Finance

How Long Is Lyft Billing Cycle

Published: March 7, 2024

Learn about the billing cycle for Lyft and how it impacts your finances. Find out the duration and frequency of Lyft's billing cycle. Understand the financial implications and plan accordingly.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

In the realm of modern transportation, ridesharing services have revolutionized the way people commute. Lyft, one of the prominent players in this space, offers a convenient and efficient means of getting from point A to point B. However, understanding the intricacies of Lyft's billing cycle is crucial for both riders and drivers. This article aims to demystify the concept of Lyft's billing cycle, shedding light on its duration, factors affecting it, and how to track it effectively.

Riders and drivers alike often wonder about the duration of Lyft's billing cycle. Understanding this cycle is essential for budgeting and financial planning, especially for frequent users or drivers who rely on Lyft as a source of income. By delving into the nuances of Lyft's billing cycle, individuals can gain a clearer understanding of how their transactions are processed and what to expect in terms of billing frequency.

Moreover, comprehending Lyft's billing cycle empowers users to monitor their expenses and earnings more effectively. Whether it's for personal budgeting or business accounting, having a firm grasp of the billing cycle can contribute to better financial management. This article seeks to elucidate the various aspects of Lyft's billing cycle, equipping readers with the knowledge to navigate the financial dimension of their Lyft experience with confidence.

Stay tuned as we explore the factors influencing Lyft's billing cycle, uncover tips for tracking the cycle seamlessly, and gain insights into the underlying mechanisms that drive this fundamental aspect of the Lyft platform. Whether you're a rider aiming to optimize your transportation budget or a driver seeking to streamline your earnings management, this article will provide valuable insights into the workings of Lyft's billing cycle.

Understanding Lyft’s Billing Cycle

Lyft’s billing cycle refers to the period over which transactions, including ride charges and driver earnings, are processed and billed. For riders, this cycle determines the frequency at which their payment methods are charged for completed rides, while for drivers, it dictates the timing of their earnings payouts. Understanding the duration of Lyft’s billing cycle is essential for both riders and drivers to effectively manage their finances and anticipate when transactions will occur.

Typically, Lyft’s billing cycle spans a week, with transactions being processed and billed on a weekly basis. This means that for both riders and drivers, the financial activity accrued within a given week will be consolidated and processed at the end of that week, with charges for rides being applied to the rider’s payment method and earnings being tabulated for drivers. This weekly billing cycle provides a regular cadence for financial transactions within the Lyft platform, allowing users to anticipate and plan for their expenses and earnings accordingly.

For riders, understanding Lyft’s billing cycle is crucial for budgeting and managing transportation expenses. By knowing when their payment methods will be charged for completed rides, riders can align their budgeting efforts with the weekly billing cycle, ensuring that they have the necessary funds available to cover their Lyft usage. Moreover, being aware of the billing cycle enables riders to monitor their ride expenses effectively, tracking their weekly usage and expenditures with clarity.

Similarly, for drivers, the billing cycle governs the timing of their earnings payouts. As the week draws to a close, drivers can expect their accumulated earnings to be processed and disbursed according to Lyft’s billing cycle. This predictability allows drivers to plan and manage their finances, leveraging their understanding of the billing cycle to anticipate their earnings and allocate funds for various purposes, be it personal expenses or business investments.

By comprehending Lyft’s billing cycle, both riders and drivers can navigate the financial dimension of their Lyft experience with confidence, leveraging the predictability and regularity of the billing cycle to optimize their budgeting, earnings management, and overall financial well-being.

Factors Affecting Lyft’s Billing Cycle

Several factors contribute to the dynamics and nuances of Lyft’s billing cycle, influencing the timing and processing of transactions for both riders and drivers. Understanding these factors is essential for gaining insight into the intricacies of Lyft’s financial operations and how the billing cycle is shaped by various elements.

- Ride Frequency: The frequency of a rider’s trips during the billing cycle can impact the overall billing experience. Riders who use Lyft services more frequently may encounter more frequent charges as their rides are processed within the weekly billing cycle. Conversely, riders with sporadic usage may experience less regular billing occurrences.

- Peak Hours and Demand: Lyft’s billing cycle can be influenced by peak hours and high demand periods, especially in areas with dynamic ride-hailing activity. During peak times, the processing of transactions and billing may reflect the increased demand and pricing fluctuations, potentially affecting the billing cycle’s timing and patterns.

- Driver Activity and Earnings: The engagement and activity of Lyft drivers play a role in shaping the billing cycle, particularly regarding the timing of earnings payouts. As drivers complete rides and accrue earnings throughout the week, the consolidation and processing of these earnings within the billing cycle impact the timing of their payouts.

- Payment Method and Processing: The payment methods used by riders and drivers can influence the billing cycle, with variations in processing times and financial institutions affecting the timing of transactions. Different payment methods may exhibit distinct processing timelines, potentially impacting the synchronization of billing cycles with individual payment methods.

These factors interplay to shape Lyft’s billing cycle, contributing to the rhythm and cadence of financial transactions within the platform. By recognizing the impact of ride frequency, demand dynamics, driver activity, and payment processing, users can gain a deeper understanding of the variables influencing Lyft’s billing cycle and adapt their financial planning and usage patterns accordingly.

How to Track Lyft Billing Cycle

Tracking Lyft’s billing cycle is essential for both riders and drivers to stay informed about their financial transactions and earnings within the platform. By monitoring the billing cycle effectively, users can anticipate charges, plan for earnings payouts, and maintain a clear understanding of their financial activity on Lyft. Here are key strategies for tracking Lyft’s billing cycle seamlessly:

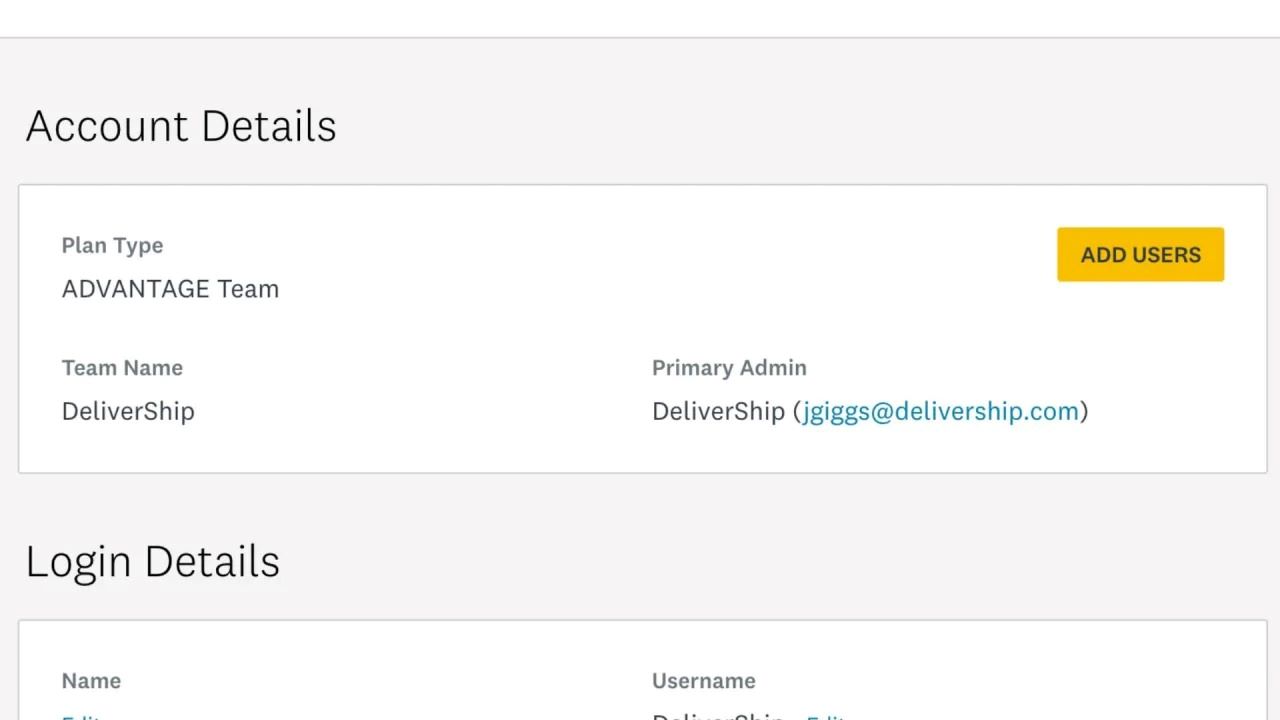

- Transaction History: Both riders and drivers can access their transaction history within the Lyft app or web interface. By reviewing the transaction log, users can track the timing and details of their financial activity, gaining insights into the processing and billing of rides, as well as the accrual and payout of driver earnings.

- Weekly Summaries: Lyft provides weekly summaries of financial activity, offering a comprehensive overview of transactions and earnings within the billing cycle. Riders and drivers can leverage these summaries to track the consolidation and processing of their financial data, aligning with the weekly cadence of Lyft’s billing cycle.

- Notification Settings: Users can customize their notification preferences within the Lyft app, enabling alerts for transaction processing, ride charges, and earnings payouts. By staying informed through notifications, riders and drivers can track the progression of the billing cycle and receive timely updates on their financial interactions with Lyft.

- Calendar Reminders: Setting calendar reminders for the end of each billing cycle week can help users stay proactive in tracking Lyft’s billing cycle. By scheduling reminders to review their financial activity and prepare for upcoming charges or payouts, users can maintain awareness of the billing cycle’s rhythm and plan accordingly.

By leveraging these tracking methods, users can stay informed and in control of their financial engagements with Lyft, ensuring that they are attuned to the billing cycle’s progression and the corresponding processing of their transactions and earnings. Whether it’s through real-time transaction monitoring, weekly summaries, proactive notifications, or calendar-based reminders, tracking Lyft’s billing cycle empowers users to navigate the financial dimension of their Lyft experience with confidence and clarity.

Conclusion

Understanding and tracking Lyft’s billing cycle is pivotal for both riders and drivers, offering insights into the timing and processing of financial transactions within the platform. By comprehending the duration of Lyft’s billing cycle and the factors influencing it, users can optimize their budgeting, anticipate charges, and plan for earnings payouts effectively. The weekly cadence of Lyft’s billing cycle provides a predictable rhythm for financial interactions, empowering users to manage their expenses and earnings with clarity and foresight.

Factors such as ride frequency, demand dynamics, driver activity, and payment processing contribute to the nuances of Lyft’s billing cycle, shaping the timing and patterns of transactions and earnings within the platform. By recognizing these factors, users can adapt their financial planning and usage patterns to align with the dynamics of the billing cycle, enhancing their financial management on Lyft.

Moreover, tracking Lyft’s billing cycle through transaction history, weekly summaries, notification settings, and calendar reminders enables users to stay informed and proactive in managing their financial engagements with Lyft. This proactive approach fosters a deeper understanding of the billing cycle’s progression, ensuring that users are prepared for upcoming charges, earnings payouts, and financial reconciliations.

In essence, a comprehensive grasp of Lyft’s billing cycle empowers users to navigate the financial dimension of their Lyft experience with confidence and control. By leveraging the knowledge and tracking methods outlined in this article, riders and drivers can optimize their financial management, stay attuned to the rhythm of the billing cycle, and make informed decisions regarding their expenses and earnings within the Lyft ecosystem.

Ultimately, understanding and tracking Lyft’s billing cycle is not only about financial awareness but also about empowering users to engage with Lyft’s services in a manner that aligns with their individual budgeting and earnings objectives. By demystifying the billing cycle and providing effective tracking strategies, this article aims to equip users with the knowledge and tools to navigate the financial intricacies of Lyft with ease and confidence.