Home>Finance>Which Is An Advantage Of Equity Financing Over Debt Financing?

Finance

Which Is An Advantage Of Equity Financing Over Debt Financing?

Published: January 3, 2024

Equity financing offers advantages over debt financing in terms of ownership control, flexibility in payment, and potential for greater returns. Explore the benefits of finance options for your business needs.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Definition of Equity Financing

- Definition of Debt Financing

- Advantages of Equity Financing over Debt Financing

- Avoidance of Debt Obligations

- Flexibility in Repaying Funds

- Shared Risk

- No Interest Payments

- Long-term Potential for Growth

- Disadvantages of Equity Financing Compared to Debt Financing

- Conclusion

Introduction

When it comes to financing options for businesses, two common methods are equity financing and debt financing. Both approaches have their advantages and drawbacks, depending on the specific needs and circumstances of a company. In this article, we will explore the advantages of equity financing over debt financing and discuss why it may be a preferable choice for some businesses.

Equity financing involves raising capital by selling shares of ownership in a company to investors. This can be done through private placements, initial public offerings (IPOs), or venture capital investments. On the other hand, debt financing is when a business borrows money from lenders or financial institutions with the promise to repay the borrowed amount, plus interest, over a specific period of time.

While debt financing is a popular choice for many businesses due to its availability and structure, equity financing offers unique advantages that are worth considering. In the following sections, we will discuss some key advantages of equity financing and how they can benefit businesses.

Definition of Equity Financing

Equity financing is a method of raising capital for a business by selling shares or ownership stakes to investors in exchange for funds. In this arrangement, the investors become shareholders and have a claim on the company’s future profits and assets. The amount of ownership stake acquired by each investor is proportional to the funds they invest.

Equity financing can be obtained through various sources, such as angel investors, venture capitalists, private equity firms, or even crowdfunding platforms. The terms of the equity financing agreement may include provisions for dividends, voting rights, and other rights and privileges associated with ownership.

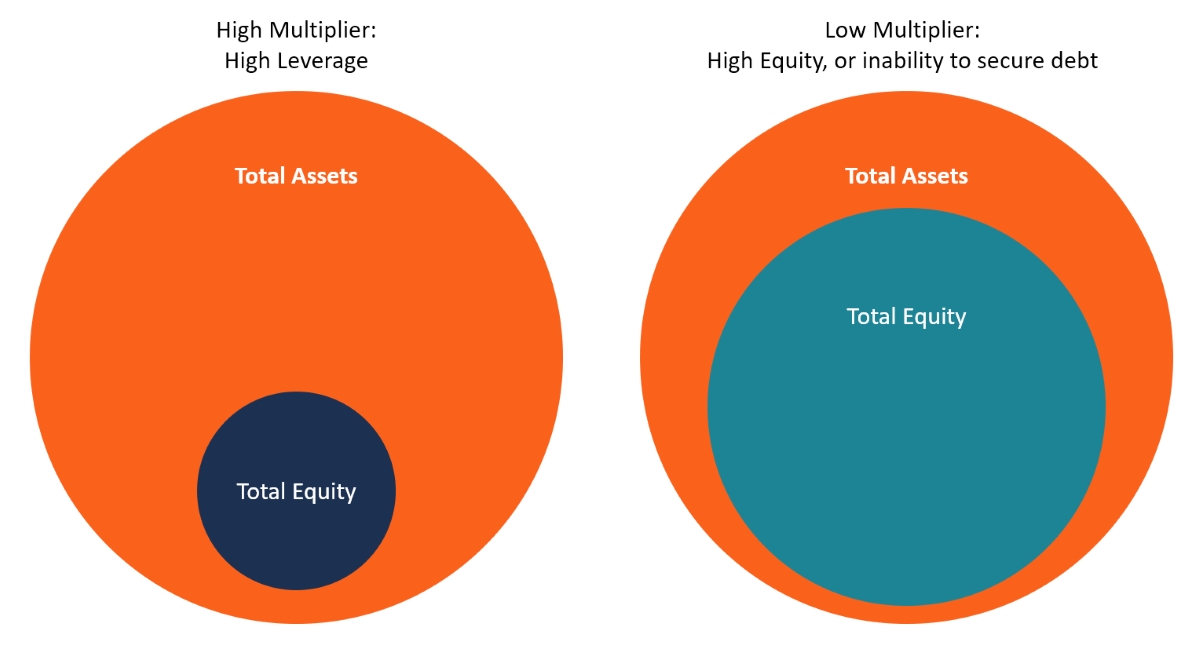

One significant characteristic of equity financing is that it does not involve any repayment of the funds raised. Unlike debt financing, where the borrowed money must be repaid over a fixed period with interest, equity financing does not create any debt obligations for the company. Instead, the investors take on the risk of their investment and expect to generate returns through the company’s growth and success.

Equity financing is commonly sought by startups and early-stage companies that may not have the necessary assets or creditworthiness to secure debt financing. It provides a way for these companies to raise capital and fuel their growth without incurring immediate repayment burdens.

It’s important to note that while equity financing can be an attractive option for raising funds, it often involves giving up some level of control and ownership in the company. Business owners must carefully consider the trade-offs and make strategic decisions regarding the amount of equity to sell and the terms of the agreement.

Definition of Debt Financing

Debt financing is a method of raising capital for a business through borrowing funds from lenders or financial institutions. In this arrangement, the borrower agrees to repay the principal amount, along with interest, over a specified period of time. Debt financing can take various forms, such as loans, lines of credit, bonds, or commercial paper.

When a company opts for debt financing, it enters into a contractual agreement with the lender that outlines the terms and conditions of the loan. These terms typically include the interest rate, repayment schedule, collateral requirements, and any other covenants or restrictions imposed by the lender.

Unlike equity financing, where ownership in the company is shared with investors, debt financing does not dilute the ownership stake of existing shareholders. The lender primarily looks at the creditworthiness and financial stability of the company when deciding whether to extend the loan.

Debt financing offers a predictable and structured method of obtaining capital for businesses. The fixed repayment schedule allows for better financial planning and budgeting, as the company knows exactly when and how much it needs to repay each period. Additionally, interest payments on the borrowed amount can be tax-deductible, providing potential tax advantages for businesses.

However, one key aspect of debt financing that distinguishes it from equity financing is the obligation to repay the borrowed funds. Failure to meet the repayment obligations can lead to penalties, damage to credit ratings, and potentially even legal action from the lenders. This creates a higher level of financial risk and pressure for businesses that rely heavily on debt financing.

Debt financing is commonly used by both small and large businesses to finance various activities such as expansion, working capital needs, or equipment purchases. It offers a way to access capital without diluting ownership, but it’s essential for businesses to carefully manage their debt levels and ensure they can meet their repayment obligations.

Advantages of Equity Financing over Debt Financing

Equity financing offers several advantages over debt financing, making it an attractive option for businesses in certain situations. Let’s explore some key advantages:

-

Avoidance of Debt Obligations: One of the significant advantages of equity financing is that it does not create any debt obligations for the company. Unlike debt financing, where borrowed funds must be repaid over a fixed period with interest, equity financing allows businesses to raise capital without incurring immediate repayment burdens.

-

Flexibility in Repaying Funds: Equity financing provides businesses with more flexibility in repaying funds compared to debt financing. While debt financing requires regular fixed payments, equity financing allows companies to focus on long-term growth and reinvest profits back into the business without the pressure of servicing debt.

-

Shared Risk: When a company raises funds through equity financing, the risk is shared among the investors. If the business faces challenges or fails to generate expected profits, the burden is not solely on the company’s shoulders. Investors assume the risk they have invested, and the company can potentially benefit from their expertise and network connections.

-

No Interest Payments: Unlike debt financing, equity financing does not involve paying interest on the capital raised. This can provide significant cost savings for businesses, especially during times of economic downturn or when interest rates are high.

-

Long-Term Potential for Growth: Equity financing enables businesses to access a pool of capital that can fuel long-term growth and expansion. With the capital injection from investors, companies can invest in research and development, marketing, talent acquisition, and other strategic initiatives that can drive future success.

Overall, equity financing offers businesses financial flexibility, shared risk, and the potential for long-term growth without the burden of repayment obligations and interest payments. However, it’s important to consider the disadvantages of equity financing as well and carefully evaluate the specific needs and goals of the business before choosing between equity financing and debt financing.

Avoidance of Debt Obligations

One of the significant advantages of equity financing is the avoidance of debt obligations. When a business raises capital through equity financing, it does not create any debt that needs to be repaid within a specific timeframe. This means that the company is not burdened with monthly or annual loan payments, making it more financially flexible.

In contrast, debt financing requires the borrower to repay the principal amount along with interest over a fixed period. This can place a significant strain on the cash flow of a business, especially if it is going through a challenging period or experiencing fluctuations in revenue. By opting for equity financing, businesses can focus on utilizing the funds for growth and development rather than diverting resources towards debt servicing.

This advantage is particularly beneficial for startups and small businesses that may not have stable or predictable cash flow. These companies often rely on equity financing to meet their capital needs without incurring the immediate burden of debt. It allows them to invest resources in product development, marketing, and talent acquisition to fuel their growth.

Moreover, avoiding debt obligations also mitigates the risk of defaulting on loan payments. With equity financing, there is no fixed repayment schedule or the risk of tarnishing the company’s creditworthiness if circumstances prevent repayment. This gives businesses the freedom to allocate resources according to their priorities and adapt to market conditions without the added pressure of meeting debt obligations.

However, it’s important to carefully consider the trade-offs of equity financing. While it provides the advantage of avoiding debt, it comes with its own set of considerations such as diluting ownership and sharing profits with investors. Businesses must strike a balance between maintaining control and attracting the necessary capital.

In summary, the avoidance of debt obligations is a significant advantage of equity financing. It provides businesses with enhanced financial flexibility, allowing them to allocate resources towards growth and development without the immediate pressure of satisfying loan repayment terms.

Flexibility in Repaying Funds

Equity financing provides businesses with greater flexibility in repaying funds compared to debt financing. Unlike debt financing, which requires regular fixed payments, equity financing allows companies to have more freedom in managing their financial obligations.

With debt financing, businesses must adhere to a predetermined repayment schedule, including both the principal amount and accrued interest. These fixed payments can sometimes strain the cash flow of a business, especially during periods of economic uncertainty or when facing unexpected challenges. In contrast, equity financing does not impose such rigid payment requirements.

Equity financing allows businesses to prioritize reinvesting their profits back into the company for growth and expansion, rather than focusing on servicing debt. This flexibility enables businesses to allocate resources strategically based on their current needs and market conditions.

For example, during a period of economic downturn, a company that has raised funds through equity financing can choose to invest in research and development, marketing, or cost-saving initiatives to adapt to changing market dynamics. In contrast, a business with significant debt obligations may find it challenging to redirect funds as they are obligated to make regular principal and interest payments.

Additionally, the absence of fixed repayments in equity financing allows companies to manage their cash flow more effectively. This is particularly advantageous for businesses with seasonal revenue patterns or fluctuating revenue streams. They have the flexibility to allocate capital to areas that require attention or reinvest in the business during peak periods, rather than diverting funds towards loan repayments during off-peak seasons.

Flexibility in repaying funds also extends to the possibility of delaying or suspending dividend payments to shareholders in times of financial difficulty. This can provide a lifeline for businesses experiencing temporary financial constraints, as they can prioritize internal reinvestment or cash preservation without immediately impacting investor returns.

Overall, the flexibility in repaying funds is a significant advantage of equity financing. It allows businesses to focus on their long-term growth and development without the constraints of fixed and regular debt repayments. This flexibility helps companies respond to market conditions, manage cash flow effectively, and make strategic financial decisions that align with their business goals.

Shared Risk

An important advantage of equity financing is the concept of shared risk. When a business raises capital through equity financing, the risks and responsibilities associated with the investment are spread among multiple investors.

With debt financing, the burden of repayment falls solely on the business. If the company faces challenges, economic downturns, or unforeseen circumstances that hinder its ability to generate sufficient cash flow for debt repayment, the business may find itself in financial distress. In contrast, equity financing distributes the risk among the investors who have purchased shares or ownership stakes in the company.

When investors participate in equity financing, they are aware that their investment is at risk and that the return on their investment is not guaranteed. They understand that there is a possibility of losing some or all of their investment if the business does not perform as expected.

This shared risk can bring added benefits to the business. For one, the involvement of multiple investors can enhance the strategic guidance and expertise available to the company. Investors often bring industry knowledge, experience, and connections that can help the business navigate challenges and unlock growth opportunities.

Additionally, the shared risk aspect of equity financing aligns the interests of investors and business owners. Both parties have a vested interest in the success of the business since the investors’ return is directly tied to the profitability and growth of the company. This alignment of interests fosters a collaborative and mutually beneficial relationship between investors and the business.

Moreover, in case of business failure, equity financing may provide some level of protection to the business owners. Since investors bear a portion of the risk, the business owners might have some personal liability protection. This varies based on the legal structure and terms of the investment, so it’s important to consult with legal and financial experts to fully understand the extent of personal protections offered in equity financing scenarios.

Overall, the shared risk aspect of equity financing can provide businesses with additional resources, expertise, and a shared responsibility for success. This can contribute to the growth and long-term sustainability of the business, as risks are distributed among investors who have a vested interest in the company’s success.

No Interest Payments

A significant advantage of equity financing over debt financing is the absence of interest payments. Unlike debt financing, where borrowed funds come with an interest rate that adds an additional financial burden to the business, equity financing does not require any interest payments.

Interest payments can be a considerable expense for businesses, especially when dealing with significant loan amounts or high-interest rates. These payments can eat into the company’s profits and cash flow, reducing the resources available for other critical business operations, such as research and development, marketing, or hiring of new talent.

By opting for equity financing, businesses eliminate the ongoing financial obligation of making interest payments on borrowed funds. This can result in significant cost savings and improved cash flow, allowing businesses to allocate their resources more efficiently and pursue growth opportunities.

Furthermore, the absence of interest payments also provides businesses with more financial stability. When relying on debt financing, businesses are subject to the fluctuations of interest rates, which can impact their repayment obligations. In times of economic uncertainty or rising interest rates, businesses with significant debt may find it challenging to adjust and manage the increased cost of borrowing.

In contrast, equity financing provides businesses with a level of stability and predictability. The funds raised through equity financing do not come with an interest rate that can fluctuate over time, providing businesses with more certainty regarding their financial obligations.

Additionally, the elimination of interest payments allows businesses to reinvest their profits back into the company for growth and development. Without the burden of ongoing interest expenses, businesses can allocate more capital towards innovation, expanding market reach, or strengthening their competitive position.

However, it’s important to note that equity financing has its own considerations, such as sharing ownership and potential dividend payments. Businesses must carefully assess the trade-offs between equity financing and debt financing to determine which option aligns best with their long-term goals and financial circumstances.

In summary, the absence of interest payments is a significant advantage of equity financing. It not only provides cost savings for businesses but also enhances financial stability, allowing companies to allocate resources more efficiently and pursue growth opportunities without the burden of ongoing interest expenses.

Long-term Potential for Growth

Equity financing offers businesses a unique advantage with its long-term potential for growth. Unlike debt financing, which creates an obligation to repay borrowed funds, equity financing allows companies to raise capital without immediate repayment obligations. This capital infusion provides businesses with the resources needed to fuel long-term growth and strategic initiatives.

By securing equity financing, businesses can access a pool of funds that can be invested in various areas of operation, such as research and development, marketing, talent acquisition, and expanding into new markets. These investments can lead to product innovation, increased market share, and improved competitive advantage, all of which contribute to sustainable long-term growth.

Equity financing is particularly attractive for startups and high-growth companies that require substantial capital to accelerate their growth trajectory. Instead of relying solely on cash flow generated by the business itself, equity financing enables these companies to access significant funds from investors who are interested in participating in their growth story.

Furthermore, equity financing provides businesses with the opportunity to tap into the expertise and networks of their investors. Investors often have industry knowledge and connections that can be leveraged to open doors to strategic partnerships, mentorship, and valuable business opportunities. These additional resources can significantly enhance a company’s growth potential.

Unlike debt financing, where payments are fixed and must be made regardless of the business’s performance, equity financing offers more flexibility. If a business is facing a challenging period or experiencing slower growth, the absence of fixed repayment obligations allows the company to redirect resources and focus on overcoming obstacles without the added pressure of debt repayments.

Additionally, the long-term nature of equity financing aligns the interests of investors and business owners. While debt financing primarily focuses on the repayment of borrowed funds, equity financing ties the return on investment directly to the company’s profitability and success. This alignment encourages investors to support the business’s growth initiatives and work collaboratively towards long-term value creation.

Overall, the long-term potential for growth is a significant advantage of equity financing. It enables businesses to access substantial capital, invest strategically, and leverage the expertise and networks of investors. This combination of resources and support creates a strong foundation for sustainable growth and success in the long run.

Disadvantages of Equity Financing Compared to Debt Financing

While equity financing offers several advantages, it also comes with its own set of disadvantages when compared to debt financing. It’s essential for businesses to consider these factors when deciding between the two financing options. Here are some key disadvantages of equity financing:

-

Loss of Ownership and Control: When a business raises capital through equity financing, it typically involves selling a portion of ownership or shares to investors. As a result, business owners may experience a dilution of their ownership stake and a loss of control over decision-making. This can impact the autonomy and strategic direction of the company.

-

Sharing Profits and Returns: Unlike debt financing, where loan repayments are the primary financial responsibility, equity financing involves sharing profits and returns with investors. As the company generates profits, a portion is distributed to shareholders in the form of dividends or reinvestment. This can reduce the amount of retained earnings available for reinvestment and limit the control over profit distribution.

-

Increased Reporting and Transparency Requirements: Equity financing often involves having multiple investors, which can lead to increased reporting and transparency requirements. Companies may need to provide regular financial updates, hold shareholder meetings, and comply with regulatory obligations. These additional administrative duties can be time-consuming and costly.

-

Potential Conflicts of Interest: With more investors in the company, there is a possibility of conflicting interests and objectives. Investors may have varying expectations and priorities, which can lead to disagreements on decisions such as business strategies, dividend policies, or exit strategies. Managing these potential conflicts of interest requires effective communication and alignment among stakeholders.

-

Higher Cost of Capital: Equity financing can come with a higher cost of capital compared to debt financing. Investors expect a return on their investment that aligns with the level of risk associated with equity investments. As a result, the cost of equity financing may be higher in terms of the potential dilution of ownership and the sharing of profits with investors.

It’s important for businesses to carefully evaluate these disadvantages when considering equity financing. They should weigh the trade-offs between ownership control, profit sharing, administrative responsibilities, and the cost of capital with the advantages offered by equity financing.

In some cases, businesses may opt for a combination of debt financing and equity financing to balance the benefits and drawbacks associated with each method. Ultimately, the decision should align with the company’s financial goals, growth strategy, and risk tolerance.

Conclusion

Both equity financing and debt financing have their advantages and disadvantages, and it’s crucial for businesses to carefully consider their specific needs and circumstances when choosing between the two. However, there are distinct advantages that make equity financing a preferred option for many businesses.

The avoidance of debt obligations in equity financing provides businesses with a level of financial flexibility, allowing them to invest resources in growth and development without immediate repayment burdens. The flexibility in repaying funds enables businesses to allocate capital strategically and adapt to changing market conditions. The shared risk associated with equity financing distributes the investment burden among multiple stakeholders, providing access to expertise and resources that can contribute to the business’s success.

Equity financing also eliminates interest payments, reducing the financial burden on businesses and freeing up capital for reinvestment. Additionally, equity financing provides businesses with the long-term potential for growth, as it enables access to significant capital for strategic initiatives and leverages the expertise and networks of investors.

However, it’s important to acknowledge that equity financing has its disadvantages, including the loss of ownership and control, profit sharing, increased reporting requirements, potential conflicts of interest, and potentially higher cost of capital compared to debt financing.

In conclusion, businesses should carefully evaluate their financial goals, risk tolerance, and growth strategies when considering equity financing. Understanding the advantages and disadvantages will help businesses make well-informed decisions that align with their long-term objectives. Ultimately, striking the right balance between equity financing and debt financing can provide businesses with the capital and resources necessary for sustainable growth and success in today’s ever-changing business landscape.