Home>Finance>How Many Times Do Mortgage Lenders Check Your Credit

Finance

How Many Times Do Mortgage Lenders Check Your Credit

Modified: January 10, 2024

Learn about how mortgage lenders check your credit multiple times during the home buying process and understand the impact it can have on your finances.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Obtaining a mortgage to purchase a home is a significant financial decision that entails several steps and considerations. One crucial aspect of the mortgage application process is the evaluation of the borrower’s creditworthiness. Lenders carefully review an applicant’s credit history and score to assess their ability to repay the loan.

During the mortgage application process, lenders will examine the borrower’s credit profile at multiple stages. These credit checks serve various purposes, from initial pre-approval to the final loan closing. But how many times do mortgage lenders check your credit? Understanding the frequency and significance of these credit checks can help potential homebuyers navigate the mortgage process more successfully.

In this article, we will explore the different stages of the mortgage application process and examine how credit checks impact the borrower. We will delve into the initial credit check, pre-approval credit checks, credit checks at loan application, credit checks before closing, and credit checks during loan processing. Along the way, we will also discuss the potential effects of multiple credit checks on the individual’s credit score.

By gaining a comprehensive understanding of the credit check process and its implications, individuals seeking a mortgage can be better prepared to manage their credit history and navigate the mortgage process more effectively.

Factors Impacting Credit Checks

Several factors influence the frequency and timing of credit checks conducted by mortgage lenders. Understanding these factors can provide a clearer picture of why and when lenders review an applicant’s credit history. Here are a few key factors that impact credit checks during the mortgage application process:

- Stage of the application process: The mortgage application process consists of several stages, including pre-approval, loan application, loan processing, and closing. Each stage involves different levels of scrutiny and, consequently, may require a credit check.

- Type of mortgage loan: The type of mortgage loan being sought can also impact the frequency of credit checks. For example, conventional loans, government-backed loans (such as FHA or VA loans), and jumbo loans may have varying credit check requirements.

- Lender’s policies: Each lender may have specific policies regarding credit checks. Some lenders may perform more thorough credit evaluations, while others may have more lenient criteria. It is essential to research and choose a lender that aligns with your financial goals and credit history.

- Changes in credit profile: If there have been significant changes to the borrower’s credit profile (such as opening new credit accounts, missing payments, or significant changes in credit utilization), the lender may conduct additional credit checks to reassess the borrower’s creditworthiness.

- Time elapsed since the last credit check: Lenders may review the borrower’s credit history multiple times to ensure there have been no substantial changes in their credit profile since the initial evaluation.

It’s important to note that while credit checks are a standard part of the mortgage application process, they are not the sole determining factor in getting approved for a mortgage. Lenders will also consider other factors, such as income, employment history, debt-to-income ratio, and the down payment amount.

Now that we understand the factors influencing credit checks, let’s delve into the various stages where these checks typically occur during the mortgage application process.

Initial Credit Check

The initial credit check is typically done when a borrower expresses interest in obtaining a mortgage and contacts a lender or mortgage broker. This preliminary credit evaluation helps lenders determine if the borrower meets the basic creditworthiness criteria to proceed further with the mortgage application process.

During the initial credit check, lenders will review the borrower’s credit score and credit history to assess their overall creditworthiness. This evaluation provides the lender with an initial understanding of the borrower’s financial situation and helps them determine the appropriate loan products to offer.

It’s important to note that an initial credit check is a “soft inquiry,” meaning it does not have a significant impact on the borrower’s credit score. Soft inquiries are visible only to the borrower and do not affect their creditworthiness.

The purpose of the initial credit check is to provide borrowers with an estimate of their loan eligibility and interest rates. This information helps them make informed decisions about the type and amount of mortgage they can afford. It also allows borrowers to compare multiple lenders’ rates and terms to choose the most favorable option.

If borrowers decide to move forward with a specific lender and loan product, they will progress to the next stage of the mortgage application process, which involves a more comprehensive evaluation and additional credit checks.

Next, we will explore the pre-approval credit checks, which occur after the initial credit check and provide borrowers with a more accurate understanding of their loan options.

Pre-Approval Credit Checks

Once a borrower has completed the initial credit check and expressed a serious intent to pursue a mortgage, they can proceed to the pre-approval stage. During this stage, the lender conducts a more thorough examination of the borrower’s financial situation and credit history.

Pre-approval involves the submission of additional documentation, such as income verification, employment history, and asset statements. This helps the lender assess the borrower’s ability to repay the loan. The lender will also request permission to conduct a credit check, known as a “hard inquiry.”

A hard inquiry is a credit check that can have a slight impact on the borrower’s credit score. While one hard inquiry typically has a minimal effect, multiple hard inquiries within a short period can lower the credit score temporarily. However, credit scoring models are designed to recognize that borrowers may shop around for the best loan terms, so multiple inquiries for mortgage loans made within a specified time frame (usually 14-45 days) are treated as a single inquiry.

The pre-approval credit check provides a more accurate assessment of the borrower’s creditworthiness. It helps lenders determine the loan amount for which the borrower may qualify, the estimated interest rate, and any potential conditions that must be met for final loan approval.

It’s important to note that pre-approval is not a guarantee of receiving a mortgage loan. It provides borrowers with an estimate of their eligibility and serves as a valuable tool during the home search process. Pre-approval allows borrowers to confidently make offers on homes within their budget, as it demonstrates financial readiness to sellers.

Once a borrower has secured pre-approval, they can now move forward with the mortgage application process, which involves additional credit checks and documentation. Next, we will explore the credit checks that occur when submitting the official loan application.

Credit Check at Loan Application

When a borrower has found a property and is ready to proceed with the mortgage application, they will submit an official loan application to the lender. At this stage, a thorough credit check is conducted as part of the underwriting process, where the lender reviews the borrower’s application and supporting documents.

The credit check at the loan application stage is a vital step in determining the borrower’s ability to repay the loan. Lenders will dive deeper into the borrower’s credit history, looking at factors such as payment history, credit utilization, and any negative marks such as late payments or collections.

This credit check is typically a hard inquiry and may have a temporary impact on the borrower’s credit score. However, as mentioned earlier, multiple inquiries made within a short timeframe for mortgage loans are usually treated as a single inquiry by credit scoring models.

The purpose of this credit check is to validate the borrower’s creditworthiness and verify the accuracy of the information provided in the application. Lenders want to ensure that the borrower’s financial situation aligns with the mortgage terms and that there are no red flags that might impact loan approval.

During this stage, lenders may also request additional documentation or clarification on specific items in the borrower’s credit report. This is part of the underwriting process, where the lender rigorously assesses the borrower’s creditworthiness and evaluates the risk associated with approving the loan.

It’s crucial for borrowers to be prepared for this credit check by ensuring their credit history is accurate and taking steps to improve their credit profile if necessary. This may involve paying down debt, resolving any outstanding issues on the credit report, or addressing discrepancies with the credit reporting agencies.

Once the credit check at the loan application stage is complete, the lender will continue with the loan processing, verifying employment, income, and other financial aspects. There may be additional credit checks conducted during the loan processing period, especially if there have been significant changes to the borrower’s credit since the initial check.

Next, we will explore the credit check that typically takes place right before the loan closing.

Credit Check before Closing

Prior to closing on a mortgage loan, it is common for lenders to conduct a final credit check. This credit check serves as a final validation of the borrower’s creditworthiness and financial stability before the loan is finalized.

The credit check before closing is essential because it ensures that the borrower’s financial situation has not significantly changed since the initial application. Lenders want to mitigate risk and ensure that the borrower is still capable of repaying the loan.

During this final credit check, lenders will review the borrower’s credit history, including any new inquiries, changes in credit utilization, or late payments. They will also verify that there have been no major negative events, such as bankruptcies or foreclosures, since the initial credit check.

It’s important for borrowers to maintain a stable financial situation during the mortgage process, as any significant changes or negative events could potentially impact loan approval or terms. Borrowers should avoid taking on new debt, missing payments, or engaging in financial activities that might raise concerns for lenders.

The credit check before closing is typically a hard inquiry, which means it can have a temporary impact on the borrower’s credit score. However, as mentioned earlier, credit scoring models take into account the timeframe of multiple inquiries related to mortgage loans.

If any issues or discrepancies are identified during this final credit check, it is crucial for borrowers to address them promptly. This may involve providing explanations, documentation, or taking corrective action to ensure the loan is not jeopardized.

Once the final credit check is completed and the lender is satisfied with the borrower’s creditworthiness, the loan proceeds to the closing stage. At closing, the borrower will sign the necessary documents, and the loan will be funded.

It’s important to note that the credit check at closing is not the end of the borrower’s responsibility regarding their credit. Throughout the life of the loan, borrowers must continue to manage their credit responsibly to maintain a good credit standing and fulfill their financial obligations.

In the next section, we will discuss the credit checks that may occur during the loan processing stage.

Credit Checks during Loan Processing

During the loan processing stage, which occurs between loan application and closing, lenders may conduct additional credit checks to ensure the borrower’s creditworthiness and financial standing remain consistent. These credit checks serve as a precautionary measure to identify any significant changes in the borrower’s credit profile that may impact the loan approval.

The frequency of credit checks during loan processing can vary depending on the lender’s policies and the specific circumstances of the borrower. In some cases, lenders may conduct only one additional credit check closer to the loan closing, while others may perform periodic checks throughout the processing stage.

The purpose of these credit checks during loan processing is to verify that the borrower’s credit situation has not deteriorated since the initial credit check or the pre-approval stage. Lenders want to ensure that the borrower’s financial circumstances have not changed in a way that would jeopardize their ability to repay the loan.

During these credit checks, lenders may review the borrower’s credit history, credit scores, outstanding debt, and payment history. They will also look for any new inquiries, late payments, or derogatory marks on the credit report.

It’s important for borrowers to maintain financial stability and avoid any actions that could negatively impact their credit during the loan processing stage. This includes avoiding incurring new debts, making late payments, or engaging in any financial activities that might raise concerns for lenders.

If any significant changes or issues are identified during these credit checks, it is essential for borrowers to communicate with their lender promptly. This allows them to address any questions or concerns that may arise and provide explanations or documentation to clarify the situation.

Overall, the credit checks during the loan processing stage serve as a final measure to ensure the borrower’s creditworthiness remains intact before the loan closing. By maintaining responsible financial behavior and keeping an eye on their credit during this stage, borrowers can help ensure a smooth and successful mortgage application process.

Next, we will discuss the potential impact of multiple credit checks on an individual’s credit score.

Impact of Multiple Credit Checks

One common concern among borrowers is the potential impact of multiple credit checks on their credit score. It’s important to understand how credit inquiries are treated and whether they can have a detrimental effect on one’s creditworthiness.

When it comes to mortgage applications, multiple credit checks are generally treated differently compared to other types of credit inquiries. Credit scoring models take into account that borrowers may shop around for the best mortgage terms, understanding that multiple inquiries related to mortgage loans within a specific timeframe are likely to be for the same purpose.

Typically, multiple inquiries made within a certain period (usually 14-45 days, depending on the credit scoring model) are considered as a single inquiry. This means that they will have a minimal impact on the borrower’s credit score.

It’s important to note that the impact of credit inquiries on credit scores is generally minor and temporary. The effect may be more noticeable for individuals with limited credit history or those with a small number of accounts. However, as long as borrowers manage their credit responsibly and make timely payments, any impact from inquiries should be short-lived.

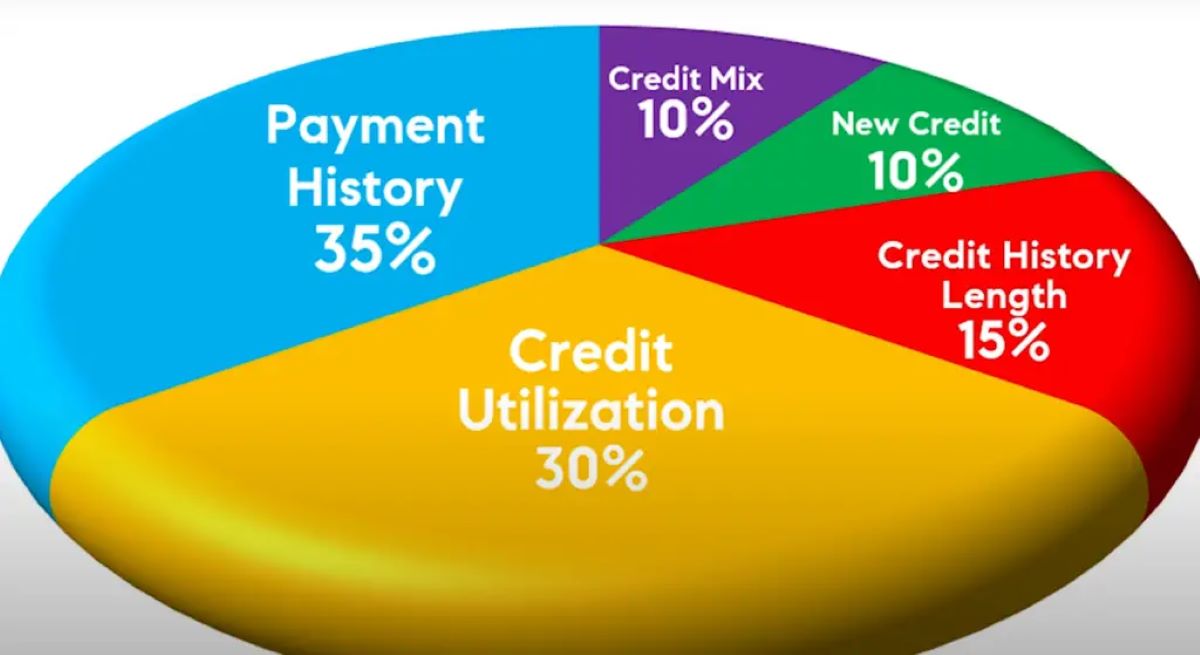

It’s worth mentioning that credit inquiries account for only a small portion of a credit score. Other factors, such as payment history, credit utilization, length of credit history, and types of credit used, have a more significant influence on overall creditworthiness.

While repeated credit checks for mortgage applications are generally treated as a single inquiry, borrowers should still exercise caution and avoid excessive credit inquiries beyond their mortgage process. Unnecessary or frequent credit inquiries for other types of loans or credit cards can potentially impact credit scores more significantly.

In summary, the impact of multiple credit checks on the credit score is typically minimal and temporary, especially when it comes to mortgage applications. It is essential for borrowers to focus on maintaining a positive credit history by making timely payments, keeping credit utilization low, and managing their overall credit responsibly.

Next, let’s wrap up the article and summarize the key points discussed.

Conclusion

Understanding the frequency and significance of credit checks during the mortgage application process is crucial for potential homebuyers. Throughout the journey to homeownership, borrowers can expect credit checks at various stages, starting from the initial credit check to pre-approval, loan application, loan processing, and the final credit check before closing.

Factors such as the stage of the application process, the type of mortgage loan, lender policies, changes in the credit profile, and the time elapsed since the last credit check can impact the frequency and timing of credit checks. It’s important for borrowers to be aware of these factors and maintain a stable financial situation to ensure a smooth mortgage application process.

While multiple credit checks are a common concern, it’s important to note that inquiries related to mortgage applications are generally treated as a single inquiry, minimizing the impact on the borrower’s credit score. Responsible management of credit, timely payments, and avoiding excessive credit inquiries for other purposes will help maintain a positive credit standing throughout the mortgage process and beyond.

Obtaining a mortgage is a significant commitment, and lenders conduct credit checks to assess the borrower’s creditworthiness and ability to repay the loan. By understanding the credit check process and taking steps to maintain a strong credit profile, borrowers can increase their chances of getting approved for a mortgage and securing favorable terms.

In conclusion, while credit checks during the mortgage application process are necessary, they are not a barrier to homeownership. With knowledge and preparation, borrowers can navigate the credit check process successfully, ensuring a smooth and successful homeownership journey.