Finance

How To Apply For A Bad Credit Surety Bond

Published: January 10, 2024

Learn how to apply for a bad credit surety bond and secure your finances. Find out the steps involved and get the guidance you need to navigate the process effectively.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of bad credit surety bonds! If you find yourself in a situation where your credit history is less than stellar, you may be worried about your ability to obtain a surety bond. While having bad credit can indeed present some challenges, it does not mean that you are completely ineligible for a surety bond.

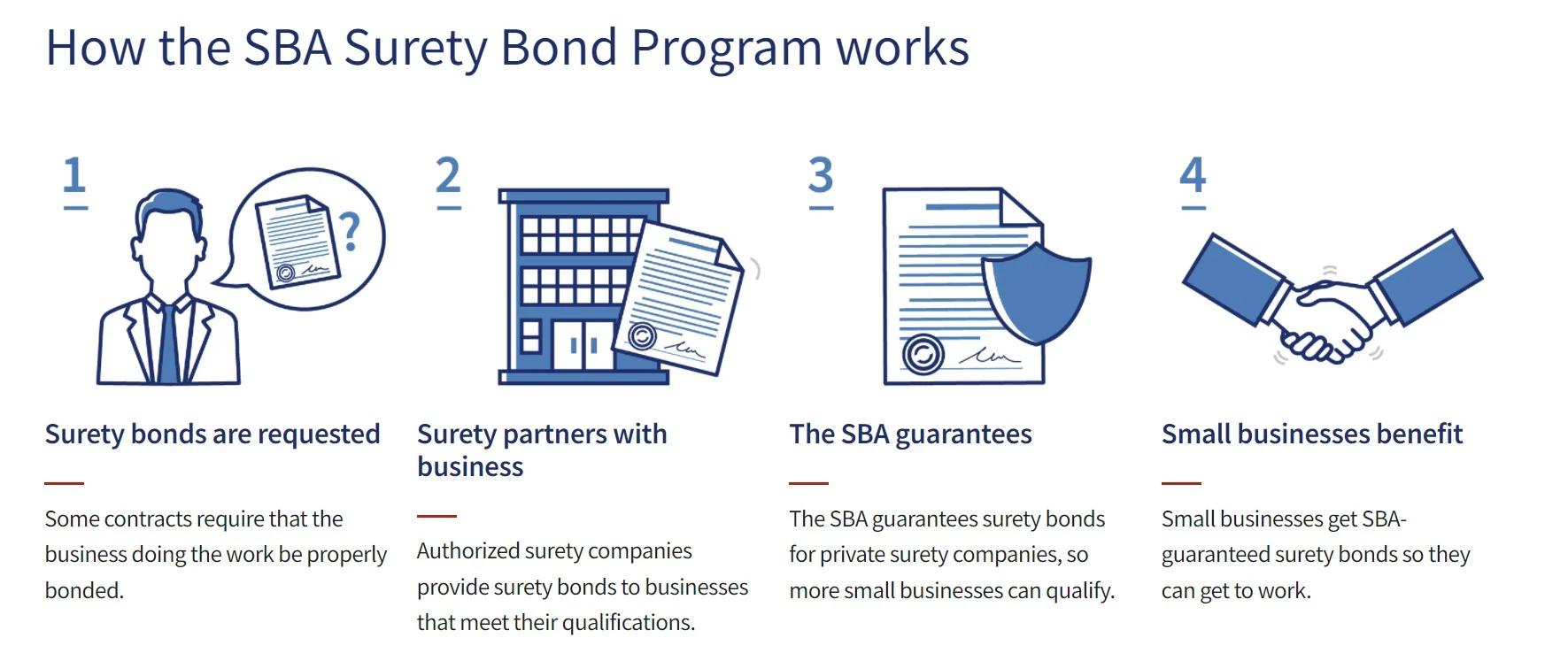

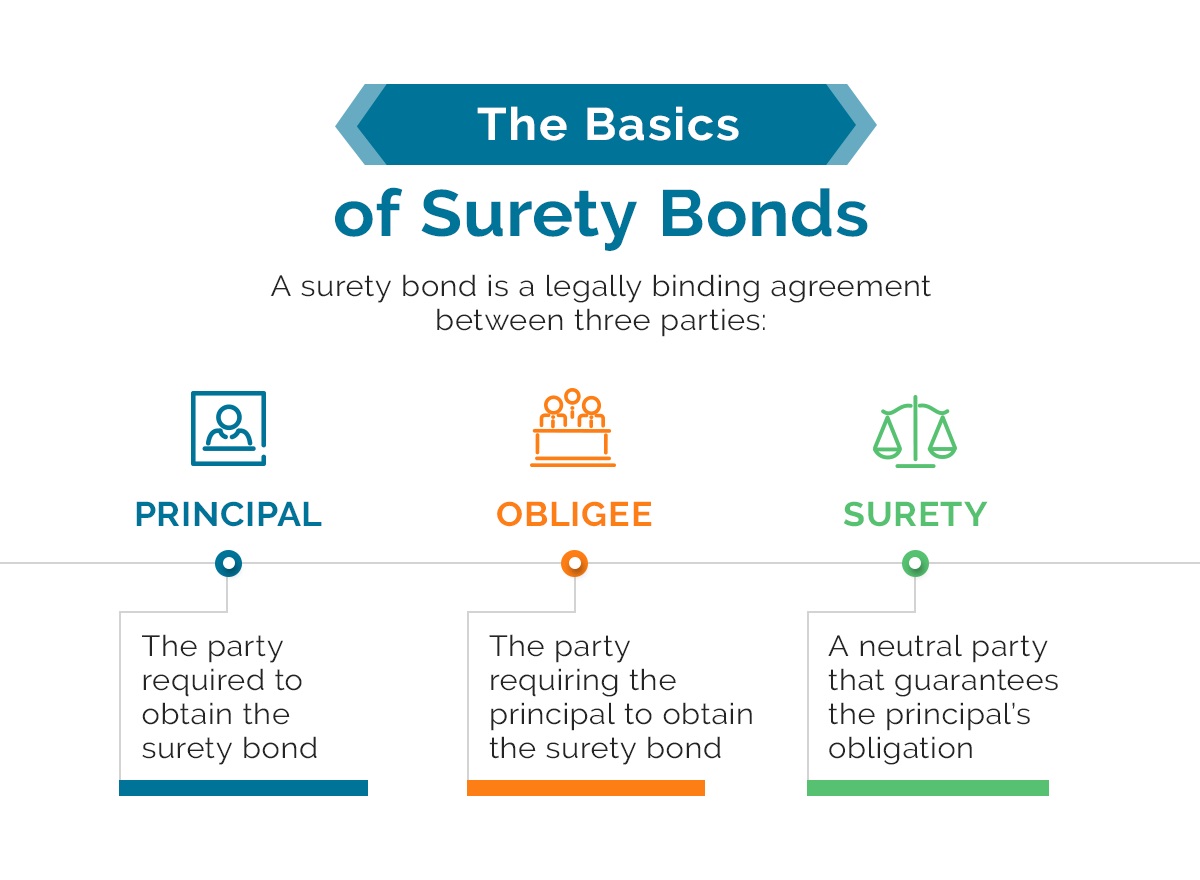

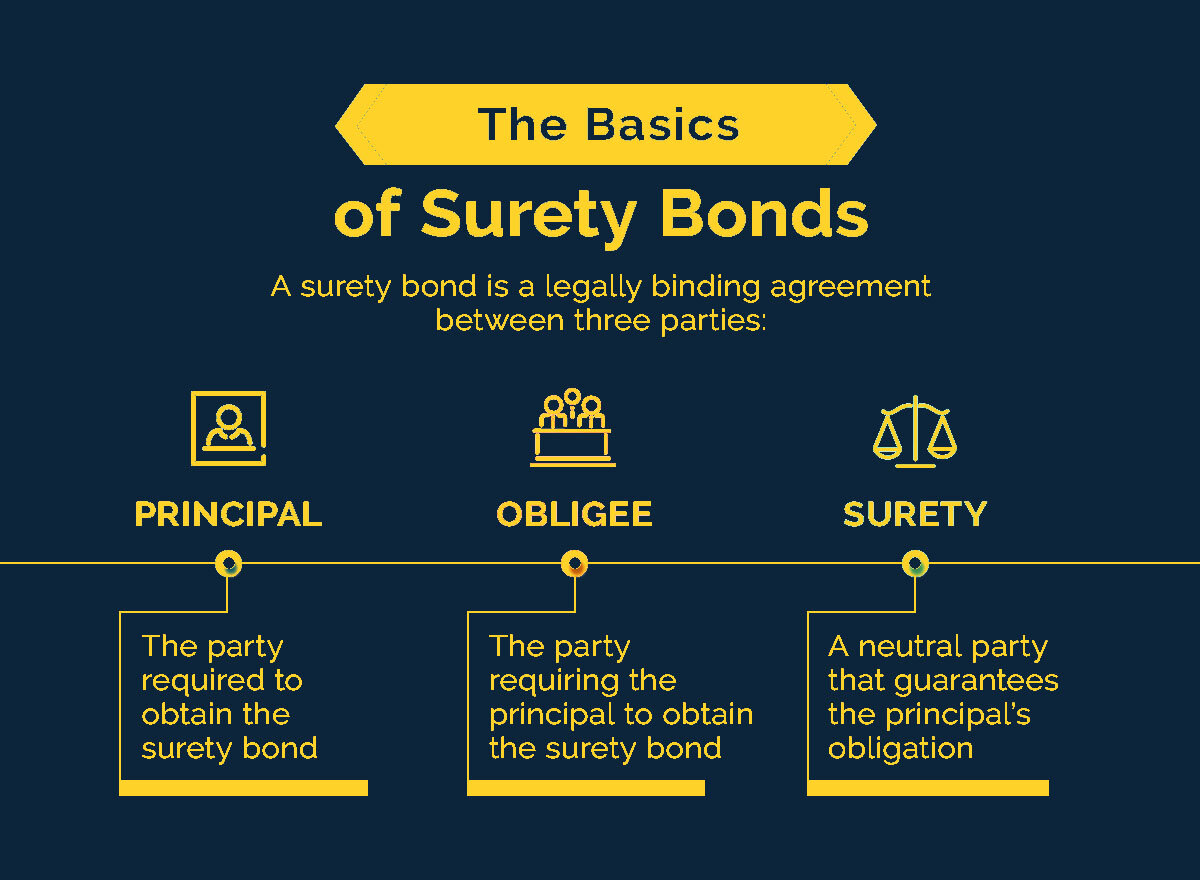

A surety bond is a type of financial guarantee that provides protection to the obligee in case the principal fails to fulfill their contractual obligations. It is commonly required in industries such as construction, transportation, and finance, where the stakes are high and risks need to be mitigated. Surety bonds are typically issued by insurance companies or surety bond providers who evaluate the creditworthiness of the applicant before granting the bond.

With a bad credit history, you might face some hurdles along the way, but don’t lose hope. This article will guide you through the process of applying for a bad credit surety bond, helping you navigate the complexities and improve your chances of approval.

Understanding the steps involved in applying for a bad credit surety bond and learning about alternative options can empower you to make informed decisions and secure the bond you need. So let’s dive in and explore the world of bad credit surety bonds together!

Understanding Bad Credit Surety Bonds

Before we discuss the specifics of applying for a bad credit surety bond, it’s important to understand what exactly a bad credit surety bond is and how it differs from a traditional surety bond.

As mentioned earlier, a surety bond is a financial guarantee that protects the obligee (the party requiring the bond) in case the principal (the party obtaining the bond) fails to fulfill their contractual obligations. A bad credit surety bond is designed for individuals or businesses with less-than-ideal credit scores or a history of financial difficulties.

Due to the increased risk associated with applicants who have bad credit, surety bond providers may impose stricter terms and conditions and charge higher premiums. Bad credit surety bonds serve as a way to bridge the gap between those who need a surety bond and those who may not meet the standard credit requirements.

It’s important to note that bad credit surety bonds can be obtained for various types of bonds, including contractor bonds, license and permit bonds, and court bonds. Regardless of the specific type of bond you need, the process of obtaining a bad credit surety bond follows a similar framework.

While bad credit surety bonds can be a lifeline for individuals or businesses with poor credit, it’s crucial to maintain open and honest communication with the surety bond provider. Being transparent about your financial challenges and demonstrating a strong commitment to fulfilling your obligations can increase your chances of approval and help you build trust with the provider.

Now that we have a foundational understanding of bad credit surety bonds, let’s move on to the next step: determining your eligibility for a bad credit surety bond.

Determine Your Eligibility for a Bad Credit Surety Bond

Obtaining a bad credit surety bond requires assessing your eligibility and understanding the factors that will be considered by the surety bond provider. While bad credit can impact your chances of approval, it doesn’t automatically disqualify you from obtaining a bond.

When evaluating your eligibility, surety bond providers will consider a variety of factors in addition to your credit history. These may include your industry experience, financial stability, reputation, and the specific circumstances surrounding your credit issues.

It’s essential to gather all relevant information about your credit history and financial situation before approaching a surety bond provider. Review your credit report to identify any inaccuracies or discrepancies and take steps to address them. Additionally, consider gathering documentation that demonstrates your commitment to improving your financial standing, such as paying off outstanding debts or improving credit scores.

Having a solid business plan or a clear understanding of the project requirements can also work in your favor. Presenting yourself as a knowledgeable and reliable applicant will help mitigate some of the concerns that may arise due to your credit history.

Keep in mind that each surety bond provider may have different eligibility criteria. Some providers specialize in working with applicants with bad credit, while others may have more stringent requirements. Research multiple providers to find one that is willing to work with your specific circumstances.

If your credit is truly hindering your ability to obtain a bad credit surety bond, consider seeking the assistance of a surety bond broker. These professionals have connections with multiple surety bond providers and can help find a suitable option for your needs.

Remember, even if you are eligible for a bad credit surety bond, expect to pay higher premiums. The exact premium amount will depend on factors such as the bond type, bond amount, and severity of your credit issues.

Now that you have a clearer understanding of your eligibility for a bad credit surety bond, the next step is to research surety bond providers who specialize in working with applicants with bad credit. Let’s explore this in the next section.

Researching Surety Bond Providers

When it comes to obtaining a bad credit surety bond, it is crucial to conduct thorough research on potential surety bond providers. Not all providers are willing to work with applicants who have bad credit, so finding the right one is essential. Here are some steps to help you in your research:

1. Seek recommendations: Start by asking for recommendations from colleagues, industry associations, or professionals in your field who may have experience with obtaining bad credit surety bonds. Their insights and referrals can help you narrow down your options.

2. Online research: Use the power of the internet to your advantage. Look for surety bond providers that specifically mention their willingness to work with applicants with bad credit. Visit their websites, read reviews, and gather as much information as possible about their services, experience, and reputation.

3. Check credentials: Verify that the surety bond provider is licensed and bonded in your state or the jurisdiction where you need the bond. This ensures that they adhere to the necessary regulations and industry standards.

4. Evaluate their experience: Look for providers who have extensive experience in the surety bond industry, particularly in dealing with applicants who have bad credit. A provider with relevant experience will have a better understanding of your unique circumstances and can offer guidance throughout the application process.

5. Consider their financial stability: It’s important to choose a surety bond provider that is financially stable and reputable. This ensures that they have the resources to support your bond and fulfill their obligations in the event of a claim.

6. Request quotes: Reach out to multiple surety bond providers and request quotes for your specific bond requirements. Compare the terms, conditions, and premiums offered by different providers. Ensure that you fully understand the cost structure and any additional fees associated with the bond.

7. Seek clarification: If you have any questions or concerns, don’t hesitate to reach out to the surety bond providers for clarification. A reliable provider will be responsive and willing to address your queries.

Remember, the goal of this research is to find a surety bond provider who is willing to work with your bad credit history and offers competitive terms and rates. Taking the time to research and evaluate providers will increase your chances of finding the right fit for your needs.

Once you have identified a suitable surety bond provider, the next step is to gather the required documentation for your application. Let’s explore this process in the next section.

Gathering Required Documentation

When applying for a bad credit surety bond, you will need to provide certain documentation to support your application. Each surety bond provider may have specific requirements, but generally, the following documents are commonly requested:

1. Personal and business financial statements: Prepare detailed financial statements for both your personal finances and your business (if applicable). These statements should include your assets, liabilities, income, and expenses.

2. Credit report: Obtain a copy of your credit report and thoroughly review it for accuracy. If there are any errors or discrepancies, take steps to rectify them before submitting your application. Being proactive in addressing credit issues can positively impact the outcome of your application.

3. Resumes and references: Provide resumes that highlight your industry experience, qualifications, and relevant skills. Additionally, gather references from clients, partners, or colleagues who can vouch for your trustworthiness and ability to fulfill contractual obligations.

4. Business plan: If you are applying for a business-related surety bond, it’s a good idea to have a well-crafted business plan that outlines your goals, strategies, and financial projections. This will demonstrate your commitment to success and provide assurance to the surety bond provider.

5. Project details: If the surety bond is for a specific project, gather all relevant project documentation, including contracts, specifications, and estimates. Providing a clear understanding of the project will help the surety bond provider assess the associated risks and determine an appropriate bond amount.

6. Indemnity agreement: In some cases, a surety bond provider may require you to sign an indemnity agreement. This agreement states that you will assume financial responsibility for any claims paid out by the surety bond provider due to your failure to fulfill your obligations.

7. Other supporting documents: Depending on your specific circumstances, the surety bond provider may request additional documentation, such as business licenses, permits, legal documents, or proof of insurance. Be prepared to provide any additional documentation requested.

It’s crucial to gather all necessary documentation and ensure that it is accurate, up-to-date, and well-organized. Presenting a clear and comprehensive application package will demonstrate your professionalism and increase your chances of approval.

Once you have gathered the required documentation, it’s time to submit your application for a bad credit surety bond. We’ll cover the application process in the next section.

Submitting Your Application

After thorough preparation and gathering of all necessary documentation, it’s time to submit your application for a bad credit surety bond. The application process may vary slightly depending on the surety bond provider, but the following steps are generally involved:

1. Contact the surety bond provider: Reach out to the surety bond provider you have chosen and inform them of your intent to apply for a bad credit surety bond. They will guide you through the application process and provide you with any additional instructions or requirements.

2. Complete the application form: Fill out the application form provided by the surety bond provider. Provide accurate and complete information, ensuring that you disclose any credit issues or challenges you have faced. Transparency is key during this process.

3. Submit the required documentation: Attach all the necessary documentation that supports your application. Ensure that you have included everything requested by the surety bond provider, as missing or incomplete documents may delay the approval process.

4. Pay the application fee: Some surety bond providers may require an application fee to cover the costs of processing your application. Make sure to inquire about any fees upfront and submit the payment along with your application.

5. Await the decision: Once you have submitted your application, the surety bond provider will review it, along with the supporting documents. The review process may take some time, so be prepared for a waiting period. During this time, the provider may perform credit checks, verify references, and assess your overall eligibility.

6. Communicate with the provider: Maintain open lines of communication with the surety bond provider throughout the application process. Respond promptly to any requests for additional information, clarification, or follow-ups. This will demonstrate your commitment and cooperation.

7. Approval or denial: After the review process is complete, the surety bond provider will inform you of their decision. If approved, congratulations! You can move forward with obtaining the bond and fulfilling your contractual obligations. If denied, the provider will typically provide an explanation for the denial.

It’s important to note that even if you are approved for a bad credit surety bond, it’s likely that you will be subject to higher premiums and potentially other terms and conditions. The exact terms will vary depending on the provider and the specifics of your credit history.

If your application is denied, don’t get discouraged. You can seek feedback from the provider to understand the reasons for the denial and work towards improving your creditworthiness for future bond applications. Additionally, you can explore alternative options, which we will discuss in the next section.

Now that we have covered the application process, let’s explore alternatives to bad credit surety bonds.

Waiting for Approval or Denial

After submitting your application for a bad credit surety bond, you must patiently wait for the surety bond provider to review and make a decision. The waiting period can vary depending on the provider and the complexity of your application, so it’s important to remain patient and optimistic. Here’s what you can expect during this waiting period:

1. Processing time: Surety bond providers typically have their own internal processes for reviewing applications. This can involve verifying your credit history, assessing your financial stability, and evaluating the risk factors associated with your bond request. The processing time can range from a few days to several weeks, so it’s important to be prepared for the potential wait.

2. Communication from the provider: During the waiting period, the surety bond provider may occasionally reach out to you for additional information or clarification. It’s crucial to promptly respond to any requests to ensure a smooth application process and to avoid unnecessary delays.

3. Stay informed: While waiting for the decision, stay informed by keeping track of the status of your application. If you have not heard back from the provider within a reasonable timeframe, don’t hesitate to reach out to them for an update. Open communication can help provide clarity and alleviate any uncertainties you may have.

4. Approval notification: If your application is approved, congratulations! The surety bond provider will provide you with the details of the approved bond, including the bond amount, premium, and any other terms and conditions. Make sure to carefully review the information and seek clarification on anything that you may not understand.

5. Denial notice: In the unfortunate event that your application is denied, the surety bond provider will typically provide a reason for the denial. It could be due to your credit history, financial instability, or other risk factors. Review the denial notice and assess whether there are any steps you can take to address the concerns raised by the provider.

Remember, if your application is denied, it doesn’t mean that you are completely out of options. You can seek feedback from the provider to understand the specific reasons for the denial. This information can guide you in improving your creditworthiness and increasing your chances of approval in the future.

If you receive approval for your bad credit surety bond, congratulations! You can now move forward with the bond in place and fulfill your contractual obligations. However, if you were denied, don’t get discouraged. There are alternative options available, and we’ll explore those in the next section.

Now that we’ve covered the waiting period and the potential outcomes of your application, let’s discuss alternatives to bad credit surety bonds.

Exploring Alternatives to Bad Credit Surety Bonds

If your application for a bad credit surety bond is denied or if you are unable to secure a bond with favorable terms, don’t lose hope. There are alternatives available that can still provide the necessary financial protection. Explore the following options:

1. Collateral-based bonds: Some surety bond providers may offer collateral-based bonds as an alternative for applicants with bad credit. These bonds require you to provide collateral, such as cash, property, or other valuable assets, as security against the bond. In case of a claim, the surety bond provider can utilize the collateral to compensate the obligee.

2. Letters of credit: Another alternative is to obtain a letter of credit from your bank. A letter of credit serves as a financial guarantee and can be used in lieu of a surety bond. This option demonstrates your ability to fulfill your obligations and provides the necessary assurance to the obligee.

3. Joint surety bonds: Consider partnering with a financially stable individual or company that has good credit. By entering into a joint surety bond agreement, their strong credit history can compensate for your bad credit, improving your chances of obtaining the bond.

4. Self-insurance: In certain cases, self-insurance may be a viable option. This entails setting aside funds in a designated account to cover any potential liabilities or claims instead of obtaining a traditional surety bond. Self-insurance requires careful financial planning and may not be suitable for all situations.

5. State bonding programs: Some states offer bonding programs specifically designed to assist individuals with bad credit. These programs work alongside surety bond providers to help applicants obtain the necessary bonds. Research state-specific resources and programs to see if you qualify.

6. Improve your credit: Working on improving your credit will not only increase your chances of being approved for a traditional surety bond but also improve your overall financial standing. Take steps to address any outstanding debt, pay bills on time, and maintain a responsible financial track record.

It’s important to note that while these alternatives may offer options for obtaining the necessary financial guarantee, they may come with their own requirements, limitations, and costs. It’s crucial to carefully evaluate each alternative and assess its feasibility and suitability for your specific situation.

Consulting with a surety bond professional or a financial advisor can be immensely helpful during this process. They can provide tailored guidance, assess your options, and help you navigate the alternative routes to secure the necessary financial protection.

Regardless of the alternative option you choose, always stay transparent, communicate openly, and demonstrate your commitment to fulfilling your contractual obligations. Building trust and maintaining strong relationships with clients and business partners can further mitigate concerns related to your credit history.

Now that we’ve explored alternatives to bad credit surety bonds, let’s wrap up our discussion.

Conclusion

Applying for a bad credit surety bond may seem daunting, but with the right approach and understanding of the process, it is possible to secure the financial protection you need. While bad credit can pose challenges, it doesn’t necessarily disqualify you from obtaining a surety bond.

Start by determining your eligibility and gathering all the necessary documentation to support your application. Thoroughly research surety bond providers who specialize in working with applicants with bad credit, ensuring they have the necessary credentials and experience to meet your needs.

Submit your application with complete and accurate information, paying attention to any additional fees that may be required. Then, patiently wait for the provider’s decision. If approved, congratulations! You can move forward with confidence, knowing that you have the necessary bond in place.

If your application is denied, don’t lose hope. Explore alternatives such as collateral-based bonds, letters of credit, joint surety bonds, or state bonding programs. Additionally, focus on improving your creditworthiness to enhance your chances of obtaining a traditional surety bond in the future.

Remember to maintain transparency, open communication, and a commitment to fulfilling your obligations, regardless of the path you choose. Building strong relationships and trust with clients and business partners is essential for success.

In conclusion, the journey of obtaining a bad credit surety bond may have its challenges, but with determination, proper research, and exploration of alternatives, you can secure the financial protection you need. Don’t let bad credit hold you back – take the necessary steps and move forward with confidence in your business endeavors.