Finance

When Does AbbVie Pay Dividends?

Published: January 3, 2024

Find out the payout schedule for AbbVie dividends in this in-depth finance guide. Discover when you can expect to receive dividends from AbbVie.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to our comprehensive guide on AbbVie’s dividend payment schedule. As an investor, understanding when a company pays dividends is crucial, as it allows you to plan your financial strategy accordingly. AbbVie, a prominent pharmaceutical company, is well-known for its commitment to rewarding shareholders through regular dividend distributions. In this article, we will delve into the details of AbbVie’s dividend policy, explore its payment schedule, and discuss the factors that can influence dividend payments.

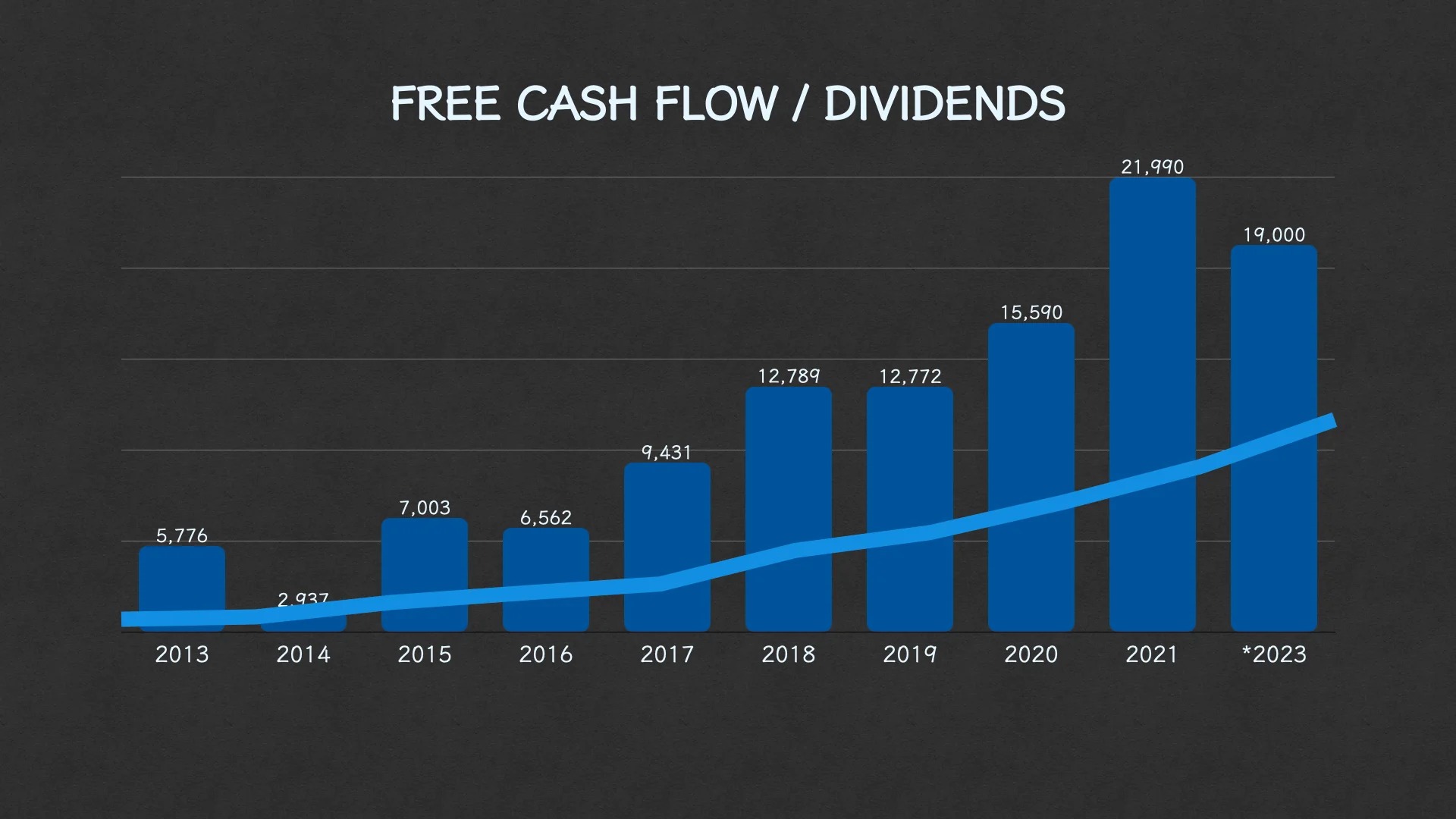

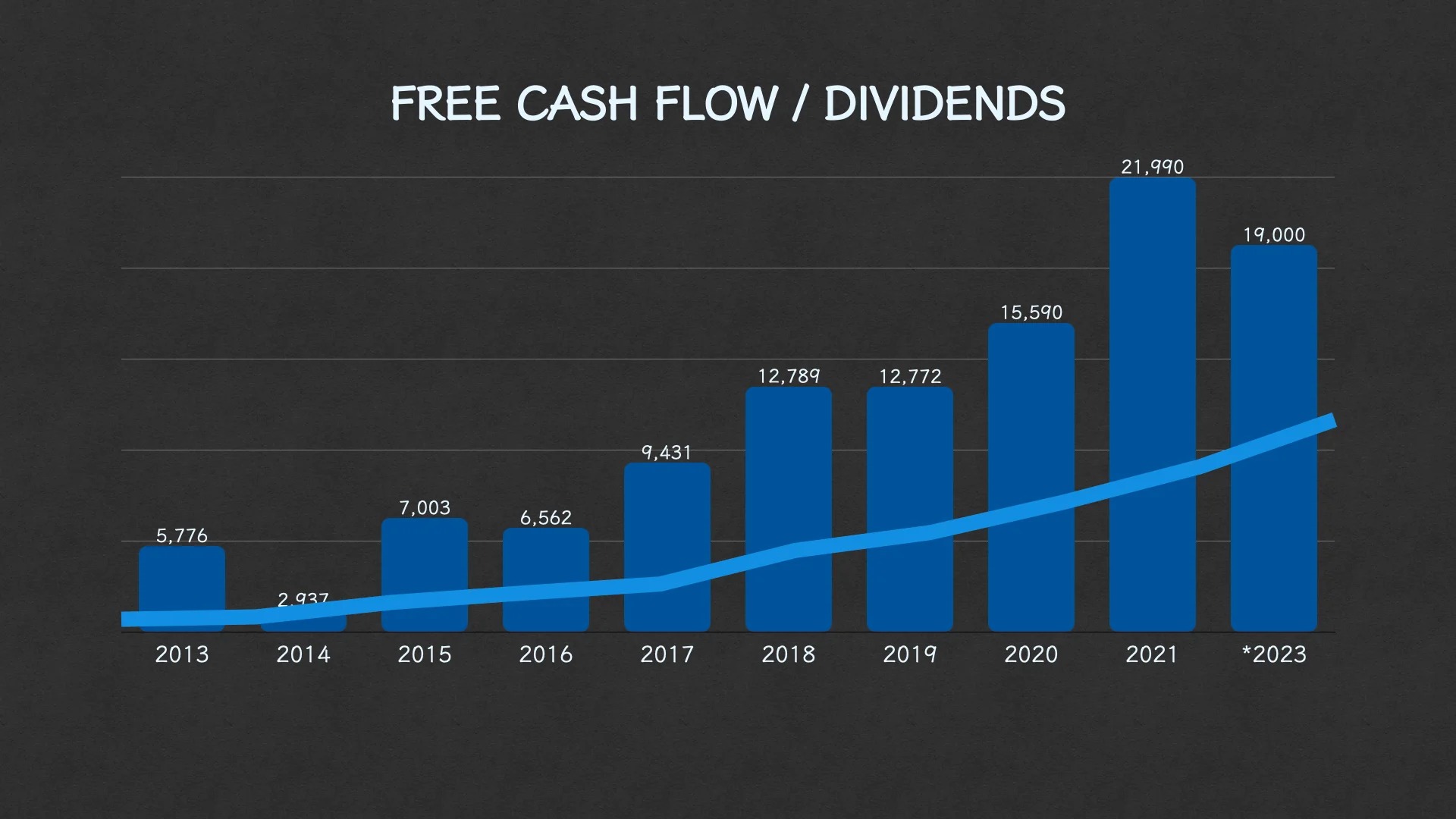

Before we dive into the specifics, let’s take a moment to briefly introduce AbbVie. Established in 2013 as a spin-off from Abbott Laboratories, AbbVie has cemented its place as a global leader in the pharmaceutical industry. The company focuses on developing and delivering innovative treatments for a wide range of diseases, including immunology, oncology, virology, and neuroscience. AbbVie’s commitment to research and development has resulted in a robust product pipeline, ensuring the company’s steady growth and financial stability.

One aspect that sets AbbVie apart from many other companies is its dedication to rewarding shareholders through regular dividend payments. This dividend policy not only reflects the company’s success but also serves as a significant benefit for investors seeking stable income from their investments.

In the following sections, we will explore AbbVie’s dividend payment schedule, including the record date, ex-dividend date, and payment date. We will also discuss the factors that can impact dividend payments, such as financial performance and market conditions. By gaining a comprehensive understanding of AbbVie’s dividend policy, you will be better equipped to make informed investment decisions and capitalize on the potential income opportunities offered by this esteemed pharmaceutical company.

AbbVie’s Dividend Policy

AbbVie has established a strong reputation for its consistent and reliable dividend payments. The company is committed to providing long-term value to its shareholders through its dividend policy, which is designed to reward investors for their trust and support.

AbbVie’s dividend policy is centered around the concept of sustainable growth. The company aims to strike a balance between reinvesting in research and development to drive innovation and returning a portion of its earnings to shareholders in the form of dividends. This approach allows AbbVie to maintain its financial stability and support its ongoing efforts to develop cutting-edge solutions for unmet medical needs.

The dividend payment is determined by AbbVie’s board of directors, who assess the company’s financial position, cash flow, future prospects, and other relevant factors. They consider shareholders’ expectations and the overall market conditions while finalizing the dividend amount.

Furthermore, AbbVie has a history of increasing its dividend payouts, demonstrating its commitment to delivering value to shareholders. The company aims to provide consistent and sustainable annual dividend growth, reflecting its confidence in its financial performance and its dedication to enhancing shareholder returns over time.

It’s important to note that while AbbVie strives to maintain a consistent dividend policy, the actual dividend payment may vary depending on various factors such as economic conditions, regulatory requirements, and corporate decisions. Investors should always refer to the company’s official dividend announcements for the most up-to-date information.

By consistently offering dividends and striving for sustainable growth, AbbVie’s dividend policy appeals to income-oriented investors who seek a reliable source of passive income from their investments. The company’s focus on shareholder value and commitment to regular dividend payments are just some of the reasons why many investors find AbbVie an attractive option in the pharmaceutical sector.

Dividend Payment Schedule

Understanding the dividend payment schedule is crucial for investors who rely on dividend income. AbbVie follows a structured schedule for dividend payments, which includes the record date, ex-dividend date, and payment date.

The record date, also known as the dividend record date, is the date on which a shareholder must be registered in the company’s books to be eligible to receive the dividend payment. This date is important because it determines who qualifies to receive the dividend. To ensure you are entitled to the dividend, you must be a shareholder of record on or before the record date.

The ex-dividend date is the date on which a stock begins trading without the dividend payment. It is typically set two business days before the record date. When a stock trades ex-dividend, the buyer is not entitled to the upcoming dividend payment, while the seller retains the right to receive the dividend. Therefore, it is essential for investors to be mindful of the ex-dividend date if they wish to receive the dividend payment.

The payment date is the date on which the company distributes the dividend to eligible shareholders. It is usually a few weeks after the record date. On the payment date, the dividend amount is credited to the shareholders’ accounts, either in the form of a direct deposit or a physical check.

AbbVie generally follows a quarterly dividend payment schedule, meaning that it distributes dividends four times a year. This regular periodic payment allows investors to receive a reliable stream of income from their investment in AbbVie.

It’s important for investors to stay updated with the specific dates for AbbVie’s dividend payments. These dates are typically announced well in advance by the company and can be found on AbbVie’s investor relations website or through other financial information sources.

By understanding and keeping track of the dividend payment schedule, investors can effectively plan their investment strategies and ensure they receive the dividend income they are entitled to. It is recommended to consult with a financial advisor or check the official dividend announcements for the most accurate and up-to-date information regarding AbbVie’s dividend payment schedule.

Record Date

The record date plays a vital role in determining which shareholders are eligible to receive dividend payments. Also known as the dividend record date, it is crucial for investors to understand this date and its significance.

The record date is set by the company’s board of directors and is typically a few days after the ex-dividend date. It represents the cut-off date for determining ownership of shares. To be eligible for the upcoming dividend payment, an investor must be listed as a shareholder of record on or before the record date.

Once the record date is established, the company’s transfer agent or registrar compiles a list of all shareholders who are entitled to receive the dividend. This list is based on the records of share ownership as of the end of the trading day on the record date. It is important to note that share transactions made after the record date do not affect an investor’s eligibility for the dividend payment.

The purpose of the record date is to provide clarity and fairness in the distribution of dividends. By establishing a specific date, the company ensures that only those shareholders who have a legitimate ownership stake in the company at that specific time receive the dividend. It helps prevent last-minute share transfers solely for the purpose of receiving the dividend, thus preserving the integrity of the distribution process.

As an investor, it is important to be aware of the record date in order to determine whether you will be eligible to receive the dividend payment. Ensuring that you are a shareholder of record on or before the record date is crucial for securing your entitlement to the dividend. It is advisable to check the company’s official announcements or consult with a financial advisor to confirm the specific record date for AbbVie’s dividend payments.

Overall, the record date serves as a critical milestone for dividend distributions. It represents the point at which shareholders are officially recognized and documented as eligible recipients of the company’s dividends. By understanding and monitoring the record date, investors can accurately assess their eligibility for dividend payments and plan their investment strategies accordingly.

Ex-Dividend Date

The ex-dividend date is an important milestone for investors as it determines whether they are entitled to receive the upcoming dividend payment. Understanding the concept and significance of the ex-dividend date is essential for those seeking to maximize their dividend income.

The ex-dividend date is typically set two business days before the record date. It marks the beginning of the period when a stock is traded without the dividend payment. Once the stock starts trading ex-dividend, the buyer of the shares is not entitled to receive the dividend, while the seller retains the right to receive the dividend payment. In other words, if an investor purchases shares on or after the ex-dividend date, they will not receive the upcoming dividend payment.

The reason behind establishing an ex-dividend date is to allow the settling of stock transactions. When an investor buys shares, there is usually a certain delay before the transaction is fully settled. By setting an ex-dividend date prior to the record date, the company ensures that only shareholders who held the stock prior to the ex-dividend date are eligible to receive the dividend. This mechanism prevents the double-dipping of dividends by sellers and buyers around the dividend distribution period.

It’s important to note that the ex-dividend date is determined by various factors, including market regulations and the rules of exchanges on which the stock is listed. It is generally announced by the company well in advance and can be found on their investor relations website or through other financial information sources.

For investors interested in receiving the dividend, it’s crucial to be aware of the ex-dividend date and plan their stock transactions accordingly. This involves buying the shares before the ex-dividend date to become eligible for the upcoming payment. As mentioned earlier, purchasing shares on or after the ex-dividend date means that the investor will not receive the dividend in that particular payment cycle.

Understanding and keeping track of the ex-dividend date allows investors to make informed decisions and optimize their investment strategy for generating dividend income. It is recommended to consult with a financial advisor or refer to official announcements to ascertain the ex-dividend date for AbbVie’s dividend payments.

By being mindful of the ex-dividend date, investors can ensure that they are eligible to receive the dividend payment and take advantage of the income opportunities provided by AbbVie’s dividend distribution program.

Payment Date

The payment date is a significant date for investors eagerly awaiting their dividend income. It represents the day when the company distributes the dividend to eligible shareholders. Understanding the payment date is crucial for investors as it allows them to plan and manage their finances accordingly.

The payment date is typically a few weeks after the record date. Once the record date has been established and the list of eligible shareholders has been finalized, the company prepares to distribute the dividend. On the payment date, the dividend amount is credited to the shareholders’ accounts or paid out in the form of physical checks, depending on the shareholder’s preference and the company’s payment procedures.

It’s important to note that the payment date is typically fixed and announced by the company in advance, allowing investors to prepare for the receipt of their dividend income. The payment date is generally consistent for each dividend payment cycle, allowing investors to anticipate when they will receive their dividends.

For investors who rely on dividend income as a source of regular cash flow, the payment date plays a crucial role in managing their finances. By knowing when the payment will be processed, investors can plan their expenses and financial obligations accordingly. Additionally, it provides clarity on when the dividend income will be available for reinvestment or other uses.

It’s worth mentioning that delays in the payment date can sometimes occur due to various reasons such as technical issues, banking processes, or extraordinary circumstances. In such cases, it’s recommended to refer to the company’s official announcements or contact the company’s investor relations department for further information and updates.

Being aware of the payment date allows investors to ensure they receive their dividend income on time and make the most of their investment strategy. It helps in effectively managing cash flow, making timely financial decisions, and maximizing the benefits of investing in dividend-paying stocks, such as AbbVie.

Overall, the payment date represents the culmination of the dividend distribution process. It is a key date for investors as it signals the actual receipt of dividend income. By staying informed about the payment date and planning accordingly, investors can effectively manage their finances and make informed decisions with regards to their investment portfolio.

Dividend Yield

Dividend yield is a key metric that allows investors to assess the income potential of a stock investment. It is calculated by dividing the annual dividend per share by the stock’s current market price. Understanding the concept of dividend yield is important for investors seeking to generate a steady stream of income from their investments.

The dividend yield is expressed as a percentage and provides valuable insights into the return on investment an investor can expect from holding a particular stock. It represents the amount of dividend income generated relative to the stock’s market price. A higher dividend yield indicates a higher potential income return, while a lower yield suggests a lower income return.

Investors often use dividend yield as a benchmark for comparing different stocks or assessing the attractiveness of dividend-paying investments. It helps in evaluating the relative income potential of various investment options and assists in making informed investment decisions.

It’s important to note that the dividend yield is subject to change based on fluctuations in the stock price and variations in the dividend payments. Market conditions, company performance, and dividend policies can all impact the dividend yield of a stock.

For investors considering an investment in AbbVie, understanding the dividend yield is crucial. AbbVie’s dividend yield can provide insights into the potential income return from holding AbbVie shares, allowing investors to assess the value and attractiveness of the investment in relation to their income objectives.

It is important to analyze the dividend yield in conjunction with other factors such as the company’s financial health, growth prospects, and dividend track record. A high dividend yield may not always indicate a favorable investment opportunity if the company’s financials are weak or if the dividend payments are not sustainable.

Investors should also be aware that dividend yield alone does not capture the entirety of an investment’s returns. Capital appreciation or depreciation of the stock’s price can greatly impact the overall returns from an investment.

Overall, dividend yield serves as a useful tool for investors to evaluate the income potential of their investments. By taking into account the dividend yield, along with other relevant factors, investors can make informed decisions and build a well-rounded investment portfolio that aligns with their income goals and risk tolerance.

Factors Affecting Dividend Payments

Dividend payments are influenced by various factors that can impact a company’s ability to distribute dividends to its shareholders. Understanding these factors is essential for investors seeking to gauge the stability and sustainability of dividend income. Let’s explore some of the key factors that can affect dividend payments:

1. Financial Performance: The financial performance of a company is a fundamental consideration when determining dividend payments. If a company is generating strong profits and has healthy cash flows, it is more likely to have the ability to distribute dividends to its shareholders. Conversely, if a company’s financial performance is weak or it faces financial challenges, dividend payments may be reduced or suspended temporarily.

2. Earnings and Cash Flow Stability: The stability of a company’s earnings and cash flow is an important factor in determining dividend payments. Companies with consistent and predictable earnings and cash flows are more likely to maintain stable dividend payments over time. On the other hand, companies operating in volatile industries or experiencing fluctuations in their earnings may have more variable dividend payments.

3. Dividend Policy: Each company establishes its own dividend policy, which guides the frequency and size of dividend payments. Some companies follow a consistent dividend payment pattern, while others may have more flexible policies that adapt to changing business conditions. It’s important for investors to understand a company’s dividend policy to assess the predictability and reliability of dividend payments.

4. Industry and Market Conditions: External factors, such as industry and market conditions, can influence dividend payments. Economic downturns or industry-specific challenges may lead companies to reduce or suspend dividend payments to conserve cash or invest in growth opportunities. Conversely, during periods of favorable economic conditions and industry growth, companies may increase their dividend payments.

5. Debt Levels and Financial Obligations: Companies with high levels of debt or significant financial obligations, such as debt repayments or capital expenditure commitments, may need to prioritize those obligations over dividend payments. High debt levels can restrict a company’s ability to distribute dividends to shareholders.

6. Regulatory Constraints: Regulatory frameworks and requirements imposed by governing bodies can impact dividend payments. Companies must comply with regulatory guidelines, which may include limitations on dividend distributions based on earnings or capital reserve requirements. Regulatory changes or restrictions can impact a company’s ability to pay dividends.

7. Future Growth Opportunities: Companies that have promising growth prospects may choose to reinvest their earnings into research and development, acquisitions, or expansion projects instead of distributing dividends. These companies may prioritize reinvesting in their business to generate long-term value and may offer lower dividend payments in the short term.

It’s important for investors to consider these factors and conduct thorough research when evaluating the potential stability and sustainability of dividend payments. By understanding the underlying factors that can affect dividend payments, investors can make informed decisions and select investments that align with their income goals and risk tolerance.

Conclusion

Understanding AbbVie’s dividend payment schedule is essential for investors seeking to maximize their income potential from their investments. AbbVie, a leading pharmaceutical company, has established a robust dividend policy and a history of rewarding its shareholders through regular dividend payments.

By grasping the concept of the record date, investors can ensure they are eligible to receive the dividend payment. The ex-dividend date serves as a critical reminder for investors to purchase shares before the ex-dividend date if they wish to receive the upcoming dividend payment. The payment date, on the other hand, represents the actual distribution of the dividend to eligible shareholders.

In addition to understanding the payment schedule, investors should consider the dividend yield as a valuable metric to evaluate the income potential of an investment. The dividend yield is calculated by comparing the annual dividend per share with the stock’s market price. It provides insights into the relative return of the investment in terms of dividend income.

Several factors can affect dividend payments, including a company’s financial performance, earnings stability, and industry conditions. It’s crucial for investors to assess these factors to gauge the stability and sustainability of dividend income.

In conclusion, AbbVie’s dividend payment schedule offers investors an opportunity to generate a regular stream of income. By understanding the key dates and factors influencing dividend payments, investors can make informed decisions and align their investment strategy with their income goals. It is important for investors to conduct thorough research, stay updated with the company’s official announcements, and consult with financial advisors to ensure they are well-informed about AbbVie’s dividend payments and make the most of their investment in this esteemed pharmaceutical company.