Finance

How Long Do Credit Card Holds Last

Modified: February 21, 2024

Discover how long credit card holds last and gain a better understanding of their impact on your finances.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of credit cards, where the power of plastic reigns supreme. Whether you use them for everyday purchases, online shopping, or emergencies, credit cards have become an indispensable financial tool for many. However, along with the convenience and perks of credit cards comes the occasional inconvenience of credit card holds.

A credit card hold, also known as an authorization hold or pre-authorization, is a temporary hold placed on your credit card by a merchant or service provider, typically when you make a purchase or reservation. This hold ensures that funds are available to cover the transaction amount, even before it is fully processed.

Understanding how long credit card holds last is crucial, as it affects the availability of your credit limit and your ability to make subsequent purchases. In this article, we will delve into the intricacies of credit card holds, exploring their duration and the factors that influence them.

Did You Know?

While credit card holds are most commonly associated with hotel bookings and car rentals, they can also occur when you dine at a restaurant, rent equipment, or even shop online.

So, how long do credit card holds actually last? The duration can vary depending on several factors, including the merchant’s policies, the type of transaction, and the payment network involved.

What is a credit card hold?

A credit card hold, also known as an authorization hold or pre-authorization, is a temporary hold placed on your credit card by a merchant or service provider. It serves as a way to ensure that funds are available to cover a transaction before it is fully processed.

When you make a purchase or reservation, the merchant requests authorization from your credit card issuer to confirm that you have sufficient funds or available credit to cover the transaction. The issuer then places a hold on the specified amount, effectively reducing your available credit limit by that amount.

During the hold period, the funds are set aside and cannot be accessed or used for other purchases. This ensures that the merchant will be paid for the transaction, even if it takes time for the actual charge to be processed. Once the transaction is finalized, the hold is released, and the funds become available again in your credit card account.

The amount of the credit card hold can vary depending on the merchant and the nature of the transaction. For example, if you check into a hotel, the hotel may place a hold for the anticipated cost of your stay, including taxes and any additional fees. Similarly, when you rent a car, the rental company may place a hold for the estimated rental fee and a security deposit.

Pro Tip: It’s important to note that a credit card hold is not the same as an actual charge. The hold is only a temporary measure to ensure the availability of funds, whereas the charge is the actual amount deducted from your credit card balance.

The duration of a credit card hold can vary widely. It may last for a few hours, a few days, or even longer, depending on various factors we will explore in the next sections. It’s important to be aware of the hold’s duration to avoid any inconvenience or potential overdrafts in your account.

How long do credit card holds last?

The duration of a credit card hold can vary depending on several factors, including the merchant’s policies, the type of transaction, and the payment network involved.

In most cases, credit card holds are released within a few days once the transaction is settled. This means that the hold is lifted, and the actual charge is processed. However, it’s essential to note that some holds may persist for an extended period or until the merchant manually releases them.

The length of a credit card hold is often influenced by the following factors:

- Type of Transaction: Certain types of transactions typically involve longer hold times. For example, hotel stays, car rentals, or cruises may have longer hold periods due to potential additional charges, damages, or potential changes to the reservation.

- Merchant’s Policies: Each merchant has the discretion to determine how long they will hold funds on a credit card. Some may release the hold quickly, while others may keep it in place until the transaction is complete or the services have been provided.

- Payment Network: The payment network used for the transaction can impact the hold duration. Different networks, such as Visa, Mastercard, or American Express, may have varying policies and processing times for releasing holds.

- Country or Region: Hold durations can also differ based on the country or region where the transaction is taking place. Local regulations and banking practices may influence the length of the hold.

It’s worth noting that even after the hold is released, it may take a few additional days for the funds to be fully available in your credit card account. This delay is typically due to the processing time required by the credit card issuer.

While there are general guidelines for credit card hold durations, it’s always best to check with the specific merchant or contact your credit card issuer for accurate and up-to-date information on hold policies and potential release times.

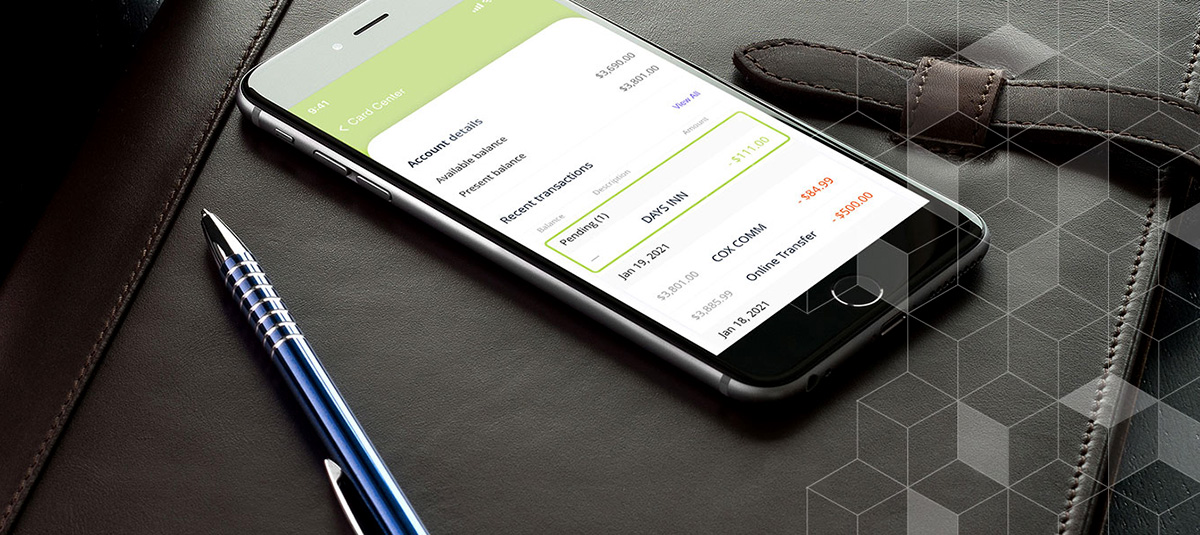

Pro Tip: Some credit card issuers provide mobile apps or online account management tools that allow you to view and track recent transactions, including any current holds on your credit card. This can help you stay informed and manage your available credit more effectively.

Factors that affect the duration of credit card holds

Several factors can influence the duration of credit card holds. Understanding these factors can help you anticipate how long a hold may last and better manage your credit card balance.

- Type of Merchant: Different types of merchants may have varying hold policies. For example, hotels, car rental agencies, and cruise lines often place longer holds due to the potential for additional charges or damages. On the other hand, quick-service restaurants or retail stores may have shorter hold durations.

- Transaction Amount: The amount of the transaction can also impact the hold duration. Larger transactions may require a longer hold period to ensure sufficient funds are available, especially if they are significantly higher than your usual spending patterns.

- Risk Assessment: Merchants or payment processors may conduct risk assessments to evaluate the likelihood of fraud. If a transaction is deemed high-risk, the hold duration may be extended to allow for additional verification or investigation.

- Merchant Category: Certain merchant categories, such as travel, hospitality, or online marketplaces, may have their own policies for hold durations, which can differ from traditional brick-and-mortar stores.

- Cardholder History: Your own credit card history can impact the hold duration. If you have a good track record of timely payments and responsible credit card usage, the hold may be released more quickly. However, if you have a history of late payments or high-risk transactions, the hold may be extended as a precaution.

- Payment Network and Issuer Policies: The specific payment network and credit card issuer can influence hold durations. Different networks may have varying guidelines, and individual issuers may have their own policies regarding how long holds should last.

It’s important to note that while you may not have control over all these factors, you can take proactive steps to minimize the impact of credit card holds. For example, you can plan ahead and budget for potential holds when traveling or engaging in activities that are likely to involve longer hold durations.

It’s also wise to stay vigilant and regularly monitor your credit card transactions and available credit. If you notice any extended holds or discrepancies, contact your credit card issuer or the merchant to clarify the situation and resolve any potential issues.

By understanding the factors that influence hold durations, you can better navigate the world of credit card transactions and ensure a smoother and more seamless financial experience.

Common scenarios where credit card holds may be extended

While credit card holds typically last for a few days, there are situations where the hold duration may be extended. These scenarios often involve certain industries or types of transactions that carry a higher risk or involve additional charges.

Here are some common scenarios where credit card holds may be extended:

- Hotels and Accommodations: When you check into a hotel, the hotel may place a hold on your credit card for the estimated cost of your stay, including taxes and any additional fees. The hold may be extended if you make any additional charges during your stay or if there are any damages to the room.

- Car Rentals: Rental car companies often place holds on credit cards to cover the rental fee and a security deposit. The hold may be extended if there are any additional charges, such as fuel charges, late fees, or damage to the rental vehicle.

- Travel and Airlines: When booking flights, hotels, or vacation packages, travel agencies or airlines may place a hold to secure the reservation. The hold may be extended in case of changes or cancellations to the itinerary.

- Restaurant Dining: Some restaurants, especially high-end establishments or those with prix fixe menus, may place a hold on your credit card to ensure payment for the meal. The hold may be extended if you add gratuity or make any additional purchases during your visit.

- Online Purchases: Certain online retailers or marketplaces may place holds on credit cards to verify the authenticity of the transaction or to secure payment for high-value purchases. The hold duration may be extended if there are any issues with the order, such as returns or disputes.

- Gas Stations: Gas stations commonly place holds on credit cards to ensure that customers have sufficient funds to cover the fuel purchase. The hold amount may be extended if you prepay for fuel or if you authorize additional purchases at the fuel station, such as snacks or car wash services.

These are just a few examples of scenarios where credit card holds may be extended. It’s important to be aware of these possibilities and to budget accordingly, especially if you anticipate engaging in activities or transactions that fall into these categories.

Keep in mind that while the hold may be extended, it will eventually be released once the merchant finalizes the transaction and resolves any outstanding charges or issues. However, it’s always a good idea to check with the specific merchant or contact your credit card issuer for more information about hold durations in these particular scenarios.

Tips for managing credit card holds

While credit card holds are a temporary inconvenience, there are several tips and strategies you can employ to effectively manage them and minimize any potential disruption to your finances:

- Plan Ahead: If you know you’ll be engaging in activities that commonly involve credit card holds, such as hotel stays or car rentals, plan your budget accordingly. Set aside funds or additional available credit to account for these holds to avoid any unexpected financial strain.

- Monitor Your Credit Card: Regularly check your credit card statements and account activity. Stay vigilant for any unauthorized charges or extended holds that may indicate fraudulent activity. If you notice any discrepancies, contact your credit card issuer immediately.

- Keep Track of Holds: Make a note of any credit card holds you’re aware of, along with their expected release dates. This will help you plan your spending and ensure that you don’t inadvertently exceed your available credit due to holds.

- Communicate with Merchants: If a credit card hold appears to be lasting longer than anticipated, especially in situations like hotel stays or car rentals, contact the merchant to inquire about the hold’s status and request its release if appropriate.

- Opt for Debit or Cash Payments: In some cases, using a debit card or cash can be an alternative to using a credit card with potential holds. Consider using these payment methods in situations where the hold duration may be a concern.

- Report Holds to Credit Card Issuer: If you believe a hold is unfair or incorrect, contact your credit card issuer and explain the situation. They may be able to assist you with resolving the hold or providing further clarification.

- Build a Good Credit History: Maintaining a positive credit card payment history and responsible credit card usage can help improve your relationship with credit card issuers. Over time, this can potentially lead to shorter hold durations as issuers trust your financial behavior.

- Be Mindful of Available Credit: Remember that a credit card hold reduces your available credit limit. Be conscious of your remaining credit to avoid potential declines or over-spending on future transactions.

By implementing these tips, you can better manage credit card holds and mitigate any potential inconveniences. Stay informed, communicate with merchants and your credit card issuer when necessary, and practice responsible credit card usage to ensure a smooth and hassle-free financial experience.

Conclusion

Understanding how credit card holds work and how long they last is an important aspect of managing your finances effectively. While credit card holds can be an inconvenience, being knowledgeable about their duration and the factors that influence them can help you navigate the world of credit card transactions with greater ease.

We’ve explored what credit card holds are, how long they typically last, and the factors that can affect their duration. From hotels and car rentals to online purchases and restaurant dining, various scenarios can lead to extended hold periods. By planning ahead, monitoring your credit card activity, and staying in communication with merchants and your credit card issuer, you can better manage credit card holds and maintain control over your available credit.

Remember to stay vigilant, keep track of holds, and report any suspicious or incorrect holds to your credit card issuer promptly. Building a positive credit history through responsible credit card usage can help improve your relationship with credit card issuers over time and potentially lead to shorter hold durations.

Managing credit card holds is just one aspect of maintaining financial well-being. By combining knowledge, responsible spending habits, and regular monitoring, you can optimize your credit card usage and experience the full benefits and convenience they offer.

Ultimately, your credit card is a valuable tool that, when used wisely, can contribute to a more seamless and efficient financial life. By staying informed and following the tips outlined in this article, you can confidently navigate credit card holds and make the most of your credit card experience.