Home>Finance>What’s The Catch With Many Services Promoting A “Free Credit Score?

Finance

What’s The Catch With Many Services Promoting A “Free Credit Score?

Published: October 23, 2023

Discover the hidden costs behind "free credit score" services and how they may impact your personal finance.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of personal finance, where understanding your credit score is key to managing your financial health. Your credit score plays a crucial role in determining your eligibility for loans, credit cards, and even rental applications. With so much at stake, it’s no wonder that many individuals are eager to monitor and track changes in their credit score.

When it comes to obtaining a credit score, many services advertise the lure of a “free credit score.” It sounds like a fantastic deal, right? But like with many things in life, there’s often a catch. In this article, we’ll explore the world of “free credit score” services and what you need to know before diving in.

Before we delve into the realities of “free credit score” services, it’s essential to understand what a credit score is and why it holds such significance.

Your credit score is a three-digit number that represents your creditworthiness. It is based on your credit history, which includes information such as payment history, outstanding debt, length of credit history, types of credit used, and new accounts.

This three-digit number, typically ranging from 300 to 850, is used by lenders to assess the level of risk associated with lending money or extending credit to individuals. The higher your credit score, the more likely you are to be approved for loans and credit at favorable terms.

Having a good credit score can give you a competitive edge in securing better interest rates, higher credit limits, and access to more opportunities. On the other hand, a poor credit score can lead to difficulties in obtaining credit and higher interest rates, impacting your financial standing and future borrowing capabilities.

Given the importance of credit scores, it’s only natural that individuals want to stay on top of their credit health. This is where “free credit score” services enter the picture, promising to provide individuals with access to their credit scores at no cost.

But is it really as straightforward as it seems? Join us as we explore the reality behind “free credit score” services and unveil the potential catches hiding behind the seemingly enticing offer.

Understanding Credit Scores

Before we dive into the complexities of “free credit score” services, let’s take a moment to understand how credit scores are calculated and what factors contribute to them.

There are several different credit scoring models used by credit bureaus and lenders, but the most widely recognized and commonly used model is the FICO score. The FICO score ranges from 300 to 850, with higher scores indicating better creditworthiness.

The calculation of credit scores takes into account various factors, with different weightings assigned to each factor. These factors include:

- Payment history: This is the most crucial factor, accounting for approximately 35% of your credit score. It reflects your track record of making timely payments on your credit accounts.

- Amounts owed: This factor accounts for about 30% of your credit score. It considers the amount of debt you owe in relation to your available credit limits, known as the utilization ratio. A high utilization ratio can negatively impact your credit score.

- Length of credit history: The length of time you’ve had credit accounts for about 15% of your credit score. Generally, a longer credit history is seen as more favorable, as it provides a more comprehensive picture of your credit management.

- New credit: This factor accounts for approximately 10% of your credit score. It includes factors such as the number of new credit accounts opened recently and inquiries made by lenders when assessing your creditworthiness.

- Credit mix: The last factor, accounting for about 10% of your credit score, considers the types of credit you have. Having a diverse mix of credit, such as a combination of credit cards, loans, and mortgages, can positively impact your score.

Understanding these key factors that contribute to credit scores is crucial in evaluating the accuracy and reliability of any “free credit score” service.

Now that we have a solid understanding of credit scores, let’s delve into the tempting realm of “free credit score” services and explore the potential pitfalls that may lie beneath the surface.

Importance of Credit Scores

Credit scores play a significant role in many aspects of our financial lives. From obtaining a mortgage to applying for a credit card, lenders and financial institutions rely heavily on credit scores to assess an individual’s creditworthiness. Understanding the importance of credit scores can help you navigate the world of credit more effectively.

1. Access to Credit: A good credit score opens doors to various credit opportunities. Whether you’re looking to purchase a car, finance a home, or obtain a personal loan, lenders use credit scores as a determining factor in approving or denying credit applications. A high credit score can increase your chances of approval and help you secure better interest rates and loan terms.

2. Interest Rates: Your credit score has a direct impact on the interest rates you will be offered. A higher credit score often translates into lower interest rates, saving you money over the life of a loan. Conversely, a lower credit score may result in higher interest rates or even denial of credit.

3. Rental Applications: Many landlords and property management companies require a credit check as part of the rental application process. A good credit score can be a deciding factor in being approved for a rental property, as it demonstrates your financial responsibility and ability to pay rent on time.

4. Insurance Premiums: Your credit score can impact the cost of insurance premiums. Insurance companies often use credit scores as a factor when determining rates for auto, home, or renters insurance. Maintaining a good credit score can potentially save you money on your insurance premiums.

5. Employment: Some employers may consider credit history during the hiring process, particularly for roles involving financial responsibilities or positions that require a security clearance. A good credit score can reflect positively on your overall financial management skills and enhance your employability.

6. Financial Security: Maintaining a healthy credit score is essential for your long-term financial security. It allows you to have better control over your financial options and provides a solid foundation for achieving financial goals, such as buying a home, starting a business, or saving for retirement.

Given the importance of credit scores in these various aspects of life, it’s no wonder that individuals are often curious about their current credit standing. “Free credit score” services claim to fulfill this curiosity at no cost. However, it’s crucial to understand the reality behind these services to make informed decisions about monitoring your credit health.

What is a “Free Credit Score”?

When you come across advertisements for “free credit score” services, it’s natural to be interested in accessing your credit score without having to pay any fees. However, it’s important to understand what exactly is being offered and the limitations that may come with these services.

A “free credit score” typically refers to a service that provides you with access to your credit score at no upfront cost. These services may be offered by credit bureaus, financial institutions, or third-party platforms.

Generally, obtaining a credit score involves paying a fee or subscribing to a credit monitoring service. However, “free credit score” services aim to attract users by offering them the opportunity to view their credit score without any immediate payment.

It’s important to note that while some “free credit score” services may provide you with a valid credit score, others offer credit score estimations or educational scores. These scores may not be the same as the scores used by lenders.

It’s crucial to carefully evaluate the source of the “free credit score” service and ensure that it is reputable and reliable. This will help you ascertain the accuracy of the scores provided and make informed decisions based on the information received.

It’s worth mentioning that “free credit score” services often come bundled with various additional features or offers, such as credit monitoring, identity theft protection, or credit improvement tools. These extras may have associated costs or trial periods, so it’s essential to carefully review the terms and conditions before signing up.

While the ability to access a credit score for free may sound enticing, it’s essential to consider the hidden fees and potential limitations that may come with these services. In the following sections, we’ll explore the realities behind “free credit score” services and the potential catches you need to be aware of.

The Reality Behind “Free Credit Score” Services

While the idea of obtaining a free credit score seems appealing, it’s important to understand the reality behind these services. Here, we uncover the potential catches and limitations that can come with “free credit score” offerings.

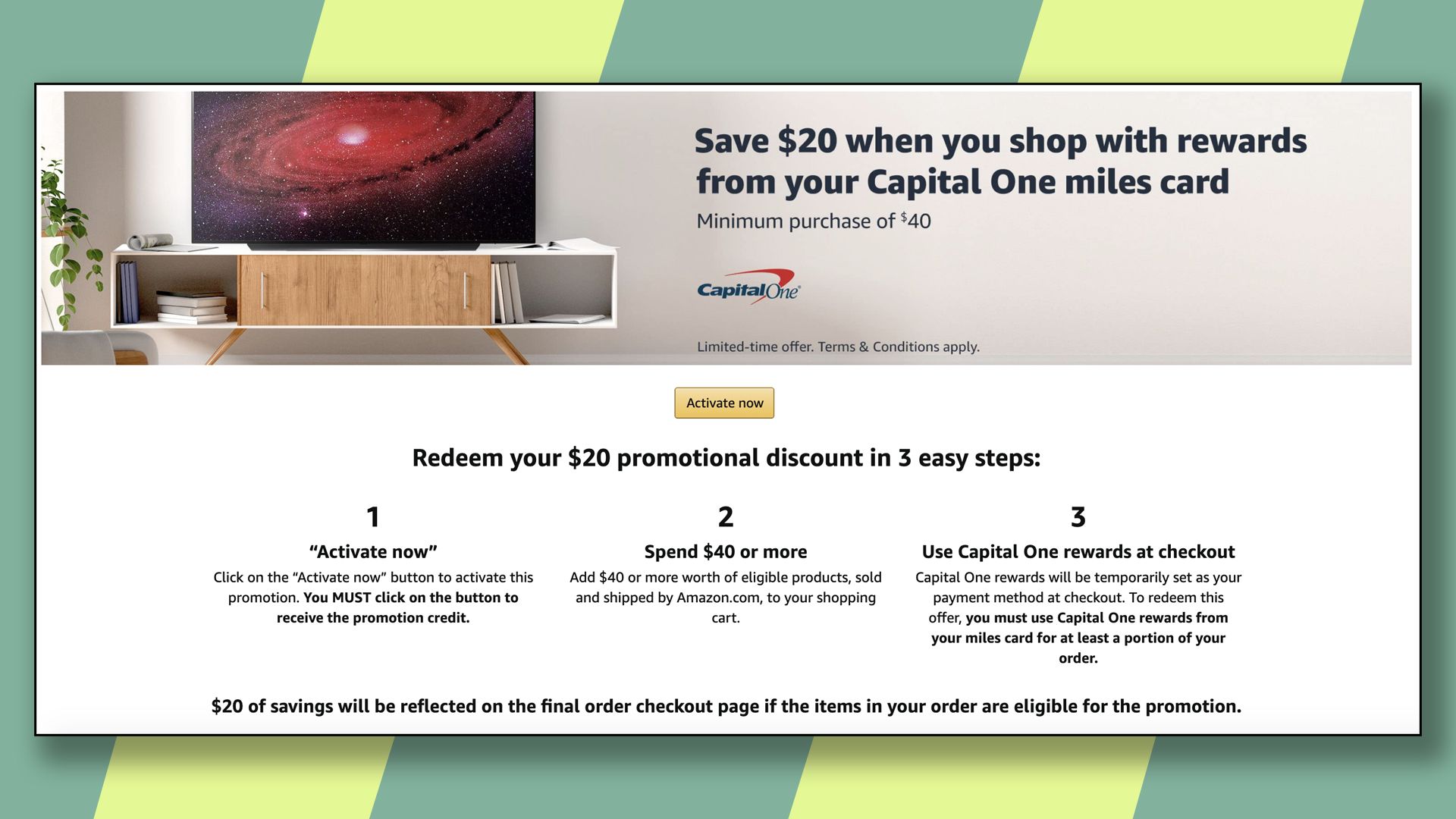

1. Hidden Fees and Subscription Models: Many “free credit score” services operate under a freemium model, where the initial access to the credit score is indeed free, but additional features or ongoing credit monitoring come at a cost. Once you sign up for the free service, you may be prompted to provide payment details or enroll in a trial period, after which you’ll be automatically charged unless you cancel. It’s important to carefully read the terms and conditions, ensuring you understand any associated costs and how to avoid unexpected charges.

2. Limited Access to Credit Information: Some “free credit score” services may only provide a partial view of your credit information. This means that you may only see your credit score without detailed insights into the factors influencing it, such as specific accounts, payment history, or credit utilization. Having a comprehensive understanding of your credit report can be crucial in identifying areas for improvement and addressing any potential errors.

3. Potential Impact on Credit Score: It’s worth noting that accessing your credit score through certain “free credit score” services may result in what’s known as a “soft inquiry” or “soft pull” on your credit report. Soft inquiries typically do not have a major impact on your credit score. However, repeated inquiries or applying for credit based on estimated scores provided by these services may result in multiple hard inquiries, which can negatively impact your credit score.

4. Reliability and Accuracy of Scores: Not all “free credit score” services use the same credit scoring models that lenders utilize. So, while the score you receive may give you a general idea of your credit standing, it may not be the exact score that a lender would see when assessing your creditworthiness. Furthermore, different credit bureaus may provide different scores, so it’s important to be aware of these variations and consider the context when interpreting your credit score.

5. Marketing and Data Sharing: When signing up for a “free credit score” service, be aware that your personal information may be used for marketing purposes. Some services may share your data with third parties, leading to an influx of targeted advertisements or solicitations. To protect your privacy, carefully review the privacy policy of any service before providing your personal details.

While “free credit score” services can be a convenient way to get a glimpse into your credit standing, it’s crucial to understand the potential limitations and risks associated with these offerings. In the next section, we’ll explore alternative options for monitoring your credit health and gaining a comprehensive understanding of your financial standing.

Hidden Fees and Subscription Models

One of the common traps associated with “free credit score” services is the presence of hidden fees and subscription models. While the initial access to your credit score may be advertised as free, additional features or ongoing credit monitoring often come with a cost.

1. Freemium Model: Many “free credit score” services operate under a freemium model. This means that while the basic access to your credit score is indeed free, certain advanced features or services require a paid subscription. Once you sign up for the initial free service, you may be prompted to provide payment details or enroll in a trial period. If you don’t cancel before the trial period ends, you’ll be automatically charged for the subscription. It’s essential to carefully read the terms and conditions and understand the associated costs to avoid unexpected charges.

2. Credit Monitoring Fees: Credit monitoring is a service offered by some “free credit score” providers to help you keep a close eye on changes to your credit report. This service typically comes with a monthly or annual fee. Credit monitoring can be valuable in detecting any fraudulent activity or unauthorized changes to your credit profile, but it’s important to consider whether the benefits justify the cost and whether there are more cost-effective alternatives available.

3. Identity Theft Protection: Some “free credit score” services bundle identity theft protection as part of their subscription plans. While identity theft protection can be essential in safeguarding your personal information, it’s important to evaluate the specific features offered and compare them to standalone identity theft protection services. It’s possible that you may find more robust and cost-effective options outside of the “free credit score” service.

4. Trial Periods: “Free credit score” services often offer trial periods for their premium features or credit monitoring services. While these trial periods may initially be free, it’s crucial to understand the terms and conditions. If you fail to cancel the trial before it expires, you may be automatically charged for the service. Always mark your calendar and set a reminder to cancel any trial subscriptions if you find that the service does not meet your needs or if you have found a better alternative.

5. Additional Fees and Upgrades: In addition to the core subscription fees, some “free credit score” services may have additional costs for premium features or upgrades. These could include access to more detailed credit reports, credit score simulators, or personalized credit advice. While these can be valuable tools, carefully consider whether the benefits outweigh the additional expenses and if they align with your specific financial goals and needs.

It’s essential to thoroughly review and evaluate the pricing structure and terms of any “free credit score” service. Take the time to compare different offerings and consider whether the additional features provided justify the associated costs. Additionally, be mindful of any cancellation policies or procedures to avoid unexpected charges.

While “free credit score” services may seem like a convenient and cost-effective option, it’s important to ensure that the overall value and benefits of these services align with your individual financial circumstances. In the next section, we’ll explore alternative options for monitoring your credit health without the potential hidden fees and subscription models.

Limited Access to Credit Information

When considering “free credit score” services, it’s important to understand that they may offer limited access to your credit information. While these services may provide you with a credit score, they may lack comprehensive details about your credit history and factors influencing your score.

1. Partial Credit Reports: Some “free credit score” services may only provide a summarized version of your credit report, focusing solely on your credit score. This means that you may not have access to the complete picture of your credit history, including specific accounts, payment history, or credit utilization. A comprehensive understanding of your credit report is crucial in identifying areas for improvement, detecting errors, and making informed decisions about your financial health.

2. Lack of Detailed Insights: Understanding the factors that influence your credit score can help you better manage your credit and work towards improving it. Unfortunately, many “free credit score” services may not provide in-depth insights into how certain factors are affecting your score. For example, you may not receive information about the impact of late payments or high credit utilization on your creditworthiness. Having detailed insights can empower you to take proactive steps to improve your credit standing.

3. Missing Credit History: Some “free credit score” services may not include a comprehensive credit history, which poses limitations in understanding your credit journey over time. Credit history is essential in demonstrating your creditworthiness and financial behavior to lenders. A detailed credit report allows you to track your progress, recognize patterns, and identify any inconsistencies or errors that may be affecting your credit.

4. Limited Credit Monitoring: While credit monitoring may be offered as an additional feature by “free credit score” services, it’s important to determine the extent of monitoring provided. Some services may only alert you to specific changes or significant events, while others may provide more comprehensive monitoring. Understanding the level of monitoring included can help you decide if it aligns with your needs and offers adequate protection against identity theft or unauthorized changes to your credit profile.

It’s important to consider these limitations when assessing the value and usefulness of “free credit score” services. If you require comprehensive access to your credit information and in-depth insights into your credit factors, you may need to explore alternative options that offer a more holistic view of your financial profile.

Don’t fret though! In the next section, we will explore alternative options for monitoring your credit health that provide more comprehensive access to credit information and insights.

Potential Impact on Credit Score

When using “free credit score” services to check your credit score, it’s important to be aware of the potential impact it can have on your credit score itself. While accessing your credit score through these services may seem harmless, certain actions associated with them can affect your creditworthiness.

1. Soft Inquiries vs. Hard Inquiries: When you check your credit score through a “free credit score” service, it typically results in a “soft inquiry” or “soft pull” on your credit report. Soft inquiries do not impact your credit score. However, if you apply for credit or request credit based on the estimated score provided by these services, it may result in a “hard inquiry” or “hard pull” on your credit report. Multiple hard inquiries within a short period can negatively affect your credit score as it may indicate that you are actively seeking credit.

2. Conflicting Credit Scores: It’s important to remember that different credit bureaus may use different scoring models, and the scores you receive from these “free credit score” services may not align with the scores used by lenders. While the estimated scores provided can give you a general idea of where you stand, it’s crucial to keep in mind that they may not accurately represent your creditworthiness in the eyes of lenders.

3. Overreliance on Estimated Scores: Relying solely on estimated credit scores from “free credit score” services without accessing your comprehensive credit report and considering all the factors that contribute to your credit score can paint an incomplete picture. It’s essential to address any potential areas of improvement and work towards building a strong credit profile.

4. Changes in Credit Behavior: Regularly checking your credit score may lead to an increased awareness of your credit health and encourage you to make positive changes in your financial behavior. However, it’s important to adopt sustainable credit habits rather than making quick, short-term changes solely to improve your credit score. A consistent and responsible credit history is key to maintaining a good credit standing.

While checking your credit score through “free credit score” services is generally considered safe, it’s crucial to be mindful of how your actions can impact your creditworthiness. Avoid applying for credit solely based on estimated scores and be cautious of services that claim to improve your credit score overnight. Building and maintaining a good credit score requires time, responsible financial habits, and a comprehensive understanding of your credit information.

In the next section, we’ll explore alternative options for monitoring your credit and gaining a deeper understanding of your credit health outside of “free credit score” services.

Alternative Options for Monitoring Credit

While “free credit score” services may have their limitations and potential drawbacks, there are alternative options available for monitoring your credit health and gaining a comprehensive understanding of your financial standing. These options can provide more in-depth insights and a holistic view of your credit information.

1. Annual Credit Reports: By law, you are entitled to a free credit report from each of the three major credit bureaus (Experian, Equifax, and TransUnion) once every 12 months. These credit reports provide detailed information about your credit accounts, payment history, and other factors that contribute to your credit score. Visit AnnualCreditReport.com to request your free credit reports and review them regularly to monitor any changes or discrepancies.

2. Credit Monitoring Services: Consider subscribing to credit monitoring services that provide ongoing monitoring and alerts for changes to your credit report. These services typically come with a monthly or annual fee but offer features such as credit score tracking, identity theft monitoring, and access to comprehensive credit reports. Look for reputable and established credit monitoring services to ensure the reliability and accuracy of the information provided.

3. Financial Apps and Tools: There are numerous financial apps and tools available that can help you monitor your credit and track your financial progress. These apps often provide features such as credit score tracking, personalized recommendations for improving your credit, and budgeting tools to manage your finances effectively. Look for apps that have positive reviews, strong security measures, and a user-friendly interface.

4. Credit Counseling Services: If you’re facing challenges with your credit or need assistance in managing your debts, consider seeking guidance from a credit counseling service. These organizations can provide personalized advice, debt management plans, and tools to help you improve your credit score and financial situation. Ensure you choose a reputable credit counseling service with certified counselors who have your best interests in mind.

5. Regular Review of Credit Accounts: Take the time to review your credit accounts regularly and monitor any changes or discrepancies. Ensure that all the information is accurate, such as your personal details and payment history. Report any errors or fraudulent activity to the credit bureaus immediately, as they can impact your credit score and overall financial health.

It’s important to remember that monitoring your credit is an ongoing process and requires your active involvement. Utilize these alternative options to gain a deeper understanding of your credit health, track your progress, and make informed decisions based on comprehensive information.

While “free credit score” services may provide a convenient snapshot of your credit score, they often lack the comprehensive insights and detailed information necessary for thorough credit monitoring. Explore these alternative options to ensure that you have a more complete view of your credit health and can take proactive steps towards maintaining a strong credit profile.

Conclusion

Understanding your credit score and staying on top of your credit health is crucial for your financial well-being. While “free credit score” services may seem like an attractive option, it’s important to be aware of the potential catches and limitations that come with them.

Hidden fees, subscription models, limited access to credit information, and the potential impact on your credit score are all factors to consider when exploring these services. It’s essential to read the fine print, understand the terms and conditions, and evaluate the overall value and benefits before committing to a “free credit score” service.

Fortunately, there are alternative options available for monitoring your credit that offer more comprehensive access to credit information and insights. Annual credit reports, credit monitoring services, financial apps and tools, credit counseling services, and regular review of credit accounts can all provide a more holistic view of your credit health.

Remember, a single credit score does not define your entire financial picture. It’s just one piece of the puzzle. Building and maintaining good credit requires responsible financial habits, a comprehensive understanding of your credit information, and ongoing monitoring.

Stay proactive in managing your credit by taking advantage of the various resources and tools available to you. Regularly review your credit reports, monitor your credit accounts, and make informed decisions based on accurate and reliable information.

By taking control of your credit health and making informed financial decisions, you can improve your creditworthiness over time and set yourself up for a strong financial future. Don’t rely solely on “free credit score” services, but instead, choose the options that offer you a broader and more detailed perspective on your credit standing.

Remember, your credit score is just one piece of the puzzle. Building and managing good credit requires responsible financial habits, comprehensive credit monitoring, and ongoing attention to detail. By utilizing the alternative options available, you can gain a clearer understanding of your credit health and make informed decisions to achieve your financial goals.

So, while “free credit score” services may seem alluring, take a step back, evaluate your options, and choose the methods that provide the most accurate and comprehensive view of your credit standing. Your financial future deserves thorough evaluation and proactive management.