Home>Finance>How Much Debt And Equity Has The Firm Issued To Finance Its Assets?

Finance

How Much Debt And Equity Has The Firm Issued To Finance Its Assets?

Published: January 3, 2024

Discover how much debt and equity the firm has issued to finance its assets. Gain valuable insights into the firm's financing strategies and investment decisions.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When a firm needs to finance its assets, it has two primary options to consider: debt financing and equity financing. Each method offers its own advantages and considerations, and understanding how much debt and equity a firm has issued is a crucial aspect of evaluating its financial health.

Debt financing involves borrowing funds from various sources, such as banks or bondholders, with the promise of repayment over a set period of time, typically with interest. On the other hand, equity financing involves raising capital by selling shares of ownership in the firm to investors, who become shareholders and expect to benefit from the firm’s profits and potential growth.

This article aims to explore the importance of understanding how much debt and equity a firm has issued to finance its assets and the implications it has on the overall financial structure of the company.

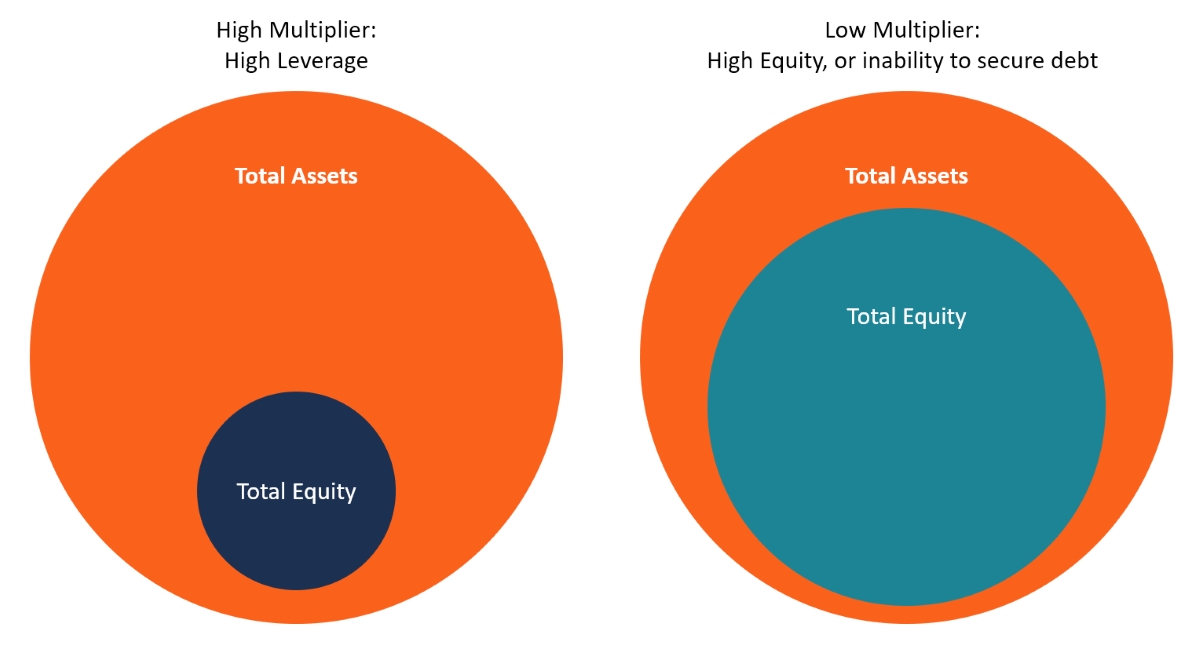

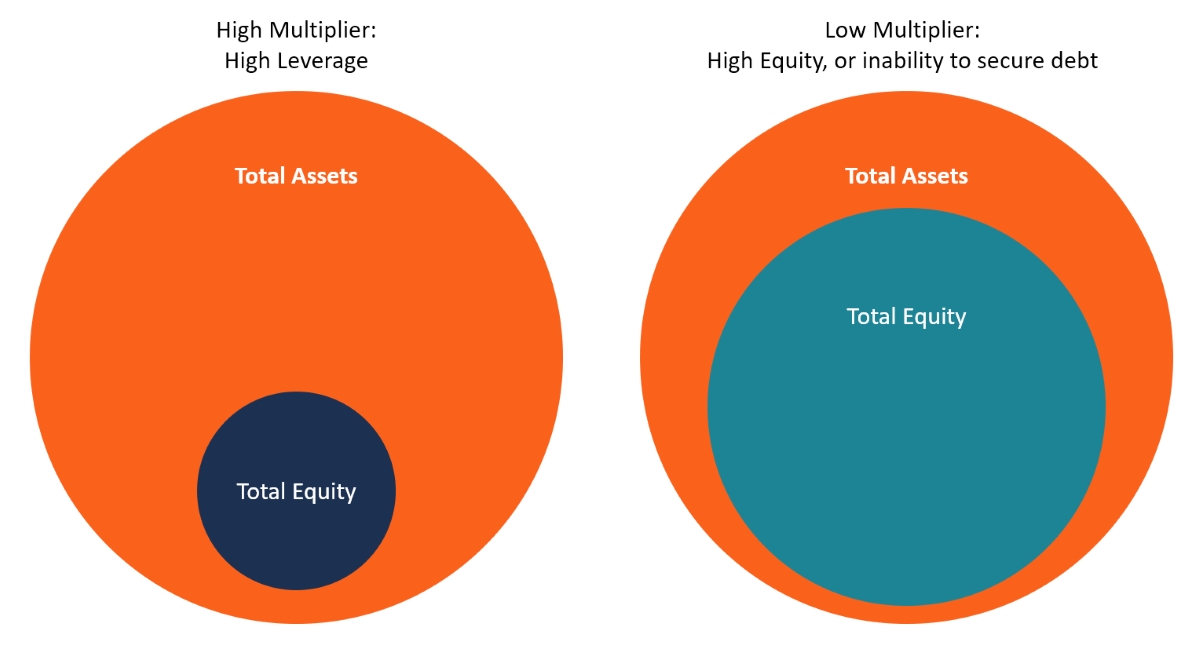

By analyzing the ratio between debt and equity, investors and stakeholders can gain insights into the firm’s risk profile, financial stability, and potential for growth. Debt carries the obligation of repayment within a specified timeframe, and interest payments can impact a company’s cash flow and profitability. On the other hand, equity provides a cushion of ownership capital that does not require immediate repayment, but dilutes existing shareholders’ ownership stake and potential earnings.

Moreover, the mix of debt and equity financing can significantly impact a firm’s cost of capital. Debt financing is generally associated with lower borrowing costs due to interest tax deductions and the security of collateral, whereas equity financing may have higher costs due to the potential for dilution of ownership and higher expectations for returns. Therefore, finding the right balance and optimizing the capital structure becomes crucial for any firm seeking to finance its assets.

Throughout this article, we will explore the differences between debt and equity financing, the implications of each on the firm’s assets, and the factors to consider in determining the optimal balance of financing sources. By understanding how much debt and equity a firm has issued, investors and stakeholders can gain a deeper understanding of the financial health and stability of the company, empowering them to make informed decisions about their investments.

Debt Financing

Debt financing is a common method used by companies to raise capital for their operations or to fund specific projects. It involves borrowing money from various sources, such as banks, financial institutions, or bondholders, with the agreement to repay the borrowed amount along with any accrued interest within a predetermined timeframe.

Debt financing offers several advantages for companies. Firstly, it provides access to a significant amount of capital that can be used to finance growth initiatives, purchase assets, or expand operations. This is especially beneficial for companies that have limited cash reserves or are unable to generate sufficient internal funds to support their objectives.

Secondly, debt financing can be a cost-effective option. While companies are required to pay interest on the borrowed funds, the interest payments may be tax-deductible, reducing the overall cost of borrowing. Additionally, the interest rates on debt instruments may be lower compared to the expected returns demanded by equity investors.

However, debt financing also comes with potential risks and considerations. Companies that rely heavily on debt may face increased financial leverage, which can amplify the impact of economic downturns or industry-specific challenges. Additionally, excessive debt levels can lead to reduced flexibility in terms of future borrowing capacity or the ability to allocate resources towards other strategic initiatives.

When assessing a company’s debt financing, it is crucial to consider various debt metrics, including the debt-to-equity ratio, interest coverage ratio, and debt service coverage ratio. These ratios help evaluate the company’s ability to repay its debt obligations and the level of financial risk it carries.

Debt financing instruments can vary depending on the needs and preferences of the company. Common forms of debt financing include bank loans, corporate bonds, lines of credit, and trade credit. Each option has its own terms and conditions, including interest rates, repayment schedules, and collateral requirements.

Overall, debt financing provides an avenue for companies to secure capital and fund their operations or growth initiatives. It offers advantages such as access to a significant amount of capital and potential tax benefits, but it also comes with risks, including increased financial leverage and reduced flexibility. By carefully managing debt levels and assessing the company’s ability to service its debt, companies can utilize debt financing as a valuable tool for achieving their financial goals.

Equity Financing

Equity financing is a method of raising capital for a company by selling shares of ownership, known as equity or stock, to investors. Unlike debt financing, equity financing does not require repayment of the funds borrowed. Instead, shareholders become part-owners of the company and have a claim on its assets and future profits.

Equity financing offers several advantages for companies. Firstly, it provides a way to raise capital without incurring debt or interest payments. This can be particularly beneficial for startups or companies with limited borrowing capacity. Additionally, equity financing allows companies to access a potentially large pool of investors who are willing to invest in the company’s growth potential.

Secondly, by offering equity in their company, firms can attract investors who have a long-term interest in the success of the business. These investors often bring valuable expertise, industry knowledge, and networks that can help the company thrive. Moreover, equity financing allows companies to distribute the ownership risk among shareholders.

However, equity financing also has its considerations and implications. By selling shares of the company, existing shareholders become diluted, which means their ownership stake and potential earnings per share are reduced. Additionally, companies that rely heavily on equity financing may face challenges in maintaining control over decision-making processes, as new shareholders may have voting rights and a say in the company’s operations.

Equity financing can be obtained through various means, such as initial public offerings (IPOs), private placements, venture capital investments, or crowdfunding platforms. The choice of equity financing depends on the company’s growth stage, industry, and specific requirements.

Investors evaluating equity financing opportunities will consider factors such as the company’s business model, growth potential, competitive positioning, and management team. They will also analyze financial ratios such as earnings per share (EPS), price-to-earnings (P/E) ratio, and return on equity (ROE) to assess the company’s profitability and potential return on investment.

Overall, equity financing allows companies to raise capital without incurring debt, tap into a network of investors, and benefit from long-term partnership and expertise. While it may lead to dilution of ownership and potential loss of control, equity financing can be a powerful tool for companies looking to fuel their growth and expand their operations.

Comparison of Debt and Equity

Debt financing and equity financing are two distinct methods by which companies can raise capital, each with its own advantages and considerations. Understanding the differences between these two forms of financing is crucial for companies evaluating their funding options.

1. Repayment Obligation: In debt financing, the borrowed funds must be repaid over a specified period, typically with interest. Equity financing, on the other hand, does not require repayment as shareholders become part-owners of the company.

2. Sharing Ownership and Control: Debt financing does not dilute ownership or control of the company, as lenders do not have ownership rights. Equity financing, however, involves selling shares of the company to investors, which dilutes existing shareholders’ ownership and can result in loss of control if large stakes are sold.

3. Cost and Risk: Debt financing often carries interest expenses, which can increase the overall cost of capital. Equity financing does not involve interest payments, but investors expect a return on their investment through dividends or capital appreciation. Additionally, debt financing poses a greater risk to a company’s financial stability, as failure to meet debt obligations can result in default or bankruptcy.

4. Flexibility: Equity financing offers more flexibility as there are typically no fixed repayment schedules or restrictive covenants. On the other hand, debt financing may come with strict repayment terms and conditions that can limit a company’s financial flexibility.

5. Tax Benefits: Interest payments on debt financing are often tax-deductible, reducing the overall cost of borrowing. Equity financing does not offer the same tax benefits.

6. Availability: Debt financing is often easily accessible for established companies with a strong credit history, collateral, and steady cash flow. Equity financing may be more suitable for startups or companies with high growth potential who may face challenges in securing traditional debt financing.

7. Investor Expectations: Debt financing generally involves lenders who have a fixed expectation of repayment, regardless of the company’s profitability. Equity financing involves shareholders who have a stake in the company’s success and expect a return on their investment through dividends or capital gains.

Overall, debt and equity financing have different characteristics and implications for companies. Debt financing provides access to capital with a repayment obligation and interest expenses, while equity financing involves sharing ownership and potential profits with investors. The choice between debt and equity financing depends on factors such as the company’s financial situation, growth prospects, and risk tolerance.

Impact of Debt and Equity on Firm’s Assets

The choices a company makes between debt and equity financing can have a significant impact on its assets and overall financial structure. Understanding this impact is crucial for companies seeking to optimize their capital structure and effectively manage their assets.

1. Debt and its Impact:

When a firm takes on debt, it increases its liabilities, as the borrowed funds need to be repaid. The principal amount borrowed forms a part of the company’s long-term debt, while interest payments on the debt represent ongoing expenses that reduce the firm’s profitability.

Debt financing allows a company to access capital that can be used to acquire assets, such as property, equipment, or inventory. However, it is important to consider the impact of debt on the company’s assets:

- Assets Purchased with Debt: The assets acquired using debt financing become a part of the company’s asset base. These assets can generate revenue and contribute to the company’s operations. However, it is essential to assess the productivity and profitability of these assets to ensure they generate sufficient returns to cover the debt costs.

- Collateral Requirements: In certain cases, lenders may require the company to provide collateral to secure the debt. This collateral often consists of specific assets that can be seized by the lender in the event of default. The company needs to carefully manage its collateral to ensure that it does not lose critical assets that are essential for its operations.

2. Equity and its Impact:

Equity financing, unlike debt financing, does not require repayment. Instead, it involves selling shares of ownership in the company to investors. Equity has a direct impact on the company’s assets in the following ways:

- Shareholder Equity: When investors purchase equity in the company, their investment contributes to the company’s shareholder equity. This equity represents the residual value of the company’s assets after deducting its liabilities.

- Retained Earnings: As the company generates profits, it can choose to retain a portion of these earnings to reinvest in the business. Retained earnings increase the company’s equity and can be used to fund future projects or growth initiatives.

- Dilution of Ownership: The sale of equity shares can dilute the ownership stake of existing shareholders. This means that their proportional ownership of the company and potential future earnings may decrease as new investors enter the picture.

Both debt and equity financing have direct implications for the company’s assets. Debt increases liabilities and involves interest expenses, while equity represents the ownership stake in the company. The company must strike a balance between debt and equity financing to optimize its financial structure and effectively utilize its assets.

By carefully managing debt levels and assessing the profitability and productivity of assets acquired with debt, a company can avoid excessive financial leverage and ensure that its assets generate sufficient returns. Similarly, by strategically utilizing equity financing and retaining earnings, a company can strengthen its equity base, attract investors, and support future growth initiatives.

Conclusion

Understanding how much debt and equity a firm has issued to finance its assets is crucial for evaluating its financial health, risk profile, and growth potential. Debt financing involves borrowing funds that need to be repaid with interest, while equity financing involves selling ownership shares to investors. Each method has its own advantages, considerations, and implications for a company’s assets.

Debt financing provides immediate access to capital and offers potential tax benefits. However, it also carries the risk of financial leverage and potential challenges in managing debt obligations. Careful consideration should be given to the company’s ability to repay the debt and the impact on its cash flow and profitability.

Equity financing allows companies to raise capital without incurring debt or interest payments. It provides long-term partnerships with investors who can contribute expertise and resources. However, it may result in dilution of ownership and loss of control over decision-making processes.

Choosing the optimal mix of debt and equity financing is vital for any company seeking to finance its assets. It depends on factors such as the company’s growth stage, industry, risk tolerance, and financial position. Striking the right balance is essential to maintain financial stability, flexibility, and maximize shareholder value.

Debt and equity financing have a direct impact on a company’s assets. Debt increases liabilities and affects cash flow, while equity represents ownership and potential return on investment. Companies need to carefully manage their debt levels to avoid excessive financial risk, and strategically utilize equity financing to attract investors and support growth initiatives.

In conclusion, understanding how much debt and equity a firm has issued is crucial for assessing its financial structure and stability. By analyzing the ratio between debt and equity and the implications on the firm’s assets, investors and stakeholders gain insights into the company’s risk profile, profitability, and potential for growth. This understanding enables informed decision-making and helps companies optimize their capital structure to support their long-term objectives.