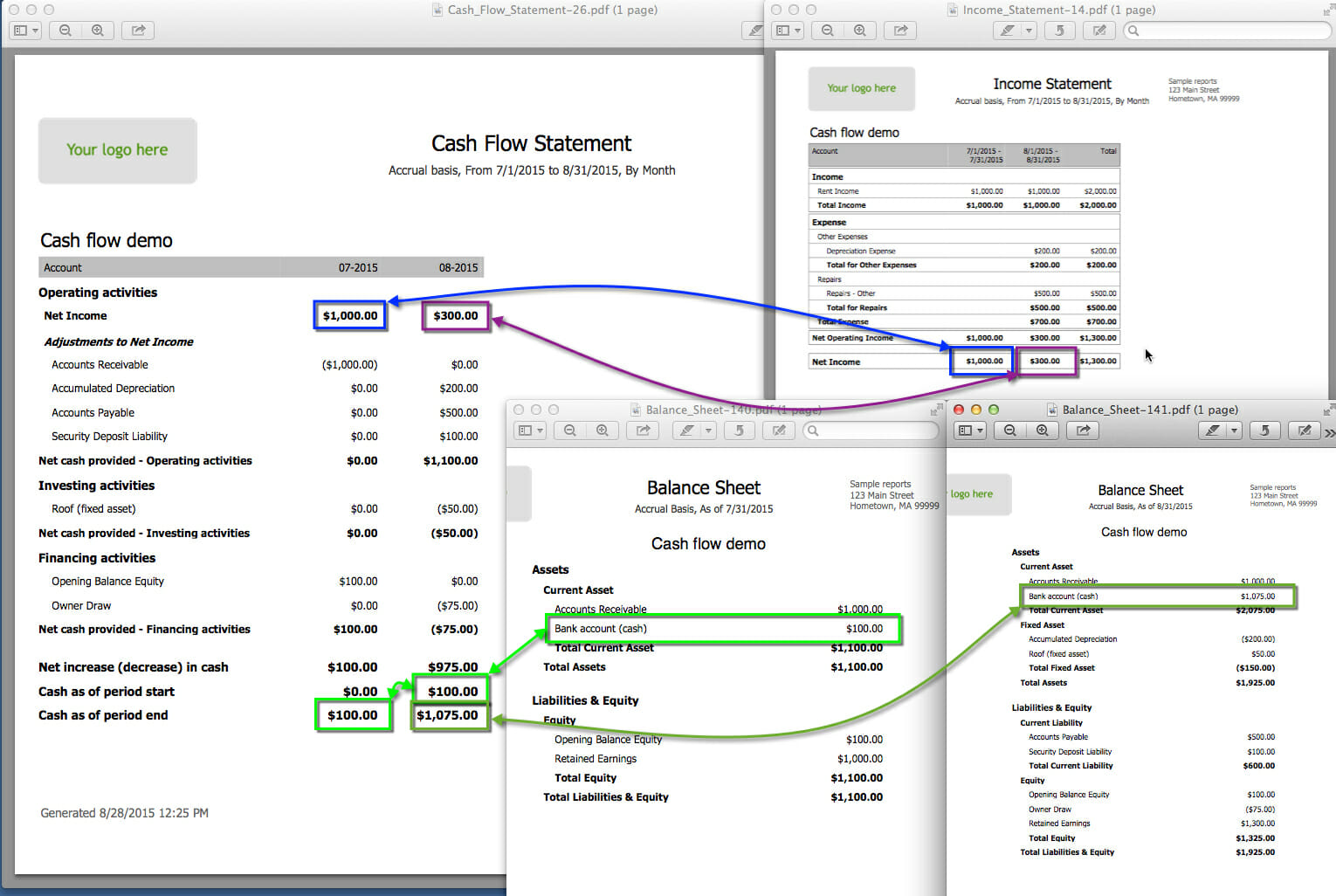

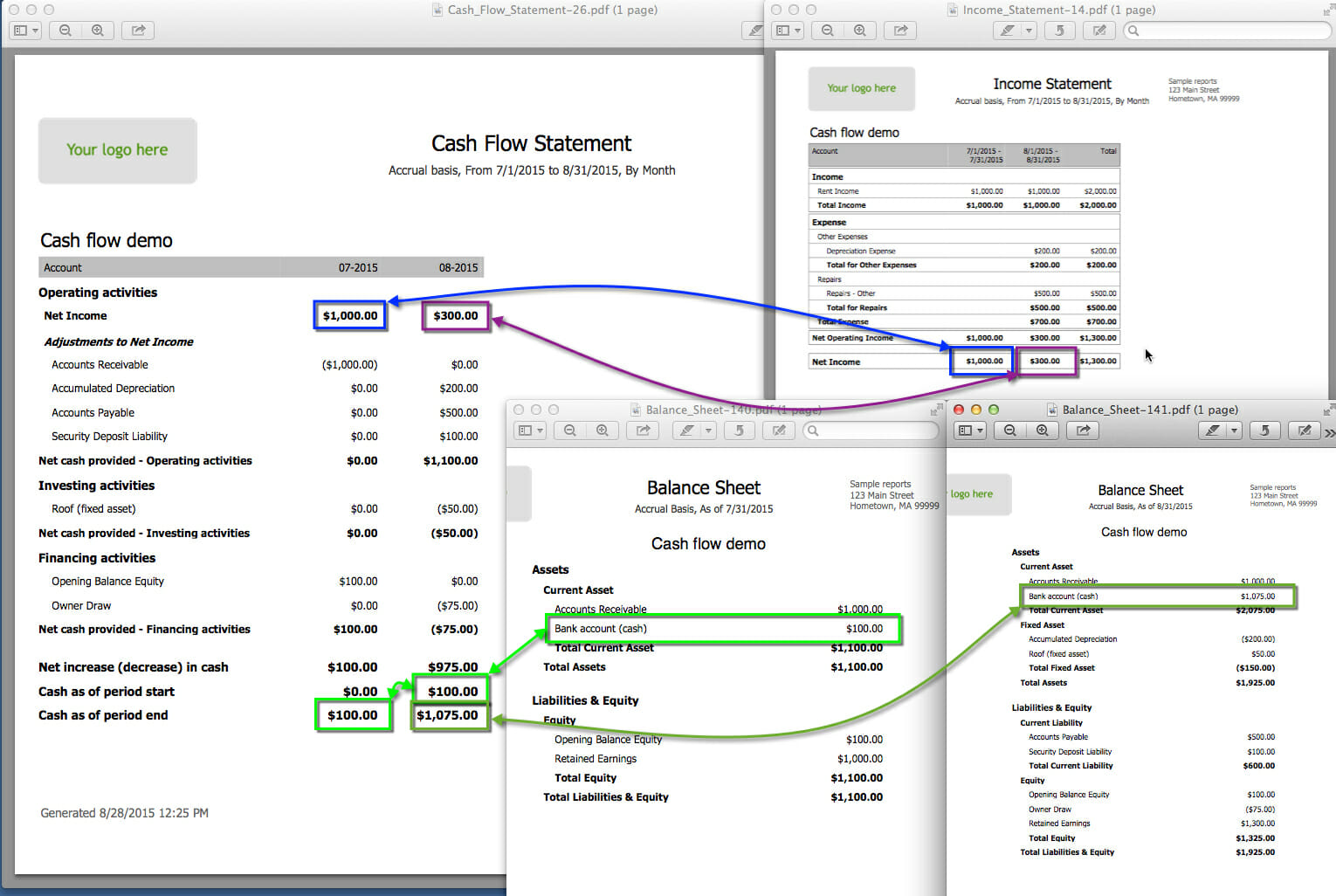

Calculating Cash Flow

Calculating cash flow is a fundamental step in evaluating the financial performance of a rental property. By determining the cash flow, investors can assess the profitability of an investment and make informed decisions about their rental properties. Here are the key components involved in calculating cash flow:

- Rental Income: Start by determining the total rental income generated from the property on a monthly basis. This includes the rent collected from all units or tenants.

- Operating Expenses: Next, identify and calculate all the operating expenses associated with the property. These expenses typically include property taxes, insurance, maintenance and repairs, property management fees, utilities, and any other costs directly related to the operation and maintenance of the property.

- Financing Costs: If the property is financed through a mortgage or other loans, calculate the monthly mortgage payment, including both principal and interest. This amount is considered a financing cost that reduces the overall cash flow.

Once the above components are identified, the cash flow can be calculated using the following formula:

Cash Flow = Rental Income – Operating Expenses – Financing Costs

If the result is a positive number, it indicates a positive cash flow, meaning the property is generating more income than it is costing to operate. Conversely, if the result is negative, it indicates a negative cash flow, implying that the property’s expenses outweigh its income.

It is important to note that calculating cash flow provides a snapshot of the property’s financial performance at a given point in time. Cash flow can vary over time due to changes in rental rates, expenses, vacancies, and other factors. Regularly monitoring and reassessing the cash flow is crucial for investors to track the financial health of their rental property investments.

In addition, investors should also consider factors such as property appreciation, tax advantages, and potential future rental income growth when evaluating the overall profitability of a rental property. Cash flow is just one component of the investment analysis, and a comprehensive assessment requires considering the property’s potential for long-term wealth accumulation and return on investment.

By accurately calculating the cash flow of a rental property, investors can make informed decisions, evaluate the financial viability of their investments, and determine whether a property meets their desired financial goals and objectives.

Evaluating Cash Flow as a Measure of Rental Property Performance

Cash flow is a crucial metric used to evaluate the performance and financial viability of a rental property. It provides valuable insights into the property’s ability to generate income and cover expenses. Evaluating cash flow can help investors analyze the profitability of their investments and make informed decisions. Here are the key reasons why cash flow is an essential measure of rental property performance:

- Profitability Indicator: Cash flow serves as a measure of the property’s profitability. Positive cash flow indicates that the property is generating more income than it costs to operate, indicating a profitable investment. Negative cash flow, on the other hand, suggests that the property is not generating enough income to cover its expenses, which may require additional funds to sustain the investment.

- Income Generation: Cash flow reflects the property’s ability to generate rental income. A property with positive cash flow signifies that the rental income is sufficient to cover the property’s expenses, leaving a surplus. This surplus can be used for reinvestment, future property purchases, or as additional income for the investor.

- Return on Investment (ROI): Cash flow is a key component in calculating the return on investment for a rental property. By analyzing the cash flow generated from the property relative to the initial investment, investors can determine the ROI and assess whether the property is meeting their financial goals. Positive cash flow contributes to a higher ROI, while negative cash flow can reduce the overall return on investment.

- Sustainability: Cash flow is an important factor in assessing the long-term sustainability of a rental property investment. A property with positive cash flow indicates that it can generate continuous income and cover its expenses without relying on additional funds. This sustainability is essential for investors to maintain a stable and profitable investment portfolio.

- Capital Appreciation: Cash flow is also intertwined with the potential for capital appreciation. Positive cash flow can provide investors with the opportunity to reinvest the surplus income into the property, improving its value and potential for appreciation over time. This combination of cash flow and capital appreciation contributes to wealth accumulation and increased property value.

When evaluating the cash flow as a measure of rental property performance, it is essential to consider other factors such as property location, market conditions, financing terms, and tax implications. These factors can significantly impact the cash flow and overall profitability of the investment.

Investors should aim to achieve a favorable cash flow that not only covers the property’s expenses but also provides a surplus income. The specific criteria for what constitutes a good cash flow may vary depending on individual investment goals, market conditions, and risk tolerance. It is important to analyze the cash flow in relation to these factors to assess the rental property’s performance accurately.

By evaluating cash flow as a measure of rental property performance, investors can make informed decisions, assess the profitability of their investments, and work towards achieving their financial objectives in real estate investing.

Determining a Good Cash Flow on a Rental Property

Determining what constitutes a good cash flow on a rental property is subjective and depends on various factors, including individual investment goals, market conditions, and risk tolerance. However, there are some general guidelines that can help investors assess the cash flow and determine if it meets their financial objectives. Here are key considerations when determining a good cash flow on a rental property:

- Positive Cash Flow: A good cash flow is typically positive, indicating that the rental property generates more income than it costs to operate. Positive cash flow suggests that the property can cover its expenses, provide a surplus income, and contribute to overall profitability.

- Covering Expenses: A good cash flow should be sufficient to cover all the property’s expenses, including mortgage payments, property taxes, insurance, maintenance, property management fees, and vacancies. The income from the property should exceed these expenses to ensure financial sustainability and profitability.

- Profitability Threshold: Investors often set a profitability threshold or target return on investment (ROI) when evaluating a rental property’s cash flow. This threshold is specific to individual investors and can be based on desired income goals or investment strategies. It is important to assess whether the cash flow meets or exceeds this threshold to consider it a good cash flow.

- Market Factors: Consider the rental market conditions and rental rates in the area where the property is located. Compare the rental income generated by the property to the average rental rates in the market. If the property’s rental income is competitive or higher than market rates, it indicates a good cash flow.

- Risk Management: Assess the risk associated with the rental property investment. Consider factors such as property appreciation potential, vacancy rates, tenant quality, and market stability. A good cash flow should provide a cushion to mitigate risks, ensuring the investor can sustain the investment even during challenging times.

- Long-Term Growth: Consider the potential for long-term growth and appreciation of the rental property. A good cash flow should not only cover expenses but also provide an opportunity for reinvestment or property improvements that can enhance its value over time.

It is important to note that what constitutes a good cash flow may vary depending on individual circumstances and investment objectives. Some investors may prioritize a higher cash flow to generate additional income, while others may focus on long-term appreciation and wealth accumulation. It is crucial for investors to determine their investment goals and evaluate the cash flow against those objectives.

Additionally, it may be beneficial to consult with real estate professionals, financial advisors, or other experienced investors to gain insights into the local market conditions, rental property performance, and strategies for achieving a good cash flow.

By carefully considering these factors and conducting a thorough analysis of the cash flow, investors can make informed decisions and determine if a rental property meets their criteria for a good cash flow.

Benefits of Having a Good Cash Flow

Having a good cash flow on a rental property offers several benefits for real estate investors. It not only enhances the financial performance of the investment but also provides stability, flexibility, and opportunities for growth. Here are some key benefits of having a good cash flow:

- Additional Income: Positive cash flow generates additional income for investors. The surplus funds can be used for various purposes, such as supplementing personal income, covering personal expenses, or reinvesting in other properties.

- Debt Service Coverage: With a good cash flow, investors can comfortably cover the mortgage payments and other financing costs associated with the property. This ensures financial stability and reduces the risk of defaulting on the loan.

- Property Maintenance and Upgrades: A good cash flow allows for allocating funds towards property maintenance, repairs, and upgrades. Regular upkeep and improvements can help maintain the value of the property, attract quality tenants, and potentially increase rental rates.

- Opportunities for Expansion: Positive cash flow from one rental property can be reinvested in acquiring additional properties, expanding the real estate portfolio, and diversifying investment holdings. This creates opportunities for increased income and long-term wealth accumulation.

- Risk Mitigation: Having a good cash flow cushions against unforeseen circumstances and market fluctuations. It provides a buffer for handling unexpected expenses, vacancies, or economic downturns, reducing the financial strain on the investor.

- Exit Strategy: A rental property with positive cash flow can be an attractive option for potential buyers if an investor decides to sell the property in the future. Positive cash flow demonstrates a well-performing investment, making it easier to sell at a profit or attract favorable financing terms.

- Financial Freedom: Consistent positive cash flow from rental properties can contribute to financial independence and freedom. It provides passive income that can supplement or even replace traditional employment, allowing investors to have more control over their time and financial resources.

- Tax Benefits: Positive cash flow can have tax advantages as well. Certain expenses related to the rental property, such as mortgage interest, property taxes, insurance, and maintenance costs, may be tax-deductible, reducing the overall tax liability for the investor.

It is important for investors to understand that maintaining a good cash flow requires ongoing management, monitoring of market conditions, and careful financial planning. Regular evaluation and adjustments to rental rates, expenses, and investment strategies may be necessary to sustain a positive cash flow.

Ultimately, having a good cash flow on rental properties not only ensures immediate financial benefits but also positions investors for long-term success and wealth building in the real estate market.

Risks and Challenges Associated with Cash Flow on Rental Properties

While having a positive cash flow on rental properties is desirable, it is important for investors to be aware of the risks and challenges that can impact cash flow. Understanding these potential pitfalls allows investors to mitigate risks and make informed decisions. Here are some common risks and challenges associated with cash flow on rental properties:

- Vacancies and Rental Demand: Vacancies can significantly impact cash flow as rental income ceases during these periods. A decrease in rental demand, increased competition, or a decline in the local economy can lead to longer vacancies and reduced cash flow.

- Market Rates and Rent Increases: An inability to increase rental rates in line with market trends can limit the potential for positive cash flow growth. Rent control regulations or stagnant rental market conditions may restrict rental rate adjustments, affecting cash flow potential.

- Expenses and Maintenance Costs: Unexpected repairs, maintenance expenses, or rising operating costs can put a strain on cash flow. Failure to account for these expenses or having inadequate reserves can result in negative cash flow.

- Tenant Turnover and Quality: High tenant turnover rates and difficulties in finding reliable tenants can impact cash flow. Frequent turnover leads to vacancies and additional costs associated with tenant screening, lease preparation, and marketing the property to attract new tenants.

- Financing Costs: Rising interest rates or unfavorable financing terms can erode cash flow, especially for properties with significant mortgage payments. It is crucial to carefully consider the impact of financing costs on cash flow when acquiring a rental property.

- Regulatory and Legal Factors: Changes in regulations, zoning laws, or local ordinances can increase operating costs and impact cash flow. Compliance with legal requirements, such as building codes, safety standards, and tenant protection laws, may result in additional expenses for landlords.

- Economic Factors: Economic downturns, recessions, or market fluctuations can affect rental demand, property values, and overall cash flow. Investors need to consider the potential impact of economic factors on the rental market and be prepared for periods of decreased cash flow.

- Property Management Challenges: Inefficient or ineffective property management can lead to higher expenses, increased vacancies, and difficulties in collecting rents. A lack of proper property management processes can negatively impact cash flow and overall investment performance.

Successful real estate investors understand the risks and challenges associated with cash flow on rental properties and take proactive measures to mitigate these risks. This includes maintaining cash reserves, conducting thorough tenant screenings, staying informed about local market conditions, regularly reviewing expenses, and developing contingency plans for unforeseen circumstances.

By carefully monitoring and addressing these risks and challenges, investors can maximize their chances of maintaining a positive cash flow and achieving long-term success in their rental property investments.

Conclusion

Cash flow is a vital aspect of rental property investing that directly impacts the financial performance and profitability of an investment. Evaluating and understanding cash flow is crucial for investors to make informed decisions and assess the viability of their rental properties.

A good cash flow on a rental property signifies that the income generated from the property exceeds the expenses, providing additional income for investors. It allows for the coverage of operating expenses, mortgage payments, and potential growth and reinvestment opportunities. Positive cash flow contributes to financial stability, flexibility, and long-term wealth accumulation.

However, investors must also be aware of the risks and challenges associated with cash flow. Vacancies, market conditions, maintenance costs, financing terms, and tenant turnover are among the factors that can impact cash flow and profitability. Understanding and mitigating these risks is essential for maintaining a positive cash flow and sustaining a successful rental property investment portfolio.

To determine a good cash flow, investors evaluate factors such as profitability, covering expenses, market rates, risk tolerance, and long-term growth potential. What constitutes a good cash flow may vary depending on individual investment goals and local market conditions. Regular monitoring, adjustments, and strategic financial planning are necessary to maintain a positive cash flow and maximize the returns on rental properties.

In conclusion, cash flow is a critical metric that allows investors to assess the financial health and success of their rental property investments. By accurately analyzing and managing cash flow, investors can make sound investment decisions, achieve financial goals, and build a strong foundation for long-term wealth in the real estate market.