Home>Finance>How Much Can You Balance Transfer To Another Credit Card

Finance

How Much Can You Balance Transfer To Another Credit Card

Modified: January 15, 2024

Learn how much you can transfer to another credit card with a balance transfer. Manage your finances wisely with this essential money-saving technique.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- What is a balance transfer?

- How does a balance transfer work?

- Benefits of balance transfers

- Factors to consider before transferring a balance

- How much can you transfer to another credit card?

- Credit limits for balance transfers

- Understanding the transfer fee

- Impact on credit score

- Steps to initiate a balance transfer

- Conclusion

Introduction

A balance transfer is a financial strategy that allows you to move your existing credit card debt from one card to another. This can be a useful tool for individuals looking to lower their interest rates, consolidate their debt, or simply manage their finances more effectively. By transferring your balance, you can potentially save money on interest and make your debt more manageable.

In this article, we will explore how balance transfers work, the benefits they offer, and the factors to consider before initiating a transfer. Additionally, we will delve into the question of how much you can actually transfer to another credit card, and the key factors that determine your transfer limits.

Understanding the ins and outs of balance transfers is crucial before deciding to pursue this financial strategy. By gaining a comprehensive understanding of the process and its implications, you can make informed decisions that align with your financial goals and circumstances.

So, whether you’re burdened with high-interest debt, looking for a way to manage multiple credit cards, or aiming to save on interest payments, read on to learn more about balance transfers and how they can benefit you.

What is a balance transfer?

A balance transfer is a financial transaction that involves moving the existing debt from one credit card to another. With a balance transfer, you essentially shift your debt from one creditor to another, usually with the aim of obtaining a lower interest rate or more favorable repayment terms.

When you initiate a balance transfer, the new credit card issuer pays off the outstanding balance on your current credit card, effectively transferring the debt to the new card. This allows you to consolidate your debt into a single card and potentially save money on interest fees.

The primary motivation behind a balance transfer is to take advantage of promotional offers from credit card issuers. These offers typically provide a lower or even 0% introductory interest rate for a specified period, which can range from a few months to over a year.

By transferring your balance to a card with a lower interest rate, you can reduce the amount of interest accruing on your debt and potentially save a significant amount of money. This can be particularly beneficial if you’re carrying a high balance or struggling to make timely payments on your existing credit card.

Balance transfers also offer the convenience of consolidating multiple credit card debts into a single payment. Instead of dealing with multiple due dates and interest rates, you can streamline your finances and simplify your debt management by consolidating everything into one card.

However, it’s important to note that balance transfers are not a magical solution that eliminates debt. They provide a temporary relief from high-interest payments, but it’s essential to have a concrete plan for paying off the transferred balance before the promotional period ends.

Overall, balance transfers can be a useful tool for individuals looking to save money on interest payments, consolidate debt, or simply gain better control over their financial situation. However, it’s crucial to understand the terms and conditions of the balance transfer offer and evaluate the associated costs and benefits before deciding to proceed.

How does a balance transfer work?

A balance transfer involves moving your existing credit card debt from one card to another. The process typically follows these steps:

- Find a suitable balance transfer credit card: Research and identify credit cards that offer attractive balance transfer promotions, such as low or 0% interest rates for a specified period. Compare the terms and fees associated with each card to find the best fit for your needs.

- Apply for the new credit card: Once you’ve chosen a suitable balance transfer card, submit an application. Be prepared to provide personal and financial information, including details about your existing credit card debt.

- Transfer your balance: If approved, the new credit card issuer will facilitate the transfer of your existing balance from your current credit card to the new card. This typically involves providing the necessary information, such as the account number and outstanding balance, to the new issuer.

- Pay attention to the transfer fee: Some balance transfer credit cards charge a transfer fee, which is usually a percentage of the amount being transferred. This fee is added to your new credit card balance, so consider this additional cost when evaluating the overall savings of the transfer.

- Start making payments: Once the transfer is complete, you’ll be responsible for making regular monthly payments to the new credit card issuer. It’s essential to make these payments on time to avoid late fees and potential damage to your credit score.

- Utilize the promotional period: Take advantage of the low or 0% interest rate promotional period to aggressively pay down your transferred balance. This can help you reduce your overall debt more quickly and save money on interest charges.

- Be aware of the promotional period end date: Keep track of when the promotional period ends. After this period, the interest rate will revert to the regular rate, which is typically higher. Plan your repayment strategy accordingly to avoid any surprises.

It’s important to note that not all credit cards offer balance transfer options, and the availability, terms, and promotional offers can vary between cards. Each credit card issuer may have its own set of rules and requirements for balance transfers, so it’s essential to carefully read and understand the terms and conditions before initiating a transfer.

Additionally, it’s crucial to remember that a balance transfer does not erase or eliminate your debt. It simply transfers the balance to a new credit card account. To fully benefit from a balance transfer, it’s important to develop a repayment plan and commit to responsible financial habits to pay off the transferred balance in a timely manner.

Benefits of balance transfers

Balance transfers offer several benefits that can help you manage your debt more effectively and save money. Let’s explore some of the advantages of utilizing a balance transfer:

- Lower interest rates: One of the primary benefits of a balance transfer is the opportunity to secure a lower interest rate. Many credit card issuers offer promotional periods with significantly reduced or even 0% interest rates for a specific duration. By transferring your balance to a card with a lower interest rate, you can save money on interest charges and pay off your debt more quickly.

- Consolidation of debt: If you have multiple credit cards with balances, managing different due dates, interest rates, and monthly payments can be overwhelming. With a balance transfer, you can consolidate all your debt into a single credit card, simplifying your finances and making it easier to keep track of payments.

- Save on interest fees: By taking advantage of a low or 0% interest rate promotional period, you can significantly reduce the amount of interest accrued on your transferred balance. This can lead to substantial savings over time, especially if you were previously paying high-interest rates on your existing credit card debt.

- Pay off debt faster: With the reduced interest charges, more of your monthly payments go towards the principal balance. This allows you to make more significant progress in paying off your debt and potentially becoming debt-free sooner.

- Simplify debt repayment: Managing multiple credit card payments can be challenging and may lead to missed or late payments. By consolidating your debt through a balance transfer, you have a single monthly payment to focus on, reducing the chances of overlooking a payment.

- Improve credit utilization ratio: Credit utilization ratio is an important factor in determining your credit score. By transferring debt to a new credit card, you can potentially lower your credit utilization ratio, which may have a positive impact on your credit score. This is particularly true if you were using a significant portion of your available credit on your old credit card.

While the benefits of a balance transfer can be significant, it’s crucial to carefully evaluate your financial situation and consider any associated fees, terms, and conditions before proceeding. Additionally, it’s important to have a clear repayment plan and commitment to responsible financial habits to fully take advantage of the benefits and achieve your debt management goals.

Factors to consider before transferring a balance

Before deciding to transfer a balance from one credit card to another, it’s important to consider several factors to ensure that it aligns with your financial goals and circumstances. Here are some key factors to evaluate:

- Balance transfer fees: Some credit card issuers charge a balance transfer fee, typically a percentage of the amount being transferred. While the savings from a lower interest rate can outweigh this fee, it’s essential to calculate the overall cost of the transfer and determine whether the potential savings make the fee worthwhile.

- Promotional period duration: Assess the length of the introductory promotional period offered by the new credit card. This period usually comes with a lower or 0% interest rate. Consider the time needed to pay off your balance and whether the promotional period provides sufficient time to accomplish your repayment goals.

- Standard interest rate after the promotional period: Understand the interest rate that will apply to your remaining balance once the promotional period ends. Determine whether this standard rate is competitive and whether it aligns with your long-term financial plans.

- Transfer limits: Each credit card may have specific transfer limits. Ensure that the credit limit on the new card is sufficient to accommodate your transferred balance and any potential transfer fees.

- Impact on credit score: Transferring a balance can impact your credit score. Opening a new credit card and closing an existing one can influence various factors such as credit utilization ratio, average account age, and credit inquiries. While a balance transfer itself may not have a significant negative impact, it’s important to be aware of how it may affect your credit score and consider the potential consequences.

- Ability to make monthly payments: Consider your financial situation and whether you have the means to make regular monthly payments towards the transferred balance. Creating a budget and assessing your income and expenses can help determine whether a balance transfer is a feasible option for you.

- Implications for existing credit cards: Closing an existing credit card may affect your credit history and credit mix. If you plan to close the original credit card after transferring the balance, evaluate the potential impact on your credit profile.

- Future credit needs: Consider any future credit needs you may have. If you plan to apply for a loan or need a credit card for emergencies, transferring a balance and opening a new credit card may impact your ability to obtain additional credit in the near future.

By carefully evaluating these factors, you can make an informed decision about whether a balance transfer is the right strategy for your financial situation. It’s essential to assess the costs, benefits, and potential implications before proceeding with the transfer, ensuring that it aligns with your long-term financial goals.

How much can you transfer to another credit card?

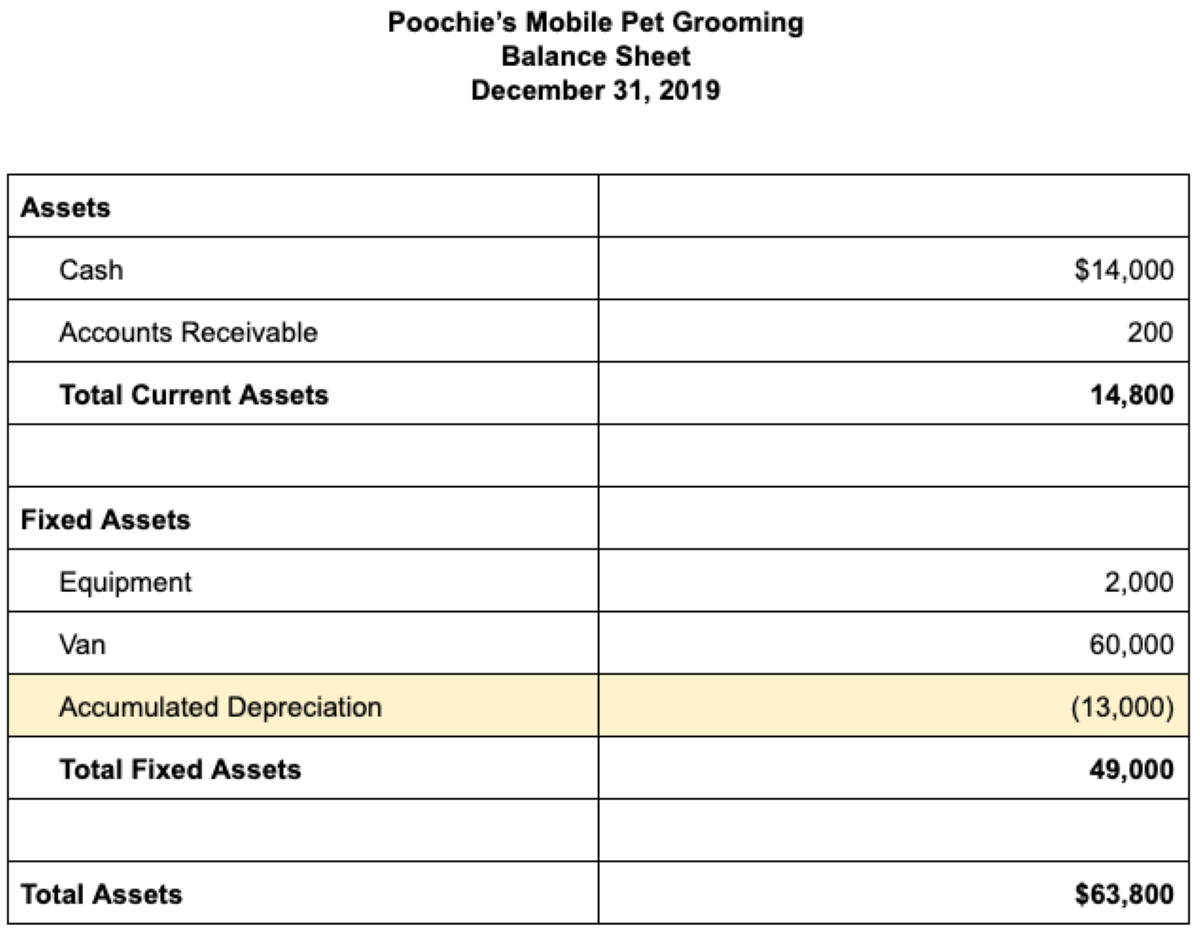

The amount you can transfer to another credit card largely depends on a few factors, including the credit limit of the new card and any restrictions imposed by the credit card issuer. Let’s explore these factors in more detail:

- Credit limit on the new card: The credit limit on the new credit card sets the maximum amount you can transfer. For example, if the new credit card has a credit limit of $10,000 and you have a $5,000 balance on your current card, you can transfer up to $5,000.

- Transfer restrictions: Some credit card issuers may impose restrictions on the maximum amount you can transfer. They may limit the transfer amount to a percentage of your available credit limit or restrict transfers to a specific dollar amount. It’s important to review the terms and conditions of the balance transfer offer to understand any limitations imposed.

- Existing balance on the new card: If you already have a balance on the new credit card where you wish to transfer your balance, you need to consider the combined balance and credit limit of that card. Ensure that the total balance, including both existing and transferred amounts, does not exceed the credit limit of the new card.

- Transfer fees: If the balance transfer offer includes a transfer fee, this fee will be added to your new credit card balance. Consider this fee and account for it when determining how much you can transfer.

- Creditworthiness: Your creditworthiness and credit history can also impact the amount you can transfer. If you have a strong credit score and a positive credit history, you may be eligible for higher credit limits and larger balance transfer amounts.

It’s important to note that transferring a balance to the maximum limit may not always be the best choice. Consider your financial situation and whether you can comfortably manage the transferred balance and make the required monthly payments.

Additionally, keep in mind that transferring your entire balance to another card may leave you without any available credit on your original card. This can have implications for your credit utilization ratio and credit scoring. It’s important to carefully evaluate the potential impact on your credit and consider keeping a small balance or limit on your original credit card to maintain a healthy credit profile.

Overall, the amount you can transfer to another credit card depends on various factors, including the credit limit of the new card, any transfer restrictions, existing balances, transfer fees, and your creditworthiness. Take these factors into account when considering a balance transfer to ensure it aligns with your financial needs and goals.

Credit limits for balance transfers

The credit limit for a balance transfer card determines the maximum amount you can transfer from your existing credit card. Credit limits vary from card to card and are influenced by several factors, including your creditworthiness and the issuer’s assessment of your ability to repay the debt. Here are some key points to consider:

- Initial credit limit: When you are approved for a balance transfer credit card, the issuer will assign an initial credit limit. This limit indicates the maximum amount you can charge or transfer to this card. The credit limit is based on various factors like your credit history, income, and debt-to-income ratio.

- Transfer restrictions: Some credit card issuers may impose restrictions on the amount you can transfer. They may limit the balance transfer to a certain percentage of your available credit limit or impose a maximum dollar amount. Ensure to review the terms and conditions of the balance transfer offer to understand any limitations imposed.

- Existing balance: If you already have an outstanding balance on the balance transfer card, the credit limit will be reduced by that amount. For example, if your credit limit is $10,000 and you have a $2,000 balance, you can transfer up to $8,000 in additional debt.

- Creditworthiness: Your creditworthiness plays a significant role in determining your credit limit. Lenders assess factors such as your credit score, credit history, and income to determine your creditworthiness. Individuals with higher credit scores and strong credit histories are more likely to receive higher credit limits, allowing for larger balance transfers.

- Financial stability: Lenders also consider your financial stability when determining your credit limit. They assess your income, employment history, and debt-to-income ratio to evaluate your ability to handle the transferred debt and make timely payments.

It’s important to remember that the credit limit granted for a balance transfer may not be the same as the credit limit you had on your original credit card. The new issuer may have different criteria and lending standards, resulting in a different credit limit on the balance transfer card.

Furthermore, keep in mind that the credit limit for a balance transfer card is not guaranteed to remain the same indefinitely. Credit limits may be subject to adjustment based on factors such as your payment history, credit utilization, and changes in your creditworthiness over time.

Before initiating a balance transfer, consider your outstanding debt, the credit limit on the new card, and any transfer restrictions imposed by the issuer. Ensure that the credit limit is sufficient to accommodate your desired balance transfer, taking into account any existing balances and potential fees associated with the transfer.

It’s advisable to approach a balance transfer with a clear understanding of your financial situation and the impact it may have on your overall credit and debt management strategy. By doing so, you can make informed decisions that align with your individual needs and goals.

Understanding the transfer fee

When considering a balance transfer, it’s important to understand the concept of a transfer fee. A transfer fee is a charge imposed by the credit card issuer for moving your existing balance from one credit card to another. Here are key points to consider:

- Percentage or flat fee: Transfer fees are typically calculated as a percentage of the amount being transferred or as a flat fee. The percentage can range from 3% to 5% of the transferred amount, while flat fees can range from $5 to $10.

- Impact on the transferred balance: Transfer fees are added to your new credit card balance. For example, if you transfer a $5,000 balance with a 3% transfer fee, you will start with a new balance of $5,150 on the destination card. It’s important to factor in the transfer fee when evaluating the overall savings and benefits of the balance transfer.

- Introductory offers: Some credit cards may offer promotional balance transfer offers with no transfer fees during the introductory period. These offers can be advantageous if you have a significant balance to transfer, as it eliminates the potential cost of the transfer fee.

- Comparing transfer fees: When evaluating balance transfer cards, it’s essential to compare the transfer fees across different offers. Consider the amount of your existing balance, the length of the promotional period, and the transfer fee to determine which card provides the most beneficial cost savings.

- Balance transfer fee caps: Some credit card issuers may impose a maximum or cap on the transfer fee amount. For example, they may state a maximum transfer fee of $100, regardless of the transferred balance. This can be advantageous if you have a large balance to transfer, as the fee is capped at a certain amount.

- Fee waiver negotiations: In some cases, you may be able to negotiate a waiver or reduction of the transfer fee. This may depend on your creditworthiness, existing relationship with the issuer, or potential incentives they offer to retain customers. It’s worth exploring if such negotiations are possible, especially if you have a strong credit profile.

While a transfer fee may seem like an additional cost, it’s essential to weigh it against the potential savings from a lower interest rate or promotional offer. If the interest savings outweigh the transfer fee in the long run, a balance transfer can still be a beneficial strategy to save money and pay off your debt faster.

Before deciding on a balance transfer, it’s critical to understand the transfer fee associated with the offer, review the terms and conditions, and calculate the impact on your overall debt. This will enable you to make an informed decision about whether the transfer fee is justified based on the potential cost savings and benefits of the balance transfer.

Impact on credit score

When considering a balance transfer, it’s important to understand how it may impact your credit score. While a balance transfer itself does not directly harm your credit score, certain factors associated with the process can influence it. Here are some points to consider:

- Credit utilization ratio: The balance transfer can impact your credit utilization ratio, which is the percentage of your available credit that you are currently using. Transferring a balance to a new credit card can affect this ratio by potentially increasing your available credit limit and lowering your utilization. Lower utilization can have a positive impact on your credit score.

- Open and closed accounts: Opening a new credit card for the balance transfer will result in a new account on your credit report. This may initially cause a small dip in your credit score due to the new credit inquiry and the lowering of the average age of accounts. However, over time, responsible credit management and timely payments can help improve your score.

- Credit mix: A diverse credit mix, including credit cards and loans, is generally seen as a positive factor by credit scoring models. However, if the balance transfer results in closing an existing credit card account, it may impact your credit mix. If possible, consider keeping the original account open with a small balance to maintain a healthy credit mix and credit scoring.

- Payment history: Making timely payments on the new credit card after the balance transfer is crucial. Late or missed payments can have a significant negative impact on your credit score. Ensure that you make your payments on time to maintain a positive payment history.

- Overall debt management: The balance transfer can be a useful tool in managing your debt effectively. Demonstrating responsible credit management by paying down the transferred balance and making consistent payments can positively impact your credit score in the long run.

It’s important to note that the impact on your credit score may vary depending on your individual credit history and overall credit profile. Each person’s credit score is calculated using various factors, and the weightage given to these factors may differ between credit scoring models.

Before proceeding with a balance transfer, it’s recommended to review your credit report, understand your current credit score, and assess the potential impact of the balance transfer on your score. By maintaining responsible credit habits, such as making timely payments and managing your overall debt, you can minimize any temporary negative effects and work towards improving your credit score over time.

Steps to initiate a balance transfer

Initiating a balance transfer requires a few key steps to ensure a smooth and successful process. Here’s a guide to help you navigate the process:

- Research and choose a suitable balance transfer credit card: Start by researching and comparing different balance transfer credit cards. Look for cards with attractive promotional offers, such as low or 0% interest rates for an introductory period. Consider the terms, fees, and credit limits associated with each card to find the best fit for your financial needs.

- Apply for the new credit card: Once you have chosen a suitable balance transfer credit card, complete the application process. This usually involves providing personal and financial information, such as your income, employment details, and existing credit card balances.

- Wait for approval: The credit card issuer will review your application and determine whether you are eligible for the balance transfer card. The approval process may take a few days to a couple of weeks. Once approved, you will receive your new credit card in the mail.

- Notify the new credit card issuer of your intent to transfer a balance: Once you have received your new credit card, contact the issuer and inform them of your intention to transfer a balance from another credit card. They will guide you through the necessary steps and provide any specific instructions or forms to complete.

- Gather the required information: Gather the necessary information and details about your existing credit card, including the account number, outstanding balance, and payment address. This information is essential for the balance transfer process.

- Initiate the balance transfer: Follow the instructions provided by the new credit card issuer to initiate the balance transfer. This may include completing a balance transfer request form online or over the phone. Provide the required details about your existing credit card and the amount you wish to transfer.

- Confirm the transfer: After initiating the balance transfer, wait for confirmation from the new credit card issuer that the transfer has been successfully processed. This confirmation may take a few days or more, depending on the credit card issuer and the timeframe for processing balance transfers.

- Continue making payments on your original credit card: While the balance transfer is being processed, continue making at least the minimum payments on your original credit card. It’s important to ensure that your payments are made on time to maintain a positive payment history and avoid any late fees or penalties.

- Monitor your new credit card account: Once the balance transfer is complete, monitor your new credit card account regularly. Ensure that the transferred balance reflects accurately, and review the terms and conditions of your new card for any additional details or obligations.

Remember, each credit card issuer may have its own specific requirements and procedures for balance transfers. It’s essential to carefully review the instructions provided by the new credit card issuer and seek clarification if needed.

By following these steps and staying organized throughout the process, you can initiate a successful balance transfer and take the first steps towards managing your debt more effectively.

Conclusion

Balance transfers can be a valuable tool for individuals looking to manage their debt more effectively, save money on interest payments, and simplify their financial obligations. By transferring existing credit card debt to a new card with a lower interest rate, you have the opportunity to consolidate your debt, pay it off faster, and potentially improve your credit score. However, it’s important to carefully consider various factors before proceeding with a balance transfer.

Understanding the intricacies of balance transfers, such as transfer fees, credit limits, and the impact on your credit score, is essential for making informed decisions. Evaluate the terms and conditions, promotional offers, and costs associated with different credit cards to determine if a balance transfer aligns with your financial goals and circumstances.

Remember to develop a clear repayment plan and commit to responsible financial habits after the balance transfer. Making timely payments, staying within your credit limit, and avoiding unnecessary debt can help you maximize the benefits of the balance transfer and maintain a healthy financial future.

Additionally, seek professional advice or guidance if you’re unsure about any aspect of the balance transfer process. Financial advisors or credit counselors can provide personalized insights into your unique situation and help you navigate the process with confidence.

By carefully considering the benefits, costs, and potential implications of a balance transfer, you can utilize this financial strategy as a stepping stone towards achieving your financial goals, managing your debt more effectively, and improving your overall financial well-being.