Finance

How Many Mortgage Loans Can I Have?

Published: February 17, 2024

Learn about the maximum number of mortgage loans you can have and how it impacts your finances. Get expert advice on managing multiple mortgage loans.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Are you considering investing in real estate and wondering how many mortgage loans you can have? Or perhaps you're already a homeowner and contemplating the possibility of acquiring an additional property? Understanding the dynamics of mortgage loan limits and the factors influencing them is crucial for making informed financial decisions. In this comprehensive guide, we'll delve into the realm of mortgage loan limits, shedding light on the factors that determine the number of mortgage loans an individual can obtain. Additionally, we'll explore strategies for effectively managing multiple mortgage loans, providing you with invaluable insights to navigate the realm of real estate investments with confidence and clarity.

Whether you're a seasoned investor or a prospective homeowner, the intricacies of mortgage loan limits can significantly impact your financial endeavors. By unraveling the complexities surrounding this subject, we aim to empower you with the knowledge needed to make sound financial choices in the realm of real estate and mortgage investments. Let's embark on this enlightening journey to uncover the truths and myths surrounding the question, "How many mortgage loans can I have?"

Understanding Mortgage Loan Limits

Before delving into the specifics of how many mortgage loans you can have, it’s essential to comprehend the concept of mortgage loan limits. These limits are imposed by lenders and are influenced by various factors, including your financial standing, creditworthiness, and the type of mortgage you’re seeking. In the United States, for instance, conforming loan limits are established by the Federal Housing Finance Agency (FHFA) and dictate the maximum amount that can be borrowed when using conventional loans backed by Fannie Mae and Freddie Mac.

Conforming loan limits vary by location and are based on the median home prices in a particular area. In addition to conforming loan limits, jumbo loans cater to higher-priced properties and may have different criteria and requirements. Understanding these distinctions is crucial when contemplating the number of mortgage loans you can obtain, as different loan types may have varying eligibility criteria and limits.

Moreover, the concept of debt-to-income (DTI) ratio plays a pivotal role in determining your eligibility for multiple mortgage loans. Lenders assess your DTI ratio to evaluate your capacity to manage additional debt based on your current income and existing financial obligations. This assessment influences the number of mortgage loans you can secure, as lenders typically prefer borrowers with a lower DTI ratio, indicating a healthier financial standing.

By comprehending the intricacies of mortgage loan limits, including conforming loan limits, jumbo loans, and DTI ratios, you’ll gain a clearer understanding of the parameters that dictate the number of mortgage loans you can feasibly obtain. This knowledge forms the foundation for informed decision-making when navigating the landscape of real estate investments and mortgage acquisitions.

Factors Affecting the Number of Mortgage Loans

Several key factors influence the number of mortgage loans an individual can acquire, shaping the eligibility criteria and determining the feasibility of securing multiple loans. Understanding these factors is instrumental in assessing your ability to obtain additional mortgage loans and effectively manage them. Here are the primary elements that influence the number of mortgage loans:

- Credit Score: Your credit score is a fundamental determinant of your creditworthiness. Lenders assess your credit score to gauge the level of risk associated with lending to you. A higher credit score enhances your eligibility for multiple mortgage loans, as it signifies responsible financial management and a lower risk profile.

- Debt-to-Income Ratio (DTI): As mentioned earlier, the DTI ratio is a critical factor in evaluating your financial capacity. Lenders typically prefer borrowers with a DTI ratio below a certain threshold, as it indicates a healthier balance between income and debt obligations. A lower DTI ratio increases the likelihood of securing multiple mortgage loans.

- Income Stability: Your income stability and employment history play a significant role in the mortgage approval process. Lenders seek assurance that you have a stable source of income to support multiple mortgage obligations, thereby influencing the number of loans you can obtain.

- Property Type: The type of property you intend to finance can impact the number of mortgage loans available to you. Different property types, such as primary residences, second homes, and investment properties, may have distinct eligibility criteria and loan limits.

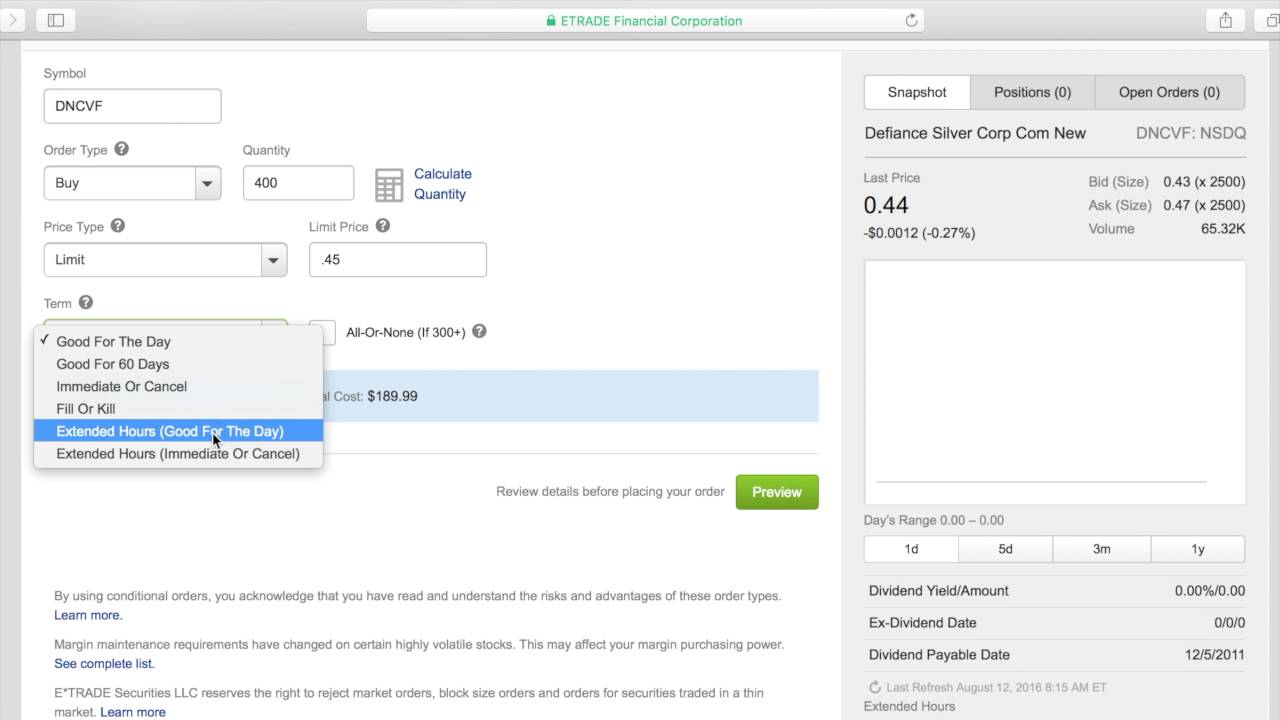

- Loan Programs: Various loan programs, such as conventional loans, FHA loans, VA loans, and USDA loans, have specific guidelines and limitations. Understanding the nuances of these programs is essential in determining the number of mortgage loans you can secure under each program.

By considering these factors and evaluating your financial standing in relation to each element, you can gain insights into your eligibility for multiple mortgage loans. Additionally, engaging with a knowledgeable mortgage advisor can provide personalized guidance tailored to your specific financial circumstances, facilitating informed decisions regarding the acquisition of additional mortgage loans.

Managing Multiple Mortgage Loans

Effectively managing multiple mortgage loans requires a strategic approach and diligent financial planning to ensure stability and mitigate potential risks. As you navigate the realm of real estate investments and property acquisitions, consider the following strategies to adeptly manage multiple mortgage loans:

- Thorough Financial Assessment: Conduct a comprehensive evaluation of your financial situation, taking into account your income, existing debt obligations, and long-term financial goals. Understanding the impact of multiple mortgage loans on your financial landscape is crucial in making informed decisions.

- Responsible Budgeting: Implement a disciplined budgeting strategy to allocate funds for mortgage payments, property maintenance, and unexpected expenses. A well-structured budget can help you effectively manage multiple mortgage loans without compromising your financial stability.

- Property Performance Analysis: If you’re acquiring investment properties, assess the potential returns and risks associated with each property. Conduct thorough market research and property analyses to ensure that your investment portfolio remains financially viable and aligned with your investment objectives.

- Engage with Experienced Professionals: Seek guidance from experienced real estate agents, property managers, and financial advisors to gain valuable insights and expert perspectives. Their expertise can provide invaluable support in managing multiple mortgage loans and optimizing your real estate investments.

- Proactive Risk Management: Mitigate risks associated with multiple mortgage loans by proactively addressing potential challenges. This may involve maintaining adequate insurance coverage, staying informed about market trends, and having contingency plans in place to navigate unforeseen circumstances.

- Regular Financial Reviews: Periodically review your financial portfolio and mortgage obligations to assess their alignment with your long-term objectives. Adjust your strategies as needed and remain attentive to evolving market dynamics and financial opportunities.

By implementing these proactive strategies and maintaining a vigilant approach to financial management, you can effectively navigate the complexities of managing multiple mortgage loans. This prudent approach not only fosters financial stability but also positions you to leverage real estate investments as a means of long-term wealth accumulation and financial security.

Conclusion

As the intricate interplay of mortgage loan limits, financial factors, and strategic management unfolds, it becomes evident that the question, “How many mortgage loans can I have?” is multifaceted and deeply intertwined with individual financial circumstances. By comprehending the nuances of mortgage loan limits and the factors influencing the number of mortgage loans one can obtain, individuals are empowered to make informed decisions regarding real estate investments and property acquisitions.

Understanding the impact of credit scores, debt-to-income ratios, income stability, property types, and loan programs provides a holistic perspective on the eligibility for multiple mortgage loans. This knowledge equips individuals with the insights needed to navigate the complexities of the mortgage landscape with confidence and clarity.

Furthermore, the art of managing multiple mortgage loans demands a strategic and disciplined approach, encompassing thorough financial assessments, responsible budgeting, property performance analyses, engagement with experienced professionals, proactive risk management, and regular financial reviews. By embracing these practices, individuals can adeptly manage multiple mortgage loans while safeguarding their financial stability and capitalizing on the potential wealth-building opportunities inherent in real estate investments.

In essence, the journey of acquiring and managing multiple mortgage loans is a dynamic and personalized endeavor, shaped by individual financial goals, risk tolerance, and long-term aspirations. By leveraging a deep understanding of mortgage loan dynamics and implementing prudent financial strategies, individuals can navigate this journey with resilience and foresight, harnessing the power of real estate investments to propel their financial success.

As you embark on your real estate investment journey or contemplate the acquisition of additional properties, may this comprehensive guide serve as a beacon of knowledge, empowering you to make sound financial decisions and chart a course towards a prosperous and secure financial future.