Finance

How Long Do Credit Card Authorizations Last

Modified: December 29, 2023

Discover how long credit card authorizations last in the world of finance. Gain insights on the duration and implications of these authorizations.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of credit cards, where financial transactions have never been easier. When making a purchase with a credit card, you might have noticed a process called “credit card authorization.” But have you ever wondered what it actually means? In this article, we will explore the concept of credit card authorizations, their duration, and the factors that can influence their length.

A credit card authorization is a preliminary transaction that confirms whether a credit card has sufficient funds available to cover a purchase. It ensures that the account holder is capable of completing the transaction and reduces the risk of fraudulent activity.

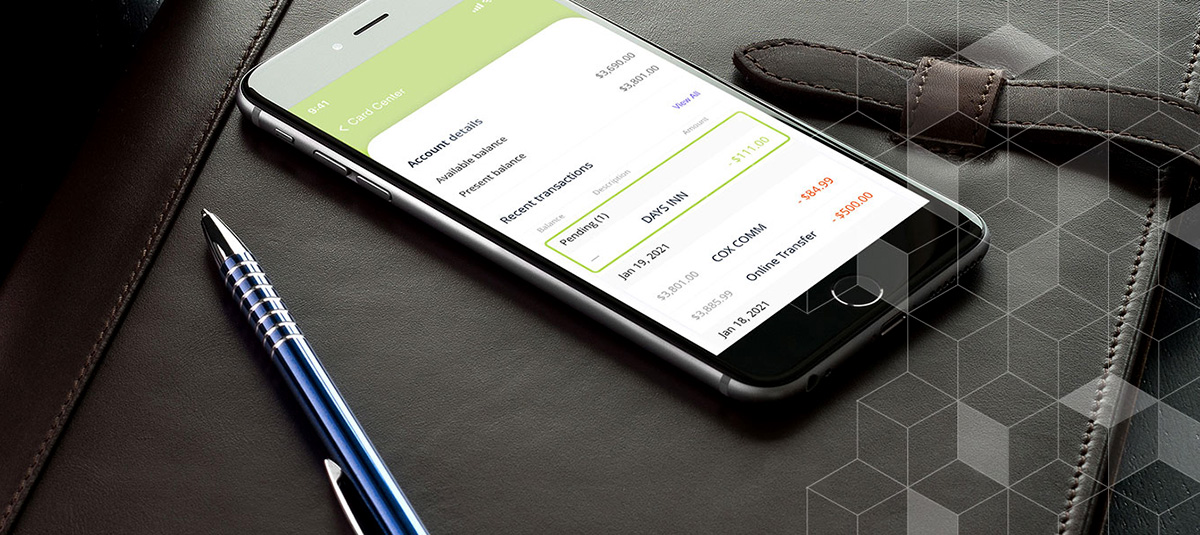

As a consumer, you may have experienced credit card authorizations when making online purchases or checking into a hotel. These authorizations serve as a temporary hold on funds in your credit card account, typically reserving the amount of the purchase plus a possible additional amount for potential tips or incidental expenses.

Now, you might be wondering, how long do credit card authorizations typically last? Well, let’s dive into the next section to find out!

What is a credit card authorization?

A credit card authorization is a process that occurs when a merchant requests approval from the card issuer to ensure that a credit card has sufficient funds available for a purchase. It acts as a security measure to protect both the merchant and the cardholder.

When you make a purchase with your credit card, the merchant submits a request to the payment processor or acquiring bank for an authorization. This request includes details such as the card number, expiration date, and transaction amount. The acquiring bank then communicates with the card issuer to verify the funds and check for any suspicious activity or account restrictions.

If the credit card authorization is successful, the card issuer places a temporary hold on the authorized amount, reducing the available credit limit on the cardholder’s account. This hold ensures that the funds are reserved for the merchant to process the transaction. However, it is important to note that a credit card authorization does not guarantee that the transaction will be completed or that the funds will be transferred to the merchant.

The duration of a credit card authorization varies depending on several factors, including the type of transaction and the policies of the card issuer. In general, credit card authorizations can last from a few hours to several days.

During this period, the authorized funds are unavailable for other purchases or withdrawals, but they are not yet transferred to the merchant. This temporary hold allows the card issuer to review the transaction details and address any potential issues or discrepancies before finalizing the transfer of funds.

Credit card authorizations are commonly used in various industries, including retail, hospitality, and e-commerce. They play a crucial role in ensuring the validity and security of transactions, minimizing the risk of fraud or insufficient funds.

Now that we have a good understanding of what credit card authorizations are, let’s explore how long they typically last.

How long do credit card authorizations typically last?

The duration of a credit card authorization can vary depending on several factors, including the policies of the card issuer and the type of transaction involved. In general, credit card authorizations can last from a few hours to several days.

For in-person transactions at physical stores, such as retail purchases or dining at a restaurant, credit card authorizations often last for a shorter period of time. Typically, these authorizations are held for a few hours or until the merchant submits the final transaction information for settlement. This allows for a swift processing of the purchase and a quick release of the hold on the authorized funds.

On the other hand, online transactions or purchases made over the phone may have longer-lasting credit card authorizations. This is because these types of transactions may require additional verification steps to ensure security and prevent fraud. In such cases, the authorization hold on the funds may last for a few days to allow for any necessary investigations or resolution of any potential issues.

Another factor that can impact the duration of credit card authorizations is the type of merchant involved. For example, in the hospitality industry, such as hotels or car rental companies, credit card authorizations may have longer durations. This is because these merchants often need to ensure that they have secured funds to cover any potential incidentals or damages that may occur during the customer’s stay or rental period.

It’s important to note that while credit card authorizations may last for a certain period, the holds on the authorized funds can be released before that time if the transaction is completed and settled. The time it takes for the hold to be released and the funds to become available again in the cardholder’s account can vary depending on the card issuer’s policies.

Furthermore, if a merchant does not submit the final transaction information for settlement within a reasonable timeframe, the credit card authorization may expire, and the hold on the funds will be released automatically.

It’s essential for cardholders to keep track of their credit card activity to ensure that unauthorized holds are addressed promptly. If you notice a credit card authorization that has been held for an extended period or if you encounter any issues with the release of funds, it’s recommended to contact your credit card issuer for assistance and clarification.

Now that we have explored the typical durations of credit card authorizations, let’s delve into the factors that can influence their length.

Factors affecting the duration of credit card authorizations

Several factors can influence the duration of credit card authorizations. Understanding these factors can help merchants and consumers better navigate the authorization process and avoid any inconveniences or misunderstandings.

1. Merchant Industry and Policies: Different industries may have varying authorization hold periods. For example, hotels and car rental companies often place longer holds to account for potential incidentals or damages. On the other hand, retail stores and restaurants may have shorter hold periods to ensure a smooth transaction process.

2. Transaction Type: The type of transaction being made can impact the duration of the credit card authorization. In-person transactions at physical stores may have shorter hold periods, while online or phone transactions may require more verification and have longer holds. Additionally, recurring payments or installment plans may have extended authorization periods due to the ongoing nature of the transaction.

3. Transaction Amount: The amount of the transaction can also affect the duration of the credit card authorization. Larger purchases may necessitate additional scrutiny and extended hold periods to ensure sufficient funds and prevent fraudulent activity.

4. Card Issuer Policies: Each credit card issuer has its own policies regarding authorization holds. These policies can dictate how long the hold remains in place and when the funds will be released. It is essential to be aware of the card issuer’s policies to anticipate the duration of an authorization hold.

5. Cardholder Account Standing: The account standing of the cardholder can impact the duration of the authorization hold. If there are any concerns regarding the cardholder’s account, such as a recent missed payment or suspected fraudulent activity, the card issuer may choose to hold the funds for a longer period for further investigation.

6. Communication and Settlement Speed: The efficiency of communication between the merchant, payment processor, acquiring bank, and card issuer can affect the speed at which the credit card authorization is processed and settled. Delays in the settlement process may result in longer authorization holds.

It’s important for both merchants and consumers to be aware of these factors and set the right expectations regarding the duration of credit card authorizations. Merchants should provide clear information to customers about the hold period, and consumers should closely monitor their credit card activity to ensure timely release of any authorization holds that are no longer required.

Next, let’s explore some best practices for both merchants and consumers to navigate the credit card authorization process effectively.

Best practices for merchants and consumers

Both merchants and consumers play crucial roles in ensuring a smooth and efficient credit card authorization process. By following best practices, they can minimize any potential issues or delays and facilitate a positive experience for all parties involved.

For Merchants:

- Provide Clear and Transparent Information: Merchants should clearly communicate their authorization hold policies to customers. This includes informing them about the duration of the hold, any additional charges that may be included in the authorization, and the process for releasing the hold.

- Promptly Submit Final Transaction Information: Merchants should strive to submit the final transaction information for settlement as soon as possible. This helps expedite the release of the hold on authorized funds and minimizes any inconvenience for the cardholder.

- Ensure Accurate Transaction Amount: It’s essential for merchants to accurately input the transaction amount during the authorization process to avoid any over or under-charging issues. Double-checking the amount entered and verifying it with the customer can help prevent disputes and delays in releasing the hold.

- Proactively Address Customer Concerns: If a customer expresses concern or confusion about the credit card authorization process, merchants should provide clear explanations and reassurance. Being responsive and addressing customer questions can help build trust and enhance the overall customer experience.

- Maintain Efficient Communication: Establishing effective communication channels with the payment processor and acquiring bank can help address any potential issues or delays in the authorization and settlement process. Promptly resolving any communication or technical issues ensures a smooth flow of transactions.

For Consumers:

- Monitor Credit Card Activity: Regularly check your credit card account for any unauthorized or unexpected charges. If you notice any discrepancies or extended authorization holds, contact your card issuer immediately to address the issue.

- Understand Authorization Policies: Familiarize yourself with your credit card issuer’s policies regarding authorization holds. Knowing the typical duration of holds and any specific requirements can help you plan your spending and avoid any surprises.

- Plan for Holds: If you know you will be making a large purchase or using your credit card for a specific purpose, such as travel or car rental, anticipate the potential for authorization holds. Ensure that you have sufficient available credit or funds to cover the potential hold amount.

- Keep Communication Channels Open: If you have any questions or concerns about a credit card authorization, reach out to the merchant or your card issuer for clarification. It’s better to address any issues proactively rather than waiting for potential problems to arise.

- Review Transaction Details: Before finalizing a purchase, review the transaction details, including the amount and any additional charges. This can help prevent any errors or discrepancies that may lead to extended authorization holds or disputes.

By following these best practices, both merchants and consumers can navigate the credit card authorization process smoothly and efficiently. It ensures transparency, reduces potential disputes, and contributes to a positive experience for all parties involved.

Now, let’s conclude our article on credit card authorizations.

Conclusion

Credit card authorizations are an integral part of the financial transaction process, ensuring that merchants receive payment for purchases and protecting consumers from fraudulent activities. Understanding the duration and factors that influence credit card authorizations is essential for both merchants and consumers to navigate the process smoothly.

We have learned that credit card authorizations typically last from a few hours to several days, depending on the transaction type, merchant policies, and card issuer regulations. In-person transactions often have shorter authorization durations, while online or phone transactions may require more verification and have longer holds.

Factors such as the merchant’s industry, transaction amount, and cardholder account standing can also impact the length of credit card authorizations. Additionally, efficient communication and prompt submission of final transaction information play a vital role in expediting the release of authorization holds.

Merchants should aim to provide clear and transparent information to customers, promptly submit final transaction details, and ensure accurate transaction amounts. Meanwhile, consumers should monitor their credit card activity, understand authorization policies, plan for potential holds, and keep communication channels open with both merchants and card issuers.

By following these best practices, merchants can provide a positive customer experience, and consumers can take proactive steps to avoid any disruptions or surprises in the credit card authorization process.

In conclusion, credit card authorizations serve as a necessary security measure in today’s digital economy. Their duration may vary, but by understanding the process and adhering to best practices, merchants and consumers can ensure a smooth and secure financial transaction experience.

So the next time you make a purchase, you can approach credit card authorizations with confidence, knowing that they play a vital role in safeguarding your financial interests.