Finance

How Is Capital One Minimum Payment Calculated

Modified: March 1, 2024

Learn how Capital One calculates minimum payments and manage your finances more effectively. Understand the factors that influence your minimum payment.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of credit cards and the intricacies of managing your finances effectively. Capital One, a prominent player in the credit card industry, offers an array of financial products, including credit cards with varying features and benefits. One crucial aspect of credit card management revolves around understanding and handling minimum payments. In this article, we will delve into the specifics of how Capital One calculates minimum payments, shedding light on the factors influencing these calculations and providing valuable tips for managing your minimum payments effectively.

Understanding the concept of minimum payments is vital for anyone with a credit card, as it directly impacts your financial well-being. By gaining insights into this topic, you can make informed decisions and take proactive steps to maintain a healthy financial profile. So, let's embark on this enlightening journey through the realm of minimum payments and unravel the mechanics behind Capital One's minimum payment calculations.

Whether you're a seasoned credit card user or new to the world of personal finance, understanding the intricacies of minimum payments is a fundamental aspect of managing your credit responsibly. Join us as we explore the nuances of minimum payments and equip you with the knowledge to navigate the financial landscape with confidence and prudence.

Understanding Minimum Payments

Minimum payments represent the lowest amount you must pay on your credit card balance each month to maintain your account in good standing. While making the minimum payment by the due date helps you avoid late fees and penalties, it’s important to recognize that primarily paying the minimum amount can lead to long-term financial repercussions due to accruing interest and prolonged debt repayment.

When you receive your monthly credit card statement from Capital One, you’ll notice the minimum payment amount specified alongside the total balance, current charges, and other pertinent details. This minimum payment is typically calculated as a percentage of your outstanding balance, subject to a minimum dollar amount. It’s crucial to comprehend that while meeting the minimum payment requirement is essential, striving to pay more than the minimum whenever possible can significantly reduce the overall interest accrued and expedite your journey toward debt freedom.

Understanding the significance of minimum payments involves recognizing their role in maintaining your creditworthiness. Consistently meeting at least the minimum payment obligation reflects positively on your credit history, demonstrating responsible financial behavior to potential lenders and credit reporting agencies. Conversely, neglecting minimum payments can lead to derogatory marks on your credit report, potentially impairing your ability to secure favorable terms for future credit needs.

By grasping the purpose and implications of minimum payments, you can make informed decisions about managing your credit card balances and formulating effective repayment strategies. Throughout the subsequent sections, we will delve deeper into the factors influencing Capital One’s minimum payment calculations and provide actionable insights to empower you in navigating the realm of credit card management.

Factors Affecting Minimum Payments

Several key factors influence the calculation of minimum payments on Capital One credit cards. Understanding these factors is pivotal in comprehending the dynamics of minimum payment requirements and their impact on your financial obligations. Here are the primary elements that contribute to the determination of your minimum payment:

- Outstanding Balance: The outstanding balance on your credit card, encompassing both the principal amount and any accrued interest or fees, serves as a fundamental factor in calculating the minimum payment. Typically, the minimum payment is calculated as a percentage of this total balance, influencing the minimum amount due each month.

- Interest Rate: The annual percentage rate (APR) associated with your Capital One credit card plays a significant role in minimum payment calculations. Higher interest rates result in increased finance charges, leading to a higher minimum payment requirement to cover the accruing interest and contribute toward reducing the principal balance.

- Minimum Payment Formula: Capital One employs a specific formula to calculate minimum payments, often based on a percentage of the outstanding balance, subject to a minimum dollar amount. Understanding this formula enables cardholders to anticipate their minimum payment obligations and devise appropriate repayment strategies.

- Regulatory Requirements: Regulatory guidelines and consumer protection laws may impact the minimum payment calculation methodology. Compliance with federal regulations and industry standards influences the structure of minimum payment requirements, ensuring consumer transparency and fairness in credit card practices.

By recognizing these influential factors, credit card users can gain insights into the mechanics of minimum payment calculations and proactively manage their financial responsibilities. Moreover, comprehending the interplay of these elements empowers individuals to make informed decisions regarding credit card usage, repayment prioritization, and long-term financial planning.

Calculating Capital One Minimum Payments

Capital One employs a specific methodology to calculate minimum payments on credit card balances, encompassing key elements such as the outstanding balance, interest rate, and predetermined minimum payment formula. Understanding how these components converge to determine your minimum payment obligation is essential for managing your credit card finances effectively.

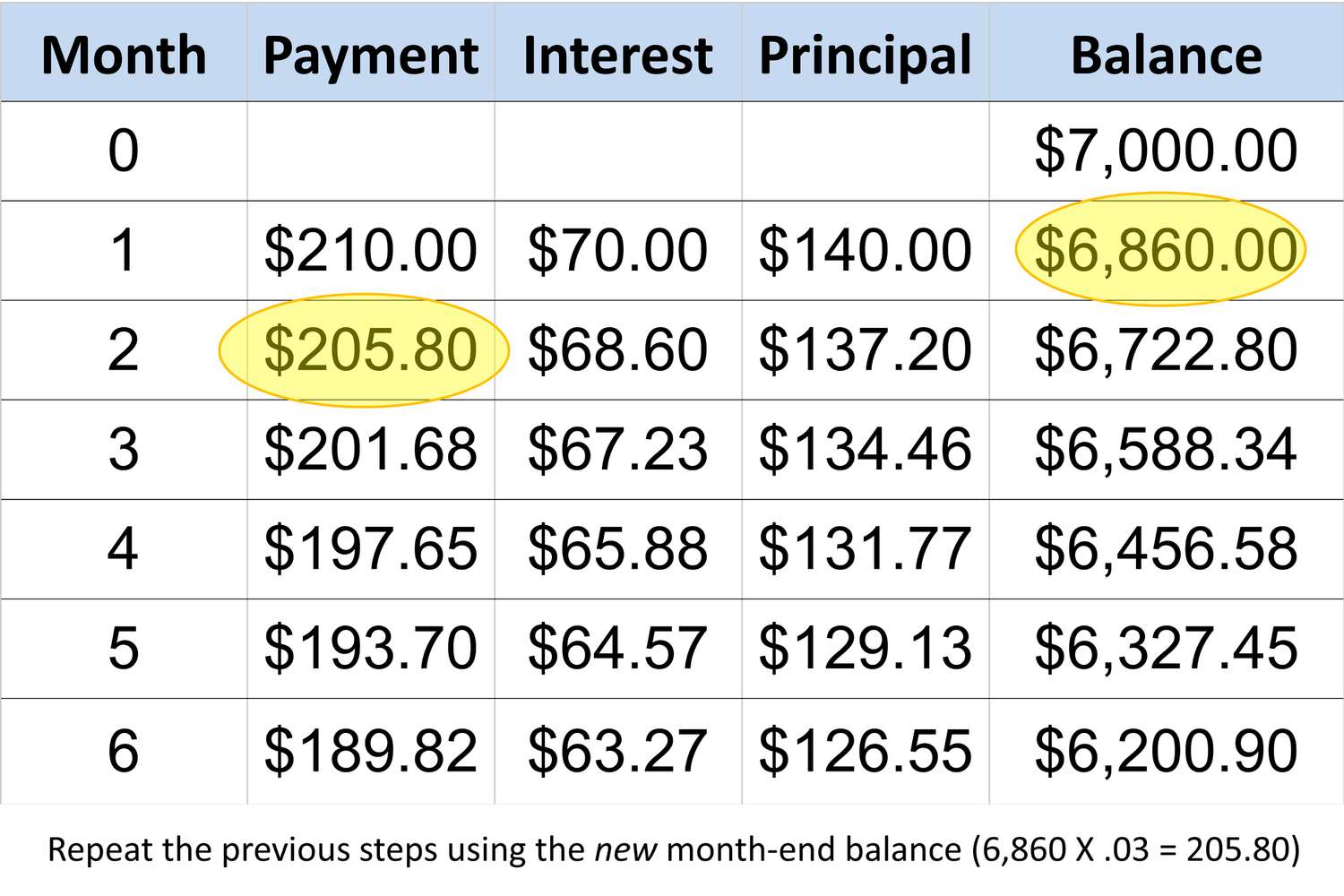

Typically, Capital One’s minimum payment is calculated as a percentage of the outstanding balance, subject to a minimum dollar amount. This percentage often ranges between 1% to 3% of the total balance, ensuring that the minimum payment adjusts in accordance with fluctuations in the outstanding balance. Additionally, a predetermined minimum payment floor, such as $25 or $35, may apply, safeguarding that the minimum payment remains above a specified threshold regardless of the outstanding balance.

Moreover, the interest accrued on the outstanding balance directly influences the minimum payment requirement. Higher interest rates lead to increased finance charges, subsequently elevating the minimum payment amount to cover the accruing interest and contribute toward reducing the principal balance. As a result, credit card users with higher APRs may encounter proportionally higher minimum payment obligations, emphasizing the significance of managing interest rates and seeking opportunities to lower finance charges through prudent financial behavior.

Understanding the specific formula and variables utilized by Capital One to calculate minimum payments enables cardholders to anticipate their minimum payment obligations accurately. By proactively assessing the impact of varying outstanding balances and interest rates on minimum payments, individuals can devise strategic repayment plans, optimize their financial resources, and work toward mitigating long-term interest costs.

It’s important to note that while meeting the minimum payment is imperative to avoid late fees and maintain account compliance, striving to pay more than the minimum whenever feasible is highly advantageous. By accelerating debt repayment and minimizing interest accrual, individuals can expedite their journey toward financial freedom and alleviate the burden of persistent credit card balances.

By comprehending the intricacies of Capital One’s minimum payment calculations, credit card users can navigate their financial responsibilities with clarity and foresight, fostering a proactive approach to credit card management and long-term financial well-being.

Tips for Managing Minimum Payments

Effectively managing minimum payments on your Capital One credit card is essential for maintaining financial stability and minimizing long-term interest costs. By implementing strategic approaches and prudent financial practices, you can navigate minimum payment obligations with confidence and optimize your journey toward debt freedom. Here are valuable tips to consider when managing your minimum payments:

- Pay More Than the Minimum: While meeting the minimum payment is crucial, endeavor to pay more than the minimum whenever feasible. By allocating additional funds toward your credit card balance, you can expedite debt repayment, reduce interest costs, and gradually alleviate the burden of persistent balances.

- Monitor Interest Rates: Stay informed about the interest rates associated with your Capital One credit card. If feasible, consider exploring opportunities to lower your interest rates, such as through balance transfers to cards with promotional APR offers or negotiating a lower rate with your existing card issuer.

- Create a Repayment Plan: Develop a structured repayment plan tailored to your financial capabilities. Prioritize paying off high-interest balances first while consistently meeting minimum payment obligations on all accounts to avoid penalties and safeguard your credit standing.

- Utilize Windfalls Wisely: If you receive unexpected funds, such as tax refunds or bonuses, consider allocating a portion toward accelerating credit card debt repayment. Utilizing windfalls to reduce outstanding balances can yield substantial long-term savings on interest costs.

- Automate Payments: Take advantage of automated payment options to ensure timely minimum payments. Setting up automatic payments for at least the minimum amount due can help you avoid late fees and streamline your financial management efforts.

- Seek Financial Guidance: If you encounter challenges in managing your credit card payments, don’t hesitate to seek financial guidance from reputable sources. Nonprofit credit counseling agencies and financial advisors can provide valuable insights and assistance in formulating effective debt management strategies.

By integrating these tips into your financial practices, you can proactively manage your minimum payments, optimize debt repayment, and cultivate healthy financial habits. Empowering yourself with the knowledge and discipline to navigate minimum payment obligations positions you to make informed decisions and progress toward achieving your long-term financial goals.

Conclusion

As we conclude our exploration of Capital One’s minimum payment calculations and the associated dynamics, it’s evident that comprehending and effectively managing minimum payments is integral to maintaining financial well-being and fostering responsible credit card usage. By gaining insights into the factors influencing minimum payments, understanding the calculation methodology employed by Capital One, and implementing strategic approaches to manage minimum payments, individuals can navigate their credit card obligations with prudence and foresight.

Recognizing the significance of paying more than the minimum whenever feasible, monitoring interest rates, and devising structured repayment plans are pivotal steps in optimizing debt repayment and mitigating long-term interest costs. Proactively addressing minimum payment obligations not only safeguards your credit standing and financial stability but also propels you toward achieving financial freedom and enhanced control over your monetary resources.

By integrating the tips and insights shared in this article into your financial practices, you can empower yourself to make informed decisions, navigate credit card management with confidence, and progress toward realizing your long-term financial aspirations. Remember, responsible credit card usage, prudent financial planning, and proactive debt management are fundamental pillars in cultivating a secure and resilient financial foundation.

As you embark on your journey toward financial empowerment, consider leveraging the knowledge and strategies outlined herein to optimize your credit card management, minimize interest costs, and pave the way for a brighter financial future. With diligence, informed decision-making, and a proactive mindset, you can navigate the realm of minimum payments with clarity and purpose, positioning yourself for sustained financial well-being and prosperity.