Home>Finance>What Is Marketable Securities On A Balance Sheet

Finance

What Is Marketable Securities On A Balance Sheet

Modified: December 30, 2023

Understanding Marketable Securities on a Balance Sheet is crucial for finance professionals. Explore their significance in managing investments and assessing liquidity.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Definition of Marketable Securities

- Types of Marketable Securities

- Classification of Marketable Securities on the Balance Sheet

- Valuation of Marketable Securities

- Reporting Marketable Securities on the Balance Sheet

- Importance and Benefits of Marketable Securities

- Risks Associated with Marketable Securities

- Examples of Marketable Securities

- Conclusion

Definition of Marketable Securities

Marketable securities, also known as marketable equity or marketable financial assets, are financial instruments that can be easily bought or sold in the open market. These securities represent ownership interests in a company or a government entity and are regarded as liquid assets, meaning they can be readily converted into cash within a short period of time.

Marketable securities are typically categorized as either debt securities or equity securities. Debt securities, such as treasury bills, corporate bonds, or commercial paper, represent a loan made by an investor to an issuer in exchange for periodic interest payments and the return of the principal amount at maturity. Equity securities, on the other hand, signify ownership in a company and include common stocks and preferred stocks.

One key characteristic of marketable securities is their ability to be bought and sold in active secondary markets, such as stock exchanges or bond markets. This liquidity distinguishes them from other investments, such as real estate or certain alternative investments, which may have limited or no active secondary markets.

Investors and companies often hold marketable securities for various reasons. For investors, marketable securities can provide diversification, potential capital appreciation, and income through dividends or interest payments. Companies may hold marketable securities as investments of excess cash, to generate additional income, or to meet short-term liquidity needs.

It is important to note that the value of marketable securities can fluctuate based on market conditions, interest rates, and the financial performance of the issuer. Therefore, investors and entities must monitor their marketable security holdings and adjust their investment strategies accordingly.

Types of Marketable Securities

There are several types of marketable securities, each with its own characteristics and investment potential. Let’s take a closer look at some common types:

- Treasury Bills (T-Bills): T-Bills are short-term debt securities issued by the government to fund its operations. They have a maturity of less than one year and are considered one of the safest investments because they are backed by the full faith and credit of the government.

- Corporate Bonds: These are debt securities issued by corporations to raise capital. Corporate bonds can have various maturities and interest rates, making them appealing to investors seeking regular income and investment diversification.

- Commercial Paper: Commercial paper is a short-term debt instrument issued by highly rated corporations and financial institutions. It typically has a maturity of less than 270 days and is used to meet short-term funding needs.

- Preferred Stocks: Preferred stocks represent ownership in a company and have both equity and debt characteristics. They offer fixed dividends, priority over common stockholders in the event of liquidation, and limited voting rights.

- Common Stocks: Common stocks represent ownership in a company and offer potential capital appreciation and participation in company profits through dividends. However, common stockholders have limited rights and are last in line to receive assets in the event of liquidation.

- Mutual Funds: Mutual funds pool money from multiple investors to invest in a diversified portfolio of marketable securities. They offer investors the opportunity to access a professionally managed investment portfolio with varying risk levels and investment objectives.

- Exchange-Traded Funds (ETFs): ETFs are similar to mutual funds but trade on stock exchanges like individual stocks. They provide investors with the ability to diversify their investments across different asset classes and sectors.

These are just a few examples of marketable securities available in the financial markets. Depending on an investor’s risk appetite, investment goals, and market conditions, a well-diversified portfolio may include a combination of these securities to optimize returns and manage risk.

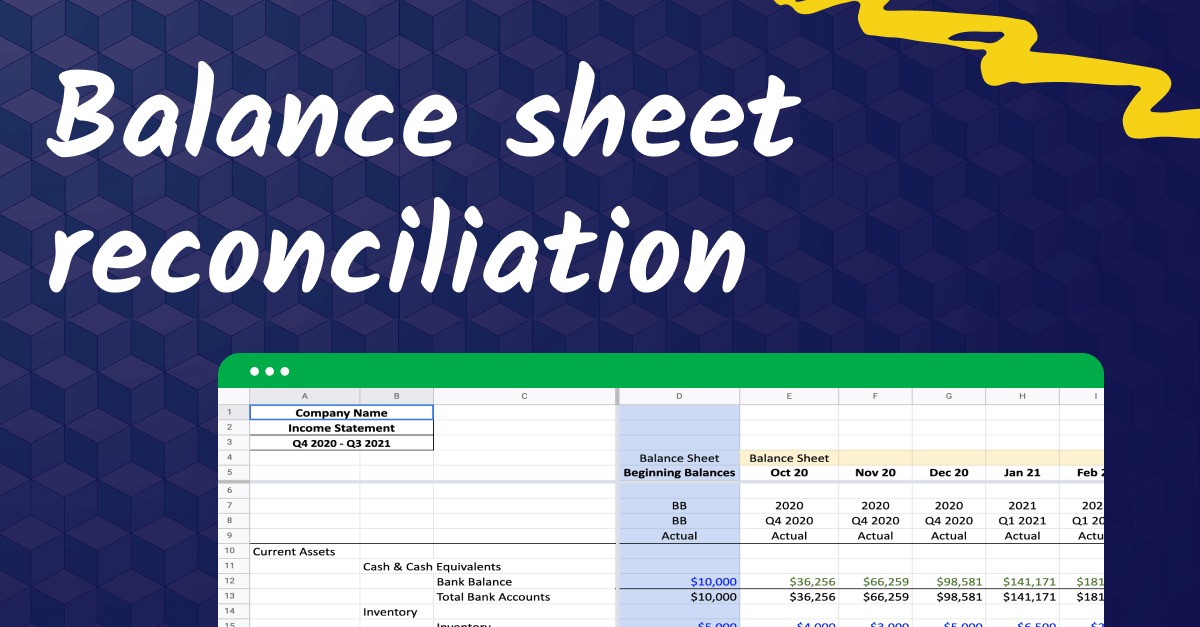

Classification of Marketable Securities on the Balance Sheet

Marketable securities are classified and reported on the balance sheet based on their holding period and the intent of the holder. The two primary classifications are:

- Held-to-Maturity (HTM): Marketable securities classified as HTM are those that the holder intends to hold until their maturity date. These securities are reported at amortized cost on the balance sheet. HTM securities are typically debt instruments, such as corporate bonds, that offer a fixed interest rate and specific maturity date. They are considered to be long-term investments and are expected to provide a regular stream of interest income until maturity.

- Available-for-Sale (AFS): Marketable securities classified as AFS are those that don’t fall under the HTM or trading categories. These securities are reported at fair value on the balance sheet. AFS securities can include a variety of marketable equity and debt instruments, such as stocks, bonds, or mutual funds. The fair value of AFS securities is determined based on current market prices or other reliable valuation methods. Unrealized gains or losses on AFS securities are reported as a separate component of shareholder’s equity until they are realized through a sale.

In addition to these two classifications, some companies may choose to report certain marketable equity securities as Trading Securities. These are securities that are actively traded and held with the intent of making short-term profits. Trading securities are reported at fair value on the balance sheet, and any realized or unrealized gains or losses are immediately recognized in the company’s income statement.

The classification of marketable securities on the balance sheet is crucial as it determines how they are valued and how any gains or losses are recognized in financial statements. It provides transparency to investors and stakeholders regarding the nature and purpose of the securities held by the company.

Valuation of Marketable Securities

The valuation of marketable securities is important for determining their fair value and reflecting their true worth on the balance sheet. The valuation methods used depend on the classification of the securities. Here are the common valuation techniques:

- Held-to-Maturity (HTM) Securities: HTM securities are typically valued using the amortized cost method. Under this method, these securities are initially recorded at their acquisition cost and subsequently adjusted for the amortization of any premiums or discounts. The amortized cost represents the principal amount of the security plus or minus the unamortized premium or discount.

- Available-for-Sale (AFS) Securities: AFS securities are valued at fair value. Fair value is determined based on current market prices or other reliable valuation methods, such as quoted market prices for identical or similar securities. The fair value of AFS securities may fluctuate over time, and any unrealized gains or losses are recorded as a separate component of shareholders’ equity.

- Trading Securities: Trading securities are also valued at fair value, similarly to AFS securities. However, any unrealized gains or losses on trading securities are recognized immediately in the income statement.

Valuation of marketable securities serves to provide accurate and reliable financial information to investors, stakeholders, and regulatory bodies. It allows for transparency and comparability across companies and enables investors to make informed decisions.

It is important to note that marketable securities, especially those traded in volatile markets, may experience significant fluctuations in value. Therefore, regular monitoring and revaluation of these securities are essential to ensure their fair valuation on the balance sheet and to provide a true picture of a company’s financial position.

Reporting Marketable Securities on the Balance Sheet

When reporting marketable securities on the balance sheet, they are typically classified as either current assets or long-term investments, depending on their expected holding period.

Current assets comprise marketable securities that are expected to be converted into cash within one year or the operating cycle, whichever is longer. These securities are reported under the current asset section of the balance sheet and are listed at their fair value, either as available-for-sale (AFS) securities or trading securities.

Long-term investments, on the other hand, are marketable securities that have an anticipated holding period exceeding one year. They are reported under the non-current or long-term asset section of the balance sheet. Long-term investments can include both held-to-maturity (HTM) securities and AFS securities.

The format of reporting marketable securities on the balance sheet typically includes the following:

- Security Description: The name and details of each marketable security owned by the company.

- Classification: Indication of whether the security is categorized as HTM, AFS, or trading.

- Cost/Amortized Cost: The original cost or amortized cost of the security, applicable to HTM securities.

- Fair Value: The fair value of the security, reflecting its current market price for AFS and trading securities.

- Unrealized Gain/Loss: Any unrealized gain or loss on AFS securities that is not yet recognized in the income statement.

- Total: The overall value of marketable securities held by the company, representing the sum of individual securities.

The reporting of marketable securities on the balance sheet provides transparency regarding the value and classification of these investments. It allows investors, analysts, and other stakeholders to assess the importance of marketable securities in a company’s financial position and make informed decisions regarding their investment strategies.

Importance and Benefits of Marketable Securities

Marketable securities play a significant role in the financial landscape and can offer several key benefits to investors and companies. Here are some important reasons why marketable securities are valued and utilized:

- Liquidity: Marketable securities are highly liquid assets that can be easily bought and sold in the open market. This allows investors and companies to convert them into cash quickly, providing financial flexibility and the ability to meet short-term cash needs.

- Diversification: Investing in a range of marketable securities allows for diversification of investment portfolios. By spreading investments across different asset classes, sectors, and issuers, investors can reduce their exposure to individual risks and potentially enhance their overall returns.

- Income Generation: Marketable securities can provide a steady stream of income in the form of dividends, interest payments, or capital appreciation. This income can be particularly beneficial for individuals seeking regular cash flow or companies looking to generate additional revenue.

- Capital Appreciation: Common stocks and certain marketable securities have the potential to appreciate in value over time. Investors may benefit from capital gains if the market value of their securities increases, allowing them to sell at a higher price and realize a profit.

- Preservation of Capital: Some marketable securities, such as high-quality bonds or treasury bills, are considered relatively safe investments that help preserve capital. These securities provide a secure place to park funds, particularly during periods of market volatility or economic uncertainty.

- Portfolio Optimization: By incorporating marketable securities into a well-balanced investment portfolio, investors can optimize their risk-return tradeoff and align their investment strategy with their financial goals and risk tolerance.

Furthermore, marketable securities add depth and efficiency to financial markets by providing a mechanism for investors to allocate capital and transfer risk. They serve as a crucial instrument for companies to manage their cash positions, generate income from excess cash, and deploy funds in a prudent and profitable manner.

However, it is important to recognize that investing in marketable securities inherently carries risks, including price volatility, issuer default, economic factors, and market conditions. Therefore, it is essential for investors to perform thorough research and due diligence before investing in marketable securities and to consult with a financial advisor or professional when necessary.

Risks Associated with Marketable Securities

While marketable securities offer various benefits, it is essential to understand and acknowledge the risks associated with these investments. Here are some key risks to consider:

- Market Risk: Marketable securities are subject to market risk, which refers to the potential for the value of the securities to decline due to factors such as economic conditions, market fluctuations, and changes in investor sentiment.

- Liquidity Risk: Although marketable securities are considered liquid, there may be instances where it becomes challenging to sell them quickly at a desired price. Liquidity risk arises when there is a lack of buyers or an imbalance in the supply and demand for the securities.

- Interest Rate Risk: Certain marketable securities, particularly fixed-income instruments, are sensitive to changes in interest rates. When interest rates rise, existing bonds with lower coupon rates become less attractive, potentially causing their market value to decline.

- Credit Risk: Investing in corporate bonds or other debt securities exposes investors to the risk of a default by the issuer. If the issuer becomes financially distressed or unable to meet its obligations, the value of the securities may be affected, and investors may face potential losses.

- Foreign Exchange Risk: Investing in marketable securities denominated in foreign currencies brings the risk of foreign exchange fluctuations. Changes in exchange rates can impact the value of the securities when converted back to the investor’s home currency.

- Operational Risk: Operational risk refers to the risk of losses resulting from errors, fraud, or system failures within the financial institution or brokerage holding the marketable securities. Issues such as trading errors, settlement failures, or security breaches can jeopardize the value and security of the investments.

It is important for investors to assess their risk tolerance and conduct thorough research before investing in marketable securities. Diversification across different asset classes and issuers can help mitigate some of these risks, as it reduces the exposure to any single security. Additionally, seeking guidance from financial professionals or advisors can provide valuable insights and assistance in managing these risks effectively.

Ultimately, understanding the risks associated with marketable securities empowers investors to make informed decisions and implement risk management strategies that align with their investment objectives and risk tolerance.

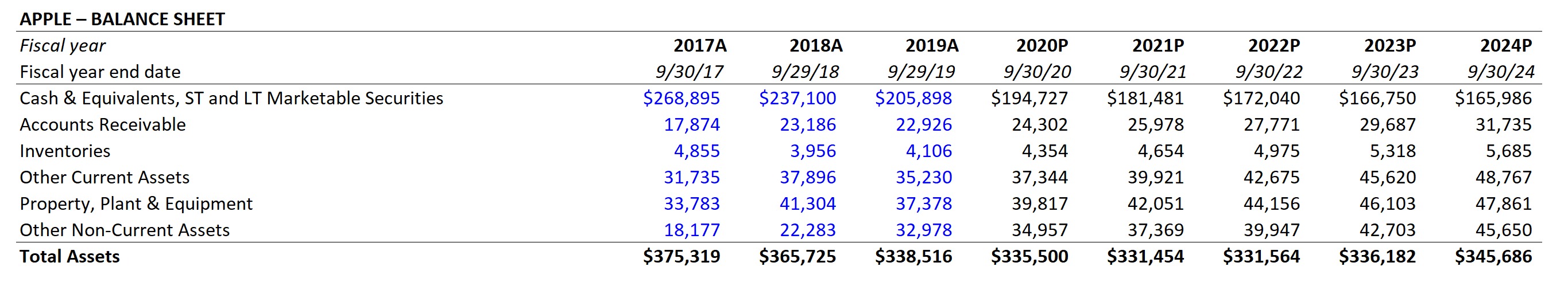

Examples of Marketable Securities

There are various types of marketable securities available in the financial markets. Let’s explore some common examples:

- Treasury Bills (T-Bills): These short-term debt securities issued by the government are considered one of the safest investments available. T-Bills are highly liquid and typically have maturities of less than one year.

- Corporate Bonds: These debt securities issued by corporations allow companies to raise capital. Corporate bonds have fixed interest rates and specific maturity dates, making them attractive to income-seeking investors.

- Preferred Stocks: Preferred stocks represent ownership in a company and offer fixed dividends, priority in the event of liquidation, and limited voting rights. They combine features of both equity and debt securities.

- Common Stocks: Common stocks represent ownership in a company and provide investors with the potential for capital appreciation and participation in company profits through dividends. Common stockholders have voting rights and may have the opportunity to receive residual assets in the event of liquidation.

- Mutual Funds: Mutual funds pool funds from multiple investors to invest in a diversified portfolio of marketable securities. They offer investors access to professionally managed portfolios across different asset classes and investment strategies.

- Exchange-Traded Funds (ETFs): ETFs are similar to mutual funds but trade on stock exchanges. They provide investors with the ability to diversify their investments across various marketable securities and sectors, often at a lower cost compared to traditional mutual funds.

- Commercial Paper: Commercial paper represents unsecured, short-term debt issued by highly rated corporations and financial institutions. It acts as a promissory note and is typically used to meet short-term liquidity needs.

These examples illustrate the diversity and range of marketable securities available to investors. Depending on their investment objectives, risk tolerance, and time horizon, individuals and companies can select the suitable mix of marketable securities to build a well-rounded portfolio.

It is important to note that the availability and characteristics of specific marketable securities may vary across different countries and markets. Investors should consider conducting thorough research and consulting with financial professionals to make informed investment decisions.

Conclusion

Marketable securities, with their liquidity and potential for capital appreciation, play a vital role in the financial landscape. These easily tradable financial instruments, such as treasury bills, corporate bonds, preferred stocks, and mutual funds, offer investors and companies the opportunity to diversify their portfolios, generate income, and optimize their risk-return profiles.

Understanding the classification, valuation, and reporting of marketable securities is important for accurate financial reporting and decision-making. Whether classified as held-to-maturity (HTM), available-for-sale (AFS), or trading securities, each category has its unique characteristics and implications on financial statements.

While marketable securities offer benefits, including liquidity, diversification, income generation, and capital appreciation, it is crucial to recognize the inherent risks. Market, liquidity, interest rate, credit, foreign exchange, and operational risks can all impact the value and performance of marketable securities. Careful risk assessment and diversification across various securities can help mitigate these risks and optimize the return potential.

Overall, marketable securities provide opportunities for individuals and companies to participate in the financial markets, access investment diversification, and potentially achieve their financial goals. Investing in these securities requires careful consideration, research, and, when necessary, guidance from financial professionals to make informed decisions based on individual circumstances and risk tolerance.

By understanding the intricacies of marketable securities and incorporating them into a well-rounded investment strategy, individuals and companies can navigate the financial markets effectively and pursue their desired financial outcomes.