Home>Finance>Permanent Life Insurance: Definition, Types, And Difference From Term Life

Finance

Permanent Life Insurance: Definition, Types, And Difference From Term Life

Published: January 7, 2024

Learn about permanent life insurance and its various types, and understand how it differs from term life insurance in the world of finance.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Permanent Life Insurance: Definition, Types, and Difference from Term Life

When it comes to financial planning, insurance is an essential component that provides protection and peace of mind. Among the various types of insurance available, a widely-used option is permanent life insurance. But what exactly is permanent life insurance, and how is it different from term life insurance? In this article, we will dive into the world of permanent life insurance and explore its definition, types, and how it differs from term life insurance.

Key Takeaways:

- Permanent life insurance is a type of life insurance that provides coverage for the entire lifetime of the insured.

- Unlike term life insurance, permanent life insurance accumulates a cash value component over time, which can be accessed during the insured’s lifetime.

What is Permanent Life Insurance?

Permanent life insurance, as the name suggests, offers coverage for the entire lifetime of the insured. It provides a death benefit to the designated beneficiaries upon the insured’s passing. One key feature that sets permanent life insurance apart from term life insurance is that it accumulates a cash value component over time. This cash value grows tax-deferred and can be accessed by the policyholder during their lifetime through withdrawals or loans.

Types of Permanent Life Insurance:

There are several types of permanent life insurance, but the main ones are:

- Whole Life Insurance: Whole life insurance is the most traditional type of permanent life insurance. It offers a fixed premium and a guaranteed death benefit. The cash value component of whole life insurance grows at a guaranteed rate.

- Universal Life Insurance: Universal life insurance is more flexible compared to whole life insurance. It allows the policyholder to adjust the premium and death benefit throughout the policy’s lifetime. The cash value growth rate of universal life insurance is not guaranteed and may vary depending on market conditions.

- Variable Life Insurance: Variable life insurance provides a death benefit, but it also allows the policyholder to invest the cash value component in various investment options such as stocks, bonds, or mutual funds. The policy’s cash value and death benefit can fluctuate based on the performance of these investments.

- Variable Universal Life Insurance: Variable universal life insurance combines the flexibility of universal life insurance with the investment options available in variable life insurance. It offers the policyholder both investment flexibility and the ability to adjust premiums and death benefits.

How Does Permanent Life Insurance Differ from Term Life Insurance?

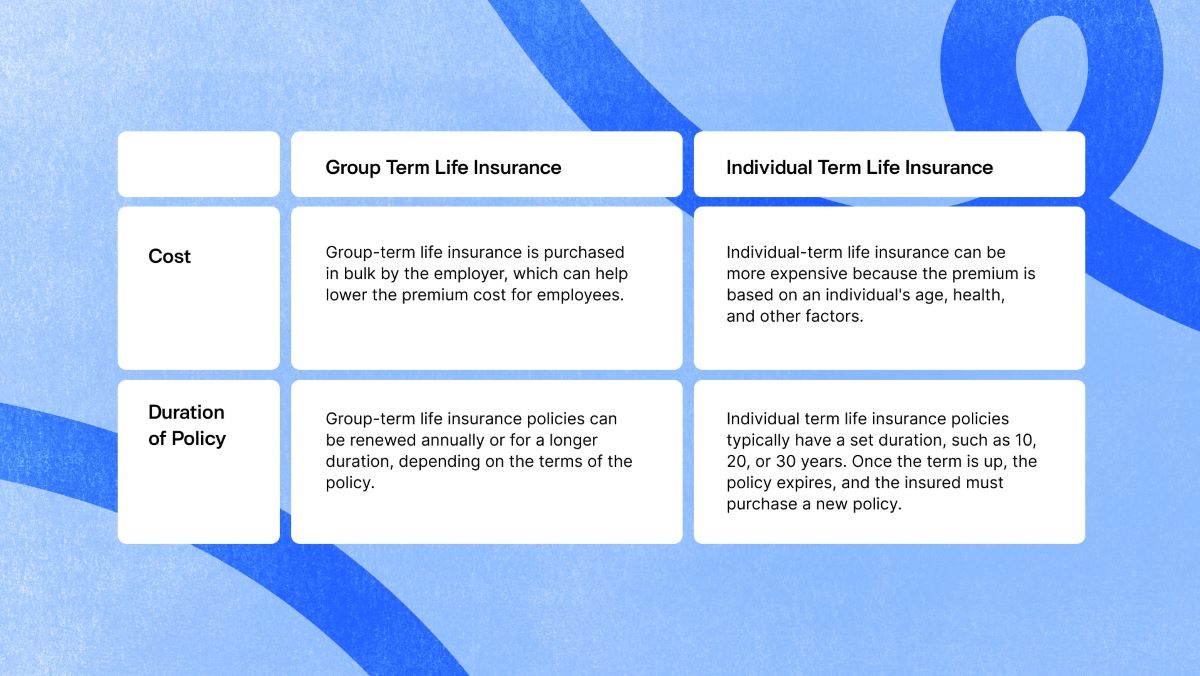

Now that we have explored permanent life insurance, it’s important to understand its key differences from term life insurance:

- Duration: Permanent life insurance provides coverage for the entire lifetime of the insured, while term life insurance offers coverage for a specific term, typically 10, 20, or 30 years.

- Cash Value: Unlike term life insurance, which does not accumulate cash value, permanent life insurance has a cash value component that grows over time. This allows the policyholder to access funds during their lifetime.

- Flexibility: Permanent life insurance offers greater flexibility in terms of premium adjustments, death benefit changes, and access to the cash value component. Term life insurance typically has fixed premiums and cannot be adjusted during the policy term.

In summary, permanent life insurance provides lifelong coverage, accumulates cash value, and offers flexibility. It is a valuable option for individuals looking for long-term financial protection, estate planning, and potential cash value growth. Understanding the different types of permanent life insurance and their differences from term life insurance can help you make an informed decision when choosing a life insurance policy.

For more information about permanent life insurance or to explore your options, feel free to reach out to our team of financial experts.