Finance

Defeasance Process Definition

Published: November 9, 2023

Learn the finance defeasance process and its definition in this informative article. Understand how it impacts your financial transactions and investments.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

The Defeasance Process: Unlocking the Secrets to Financial Freedom

Are you looking for a way to navigate the complex world of finance and secure your financial future? Look no further than the defeasance process. In this blog post, we will dive deep into the weeds of this fascinating financial maneuver and explore how it can provide you with the means to take control of your financial destiny. So, what exactly is the defeasance process? Let’s find out!

Key Takeaways:

- The defeasance process involves substituting an existing collateral with a new set of assets to release the borrower from financial obligations and pay off a loan.

- By utilizing the defeasance process, borrowers can access significant financial benefits such as lower interest rates and increased flexibility.

The defeasance process is a financial strategy that allows borrowers to replace the current collateral securing their loan with a new set of assets. This substitution essentially removes the risk associated with the loan, freeing the borrower from their financial obligations. Once the defeasance process is complete, borrowers regain control of the original collateral and enjoy a newfound sense of financial freedom.

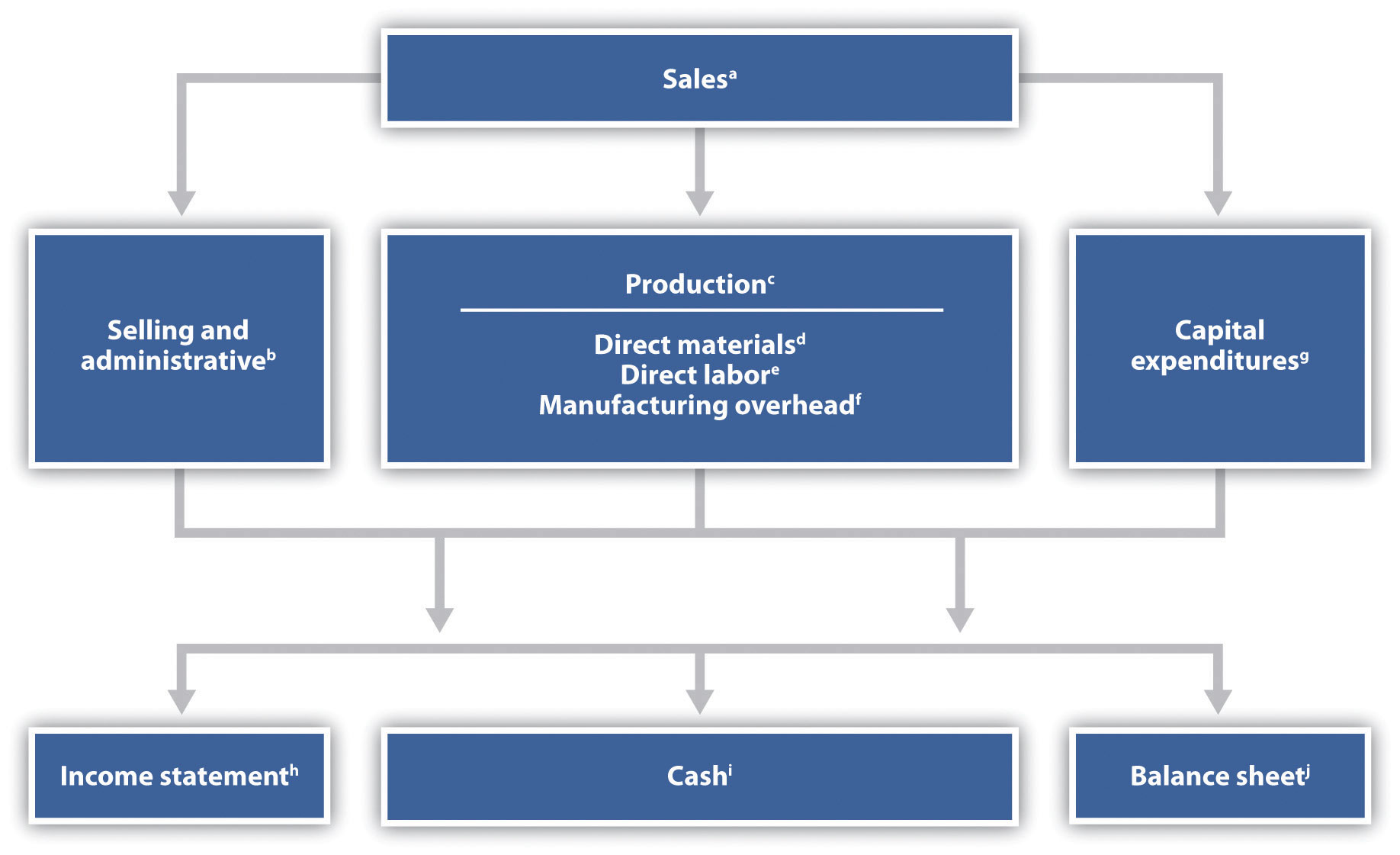

So, how does the defeasance process work? Let’s break it down into simple steps:

- Evaluation: The borrower determines if the financial benefits of defeasance outweigh the associated costs. This evaluation includes an analysis of the existing loan terms, interest rates, and potential savings.

- Asset Selection: The borrower works with a team of experts to identify a new set of assets that will not only satisfy the lender’s requirements but also provide stable cash flows to ensure the loan’s repayment.

- Cash Flow Structuring: The selected assets are structured in a way that mirrors the existing loan’s payment schedule. This step ensures a seamless transition from the original collateral to the new assets, without disrupting the borrower’s financial obligations.

- Defeasance Agreement: A legal contract is drafted, detailing the terms and conditions of the defeasance process. This agreement outlines the responsibilities of all parties involved and provides a framework for a smooth execution of the strategy.

- Collateral Substitution: The new assets are purchased and pledged as collateral to secure the loan. This collateral substitution allows the borrower to release the original collateral and removes the financial liabilities associated with it.

- Monitoring and Reporting: After completing the defeasance process, the borrower continues to monitor the performance of the new assets and provides regular reports to the lender, ensuring compliance with the terms of the agreement.

By utilizing the defeasance process, borrowers can unlock a range of financial benefits. These include gaining access to lower interest rates, which can result in significant savings over the life of the loan. Additionally, defeasance provides borrowers with increased flexibility, allowing them to reallocate funds to other investments or projects that align with their long-term financial goals.

Defeasance is a strategy that requires expert knowledge and careful planning. Working with a team of financial professionals who specialize in the defeasance process can help ensure a smooth and successful transition. So, if you’re ready to take control of your financial future, consider exploring the possibilities that the defeasance process offers.

Key Takeaways:

- The defeasance process involves substituting an existing collateral with a new set of assets to release the borrower from financial obligations and pay off a loan.

- By utilizing the defeasance process, borrowers can access significant financial benefits such as lower interest rates and increased flexibility.

Remember, the defeasance process is a powerful financial tool that can unlock doors to your financial freedom. Evaluate your options, seek expert advice, and reap the rewards of taking control of your financial destiny. Cheers to a brighter financial future!