Home>Finance>How Long Does It Take The IRS To Send A Refund Rejected By The Bank In 2022?

Finance

How Long Does It Take The IRS To Send A Refund Rejected By The Bank In 2022?

Published: October 31, 2023

Discover the timeline for receiving a rejected IRS refund from the bank in 2022. Gain insights into the process and expectations. Finance your way to clarity.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Overview of Refund Rejection by the Bank

- Common Reasons for Refund Rejection by the Bank

- Steps to Resolve a Refund Rejected by the Bank

- Contacting the IRS for Assistance

- Response Time from the IRS for Resolving Refund Rejections

- Factors that May Impact IRS Response Time

- Ways to Check the Status of a Refund Rejected by the Bank

- Avoiding Refund Rejections in the Future

Overview of Refund Rejection by the Bank

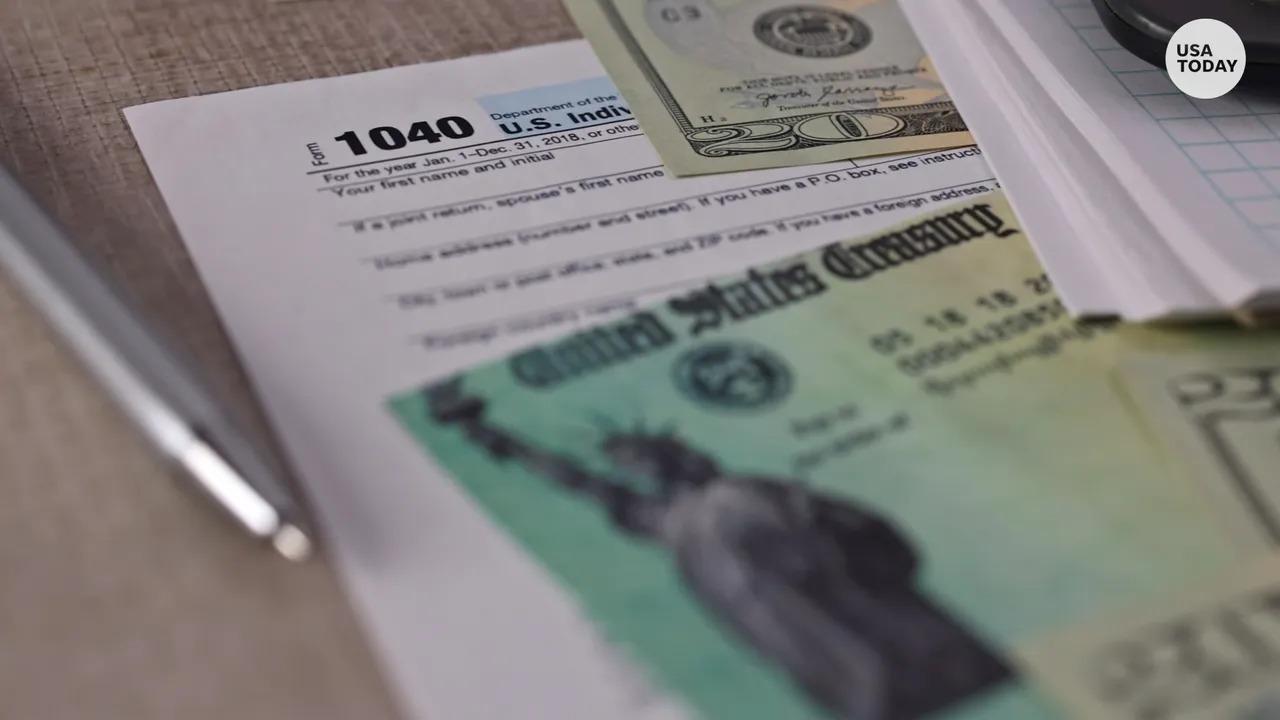

Receiving a tax refund is always a welcome surprise for many individuals. It’s a financial boost that can help pay off debts, cover expenses, or even fund a vacation. However, what happens when your tax refund is rejected by the bank? It can be disheartening and leave you wondering why this happened and what steps you need to take to resolve the issue.

When the IRS sends your tax refund to your bank account, they do a preliminary check to verify that the account information provided is correct. If there’s an issue with the account, such as a closed or incorrect account number, the bank will reject the funds and send them back to the IRS. This is known as a refund rejection by the bank.

There can be several reasons why a bank rejects a tax refund. One common reason is if the account number provided is incorrect or doesn’t match the account holder’s name. In some cases, the account may be closed or flagged for suspicious activity, leading to the rejection of the refund. Additionally, if the IRS suspects fraudulent activity, they may reject the refund and investigate further.

It’s important to understand that the bank itself determines whether or not to accept a tax refund. The IRS simply sends the funds to the account you provided, and it’s up to the bank to accept or reject them. If your refund is rejected, you’ll need to take prompt action to resolve the issue and ensure you receive your much-needed refund.

Common Reasons for Refund Rejection by the Bank

When it comes to refund rejections by the bank, there can be several common reasons why this happens. Understanding these reasons can help you take the necessary steps to avoid any future issues. Let’s explore some of the most common reasons for refund rejection:

- Incorrect account information: One of the primary reasons for refund rejection is providing incorrect account information. This can include a wrong account number, incorrect routing number, or misspelled account holder’s name. It’s crucial to double-check the account details you provide to the IRS to ensure accuracy and avoid a refund rejection.

- Closed or inactive bank account: If the account you provided for your tax refund is closed or inactive, the bank will reject the deposit. This commonly happens if you switch banks after filing your taxes, but forget to update the account information with the IRS. Make sure to keep your account information up to date to avoid refund rejections due to closed accounts.

- Suspicious activity: Banks have strict security measures in place to detect and prevent fraud. If your account is flagged for any suspicious activity, the bank may reject the refund to protect your account and funds. This can include unusual transaction patterns or attempts to deposit multiple tax refunds into the same account.

- Fraudulent activity: If the IRS suspects any fraudulent activity related to your tax refund, they may reject the refund. This can happen if someone else has attempted to file a tax return using your Social Security number or if you’re involved in any tax evasion schemes. The IRS takes fraud very seriously and thoroughly investigates any suspicious claims.

- Restrictions on the account: Some types of bank accounts may have restrictions that prevent the acceptance of certain deposits. For example, prepaid debit cards or accounts with limited functionality may not be eligible to receive tax refunds. It’s important to check with your bank to ensure that your account can receive direct deposits from the IRS.

These are just a few examples of the common reasons that can lead to a refund rejection by the bank. Keep these factors in mind when providing your account information to the IRS and ensure that your information is accurate, up to date, and meets any requirements set by your bank to avoid any potential issues.

Steps to Resolve a Refund Rejected by the Bank

Discovering that your tax refund has been rejected by the bank can be frustrating, but don’t worry! There are steps you can take to resolve the issue and ensure that you receive your refund. Here’s a guide on what to do if your refund is rejected by the bank:

- Contact your bank: The first step is to reach out to your bank to understand the exact reason for the refund rejection. They can provide valuable insight into why the rejection occurred and what can be done to rectify it. Request specific information about the rejection, such as whether it was due to incorrect account information or suspicious activity.

- Update your account information: If the refund rejection was due to incorrect account information, make sure to update your details with the IRS. You can do this by filing Form 8822, Change of Address, with the IRS and providing your correct bank account information. It’s important to double-check the account and routing numbers to avoid any future rejections.

- Confirm account status: If the refund was rejected because your account is closed or inactive, contact your bank to reopen or reactivate the account. Ensure that your bank account is in good standing and able to accept direct deposits from the IRS. Update your account information with the IRS once the account is active to receive your refund.

- Resolve suspicious activity: If the bank rejected the refund due to suspected fraudulent activity, cooperate fully with the bank’s investigation and provide any requested documentation. If you believe that your account has been compromised or used for fraudulent purposes, consider reporting the incident to the bank’s fraud department and filing a report with the local authorities.

- Follow up with the IRS: After addressing the issue with your bank, it’s essential to follow up with the IRS to ensure that they have the updated account information and are aware of the situation. You can contact the IRS directly by calling their customer service hotline or reaching out to them through their online platform. Provide them with any relevant documentation or information they may require to process your refund.

By following these steps, you can resolve a refund rejection by the bank and ensure that your tax refund is processed without any further issues. Remember to stay in contact with both your bank and the IRS throughout the process to stay informed about the status of your refund and any necessary actions.

Contacting the IRS for Assistance

When you encounter an issue with your tax refund, it’s essential to reach out to the Internal Revenue Service (IRS) for assistance. The IRS has dedicated resources and customer service channels to help taxpayers resolve refund-related problems. Here’s how you can contact the IRS for assistance:

- IRS Customer Service Hotline: The IRS operates a customer service hotline that you can call to speak with a representative. They can provide guidance and answer your questions regarding a rejected refund by the bank. The hotline is available Monday through Friday, from 7 a.m. to 7 p.m. local time.

- IRS Online Platform: The IRS offers various online tools and resources that can assist you in resolving refund issues. Visit the official IRS website and explore their “Where’s My Refund?” tool. This tool allows you to check the status of your refund, update your account information, and get helpful information about your refund.

- IRS Taxpayer Assistance Centers: If you prefer to speak to someone in person, you can visit your local IRS Taxpayer Assistance Center. These centers provide face-to-face assistance and can help you with issues related to your tax refund. You’ll need to schedule an appointment beforehand to ensure that a representative is available to assist you.

- Online Help Resources: The IRS website also offers a comprehensive FAQ section that addresses common questions and concerns about tax refunds. It’s worth exploring these resources to see if your specific issue is addressed before contacting the IRS directly. You may find the answers you need without having to wait on hold or visit a Taxpayer Assistance Center.

When reaching out to the IRS for assistance, be prepared to provide them with relevant information, such as your Social Security number, filing status, and details about your refund. Having this information readily available can help expedite the process and ensure that you receive accurate assistance. It’s essential to remain patient and persistent when dealing with the IRS, as resolving refund issues may take time.

Remember, the IRS is there to help you navigate through any problems you encounter with your tax refund. By proactively seeking assistance, you can increase the chances of resolving the issue and receiving your refund in a timely manner.

Response Time from the IRS for Resolving Refund Rejections

When it comes to resolving refund rejections, it’s natural to wonder how long it will take for the Internal Revenue Service (IRS) to address your case and provide a resolution. While exact timelines can vary depending on various factors, it’s important to understand the general response time from the IRS for resolving refund rejections.

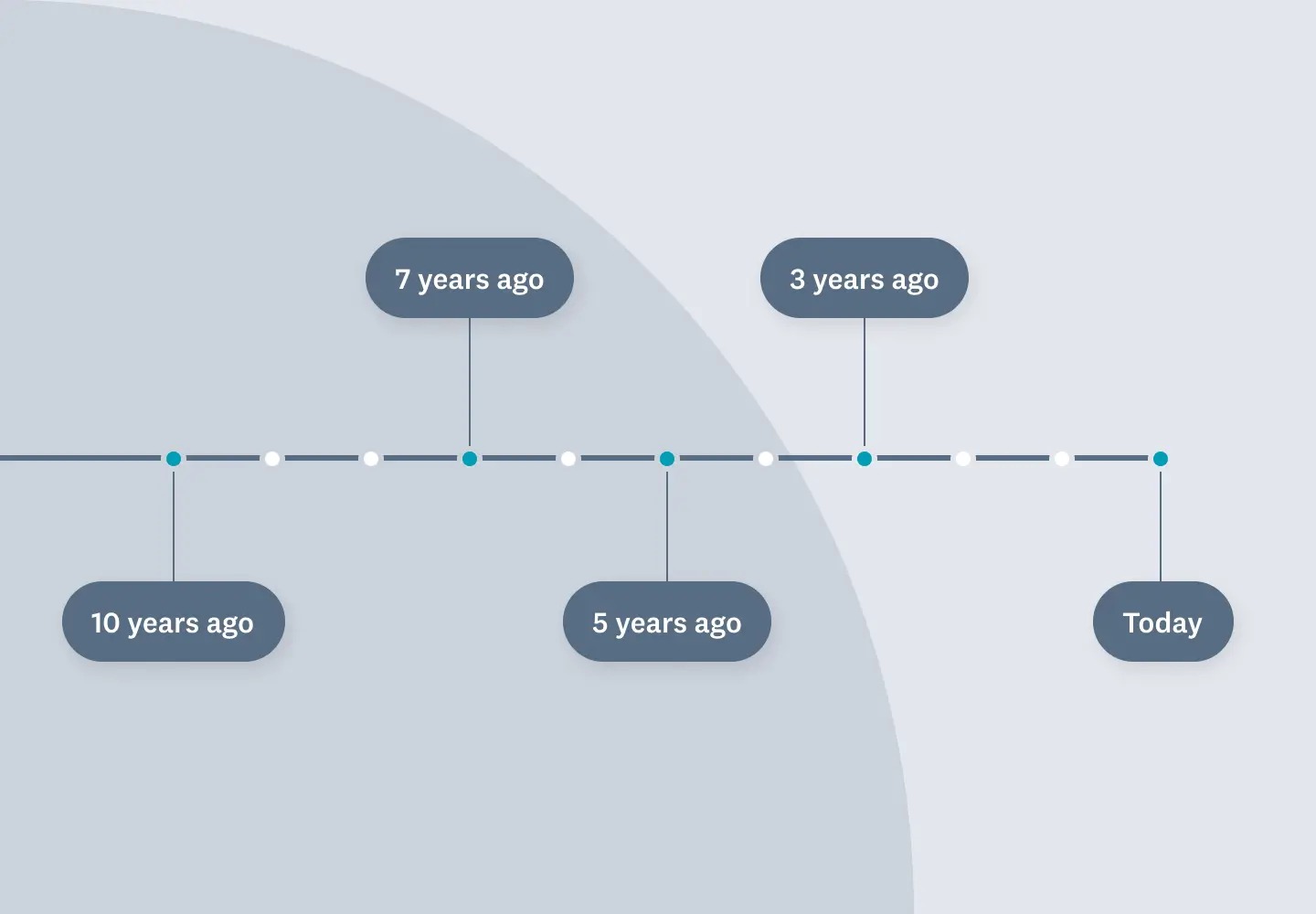

The IRS aims to process and resolve refund rejections as quickly as possible. However, due to the volume of cases they handle and the complexity of some situations, response times can vary. On average, you can expect a response from the IRS within 4 to 6 weeks after they receive notification of the refund rejection.

Keep in mind that this response time is an estimate and not a guarantee. It’s possible for the resolution process to take longer, especially if additional documentation or investigation is required. The IRS prioritizes cases involving fraudulent activity or identity theft, so those cases may receive faster attention and resolution.

To ensure that your refund rejection is resolved in a timely manner, it’s crucial to promptly take the necessary steps outlined by the IRS or advised by your bank. This may include updating your account information, providing supporting documentation, or cooperating with any investigations related to suspected fraudulent activity.

Remember that during peak tax seasons, such as in the months leading up to the filing deadline, the IRS may experience higher volumes of refund rejections and inquiries. This can result in longer response times and delays in resolving cases. Patience and persistence are key when dealing with the IRS, and it’s important to stay proactive and follow up on your case if you do not receive a response within the expected timeframe.

If you have not received any communication or resolution from the IRS within a reasonable period, it is advisable to contact them again for an update on your case. You can reach out through their customer service hotline, online platform, or by visiting a local Taxpayer Assistance Center.

By understanding the general response time from the IRS and staying actively involved in the resolution process, you can increase the chances of a timely and satisfactory resolution to your refund rejection.

Factors that May Impact IRS Response Time

The response time for resolving refund rejections by the Internal Revenue Service (IRS) can vary based on several factors. It’s important to be aware of these factors as they may impact how long it takes for the IRS to address your case and provide a resolution. Here are some key factors that may influence the IRS response time:

- Peaks in tax filing season: The IRS experiences high volumes of tax returns and refund requests during peak tax filing season. This usually occurs in the months leading up to the tax filing deadline. The increased workload can result in longer response times as the IRS has to process a larger number of cases.

- Complexity of the case: Some refund rejections may involve complex issues that require additional investigation or supporting documentation. For example, cases involving suspected fraud or identity theft typically require more time and resources to resolve. The level of complexity in your case can affect the response time from the IRS.

- Availability of resources: IRS resources, such as staffing and technology, can impact their ability to process refund rejections in a timely manner. Budget limitations or changes in staffing levels can result in delays in handling cases. Additionally, technical issues or system updates may temporarily affect the efficiency of IRS operations.

- Cooperation from the taxpayer: The speed at which the IRS can resolve a refund rejection may be influenced by the level of cooperation from the taxpayer. If the IRS requests additional information or documentation to support your case, timely response and provision of the requested materials can expedite the resolution process.

- Priority of the case: The IRS prioritizes cases involving suspected fraud, identity theft, or other types of criminal activity. These cases may receive faster attention and resolution. Non-fraudulent cases may not be prioritized as highly and may experience longer response times as a result.

While these factors can affect the IRS response time, it’s important to remember that the IRS strives to address refund rejections as quickly and efficiently as possible. However, due to the complexities and variables involved, it’s difficult to provide an exact timeline for the resolution of each case.

If you have concerns about the progress of your refund rejection case or if you believe there has been an unreasonable delay in the IRS response, consider contacting them for an update. You can reach out through their customer service hotline, online platform, or by visiting a local Taxpayer Assistance Center.

By understanding the factors that may impact IRS response time and staying proactive in following up on your case, you can ensure that your refund rejection is addressed in a timely manner. Patience, cooperation, and persistence will contribute to a smoother resolution process.

Ways to Check the Status of a Refund Rejected by the Bank

If your tax refund has been rejected by the bank, it’s crucial to stay informed about the status of your refund and take the necessary steps to resolve the issue. Fortunately, there are several ways you can check the status of a refund that has been rejected by the bank. Here are some options available to you:

- IRS “Where’s My Refund?” tool: The Internal Revenue Service (IRS) provides an online tool called “Where’s My Refund?” that allows taxpayers to check the status of their refund. You can access this tool on the official IRS website and enter relevant information such as your Social Security number, filing status, and refund amount to get real-time updates on the status of your refund. If your refund has been rejected by the bank, this tool can provide information on the next steps to take.

- IRS customer service hotline: Another way to check the status of your refund is by calling the IRS customer service hotline. The IRS representatives can provide you with updates on your refund and offer guidance on resolving any rejection issues. Be prepared to provide your personal identification information when contacting the IRS over the phone.

- Online banking: Check your bank’s online banking platform. Some banks provide a specific section where you can view the status of your deposits, including tax refunds. If your refund has been rejected, your bank may provide details on the rejection and steps to resolve the issue.

- Contact your bank directly: Reach out to your bank’s customer service department to inquire about the status of your rejected refund. They should be able to provide you with information on why the refund was rejected and what steps you need to take to resolve the issue.

It’s important to stay proactive in checking the status of your refund and resolving any rejection issues. Be sure to have relevant information, such as your Social Security number, filing status, and refund amount, readily available when using these tools or contacting the IRS or your bank. Additionally, remain patient during the process, as it may take some time to resolve the rejection and receive your refund.

If you have exhausted the available options and still need assistance, consider reaching out to a tax professional who can provide guidance and help you navigate the refund rejection process. They have specialized knowledge and experience with tax issues and can offer tailored advice based on your unique situation.

By utilizing these various methods to check the status of your refund and actively working to resolve any rejection issues, you can stay informed and ensure that your tax refund reaches you as soon as possible.

Avoiding Refund Rejections in the Future

Dealing with a refund rejection by the bank can be frustrating and time-consuming. To prevent such issues and ensure a smooth and timely receipt of your tax refund, here are some essential steps you can take to avoid refund rejections in the future:

- Double-check your account information: Carefully review and verify your bank account information before submitting it to the IRS. Ensure that you provide the correct account number and routing number, as well as the accurate account holder’s name. Even a small mistake in this information can lead to a refund rejection.

- Update your account details: If you change banks or open a new account, remember to notify the IRS promptly. File Form 8822, Change of Address, to update your account information with the IRS. This will ensure that your tax refund goes to the correct account and minimize the risk of a rejection due to outdated or incorrect account details.

- Maintain an active bank account: It’s important to keep your bank account active and in good standing to receive direct deposits. Avoid closing your account without updating your information with the IRS. If you do close your account, be sure to provide your new account details to the IRS promptly to avoid any delays or rejections.

- Be cautious of suspicious activity: Protect your personal and financial information to prevent any fraudulent activity. Safeguard your Social Security number and take precautions to avoid identity theft. Monitor your bank account regularly for any unauthorized transactions and report any suspicious activity to your bank and the IRS immediately.

- Keep records and documentation: Maintain organized records of your tax returns and supporting documents. This can include receipts, W-2 forms, 1099 forms, and any other relevant tax-related information. Having these records readily available can help you avoid errors and provide accurate information when filing your taxes.

- Stay informed: Stay updated on any changes or updates from the IRS regarding tax refunds. Visit the IRS website regularly and consider signing up for email notifications. Understanding any new guidelines or requirements can help you ensure that your tax return meets the necessary criteria, reducing the likelihood of a refund rejection.

By following these steps and staying proactive, you can significantly reduce the chances of experiencing a refund rejection by the bank. Taking the time to verify account information, keeping your bank account active, and protecting your personal information will contribute to smoother and more successful refund experiences in the future.

If you’re uncertain about any aspect of your tax return or have specific questions, it’s always a good idea to consult with a tax professional. They can provide personalized guidance and help you navigate through the tax filing process with confidence.