Finance

How To Change Name On Credit Card

Modified: February 21, 2024

Learn how to change the name on your credit card for better financial management and security. Expert tips and step-by-step guide.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Changing the name on your credit card is a necessary process that may arise due to various reasons. Whether you recently got married, legally changed your name, or simply want to update your credit card information, it’s important to ensure that your credit card reflects your current legal name. However, navigating the process of changing your name on a credit card can be overwhelming if you’re unsure where to start.

In this article, we will guide you through the step-by-step process of changing your name on a credit card. We’ll discuss the reasons why you may need to make this change, how to contact your credit card provider, the documentation required, and the overall process involved. Additionally, we’ll explore the importance of updating your name with associated accounts and billing information and verify the completion of the name change.

By following these guidelines, you can ensure that your credit card reflects your correct name. This not only helps avoid confusion and potential issues during transactions but also ensures that your credit history is accurate.

Reasons for Changing Name on Credit Card

There are several common reasons why you might need to change your name on your credit card. Understanding these reasons will help you determine whether a name change is necessary for you. Here are some of the most common reasons:

- Marriage: Many individuals choose to change their last name after getting married. If you’ve recently tied the knot, you may want to update your credit card to reflect your new name.

- Divorce or separation: Following a divorce or separation, some individuals may want to revert to their maiden name or adopt a completely new name. Changing your name on your credit card is a crucial step in aligning your financial documents with your new legal name.

- Legal name change: There are various personal reasons why someone might legally change their name. Whether it’s for cultural, religious, or personal reasons, updating your name on your credit card is essential to maintain consistency in your financial records.

- Identity theft: In unfortunate cases of identity theft, individuals may need to change their name on their credit card to protect themselves from further fraudulent activity. By updating your name, you can reduce the risk of unauthorized transactions under your previous name.

Regardless of the reason, changing your name on your credit card is an important step in ensuring that your financial documentation accurately reflects your legal name. It not only helps streamline financial transactions but also contributes to maintaining the integrity of your credit history.

Contacting Your Credit Card Provider

Once you’ve determined that you need to change your name on your credit card, the next step is to contact your credit card provider. It’s important to reach out to them directly to initiate the name change process and gather specific instructions tailored to your credit card company’s policies. Here’s how you can contact your credit card provider:

- Customer service phone number: Check your credit card company’s website or the back of your credit card for the customer service phone number. Call the number and follow the prompts to speak with a representative who can guide you through the name change process.

- Online customer portal: Log in to your credit card provider’s online customer portal. Look for a section or option related to account management or personal information. You may find a self-service option to initiate a name change request.

- In-person visit: Some credit card companies have physical branch locations. If you prefer a face-to-face interaction, visit your credit card provider’s branch and speak with a representative who can assist you with the name change process.

Remember to have your credit card account information readily available when contacting your credit card provider. This will help the representative locate your account and assist you more efficiently.

It’s important to note that each credit card company may have different procedures and requirements for initiating a name change. Therefore, it’s essential to follow their specific instructions and provide any necessary documentation to ensure a smooth and successful name change process.

Documentation Required for Name Change

When changing your name on a credit card, you will likely be required to provide certain documentation to verify your new name. The specific documents may vary depending on your credit card provider and the reason for the name change. Here are some common documents that may be required:

- Legal Name Change Certificate: If you changed your name through a legal process, such as a court order, you will need to provide a copy of the legal name change certificate or court order as proof of your new name.

- Marriage Certificate: If your name change is due to marriage, you will typically need to submit a copy of your marriage certificate. This document verifies your marriage and serves as proof of your new last name.

- Divorce Decree or Name Change Order: In the case of a divorce or separation, you may need to provide a copy of the divorce decree or name change order issued by the court. This document confirms your name change resulting from the divorce or separation.

- Valid Identification: Your credit card provider may require you to provide a government-issued identification document, such as a driver’s license or passport, to verify your identity.

- Social Security Card: Some credit card companies may ask for a copy of your updated Social Security card, especially if your name change is related to a legal process or divorce.

It’s important to contact your credit card provider directly to inquire about the exact documentation requirements for a name change. They will provide you with detailed instructions on which documents are needed and how to submit them.

Make sure to keep copies of all the documents you submit for your own records. If any issues arise during the name change process, having documentation readily available will help resolve them more efficiently.

Process for Changing Name on Credit Card

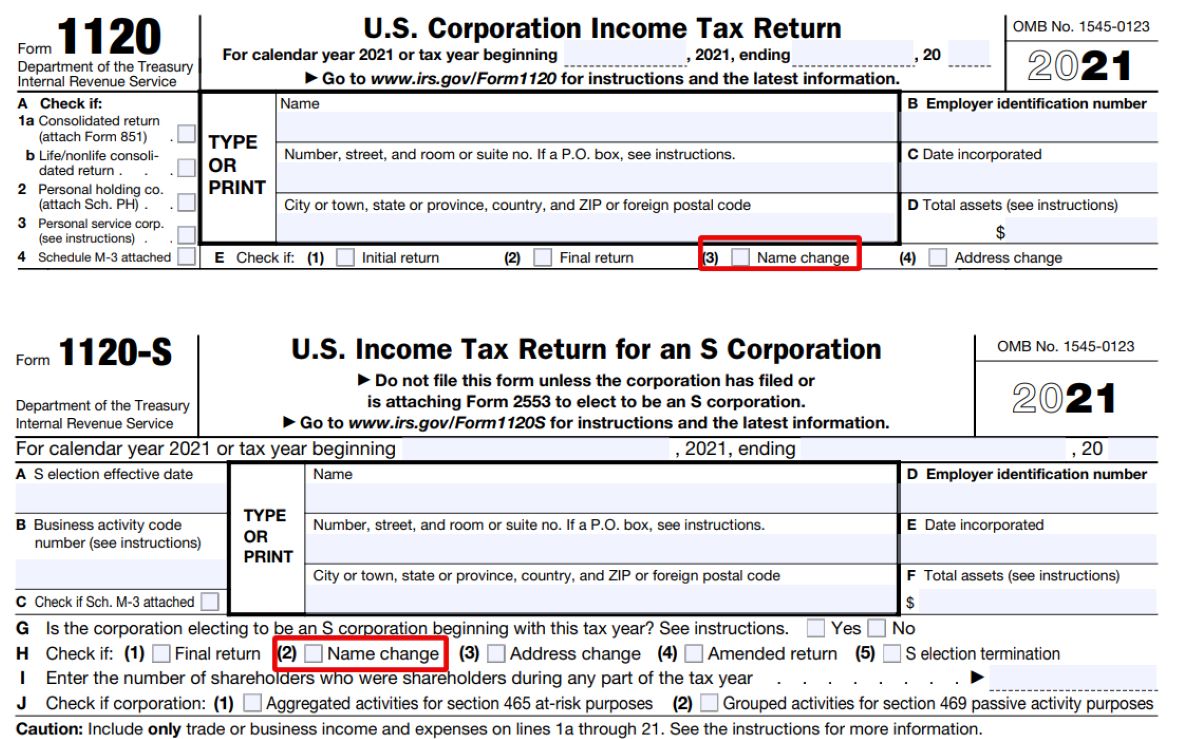

Once you’ve contacted your credit card provider and gathered the required documentation, it’s time to initiate the process of changing your name on your credit card. While the exact process may vary depending on your credit card company, here are the general steps involved:

- Submit documentation: Follow the instructions provided by your credit card provider to submit the necessary documentation for your name change. This may involve mailing copies of the required documents or uploading them through an online portal.

- Wait for confirmation: After submitting your documents, you’ll generally need to wait for your credit card provider to review and process your request. The timeframe for processing can vary, so be patient during this step.

- Receive new credit card: Once your name change request is approved, your credit card provider will issue you a new credit card reflecting your updated name. The timeframe for receiving the new card may vary. In some cases, you may need to activate the new card online or via phone before using it.

- Destroy old card: To ensure security and avoid confusion, it’s important to destroy your old credit card once you receive the new one. Cut the card into pieces or follow the specific instructions provided by your credit card provider for proper disposal.

- Update auto-payments and recurring charges: Review your credit card statements and make a list of any automatic payments or recurring charges linked to your old credit card. Update them with your new credit card information to avoid any interruptions or late payments.

Throughout this process, it’s crucial to keep an eye on your credit card statements and online account to ensure that the name change is reflected correctly. If you notice any errors or discrepancies, contact your credit card provider immediately for assistance.

Remember, changing your name on your credit card is just one step in the process. You will also need to update your name with various other institutions, such as the Social Security Administration, your bank, and other financial accounts. It’s important to stay organized and methodically update your name across all relevant platforms.

Updating Name with Associated Accounts and Billing Information

Once you have successfully changed your name on your credit card, it is important to update your name with any associated accounts and billing information to avoid any confusion or disruption in your financial activities. Here are some key areas where you should consider updating your name:

- Bank accounts: Contact your bank to update your name on all your bank accounts, including checking, savings, and investment accounts. Provide them with the necessary documentation and follow their specific process for name change requests.

- Employer payroll: If you have your credit card linked to your employer’s payroll for direct deposit of your salary, make sure to update your name with your human resources department or payroll administrator to ensure your earnings are properly credited.

- Utility bills and subscriptions: Update your name with utility companies, such as water, electricity, and gas providers. Additionally, inform any subscriptions or services you have that use your credit card for payment, including streaming services, magazine subscriptions, or gym memberships.

- Insurance policies: Contact your insurance providers to update your name on your policies, including health insurance, auto insurance, and homeowner’s or renter’s insurance.

- Government agencies: Notify relevant government agencies of your name change, such as the Social Security Administration, the Department of Motor Vehicles, and the Internal Revenue Service (IRS). Each agency may have specific requirements and procedures for updating your name.

Remember to keep copies of any documentation you provide during the name change process, as some institutions may request verification of your name change.

It can be helpful to create a checklist or spreadsheet to keep track of all the accounts and services that need your name updated. Mark each item off the list as you complete the name change process to ensure you haven’t missed any important accounts or subscriptions.

By updating your name with associated accounts and billing information, you can maintain consistency and avoid any discrepancies that may occur during financial transactions or interactions with various service providers.

Checking for Errors and Verifying Name Change

After completing the process of changing your name on your credit card and updating your name with associated accounts and billing information, it’s crucial to double-check for any errors and verify that your name change has been successfully implemented. Here’s what you should do:

- Review credit card statements: Take the time to thoroughly review your credit card statements after the name change has been processed. Ensure that your new name is accurately reflected on the statements and that there are no discrepancies or unauthorized charges.

- Monitor credit reports: Regularly check your credit reports from the major credit bureaus to ensure that your name change is accurately reflected. Any inconsistencies or errors should be reported immediately to the credit bureaus for correction.

- Contact customer service: If you notice any discrepancies or issues with your credit card or associated accounts after the name change, reach out to the customer service department of the respective institutions. Explain the situation and provide any supporting documentation that may be required to resolve the issue.

- Keep updated documents: Retain copies of all the documents related to your name change, including confirmation emails, letters, or any other correspondence from your credit card provider and other institutions. These documents will serve as proof of your name change, if needed in the future.

- Follow up: If there are any outstanding accounts or services that have not updated your name, follow up with them to ensure that the name change is processed. Be persistent in getting your name updated across all platforms.

It’s important to stay vigilant during this process to catch any errors or oversights. Proactively checking for any issues will help you resolve them promptly and prevent potential problems down the line.

Remember that changing your name on your credit card is just the beginning. Make sure to update your name across all relevant platforms to maintain consistency in your financial records.

By taking these steps, you can ensure a smooth and successful name change process, minimizing any inconvenience or potential complications that may arise from an incorrect or outdated name on your credit card and associated accounts.

Conclusion

Changing the name on your credit card is a necessary task that may arise due to marriage, divorce, legal name change, or identity theft. By following the proper process and providing the required documentation, you can ensure that your credit card reflects your current legal name.

Contacting your credit card provider is the first step in initiating the name change process. Whether through a phone call, online portal, or in-person visit, they will guide you on the specific requirements and procedures for changing your name on the credit card.

Documentation plays a crucial role in verifying your new name. Depending on the reason for the name change, you may be required to provide a legal name change certificate, marriage certificate, divorce decree, or other identification documents.

Once the necessary documentation is submitted, you’ll need to wait for your credit card provider to process your request and issue a new credit card with your updated name. Remember to destroy your old card and update your name with associated accounts and billing information to maintain consistency.

After completing the name change process, it’s essential to check for any errors and verify that your new name is accurately reflected on your credit card statements and credit reports. By monitoring your financial accounts and following up with any discrepancies, you can ensure the success of the name change.

Changing your name on your credit card is just one step in a broader process. Remember to update your name with other institutions such as banks, employers, utilities, insurance providers, and government agencies to maintain consistency across all platforms.

By following these guidelines and staying organized throughout the name change process, you can successfully update your name on your credit card and associated accounts. This will help avoid confusion during financial transactions and maintain accurate records of your financial history.

Remember, if you encounter any challenges or have specific queries regarding the name change process, reach out to your credit card provider for assistance.