Home>Finance>How Many Days In The Sears Master Card Billing Cycle

Finance

How Many Days In The Sears Master Card Billing Cycle

Published: March 7, 2024

Learn about the billing cycle for the Sears Master Card and manage your finances effectively. Understand how many days are in the billing cycle to stay on top of your payments and budgeting.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

The Sears Mastercard billing cycle is a crucial aspect of managing your credit card account. Understanding how the billing cycle works can help you make informed decisions about your finances and avoid unnecessary fees or interest charges. This article will provide a comprehensive overview of the Sears Mastercard billing cycle, including its duration, key factors that affect it, and tips for effectively managing it.

By delving into the intricacies of the billing cycle, you'll gain valuable insights into how your credit card transactions are processed, how interest is calculated, and how you can optimize your payments to minimize costs and maximize financial efficiency. Whether you're a seasoned credit card user or new to the world of credit, this guide will equip you with the knowledge needed to navigate the Sears Mastercard billing cycle with confidence and control.

Understanding the nuances of the billing cycle empowers you to make strategic decisions regarding your credit card usage, such as when to make purchases, when to pay your bill, and how to leverage the billing cycle to your advantage. Moreover, by grasping the mechanics of the billing cycle, you can proactively manage your credit card account to maintain a healthy credit score and financial well-being.

In the following sections, we will explore the Sears Mastercard billing cycle in detail, shedding light on its various components and shedding light on how you can effectively manage this aspect of your financial life. Whether you're aiming to optimize your credit card usage, minimize interest costs, or simply gain a deeper understanding of the financial systems that govern credit cards, this guide will serve as a valuable resource to help you achieve your financial goals.

Understanding the Sears Master Card Billing Cycle

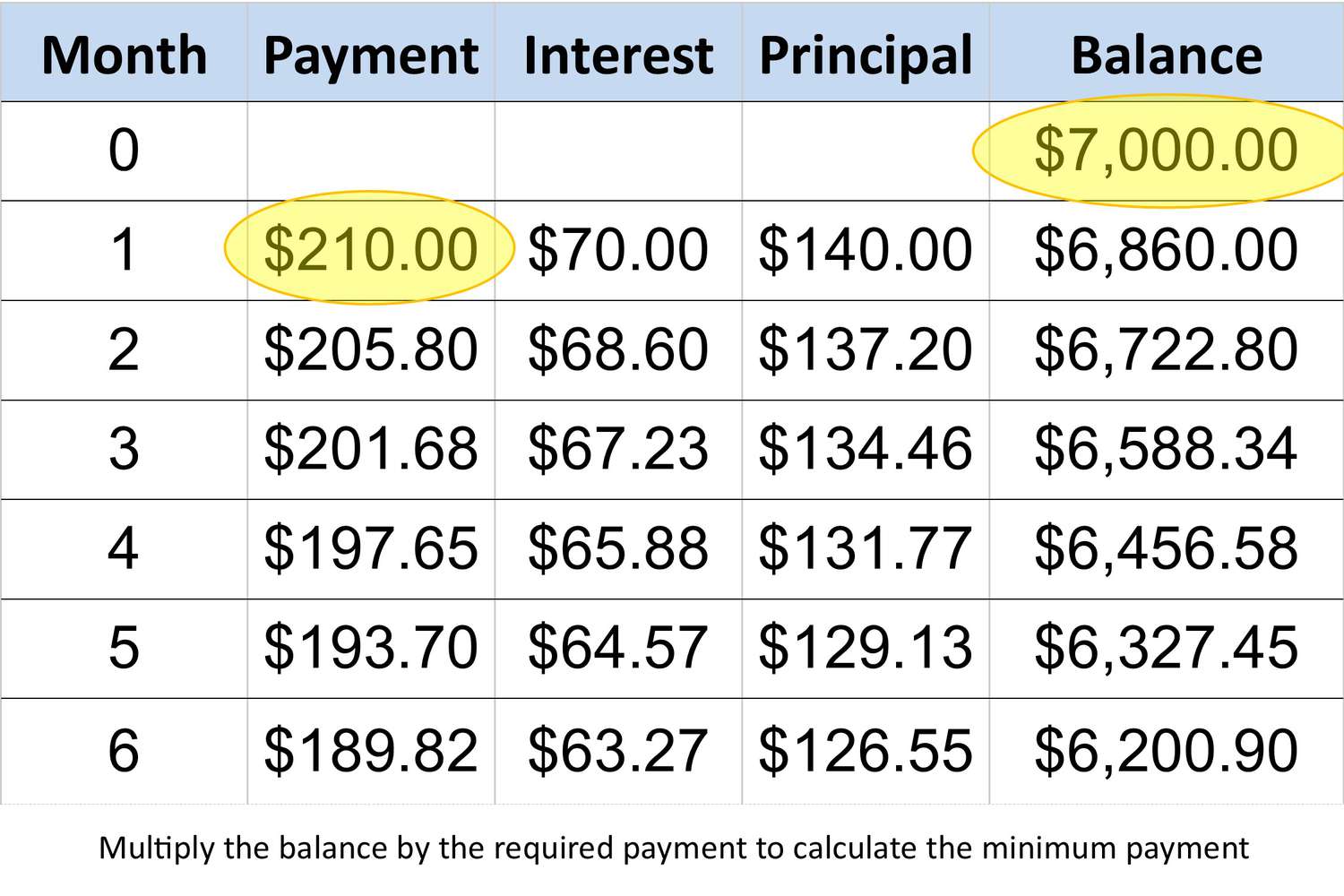

Before delving into the specifics of the Sears Mastercard billing cycle, it’s essential to grasp the fundamental concept of a billing cycle. The billing cycle refers to the period between two consecutive credit card statements. During this timeframe, your credit card transactions are recorded, and at the end of the cycle, a statement is generated, outlining the charges, payments, and outstanding balance. For the Sears Mastercard, the billing cycle typically spans around 30 days, but this duration can vary based on the specific terms of your card agreement.

Throughout the billing cycle, any purchases, balance transfers, cash advances, or payments you make are tallied to determine the total balance on your account. It’s important to note that the billing cycle does not necessarily align with a calendar month; it commences on the day your account is opened and concludes on the closing date specified in your card agreement. Understanding this timeline is crucial for effectively managing your credit card expenses and payments.

During the billing cycle, your credit card issuer tracks your daily balances to calculate the average daily balance, which is used to determine the interest charges if you carry a balance from one cycle to the next. This underscores the significance of monitoring your spending and making timely payments to avoid accruing unnecessary interest costs.

Moreover, familiarizing yourself with the specific details of your Sears Mastercard billing cycle, such as the closing date and due date, enables you to plan your expenditures and payments strategically. By staying mindful of these dates and the corresponding timelines, you can optimize your credit card usage to minimize interest and late fees while maximizing the benefits of your card.

As we continue to explore the nuances of the Sears Mastercard billing cycle, we’ll delve into the factors that can influence the cycle’s duration and the implications for your financial management. By gaining a comprehensive understanding of the billing cycle, you’ll be better equipped to navigate the intricacies of credit card usage and make informed decisions that align with your financial goals.

Factors Affecting the Billing Cycle

Several factors can influence the duration and dynamics of the Sears Mastercard billing cycle, impacting how your credit card transactions are processed and how you manage your payments. Understanding these factors is essential for optimizing your credit card usage and minimizing potential costs. Here are some key elements that can affect the billing cycle:

- Account Opening Date: The billing cycle for your Sears Mastercard typically commences on the date your account is opened. This date serves as the starting point for each cycle and may not align with the beginning or end of a calendar month.

- Closing Date: The closing date marks the end of the billing cycle. Transactions made after this date typically fall into the next cycle. Being aware of this date is crucial for managing your spending and payment timing effectively.

- Statement Generation: After the closing date, your credit card statement is generated, detailing the transactions, payments, and outstanding balance for the cycle. Reviewing this statement can provide valuable insights into your spending habits and financial standing.

- Due Date: The due date is the deadline for making payments to avoid late fees and potential negative impacts on your credit score. Understanding this date and ensuring timely payments is essential for financial responsibility.

- Grace Period: The grace period refers to the timeframe between the closing date and the due date during which you can make payments without incurring interest charges. The length of this period can vary and is a crucial consideration for managing your credit card payments efficiently.

Additionally, external factors such as weekends, holidays, and the processing times of financial institutions can influence the actual duration of the billing cycle and the timing of your payments. Being mindful of these external influences can help you plan your credit card usage and payments proactively.

By understanding the interplay of these factors, you can navigate the Sears Mastercard billing cycle with greater insight and control. This knowledge empowers you to make informed decisions about your spending, payments, and overall financial management, ultimately contributing to a more secure and efficient credit card experience.

Managing Your Sears Master Card Billing Cycle

Effectively managing your Sears Mastercard billing cycle is essential for maintaining financial stability and optimizing the benefits of your credit card. By implementing strategic practices and staying mindful of key considerations, you can navigate the billing cycle with confidence and control. Here are some valuable tips for managing your Sears Mastercard billing cycle:

- Monitor Your Spending: Regularly tracking your credit card transactions and staying within your budget can help you avoid overspending and accumulating a high balance that may be challenging to pay off within the billing cycle.

- Understand Your Statement: Review your credit card statement diligently to ensure accuracy and to gain insights into your spending patterns. Identifying any discrepancies or unauthorized charges promptly is crucial for protecting your finances.

- Utilize the Grace Period: Take advantage of the grace period to make timely payments without incurring interest charges. By paying your balance in full before the due date, you can avoid accruing additional costs and maintain a positive credit standing.

- Strategize Your Payments: Planning your credit card payments in alignment with the billing cycle’s closing and due dates can help you optimize your cash flow and minimize interest expenses. Consider making payments shortly after the closing date to reduce the average daily balance and associated interest charges.

- Set Payment Reminders: Leveraging payment reminders or automatic payments can help you stay on top of your credit card obligations and avoid missing due dates. This proactive approach contributes to a strong payment history, which is a key factor in maintaining a healthy credit score.

- Opt for Paperless Statements: Choosing electronic statements can streamline the management of your credit card account and ensure timely access to your billing cycle details. This can facilitate prompt review and action regarding your credit card transactions and payments.

Furthermore, staying informed about any updates or changes to the terms and conditions of your Sears Mastercard can empower you to adapt your management strategies accordingly. By remaining proactive and knowledgeable, you can effectively navigate the billing cycle and harness the benefits of your credit card while mitigating potential risks.

Ultimately, managing your Sears Mastercard billing cycle entails a combination of financial awareness, prudent decision-making, and proactive planning. By implementing these practices and staying attuned to the nuances of the billing cycle, you can maintain control over your credit card account and work toward your broader financial goals with confidence.

Conclusion

Understanding the intricacies of the Sears Mastercard billing cycle is a valuable asset in navigating the realm of credit card management. By grasping the duration, key factors, and management strategies associated with the billing cycle, you can wield greater control over your financial well-being and optimize the benefits of your credit card.

Throughout this guide, we’ve explored the fundamental concept of the billing cycle and delved into the specific dynamics of the Sears Mastercard billing cycle. From the account opening date to the grace period, each element plays a pivotal role in shaping how you interact with your credit card and manage your payments. By familiarizing yourself with these factors, you can proactively plan your spending and payments to minimize costs and maintain a positive credit standing.

Furthermore, the management tips provided offer actionable insights for effectively navigating the billing cycle. From monitoring your spending to strategically planning your payments, these practices empower you to take charge of your credit card account and cultivate responsible financial habits.

By integrating these strategies into your financial routine and remaining attuned to the nuances of the billing cycle, you can harness the full potential of your Sears Mastercard while safeguarding your financial stability. Whether your goal is to minimize interest expenses, maintain a healthy credit score, or optimize your cash flow, a comprehensive understanding of the billing cycle is a cornerstone of successful credit card management.

In conclusion, by leveraging the knowledge and recommendations outlined in this guide, you can approach your Sears Mastercard billing cycle with confidence and strategic acumen. Empowered with these insights, you are better equipped to make informed decisions, mitigate potential financial risks, and pave the way for a secure and rewarding credit card experience.

Remember, the billing cycle is not merely a technical aspect of credit card usage; it’s a dynamic framework that, when navigated skillfully, can serve as a tool for financial empowerment and achievement.