Home>Finance>How Many Purchases Were Made During The Billing Cycle

Finance

How Many Purchases Were Made During The Billing Cycle

Published: March 7, 2024

Discover the total number of purchases made during the billing cycle with our comprehensive finance analysis. Make informed decisions based on accurate data.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Understanding the Financial Impact of Purchases During the Billing Cycle

The billing cycle is a crucial aspect of managing personal finances, and it plays a significant role in determining the impact of purchases on an individual's financial well-being. Understanding the dynamics of the billing cycle and the frequency of purchases made during this period is essential for maintaining a balanced budget and making informed financial decisions.

During the billing cycle, individuals engage in various transactions, including retail purchases, online shopping, bill payments, and other financial activities. Each of these transactions contributes to the overall financial picture, affecting factors such as credit utilization, available funds, and potential interest charges. Therefore, analyzing the volume and nature of purchases made during the billing cycle can provide valuable insights into an individual's spending habits, financial discipline, and overall financial health.

In this article, we will delve into the nuances of the billing cycle, explore the methods for tracking purchases, and discuss the significance of analyzing purchase data. By gaining a comprehensive understanding of these elements, individuals can gain greater control over their finances, make informed decisions, and work towards achieving their financial goals. Let's embark on this journey to unravel the impact of purchases during the billing cycle and empower ourselves with valuable financial insights.

Understanding the Billing Cycle

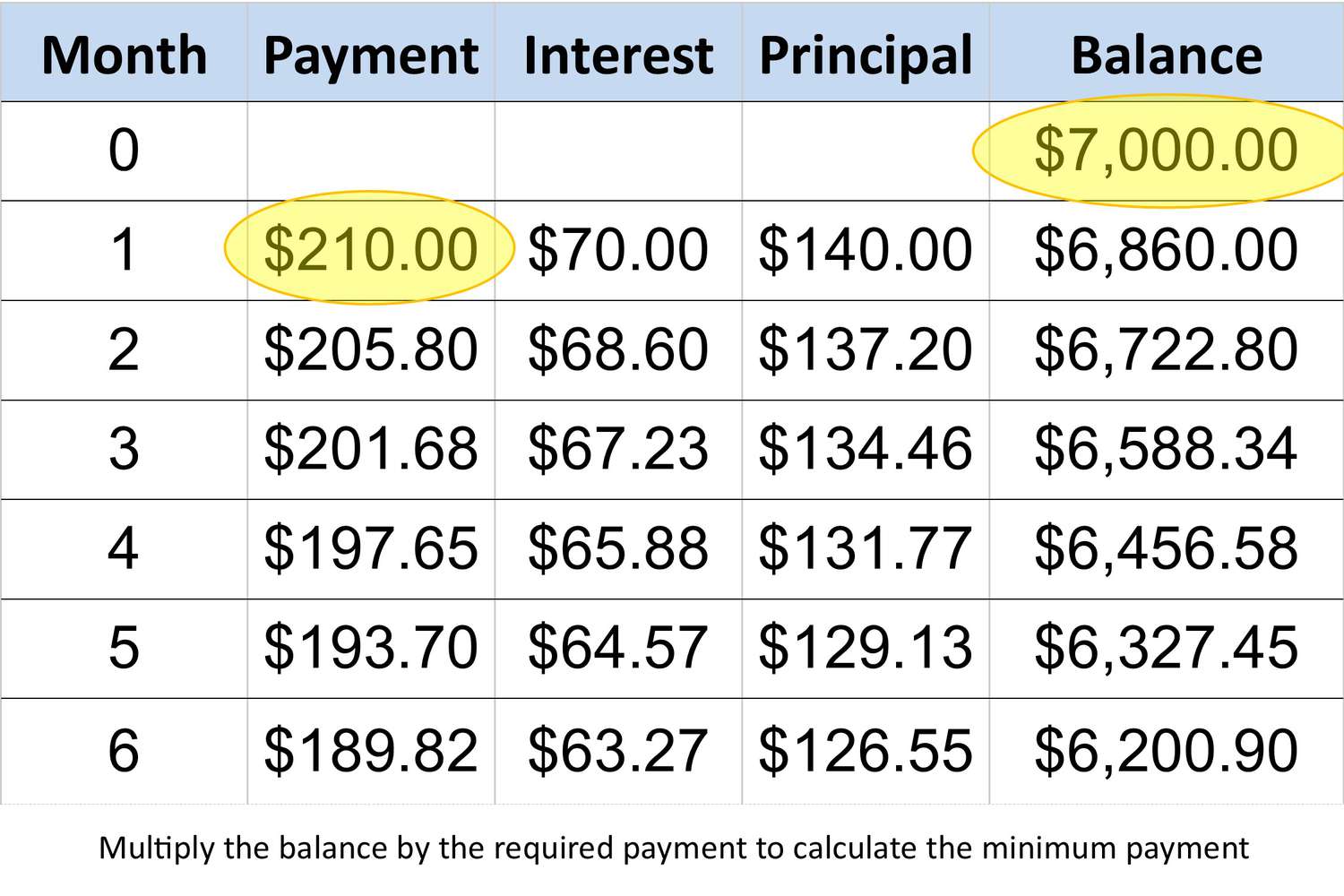

The billing cycle is a recurring period during which a credit card or loan statement is generated. It typically ranges from 28 to 31 days, and it plays a pivotal role in determining the financial obligations and opportunities for individuals. Understanding the key components of the billing cycle is essential for making informed financial decisions and managing expenses effectively.

One of the fundamental aspects of the billing cycle is the statement closing date. This marks the end of the billing cycle and the beginning of the next cycle. All transactions made between the previous statement closing date and the current one are consolidated into the billing statement, which includes details such as purchases, payments, interest charges, and fees. It is crucial for individuals to be aware of this date as it signifies the point at which the credit card balance is reported to credit bureaus, impacting credit scores and financial profiles.

Moreover, the billing cycle directly influences the grace period for making payments. The time between the statement closing date and the payment due date is known as the grace period, during which individuals can settle their outstanding balance without incurring interest charges. By understanding the duration of this period and the associated terms and conditions, individuals can optimize their payment strategies and minimize interest expenses.

Furthermore, the billing cycle serves as a window for monitoring and managing purchases. By tracking transactions within this timeframe, individuals can gain insights into their spending patterns, identify areas for potential savings, and assess their overall financial discipline. This awareness empowers individuals to make conscious decisions about their purchases, aligning them with their financial goals and priorities.

In essence, comprehending the intricacies of the billing cycle enables individuals to navigate their financial responsibilities effectively, capitalize on the benefits offered by credit facilities, and maintain a balanced approach to spending and saving. By recognizing the significance of the billing cycle and its implications, individuals can cultivate a proactive and informed attitude towards managing their finances.

Tracking Purchases

Effectively tracking purchases during the billing cycle is a fundamental practice for maintaining financial awareness and promoting responsible spending habits. By monitoring and categorizing transactions, individuals can gain valuable insights into their spending patterns, identify areas for potential savings, and make informed decisions to align their purchases with their financial goals.

One of the most efficient ways to track purchases is by leveraging digital tools and resources. Many financial institutions offer online banking platforms and mobile applications that provide real-time updates on transactions. These platforms categorize expenditures, allowing individuals to visualize their spending habits through interactive charts and graphs. Additionally, they often offer customizable budgeting features that enable users to set spending limits for different categories, thereby promoting financial discipline and accountability.

Furthermore, utilizing personal finance management software can streamline the process of tracking purchases. These applications aggregate transaction data from various accounts, providing a comprehensive overview of an individual’s financial activity. By automating the categorization and analysis of purchases, these tools empower individuals to make proactive decisions and optimize their spending behavior.

Another effective method for tracking purchases is maintaining detailed records of transactions. Whether through digital spreadsheets or traditional pen-and-paper logs, recording each purchase and categorizing it based on its nature can provide a clear understanding of spending habits. This manual approach fosters a hands-on awareness of financial transactions and encourages individuals to critically evaluate their expenditures.

Moreover, leveraging credit card statements and receipts can serve as a valuable means of cross-referencing and validating purchase records. By comparing the information from these sources with digital records, individuals can ensure the accuracy and completeness of their purchase tracking, thereby enhancing their financial diligence.

Overall, tracking purchases during the billing cycle is an indispensable practice for individuals seeking to gain control over their finances and make informed spending decisions. By utilizing digital tools, personal finance management software, and meticulous record-keeping, individuals can develop a comprehensive understanding of their spending patterns and leverage this knowledge to align their purchases with their financial objectives.

Analyzing Purchase Data

Once purchases are tracked, analyzing the resulting data provides individuals with valuable insights that can inform their financial decisions and behaviors. By delving into the patterns and trends revealed by purchase data, individuals can identify areas for potential savings, evaluate their adherence to budgetary goals, and make adjustments to their spending habits to align with their financial objectives.

One of the primary benefits of analyzing purchase data is the ability to identify discretionary and non-discretionary expenses. By categorizing purchases into essential expenditures such as groceries, utilities, and mortgage payments, as well as non-essential items like dining out and entertainment, individuals can gain a comprehensive understanding of their spending priorities. This categorization facilitates the evaluation of discretionary spending, allowing individuals to assess opportunities for cost-cutting and reallocation of funds towards savings or investment goals.

Furthermore, analyzing purchase data enables individuals to detect recurring expenses and subscription-based services. Identifying these ongoing financial commitments empowers individuals to evaluate the value derived from such services and consider potential cost-saving measures. This awareness also facilitates the identification of unused or redundant subscriptions, leading to potential savings and optimization of financial resources.

Moreover, analyzing purchase data can reveal seasonal or periodic spending trends. By recognizing fluctuations in spending across different months or seasons, individuals can anticipate and plan for upcoming financial obligations, such as holiday expenses or annual subscription renewals. This proactive approach to financial management enables individuals to allocate resources strategically and avoid financial strain during peak spending periods.

Additionally, analyzing purchase data can provide insights into impulsive or emotional spending patterns. By reviewing the frequency and nature of spontaneous purchases, individuals can assess their susceptibility to impulse buying and implement strategies to curb such behavior. This self-awareness fosters responsible spending habits and encourages individuals to prioritize mindful and intentional purchases.

In essence, analyzing purchase data serves as a powerful tool for individuals to gain a comprehensive understanding of their financial habits and make informed decisions to optimize their spending behavior. By leveraging the insights derived from purchase analysis, individuals can align their purchases with their long-term financial goals, cultivate disciplined spending habits, and work towards achieving financial stability and security.

Conclusion

The impact of purchases during the billing cycle extends far beyond mere transactions; it encompasses the intricate interplay of financial habits, discipline, and long-term goals. By gaining a comprehensive understanding of the billing cycle, tracking purchases, and analyzing purchase data, individuals can empower themselves with valuable insights to navigate their financial journey effectively.

Understanding the nuances of the billing cycle is essential for individuals to grasp the implications of their financial activities. By recognizing the significance of the statement closing date, the grace period, and the overall cycle, individuals can make informed decisions regarding their credit utilization, payment strategies, and spending behavior.

Effectively tracking purchases during the billing cycle enables individuals to maintain a proactive awareness of their spending habits. Leveraging digital tools, personal finance management software, and meticulous record-keeping, individuals can gain a comprehensive understanding of their financial transactions and align their purchases with their budgetary goals.

Furthermore, analyzing purchase data provides individuals with valuable insights into their spending patterns, enabling them to identify areas for potential savings, evaluate discretionary expenses, and anticipate periodic financial obligations. This analysis fosters a proactive and informed approach to financial management, empowering individuals to make conscious decisions regarding their purchases and prioritize their long-term financial well-being.

In conclusion, the impact of purchases during the billing cycle transcends individual transactions; it reflects the broader landscape of personal finance and financial responsibility. By embracing a proactive and informed approach to understanding the billing cycle, tracking purchases, and analyzing purchase data, individuals can cultivate disciplined spending habits, optimize their financial resources, and work towards achieving their financial goals with confidence and clarity.