Home>Finance>How Is Minimum Payment On Student Loan Calculated

Finance

How Is Minimum Payment On Student Loan Calculated

Published: February 27, 2024

Learn how the minimum payment on student loans is calculated and manage your finances effectively. Understand the factors that influence your repayment amount. Gain control of your student loan payments with expert financial guidance.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Student loans are a common means of financing higher education, enabling countless individuals to pursue their academic aspirations. However, the process of repaying these loans can be complex and daunting, especially for recent graduates who are navigating the intricacies of personal finance for the first time. One crucial aspect of managing student loan repayment is understanding the calculation of the minimum payment.

In this article, we will delve into the intricacies of minimum payment calculation for student loans, shedding light on the factors that influence this calculation and providing valuable tips for managing student loan payments effectively. By gaining a comprehensive understanding of how minimum payments are determined, borrowers can make informed decisions and take proactive steps to manage their student loan obligations responsibly.

Understanding the methodology behind minimum payment calculation is essential for borrowers seeking to maintain financial stability while repaying their student loans. Let's embark on this insightful journey to unravel the nuances of minimum payment calculation on student loans and equip ourselves with the knowledge needed to navigate the realm of student loan repayment with confidence.

Understanding Minimum Payment on Student Loans

When borrowers repay their student loans, they are typically required to make minimum monthly payments. The minimum payment amount is the lowest sum that a borrower must pay each month to fulfill their repayment obligations. Understanding the concept of minimum payments is crucial for borrowers, as it directly impacts their financial planning and budgeting.

Minimum payments are designed to ensure that borrowers make consistent progress in repaying their student loans, while also considering their financial capacity. Lenders calculate minimum payments based on various factors, including the outstanding loan balance, interest rate, and repayment term. It’s important for borrowers to grasp the significance of minimum payments, as failing to meet these obligations can result in financial penalties and negatively impact their credit score.

Moreover, comprehending the structure of minimum payments empowers borrowers to make informed decisions about their repayment strategy. By understanding how minimum payments are calculated and the implications of different payment amounts, borrowers can devise a repayment plan that aligns with their financial circumstances and long-term goals.

As we delve deeper into the intricacies of minimum payment calculation, we will explore the factors that influence these calculations and provide valuable insights into managing student loan payments effectively. By gaining a comprehensive understanding of minimum payments on student loans, borrowers can navigate the complexities of loan repayment with confidence and financial prudence.

Factors Affecting Minimum Payment Calculation

The calculation of minimum payments on student loans is influenced by several key factors, each playing a crucial role in determining the monthly repayment amount. Understanding these factors is essential for borrowers seeking to gain insight into the mechanics of minimum payment calculation and its implications on their overall financial planning.

1. Outstanding Loan Balance: The outstanding balance of the student loan directly impacts the minimum payment amount. Generally, a higher outstanding balance results in a higher minimum monthly payment. Borrowers with substantial loan balances may face larger minimum payment requirements, necessitating careful financial planning to accommodate these obligations within their budget.

2. Interest Rate: The interest rate on the student loan significantly influences the minimum payment calculation. Loans with higher interest rates typically entail larger minimum payments, as a greater portion of the payment goes towards interest accrual. Borrowers should be mindful of the impact of interest rates on their minimum payments and consider potential strategies for managing interest costs effectively.

3. Repayment Term: The duration of the repayment term also affects the minimum payment amount. Loans with shorter repayment terms often have higher minimum payments, reflecting the need to repay the loan within a compressed timeframe. Conversely, loans with longer repayment terms may feature lower minimum payments, providing borrowers with extended timelines for repayment but potentially resulting in higher overall interest costs.

4. Loan Type: The type of student loan, whether federal or private, can influence minimum payment calculations. Federal student loans typically offer more flexible repayment options, including income-driven repayment plans that consider the borrower’s income and family size when determining minimum payments. Private loans, on the other hand, may have fixed minimum payment requirements, potentially posing challenges for borrowers with fluctuating financial circumstances.

By comprehending the interplay of these factors, borrowers can gain valuable insights into the dynamics of minimum payment calculation on student loans. This understanding enables borrowers to make informed decisions about their repayment strategy and take proactive steps to manage their student loan obligations effectively.

Calculation of Minimum Payment on Student Loans

The calculation of the minimum payment on student loans is a multifaceted process that considers various financial factors to determine the monthly repayment obligation. Lenders utilize specific formulas to compute the minimum payment amount, taking into account the outstanding loan balance, interest rate, and repayment term. Understanding the methodology behind minimum payment calculation is pivotal for borrowers navigating the terrain of student loan repayment.

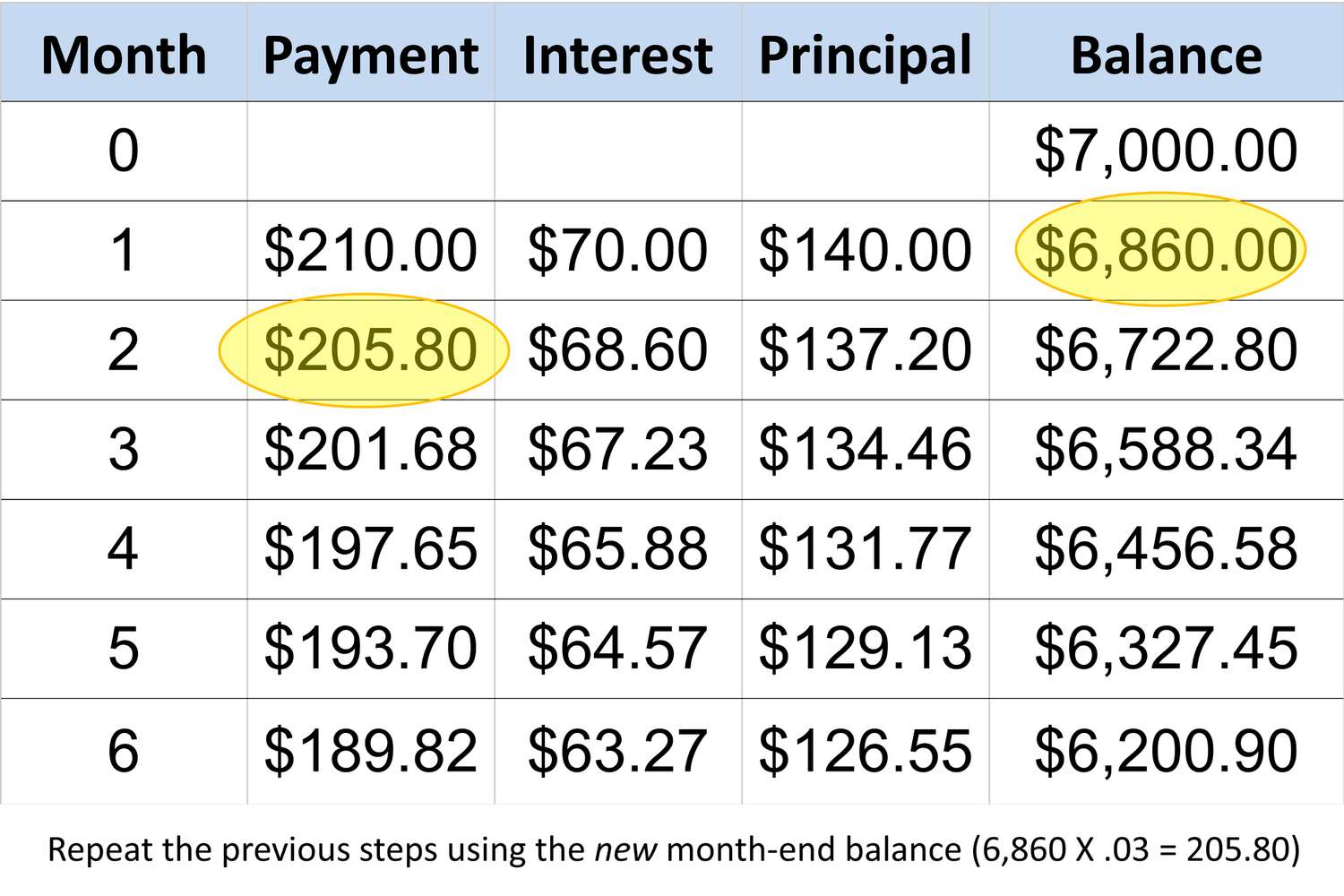

One common method for calculating minimum payments is based on a percentage of the outstanding loan balance. Lenders may stipulate a minimum payment equivalent to a certain percentage of the total loan balance, ensuring that borrowers make consistent progress in repaying the principal amount along with accrued interest. This approach aligns with the objective of facilitating steady loan repayment while considering the borrower’s financial capacity.

Moreover, the interest rate on the student loan significantly influences the minimum payment calculation. Loans with higher interest rates typically entail larger minimum payments, reflecting the higher cost of borrowing and the need to allocate a substantial portion of the payment towards interest reduction. By contrast, loans with lower interest rates may feature more manageable minimum payments, offering borrowers potential savings on interest costs.

Additionally, the repayment term plays a pivotal role in determining the minimum payment amount. Loans with shorter repayment terms often require higher minimum payments, as the borrower is expected to repay the loan within a condensed timeframe. Conversely, loans with longer repayment terms may feature lower minimum payments, providing borrowers with flexibility but potentially resulting in higher overall interest expenses.

Furthermore, federal student loans offer various repayment plans, including income-driven options that calculate minimum payments based on the borrower’s income and family size. These plans aim to align the repayment obligations with the borrower’s financial circumstances, offering a more tailored approach to minimum payment calculation. Private student loans, in contrast, may have fixed minimum payment requirements, necessitating careful financial planning to accommodate these obligations within the borrower’s budget.

By comprehending the intricacies of minimum payment calculation, borrowers can make informed decisions about their repayment strategy, budget effectively, and navigate the complexities of student loan repayment with confidence and financial prudence.

Tips for Managing Student Loan Payments

Managing student loan payments effectively is essential for borrowers seeking to maintain financial stability while repaying their educational debt. By implementing strategic approaches and proactive financial planning, borrowers can navigate the repayment process with confidence and mitigate potential challenges. Here are valuable tips for managing student loan payments:

- Understand Your Repayment Options: Familiarize yourself with the various repayment plans available for student loans, including income-driven repayment options, graduated repayment plans, and standard repayment plans. Assessing these options can help you choose a plan that aligns with your financial circumstances and provides manageable minimum payment requirements.

- Create a Realistic Budget: Develop a comprehensive budget that accounts for your essential expenses, loan payments, and savings goals. Prioritize allocating funds towards your student loan payments while ensuring that you maintain a sustainable financial lifestyle.

- Explore Loan Consolidation or Refinancing: Consider consolidating multiple student loans into a single loan with a potentially lower interest rate. Refinancing can also offer the opportunity to secure more favorable loan terms, potentially reducing your minimum payment amount and overall interest costs.

- Utilize Auto-Pay for Convenience: Enroll in automatic payment programs offered by lenders to ensure that your minimum payments are made on time each month. Many lenders provide interest rate discounts or incentives for borrowers who opt for auto-pay, offering added financial benefits.

- Communicate with Your Lender: If you encounter financial challenges or anticipate difficulty in meeting your minimum payment obligations, communicate with your lender proactively. Lenders may offer forbearance, deferment, or alternative repayment arrangements to assist you during challenging periods.

- Explore Loan Forgiveness Programs: Investigate potential eligibility for loan forgiveness programs, especially for federal student loans. Certain professions, such as public service or teaching, may offer opportunities for loan forgiveness or repayment assistance, providing relief from a portion of your student loan debt.

- Monitor Your Credit Report: Regularly review your credit report to ensure that your student loan payments are accurately reported. Maintaining a positive credit history through timely loan payments is crucial for your overall financial well-being.

By implementing these tips and adopting a proactive approach to managing student loan payments, borrowers can navigate the repayment process effectively and work towards achieving financial freedom while fulfilling their educational debt obligations.

Conclusion

Understanding the intricacies of minimum payment calculation on student loans is pivotal for borrowers as they navigate the terrain of loan repayment. By delving into the factors that influence minimum payments and the methodologies used to calculate them, borrowers gain valuable insights into managing their student loan obligations effectively.

Factors such as the outstanding loan balance, interest rate, and repayment term play crucial roles in determining the minimum payment amount. By comprehending these factors, borrowers can make informed decisions about their repayment strategy, budget effectively, and explore options for minimizing interest costs.

Moreover, proactive financial planning and strategic approaches are instrumental in managing student loan payments. By understanding repayment options, creating realistic budgets, and exploring loan consolidation or refinancing, borrowers can navigate the repayment process with confidence and mitigate potential challenges. Effective communication with lenders and exploration of loan forgiveness programs further empower borrowers to manage their student loan obligations proactively.

As borrowers strive to fulfill their educational debt obligations, maintaining open communication with lenders, monitoring credit reports, and seeking opportunities for loan forgiveness can contribute to a more sustainable and manageable repayment journey.

In conclusion, by equipping themselves with a comprehensive understanding of minimum payment calculation and implementing proactive strategies for managing student loan payments, borrowers can navigate the complexities of student loan repayment with confidence and financial prudence. This knowledge empowers borrowers to make informed decisions, maintain financial stability, and work towards achieving their long-term financial goals while repaying their student loans.