Home>Finance>How Long Will It Take To Receive My IRS Refund?

Finance

How Long Will It Take To Receive My IRS Refund?

Published: October 31, 2023

Discover how long it takes to receive your IRS refund and stay on top of your finances with our helpful guide. Plan ahead and manage your expectations.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Getting a tax refund from the IRS can be a welcome financial boost for many individuals and families. Whether you’re planning to pay off debts, save for a vacation, or make a major purchase, knowing when you can expect to receive your refund is crucial. However, the processing time for IRS refunds can vary based on several factors, including how you filed your taxes and how accurately you filled out your return.

In this article, we will explore the factors that can affect the processing time of your IRS refund and provide you with an understanding of the different methods of filing your taxes and their corresponding timeframes. Additionally, we will cover some essential tips for checking the status of your refund and navigating potential delays or issues.

It’s important to note that while we will provide general timelines and information, every tax situation is unique. The IRS processes millions of tax returns each year, and individual circumstances can impact processing timeframes. However, by understanding the various factors involved, you can have a better idea of when you might expect to see that refund in your bank account.

Factors Affecting the Processing Time

Several factors can influence the processing time of your IRS refund. It’s essential to be aware of these factors to gain a better understanding of why some tax returns may take longer to process than others. Here are some key factors to consider:

- Accuracy of your tax return: The accuracy and completeness of your tax return play a significant role in the processing time. If your return contains errors or missing information, it may be flagged for further review, leading to delays in processing. Double-checking your return for accuracy before submitting it can help minimize the chances of errors and potential delays.

- Complexity of your tax return: The complexity of your tax return can impact processing time. If you have multiple income sources, claim complex deductions or credits, or report self-employment income, your return may require additional scrutiny, leading to a longer processing time.

- Volume of tax returns received: The volume of tax returns received by the IRS during the filing season can also impact processing time. During peak tax season (typically between January and April), the IRS is inundated with returns, which may result in longer processing times.

- Filing method: The method you choose to file your taxes can affect the processing time of your refund. The IRS processes electronic returns more quickly than paper returns. E-filing, in particular, offers a quicker and more efficient processing timeframe.

- Errors or missing information: Any errors or missing information on your tax return can significantly delay the processing time. It’s essential to carefully review your return for accuracy and ensure that all required information is included. Missing Social Security numbers, incorrect bank account details for direct deposit, or unsigned forms can result in processing delays.

By being aware of these factors, you can take steps to ensure that your tax return is accurate and complete, reducing the chances of delays in processing. In the next sections, we will delve into the processing and refund timeframes for both paper filing and e-filing methods, providing you with a clearer understanding of what to expect based on your chosen filing method.

Filing Methods and Timeframes

When it comes to filing your taxes, there are two main methods: paper filing and e-filing. Each method has its own advantages and considerations, including differences in processing and refund timeframes. Let’s explore the timeframes associated with each method:

Paper Filing: Processing and Refund Time

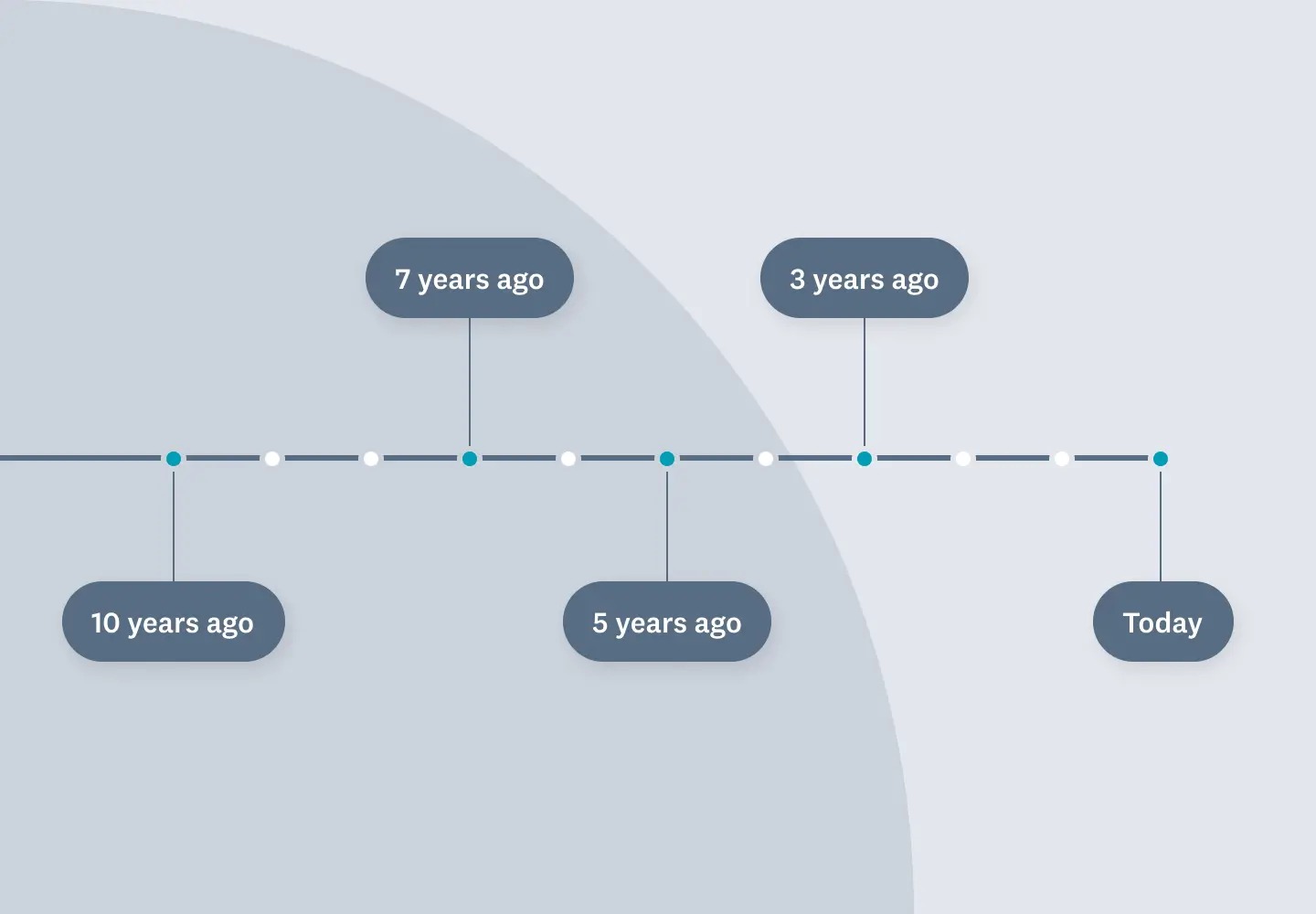

If you choose to file your tax return by mail using the traditional paper filing method, it typically takes longer for the IRS to process your return compared to electronic filing. The processing time for paper-filed returns can range from six to eight weeks on average. This timeframe includes the time it takes for the IRS to receive and input your return into their system.

Once your return has been processed, the refund time will depend on whether you choose to receive your refund via direct deposit or a physical check. If you opt for direct deposit, it can take an additional one to three weeks for the funds to be deposited into your bank account. If you choose to receive a check by mail, it can take up to several weeks for the check to arrive at your registered address.

E-Filing: Processing and Refund Time

E-filing is the electronic method of filing your tax return, which has become increasingly popular due to its convenience and faster processing times. When you e-file your return, the IRS typically processes it within 21 days.

If you select direct deposit for your refund, the funds can be deposited into your bank account within one to two weeks after your return has been processed. On the other hand, if you choose to receive a check by mail, it can take an additional one to three weeks for the check to be delivered to your mailing address.

It’s important to note that these timeframes are general estimates and may vary depending on various factors, such as the accuracy of your return, potential errors or omissions, and the volume of tax returns received by the IRS during the filing season.

Now that we’ve explored the processing and refund timeframes for both paper filing and e-filing methods, let’s discuss some additional factors to consider that may affect the overall timeline of receiving your IRS refund.

Paper Filing: Processing and Refund Time

If you choose to file your tax return through the traditional paper filing method, it’s important to understand the expected processing and refund timeframes. Here’s what you need to know:

Processing Time:

When you mail your paper tax return, it can take a bit longer for the IRS to process it compared to electronic filing. On average, the processing time for paper-filed returns is approximately six to eight weeks. This timeframe includes the time it takes for the IRS to receive and input your return into their system.

There are several factors that can affect the processing time of a paper return, such as the complexity of your tax situation, any mistakes or omissions on the return, and the volume of tax returns received by the IRS during the filing season. It’s important to ensure that your paper return is accurate, complete, and legible to avoid any potential delays in processing.

Refund Time:

Once your paper return has been processed, the refund time will depend on the method you choose to receive your refund: direct deposit or a physical check.

If you choose direct deposit, it can take an additional one to three weeks for the funds to be deposited into your bank account. The exact timing can vary depending on various factors, including the accuracy of your return and any potential errors or issues that may arise during the processing of your refund.

If you opt to receive a refund check in the mail, it can take even longer to receive your refund. The IRS typically advises allowing up to several weeks for the refund check to be mailed to your registered address. However, factors such as mail delivery speed and any potential disruptions in postal services can further impact the delivery timeframe.

It’s important to note that these timeframes are general estimates and can vary depending on individual circumstances and external factors. To ensure a smoother and faster refund process, it’s crucial to accurately complete your paper tax return, include all necessary supporting documentation, and double-check for any errors or omissions.

In the next section, we will explore the processing and refund timeframes associated with the electronic filing method, also known as e-filing.

E-Filing: Processing and Refund Time

E-filing has become the preferred method of filing taxes for many individuals due to its convenience and faster processing times. When you choose to e-file your tax return, you can expect quicker processing and refund timeframes compared to traditional paper filing. Here’s what you need to know:

Processing Time:

When you e-file your tax return, the IRS typically processes it within 21 days. This means that within three weeks of successfully e-filing your return, the IRS will review and process your information to calculate your refund or determine any taxes owed.

E-filing significantly reduces the processing time because the electronic system can automatically check for any errors, missing information, or inconsistencies in your return. This streamlines the processing and allows for faster turnaround times compared to manually reviewing paper returns.

Refund Time:

After your tax return has been processed, the refund time will depend on the method you choose to receive your refund: direct deposit or a physical check.

If you opt for direct deposit, it’s generally the fastest way to receive your refund. The funds can be deposited into your bank account within one to two weeks of your return being processed. However, the exact timing can vary depending on factors such as the accuracy of your return and any potential errors or issues that may arise during the processing of your refund.

If you choose to receive a refund check in the mail, it can take slightly longer to receive your refund. The IRS typically advises allowing an additional one to three weeks on top of the processing time for the check to be delivered to your registered address.

It’s important to note that these timeframes provided are general estimates and can vary depending on various factors, including the complexity of your tax situation and the volume of returns being processed by the IRS at any given time.

To ensure a smooth and efficient e-filing process, it’s crucial to double-check your return for accuracy, including all necessary documentation, and verify that your bank account information is entered correctly if choosing direct deposit. By doing so, you can help minimize any potential delays in processing and expedite the refund time.

Next, we will discuss some additional factors you should consider when it comes to checking the status of your refund and navigating any potential delays or issues.

Additional Factors to Consider

While understanding the processing and refund timeframes is essential, there are several additional factors to consider when it comes to receiving your IRS refund. These factors can impact the overall timeline and ensure a smooth refund process. Here are some key considerations:

- Accuracy of information: One crucial factor that can affect the processing time of your refund is the accuracy and completeness of the information provided on your tax return. Ensure that all personal details, including your Social Security number, are entered correctly, and all income, deductions, and credits are accurately reported.

- IRS backlog or delays: At times, the IRS may experience backlogs or delays due to high volumes of tax returns or other factors. These delays can extend the processing time for refunds. You can check the IRS website or use their online tools to stay updated on any known delays or issues that may affect your refund.

- Amended returns or special circumstances: If you’ve filed an amended return or have a unique tax situation, such as claiming certain tax credits or deductions, the processing time for your refund may be longer. Amended returns often require additional review and verification by the IRS, which can extend the overall processing timeframe.

- Identity theft or fraud: In cases where there are suspected cases of identity theft or fraudulent activities, the IRS may implement additional security measures and review your return more extensively. This can result in delays in processing and refund issuance. If you suspect identity theft, it’s crucial to alert the IRS and follow their guidance to resolve the situation.

- Banking and payment issues: Any errors or issues with your bank account information, including incorrect account numbers or closed accounts, can delay the direct deposit of your refund. It’s important to verify that the provided banking information is accurate and up to date to avoid any potential delays in receiving your refund.

By considering these additional factors and taking necessary precautions, you can maximize the chances of a smooth and timely refund process. However, if you encounter any delays or issues with your refund, there are ways to check the status and address any concerns, which we will discuss in the next section.

Checking the Status of Your Refund

Once you’ve filed your tax return and eagerly await your refund, it’s natural to want to check the status and stay informed throughout the process. The IRS provides several options for checking the status of your refund. Here’s how you can do it:

Online Tools:

The IRS offers an online tool called “Where’s My Refund?” that allows you to track the status of your refund. This tool is available on the IRS website and provides real-time updates on the progress of your refund. You will need to provide specific details, including your Social Security number, filing status, and the exact refund amount, to access your refund status.

IRS2Go App:

If you prefer to check the status on your mobile device, you can download the IRS2Go app, available for both iOS and Android. The app provides similar features to the online tool, allowing you to track your refund and receive notifications about the status of your return.

Phone:

If you prefer to speak with an IRS representative directly, you can call the IRS refund hotline at 1-800-829-1954. Make sure to have your Social Security number, filing status, and refund amount readily available when calling. However, keep in mind that wait times can be long, especially during peak tax season.

By utilizing these options, you can regularly check the status of your refund and stay informed about any updates or issues that may arise during the processing. However, it’s important to note that the IRS updates refund information on a weekly basis, so it may take a few days for any changes to reflect in the online tool or app.

In case there are any issues or delays with your refund, the IRS will provide instructions on how to address them. It’s crucial to follow their guidance and provide any requested documentation or information promptly to resolve any potential issues and expedite the refund process.

Next, let’s discuss some common delays and troubleshooting tips to help you navigate any potential obstacles along the way.

Delays and Troubleshooting

While the IRS aims to process and issue refunds in a timely manner, there can be instances where delays occur. Here are some common causes of delays and troubleshooting tips to help you navigate through them:

Incomplete or Incorrect Information:

If your tax return contains errors or missing information, the IRS may need to reach out to you for clarification or corrections. This can cause delays in the processing of your refund. To avoid such delays, double-check your return for accuracy, ensure all required forms and schedules are included, and provide complete information for each section.

Identity Theft or Fraud Concerns:

If there are suspicions of identity theft or fraudulent activity associated with your return, the IRS may conduct further review and verification. In such cases, it’s crucial to cooperate with the IRS, provide any requested documentation, and follow their instructions to resolve the issue as quickly as possible.

Processing Backlogs:

During peak tax season, the IRS often experiences high volumes of tax returns, leading to processing backlogs and potential delays. Be aware that it may take longer to process your refund during these periods. Staying patient and regularly checking the status of your refund through the IRS online tool or app can keep you informed about any updates or changes.

Amended Returns:

If you have filed an amended tax return, the processing time for your refund will typically be longer compared to regular tax returns. Amended returns require additional review and verification, which can extend the overall timeframe. It’s important to be aware of this and allow extra time for the processing of amended returns.

Banking or Payment Issues:

If there are any issues with your banking information or payment details, such as incorrect account numbers or closed accounts, it can lead to delays in receiving your refund. Ensure that you provide accurate and up-to-date banking information to avoid any potential issues.

If you face any delays or encounter issues with your refund, it’s advisable to contact the IRS directly. Their customer service representatives can provide guidance and assistance in resolving any refund-related concerns or inquiries.

Remember to stay vigilant and remain cautious of any fraudulent attempts claiming to expedite your refund or requesting personal information. The IRS will communicate with you through official channels and will never ask for sensitive information via email or phone.

Now that we’ve covered the possible delays and troubleshooting tips, let’s conclude our discussion with a summary of the key points.

Conclusion

Receiving your IRS refund is an eagerly anticipated moment for many taxpayers. Understanding the factors that can affect the processing time of your refund is crucial for managing your expectations and planning your finances accordingly.

In this article, we discussed the various factors that can influence the processing time, including the accuracy and complexity of your tax return, the volume of returns being processed, and the chosen filing method. We explored the processing and refund timeframes for both paper filing and e-filing methods, highlighting the advantages of e-filing in terms of quicker processing and refund times.

Additionally, we emphasized the importance of checking the status of your refund through the IRS online tool, app, or phone hotline. Regularly staying informed about any updates or issues can help ease any concerns and ensure a smooth refund process.

We also discussed potential delays and troubleshooting tips for common issues, such as incomplete or incorrect information, identity theft concerns, processing backlogs, amended returns, and banking or payment issues. Being aware of these factors and taking necessary precautions can help minimize delays and ensure a more efficient refund process.

As always, if you encounter any concerns or issues with your refund, it’s important to contact the IRS directly for assistance and follow their instructions to resolve any problems promptly.

By understanding the factors affecting the processing time of your IRS refund and being proactive in checking the status and addressing any potential delays or issues, you can have a clearer understanding of when to expect your refund and ensure a smoother and more efficient refund experience.

Remember, every tax situation is unique, and individual circumstances can impact processing timeframes. Patience, accuracy, and regular communication with the IRS are key to navigating the refund process successfully.

Now, armed with this knowledge, you can confidently plan your finances and await the arrival of your IRS refund.