Finance

How Long Does A Pension Last

Modified: February 21, 2024

Discover how long a pension can last and gain valuable insights into personal finance strategies for maximizing your retirement income.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Retirement is a significant milestone in one’s life, representing the culmination of years of hard work and the beginning of a new chapter. One of the key concerns for retirees is ensuring that their retirement savings, particularly their pension, will last for the duration of their retirement years. While the specific duration of a pension can vary widely depending on various factors, it is essential to have a clear understanding of how long a pension can last and what influences its longevity.

Several factors can affect the duration of a pension. These factors include the pension payout options chosen by the retiree, life expectancy, the impact of inflation, and strategies for managing finances in retirement. Understanding these factors and taking appropriate steps can help retirees ensure their pension lasts as long as possible, providing a stable and comfortable income throughout their retirement.

In this article, we will explore the key factors that influence the duration of a pension and discuss strategies that retirees can employ to make their pension last longer. Additionally, we will emphasize the importance of financial planning and seeking professional advice to ensure a secure and enjoyable retirement.

So, if you are approaching retirement or are already retired and wondering how long your pension will last, read on to gain insights on how to make the most of your retirement savings.

Factors Affecting the Duration of a Pension

Several factors play a crucial role in determining the duration of a pension. By understanding and taking these factors into account, retirees can make informed decisions that help maximize the longevity of their pension. Let’s explore the key factors below:

- Retirement age: The age at which you retire can significantly impact the duration of your pension. If you retire early, your pension may need to stretch over a longer period, potentially reducing its duration. On the other hand, if you continue working beyond the traditional retirement age, you may be able to delay accessing your pension, allowing it to grow and potentially last longer.

- Investment performance: The performance of your pension investments can greatly influence its duration. If your investments generate attractive returns, your pension may last longer. Conversely, poor investment performance could deplete your pension sooner than expected. Diversifying your investments and regularly reviewing their performance can help mitigate risks and increase the chances of your pension lasting longer.

- Withdrawal rate: The rate at which you withdraw funds from your pension can have a significant impact on its duration. Withdrawing a higher percentage of your pension each year may deplete it more quickly. Experts often recommend the “4% rule,” wherein retirees withdraw 4% of their pension annually, adjusting for inflation. Adhering to a sustainable withdrawal rate can help ensure your pension lasts throughout your retirement.

- Pension payout options: The payout options you choose can influence how long your pension lasts. You may opt for a fixed monthly payout, a lump sum, or a combination thereof. Each option has its pros and cons in terms of longevity. A fixed monthly payout provides a steady income, but it may not account for inflation. Conversely, a lump sum may offer more flexibility but requires careful financial planning to ensure it meets your long-term needs.

- Healthcare costs: Healthcare expenses can pose a significant threat to the duration of your pension. As healthcare costs continue to rise, it is essential to factor in potential medical expenses when estimating how long your pension will last. Obtaining comprehensive health insurance coverage and exploring options like long-term care insurance can help alleviate the financial burden of healthcare costs and preserve your pension.

By considering these influential factors and carefully planning your retirement finances, you can enhance the longevity of your pension and enjoy a secure financial future in your retirement years.

Pension Payout Options

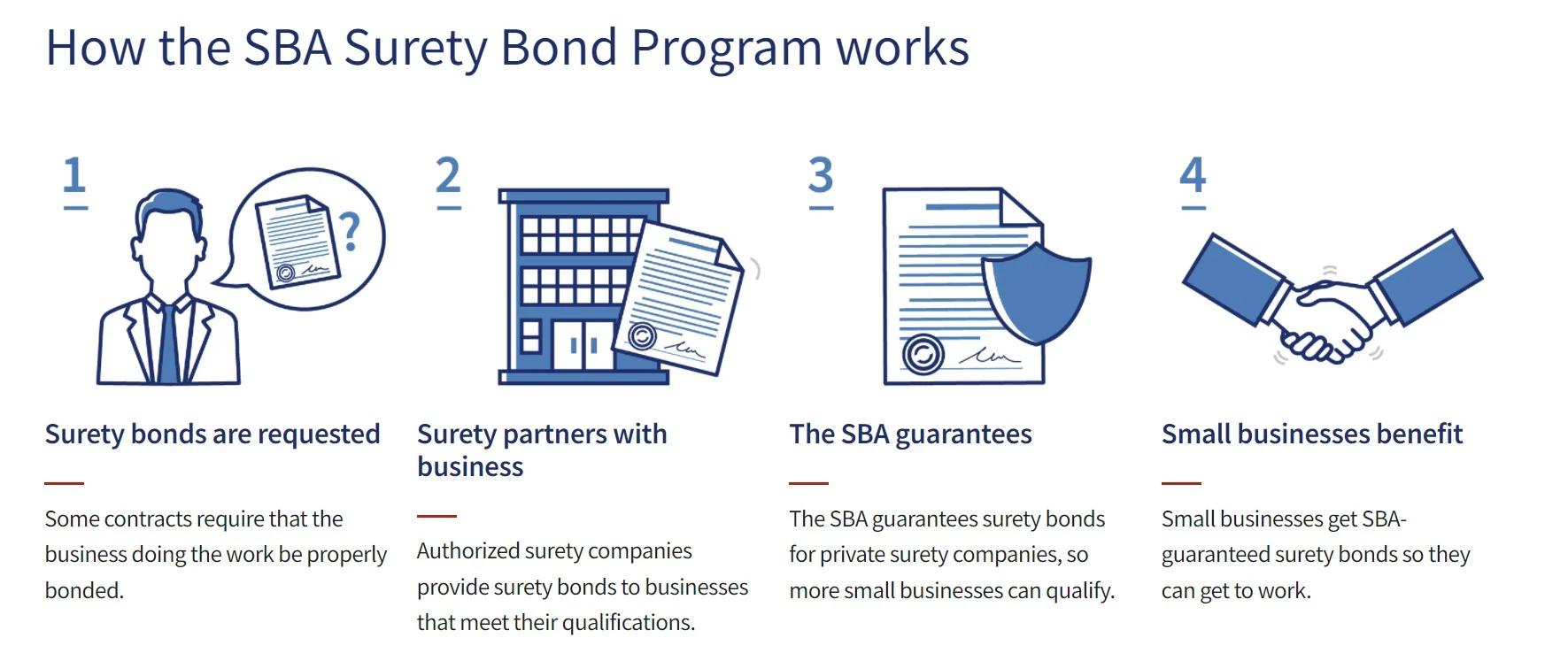

When it comes to ensuring the duration of a pension, the choice of payout options is a crucial decision that retirees must make. The payout options chosen can greatly impact how long a pension lasts and the financial flexibility it provides. Let’s explore some common pension payout options:

- Single Life Annuity: With this option, the retiree receives a fixed monthly income for the rest of their life. However, upon the retiree’s death, the payments cease, and there are no benefits for a surviving spouse or dependents. While this option provides the maximum monthly payout, it may not be suitable for retirees with dependents or those concerned about leaving a financial legacy.

- Joint and Survivor Annuity: This option ensures that the retiree and their spouse receive a reduced monthly income during their lifetime. When one spouse passes away, the surviving spouse continues to receive a portion of the pension. While the initial monthly payout may be lower than a single life annuity, this option offers financial protection for surviving spouses.

- Guaranteed Period Annuity: With this option, the retiree receives a fixed monthly income for a specified period, typically ranging from 5 to 20 years. If the retiree passes away before the end of the guaranteed period, the remaining payouts are directed to a designated beneficiary. This option provides a level of financial security for both the retiree and their beneficiaries.

- Lump Sum Payment: Instead of receiving a monthly payout, retirees may choose to receive their pension as a lump sum payment. This option provides the greatest amount of flexibility, allowing retirees to invest or use the funds as they deem fit. However, careful financial planning is crucial to ensure the lump sum lasts for the duration of retirement.

It is important to carefully evaluate the advantages and disadvantages of each pension payout option and consider your personal circumstances and financial objectives. Consulting with a financial advisor who specializes in retirement planning can help you make an informed decision that aligns with your goals and ensures the longevity of your pension.

Life Expectancy and Pension Duration

Life expectancy plays a significant role in determining how long a pension will last. With advancements in healthcare and improvements in overall well-being, people are living longer than ever before. It is essential to consider life expectancy when planning for retirement and estimating the duration of a pension.

Retirees need to account for the possibility of living well into their 80s, 90s, or even beyond. This means that their pension may need to provide income for several decades. Failing to consider a longer life expectancy can result in a pension shortfall later in retirement.

Factors such as gender, family medical history, lifestyle choices, and socio-economic factors can influence an individual’s life expectancy. However, it is crucial to take a realistic and conservative approach when estimating how long a pension will need to last.

Fortunately, there are steps you can take to ensure that your pension aligns with your lifestyle and individual life expectancy:

- Regularly review your retirement plan: Keeping track of your retirement savings and monitoring their performance can help ensure that your pension remains on track to support your desired lifestyle throughout retirement. Reviewing your plan regularly with a financial advisor can help you make adjustments as needed.

- Consider longevity insurance: Longevity insurance, also known as a deferred income annuity, provides an additional source of income that begins at a pre-determined age, typically in advanced years. This type of insurance protects against the risk of outliving your retirement savings and can provide peace of mind that your pension will last as long as you do.

- Stay healthy and active: Leading a healthy lifestyle can contribute to a longer life expectancy. By maintaining a balanced diet, engaging in regular exercise, and taking preventative measures for optimal health, you can increase the chances of your pension lasting longer.

- Consider family history: If you have a family history of longevity, it is important to factor that into your retirement planning. Genetic factors can provide insights into potential life expectancy and help you make more accurate projections for the duration of your pension.

By considering life expectancy and incorporating it into your retirement planning, you can make more informed decisions that ensure your pension lasts throughout your retirement years, providing the financial security and peace of mind you deserve.

Impact of Inflation on Pension Longevity

Inflation is an important factor that can significantly impact the longevity of a pension. Over time, the cost of goods and services tends to rise, eroding the purchasing power of your pension income. As a result, it becomes crucial to consider the impact of inflation and take steps to protect your pension against its effects.

When estimating how long a pension will last, it is essential to factor in inflation and account for the increasing cost of living. Failing to consider inflation can lead to a gradual reduction in the real value of your pension over time, potentially causing financial challenges in later years of retirement.

There are a few strategies you can employ to mitigate the impact of inflation:

- Choose inflation-adjusted payout options: Some pension plans offer inflation-adjusted payout options, meaning that the pension income increases annually to account for the rising cost of living. Opting for such a payout option can help ensure your pension maintains its purchasing power over the long term.

- Invest in assets that outpace inflation: Consider investing a portion of your pension savings in assets that have historically outperformed inflation, such as stocks or real estate. By generating returns that exceed inflation, you can help offset the erosion of purchasing power caused by inflation.

- Periodically review and adjust your retirement plan: Regularly evaluate your retirement plan to ensure it accounts for inflation. Consider working with a financial advisor who can help you make necessary adjustments to your savings and investment strategy to accommodate the rising cost of living.

- Stay informed about inflation trends: Keep up with economic news and trends to stay informed about inflation rates and how they may impact your pension. By being aware of inflationary pressures, you can make better-informed decisions about your retirement finances.

By incorporating inflation into your retirement planning and taking proactive measures to protect against its effects, you can enhance the longevity of your pension and maintain your standard of living throughout retirement.

Strategies for Making a Pension Last Longer

Retirees often have a common concern – making their pension last as long as possible. To ensure a secure and comfortable retirement, implementing effective strategies is crucial. Here are some strategies to help maximize the longevity of your pension:

- Create a realistic budget: Develop a comprehensive budget that outlines your essential expenses and discretionary spending. This will help you manage your pension income effectively and ensure that you live within your means throughout retirement.

- Minimize debt: Entering retirement with high levels of debt can put a strain on your pension income. Strive to pay off debts, such as credit cards and mortgages, before retirement, as this will free up more of your pension to cover essential expenses.

- Consider part-time or freelance work: If feasible, exploring part-time or freelance work during retirement can provide additional income and reduce the reliance solely on your pension. Not only can it extend the lifespan of your pension, but it can also keep you engaged and purposeful during retirement.

- Adjust withdrawal rates: Review your withdrawal rate regularly and adjust it based on your financial circumstances and market conditions. During periods of economic downturn, it may be prudent to reduce your withdrawal rate to preserve the longevity of your pension.

- Delay claiming Social Security benefits: If possible, consider delaying your Social Security benefits until full retirement age or even beyond. Delaying benefits can result in higher monthly payments, providing a valuable source of income later in retirement.

- Implement tax-efficient strategies: Work with a tax professional to identify and implement tax-efficient strategies that can minimize the tax burden on your pension income. This can help stretch your pension further and increase the duration of your retirement savings.

- Regularly reassess your investment portfolio: Review and rebalance your investment portfolio periodically to ensure it aligns with your risk tolerance and retirement goals. A well-diversified portfolio with a mix of growth and income assets can help generate sustainable returns and maximize the duration of your pension.

- Stay informed and adapt: Stay up-to-date on financial news, economic trends, and changes in retirement legislation. Being informed allows you to adapt your strategies and make informed decisions that can extend the lifespan of your pension.

Remember, making your pension last longer requires a comprehensive approach, combining careful budgeting, effective investment management, and strategic decision-making. By implementing these strategies, you can strive for a financially secure and fulfilling retirement.

Importance of Financial Planning for Retirement

Financial planning is essential for a secure and comfortable retirement. It involves assessing your financial situation, setting realistic goals, and implementing strategies to accumulate and manage the necessary funds for retirement. Here are some reasons why financial planning is crucial for a successful retirement:

- Setting retirement goals: Financial planning allows you to define your retirement goals and identify the lifestyle you desire. By articulating your goals, you can develop a clear roadmap to achieve them and make informed decisions about saving, investing, and spending during your working years.

- Estimating retirement expenses: Financial planning helps you understand and estimate your future expenses during retirement. It involves analyzing your current expenses, factoring in inflation, and accounting for healthcare costs, travel, hobbies, and other activities. By accurately estimating your retirement expenses, you can determine how much you need to save and ensure your pension lasts for the duration of your retirement.

- Saving and investing for retirement: A well-designed financial plan helps you determine how much you should save and how to allocate your investments to achieve your retirement goals. It takes into account your risk tolerance, time horizon, and expected returns. By following a disciplined saving and investment strategy, you can accumulate the necessary funds to support your retirement lifestyle.

- Managing retirement income: Financial planning plays a crucial role in managing your retirement income from various sources, such as pensions, Social Security, and personal savings. It helps you make informed decisions about when to start receiving benefits, which payout options to choose, and how to optimize taxes, ensuring a steady and sustainable income throughout retirement.

- Minimizing financial risks: Retirement comes with various financial risks, such as market volatility, inflation, longevity, and healthcare costs. A robust financial plan helps mitigate these risks by diversifying investments, accounting for inflation, and considering insurance options like long-term care coverage. Minimizing financial risks helps protect your pension and ensures your financial security in retirement.

- Adapting to changes: Financial planning is an ongoing process that adapts to changes in your life circumstances and external factors. It allows you to adjust your strategies as needed, whether it’s due to changes in income, unexpected expenses, or shifts in the economic landscape. Regularly reviewing and updating your financial plan ensures that it remains relevant and effective in helping you achieve your retirement goals.

Financial planning for retirement is not a one-time task but a continuous process that evolves as you progress through different life stages. Seeking professional guidance from a certified financial planner can provide invaluable expertise and ensure that your financial plan aligns with your retirement goals and adapts to changing circumstances. With proper financial planning, you can have the peace of mind knowing that your pension and other income sources will support you throughout your retirement years.

Conclusion

Planning for the duration of a pension is a vital aspect of retirement preparation. Understanding the factors that influence pension longevity and implementing effective strategies can help ensure a stable and comfortable income throughout your retirement years. By considering factors such as retirement age, investment performance, withdrawal rates, and pension payout options, you can make informed decisions that enhance the longevity of your pension.

Accounting for life expectancy and the impact of inflation is crucial when estimating how long a pension will last. By incorporating these factors into your retirement planning, you can make realistic projections and take steps to protect your pension against inflationary pressures.

Implementing strategies to make your pension last longer, such as creating a realistic budget, minimizing debt, adjusting withdrawal rates, and staying informed about economic trends, can go a long way in ensuring the financial security of your retirement.

Furthermore, recognizing the importance of financial planning for retirement is essential. Developing a comprehensive financial plan helps set clear retirement goals, estimate expenses, save and invest effectively, manage income sources, and minimize financial risks. Regularly reviewing and adapting your financial plan allows for adjustments as life circumstances change.

Seeking professional guidance from a financial advisor who specializes in retirement planning can provide valuable insights and expertise, ensuring your financial plan is tailored to your individual needs and goals.

In conclusion, by understanding the factors that affect the duration of a pension and implementing effective strategies, combined with comprehensive financial planning, you can maximize the longevity of your pension and enjoy a secure and fulfilling retirement.