Finance

How Many Credit Hours To Get Financial Aid

Published: January 7, 2024

Learn how many credit hours you need to be eligible for financial aid in the field of finance. Find out the minimum requirement to qualify for financial assistance

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Definition of Credit Hours

- Importance of Credit Hours for Financial Aid

- Minimum Credit Hour Requirement for Financial Aid

- Full-Time vs. Part-Time Enrollment

- Factors Influencing Credit Hour Requirements for Financial Aid

- Exceptions to Credit Hour Requirements for Financial Aid

- Consequences of Dropping Below Minimum Credit Hours

- Strategies for Meeting Credit Hour Requirements

- Conclusion

Introduction

When it comes to pursuing higher education, one crucial aspect to consider is financial aid. Many students rely on scholarships, grants, and loans to help cover the costs of tuition, books, and other expenses. However, accessing these resources often comes with certain requirements, such as maintaining a specific number of credit hours per semester.

Credit hours are a vital component of the higher education system. They are a way of quantifying the amount of academic work a student is expected to complete. Each course is assigned a specific number of credit hours, which typically represents the amount of time spent in class and completing coursework.

Understanding credit hours is essential because they play a significant role in determining eligibility for financial aid. The number of credit hours a student is enrolled in can influence the types and amounts of aid they are eligible to receive. In this article, we will explore the importance of credit hours for financial aid, minimum credit hour requirements, the difference between full-time and part-time enrollment, factors that influence credit hour requirements, exceptions to those requirements, consequences of dropping below the minimum credit hours, and strategies for meeting credit hour requirements.

By gaining a better understanding of credit hours and financial aid requirements, students can make informed decisions and maximize their chances of securing the necessary financial support to pursue their education.

Definition of Credit Hours

Before delving into the importance of credit hours for financial aid, it is important to understand what credit hours actually are. Credit hours can be thought of as a unit of measurement that represents the time and effort required to complete a particular course. They serve as a way to quantify the amount of work a student is expected to put into their studies.

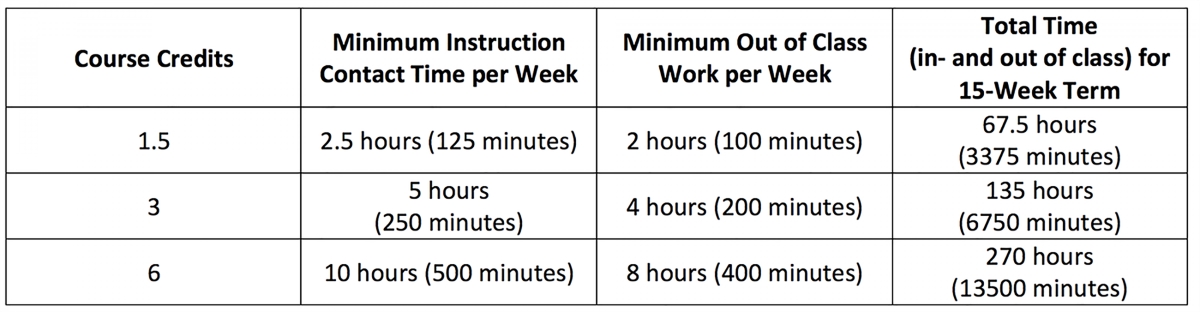

In most educational institutions, a credit hour is equivalent to one hour of classroom instruction per week over the course of a semester. This includes time spent attending lectures, participating in discussions, and engaging in other forms of classroom instruction. Additionally, credit hours also take into account the time spent on assignments, studying, and other activities related to the course.

Typically, credit hours are assigned to each individual course based on factors such as the level of difficulty, the amount of material covered, and the expected workload. For example, a three-credit-hour course may require three hours of classroom instruction per week, along with an additional six hours of studying and completing assignments outside of class.

It is important to note that credit hours can vary between institutions and even between different departments within the same institution. For example, a science course may have a higher credit hour value compared to a humanities course, reflecting the additional time and effort required for laboratory work and experiments.

Understanding the concept of credit hours is crucial as it forms the basis for determining a student’s course load and academic progress when it comes to financial aid eligibility. In the next section, we will explore the significance of credit hours in obtaining financial assistance for education.

Importance of Credit Hours for Financial Aid

Credit hours play a vital role in determining a student’s eligibility for financial aid. When it comes to scholarships, grants, and loans, many institutions and programs require students to maintain a certain number of credit hours to qualify and continue receiving support.

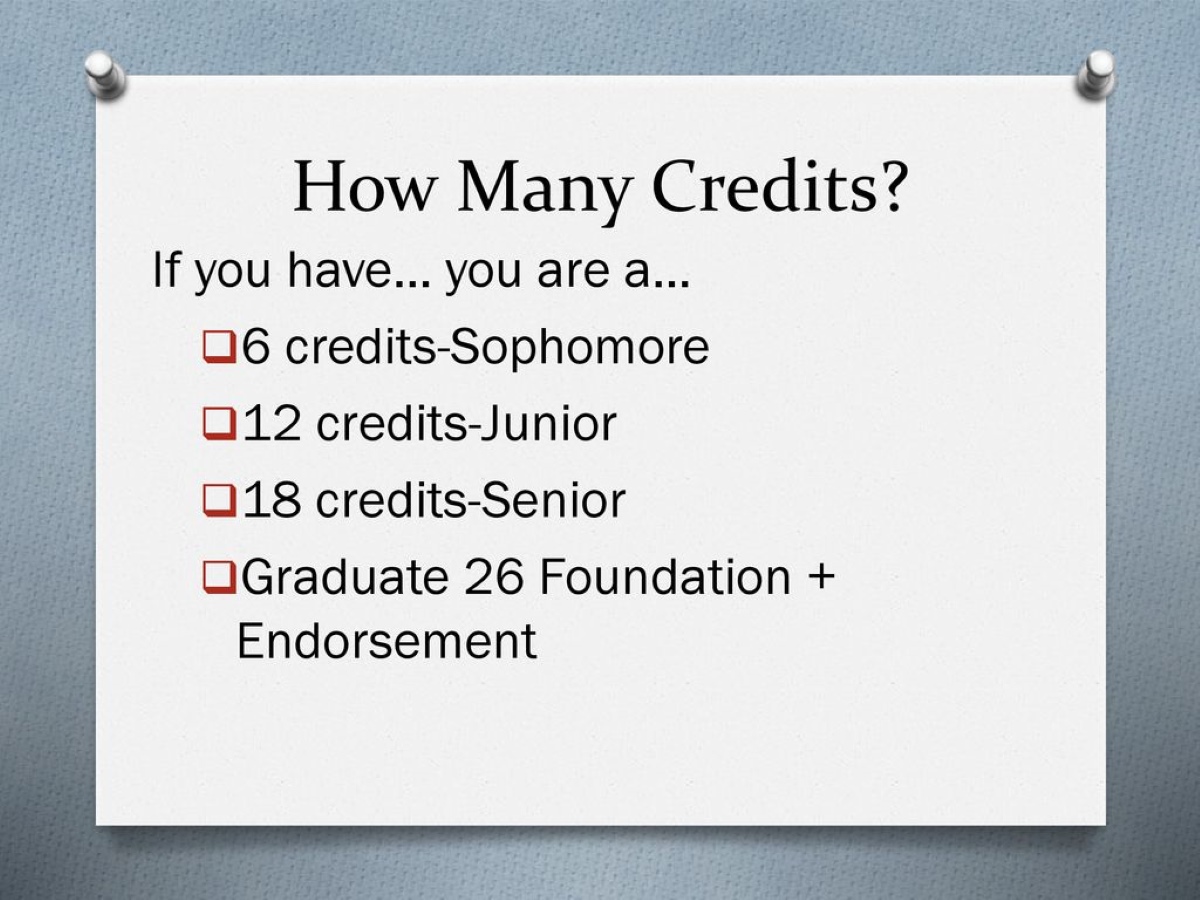

One of the main reasons credit hours are important for financial aid is that they indicate a student’s enrollment status. Most financial aid programs categorize students into two main groups: full-time and part-time students. Full-time students are generally required to be enrolled in a specific minimum number of credit hours, typically between 12 and 15 credit hours per semester. Part-time students, on the other hand, are enrolled in fewer credit hours, usually less than 12 per semester.

Financial aid programs often prioritize full-time students by offering more extensive and structured funding options. This is because full-time students are expected to dedicate more time and effort to their studies, and they are often pursuing their education without the added burden of significant employment. Therefore, financial aid programs are designed to support full-time students in meeting the costs of tuition, books, and living expenses.

Furthermore, credit hours are significant for determining the disbursement of financial aid funds. Many scholarships, grants, and loans require students to maintain a specific number of credit hours throughout the academic term to remain eligible for the aid. If a student drops below the required credit hours, they may risk losing their financial aid or having it reduced.

Another important aspect to consider is the impact of credit hours on the cost of education. Generally, tuition fees are calculated based on the number of credit hours a student is enrolled in. By enrolling in a higher number of credit hours, students may be able to optimize the cost per credit hour and potentially reduce their overall tuition expenses.

Overall, credit hours are fundamental in determining a student’s eligibility for financial aid, the type and amount of aid they receive, and the overall cost of their education. It is crucial for students to understand the importance of maintaining the required credit hour load to ensure they can access the financial support they need to pursue their educational goals.

Minimum Credit Hour Requirement for Financial Aid

When it comes to financial aid, institutions and programs often have specific minimum credit hour requirements that students must meet to be eligible for assistance. The minimum credit hour requirement sets the threshold for how many credit hours a student must be enrolled in to qualify for financial aid.

The minimum credit hour requirement varies among institutions and can also differ based on the type of financial aid program. Generally, full-time students are expected to maintain a higher credit hour load compared to part-time students. While the specific number of credit hours required may vary, full-time enrollment typically ranges from 12 to 15 credit hours per semester.

It is important for students to be aware of these minimum credit hour requirements to ensure they can access and retain their financial aid. Failing to meet the minimum credit hour requirement can result in the loss of financial aid or a reduction in the amount of aid received.

However, it’s worth noting that some financial aid programs may have exceptions or accommodations for students with certain circumstances. For example, students with disabilities or medical conditions may be granted flexibility in meeting the minimum credit hour requirement. Additionally, students in their final semester before graduation or those participating in internships or co-op programs may have different credit hour requirements.

It is crucial for students to review the specific requirements of their financial aid programs and communicate with their institution’s financial aid office to ensure they understand and fulfill the minimum credit hour requirement. This will help students maintain their eligibility for financial aid and continue receiving the support they need to pursue their education.

Full-Time vs. Part-Time Enrollment

When it comes to pursuing higher education, students have the option to enroll either as full-time or part-time students. The choice between full-time and part-time enrollment can have implications for financial aid eligibility and the overall educational experience.

Full-time enrollment typically refers to students who are registered for a minimum number of credit hours per semester, generally between 12 and 15 credit hours. Full-time students are expected to dedicate a significant amount of time and effort to their studies, attending classes, participating in discussions, completing assignments, and engaging in extracurricular activities. They often have a more structured and immersive educational experience.

Part-time enrollment, on the other hand, refers to students who are registered for fewer credit hours than the minimum required for full-time status. Part-time students may be enrolled in as few as one or two courses per semester, allowing for more flexibility in terms of scheduling and balancing other commitments such as work or family responsibilities.

When it comes to financial aid, full-time enrollment is often prioritized. Many financial aid programs and scholarships require students to be enrolled as full-time students to qualify for the maximum amount of aid. This is because full-time students are expected to dedicate more time and effort to their studies, making education their primary focus. By supporting full-time students, financial aid programs aim to ensure that students can commit to their academic pursuits without the added burden of significant employment.

Part-time students may still be eligible for financial aid, but the amount and types of aid available to them may differ. Financial aid for part-time students may be prorated based on the number of credit hours they are registered for. Additionally, some scholarships or grants may specifically target part-time students, recognizing the unique challenges they face in balancing work, family, and education.

Both full-time and part-time enrollment have their own advantages and considerations. Full-time enrollment allows students to complete their degree program more quickly and have a more immersive academic experience, while part-time enrollment offers greater flexibility for those juggling multiple responsibilities. It is important for students to carefully consider their personal circumstances, academic goals, and financial aid eligibility when deciding between full-time and part-time enrollment.

Factors Influencing Credit Hour Requirements for Financial Aid

The credit hour requirements for financial aid can vary based on several factors. Institutions and financial aid programs take into account various considerations when determining the specific credit hour requirements for eligibility. Understanding these factors can help students navigate the requirements and ensure they meet the necessary credit hour load to access financial aid.

1. Institution Policy: Each educational institution may have its own credit hour requirements for financial aid. These policies can vary based on the institution’s academic calendar, degree programs, and accreditation standards. It is important for students to familiarize themselves with their institution’s policies to ensure they meet the credit hour requirements for financial aid.

2. Academic Level: The credit hour requirements may differ based on the student’s academic level. Freshmen, sophomores, juniors, and seniors may have varying credit hour expectations, with higher-level students typically expected to take more credit hours as they progress in their degree program.

3. Degree Program: The credit hour requirements may vary depending on the type of degree program a student is pursuing. Certain programs, such as professional or technical programs, may have specific credit hour requirements due to additional coursework, internships, or clinical rotations.

4. Academic Standing: Students’ academic standing, such as their GPA or academic progress, can impact the credit hour requirements for financial aid. Some financial aid programs may have minimum GPA requirements or require students to maintain satisfactory academic progress to remain eligible for aid.

5. Graduate vs. Undergraduate Status: Graduate students may have different credit hour requirements compared to undergraduate students. Graduate programs often have specific credit hour expectations for different stages of the academic program, such as coursework, research, or thesis development.

6. Program of Study: The credit hour requirements may also vary based on the student’s program of study or major. Certain majors may have additional credit hour requirements due to laboratory work, field experiences, or specialized coursework.

Additionally, it is important to note that the specific credit hour requirements for financial aid can be influenced by federal regulations, state policies, and individual financial aid programs. It is essential for students to consult with their institution’s financial aid office to understand the specific factors that influence credit hour requirements for the financial aid programs they are applying to.

Exceptions to Credit Hour Requirements for Financial Aid

While maintaining the minimum credit hour requirement is crucial for financial aid eligibility, there are certain exceptions or accommodations that students may qualify for. These exceptions recognize that every student’s situation is unique and that there may be valid reasons for not being able to meet the standard credit hour requirements.

1. Disabilities or Medical Conditions: Students with documented disabilities or medical conditions may qualify for accommodations regarding credit hour requirements. These accommodations could include a reduced credit hour load or a modified academic schedule to ensure students can balance their health needs while pursuing their education. It is important for students to work with their institution’s disability services office to determine eligibility for these accommodations.

2. Internships, Co-op Programs, or Study Abroad: Students participating in internships, cooperative education programs, or study abroad experiences may have different credit hour requirements. These programs often provide valuable learning opportunities that enhance a student’s education and skills, but they may not require a full-time credit hour load. Students should consult with their academic advisors and the institution’s financial aid office to determine the credit hour expectations for these programs.

3. Graduating Seniors: Seniors who are in their final semester before graduation may have flexibility in meeting the standard credit hour requirements. Institutions often provide leeway for graduating seniors who may only need a few remaining credits to complete their degree requirements.

4. Part-Time Enrollment: While full-time enrollment is typically required for maximum financial aid eligibility, part-time students may still be eligible for some forms of financial aid. Financial aid programs designed specifically for part-time students may offer assistance even if they are not meeting the standard full-time credit hour requirement. These programs often consider the unique challenges faced by part-time students who are balancing work or family responsibilities.

It is important for students who believe they qualify for an exception to credit hour requirements to communicate with their institution’s financial aid office. By providing the necessary documentation and explaining their circumstances, students can explore the available options and ensure they receive appropriate consideration.

Remember that the availability and specific requirements of exceptions to credit hour requirements for financial aid may vary among institutions and programs. Therefore, it is crucial for students to consult with their financial aid office to understand the specific policies and procedures regarding exceptions to credit hour requirements at their institution.

Consequences of Dropping Below Minimum Credit Hours

It is important for students to understand the consequences of dropping below the minimum credit hour requirement for financial aid. Failing to maintain the required credit hour load can have significant implications for a student’s eligibility and the amount of financial aid they receive.

1. Financial Aid Eligibility: One of the immediate consequences of dropping below the minimum credit hours is the potential loss of financial aid eligibility. Many financial aid programs require students to be enrolled as full-time students, typically with a minimum of 12 credit hours per semester. If a student falls below this threshold, they may lose their eligibility for certain types of financial aid, such as scholarships, grants, or loans that prioritize full-time enrollment.

2. Aid Disbursement: In addition to jeopardizing overall financial aid eligibility, dropping below the minimum credit hour requirement can affect the disbursement of funds already awarded. Some financial aid programs release the funds based on the assumption that a student will maintain the required credit hour load. If a student drops below the minimum, their financial aid disbursement may be adjusted or reduced accordingly.

3. Loan Repayment: For students who have taken out loans, dropping below the minimum credit hour requirement can trigger the start of their loan repayment period. Many loan programs have a grace period that allows students to delay repayment while they are enrolled as full-time students. However, dropping below the minimum credit hours may signal the end of this grace period, requiring students to start repaying their loans sooner than anticipated.

4. Academic Progress and Loss of Aid: Dropping below the minimum credit hour requirement can also impact a student’s academic progress. Some financial aid programs require students to maintain satisfactory academic progress, including a minimum GPA and credit hour completion rate. Falling below the required credit hours can lead to academic probation or loss of aid if it negatively affects a student’s overall progress.

5. Repayment Obligations: In some cases, dropping below the minimum credit hour requirement may result in having to repay a portion of the financial aid already disbursed for the semester. This is often referred to as a repayment obligation, and it can further burden students with additional financial responsibilities.

It is essential for students to be aware of these potential consequences and communicate with their institution’s financial aid office if they anticipate dropping below the minimum credit hour requirement. In some cases, students may be able to seek waivers or explore alternative options to maintain financial aid eligibility, such as appealing the requirement or exploring part-time aid programs.

It is important to note that the specific consequences may vary among institutions and financial aid programs. Students should carefully review the policies and guidelines of their specific financial aid programs and seek guidance from the financial aid office to fully understand the potential ramifications before making any decisions regarding credit hour loads.

Strategies for Meeting Credit Hour Requirements

Meeting the minimum credit hour requirements for financial aid is crucial to maintain eligibility and access the necessary funds to support your education. If you find yourself struggling to meet the required credit hours, there are several strategies you can employ to ensure you fulfill the requirements and continue to receive financial aid.

1. Course Planning: Take the time to carefully plan your course schedule each semester. Look for courses that align with your academic goals and interests while also considering the credit hour value of each course. Balancing lighter credit hour courses with those that carry more credit hours can help you meet the minimum requirement without overwhelming yourself.

2. Summer and Winter Term Courses: Consider enrolling in summer or winter term courses to earn additional credit hours. These shorter sessions can provide an opportunity to catch up on credit hours or get ahead, allowing you to stay on track with your academic progress and maintain financial aid eligibility.

3. Double Major or Minor: Exploring the possibility of pursuing a double major or minor can help you fulfill credit hour requirements. By adding an additional field of study, you can potentially earn more credit hours without overloading your schedule.

4. Study Abroad or Exchange Programs: Participating in study abroad or student exchange programs can allow you to earn credit hours while experiencing a different culture and broadening your educational horizons. Consult with your institution’s study abroad office to identify programs that align with your academic goals and credit hour needs.

5. Online or Flexible Courses: Consider taking online courses or courses with flexible scheduling options. These types of courses can provide you with the flexibility you need to balance work, family, and other responsibilities while still earning the necessary credit hours for financial aid.

6. Seek Academic Advising: Consult with your academic advisor to help create a plan that aligns with your academic goals and meets the credit hour requirements. They can provide guidance on course selection, credit transfer options, and alternative pathways to ensure you meet the necessary credit hour load.

7. Financial Aid Office Consultation: Reach out to your institution’s financial aid office to discuss any concerns or questions regarding credit hour requirements. They can provide specific information about your financial aid options, potential exceptions or accommodations, and help you navigate the process of maintaining eligibility.

Remember, it is crucial to stay proactive and communicate with the appropriate resources at your institution. By carefully planning your course schedule, exploring alternative credit-earning opportunities, and seeking guidance, you can meet the credit hour requirements for financial aid and continue to access the support you need for your educational journey.

Conclusion

Credit hours play a significant role in determining a student’s eligibility for financial aid. Understanding the importance of credit hours and the associated requirements is crucial for students seeking financial assistance to pursue their education. The minimum credit hour requirement, whether for full-time or part-time enrollment, serves as a benchmark for financial aid eligibility and the amount of aid received.

Throughout this article, we have explored various aspects related to credit hours and financial aid. We discussed the definition of credit hours and how they are used to measure the amount of academic work a student is expected to complete. We also examined the importance of credit hours for financial aid, including the different eligibility criteria and the consequences of dropping below the minimum credit hour requirement.

We highlighted the factors that influence credit hour requirements, such as institution policies, academic level, degree programs, and program of study. Additionally, we identified exceptions and accommodations for credit hour requirements, including considerations for students with disabilities or medical conditions, participation in internships or study abroad programs, and graduating seniors.

To ensure financial aid eligibility and meet the credit hour requirements, we provided strategies, such as careful course planning, summer or winter term courses, pursuing double majors or minors, studying abroad, taking online or flexible courses, seeking academic advising, and consulting with the financial aid office.

In conclusion, credit hours are a vital component of the financial aid process. By understanding credit hour requirements, planning courses strategically, exploring alternative opportunities, and staying informed about exceptions or accommodations, students can meet the credit hour requirements for financial aid and secure the necessary funding to pursue their educational goals. It is crucial for students to communicate with their institution’s financial aid office and academic advisors to navigate the credit hour requirements effectively and access the financial support they need along their educational journey.