Home>Finance>How Long Do I Have To Get Insurance On A New Car?

Finance

How Long Do I Have To Get Insurance On A New Car?

Published: November 16, 2023

Looking to finance a new car? Find out how long you have to get insurance on a new vehicle and protect your investment.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

So, you’ve just purchased a brand-new car – congratulations! One of the most important things you need to do after buying a new car is to get insurance coverage. Adequate insurance protection is not only a legal requirement in most states, but it also provides financial security and peace of mind in case of an unforeseen accident or damage to your vehicle.

However, you might be wondering, “How long do I have to get insurance on a new car?” The answer to this question can vary depending on several factors, including state requirements and your specific circumstances. In this article, we will explore the different factors to consider when getting insurance for a new car, the state requirements you need to comply with, and the steps you can take to ensure you have the right coverage.

It’s important to note that obtaining insurance for a new car should be a top priority. Driving without insurance can lead to serious consequences, including hefty fines, license suspension, and even legal issues. To protect yourself, your investment, and others on the road, it’s essential to get insurance coverage for your new vehicle as soon as possible.

Now, let’s dive into the factors you should consider when determining how long you have to get insurance on a new car.

Factors to Consider

When it comes to getting insurance on a new car, several factors come into play. Understanding these factors will help you make informed decisions and ensure adequate coverage. Here are some key factors to consider:

- State Requirements: Each state has its own minimum insurance requirements. It’s crucial to know the specific coverage limits mandated by your state. These requirements typically include liability insurance, which covers damages to others if you are at fault in an accident. Some states may also require additional coverage, such as personal injury protection (PIP) or uninsured/underinsured motorist coverage. Familiarize yourself with your state’s requirements to ensure compliance.

- Financing or Leasing: If you purchased your new car through financing or are leasing it, the lender or leasing company may have specific insurance requirements. They may require comprehensive and collision insurance in addition to liability coverage to protect their financial interest in the vehicle. Be sure to check with your lender or leasing company to understand their insurance requirements.

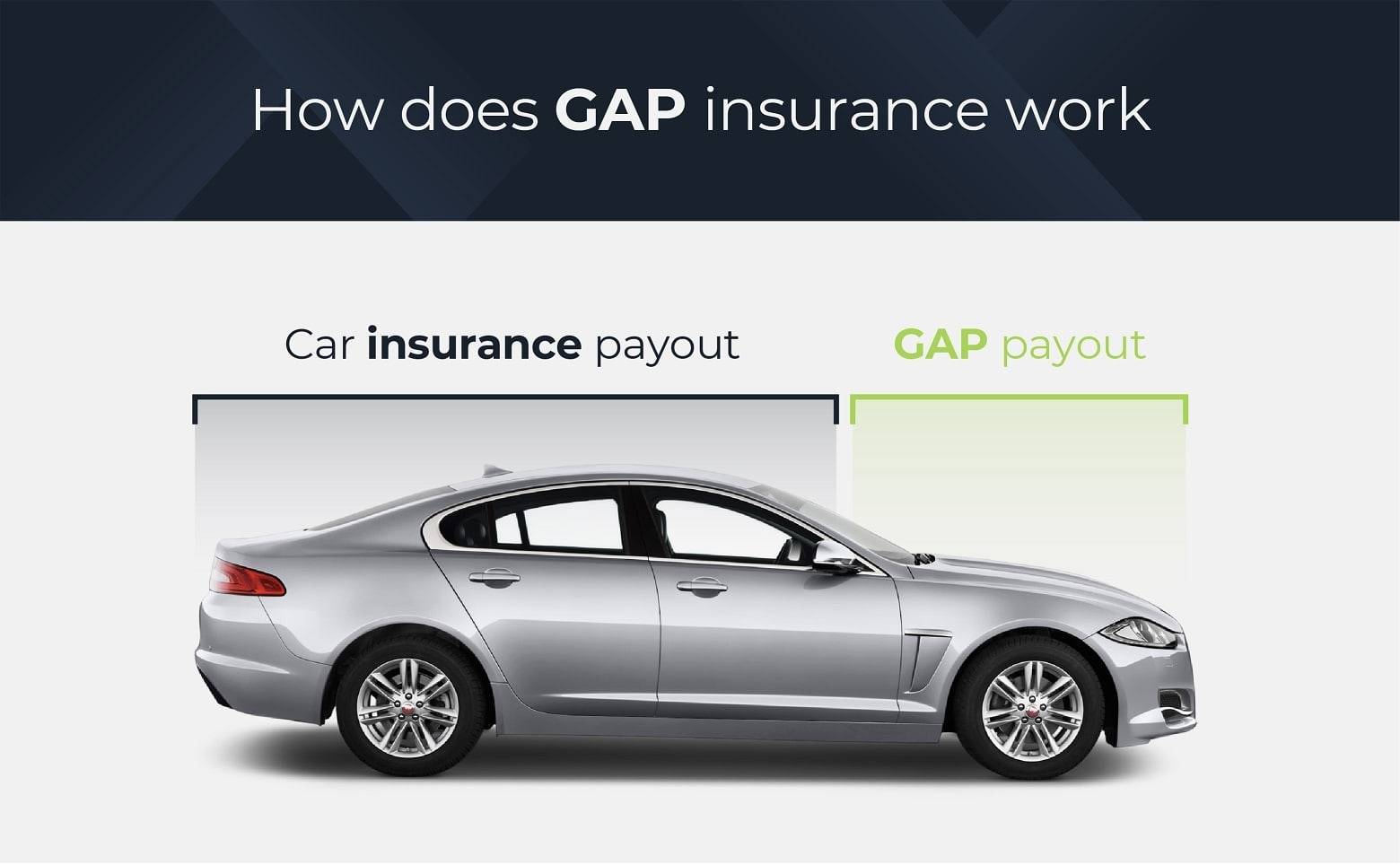

- Value of the Vehicle: The value of your new car is an important factor to consider when determining the type and amount of insurance coverage you need. If you have a high-end luxury vehicle or a car with advanced technology and features, you may want to consider additional coverage options, such as gap insurance or replacement cost coverage, to protect your investment adequately.

- Driving Record: Your driving record plays a role in determining your insurance rates. If you have a clean driving history with no accidents or violations, you may qualify for lower premiums. However, if you have a history of accidents or traffic violations, insurance providers may consider you a higher risk driver and charge higher rates. Assess your driving record and be prepared for potential rate adjustments.

Consider these factors carefully to determine the coverage and insurance provider that best suits your needs and budget. Remember, while cost is a significant consideration, it’s essential to prioritize adequate coverage to protect yourself and your new car.

State Requirements

When it comes to getting insurance on a new car, it’s essential to be aware of your state’s requirements. Each state has its own set of mandatory insurance coverages and minimum limits that drivers must meet. These requirements are in place to ensure that all drivers have at least a basic level of financial protection in case of an accident. Here are a few common types of coverage that states may require:

- Liability Insurance: Liability insurance is the most common type of coverage required by states. It provides financial protection if you are at fault in an accident that causes injury or property damage to others. It typically includes bodily injury liability coverage and property damage liability coverage.

- Personal Injury Protection (PIP): Some states require drivers to carry Personal Injury Protection (PIP) coverage. PIP covers medical expenses, lost wages, and other related costs regardless of who is at fault in an accident.

- Uninsured/Underinsured Motorist Coverage: To protect against motorists who don’t have insurance or have insufficient coverage, some states mandate uninsured/underinsured motorist coverage. This coverage helps pay for your medical expenses and damages if you’re involved in an accident caused by an uninsured or underinsured driver.

It’s vital to familiarize yourself with your state’s requirements and ensure your insurance policy meets or exceeds these minimum limits. Failure to comply with state insurance requirements can result in penalties, fines, and potential license suspension. Additionally, keep in mind that while meeting the minimum insurance requirements is necessary, it may not provide sufficient coverage in all situations.

Before purchasing insurance for your new car, research your state’s specific insurance requirements or consult with a local insurance agent who can guide you through the process. They can help you determine which types and amounts of coverage are appropriate based on your state’s requirements and your individual needs.

Financing or Leasing

If you financed the purchase of your new car or are leasing it, there are additional insurance considerations to keep in mind. When you have a loan or lease agreement, the lender or leasing company typically has requirements regarding the insurance coverage you must maintain. Here’s what you need to know:

Comprehensive and Collision Coverage: When you finance or lease a vehicle, lenders or leasing companies usually require comprehensive and collision coverage in addition to liability insurance. Comprehensive coverage protects your car against non-collision incidents, such as theft or damage from natural disasters, while collision coverage pays for damages resulting from collisions with another vehicle or object.

Required Deductibles: Lenders and leasing companies may also specify the deductible amount for comprehensive and collision coverage. The deductible is the amount you must pay out of pocket before your insurance coverage kicks in. Typically, higher deductibles result in lower monthly premiums, so consider your budget and risk tolerance when choosing a deductible amount.

Loss Payee or Lienholder: When you have a car loan or lease, the lender or leasing company is considered the loss payee or lienholder. This means that in the event of a total loss, the insurance settlement for the vehicle will go directly to the lender or leasing company to satisfy the remaining balance on the loan or lease agreement.

It’s important to review your loan or lease agreement carefully and understand the insurance requirements specified by the lender or leasing company. Failure to maintain the necessary coverage could lead to a breach of contract and potential financial repercussions. Discuss your insurance needs with your lender or leasing company and work with them to ensure compliance and adequate coverage for your financed or leased vehicle.

Temporary Coverage Options

While it’s crucial to obtain insurance coverage for your new car as soon as possible, there may be instances where you need temporary coverage before securing a long-term policy. Here are a few temporary coverage options to consider:

- Existing Auto Insurance Policy: If you already have an active auto insurance policy for another vehicle, contact your insurance provider to inquire about adding your new car to the policy temporarily. This option typically provides immediate coverage until you can make final arrangements for a separate policy.

- Insurance Binder: An insurance binder is a temporary insurance agreement that provides immediate coverage until you can obtain a permanent policy. It is a legally binding document issued by an insurance company and outlines the terms and coverage details. Insurance binders are often used when purchasing a car from a dealership.

- Dealer’s Insurance: If you purchase your new car from a dealership, they may offer temporary insurance coverage as part of the sales process. This coverage is usually valid for a limited period, such as a few days or weeks, allowing you time to secure your own insurance policy.

- Rental Car Coverage: If you plan to rent a car while you’re in the process of getting insurance for your new car, consider obtaining rental car coverage through your insurance provider. This coverage can extend to rental vehicles and provide temporary protection until you finalize your new car’s insurance.

While these temporary coverage options can provide immediate protection, it’s important to note that they may have limitations in terms of coverage and duration. Be sure to understand the terms and conditions of any temporary coverage option you choose, and make it a priority to secure a suitable long-term insurance policy for your new car.

Choosing the Right Insurance Policy

When it comes to selecting the right insurance policy for your new car, it’s important to consider several factors to ensure you have adequate coverage and protection. Here are some key points to keep in mind:

- Coverage Options: Evaluate the different coverage options available and determine which ones are essential for your needs. Consider liability coverage, comprehensive and collision coverage, uninsured/underinsured motorist coverage, and any additional coverage options, such as gap insurance or roadside assistance.

- Deductible Amount: The deductible is the amount you’re responsible for paying out of pocket before your insurance coverage kicks in. Consider your budget and risk tolerance when choosing a deductible amount. A higher deductible usually results in lower monthly premiums, but make sure you can afford the deductible if you need to file a claim.

- Insurance Provider: Research and compare insurance providers to find one that offers competitive rates, good customer service, and a strong financial reputation. Look for reviews and ratings from other customers to assess their reliability and claims handling process.

- Discounts and Bundling: Inquire about discounts available with different insurance providers. Many companies offer discounts for safe driving records, bundled policies (such as combining your auto and home insurance), installing anti-theft devices, and more. Take advantage of these discounts to save on your premiums.

- Customer Service and Claims Process: Consider the quality of customer service and the efficiency of the claims process. Look for an insurance provider with a reliable and accessible customer support team that can assist you when you need it most.

- Policy Limits and Coverage Amounts: Review the policy limits and coverage amounts to ensure they meet your needs. Consider the value of your car, potential medical expenses, and any other assets you want to protect. It’s important to have sufficient coverage that can adequately compensate you in the event of an accident.

Taking these factors into account will help you choose the right insurance policy for your new car. Remember, it’s not just about finding the cheapest option but ensuring that you have the coverage and support you need in case of an accident or other unforeseen circumstances.

Steps to Get Insurance on a New Car

Now that you understand the key factors and considerations when it comes to getting insurance for your new car, let’s walk through the steps to help you secure the coverage you need:

- Gather Vehicle Information: Collect all the necessary information about your new car, including the make, model, year, and Vehicle Identification Number (VIN). This information will be required when requesting insurance quotes.

- Research Insurance Providers: Take the time to research and compare insurance providers. Look for reputable companies that offer coverage in your area and have favorable customer reviews. Request quotes from multiple providers to ensure you’re getting the best rates for the coverage you need.

- Compare Quotes: Review the quotes you receive from different insurance providers. Compare the coverage options, deductibles, limits, and premiums to find the policy that offers the best value for your specific needs.

- Provide Necessary Information: Once you’ve selected an insurance provider, be prepared to provide them with the required information. This may include your personal details, driver’s license number, vehicle information, and any other specific information requested by the insurer.

- Choose Coverage and Policy Limits: Work with the insurance agent or representative to determine the coverage options, policy limits, and deductible amounts that align with your needs and budget. Consider factors such as the value of your vehicle, your driving habits, and any additional coverage you may require.

- Finalize the Policy: Review the policy details carefully before signing any documents. Ensure that all the information is accurate and meets your expectations. Pay attention to the effective date of the policy to ensure you have continuous coverage.

- Make the Initial Payment: Provide the necessary payment to activate your policy. Most insurance companies offer various payment options, such as paying in full or setting up monthly installments. Choose the option that works best for you.

- Obtain Proof of Insurance: Once your policy is active, the insurance company will provide you with proof of insurance. This typically includes an insurance card that you need to keep in your vehicle at all times and possibly other digital forms of proof.

- Register Your Car and Provide Proof of Insurance: If required by your state, register your new car and provide proof of insurance to the appropriate authorities. This step ensures legal compliance and avoids potential penalties or fines.

Following these steps will guide you in securing insurance coverage for your new car. Remember to ask questions and seek clarification throughout the process to ensure you fully understand your policy and the coverage it provides. By taking the time to research and choose the right insurance policy, you can drive with confidence knowing that you’re protected on the road.

Conclusion

Obtaining insurance coverage for your new car is an essential step in protecting your investment and ensuring peace of mind while on the road. Understanding the factors to consider, state requirements, and temporary coverage options will help you navigate the process with confidence.

When getting insurance for your new car, be mindful of your state’s specific requirements and any additional coverage needed for financing or leasing agreements. Take the time to research insurance providers, compare quotes, and choose a policy that provides the right coverage and meets your budget.

Remember, the insurance policy you select should not only meet legal requirements but also offer sufficient protection in case of accidents or unexpected events. Be sure to communicate with your insurance provider, ask questions, and understand the terms and coverage details of your policy.

By following the necessary steps, such as gathering vehicle information, comparing quotes, providing necessary details, and finalizing the policy, you can secure the insurance coverage you need for your new car. Always keep proof of insurance in your vehicle and comply with your state’s registration requirements to drive legally.

Insurance on a new car is not an aspect to overlook. It provides financial security, protects your investment, and ensures you can handle any unforeseen circumstances on the road. Take the time to choose the right insurance policy, and remember to periodically review your coverage as your needs may change over time.

Lastly, drive responsibly, adhere to traffic laws, and practice safe driving habits to further protect yourself and others on the road. With proper insurance and responsible driving, you can enjoy your new car with confidence and peace of mind.