Home>Finance>How Many Credits And Payments Were Made During The Billing Cycle

Finance

How Many Credits And Payments Were Made During The Billing Cycle

Published: March 7, 2024

Find out the total number of credits and payments made in the billing cycle. Manage your finances effectively with our comprehensive billing cycle analysis.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Understanding the Dynamics of Credit and Payment Transactions

Welcome to the world of finance, where every transaction tells a story. In this article, we will delve into the intricate web of credits and payments, unraveling the mysteries hidden within the billing cycle. As we embark on this journey, we will explore the fundamental concepts of credit and payment transactions, shedding light on their significance in the realm of personal and business finance.

Throughout the billing cycle, individuals and businesses engage in a myriad of financial activities, from making credit card payments to receiving loan disbursements. These transactions form the backbone of the financial ecosystem, influencing credit scores, cash flow, and overall financial well-being. Understanding the dynamics of these transactions is crucial for maintaining financial stability and making informed decisions.

Join us as we navigate through the labyrinth of financial data, uncovering the patterns and trends that shape the billing cycle. By the end of this exploration, you will gain valuable insights into the frequency, volume, and impact of credits and payments, empowering you to take control of your financial journey.

Understanding Credit and Payment Transactions

Before we embark on analyzing the data related to credits and payments during the billing cycle, it’s essential to grasp the fundamental nature of these transactions. Credit transactions encompass a wide spectrum of activities, including credit card purchases, loan disbursements, and lines of credit utilization. On the other hand, payment transactions involve the settlement of financial obligations, such as credit card payments, loan repayments, and bill settlements.

Credit transactions play a pivotal role in shaping an individual’s or business’s financial landscape. When an entity extends credit to a borrower, it provides them with the flexibility to make purchases or investments without immediate cash outlay. This mechanism fuels economic growth and enables individuals to fulfill their aspirations, from purchasing a home to launching a new business venture. However, prudent management of credit is crucial, as excessive borrowing can lead to financial strain and adversely impact credit scores.

On the flip side, payment transactions represent the culmination of financial commitments. Whether it’s settling a credit card bill, making a loan repayment, or paying utility bills, these transactions reflect the responsible management of financial obligations. Timely payments not only contribute to a positive credit history but also demonstrate fiscal discipline and reliability, fostering trust with lenders and creditors.

Understanding the interplay between credit and payment transactions is vital for maintaining a healthy financial profile. By monitoring the frequency and magnitude of these transactions, individuals and businesses can gain insights into their financial behavior, identify areas for improvement, and make informed decisions to achieve their long-term financial goals.

Tracking Credits and Payments

Tracking credits and payments during the billing cycle involves capturing and analyzing a myriad of financial data points. For individuals, this may include monitoring credit card transactions, loan disbursements, and repayments. Businesses, on the other hand, need to track receivables, payables, and other financial activities. The process of tracking these transactions is instrumental in gaining a comprehensive understanding of cash flow, credit utilization, and overall financial health.

One of the key aspects of tracking credits and payments is the utilization of financial tools and platforms that provide real-time insights into transactional activities. With the advent of digital banking and financial management apps, individuals and businesses can effortlessly monitor their credits and payments, categorize transactions, and generate detailed reports. These tools not only streamline the tracking process but also offer valuable features such as budgeting, expense tracking, and customized alerts for due payments.

Moreover, tracking credits and payments enables individuals and businesses to detect anomalies or discrepancies in their financial data. Whether it’s an unauthorized credit card charge or a missing payment, vigilant tracking can help identify potential issues and take corrective actions promptly. Additionally, by maintaining a clear record of credits and payments, entities can streamline their tax filing process, substantiate financial activities, and ensure compliance with regulatory requirements.

Furthermore, tracking credits and payments fosters financial transparency and accountability. By maintaining a clear record of all financial transactions, individuals and businesses can gain insights into their spending patterns, identify areas of excessive credit utilization, and devise strategies to optimize their payment schedules. This proactive approach to tracking credits and payments lays the foundation for informed financial decision-making and empowers entities to navigate the complexities of the billing cycle with confidence.

Analyzing the Billing Cycle Data

Once the credits and payments have been meticulously tracked, the next phase involves analyzing the billing cycle data to extract meaningful insights. This process goes beyond mere transactional recording and delves into the realm of financial intelligence, offering a comprehensive view of an entity’s financial behavior and patterns.

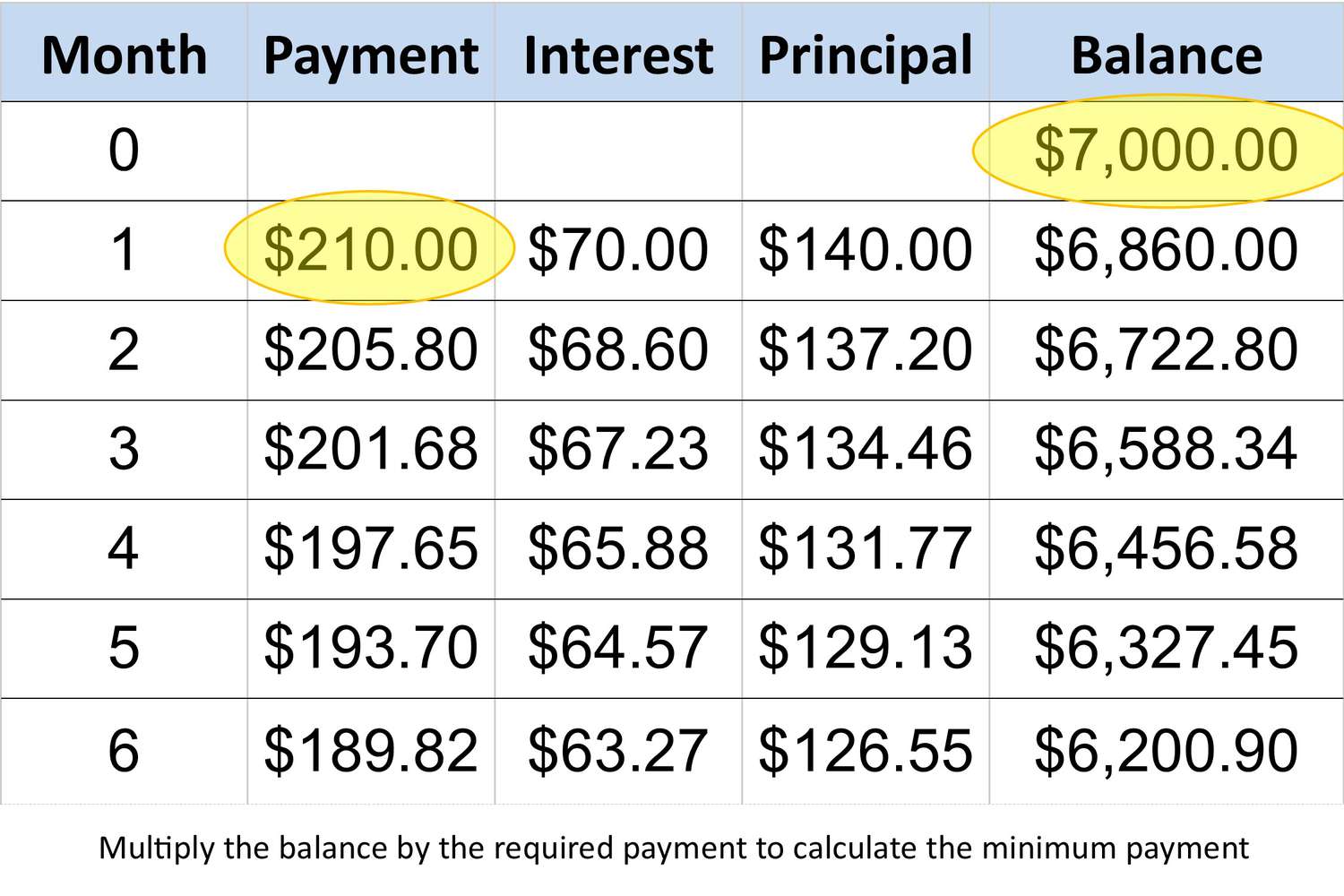

One of the primary objectives of analyzing billing cycle data is to discern trends and patterns in credit and payment activities. By examining the frequency and volume of credits and payments, individuals and businesses can identify peak periods of financial inflows and outflows. This knowledge is invaluable for optimizing cash management, ensuring sufficient funds for upcoming payments, and capitalizing on opportunities for strategic investments or debt repayments.

Furthermore, analyzing billing cycle data facilitates the assessment of credit utilization and payment behavior. Individuals can gain insights into their credit card utilization rates, loan repayment patterns, and the impact of these activities on their credit scores. Similarly, businesses can evaluate their receivables turnover, payment cycles, and the efficiency of their working capital management. Armed with this information, entities can fine-tune their financial strategies, negotiate favorable terms with creditors, and proactively address any red flags in their financial performance.

Another crucial aspect of analyzing billing cycle data is the identification of potential cost-saving opportunities and financial optimizations. By scrutinizing credits and payments, entities can uncover areas of excessive fees, interest charges, or redundant expenses. This process can lead to the renegotiation of terms with financial institutions, the consolidation of high-interest debts, or the implementation of cost-cutting measures to enhance overall financial efficiency.

Moreover, analyzing billing cycle data sets the stage for informed decision-making and long-term financial planning. Whether it’s setting realistic budgetary targets, devising a debt repayment strategy, or exploring investment opportunities, the insights derived from the analysis empower individuals and businesses to chart a prudent and sustainable financial course.

Conclusion

In conclusion, the billing cycle serves as a dynamic arena where credits and payments intersect, shaping the financial landscape for individuals and businesses alike. By understanding the nuances of credit and payment transactions, diligently tracking financial activities, and analyzing billing cycle data, entities can gain invaluable insights into their financial behavior, optimize their cash flow, and pave the way for informed decision-making.

It is crucial to recognize the impact of prudent credit management and responsible payment behavior on long-term financial well-being. Through vigilant tracking of credits and payments, individuals and businesses can detect discrepancies, streamline their financial activities, and foster transparency and accountability. The utilization of digital tools and platforms further enhances the tracking process, offering real-time visibility into financial transactions and empowering entities to take proactive measures.

Moreover, the analysis of billing cycle data unveils a treasure trove of financial intelligence, enabling entities to identify trends, assess credit utilization, and uncover opportunities for cost-saving and optimization. Armed with these insights, individuals can refine their budgeting strategies, improve their credit scores, and embark on a path of financial prudence. Similarly, businesses can bolster their working capital management, negotiate favorable terms with creditors, and fortify their financial resilience.

As we navigate through the labyrinth of the billing cycle, it becomes evident that the interplay of credits and payments is not merely a financial transactional process but a journey of financial empowerment and enlightenment. By embracing the principles of prudent credit management, responsible payment behavior, and astute financial analysis, entities can embark on a trajectory of financial stability and prosperity, transcending the complexities of the billing cycle with confidence and resilience.