Home>Finance>How Many Times Can You Run Your Credit For A Car

Finance

How Many Times Can You Run Your Credit For A Car

Published: January 8, 2024

Looking to finance a new car? Learn how many times you can run your credit for car financing and make an informed decision.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When it comes to purchasing a car, one of the important steps in the process is arranging financing. Many car buyers rely on loans to afford their dream vehicle. However, before approving a loan, car dealerships often run credit checks to assess the borrower’s creditworthiness. This may leave potential buyers wondering how many times their credit can be run for a car.

Understanding the impact of credit checks on your credit score is crucial in making informed decisions about car financing. In this article, we will explore the factors surrounding credit checks, how they affect your credit score, and why they are important for car dealerships. We will also delve into alternative options for car financing, as well as provide practical tips on minimizing the impact of credit checks on your credit score.

Whether you are a first-time car buyer or have been through the car purchasing process before, knowledge of credit checks is essential to make the best financial decisions and maintain a healthy credit score.

Understanding Credit Checks

Before delving into the impact of credit checks on your credit score, it is important to understand what a credit check is. A credit check is essentially a process where lenders or financial institutions review your credit history to evaluate your creditworthiness and assess the risk associated with lending you money.

When you apply for a car loan, the car dealership or the financing entity will typically request your permission to run a credit check. They will then contact one or more credit bureaus to obtain your credit report. This report contains information about your credit accounts, payment history, outstanding loans, and other factors that indicate your creditworthiness.

There are two main types of credit checks: hard inquiries and soft inquiries. Hard inquiries occur when a lender reviews your credit report as a result of a credit application, such as when applying for a car loan. Soft inquiries, on the other hand, occur when you review your own credit report or when a company checks your credit for promotional purposes.

Hard inquiries have a direct impact on your credit score, while soft inquiries do not. It’s important to be aware that too many hard inquiries within a short period can have a negative impact on your credit score.

To monitor and maintain a healthy credit score, it’s advisable to regularly review your credit report, which you can obtain for free from major credit reporting agencies. Understanding your credit history and knowing what is featured in your credit report can help you take proactive steps to improve your creditworthiness and financial health.

Impact of Credit Checks on Your Score

Now that we have a basic understanding of credit checks, let’s explore how these checks can impact your credit score. Credit checks, particularly hard inquiries, can have both short-term and long-term effects on your credit score.

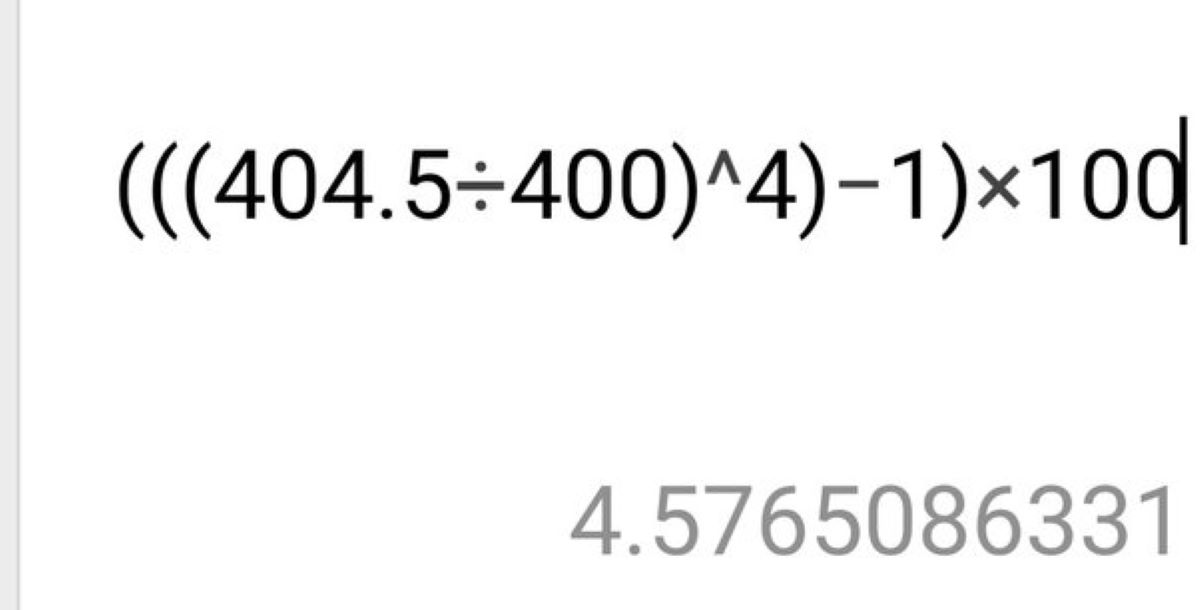

Each hard inquiry can typically cause a small dip in your credit score, usually a few points. This is because multiple credit checks within a short period can signal to lenders that you may be taking on too much debt or are in financial distress. However, the impact of a single hard inquiry is relatively small and is often outweighed by other positive factors in your credit history.

The dip in your credit score due to a credit check is temporary and can recover over time as you make consistent, on-time payments on your existing loans and maintain a healthy credit utilization ratio.

It is important to note that not all credit checks have equal impact. If you are shopping around for the best car loan rates, multiple inquiries made within a short span of time (usually within a 14-45 day window) are typically treated as a single inquiry by the credit scoring models. This allows you to compare loan offers without suffering a significant negative impact on your credit score.

However, it is advisable to be cautious and limit the number of hard inquiries you authorize. Too many credit checks, especially if done frequently and for different loan purposes, can raise red flags to lenders and can result in a decline of your credit score.

It’s important to remember that the impact of credit checks on your score will vary depending on individual credit histories and profiles. Someone with a limited credit history may see a larger impact from a single credit check compared to someone with a long and established credit history.

To minimize the impact on your credit score, it’s wise to be selective and considerate when authorizing credit checks for car loans or any loan applications. Only proceed with credit checks when you are serious about moving forward with the loan and have compared rates and terms from multiple lenders.

How Car Dealerships Run Credit Checks

Car dealerships have various methods and strategies when it comes to running credit checks on potential car buyers. Understanding how these credit checks are conducted can help you navigate the car financing process more effectively.

When you visit a car dealership and express interest in financing a vehicle, the dealership’s finance department will typically request your permission to run a credit check. They will collect your personal information, including your Social Security number, and use it to access your credit report from one or more credit bureaus.

Car dealerships usually work with multiple lenders, ranging from banks and credit unions to specialized auto finance companies. These lenders have specific criteria for approving loans, and the dealership will submit your information to multiple lenders to compare rates and terms.

The lenders will review your credit report, evaluating factors such as your credit score, payment history, outstanding debt, and employment history. Based on this information, they will determine if you are eligible for a car loan and at what interest rate. The dealership will then present you with the loan options that are available to you.

It’s important to be aware that car dealerships may also use a practice known as “shotgun credit checks,” where they send your credit application to multiple lenders simultaneously. Each lender then runs a credit check, resulting in multiple hard inquiries on your credit report. While this can provide you with more loan options, it can also potentially lower your credit score.

To protect yourself from unnecessary credit checks, ask the dealership upfront about their credit-checking practices. Inquire whether they use shotgun credit checks or if they primarily work with a specific lender for their financing needs. This can help you make an informed decision about moving forward with the credit check process.

Remember, as a consumer, you have the right to understand the credit-checking process and be informed about how it can impact your credit score. Being proactive in this regard can help you navigate the car financing process with greater confidence.

The Effect of Multiple Credit Checks

Multiple credit checks, particularly within a short period, can have an impact on your credit score. It’s important to understand how these checks can affect your overall creditworthiness and what steps you can take to minimize any potential negative impacts.

Each hard inquiry that occurs when a lender runs a credit check on your behalf can have a small negative impact on your credit score. This is because lenders may perceive multiple inquiries as a sign that you are actively seeking credit and potentially taking on more debt.

However, the credit scoring models are designed to account for rate shopping when it comes to certain types of loans, such as auto loans or mortgages. If you are in the process of shopping for car loans and multiple lenders or auto dealerships run inquiries within a short period, typically between 14 to 45 days, they are often treated as a single inquiry for credit scoring purposes.

This means that even if you’ve had multiple credit checks within that time frame, the impact on your credit score will be minimal. It allows you to shop around for the best interest rates and terms without worrying about your credit score taking a significant hit.

It is worth noting that while the credit scoring models consider multiple inquiries within a short period as a single inquiry, individual lenders may have their own criteria when assessing your creditworthiness. Some lenders may consider the number of recent inquiries as a risk factor and may adjust their lending decision accordingly.

To minimize the potential negative effects of multiple credit checks, it’s important to be mindful of the total number of inquiries you authorize. If you find yourself shopping around for car loans, try to complete your loan applications within a relatively short period. This way, the inquiries will be considered as a single inquiry by the credit scoring models.

Alternatively, you can also consider getting pre-approved for a car loan from a trusted lender. This way, you will have a clear understanding of your budget and can confidently negotiate with car dealerships, knowing that you have already been approved for financing. By doing so, you can avoid unnecessary credit checks and focus on finding the right vehicle at the best possible price.

Remember, while multiple credit checks may have a temporary impact on your credit score, maintaining healthy financial habits, making on-time payments, and keeping your credit utilization ratio low are key factors to building and maintaining a strong credit profile.

Alternative Options for Car Financing

While traditional car financing through dealerships is a common route, there are alternative options available for those who want to explore different avenues for car financing. These alternatives can provide flexibility and potentially more favorable terms. Here are a few options to consider:

- Bank or Credit Union Loans: Instead of going through a dealership, you can approach banks or credit unions to secure a car loan. These institutions often offer competitive interest rates and terms. It’s worth shopping around and comparing loan offers from different banks and credit unions to find the best option for you.

- Peer-to-Peer Lending: Peer-to-peer lending platforms connect borrowers with individual lenders who are willing to provide loans. These loans often come with competitive interest rates and the application process is typically streamlined. Research reputable peer-to-peer lending platforms to explore this option.

- Personal Loans: If you have a good credit history and a strong relationship with your bank, you may be able to secure a personal loan for your car purchase. Personal loans can give you more flexibility in terms of vehicle selection and negotiation, as you are essentially a cash buyer. However, be mindful of the interest rates and repayment terms.

- Leasing: Leasing a car allows you to drive a vehicle without committing to a long-term loan. Lease payments are typically lower than loan payments, and you can enjoy the benefits of driving a new car every few years. However, it’s important to understand the terms and conditions of the lease, including mileage limits and any potential penalties for wear and tear.

- Credit Card Financing: While not recommended for everyone, using a credit card for car financing can be an option if you have a high credit limit and can pay off the balance quickly. Some credit cards offer promotional zero or low-interest rates for a limited time, allowing you to finance your car purchase without incurring additional interest charges.

Each alternative option has its own pros and cons, and it’s essential to carefully evaluate your financial situation and goals before choosing one. Consider factors such as interest rates, repayment terms, and your ability to make timely payments.

It’s also advisable to consult with a financial advisor or conduct thorough research to understand the specific terms and conditions associated with each alternative. By exploring different financing options, you can find the one that best suits your needs and helps you achieve your car ownership goals.

Tips to Minimize the Impact on Your Credit Score

While credit checks for car financing are a necessary step, there are measures you can take to minimize the potential impact on your credit score. By being proactive and following these tips, you can protect your creditworthiness and maintain a healthy credit profile:

- Plan and Research: Before visiting car dealerships or applying for car loans, take the time to plan and research your options. Know your budget, credit score, and the loan terms you are aiming for. This will help you approach the financing process with more confidence and reduce the need for multiple credit checks.

- Limit Credit Applications: Avoid applying for multiple loans simultaneously, especially if you are uncertain about the specific terms or whether you will move forward with the purchase. Each credit check can affect your credit score, so be selective and only authorize checks when you are serious about proceeding with a loan.

- Timeframe for Rate Shopping: If you are rate shopping for car loans, try to complete your applications within a relatively short timeframe, typically between 14 to 45 days. Multiple inquiries during this period are often treated as a single inquiry by credit scoring models and have a limited impact on your credit score.

- Focus on Pre-Approval: Consider getting pre-approved for a car loan before visiting dealerships. With a pre-approval in hand, you have a clear understanding of your budget and can negotiate with car dealerships more effectively. Additionally, you can avoid unnecessary credit checks by only proceeding with loan applications when you have found the right vehicle.

- Review Your Credit Report: Regularly monitor your credit report from major credit reporting agencies to ensure accuracy and identify any potential errors. Dispute and rectify any inaccuracies promptly to maintain a healthy credit history.

- Monitor Your Credit Utilization: Credit utilization, which is the proportion of available credit that you are using, plays a significant role in your credit score. Aim to keep your credit utilization ratio below 30% to maintain a healthy credit profile. Consider paying down existing debts before applying for new credit.

- Maintain Good Financial Habits: Consistently make timely payments on your existing loans and credit cards. Late or missed payments can have a detrimental impact on your credit score. Responsible financial behavior demonstrates your creditworthiness to potential lenders.

- Seek Professional Advice: If you have questions or concerns about how credit checks may affect your credit score, consider consulting with a financial advisor or credit counselor. They can provide guidance tailored to your specific financial situation and help you navigate the car financing process with confidence.

By following these tips, you can minimize the potential negative impact on your credit score and approach car financing in a responsible and informed manner.

Conclusion

Understanding how credit checks impact your credit score is vital when it comes to purchasing a car and securing financing. While credit checks are a necessary part of the car financing process, there are steps you can take to minimize their impact on your credit score.

By being selective with credit applications, keeping them within a short time frame, and focusing on pre-approval, you can limit the number of hard inquiries and preserve your creditworthiness. Additionally, exploring alternative options for car financing, such as bank loans or peer-to-peer lending, can provide flexibility and potentially more favorable terms.

It’s important to stay proactive by monitoring your credit report for accuracy, maintaining good financial habits, and seeking professional advice when needed. By doing so, you can build and maintain a healthy credit profile, ensuring that you remain in a strong position for future financial endeavors.

Remember, credit checks are just one aspect of the car financing process. While they may have a temporary impact on your credit score, it’s your overall financial health and responsible money management that will contribute to long-term financial success.

So, whether you’re a first-time car buyer or a seasoned car owner looking to upgrade, approach the car financing process with knowledge, research, and a focus on maintaining a healthy credit score. By doing so, you’ll be well-prepared to make confident, informed decisions and secure the car loan that best suits your needs.