Home>Finance>How Is Life Insurance Policy Dividend Legally Defined

Finance

How Is Life Insurance Policy Dividend Legally Defined

Modified: February 21, 2024

Discover the legal definition of life insurance policy dividends and how they impact your financial plan. Explore key insights in the realm of finance.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Definition of a Life Insurance Policy Dividend

- Legal Considerations for Life Insurance Policy Dividends

- State Regulations Regarding Life Insurance Policy Dividends

- Tax Implications of Life Insurance Policy Dividends

- How Life Insurance Policy Dividends are Calculated

- Options for Using Life Insurance Policy Dividends

- Conclusion

Introduction

Welcome to the world of life insurance policy dividends! If you’re new to the realm of life insurance or you’re considering purchasing a policy, it’s important to understand the concept of dividends and how they are legally defined. Life insurance policy dividends can play a significant role in the overall financial benefits of your policy, so it’s crucial to have a clear understanding of their purpose and use.

A life insurance policy dividend is essentially a portion of the profits that insurance companies distribute to policyholders who meet certain criteria. Just like dividends in the stock market, life insurance policy dividends represent a share of the company’s earnings. However, unlike stocks, life insurance dividends are not guaranteed, and their amount may vary depending on various factors.

In this article, we will explore the legal considerations surrounding life insurance policy dividends, including state regulations and tax implications. We will also delve into how these dividends are calculated and the different options available for policyholders to utilize them.

By the end of this article, you will have a solid grasp of what a life insurance policy dividend entails and how it can impact your overall financial strategy. So, let’s dive in and demystify the world of life insurance policy dividends!

Definition of a Life Insurance Policy Dividend

A life insurance policy dividend is a distribution of surplus profits paid by an insurance company to its policyholders. When you purchase a participating life insurance policy, you become a policyholder and a partial owner of the company. As the company earns profits from its various investment activities and collects premiums from policyholders, it may choose to distribute a portion of those profits back to its policyholders in the form of dividends.

It’s important to note that not all life insurance policies offer dividends. Dividends are typically associated with participating policies, which allow policyholders to share in the company’s financial success. Non-participating policies, on the other hand, do not offer dividends, as the policyholders are not entitled to any share of the profits.

The amount of a life insurance policy dividend can vary, as it is determined by the insurance company’s financial performance and the specifics of your policy. Insurance companies employ actuaries to calculate the dividend distribution based on various factors such as investment returns, mortality experience, expenses, and policyholder persistency. These factors are taken into account to determine the surplus and the proportion that will be allocated as dividends.

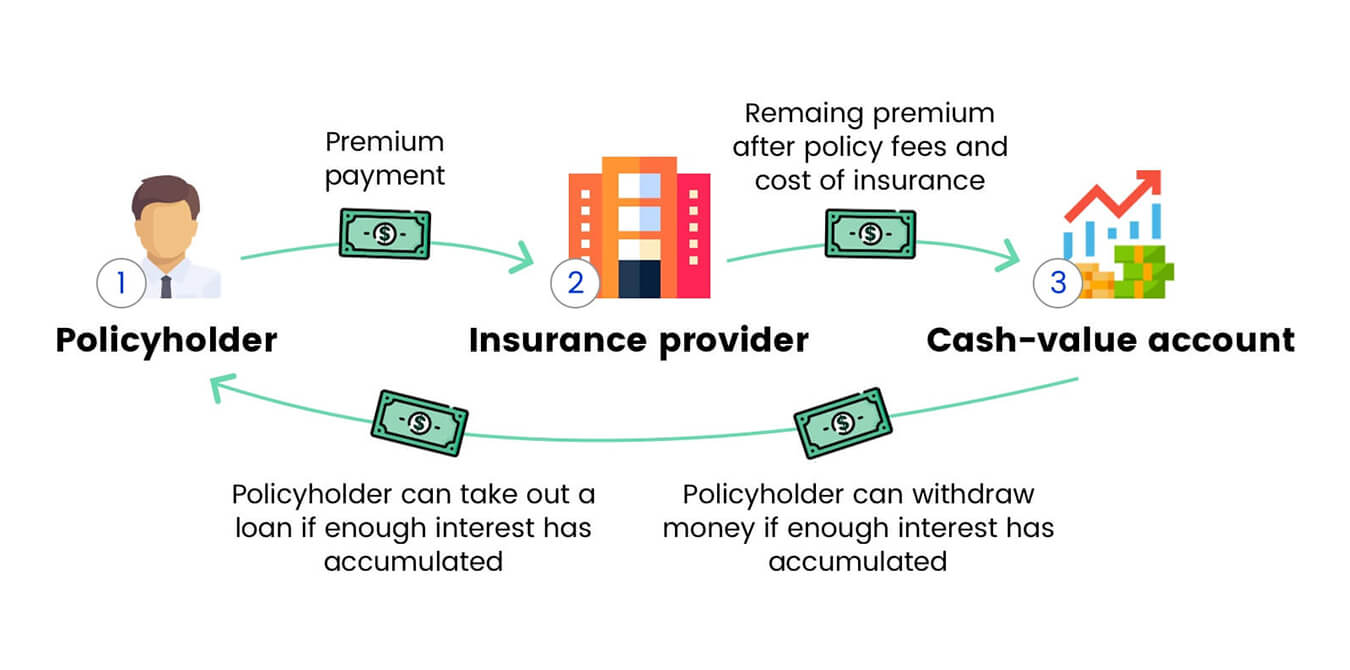

Life insurance policy dividends can be paid in different ways. Some insurance companies may offer the option to have the dividends paid out directly to policyholders in cash. Others may offer the choice to reinvest the dividends back into the policy, increasing its value and potential future earnings. Reinvesting dividends can also have some tax advantages, which we will discuss in more detail later in this article.

It’s worth mentioning that life insurance policy dividends are not considered guaranteed. Their payment is contingent upon the financial performance of the insurance company and the specific terms outlined in your policy. While insurance companies strive to consistently pay dividends, economic conditions or poor company performance may impact the availability and amount of dividends in certain years.

Overall, life insurance policy dividends are an attractive feature for policyholders, as they provide an opportunity to receive additional financial benefits beyond the core coverage of the policy. They can be a valuable source of income, helping policyholders offset premiums or accumulate cash value over time.

Legal Considerations for Life Insurance Policy Dividends

When it comes to life insurance policy dividends, there are several important legal considerations to keep in mind. These considerations help ensure that policyholders are protected and that the process of dividend distribution is fair and transparent. Let’s explore some of the key legal aspects related to life insurance policy dividends:

- Regulation by Insurance Authorities: Life insurance companies are regulated by state insurance authorities, which establish and enforce rules and regulations to protect policyholders’ interests. These regulations govern various aspects of insurance operations, including the distribution of dividends. Insurance authorities require companies to adhere to specific guidelines when calculating and distributing dividends to ensure fairness and solvency.

- Policy Contractual Obligations: The terms and conditions of your life insurance policy play a crucial role in determining the availability and calculation of dividends. The policy contract outlines the rights and benefits associated with the policy, including any potential dividends. It is essential to carefully review the policy documents to understand the dividend provisions and eligibility criteria.

- Fiduciary Duty: Insurance companies have a fiduciary duty towards policyholders, meaning that they have a legal obligation to act in the best interests of their policyholders. This duty extends to the determination and distribution of dividends. Insurance companies are required to allocate dividends fairly and equitably among eligible policyholders, without any discriminatory practices.

- Financial Stability and Solvency: Insurance regulators impose financial solvency requirements on companies to ensure that they have sufficient assets to honor their obligations, including the payment of dividends. These requirements help protect policyholders from situations where the insurer may not be able to fulfill dividend payments due to financial instability.

- Transparency and Disclosure: Insurance companies are required to provide transparent and accurate disclosures regarding the calculation and distribution of dividends. Policyholders have the right to know how dividends are determined and how they can benefit from them. Companies must provide clear and accessible information about dividend options, such as cash payouts or reinvestment.

By having these legal considerations in place, policyholders can have confidence in the fairness and reliability of the dividend distribution process. It is important for policyholders to be aware of their rights and the regulations that govern life insurance policy dividends to ensure that they receive the maximum benefits from their policies.

State Regulations Regarding Life Insurance Policy Dividends

State insurance regulations play a crucial role in governing the distribution of life insurance policy dividends. Each state has its own insurance department responsible for overseeing and regulating insurance companies operating within its jurisdiction. These departments establish guidelines and rules that insurance companies must follow when it comes to the payment of dividends. Let’s explore some of the key aspects of state regulations regarding life insurance policy dividends:

- Dividend Declaration: State regulations often require insurance companies to file dividend plans with the insurance department for approval. These plans outline how the company intends to calculate and distribute dividends to policyholders. The insurance department reviews these plans to ensure they are fair, in compliance with state regulations, and in the best interests of the policyholders.

- Dividend Calculation Limitations: State regulations may impose certain limitations on how insurance companies calculate life insurance policy dividends. This is to prevent unfair practices or excessive profit retention by the insurance company. Some states may require that a certain percentage of the company’s surplus be distributed as dividends to policyholders, ensuring that they receive a fair share of the profits.

- Timely Payment: State regulations often stipulate that insurance companies must pay dividends to eligible policyholders within a specified timeframe. This ensures that policyholders receive their dividends in a timely manner and are not subject to unnecessary delays. The specific timeframe for dividend payment may vary from state to state.

- Governance and Oversight: State insurance departments act as regulatory bodies that oversee the operations of insurance companies within their jurisdiction. They have the authority to investigate and take action against companies that fail to comply with state regulations regarding dividend distribution. These departments help ensure that insurance companies adhere to fair and ethical practices when it comes to life insurance policy dividends.

- Consumer Protection: State regulations aim to protect consumers and policyholders from unfair or deceptive practices related to dividend payment. Insurance companies are required to provide clear and accurate information about dividend options and eligibility criteria. They must also handle any policyholder inquiries or complaints regarding dividends in a prompt and transparent manner.

It’s important for policyholders to familiarize themselves with the specific state regulations governing life insurance policy dividends in their jurisdiction. By understanding these regulations, policyholders can ensure that their rights are protected, and they receive the dividends they are entitled to in a fair and timely manner.

Tax Implications of Life Insurance Policy Dividends

When it comes to life insurance policy dividends, understanding the tax implications is crucial. The tax treatment of dividends can vary depending on several factors, including the type of policy, how the dividends are received, and the purpose of the policy. Let’s delve into some of the key tax considerations related to life insurance policy dividends:

- Tax-Free Nature: In general, life insurance policy dividends are considered a return of premium and are therefore not subject to income tax. This applies to dividends received in cash or used to purchase additional coverage, known as paid-up additions.

- Policy Loans: If you choose to take a loan against the cash value of your life insurance policy, the loan proceeds are also generally tax-free. However, any outstanding loan balance at the time of policy surrender or lapse may be subject to income tax.

- Cash Surrender: If you decide to surrender your life insurance policy and receive the cash surrender value, any dividends received as part of the surrender value may be subject to income tax. The taxable portion is typically calculated based on the difference between the cash surrender value and the total premiums paid, excluding dividends.

- Dividend Interest: In some cases, if dividends are left with the insurance company and accumulate interest over time, the interest earned may be subject to income tax. This is known as “dividend interest” and is treated as ordinary income.

- Estate Tax Considerations: Life insurance policy dividends, if received as part of a policyholder’s estate, may be subject to estate tax. However, this typically applies to large estates and is subject to specific thresholds and exemptions set by the tax authorities.

It’s important to consult with a tax professional or financial advisor to fully understand the tax implications of life insurance policy dividends in your specific situation. They can provide personalized guidance based on your individual circumstances and help you navigate the complexities of tax laws.

Keep in mind that tax laws can change, and it’s essential to stay informed about any updates or revisions to tax regulations that may impact the tax treatment of life insurance policy dividends. By understanding the tax implications, you can make informed decisions regarding the utilization of dividends and ensure that you optimize the benefits of your life insurance policy.

How Life Insurance Policy Dividends are Calculated

The calculation of life insurance policy dividends is a complex process that takes into account various factors such as the financial performance of the insurance company, policyholder persistency, mortality experience, and operating expenses. While the specific calculation method can vary between insurance companies, there are some common elements to consider:

- Surplus Calculation: Insurance companies determine their surplus by subtracting their liabilities, such as claims and operating expenses, from their assets, including premiums and investment returns. The surplus represents the company’s available funds beyond what is required to fulfill its obligations.

- Allocation Formula: Once the surplus is calculated, insurance companies use an allocation formula to determine how much of the surplus will be distributed as dividends to policyholders. This formula considers factors such as the size of the policy, the policy’s duration, and the type of policy (e.g., whole life or universal life).

- Participation Rate: The participation rate is a key component in the dividend calculation. It represents the percentage of the calculated surplus that will be distributed as dividends. Insurance companies may adjust the participation rate periodically based on their financial performance or market conditions.

- Persistency: Persistency refers to the percentage of policyholders who continue to maintain their policies over a given period. Insurance companies consider persistency when calculating dividends, as policyholders who remain loyal to their policies contribute to the overall profitability of the company.

- Actuarial Analysis: Actuaries, who are experts in risk assessment and statistical analysis, play a crucial role in calculating life insurance policy dividends. They use complex mathematical models and actuarial tables to assess the financial performance and risks associated with the policy portfolio.

It’s important to note that the calculation of life insurance policy dividends is not an exact science. The process involves numerous variables, and insurance companies may use proprietary methods and formulas to determine the dividend distribution. Additionally, economic factors, investment performance, and changes in policyholder behavior can also impact the calculation and distribution of dividends.

If you have questions about how your specific life insurance policy dividends are calculated, it’s recommended to reach out to your insurance company or financial advisor. They can provide you with detailed information regarding the specific factors and calculations used in determining your policy’s dividends.

Understanding how life insurance policy dividends are calculated allows policyholders to have transparency and insight into the potential financial benefits of their policies. It also provides an opportunity to evaluate the financial strength and performance of the insurance company offering the policy.

Options for Using Life Insurance Policy Dividends

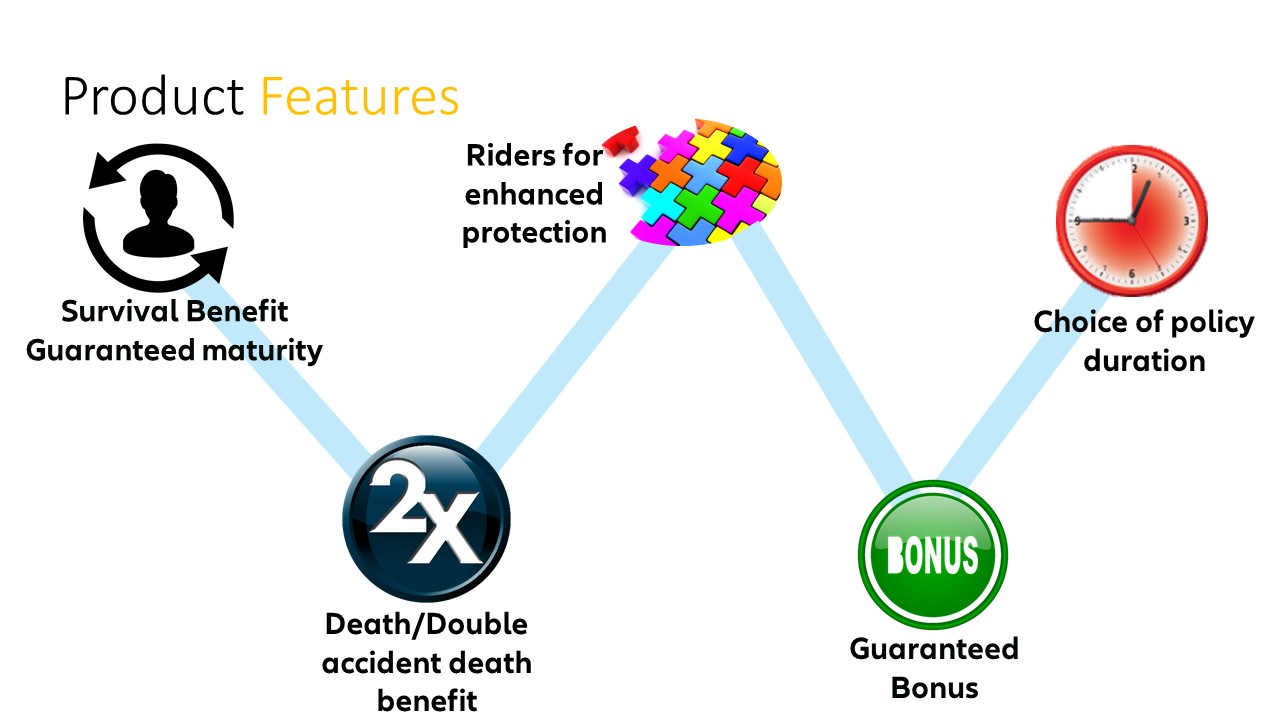

Life insurance policy dividends provide policyholders with a range of options for utilizing the additional financial benefits they receive. These options can help policyholders maximize the value of their policies and tailor them to their specific financial goals and needs. Let’s explore some of the common options for using life insurance policy dividends:

- Cash Payout: One of the simplest options is to receive the dividends as a cash payout. This provides policyholders with immediate access to the funds, which can be used for various purposes, such as covering expenses, paying premiums, or investing in other financial instruments.

- Reduce Premiums: Policyholders can choose to use their dividends to offset future premium payments. This option is particularly beneficial for individuals looking to reduce the financial burden of insurance premiums while maintaining the coverage and benefits of their policies.

- Purchase Paid-up Additions: Paid-up additions are additional coverage units that policyholders can purchase with their dividends. These additions increase the death benefit and the cash value of the policy, allowing policyholders to enhance their coverage without undergoing additional underwriting or medical exams.

- Accumulate Cash Value: By reinvesting the dividends back into the policy, policyholders can accumulate cash value at an accelerated pace. This can provide a potential source of additional funds that can be accessed through policy loans or withdrawals in the future. It’s important to consider the impact of policy loans on the death benefit and potential taxation.

- Enhance Policy Flexibility: Policyholders can use their dividends to add optional riders or features to their policies. These riders can provide additional benefits, such as accelerated death benefit riders, long-term care riders, or waiver of premium riders, which enhance the flexibility and functionality of the policy.

- Premium Offset: Policyholders can choose to use their dividends to offset future premium payments instead of receiving a cash payout. This option effectively reduces the out-of-pocket costs of maintaining the policy and can be particularly beneficial for individuals on a tight budget or looking to redirect funds to other financial priorities.

The specific options available for using life insurance policy dividends may vary depending on the insurance company and the terms of the policy. It’s important to review your policy documents and speak with your insurance agent or financial advisor to understand the available options and evaluate which one aligns best with your financial goals and circumstances.

It’s worth noting that policyholders are not limited to choosing a single option for their dividends. Depending on their needs and objectives, policyholders can allocate their dividends across multiple options or change their allocation over time as their circumstances evolve.

By considering the available options for using life insurance policy dividends, policyholders can make informed decisions that align with their financial goals, enhance the value of their policies, and provide greater financial security for themselves and their loved ones.

Conclusion

Life insurance policy dividends can be a valuable component of a life insurance policy, providing policyholders with additional financial benefits beyond the core coverage. Understanding the legal considerations, state regulations, tax implications, calculation methods, and options for utilizing life insurance policy dividends is essential for maximizing the value of your policy.

Throughout this article, we have explored the definition of life insurance policy dividends and how they are legally defined. We have also discussed the important legal considerations surrounding dividend distribution and how state regulations play a role in governing these distributions. Additionally, we have highlighted the tax implications of life insurance policy dividends, emphasizing the potential tax advantages and considerations to be aware of.

Moreover, we have delved into the calculation methods used by insurance companies to determine dividend distributions and examined the various options available for policyholders to utilize their dividends. These options range from cash payouts to premium reductions, paid-up additions, and the enhancement of policy flexibility. Each option provides a unique opportunity for policyholders to tailor their policies to their specific financial needs and goals.

It’s essential for policyholders to thoroughly review their policy documents and consult with their insurance agent or financial advisor to fully understand the specific terms, conditions, and available options related to their life insurance policy dividends.

In conclusion, life insurance policy dividends can greatly enhance the financial benefits of owning a life insurance policy. By having a clear understanding of how dividends are defined, legal implications, state regulations, tax considerations, calculation methods, and utilization options, policyholders can make informed decisions regarding their policies and maximize the overall value of their life insurance coverage.

Remember, managing your life insurance policy dividends effectively can contribute to your financial security and provide peace of mind for yourself and your loved ones.